Amazon's Rufus AI Chatbot Drives 100% Surge in Black Friday Purchases

3 Sources

3 Sources

[1]

Amazon's AI chatbot Rufus drove sales on Black Friday | TechCrunch

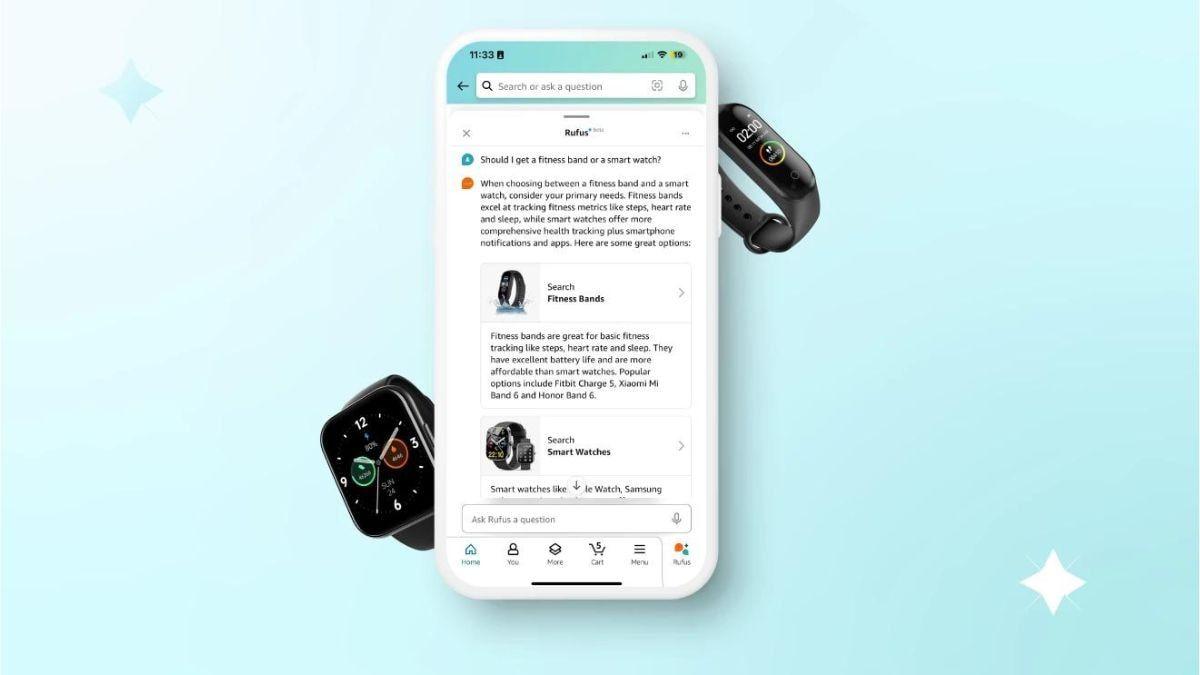

Amazon's AI chatbot, Rufus, saw a surge of adoption on Black Friday, according to new data published over the weekend by market intelligence firm Sensor Tower. In the U.S., Amazon sessions that resulted in a purchase surged 100% on Black Friday compared with the trailing 30 days, while sessions that resulted in a purchase and didn't include Rufus increased by only 20%. In addition, Amazon saw a 75% day-over-day increase for sessions that included Rufus and resulted in a purchase, compared with just a 35% day-over-day increase for sessions without Rufus that had resulted in a purchase. The firm also noted that Amazon sessions that involved the AI chatbot outpaced total website sessions. On Black Friday, Amazon's total website sessions increased by 20% day over day, while those that involved Rufus were up by 35%. Amazon's AI chat was first launched into beta in early 2024 before rolling out to all U.S. customers later that year. Today, Rufus helps Amazon shoppers find products, get recommendations, and perform product comparisons. Rufus' adoption to drive Black Friday sales is part of a broader surge in consumers turning to AI to help them with holiday shopping, data shows. According to e-commerce data from Adobe Analytics, which tracks more than 1 trillion visits to U.S. retail websites, AI traffic to U.S. retail sites increased by 805% year-over-year on Black Friday. This indicates that consumers more heavily embraced generative AI chatbots to find deals and research products this year. The AI tools were mostly used for popular Black Friday deal categories like electronics, video games, appliances, toys, personal care items, and baby and toddler products. Adobe Analytics also noted that the use of AI increased conversions. It found U.S. shoppers who came to a retail site from an AI service were 38% more likely to buy, compared with non-AI traffic sources. Whether AI directly contributed to the record Black Friday spending of $11.8 billion is less clear. Instead, the sizable figure this year could be due to higher prices, not an increase in online shopping. As TechCrunch reported on Saturday, Salesforce data showed prices were up by an average of 7%, while order volumes were down by 1%. Sensor Tower's data similarly suggests that consumers were perhaps being more conservative in their spending this year, likely due to economic strains. Even though mobile app and website adoption spiked on Black Friday compared to the previous 30 days, gains in total visits and downloads decelerated from 2024, its data indicated. For instance, Amazon and Walmart's mobile app downloads grew by 24% and 20%, respectively on Black Friday, compared with the previous 30 days. But that growth paled when compared with 2024, when Amazon downloads surged by 50% and Walmart's were up 75% during the same period, the firm pointed out. Amazon and Walmart's website visits on Black Friday were up by 90% and 100% this year, respectively, compared with the prior 30 days. However, those same numbers in 2024 were 95% and 130%, also respectively. In a related Adobe survey, 48% of respondents said they have used or plan to use AI specifically for holiday shopping.

[2]

Rufus surges Amazon Black Friday purchases by 100%

Amazon's AI chatbot Rufus experienced a significant surge in usage on Black Friday in the United States, driving higher purchase rates compared to sessions without the tool, as reported by Sensor Tower. Sensor Tower's data revealed that Amazon sessions resulting in a purchase increased by 100 percent on Black Friday compared to the previous 30 days. In contrast, sessions leading to purchases without Rufus involvement rose by only 20 percent over the same period. This disparity highlights Rufus's role in enhancing conversion during peak shopping. Day-over-day metrics further underscore this impact: sessions including Rufus that resulted in purchases grew by 75 percent, while those excluding Rufus increased by 35 percent. Overall website sessions on Amazon expanded by 20 percent day-over-day on Black Friday, yet sessions involving Rufus advanced by 35 percent, indicating accelerated adoption of the AI assistant amid heightened traffic. Rufus entered beta testing in early 2024 and became available to all U.S. customers later that year. The chatbot assists shoppers by identifying products, offering recommendations, and enabling comparisons. These functionalities allow users to navigate vast inventories efficiently, particularly during high-demand events like Black Friday, where quick decision-making influences buying behavior. The rise in Rufus usage aligns with a wider trend of consumers relying on AI for holiday shopping assistance. Adobe Analytics, monitoring over one trillion visits to U.S. retail websites, recorded an 805 percent year-over-year increase in AI-generated traffic to these sites on Black Friday. This growth reflects greater integration of generative AI chatbots in deal discovery and product research processes. Shoppers directed queries toward prominent Black Friday categories, including electronics, video games, appliances, toys, personal care items, and baby and toddler products, where AI tools provided targeted insights and comparisons. Beyond traffic volume, AI engagement boosted purchasing outcomes. Adobe Analytics determined that U.S. shoppers arriving at retail sites via AI services demonstrated a 38 percent higher likelihood of completing a purchase than those from non-AI sources. This elevated conversion rate stems from AI's ability to deliver precise recommendations, aligning user intent with available offerings and streamlining the path to checkout.

[3]

Amazon's AI Bet Pays Off as Rufus AI Boosts Black Friday Sales

Black Friday also saw 38 percent of the users interacting with Rufus Amazon's Rufus, an artificial intelligence (AI) shopping assistant, is now helping drive sales on the platform. As per new data, on Black Friday, the e-commerce giant's shopping platform witnessed a strong uptick when it came to shopping sessions with Rufus as well as shopping sessions that led to purchase. The data also highlights the shift in users' preference, as interacting with an agentic AI chatbot to help in shopping processes appears to be growing popular. Notably, ahead of Black Friday, Google, OpenAI, Perplexity, and Microsoft also released AI-powered shopping tools. Rufus Drives Sales on Amazon, Data Says Ian Simpson, Senior Vice President, Innovation and Strategy at Sensor Tower, shared company data in a post on LinkedIn, highlighting that Rufus played an important role in driving both engagement (shopping session duration) on Amazon's e-commerce platform and sales. Based on the data, shopping sessions in the US on the Amazon app with Rufus saw an uptick by 86 percent when compared to a non-sale day just two weeks before that. In the same duration, shopping sessions without Rufus just marked an increase of 16 percent. Of course, the data does not paint the full picture since Rufus' adoption is not very large, and the uptick percentages could mean little when it comes to absolute increases. However, it does highlight that users are starting to use the AI assistant. Notably, total sessions with Rufus on Amazon was noted at 38 percent, or a little over one-third of the shoppers. This is a slight increase compared to Prime Day sale, where Rufus was used in 34 percent of all sessions. Another interesting data shared by Simpson is sessions that led to a purchase. The difference between non-Rufus sessions leading to purchase and Rufus-based sessions leading to purchase was as high as 75 percent. This is a far more important metric, because it shows that Rufus is not only an engagement or interaction tool, but it is also helping in conversions. Separately, Adobe Analytics also reported a significant increase in AI-driven e-commerce traffic during the holiday season. Between November 1 and November 30, traffic from AI sources to e-ecommerce platforms is said to have increased 770 percent year-on-year, with 74.4 percent of those coming from desktop devices and 25.6 percent redirected on a smartphone or tablet. However, despite the positive data, Simpson advises tempered expectations. In a separate post, he said, "My bet is consumers are using Rufus more as advanced search and less as an agentic shopper. Conversions do seem to be higher with Rufus but that could be because it's driving better search results vs radically changing the shopping experience."

Share

Share

Copy Link

Amazon's AI shopping assistant Rufus significantly boosted Black Friday sales, with sessions resulting in purchases increasing 100% compared to non-AI sessions. The data reveals growing consumer adoption of AI for holiday shopping across the retail sector.

Amazon's AI Shopping Assistant Delivers Record Black Friday Performance

Amazon's artificial intelligence chatbot Rufus demonstrated remarkable effectiveness during Black Friday 2024, driving significantly higher conversion rates and engagement compared to traditional shopping sessions. According to data from market intelligence firm Sensor Tower, Amazon sessions that resulted in purchases surged 100% on Black Friday compared to the trailing 30 days when Rufus was involved, while sessions without the AI assistant increased by only 20% over the same period

1

.

Source: Gadgets 360

The day-over-day metrics further highlighted Rufus's impact on consumer behavior. Sessions including the AI chatbot that resulted in purchases grew by 75%, compared to just 35% for sessions without Rufus

2

. This substantial difference indicates that the AI assistant is not merely an engagement tool but actively contributes to conversion optimization.Growing Consumer Adoption of AI Shopping Tools

Rufus usage reached significant penetration during the Black Friday shopping event, with 38% of Amazon shoppers interacting with the AI assistant—an increase from 34% during Prime Day sales earlier in the year

3

. The chatbot, which entered beta testing in early 2024 before rolling out to all U.S. customers, assists shoppers by identifying products, offering personalized recommendations, and enabling product comparisons.Total Amazon website sessions increased by 20% day-over-day on Black Friday, while sessions involving Rufus advanced by 35%, demonstrating accelerated adoption of the AI assistant during peak shopping periods

1

. This outpaced growth suggests consumers are increasingly comfortable relying on AI assistance for their shopping decisions.Industry-Wide AI Shopping Surge

Amazon's success with Rufus reflects a broader trend across the retail sector. Adobe Analytics, which tracks over one trillion visits to U.S. retail websites, recorded an extraordinary 805% year-over-year increase in AI-generated traffic to retail sites on Black Friday

1

. This dramatic growth indicates widespread consumer adoption of generative AI chatbots for deal discovery and product research.The effectiveness of AI-driven shopping extends beyond traffic volume to actual purchasing behavior. Adobe Analytics found that U.S. shoppers who arrived at retail sites via AI services were 38% more likely to complete a purchase compared to those from non-AI sources

2

. This elevated conversion rate stems from AI's ability to deliver precise recommendations and streamline the path to checkout.Related Stories

Market Context and Consumer Behavior Shifts

Despite the AI-driven engagement success, broader market indicators suggest consumers exercised more caution in their spending patterns. While Black Friday achieved record spending of $11.8 billion, Salesforce data revealed that prices increased by an average of 7% while order volumes decreased by 1%

1

. This suggests that higher spending figures may reflect inflation rather than increased shopping activity.Sensor Tower's analysis indicates that while mobile app adoption and website visits spiked compared to the previous 30 days, growth rates decelerated from 2024 levels. Amazon and Walmart's mobile app downloads grew by 24% and 20% respectively on Black Friday, compared to 50% and 75% growth rates in 2024

1

.However, industry experts maintain measured expectations about AI's role in shopping transformation. Ian Simpson from Sensor Tower suggests that consumers may be using Rufus more as an advanced search tool rather than a fully agentic shopping assistant, noting that higher conversions could result from improved search results rather than fundamental changes to the shopping experience

3

.References

Summarized by

Navi

[2]

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation