AI Stocks: Potential Gems or Risky Bets in the Tech Market?

2 Sources

2 Sources

[1]

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic | The Motley Fool

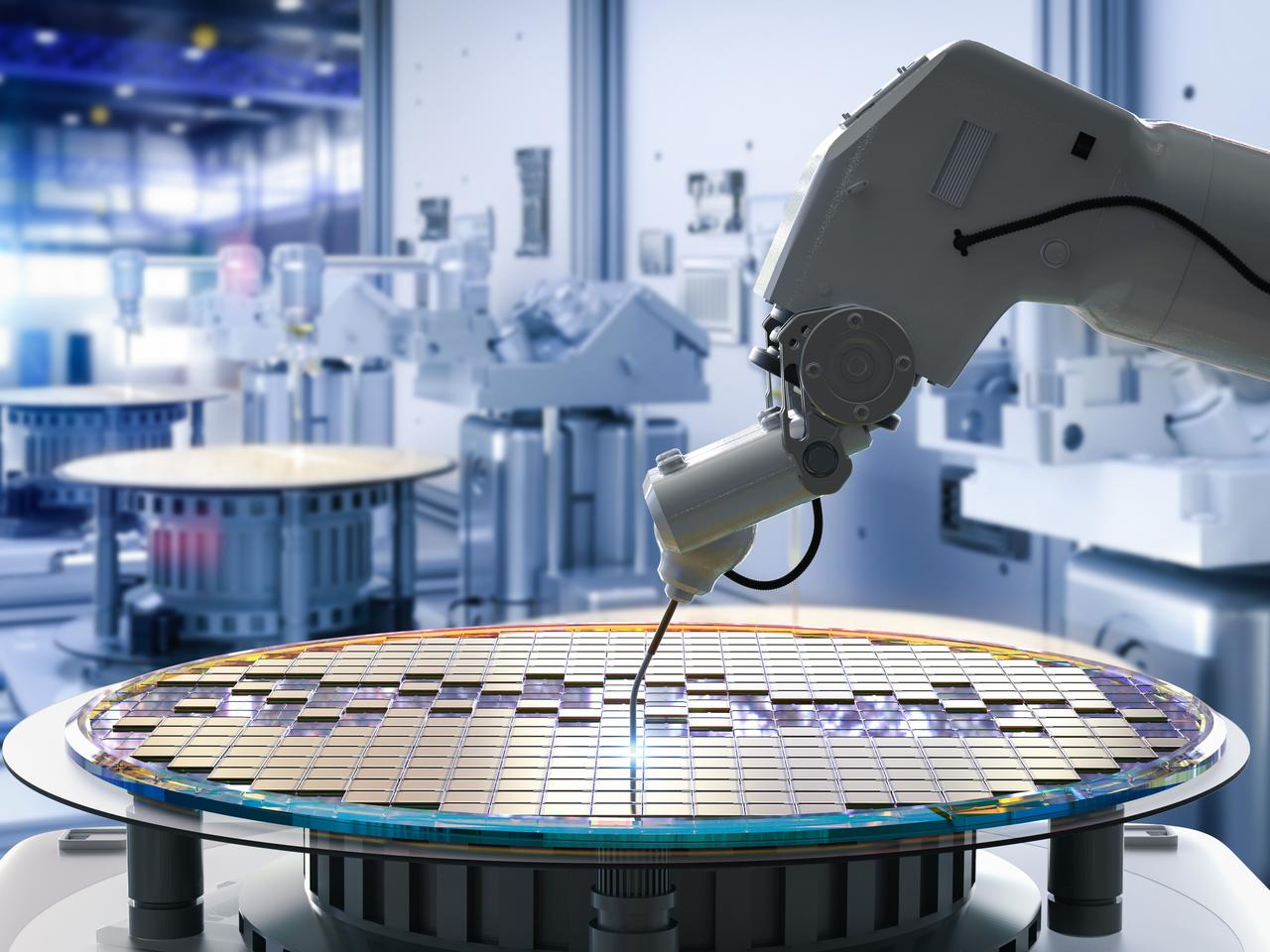

These two companies are set to capitalize on two lucrative AI-related growth opportunities. The fast-growing adoption of artificial intelligence (AI) in multiple industries has given shares of several companies a massive boost in the past year and a half, helping the tech-laden Nasdaq-100 Technology Sector index clock terrific gains of 80% since the beginning of 2023. Thanks to AI, many technology companies have seen a parabolic jump in their share prices. These include Nvidia, SoundHound AI, Super Micro Computer, and Broadcom, among others. A parabolic move refers to the rapid increase in the stock price in a very short period, similar to the right side of a parabolic curve. Let's take a closer look at two such stocks that could go parabolic due to the proliferation of AI. ASML Holding (ASML -0.20%) is arguably one of the most important companies in the AI revolution. Its extreme ultraviolet (EUV) lithography machines are helping chipmakers and foundries shrink the sizes of their chips. More specifically, EUV lithography enables semiconductor companies to manufacture chips based on 7 nanometer (nm), 5 nm, and 3 nm process nodes. The smaller the node size, the more powerful and power-efficient a chip is considered to be. A smaller process node allows a chipmaker to pack more transistors into a smaller area, leading to more computing power and reduced heat generation. Not surprisingly, popular AI chips, such as Nvidia's H100 and AMD's MI300 series of accelerators, are based on 4 nm process nodes. These chipmakers can only produce these smaller chips through ASML's machines, as the Dutch semiconductor giant has a monopoly in this market. This solid position puts ASML on track to deliver outstanding long-term growth as the size of the EUV lithography market is expected to grow at a 22% annual rate through the end of the decade, generating annual revenue of $37 billion in 2030. More importantly, semiconductor companies around the globe are set to invest huge amounts of money in upgrading their infrastructures. The U.S., for instance, is expected to triple its semiconductor manufacturing capacity by 2032. The country's capital expenditure on semiconductors is expected to be around $2.3 trillion between 2024 and 2032, compared to $720 billion in the preceding 10 years. On the other hand, Taiwan Semiconductor Manufacturing (TSMC), the world's largest semiconductor foundry, will reportedly buy $12.3 billion worth of EUV machines going forward. All this bodes well for TSMC, and there is a good chance that the company could also sustain its impressive growth in the long run, considering the AI chip market could grow at an annual rate of almost 41% through 2032. Not surprisingly, ASML's earnings are expected to grow at an impressive pace from next year, following a flat performance in 2024. Additionally, analysts expect the company's earnings to increase at a healthy annual rate of 21% for the next five years. An improvement in ASML's growth could lead the market to reward the stock with more upside. Shares of the semiconductor bellwether have gained 20% so far in 2024. Still, as the discussion above indicates, there is a good chance it could end the year with much stronger gains, as the increase in semiconductor equipment spending could spark a parabolic move in ASML stock. It would be safe to say that Palantir Technologies (PLTR -1.56%) stock has already made a parabolic move of late, jumping nearly 32% since releasing its second-quarter 2024 results on Aug. 5. This sharp jump in Palantir's stock price this month can be attributed to the fast growth in the company's revenue pipeline thanks to AI. More specifically, Palantir's AI software platform is gaining healthy traction among customers, leading to an acceleration in the company's growth. It reported Q2 revenue growth of 27% on a year-over-year basis to $678 million. That was much faster than the 13% year-over-year revenue growth Palantir clocked in the same quarter last year. On the company's recent earnings conference call, Palantir management remarked that its Artificial Intelligence Platform (AIP), which allows customers to integrate AI for their use cases, is playing a direct role in boosting its growth. The company is not only attracting new customers for its AI services, but its existing customers are also signing bigger deals to use Palantir's AI offerings. For instance, the company's commercial customer count in the U.S. increased 83% year over year, while the overall customer count was up by 41% from the same quarter last year. The company also closed 27 deals worth at least $10 million, an increase of 50% from the same quarter last year. The improving customer count and an increase in deal sizes explain why Palantir's revenue guidance of $699 million for the current quarter points toward a 25% year-over-year increase. That would be better than the 17% revenue growth it clocked in the same quarter last year. More importantly, Palantir seems capable of sustaining the improvement in its revenue growth in the future as well, considering its remaining deal value stands at an impressive $4.3 billion. This metric refers to the total remaining value of the company's contracts at the end of a quarter, and it increased 26% from the same quarter last year. What's more, the expansion in Palantir's customer base and spending is accompanied by an improvement in the company's margin profile. The company's adjusted operating margin increased to 37% in the previous quarter from 25% in the same period last year. Palantir management says its business has "strong unit economics," meaning it can generate more profit from each customer and is enjoying lower customer acquisition costs. As such, there is a solid chance that Palantir's margin profile could continue to improve in the future and help the company clock healthy earnings growth. Not surprisingly, consensus estimates are projecting Palantir's earnings to increase at a compound annual growth rate of 85% for the next five years. This indicates that the stock could keep heading higher, even after its latest parabolic move.

[2]

2 AI Stocks Down Over 80% to Buy Before It's Too Late | The Motley Fool

Artificial intelligence (AI) is expected to provide the biggest increase to worker productivity since the adoption of the PC in the 1990s, and like shareholders of the leading tech companies that emerged from that period, investors could realize tremendous returns if they own the right AI stocks. If you're looking for the "right" AI stocks, here are two to consider. Once headwinds are lifted, growth could explode for these two companies and send their share prices soaring. One of the ways companies are using AI is to automate tasks. Companies can get significantly more value out of their employees' time by using AI-powered software to take over tasks such as pulling information from dense documents, logging into applications, filling out forms, and many other use cases. This is a huge opportunity for automation specialist UiPath (PATH -2.18%), which estimates its long-term addressable market at $60 billion. Since 2021, UiPath's revenue has doubled to over $1.3 billion. It has a huge growth runway ahead, but the company's growth has fallen below expectations this year, which has sent the stock well off its highs. The company started to experience a slowdown in sales earlier this year due to macroeconomic challenges, but this is impacting other software companies, too, not just UiPath. Management's guidance calls for full-year revenue to be up approximately 8% year over year. Still, the stock could be a steal right now. The shares were trading at a high valuation at their all-time high a few years ago, which contributed to the 86% haircut, but the stock looks oversold now. Wall Street typically punishes stocks of companies that have a cloudy near-term outlook, but the demand for automation software will continue to grow over the next several years and increase the value of UiPath's business. It's a positive sign that UiPath's larger customers are continuing to expand their product usage. Moreover, the company's founder, Daniel Dives, has returned as CEO with a focus on improving the company's profit margin. With the stock selling at a modest price-to-free-cash-flow ratio of 22, investors could earn stellar returns once the software industry recovers. Financial services is another market where AI could be a game changer, particularly in areas of risk assessment and lending. This is a massive opportunity for Upstart Holdings (UPST -4.60%). The company charges fees to lending partners, such as banks, for using its AI lending marketplace. Its AI models are powered by over 1,600 variables and are trained by over 58 million past repayments. It helps banks accurately evaluate the risk profile of a borrower, which can lead to more approvals and better payback rates. Upstart's trailing-12-month revenue peaked at $1 billion in 2022 before a weak lending market cut its revenue in half over the last two years. Not surprisingly, the stock fell sharply and is currently down 90% from its previous peak. However, Upstart has continued to train its AI models with more data, and this is starting to lead to improving growth prospects. The product has made huge strides in accuracy, fraud detection, and automation, and these improvements are starting to show in the company's financial results. Management expects a return to growth next quarter, with guidance calling for sequential revenue growth of 17%. Using AI to improve credit profiling is a very complex process, and Upstart's continued investment in its models is leading to a substantial competitive advantage. Management said eight new lenders joined the platform last quarter, and other banks and credit unions continue to return -- a sign that the lending market might be in the early innings of a recovery. The stock jumped 75% following the company's recent earnings report, but it's still trading at a deep discount. With Upstart Holdings at the start of a turnaround, investors could earn handsome returns over the next few years.

Share

Share

Copy Link

An analysis of AI stocks with significant potential for growth, focusing on companies that have seen substantial declines but may offer attractive investment opportunities in the rapidly evolving artificial intelligence sector.

The AI Stock Landscape: A Mixed Bag of Opportunities and Risks

In the ever-evolving world of technology investments, artificial intelligence (AI) stocks have become a focal point for many investors. Recent market trends have highlighted both the potential for explosive growth and the inherent volatility in this sector. Two notable AI stocks have caught the attention of market analysts, presenting intriguing possibilities for investors willing to navigate the complex landscape of tech investments.

C3.ai: A Polarizing AI Play

C3.ai (NYSE: AI) has emerged as a contentious stock in the AI arena. The company, which specializes in enterprise AI applications, has seen its stock price plummet by over 80% from its all-time high

1

. Despite this significant decline, some analysts argue that C3.ai's potential remains undervalued. The company's focus on providing AI solutions for large enterprises positions it uniquely in a market expected to grow substantially in the coming years.UiPath: Automation and AI Synergy

Another stock drawing attention is UiPath (NYSE: PATH), a leader in robotic process automation (RPA) that has integrated AI capabilities into its offerings. Like C3.ai, UiPath has experienced a steep decline of over 80% from its peak

2

. However, the company's strong revenue growth and expanding customer base suggest potential for a significant rebound.The Bull Case: Growth Potential and Market Positioning

Proponents of these stocks argue that both C3.ai and UiPath are well-positioned to capitalize on the growing demand for AI and automation solutions. C3.ai's partnerships with major tech players and its focus on critical sectors like oil and gas, aerospace, and defense could drive future growth

1

. UiPath, on the other hand, benefits from the increasing need for automation in various industries, with its AI-enhanced RPA solutions offering a compelling value proposition.The Bear Case: Competitive Pressures and Profitability Concerns

Critics point to the intense competition in the AI space as a significant challenge for both companies. Tech giants like Microsoft and Google are investing heavily in AI, potentially squeezing out smaller players. Additionally, concerns about profitability and cash burn rates have made some investors wary

2

. Both C3.ai and UiPath have yet to achieve consistent profitability, which adds an element of risk to their investment profiles.Related Stories

Market Dynamics and Investor Sentiment

The broader market sentiment towards AI stocks has been a mix of enthusiasm and caution. While the potential of AI technology is widely recognized, the valuation of AI companies remains a point of debate. The recent pullback in many AI stock prices reflects this uncertainty, but it also presents potential buying opportunities for those who believe in the long-term prospects of the sector

1

2

.Conclusion

As the AI industry continues to evolve, stocks like C3.ai and UiPath represent both the enormous potential and the significant risks inherent in this sector. Investors considering these stocks should carefully weigh the growth prospects against the competitive landscape and financial performance. While the potential for substantial returns exists, so does the risk of further volatility.

References

Summarized by

Navi

Related Stories

AI Stocks Surge Amid Market Volatility: Palantir, SoundHound, and UiPath Lead the Way

26 May 2025•Technology

AI Stock Market Volatility: Insider Activity and Investment Opportunities Amid Tech Sector Pullback

02 Mar 2025•Business and Economy

AI Stock Showdown: Nvidia vs Palantir - Billionaires' Shifting Bets and Market Outlook

09 Jul 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology