AI Stocks Poised for Growth: Analyzing Top Contenders in the Semiconductor and Software Sectors

15 Sources

15 Sources

[1]

2 Artificial Intelligence (AI) Stocks That Are Screaming Buys in December | The Motley Fool

The growing adoption of artificial intelligence (AI) has lifted many technology stocks this year, and the good part is that this trend is likely to continue in 2025. Market researcher IDC forecasts that global AI-related spending could hit $337 billion next year and jump to a whopping $749 billion by 2028. As a result, technology companies selling AI-related hardware and software should ideally witness healthy growth in their businesses next year. That's the reason why investors would do well to buy shares of Micron Technology (MU -4.59%) and Twilio (TWLO -1.60%), two AI stocks that are set to benefit from the billions of dollars that are being poured into AI. Let's look at the reasons why. Micron Technology may not have set the stock market on fire this year as shares of the chipmaker have gained 18% in 2024, losing momentum in the second half of the year despite posting solid results of late, but that's good news for investors looking to buy an AI stock at a reasonable valuation. After all, Micron is trading at just 11 times forward earnings, a nice discount to the tech-heavy Nasdaq-100 index's forward earnings multiple of 28. Additionally, Yahoo! Finance puts Micron's price/earnings-to-growth ratio (PEG ratio) at just 0.16 based on the estimated earnings growth that it is forecast to deliver over the next five years. A PEG ratio of less than 1 means that a stock is undervalued with respect to the growth that it is expected to deliver. Buying Micron at this valuation is a no-brainer. That's because the company is set to benefit from the massive jump in memory spending in 2025. Market research firm TrendForce is forecasting a 51% increase in spending on dynamic random access memory (DRAM) in 2025, along with a 29% increase in NAND flash revenue. AI is set to play a central role in this healthy growth as the demand for high-bandwidth memory (HBM) that's deployed in AI servers is expected to take off. According to Micron, sales of HBM are expected to hit $25 billion in 2025 from just $4 billion in 2024. Even better, the bump in HBM demand is going to impact the pricing environment positively and help Micron enjoy fatter margins. It is worth noting that Micron is already benefiting from the favorable dynamics in the memory market. When the company released its fiscal 2024 fourth-quarter results in September, it posted a terrific year-over-year increase of 93% in its top line to $7.75 billion. The company's non-GAAP operating margin came in at 22.5%, as compared to a negative reading of 30% in the prior-year period. The chipmaker is set to release its fiscal Q1 results on Dec. 18. Micron is expecting $8.7 billion in revenue along with earnings of $1.74 per share. Those numbers would be a massive improvement over the year-ago period's revenue of $4.7 billion and non-GAAP loss of $0.95 per share. Even better, analysts are expecting Micron's revenue in fiscal 2025 to jump by 52% to $38.2 billion, while earnings are expected to shoot up to $8.93 per share from last year's reading of $1.30 per share. However, don't be surprised to see Micron clocking stronger growth in the new fiscal year, as a potential jump in sales of smartphones and personal computers (PCs) next year, driven by AI, could give it an additional boost. Gartner is forecasting AI PC shipments to jump by 165% in 2025. Meanwhile, shipments of generative AI-capable smartphones are expected to increase to 405 million units in 2025 from 234 million units this year, according to IDC. These two markets could drive considerable growth in memory shipment volumes next year as AI-capable smartphones and PCs require more memory and storage. In all, Micron's attractive valuation and its impressive growth make this AI stock a screaming buy this month, as the sunny prospects of the memory market in 2025 could send it on a bull run. Shares of Twilio have shot up remarkably since the company released its third-quarter results on Oct. 30, as the company's revenue and earnings turned out to be well ahead of Wall Street's expectations. Even then, investors can buy Twilio at a reasonable 4.5 times sales (which is lower than the U.S. tech sector's average sales multiple of 8.4) and 27 times forward earnings. Investors would do well to buy Twilio stock hand over fist at these multiples as the company's growth is likely to accelerate thanks to the growing adoption of AI in the contact center and customer service space. Twilio management said on its recent earnings conference call that it is making a concerted effort to integrate AI throughout its platform. This move seems to be bearing fruit as Twilio's revenue growth in the previous quarter hit 10%, a nice improvement over the 4% growth it clocked in the first two quarters. The company not only saw improvement in its customer base but also witnessed higher spending by existing customers. Twilio's active customer accounts increased to 320,000 last quarter from 306,000 in the year-ago period. More importantly, its dollar-based net expansion rate increased by four percentage points year over year to 105% in Q3. This suggests Twilio's existing customers increased their spending as this metric compares the spending by its customers in a quarter to the spending by the same set of customers in the year-ago period. The addition of AI-specific offerings to Twilio's platform means that it has an opportunity to cross-sell new solutions to a huge base of existing customers. Future Market Insights estimates that the growing demand for AI-specific tools in the communications platform-as-a-service (CPaaS) market could increase this industry's annual revenue from $12 billion this year to $121 billion in 2034. Given that Twilio has been integrating AI-powered tools into its communications platform since last year, it won't be surprising to see the company's growth accelerating in the future as it should be able to win a bigger share of customers' wallets. All this explains why analysts increased revenue expectations from Twilio for the next couple of years. This impressive growth is set to filter down to Twilio's bottom line as well. Analysts are expecting its earnings to increase by 17% in 2025 to $4.29 per share. Assuming Twilio trades at 34 times earnings after a year (in line with the Nasdaq-100's earnings multiple), its stock price could jump to $146 based on its projected 2025 earnings. That would be a 29% increase from current levels. So, savvy investors should consider buying Twilio stock right away, considering its attractive valuation and the acceleration witnessed in the company's growth since it seems capable of sustaining its impressive momentum in 2025 and beyond.

[2]

2 Top Artificial Intelligence Stocks to Buy in December | The Motley Fool

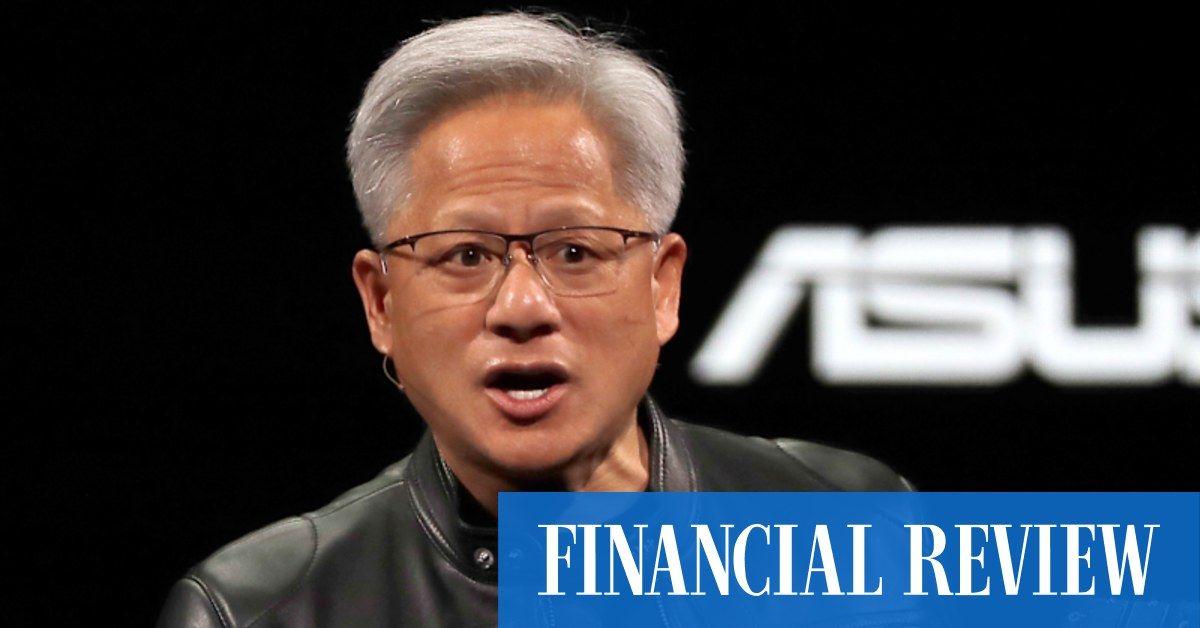

Artificial intelligence (AI) continues to be one of the biggest driving forces in the stock market. While chipmakers and cloud computing companies have been the biggest early beneficiaries, software companies are starting to see nice growth opportunities emerge as well. That said, the semiconductor sector is still one of the best places to find attractively valued stocks tied to AI. Let's look at two semiconductor stocks that should see AI help power their growth in December and beyond. The biggest AI winner thus far has been Nvidia (NVDA -1.81%), which has grown to become the second-largest company in the world. Nvidia originally developed a new type of semiconductor chip called a graphics processing unit (GPU) to help speed up the rendering of graphics in video games and elsewhere. For a long time, this was a niche industry dominated by Nvidia and ATI (which has since been acquired by Advanced Micro Devices). Nvidia was able to expand the use of GPUs to other industries with the help of its CUDA software platform, which allowed the chips to be programmed to more efficiently handle tasks. This led to more developers learning to program GPUs using CUDA, which led to the developers purchasing Nvidia GPUs to do their work on, creating a virtuous circle and helping create the wide moat the company sees today. The use of GPUs in cryptocurrency mining became a growth driver for the company back in 2016-2017, but it was the use of GPUs for training large language models (LLMs) and AI inference in beginning in 2021-2022 that led to astronomical growth for Nvidia. Today, Nvidia's GPUs have become the backbone of the AI infrastructure buildout, and through the wide moat it gained with CUDA, it now holds an approximate 90% market share. Nvidia's CEO says the current demand for its chips is "insane," as the world's top tech companies race to become AI leaders. The biggest risk to the stock is if demand slows. However, Nvidia's largest customers have by and large expressed plans to continue ramping up AI infrastructure spending to take advantage of what many view as a once-in-a-generation opportunity. Also working in Nvidia's favor is that in order to improve their AI models, these companies need exponentially more computing power, and thus more GPUs, to train their models on. Despite its huge gains in the past few years, the stock trades at an attractive valuation. It has a forward price-to-earnings (P/E) ratio of about 33 based on 2025 analyst estimates, and a price/earnings-to-growth (PEG) ratio of approximately 1. A PEG ratio under 1 is usually considered undervalued, but growth stocks will often command PEG ratios well above 1. All this makes Nvidia an attractive option to consider buying this month as we head into 2025. While Nvidia has become the dominant player in the GPU market, Taiwan Semiconductor Manufacturing (TSM -0.63%), or TSMC for short, has become the leading player in the contract semiconductor manufacturing space. The company is a close partner with Nvidia and the primary manufacturer of its GPUs. Apple, meanwhile, is its largest customer, and the iPhone maker regularly buys out all of the capacity of TSMC's advanced nodes when TSMC moves to newer advanced chip manufacturing technology. TSMC thus has two big AI growth opportunities in front of it. The biggest remains making chips to meet the huge demand for AI chips coming from the AI infrastructure buildout. TSMC will continue to benefit from Nvidia's success, but it will also benefit from any companies looking to get in on this space as well. A number of companies have started to design custom AI chips through Broadcom and Marvell to meet specific needs, while Arm Holdings and Softbank have been rumored to be looking for manufacturing capacity to make their own AI chips. In addition to AI chips for data centers, TSMC would also benefit from any increased demand coming from an end device hardware upgrade cycle. Newer smartphones and PCs are generally needed to run the latest AI offerings, so any increased demand for smartphones or computers would benefit the company. Apple is pushing its new AI features with Apple Intelligence, which is expected to boost iPhone 16 sales, while Microsoft has been advancing its AI Copilot, which could help with an enterprise PC upgrade cycle. To meet growing demand, TSMC continues to invest in adding more capacity while also continuing to push technology innovation and shrinking node sizes. Smaller nodes allow for better chip performance and power consumption, while also increasing the number of chips that can fit on a wafer. TSMC has also displayed strong pricing power over the past few years, and it is set to raise prices once again in 2025. According to Morgan Stanley, the company will increase prices by 10% for CoWoS (chip on wafer on substrate), 6% for high-performance computing, and 3% for smartphones. Notably, CoWoS is a packaging technology used for high-performance chips, such as Nvidia's GPUs. Like Nvidia, TSMC trades at an attractive valuation, with a forward P/E under 23 based on analysts' 2025 estimates and a PEG of 1.2. Given the opportunity still in front of TSMC, it looks like a solid stock to buy in December ahead of what should be a strong 2025 for the company.

[3]

2 Artificial Intelligence (AI) Stocks to Buy Right Now That Could Make You a Millionaire | The Motley Fool

Advances in artificial intelligence (AI) are expected to reshape vast swaths of the global economy. Fortunes will be made by savvy investors who position themselves to profit from this powerful megatrend. To help you claim your share of the coming AI boom, here are two top tech stocks set to deliver handsome gains to their shareowners in the years ahead. Investors have crowned Nvidia (NASDAQ: NVDA) the early winner of the AI arms race. The semiconductor behemoth designs the cutting-edge chips that power many leading AI applications. But no business likes to be beholden to just one supplier for their most crucial computing hardware. Chip buyers want to see more competition among AI chipmakers -- and Advanced Micro Devices (AMD -1.96%) intends to provide it. The stakes are massive. AMD CEO Lisa Su sees sales of chips that accelerate AI workloads growing by over 60% annually to a whopping $500 billion by 2028. AMD is just beginning to penetrate this lucrative market. The chipmaker expects sales of its graphic processing units (GPUs) used in AI data centers to top $5 billion in 2024. Yet its AI chip sales are booming -- AMD's data center revenue soared by 122% year over year to $3.5 billion in the third quarter -- and the company sees much more gains ahead. Tech giants are eager to deploy AMD's chips in their rapidly expanding cloud computing operations. Microsoft is using AMD's MI300X accelerators to power its popular "copilot" AI assistants. Meanwhile, Meta Platforms uses MI300X chips to deliver predictions from its high-performing Llama 405B AI model. AMD's forthcoming MI325X accelerators, which promise substantial performance upgrades, should also be well received by chip buyers. AMD has another powerful growth opportunity in the burgeoning market for AI-enabled personal computers (PC). PC makers like HP and Lenovo are set to roll out more laptops featuring AMD's new Ryzen AI Pro 300 Series processors. The chipmaker believes these high-performing AI chips will help it win market share, particularly as more businesses choose to upgrade their devices after Microsoft discontinues technical support for Windows 10 PCs in 2025. AMD is already seeing a boost in its client segment, which houses its PC-based business. Sales in the division jumped 29% to $1.9 billion in the third quarter. While AMD wants to provide companies with the hardware they need to realize their AI ambitions, Palantir Technologies (PLTR 6.22%) is supplying the software. The analytics leader enables customers to discern valuable insights from their data faster than their competitors. Palantir's top-rated machine learning technology can find patterns across disparate data sources. Its software strengthens its clients' decision-making processes, whether on the battlefield or in the boardroom. Moreover, Palantir boosts the productivity of frontline personnel by bringing advanced AI and real-time data to its customers' daily workflows. The U.S. military is partnering with Palantir to bolster its intelligence-gathering and AI capabilities. The value of these increasingly vital services can be seen in Palantir's U.S. government revenue, which surged by 40% year over year to $320 million in the third quarter. Companies are also beginning to recognize the value of Palantir's AI offerings. Mining giant Rio Tinto is working with the analytics leader to improve the safety and throughput of its railway network. Meanwhile, energy producers like APA and BP are using Palantir's new Artificial intelligence Platform (AIP) to make their oil and gas production operations more efficient and reliable. Recently struck partnerships with major cloud computing providers like Microsoft and Oracle are accelerating Palantir's growth. The rapidly expanding company's U.S. commercial revenue soared by 54% to $179 million in the third quarter. Better still, Palantir is highly profitable and cash-rich. Its Q3 net income more than doubled to $144 million, bringing its cash reserves and investments to $4.6 billion as of Sept. 30.

[4]

2 AI Stocks to Buy in December and Hold for 20 Years | The Motley Fool

Every decade seems to create a new wave of growth stocks that benefit from the latest trends in the economy. The last 20 years have created tremendous wealth for investors who jumped early on the growth of e-commerce (Amazon), streaming video (Netflix), and electric cars (Tesla). Artificial intelligence (AI) has the makings of the next wealth-building opportunity in the stock market. The AI market is expected to grow from $184 billion in 2024 to $826 billion by 2030, according to Statista. Here are two stocks that many investors may wish they had bought in another 20 years. AI-powered voice assistants are starting to see widespread adoption for things like customer service and smart ordering, but it could create many new use cases in electric cars and other markets over the next decade. SoundHound AI (SOUN 12.60%) is emerging as the leader in this market. It's a relatively small company that is experiencing rapid growth. SoundHound has a trailing revenue of $67 million, which provides the foundation for explosive returns in the coming years as more businesses adopt its technology. Its third-quarter revenue grew 89% year over year, partly boosted by the recent acquisition of Amelia, but it was already reporting high growth before that, with revenue up 54% year over year in Q2. SoundHound is in the process of expanding its customer base beyond automotive and restaurants, which have been its focus, to other markets like retail, healthcare, and banking. This will significantly expand its addressable market and help the company scale to improve margins. Last year, SoundHound's top five customers comprised over 90% of the business but now represent less than a third. Another encouraging sign about SoundHound's growth prospects is the list of partnerships with other leading tech companies. Nvidia, Samsung, Oracle, and ServiceNow are among the companies working with the AI voice leader. The main negative against SoundHound AI is a lack of profitability, but this is not unusual for a small tech company. Management expects the business to achieve positive adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) by the end of 2025, which is a catalyst for the share price. Investors have the opportunity to get in on the ground floor before Wall Street catches on to this emerging growth story and bids the share price higher. Advanced Micro Devices (AMD -1.96%) shares tripled over the last five years as it gained market share against Intel. AMD is a leading supplier of central processing units (CPUs), graphics processing units (GPUs), System-on-a-Chip (SoC), and other products for a variety of markets. However, the growing demand for its data center GPUs continues to show why the shares can deliver outstanding returns. Data center revenue jumped 122% year over year in Q3 to $3.5 billion, which helped drive AMD's total revenue up 18%. Management credited higher data center revenue to strong demand for its Instinct family of GPUs. As more advanced AI models launch and more use cases emerge for this technology, it could drive significantly more demand for AMD's chips. Last year, management estimated the data center AI chip market to grow from $45 billion in 2023 to more than $400 billion in 2027. But after its data center business exceeded revenue estimates in 2024, management recently updated its long-term forecast and now anticipates the market for AI accelerators to reach $500 billion by 2028. The writing is on the wall for investors. The adoption of AI is causing new leaders to emerge in the semiconductor industry. AMD generated more data center revenue last quarter than Intel. Intel dominated the CPU market for decades, but the AI boom now favors companies with expertise in developing GPUs, which are essential for training AI models. Nvidia is the other GPU supplier that could be a good choice for investors, but AMD still has a lot of opportunity to gain share on Intel in CPUs, which may not be fully reflected in the stock's valuation. With AMD stock currently down 33% from its recent high, it's a great time to start an investment before more growth sends the stock higher.

[5]

2 Artificial Intelligence (AI) Stocks You Can Buy and Hold for the Next Decade | The Motley Fool

Artificial intelligence (AI) is already a huge growth driver for many tech companies and will likely be a catalyst for years to come. IDC research estimates that AI spending will contribute nearly $20 trillion to the global economy by 2030. But which companies are poised to benefit over the next decade as AI takes off? Here's why Nvidia (NVDA -0.05%) and Taiwan Semiconductor Manufacturing (TSM 1.80%) should be on your short list of AI stocks. While many companies are currently benefiting from artificial intelligence, Nvidia has the potential to continue tapping into this massive trend for many years. Nvidia's GPUs have long been a top choice among tech companies needing the best chips for their data centers, with the company having an estimated 70% to 95% of the AI processor market. That lead gives Nvidia a healthy head start in the AI chip race, and the company continues to release new semiconductors to ensure it won't get caught flat-footed. The latest iteration is the company's Blackwell GPU for AI, which Nvidia CEO Jensen Huang said on the third-quarter earnings call was already in the hands of top customers and is 2.2x faster than its Hopper GPUs. Huang is preparing his company for an unprecedented wave of AI data center spending, which he estimates will reach $2 trillion over the next five years. The good news for investors is that it won't take years for Nvidia to benefit from AI. In the company's third quarter (ending Oct. 27), revenue increased 94% to $35.1 billion, and non-GAAP (generally accepted accounting principles) earnings soared 118% to $0.81 per share. Much of the company's growth is already being spurred by Nvidia's data center segment, which had a 112% sales increase to $30.8 billion in the quarter. The one thing to note with Nvidia's stock is that it isn't cheap. The company's shares have a price-to-earnings ratio of 54.5 right now, higher than the S&P 500's (SNPINDEX: ^GSPC) 30.6. But with AI spending ramping up and Nvidia leading the pack with its GPUs, there's likely more room for this tech giant to run. Taiwan Semiconductor is a unique AI investing angle because the company doesn't create any cutting-edge software or high-powered processes. Instead, it manufactures the semiconductors that go into the world's most advanced data centers. The company manufactures about 90% of the world's most advanced processors, and business is booming. In the third quarter (ending Sept. 30), the company reported sales of $23.5 billion, up 36% from the year-ago quarter, and an earnings increase of 54% to $1.94 per American depository receipt (ADR). Just as with Nvidia, huge demand for AI chips over the coming years will likely continue to fuel Taiwan Semiconductor's growth. On the latest earnings call, CEO C.C. Wei said, "Almost every AI innovator are working with us," and added that his company "... probably gets the deepest and widest growth of anyone in this industry." In short, as the $2 trillion in data center spending ramps up, Taiwan Semiconductor will be the main supplier of all the processors. Though Taiwan Semiconductor's stock is up about 97% over the past year (as of this writing), it's not outrageously expensive, at a P/E ratio of just 29.5. That makes now a good time to pick up shares of the chip manufacturer as AI semiconductor demand ramps up.

[6]

Nvidia Says This Artificial Intelligence (AI) Stock Is Worth Watching in 2025 | The Motley Fool

When chipmaker Nvidia says it's partnering with a company to produce an artificial intelligence (AI) product, it's probably something that investors should pay attention to. Considering that the majority of servers built for AI have Nvidia GPUs in them, it knows plenty about what's happening in that part of the computing space. During Nvidia's Q3 conference call, it highlighted one company that it's working with to bring AI to more customers: Accenture (ACN 1.28%), the largest tech consulting firm in the world. Nvidia CFO Colette Kress said during its conference call that Accenture created a new unit with 30,000 employees trained on Nvidia's AI technology. This makes it one of the most well-equipped companies to provide clients with the AI expertise they may lack in-house. While tech giants like Alphabet or Microsoft have huge teams devoted to this technology, companies in the banking, industrial, or oil sectors, for example, are unlikely to have those sorts of internal resources. As a result, they need to work with consulting firms like Accenture. Accenture CEO Julie Sweet had this to say about generative AI: In every industry, there is a challenge or opportunity that GenAI can now uniquely solve. Our deep understanding of both the industry and the technology positions us to be the best at creating real value from GenAI with our clients. That perfectly sums up the AI-related investment thesis for Accenture, as it is set to benefit from generative AI going mainstream in the coming years. Still, it is a huge consulting firm with many areas of specialization and expertise. It isn't an AI pure-play. But does the rest of the business plus an AI boost equal a winning investment? In its fiscal 2024 fourth quarter, which ended Aug. 31, Accenture saw new bookings of $20.1 billion, of which generative AI made up $1 billion. So while generative AI has clearly given the business a boost, it only accounted for 5% of total bookings, making it a relatively minor part of the larger investment picture. Fiscal 2024 wasn't the greatest year for Accenture, as clients were conservative with their spending. Revenue rose just 3% in Q4 and only 1% for the year. The outlook for fiscal 2025 is slightly better -- management expects revenue to grow by 3% to 6% in local currencies. (As a global business headquartered in Ireland, it's exposed to changes in currency exchange rates.) Still, considering that many AI companies are boosting their revenue at much faster rates than that, is Accenture worth investing in? From a forward price-to-earnings standpoint, Accenture's stock is quite expensive. Shares are trading at around 28 times forward earnings, a similar valuation to Meta Platforms and Taiwan Semiconductor, both of which are growing much faster than it is. So why would Accenture make a better stock pick? One advantage investors get from Accenture is its generous shareholder capital return program. It increased its dividend by 15% in Q4, and at the current share price, it has a yield of about 1.6%. It also repurchases a lot of stock -- $4.5 billion worth last year alone. Reducing the outstanding share count boosts its earnings per share, which are expected to increase between 5% and 8% in fiscal 2025. Still, even with the dividend and stock buyback program, Accenture's stock is a bit too expensive for my taste, especially when there are other AI companies that are growing much faster and trade at similar or cheaper valuations. As a result, I'll take a pass on it for now.

[7]

Nvidia's Growth Is Slowing. Here Are 2 Lesser-Known AI Stocks With Monster Return Potential. | The Motley Fool

Nvidia continues to be the runaway leader in chips used for artificial intelligence (AI). The company's leading position in the data center market has driven triple-digit revenue growth over the last few years. Nvidia is now one of the most valuable companies in the world, with a $3.4 trillion market cap at present. However, with $113 billion in trailing revenue, Nvidia has become a very large business, which will make it more difficult to maintain this level of growth. Nvidia's top-line growth is already slowing from triple-digit rates, coming in at 94% year over year in the most recent quarter. The stock soared on accelerating growth, but slowing growth could weigh on shareholder returns over the next few years. The good news is there are plenty of other opportunities to profit off the AI arms race. If you're looking for smaller AI companies that can potentially deliver monster returns, here are two to consider buying heading into 2025. Shares of this AI voice-solutions provider have given investors a wild ride over the last few years, but the stock is surging following another strong quarter of growth. As its latest results show, SoundHound AI (SOUN -0.78%) is still a relatively small company going after a big opportunity. The company's revenue grew 89% year over year in the third quarter, which was partly boosted by a recent acquisition and expanding market demand for its AI voice solutions. It continued to see double-digit growth from automotive, but it's also having success diversifying into customer service and retail-banking solutions through its acquisition of Amelia. While SoundHound's business is still unprofitable -- it reported a loss of $22 million on just $25 million of revenue last quarter -- the stock is moving higher because the company is showing that there is, indeed, a large and growing market for its technology. SoundHound's AI agents are helping reduce the number of calls coming into customer support centers. Moreover, its Smart Ordering AI service for restaurants recently crossed the 100 million customer-interaction milestone. Major restaurant brands, like Chipotle Mexican Grill, Jersey Mike's, and Applebee's, are using SoundHound's technology. The company is also positioning itself as a leader in generative AI voice assistance for drivers. A recent survey commissioned by tSoundHound with Big Village found that 76% of U.S. drivers would use an AI-powered voice assistant if it was available in the car. This could be a huge opportunity over the long term, since nearly half of drivers expressed frustration in finding and operating car features. SoundHound's voice assistance could prove to be a must-have for car manufacturers and already has a strong foothold in the market. A partnership with Stellantis, owner of the Jeep, Dodge, and Ram line of vehicles, has brought SoundHound's generative AI assistance to several of the company's European brands, including Alfa Romeo, Peugeot, and DS Automobiles. Although the stock has jumped sharply in the last few months, I wouldn't be afraid of starting a position here. SoundHound is growing at a brisk pace and has a market capitalization of just $3.4 billion. I would look at the stock's recent advance as a bullish indicator of the future. While the shares will be volatile, an investment in SoundHound could be very rewarding over the next decade as the business expands into retail and banking. The insatiable demand for Nvidia's chips can point you to other opportunities in the AI infrastructure market. Astera Labs (ALAB 12.69%) is a leading supplier of connectivity products for data centers. These products allow data to be transmitted between chips and are just as essential as the graphics processing units (GPUs) from Nvidia for enabling AI training. With demand for its products surging, Astera Labs just completed its initial public offering (IPO) earlier this year and could be looking at years of strong growth. Astera Labs' revenue grew 206% year over year in the third quarter, which shows the company emerging as a leader in this market. "Our business has now entered a new growth phase with multiple product families ramping [up] across AI platforms based upon both third-party GPUs and internally developed AI accelerators," CEO Jitendra Mohan said. The stock looks very expensive. Astera Labs generated only $305 million in trailing revenue, which doesn't appear to be enough to support its $16 billion market value. But investors are paying a high valuation, expecting the company to maintain a high level of growth for several more years -- and there are a few reasons why it can meet those expectations. The company is diversifying its product lineup, which is also expanding its addressable market opportunity. Importantly, management is investing in products that can drive higher profitability over the long term. For example, Astera's new Scorpio Smart Fabric switches help data centers improve performance and command high average selling prices that could be beneficial to margins. Astera Labs earns a high gross margin of nearly 78%, which means customers are willing to pay a premium for its products. The company's adjusted net income was $40 million in Q3 on $113 million of revenue -- a stellar profit margin of 35%. AI is a major long-term growth catalyst for chip suppliers and other infrastructure companies. There will be more data centers and AI servers built over the next 10 years. Adding shares of a fast-growing supplier like Astera Labs could help you profit off that opportunity.

[8]

Got $3,000? 3 Artificial Intelligence (AI) Stocks to Buy and Hold for the Long Term | The Motley Fool

Artificial intelligence (AI) was a huge theme in the market during 2024, with several stocks becoming big winners from the emerging technology. AI technology still appears to be very much in its early days and there is mounting evidence that AI will continue to be a powerful growth driver in the years ahead. This largely stems from large tech companies, as well as well-funded start-ups such as OpenAI and Elon Musk-backed xAI, continuing to ramp up spending, looking to take advantage of what they see as a generational opportunity. Against this backdrop, let's look at three AI stocks across infrastructure, cloud computing, and software that all currently trade at attractive valuations. If you have $3,000 available to invest that isn't needed for monthly bills, paying off short-term debt, or bolstering an emergency fund, you might want to consider buying and holding one (or all) of these stocks for the long term. When looking at AI-related stocks to buy, the first name to consider remains Nvidia (NVDA 3.48%). The stock has been a huge winner over the past several years. Despite that, it still trades at an attractive valuation with a forward price-to-earnings (P/E) ratio of about 31 based on 2025 analyst estimates, and a price/earnings-to-growth (PEG) ratio of approximately 0.98. A PEG ratio less than 1 is typically viewed as undervalued, but growth stocks tend to command PEG ratios well above 1. Nvidia developed a wide moat through its CUDA software that helped it obtain approximately 90% market share in the graphic processing unit (GPU) market. With competition and valuation not much of a concern, the biggest question surrounding Nvidia is whether AI infrastructure spending will continue at its rapid pace. Large language models (LLMs) need more and more GPUs to train on as they advance, so the question becomes: Is there a point where these models become good enough for the companies creating them to pull back on their spending? To believe they will, one must think that the likes of Microsoft, Amazon, Alphabet (GOOGL 1.77%) (GOOG 1.77%), Meta Platforms, and xAI, among others, will be satisfied not having the best AI model out there. If you don't think they will be satisfied, Nvidia is a buy. In part due to some uncertainty following a government antitrust ruling, Alphabet became the cheapest of the big tech companies that have been driving AI infrastructure spending, trading at a forward P/E of only 19 times next year's analyst estimates. Nonetheless, Alphabet is showing signs of being a big AI winner. Not only is its cloud computing unit growing its revenue rapidly, but the high-fixed-cost business also hit a profitability inflection point. Last quarter, Google Cloud was the fastest growing of the three big cloud providers, with the segment's revenue jumping 35% year over year to $11.4 billion and the segment's operating income surging from $266 million a year ago to $1.95 billion. Alphabet is at the forefront of customized application-specific integrated circuits (ASICs) for AI, and it credits the combination of its customized tensor processing units (TPUs) with GPUs in helping reduce inference processing times and lower costs. It also said customers are attracted to AI large language model Gemini's strong multimodal capabilities. Meanwhile, the company is using AI to help better understand its users and connect them with advertisers. Its use of AI overviews also opens up additional monetization opportunities with different ad formats. The company traditionally has only served ads to about 20% of its searches, so this represents a great opportunity. Overall, Alphabet is well positioned to benefit from AI, and I think the company could be worth more if it were broken up, as the values of Google Cloud; its self-driving unit, Waymo; and YouTube would likely command higher multiples as stand-alone entities given their strong positions in their respective markets. The company has been turning to AI to help drive growth, saying last quarter that 30% of its customer expansions in the quarter came from adopting AI solutions. It noted that products such as Recruiter Agent and Talent Optimization were seeing strong traction. Meanwhile, management says the company's upcoming Optimize Agent solution could be a "game changer," as it is able to identify bottlenecks and inefficiencies. Workday is also looking to aggressively pursue the federal government vertical, where it sees an opportunity to replace older inefficient systems that are pricey to maintain. With a new administration coming in with a stated focus on cost reductions and efficiency, this should be a nice opportunity. Workday is looking to grow revenue by a mid-teens percentage while expanding its operating margin. If achieved, it should be a nice combination that helps its stock move higher over the long term.

[9]

Meet the Supercharged Growth Stock That Could Make You a Millionaire | The Motley Fool

Growth stocks have powered the gains of the S&P 500 in recent times, helping it roar into a bull market early in the year and continue climbing to new records. Many of these players are technology companies present in one of today's hottest growth areas: artificial intelligence (AI). If AI meets its promise of revolutionizing business and daily life, these companies and those buying their shares today could win big a few years from now. And this is why investors have piled into AI stocks over the past year or so, hoping to get in early on this technology and maximize their gains. One particular stock has emerged as a leader in the field -- dominating the AI chip market, bringing in triple-digit revenue growth into the billions of dollars, and delivering a triple-digit stock price increase this year. The great news is it's not too late to get in on this AI winner of today and tomorrow. Meet the supercharged growth stock that could make you a millionaire. First, though, it's important to note that when I say "make you a millionaire" I mean in the context of a diversified portfolio over a period of years. It's too risky to bet everything on one particular stock and hope for it, alone, to grow your wealth -- no matter how solid the company. So, you'll want to invest in several quality stocks, add this particular growth stock to your portfolio, and hold on to these players for at least five to 10 years. Now let's take a look at this millionaire-maker stock, one that's climbed 2,600% over five years and is heading for a gain of about 190% this year. And because of this performance, it's most likely already made some millionaires. I'm talking about Nvidia (NVDA -1.81%). The AI giant has made headlines quarter after quarter with its enormous revenue growth and profitability. For example, in the most recent quarter, revenue reached a record of more than $35 billion, and this is with a gross margin in the mid-70% range. And even in the coming quarters, as Nvidia launches a major new product -- its Blackwell architecture -- it expects to maintain margins in the low-70% range. This will be a huge accomplishment -- and proof of Nvidia's financial strength. Why does Nvidia stand out in this competitive market? The company arrived on the AI scene early with its graphics processing units (GPUs), powerful chips that process many tasks simultaneously. This makes them perfect for AI, including crucial jobs like the training and inferencing of models. By the time rivals launched their high-performance AI chips, Nvidia already was in the lead -- and thanks to the company's focus on ongoing innovation, it's likely to maintain this position. Nvidia promises to update its GPUs on an annual basis, making it difficult for the competition to get ahead. And today, Nvidia is on track with what may be its biggest launch yet. As mentioned, it's releasing the Blackwell architecture, a game-changing platform with customizable components -- from chips to networking options. (Though Nvidia is referred to as a chip designer, it's important to note that the company offers a wide variety of related products and services.) Demand for Blackwell has been "staggering," the company said during its latest earnings call, and it's racing to fill orders from customers including the world's biggest tech companies. And these customers are willing to wait and pay more for Nvidia's platform thanks to its top performance. They want to win in the AI market and know they have a better chance of doing so if they are using the most advanced AI platform. Today, Nvidia stock trades for 49 times forward earnings estimates, and considering all I've mentioned and the fact that we're in the early days of AI growth, this valuation looks reasonable. The AI market is forecast to expand from $200 billion today to $1 trillion by the end of the decade -- and Nvidia is well positioned to benefit. And as an investor, you also could benefit -- and potentially set off on the path to millions -- by buying this top AI stock and holding on for the long term.

[10]

These Top Artificial Intelligence Stocks Completed Stock Splits This Year. Will They Soar in 2025?

The S&P 500 roared into bull territory this year, and the fantastic pace continues, with the benchmark heading for a 26% gain. The Nasdaq and Dow Jones Industrial Average also have reflected investors' optimism, on track for increases of 29% and 18%, respectively, this year. Against this backdrop, one major theme stood out and grabbed investors' attention: artificial intelligence (AI). Investors have piled into players in this field thanks to AI's potential to revolutionize the world as we know it. From potential gains in efficiency to the development of better products and services, AI could transform industries -- and significantly boost companies' earnings over time. And we may be in the very early days of this growth story since analysts forecast today's $200 billion AI market may reach $1 trillion by the end of the decade. All of this has resulted in enormous gains for AI stocks -- actually over the past few years as some investors got in on these players extra early. As a result, some of these stocks have soared, in certain cases to levels beyond $1,000 per share. This is great, but when a stock reaches these prices, it may be more difficult for certain smaller investors to access. There's a solution for this problem, and it's called the stock split. Three top AI players completed such operations this year. Let's find out more about them -- and consider whether these players will soar in 2025. First, though, a quick word about stock splits. These operations reduce the per-share price through the issuance of more shares to current holders of a particular stock. This doesn't change the value of their holding, the market value of the company, or anything fundamental. But it does make it easier for more investors to buy the stock since it will trade at a lower price -- determined by the ratio of the split. Nvidia Nvidia (NVDA -1.81%) may have been the most eagerly awaited stock split of the year. When the company announced the 10-for-1 operation, its shares climbed 12% over the two trading sessions that followed. A stock split itself isn't a reason to buy the stock, but the move, as mentioned, opens the investment opportunity up to more players -- and that's positive. This AI company has seen its shares skyrocket 2,600% over the past five years thanks to its leadership in the AI chip market. Nvidia's graphics processing units (GPUs) are the fastest around and power critical AI tasks such as the training and inferencing of models. This has resulted in enormous demand and earnings growth. In many recent quarters, earnings have climbed in the triple digits and Nvidia has maintained an impressive gross margin of more than 70%. Its prospects look excellent, and this is thanks to Nvidia's leadership as well as a sharp focus on innovation. The company this quarter is launching its new Blackwell architecture and pledges to update its GPUs on an annual basis. Will Nvidia climb next year even after this year's 180% increase? It's possible -- because the Blackwell launch could serve as a key catalyst and Nvidia's valuation at 47 times forward earnings estimates offers some room for this growth stock to run. Broadcom Broadcom (AVGO 5.32%) launched a 10-for-1 stock split in July, bringing its shares down from about $1,600 to $160. The networking giant's shares, like those of Nvidia, had soared in recent times due to its growth and potential in the AI market. The stock rose about 450% over five years and has climbed 50% year to date. Broadcom makes thousands of products widely used in various areas -- from data centers to smart phones. But in recent times it's the company's products for AI customers that have driven growth. Broadcom said in its recent earnings report that cloud service providers are driving massive demand for its AI networking and custom AI accelerators. And this trend is likely to continue since these customers are in the scaling-up phase of their AI clusters -- and AI market growth in the coming years could keep this momentum going. In the quarter, Broadcom said revenue from custom AI accelerators more than tripled, and Ethernet switching quadrupled. And for the fiscal year, Broadcom predicts AI revenue of $12 billion, an increase from its earlier forecast of $11 billion. Today, Broadcom shares trade for only 27 times forward earnings estimates, which looks like a steal considering the company's prospects in the AI market. So, I wouldn't be surprised to see Broadcom advance in the new year. Super Micro Computer Super Micro Computer (SMCI 6.78%) shares soared early in the year, even beating the performance of Nvidia in the first half -- with a gain of 188% versus 149%. And the company followed up by announcing a 10-for-1 stock split, to take place in the fall. But when the split happened, the shares already had fallen 65% from their 2024 high. The reason for the drop? A short report alleging troubles at Supermicro set off the movement. But what may truly have weighed on the stock was the company's delay in financial reporting. Supermicro announced it would be late in filing its 10-K annual report and a 10-Q quarterly report, moves that put it at risk for a Nasdaq delisting. The company since has hired a new auditor and sent a plan to Nasdaq to regain compliance. Meanwhile, the company's revenue growth in recent quarters and demand for its products both have been strong. Supermicro sells workstations and servers crucial to AI data center operations, and it incorporates the latest chips from Nvidia and others into this equipment. Supermicro also specializes in direct liquid cooling technology, an area that could represent a new growth driver. Will Supermicro climb in 2025? That probably will depend on its financial reporting situation. If the company doesn't regain compliance or issues disappointing reports, the stock could suffer. But if Supermicro completes its reports and they're positive, the stock may take off in 2025.

[11]

Better Artificial Intelligence Stock: Nvidia vs. AMD | The Motley Fool

Nvidia's AI accelerators have redefined the company and the overall semiconductor industry as customers scramble to capitalize on the power of AI. In contrast, AMD has become known for catching up to its competitors technically, and it is again attempting to do so in the AI accelerator market. The future could potentially bode well for both companies. Grand View Research forecasts a compound annual growth rate (CAGR) for the global AI chip industry of 29% through 2030. Such growth rates mean a rising tide should lift all major industry players. Nonetheless, the prospects for investors are less clear since both stocks have benefited from considerable AI-driven growth. Still, given where both stocks currently stand, one is likely to fare better for the foreseeable future. Nvidia stock has surged since investors discovered that Nvidia's AI accelerators powered ChatGPT's AI platform. This discovery ignited unprecedented demand for its accelerators, so much so that Nvidia could not produce enough of these chips. Consequently, the data center segment that designs these chips has become Nvidia's dominant focus. To stay ahead of competitors, Nvidia continues to innovate and has just begun releasing its latest Blackwell accelerators. They are rumored to cost between $30,000 and $40,000 per unit, with the Blackwell superchip rising to as much as $70,000, according to numerous sources. Despite such prices, Nvidia claims between 70% and 95% of the AI accelerator market, according to Mizuho Securities' estimates. Thus, it will likely not surprise investors that Nvidia reported $91 billion in revenue in the first three quarters of fiscal 2025 (ended Oct. 27), a 135% yearly increase. Nvidia's data center segment, which was not even Nvidia's largest revenue source three years ago, accounted for $80 billion, or 87% of overall revenue. The growth has boosted net income even more profoundly, as the $51 billion profit for the first nine months of fiscal 2025 rose 190%. Unfortunately for investors, Nvidia's stock likely prices in this growth -- and then some. That is not because of the P/E ratio, which is 55. However, even with the growth, investors may hesitate amid Nvidia's price-to-sales (P/S) ratio of 31. That is a high level even for a fast-growing stock, particularly with revenue growth in fiscal 2026 expected to slow to 51%. Investors tend to punish stocks whose revenue growth slows, a factor that could bode poorly for Nvidia's stock. Indeed, Nvidia's struggles could motivate investors to look at its emerging competitor, AMD. AMD began selling its MI300 series of accelerators in response to Nvidia's dominance of that market. Also, amid the need to innovate, it released the MI325X accelerators in October to compete with Nvidia's Blackwell line. It is unclear how much business AMD can draw away from Nvidia. Nonetheless, its price, widely reported to be just under $15,000, is far below the cost of Blackwell. Given the aforementioned CAGR for AI accelerators and Nvidia's struggles to meet demand, AMD may have a competitive niche despite failing to match Nvidia. However, AMD also lags behind Nvidia in terms of financial performance. In the first nine months of 2024, its $18 billion in revenue grew by only 10% compared to the same period in 2023. Moreover, the data center segment is only 48% of revenue. Even though that segment increased its revenue by 107% over the previous year, it continues to lag behind Nvidia. Still, it may also point to more growth potential, assuming data center revenue also becomes the dominant revenue source for AMD. AMD is also much less profitable, though its $1.2 billion net income for the first three quarters of 2024 rose more than sixfold annually. Amid that profit recovery, its 128 P/E ratio likely does not represent its valuation well. Nonetheless, the 9.6 P/S ratio makes it a relative bargain compared to Nvidia, and with revenue growth for 2025 forecast to reach 27%, overall growth is set to accelerate. AMD stock looks like the better buy under current conditions. Admittedly, Nvidia holds a dominant share of the market, and even if both revenue forecasts hold, Nvidia's estimated 51% revenue growth is significantly faster than the 27% forecast for AMD. However, stocks tend to respond poorly to slowing revenue growth. Even though 51% revenue growth is impressive, it is enough of a slowdown for investors to question Nvidia's 31 P/S ratio. In contrast, AMD's revenue growth should ramp as AI accelerators claim a larger share of AMD's revenue base. With revenue growth rates advancing and the P/S ratio under 10, it is likely the better buy under current conditions.

[12]

Missed Out on Nvidia? Buy This Magnificent Artificial Intelligence (AI) Stock Before It Soars at Least 43% in 2025. | The Motley Fool

Artificial intelligence (AI) has helped Nvidia's (NVDA -1.81%) stock clock stellar gains in 2024, with shares of the semiconductor giant rising more than 183% as of this writing, but it seems that investors are now having doubts about the company's ability to maintain its stunning growth rate over the long run. This is probably why Nvidia stock has retreated despite delivering better-than-expected numbers and guidance last month. The company's revenue for the third quarter of fiscal 2025 increased an impressive 94% from the year-ago period to $35.1 billion, while earnings jumped 103% year over year to $0.81 per share. However, Nvidia's revenue guidance of $37.5 billion for the current quarter suggests that its top line is on track to increase at a relatively slower pace of 70% from the year-ago quarter. Additionally, the margin pressure that the company will face in the near term on account of the rollout of its Blackwell processors seems to have dented investors' confidence. Of course, Nvidia can overcome these challenges and deliver more gains to investors. However, those who missed out on Nvidia's rally and are looking for a relatively cheaper AI stock that isn't trading at an expensive 31 times sales can consider taking a closer look at Marvell Technology (MRVL 0.12%). Let's look at the reasons why. Marvell Technology released its fiscal 2025 third-quarter results (for the three months ended Nov. 2) on Dec. 3. The chipmaker's total revenue increased 7% year over year to $1.52 billion, which was higher than the consensus expectation of $1.46 billion. Its non-GAAP (adjusted) earnings increased to $0.43 per share from $0.41 per share in the year-ago period, again beating the consensus estimate of $0.41. You might be wondering why Marvell may be a good alternative to Nvidia considering its slow pace of growth, but a closer look at the company's data center business will reveal the true picture. The data center segment produced 73% of Marvell's top line last quarter, up from 39% in the year-ago period. The segment's revenue nearly doubled on a year-over-year basis to $1.1 billion, offsetting the steep declines that the company witnessed in other segments such as enterprise networking, carrier infrastructure, automotive/industrial, and consumer. The good part is that the strength of Marvell's data center business, which is benefiting from the growing demand for custom AI processors and optical networking equipment, will be enough to lift the company's growth higher in the current quarter. That's evident from Marvell's fiscal fourth-quarter revenue guidance of $1.8 billion, which would be a 26% jump from the year-ago period. Analysts would have settled for $1.65 billion in revenue from Marvell for the current quarter. Additionally, the chipmaker expects earnings to land at $0.59 per share in the current quarter, which would translate into a 28% increase from the same period last year. Marvell CEO Matt Murphy pointed out on the latest earnings conference call that the stronger-than-expected demand for its custom AI processors played a central role in its better-than-expected performance and robust guidance. Marvell management believes that it will "significantly exceed the full year AI revenue target of $1.5 billion." The chipmaker is forecasting $2.5 billion in AI chip sales in the next fiscal year, though analysts believe that its AI-focused revenue could go up to $3 billion next year. It is easy to see why analysts are expecting the strong growth in Marvell's AI-related business to continue. After all, the company is one of the two major designers of custom chips, which are being developed by major cloud computing providers to reduce their reliance on Nvidia by developing in-house chips. These cloud companies turn to the likes of Marvell and Broadcom for designing their in-house chips. Reuters reports that the market for custom AI chips could be worth an impressive $45 billion by 2028, compared to an estimated $10 billion this year. Meanwhile, the company sees an additional revenue opportunity of $26 billion in data center switching and interconnect by 2028, thanks to AI. So, it won't be surprising to see Marvell delivering much stronger revenue and earnings growth in the next fiscal year and beyond. Based on Marvell's fiscal Q4 guidance, the company is on track to finish fiscal 2025 with revenue of $5.75 billion. That would be an increase of just 4% from fiscal 2024 levels. Its earnings are on track to hit $1.56 per share for the full year, an increase of 3% over the previous fiscal year. Analysts, however, are expecting much stronger growth in fiscal 2026 (which will begin in February next year and coincide with 11 months of calendar 2025). The top-line forecast for fiscal 2026 points toward a 31% increase, while the bottom line will increase by an impressive 63%. Of course, it won't be surprising to see analysts bumping up their estimates following Marvell's latest quarterly report. However, even if Marvell manages to achieve $7.5 billion in sales next year and trades at 16 times sales at that time, its market capitalization could hit $120 billion. That would be a 43% increase from current levels. However, the market has rewarded the likes of Nvidia with a much higher sales multiple of 31. If something similar happens with Marvell and the company manages to deliver stronger growth in 2025, it may be able to deliver much stronger gains than what's projected above.

[13]

5 Top Artificial Intelligence (AI) Stocks Ready for a Bull Run | The Motley Fool

Artificial Intelligence (AI) is proving to be a game-changing technology and with it, several companies are emerging as winners in this sector of the economy. The stocks for many of these companies have already seen large gains. But with AI still looking to be in the early innings, many of these stocks have additional room to run. Let's look at five AI stocks that could be set to continue to run higher in the coming years. Nvidia (NVDA 3.48%) is already one the biggest beneficiaries of AI, as its graphics processing units (GPUs) have become the backbone of the AI infrastructure buildout. Demand for its chips is insatiable, and it appears there will be no letup as large language models (LLMs) need ever-increasing computing power and thus GPUs to be trained on as they become more advanced. With its CUDA software platform long ago becoming the standard on which developers learned to program GPUs, Nvidia has a wide moat that allowed it to attain a dominant share of the GPU market. Meanwhile, the company continues to advance its technology, accelerating its design cycle to once a year (from the previous two-year to three-year cycle). This combination of a wide moat and advancing technology should allow Nvidia to keep its huge market share and continue to be one of the biggest AI winners. For investors looking for the next big AI chip winner, Broadcom (AVGO 1.43%) tops the list of candidates. The company participates in the AI infrastructure buildout through its networking portfolio, which provides switches and network interface cards (NICs), as well as through helping customers build custom AI chips. The company is looking to grow and take share in the AI data center switching market where its Ethernet switches compete against Nvidia's InfiniBand technology. It touts that Ethernet technology is superior to InfiniBand in handling AI workloads and transferring data between GPUs. While both technologies have their pros and cons, this is a growing market that is becoming more important as GPU clusters become larger. Thus, there is a lot of potential upside for multiple players to benefit. Broadcom's biggest opportunity, though, is in helping customers develop chips designed for specific computing and power needs. The company has been adding a number of big customers in this area, and it should be a strong growth driver in the years to come. Microsoft (MSFT 1.44%) was one of the first big tech companies to embrace AI and bring it to the mainstream following a large, increased investment in OpenAI, the maker of ChatGPT. Since then, its cloud computing unit Azure has been a big AI winner, as customers embrace its services to create their own AI agents and copilots. This has led to consistent growth from Azure, including 33% revenue growth last quarter. The company is investing heavily in expansion in order to keep up with demand. Microsoft is also in the early days of benefiting from AI within its software segment, where it has introduced several AI assistant copilots for its productivity tools within its Microsoft 365 offering. As these AI assistants advance and user adoption increases, the company has a huge opportunity in front of it. At a cost of $30 per month per enterprise user (with a Microsoft 365 subscription needed), the costs of the AI assistant in some cases can be as much as or even more than the cost of Microsoft 365 itself. While Microsoft has been an early AI winner, its biggest opportunities may still be ahead. One of the biggest AI software winners has been AppLovin (APP 1.95%), which has seen astronomical growth since it launched its AI-powered adtech platform Axon 2.0. Since then, its adtech solution has become the go-to solution for mobile gaming companies to attract new customers and better monetize their games. While growth has been explosive since its launch, the company thinks it can continue to grow its gaming customer revenue by between 20% to 30% a year. However, the biggest opportunity for the company moving forward is expanding the use of Axon 2.0 beyond gaming customers into other segments. It just began piloting Axon 2.0 within the broader e-commerce sector and is seeing good early results. Meanwhile, AppLovin management believes the e-commerce vertical will become a meaningful revenue growth driver as early as next year. If the company can successfully expand Axon 2.0 beyond gaming, the stock should have a lot more upside in the years ahead. After finding early success within the automobile and restaurant verticals, SoundHound (SOUN 14.30%) is looking to become the world's leading AI-based commerce voice platform following its recent acquisition of Amelia. A conversational and generative AI platform, Amelia gives SoundHound a broader range of customers in industries such as healthcare, financial services, insurance, and retail. While the company has a lot of growth opportunities remaining in the auto and restaurant industries, the stock's true upside lies in the use of its technology across a wide range of industries, each with its own specific vocabularies and interactions. These can include making doctors' appointments or answering complicated questions related to a stock trade. If it can advance its AI voice platform to this level and serve a multitude of industries, the sky is the limit.

[14]

3 Hypergrowth Tech Stocks to Buy in 2025 | The Motley Fool

In the fast-moving tech space, separating companies in hypergrowth mode from ones that are just hype isn't always easy. Throw in the fact that artificial intelligence (AI) is fueling speculation in tech stocks, and things become even cloudier. To help you cut through all the noise, here are three compelling buy opportunities for the new year that have potential for years. Nvidia's (NVDA -0.05%) leading position in artificial intelligence semiconductors cannot be overstated. The company holds an estimated 70% to 95% of the AI semiconductor market, and Nvidia's strong third quarter (which ended Oct. 27) proved this AI juggernaut isn't slowing down. Nvidia's total sales rose 94% in the quarter to $35.1 billion, and non-GAAP (generally accepted accounting principles) earnings per share increased by 119% to $0.81, both outpacing Wall Street's estimates. Nvidia's data center segment is the catalyst behind that growth, with revenue jumping 103% from the year-ago quarter to $30.8 billion. CEO Jensen Huang estimates companies will spend $2 trillion in AI data center investments over the next five years. Even if it's half that, Nvidia would benefit immensely from that spending, as large tech companies gobble up its powerful GPUs for AI. With its stock trading at a price-to-earnings ratio of 54.5, Nvidia isn't cheap. However, the company's fantastic growth and leading position in AI chips at a time of huge investments means the company is still a great long-term buy. Palo Alto Networks (PANW -0.38%) is another great hypergrowth opportunity for investors, especially if you're interested in cybersecurity. The company's firewalls, cloud security, and endpoint security products and services consistently put the company in a leadership position in Gartner's cybersecurity rankings. The company recently reported its fiscal 2025 first-quarter (which ended Oct. 31) results, and revenue rose 14% to $2.1 billion, while non-GAAP earnings spiked 77% to $0.99, beating analysts' consensus top- and bottom-line estimates. A bright spot in Palo Alto's quarter was the company's 40% increase in next-generation security annual recurring revenue (ARR) to $4.5 billion. This means the company's active contracts for cloud-based cybersecurity services are growing quickly, which is great news, as the global cybersecurity market grows to an estimated $272 billion by 2029, according to Statista. Like many tech stocks right now, Palo Alto's shares aren't cheap, at a P/E ratio of about 50.3. But the company's leadership position in security, current growth, and its long-term opportunity in the growing cybersecurity space make it a compelling opportunity for investors. AppLovin (APP 1.44%) is an advertising technology company that uses AI to help companies place ads on mobile apps and connected TVs. While the company may not be a household name, it's garnered tons of attention among investors, as its stock has soared nearly 800% over the past year. AppLovin reported strong third-quarter results (ending Sept. 30), with total revenue increasing 39% to $1.2 billion and diluted earnings per share rising 317% to $1.25. Both of these beat Wall Street's consensus estimates. AppLovin is tapping into a massive digital advertising market that's currently worth $740 billion worldwide. And by 2028, an estimated 81% of digital ads will be generated through programmatic advertising, like AppLovin's platform, according to Statista. That gives the company lots of opportunity to expand its reach in the coming years, even on top of its current growth. Like the other stocks on this list, AppLovin isn't cheap, with a P/E ratio of 102.3. Long-term investors may want to wait until the share price dips a bit before picking up shares, but with analysts estimating AppLovin's earnings per share will rise 32% from 2024 to 2025 and the AI-driven adtech market expanding quickly, the stock likely has more room to run.

[15]

Could AMD Be the Nvidia of 2025? | The Motley Fool

2025 is going to be a pivotal year for AMD as it seeks to gain ground on its rival Nvidia. When it comes to semiconductor stocks, it's virtually impossible not to think of Nvidia. Over the last two years, the company has become the undisputed leader among chip stocks, and with that, is swiftly emerging at the forefront of the pack among artificial intelligence (AI) companies more broadly. In my eyes, though, investors have been so eager to get in on the action with Nvidia that they've essentially forgotten about other opportunities in the chip realm. With 2024 coming to a close, I'd encourage investors to take a look around and consider what under-the-radar opportunities could be looming. I'm going to make the case for why an investment in Advanced Micro Devices (AMD -1.96%) looks especially enticing right now. Could AMD be next year's Nvidia? I think so. On the surface, it would appear obvious that Nvidia is miles ahead of AMD in the AI marathon. Over the last 12 months, Nvidia has generated a mammoth $113 billion in revenue -- almost fivefold compared to that of AMD. However, taking a look at where this revenue stems from may change how you think about AMD's trajectory in comparison to its larger cohort. In the table, I've broken down the annual revenue growth rates for each of AMD's and Nvidia's respective data center businesses: Data Source: Investor relations. Over the last year, Nvidia's data center businesses has decelerated significantly. At the same time, AMD's data center business has evolved from essentially nothing to reaching more or less the same rate of growth compared to Nvidia. Don't get me wrong -- I'm not going to posit the notion that Nvidia is in trouble. It's hard to make a bear case on a company that's posting growth in excess of 100% every quarter. But my broader point is that even though Nvidia is larger than AMD, that doesn't necessarily make it a better investment opportunity. I'm going to detail how AMD has built such a formidable competing data center business and explore why 2025 could be a milestone year for the company. Much of the reason why Nvidia experienced such enormous growth in its data center business stems from the fact that the company had virtually no competition in the graphics processing unit (GPU) landscape until recently. With the successful launch of AMD's MI300 accelerator, Nvidia's first-mover advantage is finally facing some headwinds. Now, you may counter my point by arguing that Nvidia's next-generation Blackwell GPU architecture is going to help dissipate any chance of AMD dethroning the chip king. Well, consider the fact that many of Nvidia's own customers, including Microsoft and Meta Platforms, are also using AMD's MI300 GPUs. On top of that, remember that these big tech giants, in addition to Alphabet and Amazon (both of which are also Nvidia customers), are also investing heavily into the development of their own in-house chips in an effort to migrate away from an overreliance on Nvidia. Lastly, keep in mind that AMD is also developing a successor GPU to the MI300 called the MI325X -- slated to launch in 2025. Moreover, the company's MI400 architecture is targeting a launch date sometime in 2026. My point? I don't see Nvidia's Blackwell launch as much of a threat to AMD at all. AMD is innovating at an unprecedented pace, and considering investment in AI infrastructure is expected to rise for the next several years, I see the launch of the MI325X and MI400 as catalysts that can help AMD acquire incremental market share away from Nvidia. At the time of this writing, AMD trades at a forward price-to-earnings (P/E) multiple of 29. By comparison, Nvidia's forward P/E ratio is currently 34. With the Blackwell launch imminent, I can't help but feel that expectations surrounding Nvidia will creep higher. If the company fails to meet investor expectations, there could very well be a panic-driven sell-off in the stock. Meanwhile, given AMD's meaningfully discounted valuation compared to Nvidia, I think investors are overlooking its new lineup of GPUs over the next two years. The existing footprint from the MI300, combined with next year's launch of the MI325X to compete head-to-head with Blackwell, should help AMD continue making headway against Nvidia -- in particular, from its own customer base, which is already demonstrating that it's looking for alternative GPU providers. I think now is a lucrative time to buy AMD stock and prepare to hold on tight.

Share

Share

Copy Link

An analysis of promising AI-related stocks, focusing on semiconductor companies like Nvidia, AMD, and TSMC, as well as software providers like Palantir and SoundHound AI, highlighting their potential for growth in the expanding AI market.

AI Market Growth and Investment Opportunities

The artificial intelligence (AI) sector is experiencing rapid growth, with global AI-related spending projected to reach $337 billion in 2025 and $749 billion by 2028

1

. This expansion is creating significant investment opportunities, particularly in the semiconductor and software industries.Semiconductor Giants Leading the Charge

Nvidia (NVDA) continues to dominate the AI chip market, holding an estimated 90% market share in GPUs used for AI applications

2

. The company's recent financial performance reflects this dominance, with a 94% increase in revenue to $35.1 billion and a 118% surge in non-GAAP earnings in the third quarter3

.Taiwan Semiconductor Manufacturing Company (TSMC) is another key player, manufacturing about 90% of the world's most advanced processors

4

. TSMC reported a 36% increase in sales to $23.5 billion and a 54% rise in earnings in the third quarter, largely driven by AI chip demand4

.Advanced Micro Devices (AMD) is rapidly gaining ground in the AI chip market. The company expects its AI GPU sales to exceed $5 billion in 2024, with data center revenue soaring 122% year-over-year to $3.5 billion in the third quarter

5

.Software Companies Capitalizing on AI

Palantir Technologies (PLTR) is leveraging its analytics expertise to provide AI-powered software solutions. The company's U.S. government revenue increased by 40% year-over-year to $320 million, while its U.S. commercial revenue surged 54% to $179 million in the third quarter

6

.SoundHound AI (SOUN) is emerging as a leader in AI-powered voice assistants, with third-quarter revenue growing 89% year-over-year

7

. The company is expanding beyond its initial focus on automotive and restaurant sectors into retail, healthcare, and banking.Related Stories

Market Projections and Investment Considerations

The AI chip market is expected to grow from $45 billion in 2023 to over $500 billion by 2028, according to AMD's estimates

5

. This growth is driven by increasing demand for advanced AI models and expanding use cases across various industries.Investors should consider the following factors:

-

Valuation: While some AI stocks like Nvidia trade at premium valuations, others like TSMC and AMD offer more attractive price-to-earnings ratios

3

4

5

. -

Market position: Companies with strong market positions and technological advantages, such as Nvidia in GPUs and TSMC in chip manufacturing, are well-positioned for long-term growth

2

4

. -

Diversification: Investing in both hardware (semiconductors) and software companies can provide exposure to different aspects of the AI value chain

6

7

. -

Long-term potential: The AI market is expected to contribute nearly $20 trillion to the global economy by 2030, suggesting significant long-term growth potential for well-positioned companies

1

.

As the AI revolution continues to unfold, these companies are at the forefront of innovation and stand to benefit from the increasing adoption of AI technologies across various sectors of the global economy.

References

Summarized by

Navi

[1]

[3]

Related Stories

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation