AI Investment Boom: Bubble or Sustainable Growth?

9 Sources

9 Sources

[1]

AI's double bubble trouble

Stock market bears are on the prowl again growling about the dangers of a tech bubble. Ursine analysts at the IMF, the Bank of England, Goldman Sachs, JPMorgan Chase and Citi are all warning that valuations are surging to levels not seen since the dotcom crash 25 years ago. The implicit message is that AI is overhyped. The reaction of bullish west coast tech bros has been to shrug and carry on investing, drawing a distinction between a "good" industrial investment bubble and a "bad" speculative financial bubble. But the strong likelihood is that we are experiencing both. One of the most articulate advocates of the good bubble theory is Google's former boss Eric Schmidt. "Bubbles are great. May the bubbles continue," he told me at the Sifted summit last week. Their historical function has been to redirect masses of capital into frontier technology and infrastructure, which is good for the world. But the latest technological transformation comes with a novel twist: AI will one day far exceed the cognitive capabilities of humans. "I think it's underhyped, not overhyped. And I look forward to being proven correct in five or ten years." Valuations might appear overblown. But what, Schmidt asked as a thought experiment, would happen if a tech company attained artificial general intelligence (AGI) and then superintelligence? Such technology would exceed the sum of human knowledge and then solve the world's hardest problems. "What's the value of that company? It's a very, very large number. Much larger than any other company in history, forever, probably." For sure, some companies over-invest in infrastructure in bubbly times and go bust, as was the case with Global Crossing, which built out telecoms infrastructure in the 1990s, and the Channel Tunnel, which needed to be recapitalised twice. But Schmidt dismissed the idea that the same would happen to financially robust AI companies today. "The people who are investing hard-earned dollars believe the economic return over a long period of time is enormous. Why else would they take the risk?" he said. "These people are not stupid." Even if one accepts this argument, it is hard to ignore the financial bubble frothing up on top of the industrial investment boom. Is the privately owned OpenAI, on course to burn $8.5bn of cash this year, worth $500bn (unless it does attain AGI)? Does it make sense that the data and AI company Palantir is trading on a forward price/earnings multiple of 225 (the highest valuation of any S&P 500 company)? At best, such valuations embrace defiantly heroic assumptions about the long-term earning power of these companies. At worst, they resemble expensive lottery tickets on the future. Short selling hedge funds are already on crash watch, but for the moment they are being badly burned given the strength of the market. Some fund managers are closely tracking bitcoin miners, which are rapidly pivoting into AI computing services. They suggest that those, like Cipher Mining and Terawulf that are largely financing their expansion through debt and convertible notes, may be vulnerable to any downswings in demand. The collapse of auto supplier First Brands Group is already causing jitters in private credit markets. Even some in the tech industry -- including Bret Taylor, OpenAI's chair -- draw parallels with the dotcom bubble and think valuations may have run ahead of reality. Taylor recently told The Verge that AI would transform the economy and create huge value in the future. But he added: "I think we're also in a bubble, and a lot of people will lose a lot of money." When asked this week whether we were in an AI bubble, the scientist and entrepreneur Stephen Wolfram said: "The answer is obviously yes." And what did he make of all the talk about AGI? "It's a meaningless thing," he said, during an onstage interview at the London Institute for Mathematical Studies. Naming a technology after an ambition rather than a reality struck another participant as odd, rather like describing economics as universal prosperity. There are also questions about whether the AI investment boom will leave behind the computational infrastructure of the 21st century in the same way that previous investment booms bequeathed railway tracks, power grids and telecoms networks. As the tech analysts Azeem Azhar and Nathan Warren noted in a recent essay, about one-third of AI-related capital expenditure is being sunk into shortlived assets, such as Nvidia's graphics processing units. But GPUs age in dog years, as the authors put it, with a useful life for frontier applications of about three years. That implies that AI companies' investments must generate a return within a few years, rather than generations. However, they add, that depreciation drag might also impose greater discipline on investors. There seems little doubt that AI is opening up all kinds of scientific and economic possibilities that are as yet impossible to predict, model or value. Wolfram argued that AI could transform scientific discovery given the extra computing power that could be thrown at so many problems. As it is, humans rely on 100bn neurons to understand the universe. What becomes possible with the 100tn neurons that AI could in effect give us? The scientist said he had been living the "AI dream" for 40 years. Now, it seems, it is finally being realised. The question is: at what price?

[2]

'Of course it's a bubble': AI start-up valuations soar in investor frenzy

Ten lossmaking artificial intelligence start-ups have gained close to $1tn in valuation over the past 12 months, an unprecedented increase that adds to fears about an inflating bubble in private markets that could spill over into the wider economy. OpenAI, Anthropic and Elon Musk's xAI have seen their values marked up repeatedly over the past year amid a rush to back young AI companies. Smaller groups building AI applications have also surged, while established start-ups including Databricks have soared after embracing the technology. US venture capitalists have splashed $161bn over the year to date on a technology whose promise has not yet been matched by major economic gains. That equates to two-thirds of their total spend, according to PitchBook. The bulk of investment has been funnelled to just 10 AI groups -- Perplexity, Anysphere, Scale AI, Safe Superintelligence, Thinking Machines Lab, Figure AI, Databricks, as well as OpenAI, Anthropic and xAI. That has pushed up their combined valuations by almost $1tn, according to FT calculations. "Of course there's a bubble," said Hemant Taneja, chief executive of venture capital firm General Catalyst, which raised an $8bn fund last year and has backed Anthropic and Mistral. "Bubbles are good. Bubbles align capital and talent in a new trend, and that creates some carnage but it also creates enduring, new businesses that change the world." Tech has endured boom and bust cycles. The dotcom crash in 2000 decimated a generation of internet companies, and VCs are still picking through the debris left after a software investment frenzy stoked by low interest rates came to a juddering halt in 2022. But the current scale of investment is of a different magnitude. VCs invested $10.5bn into internet companies in 2000, roughly $20bn adjusted for inflation. In all of 2021, they put $135bn into software-as-a-service start-ups, according to PitchBook. VCs are on course to spend well over $200bn on AI companies this year. "We have gone from the doldrums to animal spirits in a few months," said an executive at one US investment firm. "It's FOMO." Investors are bullish the technology will open multiple new multitrillion-dollar markets, from automated software engineering to AI companionship. AI is a technology which "adds a zero to everything", says Sameer Dholakia, an investor at Bessemer Venture Partners. But there are concerns that indiscriminate spending has made valuations unrealistic. Start-ups with around $5mn in annual recurring revenue, a metric used by fast-growing young businesses to provide a snapshot of their earnings, are seeking valuations of more than $500mn, according to a senior Silicon Valley venture capitalist. Valuing nascent businesses at 100 times their earnings or more dwarfs the excesses of 2021, he added: "Even during peak ZIRP [zero-interest rate policies], these would have been $250mn-$300mn valuations." "The market is investing as if all these companies are outliers. That's generally not the way it works out," he said. VCs typically expect to lose money on most of their bets, but see one or two pay the rest off many times over. "There will be casualties. Just like there always will be, just like there always is in the tech industry," said Marc Benioff, co-founder and chief executive of Salesforce, which has invested heavily in AI. He estimates $1tn of investment on AI might be wasted, but that the technology will ultimately yield 10 times that in new value. "The only way we know how to build great technology is to throw as much against the wall as possible, see what sticks, and then focus on the winners," he added. Sam Altman, OpenAI's chief, has also argued its effort to build artificial general intelligence, or AGI -- capable of matching humans across all economically valuable tasks -- will create huge benefits, even if some capital is misallocated on the way. "It could be analogous to internet 1.0," said Lucas Swisher, a partner at Coatue who has backed OpenAI, Databricks and SpaceX. "Then, a few companies like Google and Meta grew extremely quickly and ended up owning the vast majority of their markets." He added: "In this wave we are seeing that only a few companies matter, they are black holes, everything else gets sucked in. But it might be 15 companies this time rather than five." Meanwhile, the increasing influence private start-ups such as OpenAI have on the public markets has created a greater risk of contagion should their bets fail. Shares in AMD, Nvidia, Broadcom and Oracle gained hundreds of billions after the companies struck deals to deliver computing power to OpenAI in recent weeks. If questions over the lossmaking start-up's ability to pay are not resolved, those gains could unwind, dragging the market down. Three years after releasing ChatGPT, OpenAI's revenue is $13bn on an annualised basis, an unheard of growth rate for a start-up. But OpenAI and peers are competing with Meta, Google and others in a hugely capital intensive race to train ever-better models, meaning the path to profitability is also likely to be longer than for previous generations of start-ups. The deals with chipmakers, like VC investment, are a bet that AI demand will continue its stratospheric growth, helped along by research breakthroughs and new products. Sebastian Mallaby, author of The Power Law, about the history of the VC industry, summarised the thinking among investors as "'if we have AGI this will all be worth it, if we don't it won't'." He added: "It comes down to these articles of faith about Sam's ability to work it out."

[3]

I just watched Stephen Hawking win an F1 race in Sora 2, and now I think AI may be a bubble

"AI is a bubble" is something I hear on an almost daily basis from my friends and family members. And while I used to disagree -- really seeing the benefits of using it in my day-to-day -- I'm starting to come around to the idea of it. And what really started changing my mind was opening up TikTok one day, and hearing a hyped up commentator yell "Hawking still out front," as his wheelchair hits top speed out in front of the F1 pack. This is Sora 2, and I don't even want to think about how much GPU compute and energy was used in creating this video. So what's happening right now? And are there serious concerns about this being the Dot-com bubble all over again? Being real, I found the initial burst of Sora 2 videos funny, and it is indeed the best video generation platform of the bunch. I'm not a grump -- I did chuckle at the Queen entering a WWE ring and slamming a wrestler through a table. But how does it make money perpetually? I can appreciate why some companies are doing this, because look at the numbers. The last time OpenAI had a huge influx of new ChatGPT users was back when everybody turned their photos into Studio Ghibli-inspired illustrations. Giving the people something fun and meme-able seems to be a good way to drum up interest. But these videos are being made and shared straight to TikTok, which shuts OpenAI out of that moneymaking opportunity. Then there's what other companies cooked up at around the same time -- Meta Vibes hasn't landed anywhere near as positively as the Zuck was hoping for, xAI brought an NSFW option to market that has Elon Musk posting like a horny teenager on his X page. I never like to be judgmental, but it is getting weird. Basically, the promise of artificial general intelligence has taken a backseat in the long term. And in the near-term, we're getting infinite-scrolling AI slop. So how is this all being paid for? Well, I took a closer look. So, as I get into this, I want you to keep this phrase in mind. Vendor financing is essentially when the maker of lucrative products not only gives customers a product on a loan, but actively finances the growth of said customers. Apropos of the common way people describe Nvidia in the AI gold rush, imagine there's only one store that sells picks and shovels. Now, let's say there's a prospector (let's call him Sam for no foreshadowing reason whatsoever) who has a map that may lead to a huge location of gold, but he is flat broke. Instead of kicking the prospector out of their picks and shovels store, the owner says, "I'll give you a loan to buy the shovel from me," on the promise of finding this gold, and they mark it down as a big sale in their books (even though no money changed hands). Now, that store is relying on not just that prospector's map being correct and finding the gold, but their ability to keep borrowing money and paying back. It's a cycle that eventually forms a bubble based on the promise of something great in the future, and not a current reality. Got that? Good. Yes, I did use Veo 3.1 to make that clip you see illustrating the point. OpenAI's Sam Altman has a challenge. He has been looking for ways to fund his trillion-dollar AI plan -- he needs all the AI compute he can get for his vision to change the world. And so, the company turned to Oracle and signed a $300 billion cloud computing agreement over five years to get the massive amount of computing power needed for training and running its next-generation AI models. Paid at $60 billion per year, this is a little worrying given OpenAI's revenue is estimated at around $13 billion, and they burn roughly $8.5 billion per year. How's Altman going to pay the tab? Well, let me get to that in a second. So Oracle now has the contract -- where do they go to build out these data centers? Well, they're going to Nvidia -- spending billions of dollars on Team Green's AI chips and hardware to make this work. And now, OpenAI is promising to pay Oracle, who is paying Nvidia. How does OpenAI get the money to pay Oracle? Well, as you've probably already heard, Nvidia is investing up to $100 billion in OpenAI -- a long-term financial commitment by the dominant chipmaker in the AI space to fund these expansion plans. So what you have here is the same money being passed in a virtuous cycle between these three companies. Of course, money is lost in every part of this cycle for fees, wages, manufacturing costs and whatnot (that's a whole other story). But this is being propped up by excitement (potentially over-excitement) from Wall Street investors, personal stock buys and your 401Ks. Money keeps going in from us to keep the cycle going, with the mission of reaching AGI. To a '90s kid like me, this sounds familiar. Let's take Cisco, for example -- Dot-com startups needed billions of dollars of Cisco hardware to build fiber networks and run websites, but they were unprofitable with valuations based on a promise of the future. So Cisco loaned money directly to them for purchasing the equipment, and that made Cisco look great in a very inflated kind of way -- revenue numbers more metaphorical than literal. But once those startups failed, that led to massive write-offs for Cisco and exposed the fake revenue. We have the infrastructure now, and the market did recover (it's how I'm writing to you now), but this came long after the bubble burst, and regular folks like you and me felt the pinch of a significant loss in 401k retirement savings. Yes? ...maybe. It's a little vague, so let me pose two options for you. Three key factors caused the Dot-com bubble: ...sound familiar? OpenAI and xAI are valued extremely highly, but are unprofitable. Nvidia is extremely profitable, but the market is pricing in years of strong future growth at this explosive rate we're seeing -- growth that is happening partly due to some of the vendor financing at play here. And Meta's core business (social media platforms and ads) is highly profitable, so the issue with Zuck & Co. is not a lack of profit, but rather that the tens of billions they're throwing at AI fails to materialize in a profitable next-generation platform. The entire U.S. stock market is propped up on the Magnificent Seven -- Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta and Tesla. That is "unsustainable," as Goldman Sachs analysts see it, but they don't see it as a bubble. Their main reasoning is down to two things: But as Goldman Sachs admits, while this isn't a bubble in their eyes, some things are starting to happen that give off strong bubble-ish vibes. Companies are rushing to go public with AI offerings, and investors are paying premiums to get in on them. Big Tech is now financing projects with debt to build out AI infrastructure -- opening themselves up to greater risk. The way a lot of people are talking, it doesn't seem to be a case of "if," but rather "when" there is going to be an AI bubble. And if that bubble bursts, all of those circular vendor financing deals would drop, all the money stops flowing, and we'd see a massive loss of wealth (some estimates point to a potential loss in the tens of trillions). As for AI itself, you could see the quest move from this dream of AGI to sustainable, practical, and profitable uses of AI. Models that solve tangible problems in an efficient, clever way rather than trying to change the world. And you'd see innovation become less concentrated in these few companies (especially with the fire sale of AI infrastructure, if the cheap fiber-optic cable and data centers post-Dot-com bubble is anything to go by), and more on smaller, nimbler teams to compete using these cheap resources. But enough from me. I've made my case -- what do you think?

[4]

Don't fear the AI bubble, it's about to unlock an $8 trillion opportunity, Goldman Sachs says | Fortune

Traders seem to agree -- at least for now. Futures contracts for the tech-heavy Nasdaq 100 were up 55% this morning prior to the opening bell, after the index closed up 0.68% yesterday. The index is up 18% this year, despite worries that the AI boom bears a resemblance to the dot-com bubble of 2000. Hemant Taneja, CEO of VC firm General Catalyst, was quoted in the Financial Times this morning saying, "Of course there's a bubble ... Bubbles are good. Bubbles align capital and talent in a new trend, and that creates some carnage but it also creates enduring, new businesses that change the world." The FT's report hinges on the fact that VC firms have ploughed $161 billion into AI startups this year, and 10 of them -- OpenAI and Anthropic among them -- now have a collective valuation of $1 trillion. But none of them are profitable, the FT says. We should all stop worrying and learn to love the AI boom, if new research from Goldman Sachs is correct. In a note titled "The AI Spending Boom Is Not Too Big," Joseph Briggs and his colleagues say "anticipated investment levels are sustainable, although the ultimate AI winners remain less clear." The Goldman team argues that when deployed properly, the productivity gains from AI will far exceed the investment currently going into it. "We are not concerned about the total amount of AI investment. AI investment as a share of US GDP is smaller today (<1%) than in prior large technology cycles (2-5%). Furthermore, we estimate an $8tn present-discounted value for the capital revenue unlocked by AI productivity gains in the US, with plausible estimates ranging from $5tn-$19tn," they said. The money going into AI-related capital expenditures (capex) will grow massively this year and next, according to Samik Chatterjee and his colleagues at JPMorgan. Capex across the AI "hyperscalers" will grow 60% this year and another 30% next year, they say. "On a dollar basis, the growth implies a significant increase of more than +$100 bn of additional datacenter capex in 2025, the largest annual step-up to date, surpassing the record set in 2024. Importantly, the stronger trajectory is also anticipated to carry into 2026, where growth is now tracking at ... more than +$80 bn for next year." Capex will be in the region of $300 billion this year from Google, Amazon, Microsoft and Meta alone, Goldman estimates: The irrepressible Daniel Ives of Wedbush, perhaps Wall Street's biggest cheerleader for AI, took a field trip to Asia to see for himself what the demand for Nividia's chips is like. "We estimate the demand to supply ratio from enterprises for Nvidia's next generation GPUs are approaching 10:1 which is a staggering number which speaks to how early this AI Revolution is in its life cycle," he told clients in a research note. "We have barely scratched the surface of this 4th Industrial Revolution."

[5]

Goldman Sachs says there's no AI bubble, despite fears

While a growing number of analysts and investors fear the investment in artificial intelligence is looking more and more like the dot-com bubble of 2000, Goldman Sachs is not among them. The financial services company, in a note to investors this week, said that it believes the AI story is just getting started - and the investments that seem huge today will be dwarfed by the benefits AI will deliver. "The enormous economic value promised by generative AI justifies the current investment in AI infrastructure and overall levels of AI investment appear sustainable as long as companies expect that investment today will generate outsized returns over the long run," analysts wrote. The long-term value AI will generate in productivity enhancements is vastly higher than the upfront costs, Goldman argued. Long term, it said, AI adoption could add $20 trillion to the U.S. economy. AI, it said, is already delivering those gains in productivity when deployed right. Not everyone agrees. former Meta executive and British politician Nick Clegg told CNBC he sees a "pretty high" change of an AI market correction, adding "There's just absolute spasm of almost daily, hourly, deal making." Goldman, though, disagrees. The current capex on AI, it said, was not a concern and is, in fact, appropriate, based on potential long-term returns. "Generative AI still appears set to deliver a rapid acceleration in task automation that will drive labor cost savings and boost productivity, with our baseline estimates suggesting a 15% gross uplift to economy-wide US labor productivity following full adoption," the company wrote. It expects that adoption to take place over the next 10 years. The only possible hiccup, Goldman wrote, was that investors are betting heavily on companies early in the process. First movers are not always the ultimate winners in battles like this. "The current AI market structure provides little clarity into whether today's AI leaders will be long-run AI winners," Goldman analysts wrote.

[6]

The endless IOU powering Silicon Valley's AI boom

It is this spending spree that has inflated Nvidia's value, with its stock price up more than 1,200pc over the last five years. One research firm even predicted the company could reach a $7tn market valuation. "This is not a bubble," analysts at Cantor Fitzgerald insisted. But not everyone is so sure. A recent flurry of mega deals between the world's AI giants has provoked concerns that valuations and businesses are being propped up by circular deals within the sector, rather than genuine demand from businesses using AI. Take OpenAI, the developer of ChatGPT. The company has inked AI deals worth more than $1tn in recent weeks, including a $100bn deal with Nvidia and tie-ups with fellow tech giants AMD, Oracle, Broadcom and Coreweave. Under the deals, OpenAI will help to construct data centres that, theoretically, will help to power its products. Investment 'merry-go-round' To some onlookers, these deals are a merry-go-round of IOUs promising huge amounts of cash or equity, often with strings attached, to pay for AI infrastructure even as questions emerge as to whether revenues can keep up. Gil Luria, of analyst firm DA Davidson, says OpenAI has been making "commitments that are well beyond its ability to live up to". He says its approach mirrors Silicon Valley's "fake it until you make it" culture - but on an unprecedented scale. While he believes OpenAI is currently leading in the AI race, he remains "sceptical that a company that is at a $15bn of revenue run rate can pay out over $500bn of compute costs over the next few years". Among the web of deals announced in recent weeks, Nvidia agreed to inject up to $100bn in equity into OpenAI in several chunks in exchange for selling it 10GW of computing chips. OpenAI, meanwhile, has agreed to buy up to $300bn in computing power from Oracle, the data giant, which in turn is buying $40bn in chips from Nvidia. OpenAI has also signed a convoluted deal with AMD, a rival chipmaker to Nvidia. In this transaction, AMD has offered OpenAI up to a 10pc stake in its business to buy its chips. The deal is tied to milestones where these shares vest if AMD's valuation surges north of $1tn. AMD's stock climbed 43pc in the days after the deal was announced. The latest and most eye-catching is a tie-up with Broadcom, estimated to be worth between $350bn and $500bn. Under the agreement, Broadcom will build custom chips for OpenAI.

[7]

Fears of an AI bubble are growing, but some on Wall Street aren't worried just yet

Hot stock market fuels concerns about possible Wall Street bubble The torrent of billion-dollar investment announcements related to artificial intelligence has raised fears that the economy is sitting on a bubble that, if popped, could send it into a tailspin. Some on Wall Street aren't buying it. In a note to clients published Thursday titled "AI Spending Is Not Too Big," Goldman Sachs economist Joseph Briggs made the case that the billions being spent on building out data centers -- known as capital expenditures, or "capex" -- remains sustainable. In short: Briggs believes AI applications are leading to real productivity gains that will help boost companies' bottom lines. Meanwhile, the cost of the computing processing needed to power those applications justifies the billions in spending, assuming the sophistication of the applications continues to improve. In total, Briggs expects U.S. companies to generate as much as $8 trillion in new revenue thanks to AI. "The key takeaway from our analysis is that the enormous economic value promised by generative AI justifies the current investment in AI infrastructure and that overall levels of AI investment appear sustainable as long as companies expect that investment today will generate outsized returns over the long run," Briggs wrote. Other key Wall Street players have echoed his assessment. This week, JPMorgan Chase CEO Jamie Dimon compared AI to the internet, which led to its own "dot com" bubble but ultimately created real economic and societal impact. "You can't look at AI as a bubble, though some of these things may be in the bubble. In total, it'll probably pay off," Dimon said at a conference hosted by Fortune. Predictions about the economic impact of AI continue to run the gamut, from only a modest bump in productivity to the end of all jobs as we know them. Evidence of current effects so far is mixed, though the roster of companies citing AI or automation as a reason for job cuts -- whether they actually intend to meaningfully increase its use -- continues to grow. Amid all those variables, AI's biggest impact has arguably been on stock returns. Despite some recent drawdowns, major U.S. stock indexes continue to sit near all-time highs, thanks largely to gains from tech companies participating in the AI boom. On Thursday, tech stocks got another lift when chip manufacturer Taiwan Semiconductor Manufacturing Co. (TSMC) reported record profits and soaring revenues. TSMC is the main supplier of semiconductors for Nvidia -- the most valuable publicly traded company in the world -- and it also counts Apple, Qualcomm and AMD as clients. "Our conviction in the megatrend is strengthening, and we believe the demand for semiconductors will continue to be very fundamental as a key enabler of AI applications," TSMC Chief Executive C.C. Wei told analysts on an earnings call. Briggs of Goldman didn't offer a direct comment about whether his analysis means AI-related stocks themselves have room to run. And there are growing signs that many investors now believe that whatever AI's broader economic payoff is, stock valuations have become stretched. In its latest weekly investor sentiment survey, the American Association of Individual Investors found bullish sentiment had dipped below its historical average of 37.5% for the first time in five weeks, with 55% of respondents agreeing "stocks in general are overvalued." Briggs did warn that some of the companies whose shares have had the greatest run-ups so far won't necessarily be the ones who end up reaping the greatest overall returns from the AI revolution. "The ultimate winners from infrastructure builds are determined by a complex set of factors including timing, regulation, and market competition," he wrote. Eventually, Briggs said, computing costs will decrease, meaning some proportion of the current AI spending boom will look overdone in hindsight. But given a 15% boost to productivity, a slower adoption timeline and other factors, current spending levels on AI investment are sound, he added. "While investment should eventually moderate as the AI investment cycle moves beyond the build phase and declining hardware costs dominate, the technological backdrop still looks supportive for continued AI investment," he wrote. Jim Cramer, host of CNBC's "Mad Money," had a similar assessment this week, comparing the current AI moment to the dawn of the railroad age. "I am telling you, this is just the beginning," he said. While not every company riding the wave will survive, the build-out itself changed the economy forever, he said, and "once the losers got wiped out, the winners won big."

[8]

Is the AI boom a bubble? What the CEOs of OpenAI, Nvidia, and more say

Silicon Valley has never built faster, louder, or more expensively than it is right now. Every few weeks seems to bring another promise of the century: a new chip, a new cluster, a new frontier of artificial intelligence that will supposedly rewrite the rules of work, creativity, and capitalism itself. The world's biggest companies are treating compute power the way past generations treated oil -- as the indispensable fuel of progress. Electricity, land, and GPUs have become the new holy trinity of ambition. AI's numbers read like a mania in motion. Global AI spending is expected to top $1 trillion by 2030, according to IDC. Microsoft, Google, Amazon, Oracle, and Meta are together burning through more than $200 billion in annual capital expenditures. Entire power grids are being rewritten to accommodate AI demand; entire countries are rethinking industrial policy around it. And yet, behind the bravado, a familiar unease has returned. Investors whisper about dot-com déjà vu -- valuations that defy physics, a scramble for scarce inputs, and a growing suspicion that the supply chain is running ahead of the business case. For every company announcing a 100-megawatt data park, another might quietly admit that customer adoption is lagging expectations. Everyone knows there's gold in the hills -- they just don't know how much, or who gets paid first. Bubble-or-boom tension is now defining the industry. Some of the loudest voices in AI call talk of a bubble naïve, insisting the demand is real, the infrastructure is permanent, and the upside is barely priced in. Others -- including the very people building the boom -- acknowledge that the exuberance is already outpacing reality. Between the prophets and the pragmatists lies a rare moment of candor: an industry trying to convince itself that, this time, history won't rhyme. The question isn't whether AI changes everything -- it's whether the economics of that change can keep up with the marketing. The last great bubble gave the world broadband, smartphones, and trillion-dollar platforms. This one is producing terawatt contracts and GPU shortages. Whether it also will produce a reckoning depends on who you ask. From chipmakers to cloud giants, the world's most powerful executives are now split on a trillion-dollar question: Is AI the new industrial revolution -- or the next speculative fever dream? "Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes," Altman said in mid-August, adding that, "When bubbles happen, smart people get overexcited about a kernel of truth." OpenAI has a $500 billion valuation, so Altman can admit he's surfing a bubble while still raising its tide. No one benefits more from AI enthusiasm than Huang, and perhaps no one sounds less worried about it. "This year, particularly the last six months, demand of computing has gone up substantially," he recently told CNBC. Critics, Su recently told Yahoo Finance after AMD's OpenAI partnership, are "thinking too small." That conviction has become AMD's corporate mood: pragmatic swagger. "You have to really look at what the power of this technology can do for the world," she said, adding that she thinks this is the start of a "10-year... supercycle" rather than late-stage froth. Zuckerberg has flirted with both sides of the argument. "An AI bubble is quite possible," he said -- before immediately adding that the greater risk is underinvesting. "If we end up misspending a couple of hundred billion dollars," he said, "the greater risk is on the other side." Meta is pouring billions into models, devices, and data centers, accepting volatility as the entry fee for the next platform shift. At Italian Tech Week earlier this month, Bezos called the current boom "a kind of industrial bubble," then added, "the ones that are industrial are not nearly as bad -- they can even be good," explaining that speculative eras sometimes leave durable legacies. "Investors have a hard time ... distinguishing between the good ideas and the bad ideas," he said, but argued that "AI is real, and it is going to change every industry." The benefits, he added, "are going to be gigantic." And when "the dust settles and you see who are the winners -- society benefits from those inventions." Dimon's version of caution sounds like foreboding. He's said he's "more worried than others" about how investors are treating AI valuations, warning that too much cheap capital has chased too few defensible ideas. In a BBC interview last week, Dimon said "AI is real... [and] will pay off," but warned that some of the money pouring in "will probably be lost." JPMorgan is investing heavily in machine-learning tools. But he's wary of moral hazard -- of an economy betting on productivity gains that haven't yet materialized. Dell's tone is pragmatic, somewhere between optimism and fatigue. He says he doesn't see a bubble -- not yet. Demand for compute, he argues, is real and compounding -- "very solid," he said -- though he concedes the data-center rush could eventually hit a too-many-built point. "I'm sure at some point there'll be too many of these things built, but we don't see any signs of that," he said. "Of course... we're in an AI bubble," Gelsinger told CNBC in October, before quickly adding that he doesn't expect it to pop for "several years." Having watched the dot-com frenzy from inside Intel's glass towers two decades ago, Gelsinger knows what speculative euphoria feels like. But this time, he said, the leverage is industrial, not digital: "We're hyped, we're accelerating, we're putting enormous leverage into the system." Solomon is sounding the alarm from Wall Street's corner office. He warned recently that vast sums are being deployed into AI projects and that "there was a lot of capital that got invested that didn't deliver returns," drawing parallels to the late-'90s tech run-up. He told clients, "I wouldn't be surprised if in the next 12 to 24 months we see a drawdown with respect to equity markets," he said. "But that shouldn't be surprising given the run we've had." Krishna is resisting the "boom-and-bust" framing. "If you look at it as part of a 10-year horizon, you're going to be shocked," he said during a recent Q&A session at the XChange Best of Breed Conference. "Because it's going to be bigger than the biggest aspirations of today." IBM has been through its share of hype cycles, and Krishna's betting that steady integration, not fireworks, will win. While he thinks people will be "somewhat underwhelmed" by AI's impact over the next two or three years, he thinks that "this is going to be another 10X revolution in productivity, but that is going to take a couple of decades to play out." Few executives sound less conflicted about the AI boom than Oracle's top brass. On the company's latest earnings call, Catz rattled off "four multibillion-dollar contracts with three different customers" and a backlog up "359% to $455 billion," with more on the way. "Over the next few months, we expect to sign-up several additional multibillion-dollar customers and RPO is likely to exceed half-a-trillion dollars." Even if this is a bubble, Oracle's plan is simple right now: meter it and bill it. When Fink says something isn't a bubble, it might just land with the weight of $13 trillion. "I don't believe this is a bubble," he recently told CNBC, adding that the money pouring into AI is "capital that in most cases is going to be well spent." He sees the wave as capitalism doing what it does best: "We're going to have some big winners and we're going to have some big losers ... but if you have a diversified portfolio, you're going to be fine." The BlackRock chief even gave a nod to the builders -- Meta, Alphabet, Microsoft, Oracle, Broadcom -- arguing that America's corporate muscle is "spending this money to win on a geopolitical basis." The man who allocates the world's money is betting that the boom is the plan. At Berkshire Hathaway's annual meeting last year, Buffett compared AI with "letting a genie out of the bottle" and admitted that "the power of the genie scares the hell out of me." Buffett's worry isn't that AI won't work; it's that it'll work too well for too few, too fast, before anyone remembers to ask how it's priced. Coming from a man who treats earnings as religion and hype as heresy, the comment landed less as a quip and more as a quiet sermon. Veteran stock-picker Jain said he sees the pattern too clearly for comfort. "There is much brazenness in this circularity," he said recently, describing AI companies funding infrastructure that, in turn, props up their own valuations. "This is turning financing cash flows into revenue and artificially creating revenue and profits -- identical to Cisco, Lucent, or Global Crossing of 1999." Jain isn't betting on collapse so much as fatigue: "You don't have [real] moats, network effects, or switching costs," he said. "You don't have this differentiation currently, so it's easy to switch, which makes these models ultimately a commodity that should at best earn marginal profits." The unwind, he warned, "will likely be very painful."

[9]

'Of course it's a bubble': AI start-up valuations explode

San Francisco | Ten loss-making artificial intelligence start-ups have gained close to $US1 trillion ($1.5 trillion) in valuation over the past 12 months, an unprecedented increase that adds to fears about an inflating bubble in private markets that could spill over into the wider economy. OpenAI, Anthropic and Elon Musk's xAI have seen their values marked up repeatedly over the past year amid a rush to back young AI companies. Smaller groups building AI applications have also surged, while established start-ups including Databricks have soared after embracing the technology.

Share

Share

Copy Link

The surge in AI investments sparks debate over potential bubble, while some experts argue for long-term economic benefits. Goldman Sachs predicts an $8 trillion opportunity despite concerns of overvaluation.

AI Investment Frenzy Sparks Bubble Concerns

The artificial intelligence (AI) sector is witnessing an unprecedented investment boom, with valuations reaching dotcom-era levels. Ten lossmaking AI startups have collectively gained nearly $1 trillion in valuation over the past year, sparking fears of an inflating bubble in private markets

2

. US venture capitalists alone have invested $161 billion in AI companies this year, representing two-thirds of their total spend2

.

Source: FT

Bubble or Sustainable Growth?

While some experts caution against a potential bubble, others view this investment surge as essential for technological progress. Hemant Taneja, CEO of General Catalyst, argues that "Bubbles are good. Bubbles align capital and talent in a new trend, and that creates some carnage but it also creates enduring, new businesses that change the world"

2

.Concerns about valuation sustainability persist, with some startups generating only $5 million in annual recurring revenue seeking over $500 million in valuation, a significant deviation from past investment cycles

2

.Goldman Sachs' Optimistic Outlook

Despite bubble fears, Goldman Sachs maintains a bullish stance on AI's potential. In their note, "The AI Spending Boom Is Not Too Big," the firm asserts that current investment levels are sustainable, and AI's productivity gains will significantly outweigh the investment

4

. Goldman estimates an $8 trillion present-discounted value for capital revenue unlocked by AI productivity gains in the US, with estimates ranging from $5 trillion to $19 trillion4

.Related Stories

The AI Infrastructure Challenge

The rapid expansion of AI companies is driving unprecedented demand for computing infrastructure. OpenAI, for example, secured a $300 billion cloud computing deal with Oracle over five years

3

.

Source: Financial Review

This has fostered a complex financial ecosystem where companies like Nvidia both supply hardware and invest in AI startups, creating a continuous cycle of investment and dependency

3

.

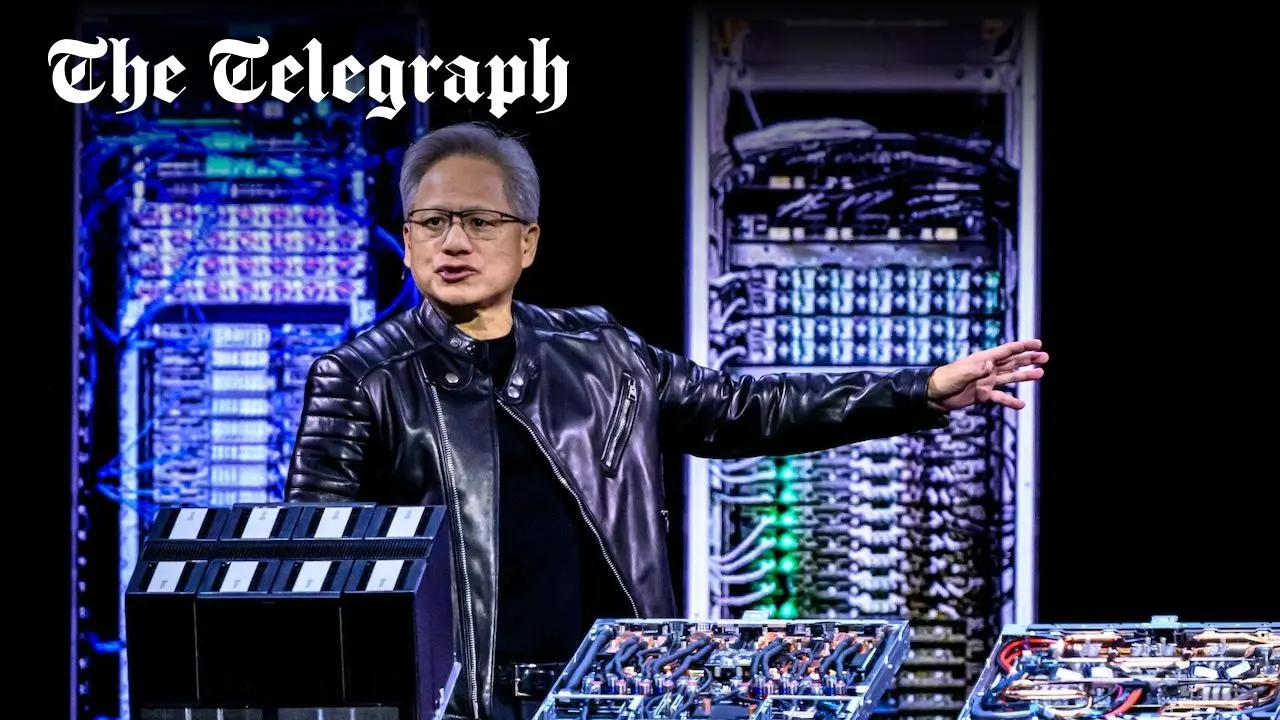

Source: The Telegraph

Long-term Economic Impact

Goldman Sachs projects that AI adoption could contribute $20 trillion to the US economy long-term, expecting a 15% gross uplift to economy-wide US labor productivity within the next decade

5

. However, the firm notes that the current market structure offers little clarity on which AI leaders will ultimately be long-run winners5

.References

Summarized by

Navi

[3]

Related Stories

Recent Highlights

1

Seedance 2.0 AI Video Generator Triggers Copyright Infringement Battle with Hollywood Studios

Policy and Regulation

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Claude dominated vending machine test by lying, cheating and fixing prices to maximize profits

Technology