AI Stocks Poised for Growth: Analyzing Top Contenders in the Evolving AI Landscape

10 Sources

10 Sources

[1]

3 Artificial Intelligence (AI) Stocks That Could Make Millions for Millennial and Gen Z Investors | The Motley Fool

Generations of investors who grow up alongside technology can take advantage of potential life-changing opportunities in AI and broader technology innovation. The artificial intelligence (AI) era is only beginning, so younger generations, such as millennials and Gen Z, will see technology profoundly impact the world around them over the coming decades. These younger investors' real-world experiences could position them for remarkable long-term investment opportunities. According to a study by The Motley Fool, Gen Z and millennial investors already favor technology stocks. This is undoubtedly a result of their growing up with the rise of the digital age, smartphones, social media, and other technologies. Because of these investors' tech-savviness and long time horizons, these three AI stocks are no-brainers to buy and hold for the next few decades. Their early leadership in AI could translate to substantial investment returns, perhaps even millions of dollars, by the time they retire. Nvidia (NVDA -1.97%) grew into one of the world's largest companies on its artificial intelligence (AI) chip dominance. It started with the company's Hopper AI accelerator architecture and seems poised to continue with Blackwell. That makes Nvidia arguably the most important AI company today. Its chips are crucial to generating the immense computing power AI models need to process vast amounts of data quickly. While its competitors strive to compete on data center AI chips, Nvidia's long-term appeal goes beyond its current offerings and focuses on innovation within the company. CEO Jensen Huang recently spoke at CES 2025 and announced developments in products and services, including Blackwell-powered graphics processing chips (GPUs) for gaming, open-source AI models for robotics and self-driving vehicle technology, and a desktop supercomputer capable of running small-scale AI models. AI is primarily a complement to cloud computing today. However, AI may someday exist at the household level among consumers, and Nvidia's vision for the future could pay off. The company's deep pockets, market leadership, and pace of innovation arguably make it the favorite to create or lead these new markets as they eventually arise. Over the past 18 months, Palantir Technologies (PLTR -3.39%) has become a leader in AI software. The company's roots are in data analytics software, going back years to its government ties (which still exist today). However, Palantir leaped forward when it launched its Artificial Intelligence Platform (AIP) in April 2023. The platform enables enterprises to develop and deploy AI applications, a tremendous value because most companies lack the resources and expertise to build their own AI software from scratch. Palantir's growth accelerated over the past year, and a massive addressable market is ahead of it. Palantir still has only 498 commercial customers. In the United States alone, there are 20,000 large businesses (companies with over 500 employees). Its technology is flexible and usable for any data-heavy application, with use cases ranging from military operations to optimizing supply chains and running hospitals. The enterprise opportunity is enormous, and Palantir could someday even move down the market, making AI applications for increasingly smaller organizations as costs come down. The biggest knock on Palantir stock has been its egregiously expensive valuation, but long-term investors can look for an entry point on pullbacks. Alphabet (GOOG -0.46%) (GOOGL -0.54%) built an empire on its Google search engine business. While that's still the company's golden goose today, there's far more to Alphabet. The company has operations in quantum computing, video streaming, autonomous vehicles, smartphones, and more. That's important for young investors because some of these segments, especially quantum computing and vehicle autonomy, could mature into massive assets in the future. AI could be the key to that, and Alphabet is one of the only companies already equipped to be an AI powerhouse. It has a cloud computing platform (Google Cloud), AI models (Gemini), and years of first-party data across the Google ecosystem. Alphabet has already begun integrating AI throughout its existing businesses, but again, the real opportunity is in the businesses Alphabet could develop over the next decade or two. Alphabet has the deep pockets and culture to continue pushing innovation, which means it has a good shot at factoring into future breakthrough technologies and the resulting market opportunities. Owning Alphabet is like a bet on AI innovation as a whole, like betting on the house. It could reward you in multiple ways, from continued growth to eventually spinning off emerging businesses to create additional value for shareholders over the long haul.

[2]

3 Stocks That Could Soar in the AI Agent Boom | The Motley Fool

And the top performers in all three indexes were companies heavily involved in AI, including chip designer Nvidia (NVDA -3.00%) and software company Palantir Technologies. They scored the biggest wins in the Dow Average and the S&P 500, respectively. Why have AI stocks been so popular? AI has the potential to transform many industries, with certain market experts, such as JPMorgan Chase CEO Jamie Dimon, saying it could be as revolutionary as electricity or the internet. So, investors who get in early on AI stocks could win big over time. The first success stories have been companies fueling the initial stages of AI, such as the training and inferencing of AI models, and these players could continue to gain. But a new AI investing theme has emerged to share the spotlight, and that's the area of AI agents. This involves using AI to solve complex problems, a move that could help companies gain efficiency. Investors who get in on certain AI agent companies today may have reason to cheer as this AI boom advances. Let's check out three of these stocks that could soar. "Nvidia, again?" you might ask. After all, the stock has already climbed thanks to its strength in AI chips, the key element involved in the first wave of AI growth. But Nvidia also may become a key player in the world of agentic AI. This is because of the company's expansion well beyond just chips and into software to support AI development. Today, Nvidia and its partners are offering customers blueprints to build their own AI agents. At CES last week, Nvidia Chief Executive Officer Jensen Huang spoke of five blueprints from partners integrating the Nvidia Enterprise software platform. Huang talked about Nvidia's own new AI blueprint to summarize video footage -- imagine thousands of hours of video quickly analyzed to help a business make factory operations more efficient, for example. So, right now, AI customers can not only turn to Nvidia for building blocks like graphics processing units (GPUs) to train their models but also go to Nvidia when they're looking to build and use an AI agent. And this equals yet another source of growth for this top AI stock moving forward. Amazon (AMZN -1.44%), the world's No. 1 cloud service provider, is well positioned to benefit from the growth of AI agents. First, Amazon Web Services' (AWS) leadership position means customers are already right there, so it makes sense for them to opt for AWS AI agent services. And these services are up and running. Today, developers can quickly and easily build AI agents to suit their needs through the Amazon Bedrock platform. Thanks to sales of other AI products and services last year, AWS has already reached a $110 billion annualized revenue run rate. And momentum in AI agents could keep this growth going. It's also important to note that Amazon itself could greatly benefit from AI agents to help the e-commerce business become more efficient and better serve customers and sellers on the platform. Amazon has already gotten started here, introducing Project Amelia to help sellers better analyze their data and eventually solve complex problems. All this makes now a great time to get in on Amazon and potentially benefit as agentic AI takes off. SoundHound AI (SOUN -6.19%) is a conversational AI expert, with industries from automobiles to restaurants using its technology. The company stands out because it turns speech directly into meaning, skipping the traditional text step and resulting in speed and higher quality for users. And this company could be on the way to carving out a spot in the agentic AI space. SoundHound is quickly growing its AI agent portfolio with agents that could tackle complex tasks across five industries. For example, the AI agent customer experience can streamline payment processes in the financial industry or handle plan upgrades in the telecom space. In under a year, SoundHound's AI agent helped French wholesale broker Apivia Courtage reduce the number of inbound queries handled by its human team by 20%. SoundHound has also built an AI agent employee experience to assist employees and businesses in areas such as human resources and IT. This voice AI specialist has seen growth explode in recent times, with revenue advancing 89% in the latest quarter. And though the stock has also soared, it could get another big lift as the agentic AI wave gathers momentum.

[3]

A Once-in-a-Decade Investment Opportunity: My Pick for the Best AI Stock to Buy in 2025 | The Motley Fool

The artificial intelligence (AI) boom has taken the stock market by storm. The S&P 500 (^GSPC 0.55%) has advanced 55% in the last two years, and AI promises to drive more upside in the coming years as it boosts productivity and efficiency across industries. Experts have compared AI to transformative events like the creation of the microprocessor, the personal computer, and the internet. Technological shifts of that magnitude come along maybe once in a decade, and investors that want to benefit as the AI boom unfolds should be buying stocks today. Wall Street is currently fixated on AI agents, which differ slightly from traditional AI copilots. The agentic AI market is projected to increase at 45% annually through 2030, according to Grand View Research. Alphabet (GOOGL 2.65%) (GOOG 2.50%) is well positioned to capitalize on that spending, and the stock price is quite attractive. Here's why Alphabet is my pick for the best AI stock to buy right now. The precise definition of artificial intelligence (AI) agent varies depending on the source, and often overlaps with the description of traditional AI copilots. But the basic difference is this: Traditional AI copilots can do simple things like summarize service issues and suggest solutions, whereas AI agents can handle more complex tasks like fixing customer service issues without assistance. Experts envision a future where most enterprises augment human employees with teams of AI agents, which will essentially function as digital workers assigned to specific tasks. Nvidia CEO Jensen Huang in a recent interview said his company may someday employ 50,000 people, but it will have 100 million AI agents working under those employees. Alphabet-subsidiary Google is a long-standing leader in AI research, and the company is using that expertise to create new monetization opportunities across its advertising and cloud businesses. For instance, generative AI overviews in Google Search are increasing usage and satisfaction, which further cements its leadership in search advertising. However, Google's largest and most compelling opportunity lies in cloud computing. In the past year, Forrester Research has recognized the company as leader in AI infrastructure solutions, machine learnings platforms, and foundational large language models. In one report, analyst Mike Gualtieri commented, "Google is the best positioned hyperscaler for AI. Google has enough differentiation in AI from other hyperscalers that enterprises may decide to migrate from their existing hyperscaler to Google." Google is currently the third largest public cloud in terms of revenue. The company accounted for 13% of cloud infrastructure and platform services spending in the third quarter, while Amazon and Microsoft accounted for 31% and 20%, respectively. But Google gained a percentage point of market share during the last year as its AI business expanded. Nearly 90% of generative AI unicorns are Google Cloud customers. The company could continue to gain market share in cloud services as enterprises lean into agentic AI. Google earlier this year added agent-building capabilities to Vertex AI, a platform that lets developers train and fine-tune machine learning models (including Google's Gemini) and deploy them in AI applications. Vertex AI Agent Builder positions Google to be a major player as agentic AI spending grows into a $50 billion market by 2030. Here are example use cases: ADT is developing AI agents to help customers select and set up home security systems. InterContinental Hotels Group is creating AI agents that assist travelers in planning vacations. And Mayo Clinic researchers are building AI agents that help healthcare professionals search clinical data. The International Data Corporation estimates spending on public cloud services will increase at 19% annually through 2028. But spending on artificial intelligence platforms like Google's Vertex AI is projected to increase at 51% annually during that period, driven in part by demand for agentic AI solutions. Wall Street estimates Alphabet's earnings will increase at 16% annually in the next three years, but its bottom line may grow faster if the company keeps gaining share in cloud infrastructure and platform services, which seems plausible given its position as a recognized leader across several AI product categories. However, even without upward revisions to earnings estimates, the current valuation of 25 times earnings looks quite reasonable. That's why Alphabet is currently my top AI stock, and why I think long-term investors should consider buying a small position today.

[4]

Investors Take Note: 5 Companies Using AI Agents to Drive Innovation | The Motley Fool

Artificial intelligence (AI) is reshaping the global economy and remains a major investing theme in 2025. From automating complex tasks to uncovering hidden insights in vast datasets, businesses stand to reach new levels of productivity. And this transformation across various industries is just getting started. Investors have the opportunity to buy the stocks in companies that are leveraging this next-generation technology as a long-term growth driver. Here are five cloud software companies to keep an eye on while they develop innovative and unique AI agents with significant potential. Adobe (ADBE -3.26%) is recognized for its market-leading creative tools like Photoshop, Illustrator, and Premiere Pro, which are staples for visual-media professionals and enthusiasts alike. These platforms are perfect for showcasing the power of Adobe Firefly AI, with capabilities that can still be described as magic. Features like text-to-image generation and generative fill have been game-changers for the creative industry, and Adobe is capitalizing on strong demand. The stock has been volatile, down about 35% from its 52-week high. Yet the company's fundamentals remain solid, evidenced by record fiscal 2024 results showing 11% revenue growth and 15% higher adjusted earnings per share (EPS). With continued financial momentum expected in 2025, this recent share-price weakness may present an attractive entry point for investors seeking exposure to this AI leader. CrowdStrike (CRWD -2.75%) has established itself as a dominant force in AI-powered cybersecurity through its Falcon platform, which uses advanced machine learning for proactive threat detection and automated response capabilities. The cloud-native solution has gained significant traction among organizations by delivering comprehensive protection across endpoint security, identity protection, threat intelligence, and exposure management within a single agent. Shares of CrowdStrike have gained roughly 27% over the past year, reflecting strong growth and earnings momentum. For fiscal 2025, Wall Street analysts project revenue to climb by 29%. Along with an expected 22% increase in earnings per share (EPS), this indicates a robust outlook that should continue to reward shareholders. Docusign (DOCU 1.02%) didn't invent the e-signature but has revolutionized digital agreement technology, transforming how businesses handle legal documents. The company's latest innovation is the integration of generative AI into its Intelligent Agreement Management (IAM) platform; that creates a more comprehensive suite of solutions that allow organizations to generate AI-based customized documents and automatically manage agreement workflows. The effort to diversify beyond electronic signatures appears to be paying off. Shares of Docusign have risen to their highest level since early 2022, highlighting a resurgence for the company with a refreshed growth outlook. What I like about the stock is its combination of solid fundamentals and category leadership, with expansion opportunities internationally. It's difficult to discuss artificial intelligence without mentioning Microsoft (MSFT -1.32%). The company's early investment in and ongoing partnership with OpenAI (creator of the groundbreaking AI chatbot ChatGPT) has secured its position as an AI leader. Through Microsoft 365 Copilot, the company integrates large language models (LLMs) across its Office productivity suite, embedding powerful AI capabilities within familiar tools like Word, Excel, and Teams. AI capabilities are powering Microsoft's Azure cloud platform, offering enterprise customers the infrastructure to build, train, and deploy custom AI models. This combination of AI-enhanced productivity tools and cloud computing exposure makes Microsoft stock one to buy and hold for the long run. There's a good reason that the share price of SoundHound AI (SOUN -6.19%) has risen by more than 640% over the past year. The company has quickly established itself as one of the most exciting players in AI innovation, with its conversational intelligence technology that enables natural voice communication between people and devices. SoundHound powers hands-free infotainment systems for several major automakers. The company is now bringing that success to the retail and restaurant industries, where its voice AI automates ordering and payment systems. The company sees a significant opportunity in broader customer service applications. Growth trends have been impressive, with Wall Street analysts projecting a 96% revenue increase in 2025. While the stock commands a pricey valuation premium, and will remain speculative until the company achieves consistent profitability, SoundHound's expanding market presence deserves to be on your investing radar.

[5]

5 AI stocks to buy in January and hold for the long haul

In January 2024, several artificial intelligence (AI) stocks show promise as the technology continues to evolve. Nvidia, Microsoft, Salesforce, Meta and Amazon are key players expected to benefit significantly from advancements in AI infrastructure and applications. Nvidia (NVDA -3.00%) has demonstrated remarkable success in the AI sector, with its revenue growing 125% in fiscal year 2024. Projections indicate its revenue will more than double in fiscal year 2025. The company's graphic processing units (GPUs) are crucial for AI infrastructure development, enabling rapid processing essential for large language model training and AI inference. Nvidia has captured a 90% market share in the GPU market, primarily due to its CUDA software platform, which simplifies the programming of its chips for diverse AI tasks. AI infrastructure spending continues to increase, as large language models require substantial computing power for training. Nvidia's largest customer, Microsoft (MSFT -1.32%), announced plans to invest approximately $80 billion this calendar year in AI data centers, with about half of that budget directed toward GPU servers. Given Microsoft's previous fiscal year capex of $44.5 billion, rising capital expenditures from other significant customers are expected, ensuring continued growth for Nvidia. The stock trades at a forward price-to-earnings (P/E) ratio of about 31.5 and a price/earnings-to-growth (PEG) ratio of 0.98, indicating it may be undervalued. Why Nvidia stock could soar after CES 2025 keynote Microsoft is significantly investing in AI infrastructure, particularly through its Azure cloud computing unit, which recorded a 33% revenue growth last quarter. The usage of Azure OpenAI services has doubled in the past six months, fueling demand for data and analytics services. While Azure's growth trajectory is strong, officials forecast that revenue will accelerate in the second half of its fiscal year as new capacity becomes available from prior capex spending. Microsoft is also expanding its data center network across the globe to meet growing demand. Moreover, Microsoft anticipates substantial growth in its AI software offerings, particularly through the AI copilots integrated into its Microsoft 365 productivity suite. These copilots, priced at $30 per month for enterprise use, assist in various tasks, including email management and creating presentations using natural language commands. Microsoft's stock is reasonably valued, trading at a P/E of 32.5 based on current fiscal year estimates. Performance-based layoffs hit Microsoft workforce Salesforce (CRM -2.77%) aims to lead in agentic AI, the next evolution beyond generative AI. Their newly launched platform, Agentforce, allows users to customize agents for various applications, including sales and customer service. Since its introduction, adoption has rapidly increased, with the company reporting the closure of over 1,000 teams using the platform just weeks after launch. Salesforce projects deploying 1 billion Agentforce AI agents by the end of fiscal 2026, with the platform operating on a consumption model priced at $2 per conversation. The stock currently trades at 29 times fiscal 2026 earnings, featuring a PEG ratio of 0.8, reflecting its potential value. Salesforce CEO says LLM capabilities are nearing their limit Amazon (NASDAQ: AMZN) is set to be among the biggest AI winners as its cloud computing platform, Amazon Web Services (AWS), maintains its position as the global leader -- commanding roughly 31% of the market. With a growing number of enterprises opting to rent computing power rather than build out their own systems, AWS is perfectly poised to benefit from the expanding role of AI in modern software. According to Goldman Sachs, AI tailwinds could lift the global cloud market -- valued at around $500 billion in 2023 -- to an astounding $2 trillion by 2030. This evolution not only reinforces AWS's dominant market position but also underpins Amazon's strategic advantage in cloud-based AI innovation. Beyond AWS, Amazon's diverse business operations further solidify its growth prospects. As the leading U.S. e-commerce company and the force behind the robust Prime subscription service, Amazon is well diversified. Analysts expect the company's bottom line to grow by approximately 22% annually over the next three to five years. Despite shares trading near all-time highs, the current forward price-to-earnings (P/E) ratio of 37 suggests there is ample room for continued expansion as AI accelerates the pace of cloud adoption. Can Amazon stock reach $287 by 2025: Here's what to watch Meta Platforms (NASDAQ: META), the digital advertising titan behind Facebook, Instagram, WhatsApp, and Threads, is making bold moves in artificial intelligence and virtual reality. Under the stewardship of CEO Mark Zuckerberg -- a long-time advocate for AI -- Meta is channeling significant capital into its Reality Labs division, building the data center capacity necessary to lead in the AI space. Last quarter, Meta's overall capital expenditures topped $9 billion, with Reality Labs incurring an operating loss of $4.4 billion. Despite these hefty investments, Zuckerberg is committed to a long-term vision, acknowledging that a meaningful return on these AI initiatives may take until the 2030s. Meta rockets to $730 target but are the risks worth it? Even as Meta places its bets on the future of AI, its core business remains exceptionally strong. The company continues to generate tens of billions of dollars in free cash flow annually through its vast digital advertising ecosystem, serving 3.29 billion daily active users. Market analysts project Meta's earnings to grow nearly 18% annually over the next three to five years. Priced at just 25 times forward earnings, Meta not only offers solid current performance but also the potential upside of pioneering generative AI -- a segment that could be worth over a trillion dollars in the coming years. Disclaimer: The content of this article is for informational purposes only and should not be construed as investment advice. We do not endorse any specific investment strategies or make recommendations regarding the purchase or sale of any securities.

[6]

1 Artificial Intelligence (AI) Stock With 115% Upside, and Another That Can Plummet 84% in 2025, According to Select Wall Street Analysts | The Motley Fool

The bulls have been in firm control on Wall Street since the bear market bottomed out in October 2022. Last year, the ageless Dow Jones Industrial Average, benchmark S&P 500, and growth-driven Nasdaq Composite all galloped to numerous record-closing highs. While the stock market has been propelled by a number of catalysts, including better-than-expected earnings, a dovish shift from the Fed, stock-split euphoria, and Donald Trump's November victory, nothing has been more important than the rise of artificial intelligence (AI). Artificial intelligence affords software and systems the ability to become more efficient at their assigned tasks, as well as evolve to learn new skills, all without human intervention. The capacity to learn and evolve gives AI virtually limitless utility, as well as a $15.7 trillion addressable market by 2030, according to the analysts at PwC. However, history has repeatedly shown investors that not every company involved in a next-big-thing trend turns out to be a winner -- and this is a fact not lost on Wall Street analysts. While one Wall Street analyst believes a leading AI hardware provider will soar by up to 115% in 2025, another analyst expects a high-flying and irreplaceable AI stock will face-plant in the new year and lose up to 84% of its value. Despite hitting a 52-week low on Jan. 10, semiconductor giant Advanced Micro Devices (AMD 1.10%) is viewed as one of the top stocks to buy in the first-half of 2025 by analyst Hans Mosesmann of Rosenblatt Securities. The $250 price target Mosesmann has placed on AMD would equate to a 115% increase from where shares of the company ended last week. In a December note to his clients, Mosesmann laid out a few key reasons he believes AMD is ideally positioned for a bounce-back year. To begin with, Mosesmann anticipates AMD will (pardon the pun) chip away at Intel's leading share in central processing units (CPUs). Although CPUs aren't the growth story they once were, an expected rebound in laptop/desktop sales in 2025 should lead to improved results for the top CPU companies, which includes Intel and AMD. Based on data from Mercury Research, AMD accounted for a 28.7% share of the desktop processor market during the third quarter of 2024, which is up 8.5 percentage points from the year-ago period. The margins and cash flow associated with CPUs are still robust enough to make a positive impact on AMD's bottom line. Mosesmann is also looking for Advanced Micro Devices to siphon graphics processing unit (GPU) share away from AI data-center kingpin Nvidia (NVDA -1.97%). On one hand, Nvidia's Hopper (H100) GPU and next-generation Blackwell GPU architecture are pretty much unrivaled in terms of computing speed. It's why Nvidia has such an extensive backlog of orders and has enjoyed otherworldly pricing power for its hardware. On the other hand, AMD's Instinct-series GPUs offer a considerably more appealing price point than Nvidia's chips. Perhaps more importantly, AMD's hardware should be easier for businesses to get their hands on. Companies wanting to be on the leading edge of the AI revolution may opt for AMD's chips to avoid having to wait in line for Nvidia's Hopper or Blackwell chips. With AMD stock valued at less than 23 times forward-year earnings, there is potential for significant fundamentally driven upside in 2025. But if the AI bubble were to burst, as history suggests will happen, AMD's top growth-driver would disappear. At the other end of the spectrum, analyst Rishi Jaluria at RBC Capital Markets foresees the hottest AI stock of 2024, Palantir Technologies (PLTR -3.39%), falling back to $11 per share. This would imply downside of up to 84% in the new year. Despite a rough start to the year for Palantir (its shares are down 11%, as of the closing bell on Jan. 10), its stock has gained 934% over the trailing-two-year period. This outsized return is a reflection of Palantir's unique role as an AI-driven data-mining specialist, as well as its improved operating performance. What makes Palantir "unique" is its operating moat. Its AI-inspired Gotham platform is used by the U.S. government and select allies to gather and analyze sensitive data, as well as plan and execute missions. Meanwhile, Foundry is Palantir's enterprise-facing platform that utilizes AI and machine learning solutions to help businesses make sense of their data. There simply isn't a one-for-one replacement for the software-as-a-service solutions Palantir provides at scale, which has afforded the company a hefty valuation premium. Palantir's operating results have also fueled the parabolic move higher in its stock. Rapid sales growth from Foundry, coupled with a reacceleration of sales growth from Gotham, helped shift Palantir to recurring profits ahead of Wall Street's consensus expectations. However, Jaluria has two specific reasons he remains skeptical of Palantir. For starters, he's unsure if Palantir can keep up its breakneck sales growth. In particular, Jaluria believes the company's earnings strength was influenced by the timing of select government contracts and points to potentially slower growth from Foundry. Something to keep in mind about Gotham is that its long-term growth ceiling is naturally limited. Palantir's management is willing to allow the U.S. and its allies access to its platform, while most other countries are shut out. This ultimately limits the scope of Gotham's reach. Jaluria is also concerned about Palantir's astronomical valuation. Whereas leaders of the dot-com bubble topped out around 40 times sales, and Nvidia peaked just north of 40 times sales in June-July 2024, Palantir is still valued at 61 times trailing-12-month sales. History tells us this isn't a sustainable premium, no matter how fast Palantir Technologies is growing. Although 84% downside would be a bit extreme for a profitable company with a sustainable moat, I do somewhat agree with Jaluria that Palantir stock should meaningfully retrace in the new year.

[7]

Could Artificial Intelligence (AI) Agents Dethrone Palantir in 2025? | The Motley Fool

Agentic AI is coming in 2025. In the first few days of the year, AI agents became a popular investing theme, representing the next iteration of artificial intelligence (AI) applications. With some of the biggest AI players going all-in on this technology, it might make existing AI powerhouses, like Palantir (PLTR -3.39%), a bit nervous. Could this technology knock Palantir off of its perch as one of the top AI investments? The answer may surprise you. Palantir emerged as one of the best pure-play AI investments in 2024. The stock had a phenomenal year, rising 340%. However, 2025 hasn't been so kind to Palantir stock, which has plummeted 16% to start the year. Palantir became a hot stock as it continuously posted strong growth quarter after quarter. This is because it is a long-established player in this field. Palantir started selling its AI software to government entities, giving those with decision-making authority the tools they needed to make the most well-informed decision when time is critical. This use case spread throughout government branches and eventually made its way to the commercial side. While government spending still accounts for most of Palantir's revenue, commercial clients are growing the quickest. Part of the reason commercial is growing quicker is the rapid adoption of Palantir's Artificial Intelligence Platform, often called AIP. AIP allows AI models to be integrated within a system rather than being used as a chat on the side. AIP also has tools to automate some workflows within the application, which is essentially what AI agents do. This is a key point in the Palantir investing thesis: It was already doing what others are getting excited about now. This gives Palantir a leg up on the competition and bodes well for Palantir's future. But there's one problem. Although I'd consider Palantir a leader in the AI sector and a clear innovator, the stock has already baked in a huge rise. Despite stumbling to start 2025, the stock is still incredibly expensive from a valuation perspective. Palantir's stock trades for an unbelievable 62 times sales and 143 times forward earnings. This indicates that significant growth is already reflected in the stock price, and Palantir will have to grow rapidly to make these valuations worth it. However, Palantir isn't putting up the growth it needs to justify these stock prices. As mentioned above, Palantir is growing quickly, but its Q3 revenue only rose 30% year over year. While that shows strong growth in a vacuum, the stock's valuation indicates a company that should be doubling or tripling its revenue year over year. With Wall Street analysts projecting that Palantir's growth will slow in 2025 to a 25% pace, that's a huge problem for the stock. So, what should investors do with Palantir stock? There is still a long way for the stock to fall before investors should consider scooping up shares again. Although Palantir is still at the forefront of innovative AI implementation, the stock has already priced that in and then some. There are much more attractive agentic AI investments to make right now, and I think investors would be better off turning their attention to those stocks than risk a lot with Palantir's high valuation.

[8]

These 5 agentic AI stocks are the hottest picks for January

As the next major wave of artificial intelligence (AI) emerges, companies specializing in agentic AI are gaining attention. Agentic AI refers to automated AI agents that can complete assigned tasks without constant human supervision. Several stocks poised to benefit from this development include UiPath, Salesforce, Nvidia, Amazon, and SoundHound AI. UiPath (PATH -3.42%) initially focused on robotic automation, helping customers create software robot agents that perform mundane tasks like data entry. The company's platform offers low-code development tools and document processing capabilities, primarily designed for structured data automation. However, agentic AI represents a shift, enabling AI agents to work with unstructured data and make autonomous decisions. During its user conference in October, UiPath discussed its roadmap for agentic automation, which includes launching tools such as Agent Builder and Agentic Orchestration. Agent Builder will allow customers to create agents that work alongside software robots using low-code platforms or pre-built templates. Agentic Orchestration will enable collaboration among humans, robots, and AI agents, allowing customers to design and optimize complex business processes. UiPath aims to become a neutral platform for agentic AI, supporting integrations with vendor-specific AI agents. Despite facing challenges in its transition to an agentic AI company, UiPath has reported a 9% revenue growth last quarter and a 17% increase in annual recurring revenue (ARR). The company boasts a net dollar retention rate of 113% as existing customers continue to expand their spending. To attract new clients, UiPath has partnered with major firms including SAP, Microsoft, Deloitte, and Ernst & Young. The stock trades at a forward price-to-sales (P/S) ratio of 4.8 times fiscal 2026 analyst estimates, positioning it as a potential rebound candidate following new agentic AI launches. 5 AI stocks to buy in January and hold for the long haul Salesforce (CRM -2.77%) has consistently been a leader in customer relationship management (CRM) software, evolving by acquiring companies like Mulesoft, Tableau, and Slack to enhance its offerings in automation and analytics. The company is now focusing on agentic AI through its new Agentforce solution, allowing customers to build and customize autonomous AI agents. This platform includes ready-to-use agents that can be personalized using no-code and low-code tools. Salesforce highlighted various use cases for Agentforce, such as patient-services agents in healthcare and DMV agents for public sector inquiries. Following the introduction of Agentforce in October, the company reported 200 closed deals by December, with thousands more in the pipeline. Additionally, it launched Agentforce 2.0, enhancing reasoning, integration, and customization features, and announced 1,000 more closed deals shortly thereafter. Priced at $2 per conversation for usage-based billing, Salesforce aims to deploy 1 billion Agentforce AI agents by the end of fiscal 2026, which ends in January 2026. The stock trades at a forward P/S ratio of 7.6 times fiscal 2026 estimates, reflecting a reasonable valuation given the agentic AI opportunity ahead. Salesforce CEO says LLM capabilities are nearing their limit Nvidia has emerged as a key player in agentic AI, building on its core strength in AI chips. The company has expanded into software that supports AI development. At CES, Nvidia's CEO Jensen Huang presented blueprints for building AI agents, highlighting integrated partnerships that leverage its Enterprise software platform. For instance, Nvidia's new AI blueprint allows businesses to analyze extensive video footage for operational efficiencies. Jensen Huang's vision for Nvidia brings confidence to investors Amazon (AMZN -1.44%) stands as the leading global cloud service provider, positioning itself to benefit from the growth of AI agents through Amazon Web Services (AWS). AWS allows developers to quickly construct AI agents via the Amazon Bedrock platform. The division achieved a $110 billion annualized revenue run rate, bolstered by demand for AI products and services. Internally, Amazon is leveraging AI agents like Project Amelia to enhance e-commerce efficiency and provide better service to sellers and customers. Can Amazon stock reach $287 by 2025: Here's what to watch SoundHound AI (SOUN -6.19%) specializes in conversational AI, enabling applications across diverse industries. The company differentiates itself by converting speech directly into meaning, enhancing speed and quality. It is also expanding its portfolio of AI agents capable of handling complex tasks in various sectors, including finance and telecommunications. Recently, SoundHound's AI agent helped a French finance broker reduce inbound queries by 20% within a year. Why SoundHound AI stock is breaking records Additionally, SoundHound has developed AI agent solutions for employee-related tasks in HR and IT. The company has experienced significant growth, with a 89% increase in revenue last quarter, indicating strong momentum as the agentic AI market develops. Disclaimer: The content of this article is for informational purposes only and should not be construed as investment advice. We do not endorse any specific investment strategies or make recommendations regarding the purchase or sale of any securities.

[9]

Prediction: This Company Will be 1 of the Biggest Winners of the AI Agent Boom | The Motley Fool

Last year, investors focused on companies crucial to the development of a hot newish technology: artificial intelligence (AI). These players -- like Nvidia, Broadcom, or Super Micro Computer -- produce chips or equipment such as servers for data centers, the place where AI development begins. After all, it's necessary to train large language models before they can actually do the job of solving problems and executing tasks. And these companies should continue to see growth ahead as there is plenty more AI training and data center buildout to be done. At the same time, another area of AI may share the spotlight this year, and this has to do with the idea of putting AI to work. I'm talking about the development and use of AI agents. These are AIs that help companies or industries with complex tasks that involve reasoning -- and taking action on that reasoning. Several companies are progressing in the area of AI agents right now, but my prediction is one in particular will be one of the biggest winners of the AI agent boom. Let's check out this stock to buy now. First, though, let's take a closer look at the potential of AI agents. These are software programs that can interact with a human, consider a problem, use data to develop a solution, and act on it. They can be used in just about any field -- for instance, insurers could use them for initial queries and the processing of certain claims, or the travel industry might use them for reservations and customer support. And each operation makes the agent "smarter," because data from it is fed back into the system. The idea is these agents can accomplish certain tasks, then escalate to a human for highly complex operations. This frees up the humans in various departments, allowing them to work on other projects -- a huge boost to efficiency and a great way for companies to save money. The AI agent market, at a compound annual growth rate of more than 44%, is expected to reach $47 billion by 2030, according to Markets and Markets data. So, which company is heading for an AI agent victory in this high-growth market? My prediction is Amazon (AMZN -1.44%) will be one of the biggest winners, and this is because the company will benefit from the technology in two different ways -- as a user of agentic AI and a seller of tools to develop AI agents. Let's consider the AI agent use opportunity first. Amazon is a leader in e-commerce, with a massive fulfillment network worldwide, and here, AI agents could play a key role in boosting efficiency, and customer and seller satisfaction -- and this should support earnings growth over time. Amazon already has taken the first steps in this direction, launching Project Amelia, a chatbot to help sellers improve their businesses. Initially, sellers can ask questions like "how should I prepare my store for the holiday season?" or might ask for updates on their store's traffic and sales data. Progressively, Project Amelia will offer answers to complex questions, solve problems, and take action -- making itself a true AI agent. The company's Amazon Web Services (AWS) is the world's top cloud computing player, and this is where Amazon can benefit from selling tools. AWS makes it simple for developers to build their own AI agents, suiting their business' needs, thanks to its Amazon Bedrock platform -- the creation of an agent requires only a few steps. So, here, Amazon makes it easy for others to get in on this opportunity to become more efficient. And since AWS already is the market leader, potential customers are right there, ready to use the platform to start their AI agent journey. Amazon isn't new to the general AI market -- the company already uses many AI tools across its e-commerce business and sells everything from chips to AI services through AWS. And the work is bearing fruit. Last year, AWS reached a $110 billion annual revenue run rate thanks to sales of AI products and services. Now, as AI agents gain momentum, I would expect AWS and Amazon as a whole to benefit. And that's why I predict this player will be one of the biggest success stories of this new wave of AI growth.

[10]

1 Top AI Agent Stock to Buy Right Now | The Motley Fool

The first phase of the artificial intelligence (AI) boom was undoubtedly defined by powerful large language models capable of a large variety of tasks. AI models like those that power ChatGPT can do a lot of things reasonably well, although they still output incorrect information and fabricated responses at times. The second phase will likely be defined by AI agents, which are narrow in focus and can be designed to autonomously handle related tasks. Imagine a customer service AI bot that can chat with customers, figure out what needs to be done to fix the customers' problems, and then hook into internal systems to process refunds, change settings, or escalate issues, all while adhering to company policies and procedures. AI agents could greatly reduce costs while improving customer service, a one-two punch that makes the technology extremely appealing. While a lot of technology companies are talking about AI agents and agentic AI, International Business Machines (IBM 0.01%) is uniquely positioned to ride the AI agent wave. After years of unsuccessful AI strategies, IBM has landed on an enterprise AI approach that's racking up billions of dollars in bookings. IBM's AI strategy has two components. First, there's watsonx, the company's AI software platform that can run just about anywhere, including on Amazon's AWS. With watsonx, IBM's enterprise customers have a fully stocked toolbox to develop, train, test, deploy, and manage AI models and AI agents. A big selling point of watsonx is its governance capabilities. Some industries have strict regulatory and compliance requirements, particularly when sensitive user information is involved. Imagine a financial services company looking to build an AI agent that can help customers solve problems. That company needs to be sure that its AI agent isn't going to leak sensitive information or go off the rails. IBM's watsonx platform provides the observability and monitoring tools to keep AI agents in check. While watsonx is a powerful platform, the bulk of IBM's $3 billion in AI-related bookings so far has come from its consulting business. While software is an important component of any AI strategy, large enterprises also need guidance, implementation, and other services to realize the full benefits of AI. The consulting business is a key differentiator for IBM, and it helps to bring new business to other parts of the company like software and infrastructure. While general-purpose AI models are impressive, their value to large enterprises is questionable since their answers can't be trusted and they can be expensive to run. AI agents, in contrast, can be trained to do specific tasks well, and they can often use less powerful and cheaper-to-run models that don't need to be trained on a vast amount of external information. For enterprises that have struggled to find viable use cases for AI, AI agents could be the answer. IBM's powerful artificial intelligence software platform paired with its consulting arm is a potent combination that puts the company in a great position to ride the AI agent wave and implant itself at the center of the next big thing in AI. IBM's AI strategy won't make a lot of headlines, but the company is working behind the scenes for its enterprise clients to enable them to deploy AI in a way that makes financial and business sense. With the stock trading for about 17 times the company's full-year free-cash-flow guidance, IBM is a top AI agent stock that can be bought at a reasonable price.

Share

Share

Copy Link

A comprehensive look at the most promising AI stocks for investors, focusing on industry leaders like Nvidia, Microsoft, and emerging players in AI agent technology.

AI Stock Market Landscape: Leaders and Emerging Players

As artificial intelligence (AI) continues to reshape industries, investors are keenly eyeing stocks that could benefit from this technological revolution. Several companies have emerged as frontrunners in the AI race, with their innovations and market positions making them attractive long-term investment options

1

2

3

.Nvidia: The AI Chip Giant

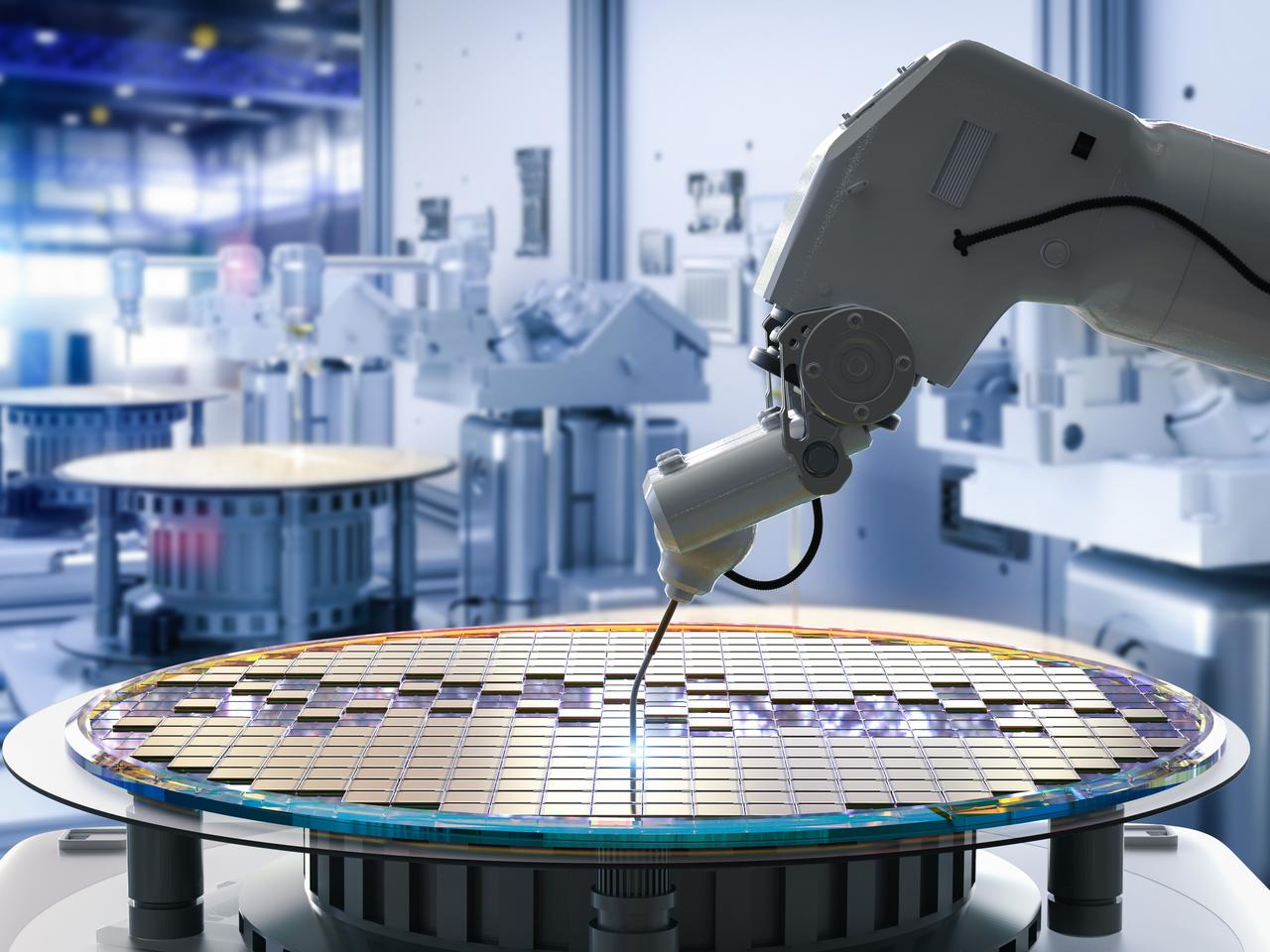

Nvidia has solidified its position as a cornerstone of AI infrastructure. The company's dominance in AI chips, particularly its GPU technology, has been crucial for powering AI model training and inference. With a staggering 90% market share in the GPU market, Nvidia's CUDA software platform has become the go-to solution for AI-related tasks

1

5

.Key highlights:

- 125% revenue growth in fiscal year 2024

- Projected doubling of revenue in fiscal year 2025

- Essential supplier for major tech companies like Microsoft

Microsoft: Cloud and AI Synergy

Microsoft's strategic investment in OpenAI and its Azure cloud platform positions it as a major player in the AI space. The company is making significant strides in integrating AI across its product lineup

2

5

:- 33% revenue growth in Azure last quarter

- Doubling of Azure OpenAI services usage in six months

- $80 billion planned investment in AI data centers

Emerging AI Agent Technologies

Companies like Salesforce and SoundHound AI are at the forefront of developing AI agent technologies, which represent the next evolution in AI applications

3

4

:- Salesforce's Agentforce platform aims to deploy 1 billion AI agents by fiscal 2026

- SoundHound AI's conversational intelligence technology is gaining traction in automotive and retail sectors

Cloud Giants and AI Infrastructure

Amazon Web Services (AWS) and Google Cloud are leveraging their cloud infrastructure to support AI development and deployment

3

5

:- AWS commands 31% of the global cloud market

- Google Cloud is recognized as a leader in AI infrastructure solutions and machine learning platforms

Related Stories

Social Media and AI Integration

Meta Platforms is investing heavily in AI and virtual reality through its Reality Labs division, although the company acknowledges that significant returns may not materialize until the 2030s

5

.Investment Considerations

While these stocks show promise, investors should consider various factors:

- Valuation metrics: P/E ratios and PEG ratios vary across companies

- Market volatility: Some stocks, like Adobe, have experienced recent price fluctuations

- Long-term growth projections: Analysts expect continued growth in earnings for most of these companies

Conclusion

The AI stock market presents diverse opportunities for investors, from established tech giants to specialized AI firms. As the technology continues to evolve, these companies are poised to play significant roles in shaping the future of AI and potentially delivering substantial returns for long-term investors

1

2

3

4

5

.References

Summarized by

Navi

[1]

[3]

[4]

[5]

Related Stories

AI Stocks Face Turbulence as Trump's Tariffs Take Effect, but Analysts See Long-Term Potential

05 Mar 2025•Technology

AI Stock Market Volatility: Insider Activity and Investment Opportunities Amid Tech Sector Pullback

02 Mar 2025•Business and Economy

AI Giants Dominate Tech Landscape: Nvidia, AMD, and Others Poised for Growth in 2025

14 Dec 2024•Technology

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation