AI Revolutionizes Accounting: Boosting Efficiency and Transforming Financial Management

2 Sources

2 Sources

[1]

From Double-Entry To Deep Learning: The Transformation Of Accounting In The AI Age

Enter your email to get Benzinga's ultimate morning update: The PreMarket Activity Newsletter The abacus, the quill, the painstaking hand-written ledger-these are the iconic symbols of traditional accounting, practices that have underpinned commerce for centuries. While the fundamental principles of debits and credits remain steadfast, the landscape in which they operate has undergone a colossal shift, propelled by technological advancements that would have been unimaginable a decades ago. We are no longer simply "keeping books;" we are orchestrating financial intelligence, and at the heart of this transformation lies artificial intelligence. Sizing Up the Accounting Sector: Trends and InsightsThe Global Accounting Industry Market Size The global accounting services sector grew from $652.32 billion in 2023 to $676.73 billion in 2024 at a compound annual growth rate (CAGR) of 3.7%. The market is forecast to see this growth continue in the next few years, surging at a CAGR of 4.4% to reach $804.27 billion in 2028. International accounting firms are experiencing strong growth, fueled by sustained demand for efficient and dependable accounting solutions. This momentum is powered by several key factors: increased globalization, the outsourcing of administrative functions, higher investments in research and development, robust economic expansion in emerging markets, the continuing prosperity of developed economies, and heightened productivity in lower-income countries. As global GDP climbs, financial transactions, auditing activities, and mergers and acquisitions all increase, driving a corresponding surge in the need for professional accounting services. Source: Benchmark International The Global Accounting Software Market The global accounting software market size was estimated at $19.38 billion in 2024 and is projected to reach $31.25 billion by 2030, growing at a CAGR of 8.4% from 2025 to 2030. Rising demand for automation in financial processes, the surge of small and mid-sized businesses, and a heightened focus on real-time data access are key market drivers. Companies are increasingly seeking cost-effective solutions, greater transparency, and regulatory compliance, fueling the transition from manual workflows to digital financial management tools. The shift to remote work has accelerated adoption, as organizations require secure, cloud-based platforms to support geographically dispersed finance teams. Source: Grand View Research The Echoes of a Bygone Era: Unpacking Traditional Accounting's Limitations For countless businesses, traditional accounting and bookkeeping are synonymous with laborious, manual processes. Think of the stacks of invoices, the overflowing inboxes of receipts, and the dedicated hours spent by highly skilled professionals meticulously inputting data. This isn't merely tedious, it is inherently inefficient and prone to error. Here's a closer look at the limitations and challenges that characterize the traditional accounting approach: Manual Data Entry and Reconciliation: The sheer volume of transactions demanded endless hours of manual data entry. Each invoice, each receipt, each bank statement item had to be physically entered into accounting software or, in earlier days, physical ledgers. This process was a prime breeding ground for human error, leading to discrepancies that then required time-consuming reconciliation. Time Delays and Lagging Insights: Financial reporting often lagged significantly behind actual business activity. Quarterly or even monthly closures were the norm, meaning decision-makers were often operating with outdated financial snapshots. Identifying trends, understanding cash flow, or pinpointing areas of concern became reactive rather than proactive. Limited Scalability: As businesses grew, so did the financial data, quickly overwhelming existing manual systems. Scaling operations often meant hiring more accounting staff, a linear and often expensive solution that didn't fundamentally address the inefficiencies. Lack of Real-time Visibility: The ability to see a business's true financial position at any given moment was a luxury, not a standard. This absence of real-time visibility hampered agile decision-making, restricting the capacity to quickly adapt to market changes or operational shifts. Repetitive and Low-Value Tasks Dominance: Highly trained accountants and bookkeepers often found themselves bogged down in repetitive, administrative tasks. This not only led to professional burnout but also meant their valuable analytical skills were underutilized, limiting their contribution to strategic business objectives. Security Vulnerabilities: Manual paper-based systems or less sophisticated digital databases were often more susceptible to physical loss, unauthorized access, or internal fraud, making security a constant concern. These challenges, while once accepted as the cost of doing business, highlight an urgent need for innovation, and AI has undeniably stepped into that role. Accounting Meets AI: Transforming Ledgers with Intelligence Source: AI-Generated by Andre Bourque The advent of AI has not merely improved traditional accounting; it has fundamentally reshaped it, moving it from a backward-looking function to a forward-looking, strategic powerhouse. AI's ability to process vast amounts of data at lightning speed, identify patterns, automate repetitive tasks, and even predict future trends is transforming every facet of the finance function. Why AI in accounting? Bottom line, AI technology can save businesses money. It is forecast that AI will save the financial services industry more than $1 trillion by 2030. Companies that have already adopted AI into their accounting processes report as high as 45% cost savings. Source: Benchmark International Automation Accounting AI algorithms can now automatically extract data from invoices, receipts, and bank statements with remarkable accuracy, eliminating the need for manual input. The automation of repetitive tasks means finance teams can operate with fewer resources dedicated to manual processing. This doesn't necessarily mean job losses, but rather a reallocation of human capital. Accountants are now freed from the drudgery of data entry to focus on higher-value activities: analysis, strategic planning, compliance adherence, and providing crucial business insights. Imagine a scenario where a small team can manage the complex accounting needs of a rapidly growing enterprise, simply because AI handles the grunt work. More Time. Higher Quality. At its core, acounting AI gives users back more time. Although this increased efficiency may sometimes lead to fewer billable hours per engagement, it enables accountants to expand their client base and take on additional work. Augmentation Accounting AI technology doesn't just automate repetitive processes; it augments human expertise, allowing accounting professionals to oversee far larger operations with minimal staff. Imagine a scenario where one finance expert, armed with advanced AI tools, can manage complex workflows, generate robust forecasts, and ensure audit-ready compliance across a vast enterprise. AI acts as a force multiplier, unlocking scalability that was once thought impossible, and enabling organizations to achieve more with less. "There may be a billion-dollar company in the near future with a single accountant," Kopp predicts. Collaboration With less manual intervention required from AI-driven accounting, staff can dedicate their expertise to analysis, strategy, and cross-department collaboration. Harnessing AI: The Future Prospects of Financial Technology and Accounting Source: AI-Generated by Andre Bourque The journey from ink-stained ledgers to intelligent algorithms is a testament to the relentless march of progress. Traditional accounting laid the foundational principles, but AI is providing the power and precision to navigate the complexities of the modern global economy. Looking ahead, the future of accounting technology appears focused on several key developments. Predictive analytics will likely become even more sophisticated, enabling finance teams to forecast cash flow, identify potential financial challenges before they materialize, and model various business scenarios with greater accuracy. And while not strictly AI, the convergence of AI with blockchain technology offers fascinating prospects for enhanced security, immutable record-keeping, and unprecedented transparency in financial transactions and audits. Meanwhile, natural language processing advancements will make financial data more accessible to non-financial stakeholders. Users may soon be able to query financial systems conversationally, asking questions like "How did marketing expenses compare to budget last quarter?" and receiving instant, visualized responses. As more businesses use AI to replace their legacy accounting platforms will play an even larger role in automatically monitoring and adapting to evolving regulatory landscapes, ensuring continuous compliance with minimal human intervention. The accounting profession itself will continue to transform, with less emphasis on technical bookkeeping skills and greater value placed on data analysis, business partnership, and strategic thinking. Feature Image: AI-Generated by Andre Bourque Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy. Market News and Data brought to you by Benzinga APIs

[2]

Does Gen AI in Accounting Live up to the Hype? | PYMNTS.com

By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions. In a survey of 277 accountants and proprietary data from 79 small- and mid-sized firms, the researchers found that gen AI makes users more productive and lets them finish tasks faster -- time they use to meet with clients. But there are fears as well: The top concern is accuracy, security of the data and also job loss if the AI ends up replacing accountants. The most striking finding: Accountants using AI handled 55% more clients per week than those who did not use it. They also worked 8.5 percentage points less in data entry and transaction coding tasks, which amounts to 3.5 hours saved per week. In a sign that they didn't use the extra time for idle activities, AI-using accountants also logged 21% more billable hours. This shows that they were engaged in activities that boost revenue. In practice, this meant accountants could spend more time advising clients, addressing complex issues and reviewing work for accuracy. "AI is augmenting accountants' capacity by taking over low-level tasks and allowing them to focus more on advisory and analytical work," the authors wrote. According to a PYMNTS Intelligence report, CFOs are gaining confidence about using AI to optimize financial processes. Accounts receivable is a particularly promising target for AI investment, with 55% of CFOs in middle-market companies willing to spend on solutions that would automate invoice approval and payment. See here: CFOs Eye Accounts Receivable as New Direction for AI Investments In the study, the authors used gen AI for lower-level accounting tasks such as data entry, categorizing transactions and preliminary information processing. They used software provided by an AI accounting firm whose system can "understand" receipts, invoices, bank statements and other similar inputs. The technology's benefits extended beyond time savings. AI adoption was linked to a 12% increase in granularity in the general ledger -- the number of unique accounts used to classify transactions -- resulting in richer and more informative financial statements. It also sped up reporting cycles. On average, AI-using accountants closed their monthly books 7.5 days faster than non-users. They finalize monthly financial statements within two weeks after the end of the month, while non-users take at least a week longer. For many small- and mid-sized businesses, that speed can mean earlier detection of cash flow issues, faster tax preparation and more timely reporting to investors or lenders. These improvements did not hurt quality of the work, according to the study. In fact, the data suggested quality improved. Human oversight remains essential to making AI effective in accounting. The AI system used by the partner firms provided "confidence scores" indicating how certain it was about a transaction classification. Experienced accountants were more likely to intervene when confidence scores were low to catch potential errors. By contrast, less experienced accountants sometimes accepted AI outputs even when the system was uncertain, which could allow mistakes to slip through. The authors concluded: "AI augments, rather than replaces, human judgement." Read more: Intuit Upgrades QuickBooks as Small Businesses Tap AI for Accounting AI in Accounting Services May Level Playing Field for Small Businesses

Share

Share

Copy Link

A comprehensive look at how artificial intelligence is reshaping the accounting industry, improving productivity, and changing the role of accountants in the digital age.

The Rise of AI in Accounting

The accounting industry is undergoing a significant transformation, driven by the integration of artificial intelligence (AI) into financial management processes. This shift is reshaping traditional practices and offering new opportunities for efficiency and growth in the sector.

Market Growth and Adoption

The global accounting services sector has seen steady growth, increasing from $652 billion in 2023 to $676 billion in 2024, with projections to reach $804 billion by 2028

1

. This growth is complemented by the expanding accounting software market, estimated at $19 billion in 2024 and expected to reach $31 billion by 20301

.The adoption of AI in accounting is driven by several factors:

- Increased globalization

- Outsourcing of administrative functions

- Higher investments in research and development

- Economic expansion in emerging markets

- Demand for efficient and reliable accounting solutions

AI's Impact on Productivity and Efficiency

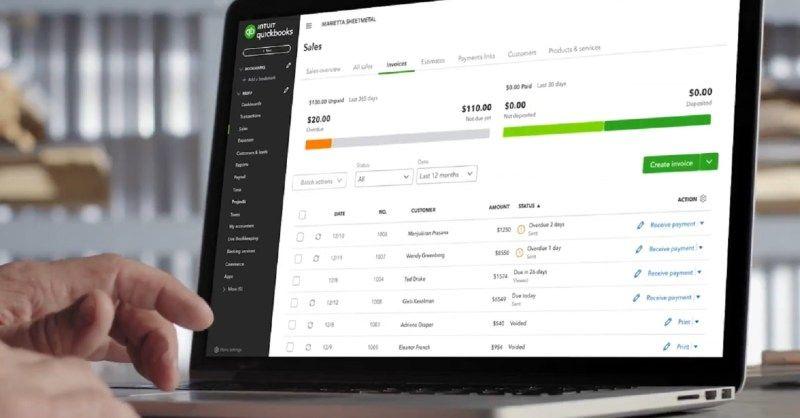

Source: PYMNTS

A recent study involving 277 accountants and 79 small- and mid-sized firms revealed significant improvements in productivity with AI adoption

2

:- Client Management: AI users handled 55% more clients per week compared to non-users.

- Time Savings: 8.5 percentage points less time spent on data entry and transaction coding, equating to 3.5 hours saved per week.

- Billable Hours: 21% increase in billable hours for AI-using accountants.

Transforming Financial Processes

AI is revolutionizing key accounting processes:

- Faster Reporting: AI-using accountants closed monthly books 7.5 days faster than non-users

2

. - Enhanced Detail: 12% increase in general ledger granularity, resulting in more informative financial statements

2

. - Automation: AI systems can now "understand" receipts, invoices, and bank statements, automating preliminary information processing

2

.

The Changing Role of Accountants

Source: Benzinga

As AI takes over routine tasks, accountants are shifting towards more strategic roles:

- Advisory Services: More time spent on client consultations and addressing complex issues.

- Quality Assurance: Increased focus on reviewing work for accuracy.

- Strategic Analysis: Greater emphasis on providing insights and forward-looking analysis.

Related Stories

Challenges and Concerns

Despite the benefits, the integration of AI in accounting faces some challenges:

- Accuracy Concerns: Ensuring the reliability of AI-generated outputs remains a top priority.

- Data Security: Protecting sensitive financial information in AI systems is crucial.

- Job Displacement Fears: Concerns about AI potentially replacing human accountants persist.

The Importance of Human Oversight

The study emphasizes that human judgment remains essential in AI-augmented accounting:

- Experienced accountants are more likely to intervene when AI confidence scores are low, catching potential errors.

- Less experienced accountants may over-rely on AI outputs, highlighting the need for proper training and oversight

2

.

Future Outlook

The accounting industry is poised for continued transformation as AI technology evolves:

- CFOs are increasingly confident about using AI to optimize financial processes, particularly in accounts receivable

2

. - 55% of CFOs in middle-market companies are willing to invest in AI solutions for automating invoice approval and payment

2

. - AI is expected to save the financial services industry more than $1 trillion by 2030

1

.

As AI continues to reshape the accounting landscape, the industry is moving towards a model where technology augments human expertise, enabling accountants to provide more value-added services and strategic insights to their clients.

References

Summarized by

Navi

Related Stories

Intuit Revolutionizes QuickBooks with AI Agents for Enhanced Business Efficiency

29 Jul 2025•Business and Economy

Intuit Integrates Generative AI into QuickBooks, Boosting SMB Financial Management

22 Nov 2024•Business and Economy

Intuit Revolutionizes Business Operations with AI Agents in QuickBooks

27 Jun 2025•Technology

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology