Airtel launches AI fraud alert to protect users from OTP-related banking scams across India

5 Sources

5 Sources

[1]

Airtel Unveils AI-Powered System Designed to Warn Users About OTP Frauds

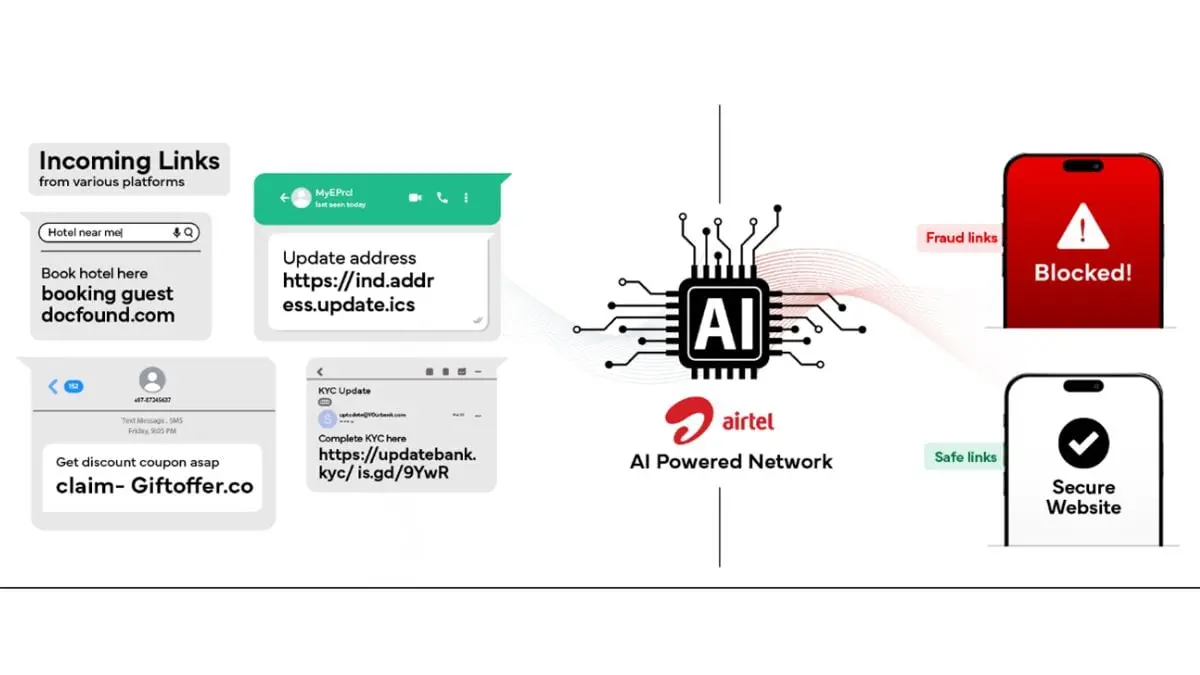

Airtel, India's second-largest telecom service provider (TSP), introduced its network-based AI spam detection solution for calls and SMS in September 2024. Later, in May 2025, the company launched its AI-enabled fraud detection feature in India for emails and WhatsApp. Now, Airtel has unveiled its new Fraud Alerts system to curb bank-related scams, which are committed by bad actors via leaked one-time passwords (OTPs). Leveraging AI, the alert system will identify "potentially risky situations" to warn subscribers. This comes as the instances of digital arrests, fraud, and scams increase. Recently, the Supreme Court reportedly said that Indians lost about Rs. 54,000 crore to digital arrest scams. Airtel's Fraud Alerts Use AI to Detect Potentially Risky Incoming Calls The TSP, on Wednesday, announced that it is introducing the new Fraud Alert system to warn users about OTP-related bank scams. The functionality is already live in Haryana. However, the company plans to roll out Fraud Alerts to all Airtel users across the country over the next two weeks. After a user receives an OTP over SMS, the functionality will leverage AI to identify potentially risky incoming calls. Claimed to offer real-time fraud protection over its network, the customers will be sent an alert that intervenes and warns them about the potential risks of providing consent for a banking transaction OTP while they are still on the call. The company said that bad actors often exploit the urgency "associated with OTPs for day-to-day services", including delivery. Fraudsters then dupe users into sharing banking transaction OTPs, which exposes their account savings to fraud. Fraud Alerts is the latest addition to the company's suite of scam and spam protection features. In September 2024, Airtel launched the AI-powered spam detection feature for calls and SMS, which was later expanded to include Indian regional languages in April 2025. Similarly, in May 2025, Airtel introduced a fraud detection solution for OTT apps and social media platforms, including WhatsApp, Instagram, and Facebook. The TSP uses AI to identify malicious links and websites, and blocks access to them if the same have been flagged as a potential risk. This comes amid growing concerns about the increasing instances of digital arrests and telephonic scams. The Mint reports that the Supreme Court recently highlighted that Indians have lost over Rs. 54,000 crores to digital arrests, during which the victim is coerced into sharing their banking information and OTPs, or even transferring money to the fraudster's account.

[2]

Airtel unveils new AI-powered protection from bank frauds caused by OTP leakages

Airtel has launched an AI-powered tool to combat OTP-related bank frauds, offering real-time protection to customers. The system identifies risky situations and alerts users if a banking OTP is detected during a potentially fraudulent incoming call. This proactive network-level solution aims to prevent scammers from exploiting customer urgency and secure digital transactions. Telecom major Airtel launched an AI-powered tool that delivers real-time protection to customers against the rapidly growing menace of One-Time Password (OTP)-related bank frauds. This comes at a time when the company is ramping up efforts to combat the menace of spam. The system identifies potentially risky situations and warns the involved customers. Whenever a bank OTP is detected as fraud during a potentially risky incoming call, Airtel's AI tool would intervene with a fraud alert check to the customer. This solution is already live in Haryana and the company will roll it out to 100% of its customers over the next two weeks. It would alert the user about the potential risk of giving consent for a banking transaction OTP to be delivered while they are still on the call. This powerful combination of AI-driven intelligence and human judgment gives customers the crucial time they need to think, verify, and stay firmly in control of their security, effectively closing the gap scammers exploit, the company said. Fraudsters often exploit the customers' urgency associated with OTPs for day-to-day services like delivery, and dupe customers into sharing banking-transaction-OTPs, thereby exposing their account savings to the risk of fraud. "We have realised that despite the foundational role played by OTPs in securing digital transactions, their efficacy is frequently being undermined by criminal tactics. We are, therefore, pleased to announce a significant advancement in Airtel's network layer that is designed to strengthen protection against banking frauds," said Shashwat Sharma, Managing Director & CEO Airtel, India. Sharma noted that the newly developed, AI-powered, autonomous solution operates proactively at the network level and is engineered to detect and intervene against fraudulent activity in real-time. The telecom operator has carried out extensive trials that have demonstrated a remarkable level of accuracy and impact in preventing the menace of such scams. Over the past two years, Airtel has rolled out multiple AI-powered, tech-led safeguards like spam- call warnings and malicious link-blocking to stop fraud at the source.

[3]

Airtel launches AI-powered 'Fraud Alert' to combat OTP scams

Bharti Airtel has announced the launch of a new security feature titled "Fraud Alert," an AI-powered tool designed to protect customers from One-Time Password (OTP) related banking fraud. The telecom operator stated that the initiative is part of its broader strategy to secure its network against digital spam and scam activities. The new system specifically targets a common method used by fraudsters: social engineering. Scammers frequently manipulate victims by creating a false sense of urgency -- often masquerading as service providers or delivery personnel -- to obtain OTPs. While these codes are intended for banking transactions, victims are often misled into believing they are verifying a routine service, inadvertently granting access to their savings. Airtel's solution aims to disrupt this process by identifying risky scenarios in real-time. The "Fraud Alert" system utilizes artificial intelligence to monitor communication patterns. According to the company, the feature operates through the following mechanism: This alert serves as a warning, prompting the user to pause and verify the nature of the transaction before verbally sharing the OTP. The goal is to provide a "check" that counters the pressure tactics used by scammers, ensuring users remain in control of their security credentials. This development follows a series of technical safeguards implemented by Airtel over the past two years, including spam-call warnings and malicious link blocking. While these measures have reduced network-level spam, the company acknowledges that fraudsters have adapted by focusing on human vulnerabilities through impersonation. The "Fraud Alert" is designed to bridge the gap between network security and user behavior, offering protection against scams that rely on user consent rather than technical hacking. Airtel has confirmed that the solution is currently live for customers in Haryana. The company plans to complete a nationwide rollout, covering 100% of its customer base, within the next two weeks. Commenting on the initiative, Shashwat Sharma, Managing Director & CEO Airtel, India said:

[4]

Airtel launches new AI-powered protection from 'frauds caused by OTP leakages'

As part of its ongoing efforts to combat the menace of spam, Airtel, today, unveiled its innovative Fraud Alert, an AI-powered, cutting-edge solution that delivers real-time protection to customers against the rapidly growing menace of One-Time-Password (OTP)-related bank frauds. Fraudsters exploit the urgency often associated with OTPs for day-to-day services like delivery, and dupe customers into sharing banking-transaction-OTPs, thereby exposing their account savings to the risk of fraud. Airtel's new AI-powered system identifies such potentially risky situations and warns the customers involved. Whenever a bank OTP is detected during a potentially risky incoming call, Airtel intervenes with a fraud alert check to the customer about the potential risk of giving consent for a banking transaction OTP to be delivered while they are still on the call. This powerful combination of AI-driven intelligence and human judgment gives customers the crucial time they need to think, verify, and stay firmly in control of their security, effectively closing the gap scammers exploit. Commenting on the initiative, Shashwat Sharma, Managing Director & CEO Airtel, India said, "We are on a mission to make Airtel the safe network. While working towards this, we have realised that despite the foundational role played by One-Time Passwords (OTPs) in securing digital transactions, their efficacy is frequently being undermined by criminal tactics. We are, therefore, pleased to announce a significant advancement in Airtel's network layer that is designed to strengthen protection against banking frauds. Our newly developed, AI-powered, autonomous solution operates proactively at network level and is engineered to detect and intervene against fraudulent activity in real-time. Extensive trials have demonstrated a remarkable level of accuracy and impact in preventing the menace of such scams." Over the past two years, Airtel has rolled out AI-powered, tech-led safeguards like spam- call warnings and malicious link-blocking to stop frauds at the source. While it has succeeded in its efforts to reduce fraud on its network to a great extent, fraudsters have continued to exploit human vulnerabilities through impersonation and social engineering. This breakthrough feature designed to protect mobile phone users is yet another step to protect its customers from digital fraud. This solution is already live in Haryana and Airtel will roll it out to 100% of its customers over the next two weeks. Headquartered in India, Airtel is a global communications solutions provider with over 600 million customers in 15 countries across India and Africa. The company also has its presence in Bangladesh and Sri Lanka through its associate entities. The company ranks amongst the top three mobile operators globally and its networks cover over two billion people. Airtel is India's largest integrated communications solutions provider and the second largest mobile operator in Africa. Airtel's retail portfolio includes high-speed 4G/5G mobile, Wi-Fi (FTTH+ FWA) that promises speeds up to 1 Gbps with convergence across linear and on-demand entertainment, video streaming services, digital payments and financial services. For enterprise customers, Airtel offers a gamut of solutions that includes secure connectivity, cloud and data centre services, cyber security, IoT, and cloud-based communication. Airtel's digital arm - Xtelify, empowers telcos globally to leverage the power of AI, data and technology to accelerate their digital transformation and drive growth. Xtelify also offers Airtel Cloud in India enabling enterprises with a sovereign, telco-grade cloud platform that guarantees secure migration, effortless scaling, lower costs and no vendor lock-ins. Within its diversified portfolio, Airtel also offers passive infrastructure services through its subsidiary Indus Tower Ltd.

[5]

Airtel launches AI-based fraud alert system to tackle OTP-related banking scams: How it works

Currently live in Haryana, the system will be rolled out to all Airtel customers nationwide. Bharti Airtel has introduced a new AI fraud detection system to reduce the growing number of OTP-based banking scams in India. It is called as Fraud Alert and is specifically designed to offer real-time warnings to customers when they may be at risk of sharing sensitive one-time passwords during suspicious phone calls. For the unversed, OTP fraud has become a common tactic used by scammers, who often create a sense of urgency by posing as delivery agents, bank representatives or service providers. Victims are tricked into revealing banking OTPs, allowing fraudsters to gain access to their accounts and siphon off funds. The new Airtel system works at the network level and uses AI to flag potentially risky situations. If a bank-related OTP is triggered while a customer is on what the system identifies as a suspicious incoming call, Airtel sends an immediate alert cautioning the user about the risks of sharing the code. The idea is to interrupt the scam in progress and give users a moment to reassess before proceeding. Also read: Samsung Unpacked 2026: Galaxy S26 series and Galaxy Buds 4 to launch on this date Over the past two years, Airtel has rolled out several AI-backed tools, including spam call identification and malicious link blocking, to reduce fraud exposure for its subscribers. However, the company acknowledged that social engineering and impersonation scams continue to pose challenges, prompting the need for more proactive, real-time interventions. The new Airtel Fraud Alert feature is available in Haryana and will be rolled out in other states in a phased manner. However, the exact timeline remains under the wraps.

Share

Share

Copy Link

Bharti Airtel has unveiled an AI-powered fraud detection system that delivers real-time alerts when customers receive banking OTPs during suspicious calls. Already live in Haryana, the network-level solution aims to combat social engineering tactics as Indians reportedly lost Rs. 54,000 crore to digital arrest scams.

Airtel Introduces AI-Based Fraud Alert System for Real-Time Protection

Bharti Airtel has launched a new AI fraud alert feature designed to protect its customers from the escalating threat of OTP-related banking scams. The telecom operator's latest security measure operates at the network level, identifying potentially risky situations and intervening with real-time alerts when customers receive One-Time Password messages during suspicious incoming calls

1

. This AI-powered protection from bank frauds represents a significant advancement in Airtel's ongoing mission to create what the company calls a "safe network" for its subscribers across India2

.

Source: ET

The system specifically targets a pervasive fraud tactic where scammers exploit the urgency associated with OTPs for everyday services like delivery. Fraudsters typically pose as service providers or delivery personnel to dupe customers into sharing banking transaction OTPs, thereby exposing their account savings to theft

3

. According to Shashwat Sharma, Managing Director & CEO Airtel India, the company recognized that despite the foundational role played by OTPs in securing digital transactions, their efficacy is frequently undermined by criminal tactics4

.How Network Level Fraud Detection Works to Combat Social Engineering

Airtel's AI-based fraud alert system uses artificial intelligence to monitor communication patterns and detect banking fraud in progress. When a bank OTP is detected during a potentially risky incoming call, the system intervenes immediately with a fraud alert check to warn the customer about the potential risk of giving user consent for a banking transaction OTP while still on the call[5](https://www.digit.in/news/telecom/airtel-l aunches-ai-based-fraud-alert-system-to-tackle-otp-related-banking-scams-how-it-works.html). This powerful combination of AI-driven intelligence and human judgment gives customers crucial time to think, verify, and stay firmly in control of their cyber security, effectively closing the gap that scammers exploit through impersonation and social engineering tactics

2

.

Source: CXOToday

The solution is already live in Haryana, and Airtel plans to roll it out to 100% of its customers across the country over the next two weeks

1

. Extensive trials have demonstrated a remarkable level of accuracy and impact in preventing such scams, according to the company4

. This proactive approach to protection from OTP leakages marks a shift from traditional network security measures that focus primarily on technical vulnerabilities rather than human behavior.Growing Threat of Digital Fraud and Banking Fraud in India

The launch of this fraud detection system comes amid alarming statistics about digital fraud in India. The Supreme Court recently highlighted that Indians have lost over Rs. 54,000 crore to digital arrest scams, during which victims are coerced into sharing their banking information and OTPs, or even transferring money directly to fraudsters' accounts

1

. These figures underscore the urgent need for real-time protection against bank frauds that can intervene before damage occurs.

Source: Gadgets 360

Over the past two years, Airtel has deployed multiple AI-powered safeguards including spam detection features for calls and SMS launched in September 2024, which were later expanded to include Indian regional languages in April 2025

1

. In May 2025, the company introduced fraud detection for OTT platforms including WhatsApp, Instagram, and Facebook, using AI to identify and block access to malicious links and websites1

. However, the company acknowledges that while these measures have succeeded in reducing fraud on its network, scammers continue to exploit human vulnerabilities through sophisticated social engineering techniques3

.Related Stories

What This Means for Airtel Customers and India's Telecom Security

The new system bridges the gap between network security and user behavior, offering protection against scams that rely on user consent rather than technical hacking

3

. For Airtel's over 600 million customers across 15 countries, this represents a significant enhancement in their defense against increasingly sophisticated fraud tactics. The feature to warn users about OTP frauds operates autonomously and proactively, requiring no action from customers to activate it2

.As India's second-largest telecom service provider continues to expand its AI-powered security infrastructure, industry observers will watch whether competing operators adopt similar network-level interventions. The success of this initiative could set a precedent for how telecom companies approach their role in protecting customers from digital fraud beyond traditional spam detection. With the nationwide rollout expected within two weeks, the effectiveness of this AI-based approach in reducing OTP fraud will soon become measurable across Airtel's entire customer base.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology