Nvidia's AI Dominance Challenged: Analysts Predict $4-10 Trillion Valuation Despite DeepSeek Scare

5 Sources

5 Sources

[1]

Prediction: Even With DeepSeek's Interruption, Nvidia Will Still Be the First Artificial Intelligence (AI) Stock to Reach a $4 Trillion Valuation. Here's Why. | The Motley Fool

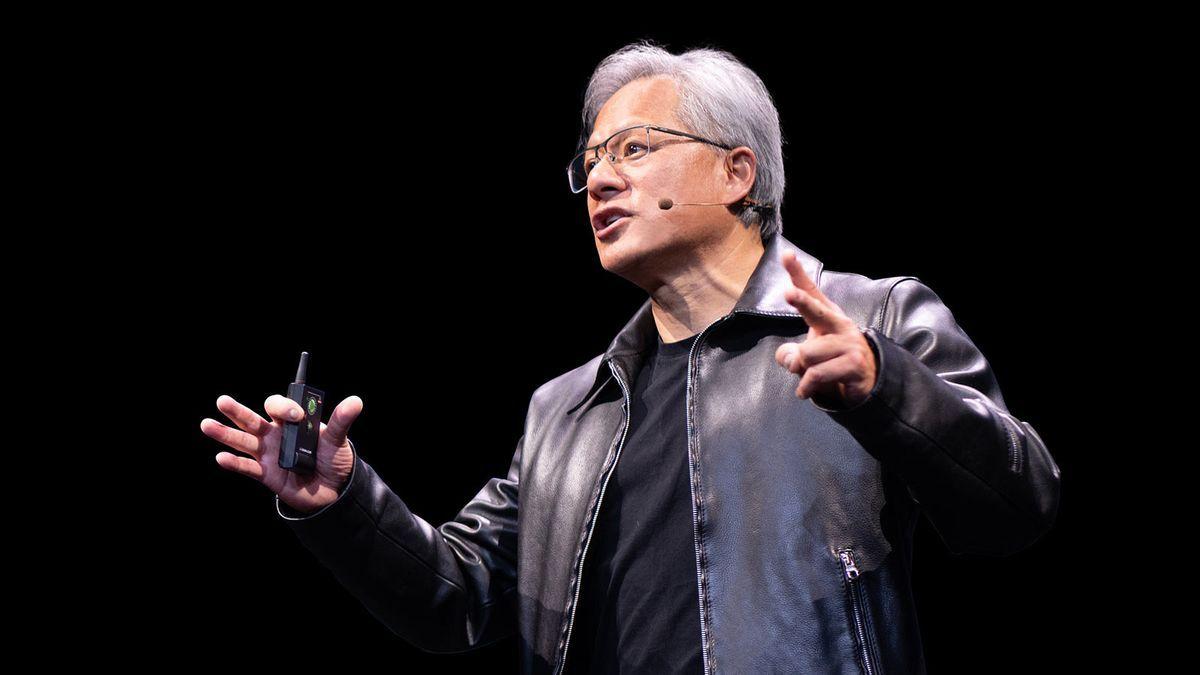

Nvidia stock has been in a downward tumble as fears from a new Chinese start-up called DeepSeek linger. OpenAI commercially launched ChatGPT on Nov. 30, 2022. In my eyes, that date represents the dawn of the ongoing artificial intelligence (AI) revolution. For much of the last two years, no other company has witnessed such an epic rise as Nvidia (NVDA 2.87%). Between Nov. 30, 2022 and Jan. 24, 2025, shares of Nvidia soared by 743% -- adding nearly $3 trillion in market value to the company. This meteoric rise captivated the investment world, inspiring investors to plow into Nvidia stock at all costs (literally). As is often the case in situations like these, investors begin to only consider one side of the story -- namely, that the stock in question will continue rising because nothing bad could possibly happen. But as seasoned investors are well aware, the capital markets always have something up their sleeves. In late January, a Chinese start-up called DeepSeek emerged in the AI realm -- claiming that it built a platform on par with ChatGPT, but for a mere fraction of the cost. Basically overnight, the investment world went into shock, and unsurprisingly, Nvidia stock tanked. All of a sudden, the bull narrative surrounding Nvidia seems to have disappeared as investors continue panic selling. I'm going to detail just how much Nvidia has been impacted by DeepSeek so far. Moreover, I'll make the case for why I think the sell-off is overblown and explain why I think Nvidia will become the first $4 trillion stock on Wall Street. Prior to DeepSeek's arrival, Nvidia boasted a market capitalization of $3.5 trillion. As of this writing (Feb. 4), Nvidia's value has dropped by almost $600 billion. This is quite a decline in value, considering investors don't yet know how DeepSeek is going to change the trajectory of Nvidia's business. I say that because the company has not yet reported earnings for the fourth quarter of 2024 -- and isn't scheduled to do so until Feb. 26. The three most valuable companies in the world, as measured by market cap, are Apple, Microsoft, and Nvidia. For the sake of this article, one of these three companies has the most realistic chance of reaching a $4 trillion valuation before any of its cohorts. As I explained in a prior article, much of the upside in Apple stock hinges on a successful iPhone 16 launch and adoption rates of the company's new AI, dubbed Apple Intelligence. While this is my personal opinion, I'm not entirely convinced that Apple Intelligence will be a game changer, so I have some doubts over whether investors will be enthusiastic buyers of Apple stock this year. Although I see Microsoft as more of a growth opportunity compared to Apple, I am questioning what direction the stock could be headed. Much of the bull thesis surrounding Microsoft is rooted in the company's cloud computing infrastructure, Azure. Azure competes heavily with Amazon Web Services (AWS) and Google Cloud Platform (GCP). While each of these cloud hyperscalers is investing billions into AI-powered services, the intense competitive landscape simply cannot be dismissed. While Azure is a robust business overall, demand trends can be quite difficult to forecast. In my eyes, it's hard to match investor expectations with an unpredictable business. For this reason, I think Microsoft stock is a bit vulnerable and could experience sharp turns in either direction based on how investors feel about the performance of Azure and the company's AI investments. There are still a lot of unknown variables as they relate to precise dollar figures and the training methodologies that DeepSeek used to build its model, called R1. But even if the Chinese start-up did achieve a technological breakthrough in which it built highly capable AI for a lower cost compared to other models, is Nvidia really at risk here? I'll ask the same question differently: If businesses can train AI for more efficient, less expensive protocols, what direction do you think spending on AI infrastructure will go? According to Jevons paradox, spending would actually rise. This concept explores the idea that efficiencies brought by technology helps lead to lower prices, but paradoxically, winds up leading to more spending as goods and services become more accessible. In other words, just because AI development might cost less over time, this does not also imply that demand for Nvidia's services would diminish. It's actually quite the contrary. I'm aligned with this idea, and I think demand levels for Nvidia's architecture could in fact enter a new phase of growth precisely because of DeepSeek. In order for Nvidia to reach a $4 trillion valuation, shares would need to gain 38% from current levels (as of Feb. 4). Should investors be pleased with Nvidia's earnings report later this month, I wouldn't be surprised to see the stock bounce back to where it was before the DeepSeek hoopla -- in which case, investors would only need to see about a 14% share price increase to achieve the $4 trillion valuation. If management can demonstrate that demand for its processors remains robust, then I think some new life in Nvidia stock is highly achievable. In my eyes, DeepSeek should be a net benefit for Nvidia in the long run, and I think the stock could be headed to new highs.

[2]

Prediction: This Unstoppable Stock Will Soar to $10 Trillion By 2030 | The Motley Fool

An industry-leading position and strong secular tailwinds should help drive this artificial intelligence (AI) pioneer higher. Artificial intelligence (AI) has taken center stage over the past couple of years, and there's good reason to think this is just the beginning. Developers are still coming up with new applications for the technology, which is being harnessed to create original content, streamline business processes, and increase productivity. It's still early days for the adoption of AI and the evidence suggests spending has only just begun to ramp up. In fact, the biggest names in technology -- Microsoft, Meta Platforms, Alphabet, and Amazon -- have announced plans to collectively lay out more than $315 billion for the capital expenditures necessary to support AI in 2025, and these outlays show no signs of slowing. The undisputable beneficiary of much of this spending is Nvidia (NVDA 3.16%). The company developed the graphics processing units (GPUs) that have become the gold standard for processing AI and could parlay the unrelenting demand into charter membership of the $10 trillion club. Nvidia created the GPU in 1999 to create realistic images in video games. The groundbreaking development was parallel processing, which processes a multitude of mathematical computations simultaneously. By breaking up these large computing jobs into smaller, bite-sized chunks, Nvidia's chips were a game-changer. Over the years, however, these same processors have proven adept at other applications, including cloud computing and data center operations -- where AI lives. The unrelenting demand for these chips has driven Nvidia's financial results and its stock price to new heights. Over the past decade, Nvidia's revenue has grown by 2,950% (as of market close on Monday), while its net income has surged 14,310%. Furthermore, the company's consistent financial results have fueled a blistering rise in its stock price, which has soared 23,960%. In its fiscal 2025 third quarter (ended Oct. 27), Nvidia generated record revenue of $35 billion, which surged 94% year over year and 17% sequentially. This fueled adjusted earnings per share (EPS) that soared 103% to $0.81. The headline was the data center business, including chips used for cloud computing, data centers, and AI. Revenue for the segment clocked in at $30.8 billion, up 112%, driven by unprecedented demand for AI. This could be just the beginning. Goldman Sachs Research estimates the AI market could be worth $7 trillion by 2030, with Nvidia supplying the chips that underpin the technology. Nvidia currently sports a market cap of roughly $3.27 trillion (as of this writing). That means it will take stock price gains of 212% to drive its value to $10 trillion. According to Wall Street, Nvidia is poised to generate revenue of more than $129 billion in fiscal 2025, giving it a forward price-to-sales (P/S) ratio of roughly 25. Assuming its P/S remains constant, Nvidia would need to grow its revenue to roughly $402 billion annually to support a $10 trillion market cap. Wall Street is forecasting annual revenue growth for Nvidia of 40% over the next five years. If the company can attain that benchmark, it could reach a $10 trillion market cap as early as 2029. But don't take my word for it. Beth Kindig, CEO and lead tech analyst for the I/O Fund, estimates that Nvidia's market cap will reach $10 trillion by 2030 (emphasis mine): "We believe Nvidia will reach a $10 trillion market cap by 2030 or sooner through a rapid product road map, its impenetrable moat from the CUDA [Compute Unified Device Architecture] software platform, and due to being an AI systems company that provides components well beyond GPUs, including networking and software platforms." Given the rapid and accelerating adoption of AI, I think Kindig is spot-on in her assessment. That said, investors should be prepared to deal with the inevitable volatility. Given its meteoric rise over the past few years, any failure on Nvidia's part -- real or imagined -- could crater the stock price, a fact we've seen play out in recent months. Reports that Chinese start-up DeepSeek's R1 model was on par with OpenAI's o1 model -- and was developed using older processors at a fraction of the cost -- crushed Nvidia, as the stock plunged 17% and lost $600 billion in market cap in a single day. The popular narrative was that there would be no need to use cutting-edge GPUs when inferior ones would work just as well. Analysts have had time to digest the news and have found some of DeepSeek's claims to be questionable. Wall Street expects Nvidia to generate EPS of $4.44 in fiscal 2026, which began in late January. That works out to roughly 30 times forward earnings (as of this writing). That's well below the stock's average forward multiple of 42 over the past five years and an attractive price to pay for a company supplying the picks and shovels fueling the AI revolution.

[3]

NVIDIA Can Earn $259 Billion In AI Revenue By 2027, Believes Analyst

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. Chip designer NVIDIA Corporation could earn $259 billion in AI revenue by 2027 believes Mizuho's analyst Vijay Rakesh. Rakesh kept an Overweight rating for the shares and a $175 share price target in his note before the firm's highly anticipated earnings later this month. NVIDIA, whose shares are at the center of Wall Street's AI attention, lost close to $600 billion in market value last month during the DeepSeek selloff. While the shares have pared back some of their losses since then, investors are waiting to see whether the orders for its GPUs will materialize. Even before the DeepSeek selloff, NVIDIA's shares had lost some of their shine when it came to gains. While the firm was the most valuable technology company in the world, between the mid-June 2024 peak and before the selloff, its shares had added a modest 8.6%, which sharply lagged the S&P 500's 11.5% in gains. The reason behind NVIDIA's sluggish share price movement lay in investors pausing to take stock of its margins and purported delays for the Blackwell GPUs. NVIDIA admitted in 2024 that Blackwell design problems had increased costs, and in 2025, the narrative for the latest AI GPUs appears to have shifted to their deliveries. Mizuho's Vijay Rakesh comments on Blackwell shipments in a fresh note released today. The analyst believes that the first half of 2025 will be lackluster for the Blackwell ramp. As a result, he has trimmed his second fiscal quarter revenue estimates for NVIDIA to $36.7 billion. Rakesh believes that cooling requirements on the GB200 are a key driver behind the orders being shifted later into the year. However, his long-term outlook for NVIDIA is positive. Within the note, Mizuho maintains a total addressable market (TAM) estimate for artificial intelligence accelerators at $350 billion and expects NVIDIA to capture 74% of the pie. The expected market share means that NVIDIA could earn $259 billion in AI revenue by 2027. Its smaller rival AMD is estimated to capture a modest 4% of the market, while custom AI chips, such as those designed by Broadcom and Marvell, are expected to command a 21% market share. AMD's shares are down by 34% over the past year as Wall Street has soured on the firm's ability to capture the AI market by computing with NVIDIA and custom designers and wondered whether it could sustain growth momentum in the personal computing market. For NVIDIA's fiscal fourth quarter, which ended in January, Mizuho believes that the firm can rake in $37.5 billion in revenue and $0.83 in adjusted EPS. The expected Blackwell ramp shifting in H2 has led it to reduce its fiscal year 2026 Q1 revenue estimate by $700 million to $41.1 billion and slash the EPS estimate by two cents to 89 cents a share. However, for NVIDIA's current fiscal year, which will end in January 2026, Mizuho believes the firm can earn $196 billion in revenue, up from its earlier $189 billion estimate.

[4]

1 Unstoppable Artificial Intelligence (AI) Stock to Buy Before It Punches Its Ticket to the $4 Trillion Club | The Motley Fool

The $4 trillion club is still awaiting its founding member, and although there is no way to know for sure which company will get there first, the following three names likely have the most realistic chance: Even though Apple is closest to the mark, Nvidia is generating enough growth to potentially reach $4 trillion first, thanks to its leadership position in the artificial intelligence (AI) hardware industry. But the candidate I want to focus on today is Microsoft because its efforts to weave AI into its portfolio of legacy products are starting to yield incredible results. During its fiscal 2025 second quarter (ended Dec. 31), the company's AI cloud revenue alone soared by 157%. There is no guarantee that Microsoft will beat Apple or Nvidia to the $4 trillion milestone, but here's why I think it has the most potential to not only get there eventually but stay there for the long term. Microsoft invested around $14 billion in ChatGPT creator OpenAI since 2019, and it used some of the start-up's latest models to create its Copilot virtual assistant. Microsoft embedded Copilot into flagship software products like Windows, Edge, and Bing, which can be used to answer complex questions and even generate images, free of charge. However, Copilot is also available as a paid add-on for customers who use products like the 365 productivity suite, which includes applications like Word, Excel, and PowerPoint. Enterprises around the world pay for over 400 million 365 licenses for their employees, and practically all of them are candidates to add Copilot. Microsoft's Q2 results suggest demand is rapidly climbing. The company said customers who bought Copilot during its first quarter of availability 18 months ago have since expanded their seats by a whopping tenfold. Plus, their employees used Copilot 60% more frequently in Q2 than they did in the fiscal 2025 first quarter. Moreover, Microsoft says 160,000 organizations used its Copilot Studio platform, which allows them to create custom AI agents. An agent can be deployed into almost any software application that employees use to complete their jobs, and they are capable of doing everything from summarizing virtual meetings, to onboard new team members. During Q2, companies created over 400,000 custom agents, which was double the number they created in Q1. Copilot is only one piece of Microsoft's AI strategy. The company's cloud computing platform, Azure, has become a go-to destination for businesses seeking computing capacity from state-of-the-art data centers and ready-made large language models (LLMs) from third-party developers like OpenAI. They are two of the main ingredients needed to build AI software. Azure's overall growth is increasingly driven by AI revenue, which soared by 157% during Q2 compared to the year-ago period. That meant Azure AI alone accounted for 13 percentage points of the Azure cloud platform's overall revenue increase of 31%: Demand for data center capacity from AI developers continues to exceed supply, so Microsoft is investing heavily in building new infrastructure. The company has already allocated $42.6 billion to capital expenditures (capex) in the first six months of fiscal 2025, most of which went toward data center infrastructure and chips from suppliers like Nvidia. That followed $55.7 billion in capex spending during fiscal 2024. Azure AI's revenue is a good way for investors to assess the payoff Microsoft is earning for all of that spending. As long as it continues to contribute an increasing amount of growth to the Azure cloud business overall, the company's substantial investments make sense. Nvidia CEO Jensen Huang believes cloud operators could earn $5 for every $1 they spend on his company's AI hardware (over four years), so if he's right, Microsoft's capex spending could result in hundreds of billions of dollars in new revenue. Microsoft stock trades at a price-to-earnings (P/E) ratio of 33.2, which is roughly in line with the 33.3 P/E ratio of the Nasdaq-100 index. In other words, you could argue that Microsoft is fairly valued relative to its big-tech peers at the moment. If we assume Microsoft's P/E ratio remains constant from here, it has to grow its earnings per share (EPS) by 33% to warrant a valuation of $4 trillion. Since it has grown its EPS by an average of 20.6% annually over the past decade, it could get there in less than two years. With that said, the company is growing below trend right now, partially due to its enormous AI capex spending, which is eating into its earnings. It's on track for an EPS increase of 11.5% in fiscal 2025, followed by a 14.5% increase in fiscal 2026, according to Wall Street's consensus forecast (provided by Yahoo). If its 14.5% growth rate persists, Microsoft could become a $4 trillion company during fiscal 2027 (two and a half years from now). However, its stock also trades at a discount to both Apple and Nvidia, which are the only other two companies to cross the $3 trillion valuation milestone. If its P/E ratio increases (a phenomenon called multiple expansion), it could enter the $4 trillion club much sooner. This typically happens when investors see a company's growth accelerating, and AI could be the catalyst to make it happen for Microsoft. Microsoft says its total AI revenue across all of its businesses is now at an annual run rate of $13 billion (based on its Q2 result, multiplied by four), which is up by an eye-popping 175% compared to the year-ago period. It's still a fraction of Microsoft's overall revenue, which came in at $245 billion in fiscal 2024, but if AI revenue continues to increase by triple-digit percentages, it won't be long before it's a major driver of the company's overall growth at the top and bottom line.

[5]

1 Magnificent Stock That Could Join Nvidia, Microsoft, and Apple in the $3 Trillion Club | The Motley Fool

Eight American technology companies joined the exclusive $1 trillion club since Apple blazed the trail in 2018, but only three have gone on to amass valuations of $3 trillion or more: One more could join them within the next couple of years. Alphabet (GOOG 0.01%) (GOOGL 0.14%) is the world's fifth-largest company, with a market capitalization of $2.3 trillion. It's experiencing strong growth thanks to artificial intelligence (AI), which is transforming its legacy businesses, such as Google Search and Google Cloud. Here's how Alphabet can chart a path to the ultra-exclusive $3 trillion club. AI chatbots like OpenAI's ChatGPT offer a new way to access information online. Since they can provide direct answers to almost any question, they provide a more convenient user experience than traditional search engines, like Google, which require users to sift through web pages to find the information they need. Alphabet developed the Gemini family of large language models (LLMs) to compete with OpenAI's latest models, and it released a chatbot with the same name. However, Gemini is also powering new features within Google Search to protect its dominant market share during the AI era. One of those features is AI Overviews, which uses a combination of text, images, and links to third-party websites to produce complete responses to user queries. They appear at the top of the traditional search results, so users no longer have to click through to different web pages. Alphabet says Overviews are live in more than 100 countries and are driving people to use Google Search more frequently because they can ask different questions and extract more information than before. Plus, Alphabet says Overviews monetize just as well as traditional sponsored ads in Google Search results, so they shouldn't cannibalize its advertising business. Last year, Alphabet noticed that the links placed within Overviews received more clicks than the same links placed among traditional search results, which might create an opportunity to make even more money in the future. Monetization is extremely important because Google Search generated $54 billion in revenue during the fourth quarter of 2024 (ended Dec. 31), representing more than half of Alphabet's total revenue of $96.4 billion. Although the search business accounts for the lion's share of Alphabet's revenue, Google Cloud is the conglomerate's fastest-growing segment. It generated $11.9 billion in revenue during Q4, up 30% from the year-ago period (compared to just 12% growth in search revenue). Google Cloud operates data centers worldwide and provides many different services to help its business customers transition into the digital age. However, it's also becoming a popular destination for businesses needing data center computing capacity and ready-made LLMs (like Gemini) to build their own AI software. Alphabet says customers are currently using eight times the amount of computing capacity for AI training and inferencing than they were just 18 months ago. Plus, the number of developers using Gemini models to create their own AI software through Google Cloud doubled over the last six months to 4.4 million. Moreover, Google Cloud's AI developer platform, Vertex AI, saw a fivefold increase in customers during 2024 and a whopping 20-fold increase in usage. It now hosts more than 200 LLMs (including Gemini) for customers to choose from, giving them an incredible amount of variety to suit almost every use case. Alphabet allocated a record $52 billion to capital expenditures (capex) during 2024, most of which went toward building AI data center infrastructure and buying chips from suppliers like Nvidia. The company plans to increase its capex spending to $75 billion during 2025, which is the main reason its stock price sank by 7% the day after these results were released. Capex spending eats into profits, so investors are concerned about a potential dip in Alphabet's future earnings. However, Nvidia CEO Jensen Huang says for every $1 cloud providers spend on AI hardware, they could earn $5 over four years. Therefore, the long-term payoff could be enormous for Alphabet and its shareholders. Alphabet generated $8.04 in earnings per share (EPS) during 2024, which places its stock at a price-to-earnings (P/E) ratio of 23.7. That makes it significantly cheaper than Nvidia, Microsoft, and Apple, which trade at an average P/E ratio of 39.7: If Alphabet's P/E ratio simply rises to meet the average of the other three $3 trillion companies (39.7), it would translate to a 67% increase in its stock price and its market capitalization. In other words, Alphabet would become a $3.8 trillion company. Alphabet could also join the $3 trillion club if its P/E ratio remains the same (23.7) but grows its EPS by 30%. Wall Street's consensus forecast (provided by Yahoo!) suggests Alphabet's EPS could reach $10.22 in 2026, translating to 27% growth over the next two years. That means the company's valuation could cross $3 trillion sometime in 2027, with only a tiny amount of EPS growth required that year. I think a mixture of a higher P/E ratio and higher EPS will catapult Alphabet into the $3 trillion club sometime in the next 12 to 18 months. The company's P/E is currently so low because it lost a lawsuit against the U.S. Department of Justice last year in which it was found guilty of monopolistic practices. The official punishment is expected to be handed down later this year. The lawsuit was brought in 2020, at the tail end of President Donald Trump's first term, but he has returned to office with a very aggressive plan to slash regulation for businesses. When President Joe Biden was in the White House, the DOJ asked the judge to consider breaking Alphabet apart, which would hurt the company's earnings potential. However, on the campaign trail last year, Trump suggested he wasn't in favor of that outcome. If the punishment amounts to a simple financial penalty instead (which sounds like the more probable outcome under Trump's DOJ), I think Alphabet's P/E ratio could soar from here and create a much easier path to the $3 trillion club.

Share

Share

Copy Link

Nvidia faces a market cap drop after DeepSeek's AI claims, but analysts remain bullish on its long-term AI revenue potential and path to a $4-10 trillion valuation by 2030.

Nvidia's Market Valuation Rollercoaster

Nvidia, a frontrunner in the artificial intelligence (AI) revolution, has experienced a tumultuous journey in the stock market. Between November 30, 2022, and January 24, 2025, Nvidia's shares soared by 743%, adding nearly $3 trillion in market value

1

. However, this meteoric rise was interrupted in late January 2025 when Chinese start-up DeepSeek emerged, claiming to have built an AI platform comparable to ChatGPT at a fraction of the cost. This news sent shockwaves through the investment world, causing Nvidia's stock to plummet and wiping out almost $600 billion in market value1

2

.DeepSeek's Impact and Analyst Predictions

Despite the initial panic, some analysts believe the sell-off is overblown. They argue that even if DeepSeek's claims are true, it could paradoxically lead to increased demand for Nvidia's AI infrastructure. According to Jevons paradox, technological efficiencies that lower prices often result in increased overall spending as goods and services become more accessible

1

.Mizuho analyst Vijay Rakesh maintains an optimistic outlook for Nvidia, predicting that the company could earn $259 billion in AI revenue by 2027. Rakesh estimates that Nvidia will capture 74% of a $350 billion total addressable market for AI accelerators

3

. For the current fiscal year ending January 2026, Mizuho projects Nvidia's revenue to reach $196 billion3

.Path to $4-10 Trillion Valuation

Several analysts and investors are bullish on Nvidia's long-term prospects. Some predict that Nvidia could be the first AI stock to reach a $4 trillion valuation, requiring a 38% gain from its current levels

1

. More ambitious forecasts suggest Nvidia could hit a $10 trillion market cap by 2030 or sooner, according to Beth Kindig, CEO and lead tech analyst for the I/O Fund2

.AI Industry Growth and Competition

The AI market is estimated to be worth $7 trillion by 2030, according to Goldman Sachs Research

2

. While Nvidia currently dominates the AI chip market, it faces competition from other tech giants and custom AI chip designers. AMD is expected to capture a modest 4% market share, while custom AI chips from companies like Broadcom and Marvell could command 21% of the market3

.Related Stories

Challenges and Considerations

Nvidia's journey to a higher valuation is not without obstacles. The company faces potential delays in the rollout of its next-generation Blackwell GPUs, with cooling requirements for the GB200 cited as a key factor in shifting orders later into the year

3

. Additionally, investors should be prepared for volatility, as demonstrated by the recent market reaction to DeepSeek's claims2

.Broader AI Landscape

While Nvidia leads in AI hardware, other tech giants are making significant strides in the AI race. Microsoft's AI efforts, particularly its Copilot virtual assistant and Azure AI services, are yielding impressive results. Microsoft's AI cloud revenue alone surged by 157% in its fiscal 2025 second quarter

4

. Similarly, Alphabet is leveraging AI to transform its core businesses like Google Search and Google Cloud, positioning itself as a potential candidate to join the $3 trillion valuation club in the near future5

.As the AI revolution continues to unfold, Nvidia's position as a key supplier of the underlying hardware positions it well for potential growth. However, the rapidly evolving landscape and intense competition in the AI sector mean that investors should closely monitor developments in this dynamic field.

References

Summarized by

Navi

[2]

[4]

Related Stories

Nvidia's Dominance in AI Chip Market Fuels Unprecedented Growth and Valuation

18 Nov 2024•Technology

Nvidia Surges Towards $4 Trillion Valuation, Fueled by AI Chip Demand

02 Jul 2025•Business and Economy

AI Giants Race to $4 Trillion Valuation: Nvidia, Microsoft, and Apple Lead the Pack

28 Dec 2024•Technology

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation