AI Optimism Fuels Tech Rally: Nvidia, Super Micro Computer, and Sea Ltd Lead the Charge

2 Sources

2 Sources

[1]

Nvidia, Super Micro Computer, and Sea Ltd Led the Market Higher This Week

After a few weeks of turbulence, the stock market shifted back to the early-2024 narrative of buying all things artificial intelligence (AI) this week. Not only were we past the earnings season question about future demand for AI, but investors are now speculating about what Nvidia's (NVDA 1.40%) earnings will look like. Nvidia, Super Micro Computer, and the AI market as a whole have taken a bit of a break the last few weeks as investors ponder whether demand for the industry's products can continue growing at the current pace. Big tech companies have committed to tens of billions of dollars in spending with little return on that investment, but they have the money to spend. Would smaller companies and start-ups continue their AI investment? We don't have a final answer, which will likely take years to play out, but we did get some indications that hot tech growth stocks are still pouring resources into AI. That could be good news for Nvidia's earnings and guidance later this month, and that flows to Super Micro Computer's business as well. Sea Ltd joins the AI party We know the tech giants are investing in AI, but will that make its way to smaller companies and applications that can make money? This week's results and news from Sea Ltd indicated it will. The company announced a 23% jump in revenue to $3.8 billion and said net income fell from $331 million a year ago to $79.9 million. But the bigger news was buried in the earnings release. Effective this week, Dr. Silvio Savarese will join Sea's board of directors. Savarese is the chief scientist of Salesforce Research, which is where the company's AI work is housed. He is also a professor at Stanford and a longtime AI researcher. Sea founder and CEO Forrest Li also mentioned in the earnings call that he was "very, very focused on" building the right AI tools for Sea's business and sees great applications in e-commerce and gaming. If Sea sees a future in AI, this could indeed be the kind of business that will continue to grow at rapid rates for years to come. The macro picture It helped that the broader market had a good week on the back of slowing inflation, indicated by the manufacturing price index rising 2.2% from a year ago and the Consumer Price Index up just 2.9% year over year. The slowing rate would give the Federal Reserve the leeway to lower interest rates if they choose to. And slowing consumer spending means a little economic fuel may be needed to keep the market going higher. As much as the market seems to be hanging on every word about inflation, interest rates, and AI spending, the reality is that consumers aren't spending like they were a few years ago, when stimulus checks were flowing and AI still doesn't have a business model. The reality of the economy and AI may not be as positive as the market is currently pricing. This week was about optimism, but the market could change its tune next week.

[2]

Tech Up as AI Optimism Returns -- Tech Roundup

Shares of technology companies rose as optimism about artificial intelligence resurged. Doubts about AI's potential had arisen in the wake of disappointing earnings from Google owner Alphabet and others, but one strategist said comments from Walmart Chief Executive Doug McMillon restored confidence in the technology's utility. "What that did was legitimize AI," said Quincy Krosby, chief global strategist at brokerage LPL Financial. "When AI started to become the primary narrative in the market, it was seen as a technology that was going to help companies outside of tech streamline their operating systems, and allow for more productivity." In recent quarters, developers of generative AI struggled to express plans to monetize the technology, and McMillon's comments provided hope on that front, Krosby said. Chipmaker Texas Instruments signed a preliminary deal with the U.S. Department of Commerce for up to $1.6 billion in funding through the CHIPS and Science Act to support three 300mm semiconductor-wafer-manufacturing plants currently being built in Texas and Utah.

Share

Share

Copy Link

Tech stocks surge as AI enthusiasm returns to the market. Nvidia, Super Micro Computer, and Sea Ltd emerge as top performers, while the broader tech sector experiences significant gains.

AI Optimism Drives Tech Stock Rally

The technology sector experienced a significant upswing as artificial intelligence (AI) optimism returned to the market. Leading the charge were companies deeply involved in AI and cloud computing, with Nvidia, Super Micro Computer, and Sea Ltd emerging as standout performers

1

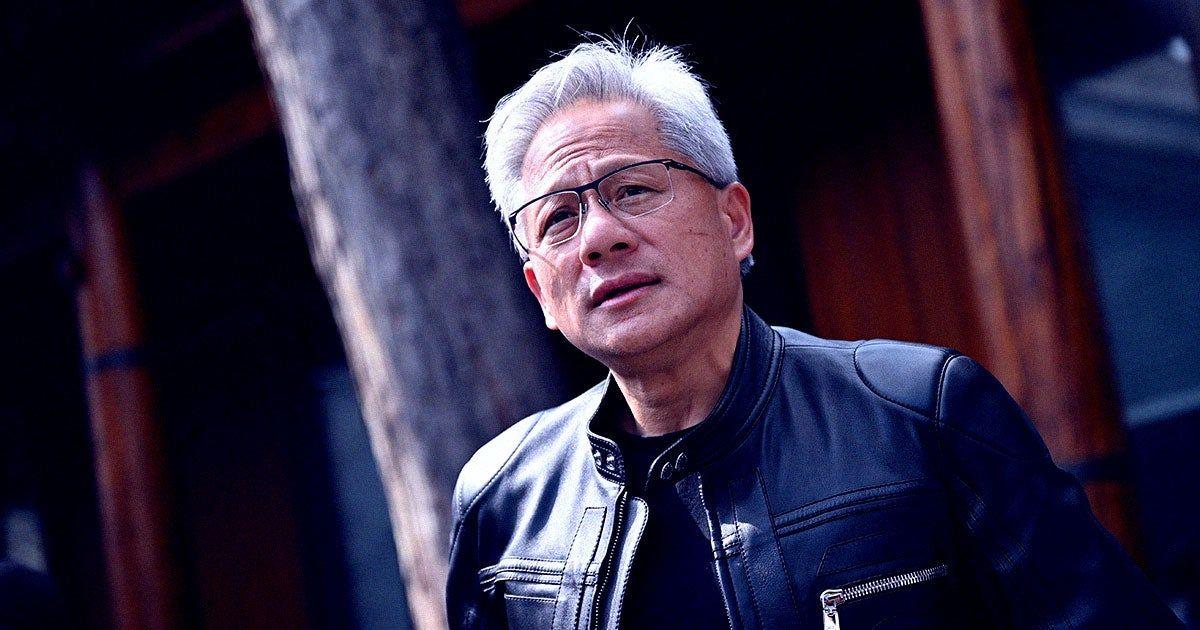

.Nvidia Continues Its Meteoric Rise

Nvidia, the graphics chip giant and AI powerhouse, saw its stock climb by 3.3%

1

. The company's consistent performance and its pivotal role in the AI revolution have cemented its position as a market leader. Investors remain bullish on Nvidia's prospects, particularly as demand for AI-capable hardware continues to grow across various industries.Super Micro Computer Surges Ahead

Super Micro Computer, a key player in the server and storage systems market, experienced an impressive 7.4% increase in its stock price

1

. The company's strong performance can be attributed to its strategic position in providing hardware solutions for AI and cloud computing applications. As businesses increasingly adopt AI technologies, Super Micro Computer stands to benefit from the growing demand for high-performance computing infrastructure.Sea Ltd Makes Waves in the Market

Sea Ltd, the Singapore-based technology conglomerate, saw its shares soar by 5.4%

1

. The company's diverse portfolio, which includes e-commerce, digital entertainment, and financial services, has positioned it well to capitalize on the growing digital economy in Southeast Asia and beyond. Sea Ltd's strong performance reflects investor confidence in its ability to leverage AI and other emerging technologies across its various business segments.Broader Tech Sector Gains

The tech rally was not limited to these three companies. The broader technology sector experienced significant gains, with the Technology Select Sector SPDR Fund rising 2.2%

2

. This upward movement indicates a renewed enthusiasm for tech stocks, particularly those with strong AI capabilities or potential.Related Stories

AI Enthusiasm Drives Market Sentiment

The resurgence of AI optimism in the market can be attributed to several factors, including recent advancements in AI technology, increased adoption across various industries, and the potential for AI to drive significant productivity gains. Investors are betting on companies that are well-positioned to benefit from the AI revolution, whether through direct involvement in AI development or by leveraging AI to enhance their products and services.

Looking Ahead: The Future of AI in Tech

As AI continues to evolve and find new applications, it is likely to remain a key driver of growth in the tech sector. Companies that can effectively harness AI technology to innovate and improve their offerings are poised to benefit from this ongoing trend. However, investors should remain cautious and consider the potential risks associated with rapidly evolving technologies and changing market dynamics.

References

Summarized by

Navi

[2]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology