AMD's AI Chip Momentum Drives Stock to New Heights Amid Market Optimism

6 Sources

6 Sources

[1]

AMD stock surges 5% to a new 52-week high -- will August 5 earnings finally trigger the breakout Wall Street's been betting on?

AMD stock hits 52-week high as AI momentum and earnings outlook fuel investor optimism- Advanced Micro Devices (AMD) stock is making headlines again as it recently surged to a fresh 52-week high of $174.16, fueled by accelerating AI chip momentum, bullish analyst upgrades, and a highly anticipated Q2 2025 earnings report. The stock's parabolic rise reflects growing investor confidence in AMD's expanding presence in artificial intelligence, data centers, and high-performance computing. As the AI chip war between AMD and Nvidia intensifies, market watchers are closely tracking every catalyst, from the company's MI350 GPU series to forward-looking analyst targets reaching up to $200 per share. With AMD earnings scheduled for August 5, 2025, the stage is set for what could be a pivotal moment for investors. On July 28, 2025, AMD stock soared to a new 52-week high of $174.16, driven by mounting optimism over its AI-focused product roadmap and improving earnings performance. This move marks a 24% gain over the past year and nearly a 46% jump in the last six months. This impressive rally comes amid growing market enthusiasm around AMD's positioning in the AI hardware space, particularly with its latest MI350 Instinct series, which is already gaining traction among enterprise and hyperscale cloud customers. The price momentum reflects renewed investor sentiment as AMD continues to grab market share from rivals like Intel and positions itself as a formidable challenger to Nvidia in the booming AI GPU market. AMD's strong performance has prompted several major analysts to revise their forecasts. Melius Research recently upgraded AMD to Buy, lifting its target from $110 to $175, citing accelerating AI traction and a robust product cycle. HSBC followed up with a bullish call, assigning a Buy rating and a price target of $200, pointing to AMD's pricing advantage and competitiveness in the AI chip landscape. According to analysts, AMD's MI350 chips, especially the MI355X, offer a balance of power and affordability, with average selling prices near $25,000 -- 30% cheaper than comparable Nvidia offerings. These upgrades are part of a broader Wall Street trend recognizing AMD as a key beneficiary of enterprise AI adoption, hyperscale data center upgrades, and increasing cloud GPU demand. AMD's MI350 Instinct GPU series, launched earlier this year, is already making waves due to its performance-per-dollar edge over Nvidia's H100 chips. The MI355X model, in particular, is being pitched as a high-efficiency AI accelerator designed for training and inference at scale. What sets AMD apart is not just the hardware. The company has been steadily building its ROCm (Radeon Open Compute) software stack to rival Nvidia's CUDA, giving developers more flexibility and cost-effective alternatives. This is critical for long-term success, as software support often dictates hardware adoption in AI workloads. With the MI400 series expected to launch in 2026, AMD is well-positioned to further disrupt the AI silicon market, particularly in inference workloads, where Nvidia currently dominates. AMD is scheduled to release its Q2 2025 earnings on August 5, and expectations are running high. Analysts predict revenue growth near 35% year-over-year, with particular strength in the data center and AI segments. In Q1 2025, AMD reported $7.44 billion in revenue, up 36% YoY, with net income per share of $0.96, well above Wall Street estimates. The data center business accounted for $3.67 billion, a 57% YoY surge. The company's guidance for Q2 revenue is between $7.1 billion and $7.7 billion, slightly ahead of market consensus. Investors are watching for updates on MI355X adoption, AI market share gains, and gross margin expansion, all of which will shape AMD's growth narrative into 2026. Despite the strong performance, some market observers are raising caution flags around AMD's valuation metrics. The stock is currently trading at a forward P/E of ~40, with a price-to-free-cash-flow (P/FCF) ratio near 98, and a PEG ratio around 1.3. While these numbers are not unheard of in the high-growth tech space, they do suggest that much of the expected future growth is already priced in. Any earnings miss or delayed product roadmap execution could lead to a sharp correction. Key concerns include production delays at TSMC, which manufactures AMD's AI chips, and the challenge of scaling its ROCm software ecosystem to compete with Nvidia's dominant CUDA platform. From a technical standpoint, AMD faces short-term resistance at $175, which coincides with its current 52-week high. If it breaks through this level following strong Q2 results, the next target could be in the $200-$215 range, echoing March 2024's intraday highs. Support levels to watch include $135 (near previous breakout points) and $115, which may act as a safety zone in case of a broader tech sell-off or earnings disappointment. These levels are critical for swing traders and momentum investors looking to capitalize on short-term volatility in a high-beta name like AMD. AMD's continued investment in AI acceleration and data center GPUs is transforming its position in the tech ecosystem. With Nvidia dominating the market through its H100 and the upcoming Vera Rubin platform, AMD's success depends on two key factors: product differentiation and developer support. Unlike Nvidia, which has a tightly integrated hardware-software stack, AMD is relying on open-source flexibility and pricing advantages to win customers. Meanwhile, Intel is struggling to keep pace, giving AMD a window to establish a strong #2 position in the AI compute race. If AMD can successfully ramp its MI350 and MI400 chips while building ROCm adoption among developers, it may cement its status as a long-term leader in enterprise AI infrastructure. The recent rally has reignited discussions about whether AMD stock can break past the $200 mark in the next 12 months. While the current valuation is rich, multiple tailwinds support a long-term bullish case: That said, investors should remain cautious. The stock is priced for perfection, and any stumble in earnings, product delays, or macro pressures could trigger a pullback. For those considering a position in AMD, the strategy largely depends on risk tolerance and investment horizon. AMD's latest surge to a 52-week high showcases the market's growing confidence in its ability to compete in the AI and data center markets. With earnings approaching on August 5, investor focus will shift to whether the company can back up its valuation with solid results and forward guidance. If AMD delivers another quarter of strong revenue growth, margin expansion, and MI350 adoption, it could very well cement its path toward $200+, redefining its role as a key AI infrastructure player. For now, all eyes are on AMD as it gears up for one of the most anticipated earnings seasons in recent tech history. Q1: Why is AMD stock rising so fast? AMD stock is rising due to strong AI chip demand, analyst upgrades, and solid earnings momentum. Q2: What is AMD's next big AI product? AMD's next AI product is the MI400 series, expected to challenge Nvidia in 2026.

[2]

What Is Going On With AMD Stock On Monday? - Advanced Micro Devices (NASDAQ:AMD)

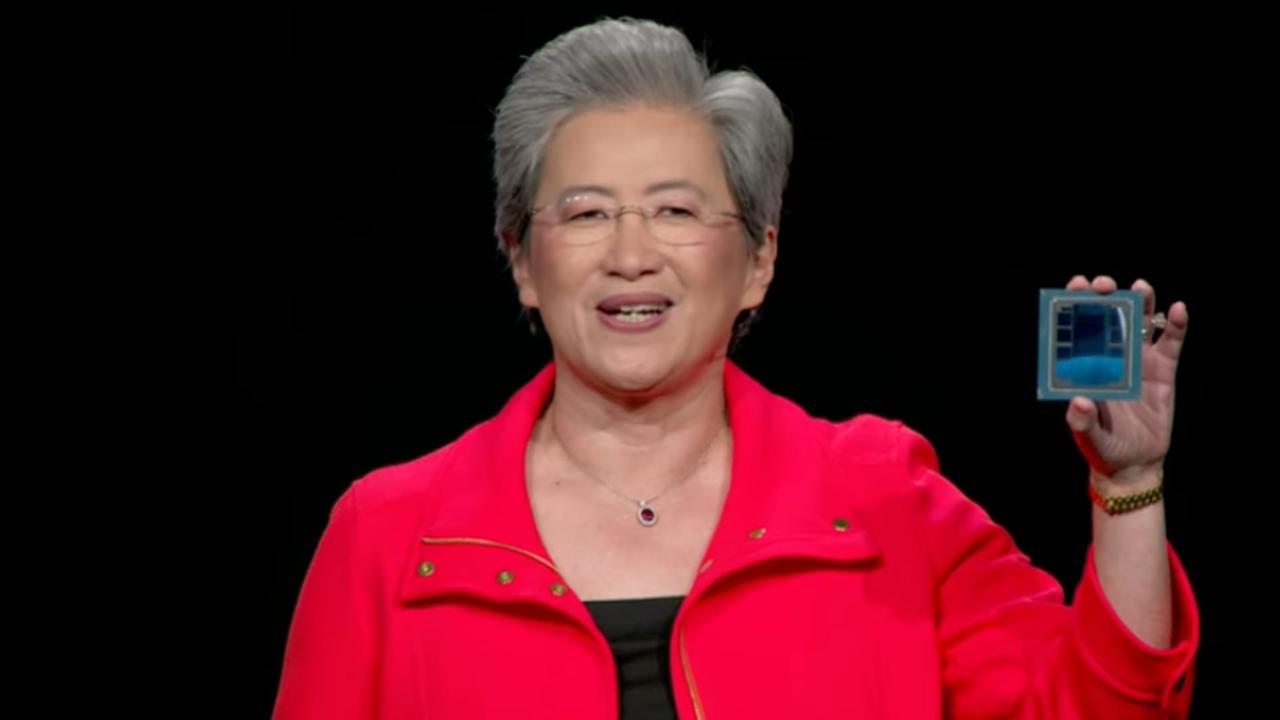

As global demand for artificial intelligence continues to surge, major tech companies are racing to enhance their chip capabilities and secure their positions in the market. This competitive landscape is driving significant price adjustments and strategic forecasts, as evidenced by Advanced Micro Devices' AMD recent developments. AMD stock gained on Monday amid reports indicating that the company has raised the price of its MI350 AI chip by $10,000 to $25,000. AMD stock is on the move, climbing higher. Track it now here. Additionally, HSBC evaluated that "MI350 can now compete with Nvidia's NVDA Blackwell B200 in the market. The Wall Street firm expects AMD's 2026 AI chip sales to be significantly higher than the prior estimate of $9.6 billion, at $15.1 billion. Also Read: AMD CEO Highlights Higher Costs For US Made Chips As Supply Chain Strengthens The semiconductor chip stock also received a boost from a favourable industry regulatory report, which indicated that the United States had paused new restrictions on tech exports to China to avoid disrupting trade talks and support President Donald Trump's efforts to meet with Chinese President Xi Jinping later this year. In recent months, the Commerce Department's Bureau of Industry and Security received instructions to delay the strict enforcement of export controls on China, according to a Financial Times report, which cites current and former U.S. officials. This policy shift comes as top U.S. and Chinese economic officials prepare to launch high-level trade discussions in Stockholm aimed at resolving long-standing disputes. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get Started AMD stock surged 44% year-to-date, gaining over 80% in the last three months. Last week, Trump unveiled aggressive new AI initiatives at a summit event. Trump signed three executive orders to reduce AI regulation, accelerate infrastructure development, and promote U.S. leadership in AI. Nvidia CEO Jensen Huang praised the White House's approach, calling it a competitive advantage for the U.S.. At the same time, AMD CEO Lisa Su projected that the demand for AI chips could exceed $500 billion in the years to come. Trump publicly acknowledged Huang and Su as key figures advancing America's AI leadership. Alphabet's increased 2025 capital spending forecast -- up to $85 billion -- also contributed to optimism, signaling growing demand for cloud and AI infrastructure. Trump is expected to roll out further plans to secure power access for AI-driven data centers. AMD Price Action: Advanced Micro Devices shares were up 3.58% at $172.43 at the time of publication on Monday, according to Benzinga Pro data. Read Next: Broadcom's $61 Billion VMware Deal Faces EU Court Challenge -- Could Regulatory Blowback Hit Growth? Photo: sdx15 / Shutterstock.com AMDAdvanced Micro Devices Inc$172.163.42%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum83.14Growth97.20Quality79.04Value11.38Price TrendShortMediumLongOverviewNVDANVIDIA Corp$174.970.85%Market News and Data brought to you by Benzinga APIs

[3]

AMD Stock Is Sliding Tuesday: What's Driving The Action? - Advanced Micro Devices (NASDAQ:AMD)

Tim Melvin's system has spotted 10X winners like NVIDIA and Matador -- see his next 6 picks and the options strategies to multiply gains at a free July 23 event. Register Here. Shares of Advanced Micro Devices Inc AMD are trading lower Tuesday afternoon, caught in a broader downturn affecting the semiconductor industry. Here's what investors need to know. What To Know: The sector-wide pressure appears linked to reports that a massive artificial intelligence infrastructure project is facing significant headwinds, raising concerns about the near-term demand for high-performance chips. The venture in question, a $500 billion project named "Stargate" by SoftBank and OpenAI, is reportedly scaling back its ambitious goals. Announced six months ago with plans for a $100 billion immediate investment, the project has yet to secure a major data center deal. According to reports, persistent disagreements between SoftBank and OpenAI over strategy and control have stalled progress, reducing near-term plans to a much smaller facility in Ohio. The news has dampened investor enthusiasm for chip stocks because mega-projects like Stargate are expected to be a primary driver of future growth. A delay or reduction in scope of such a large-scale build-out could temper the explosive demand for AI accelerators that has propelled stocks like AMD. While OpenAI has secured capacity elsewhere, the struggles of its flagship joint venture are casting a shadow over the outlook for AI spending, prompting a cautious pullback. Benzinga Edge Rankings: According to Benzinga Edge stock rankings, AMD shows exceptional strength in several key areas. The company earns an outstanding Growth score of 97.12, signaling powerful forward-looking prospects. It also posts strong scores for Quality at 79.65 and Momentum at 74.16, suggesting a fundamentally sound business with positive recent market performance. However, these strengths come at a high price, as reflected by a very low Value score of just 11.68. This indicates that, while a high-quality growth name, the stock is considered expensive on a valuation basis. Price Action: According to data from Benzinga Pro, AMD shares are trading lower by 1.57% to $154.53 Tuesday afternoon. The stock has a 52-week high of $174.05 and a 52-week low of $76.48. Read Also: Apple's Online Store Is Now Live In Saudi Arabia, Flagship Stores Coming By 2026 Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get StartedHow To Buy AMD Stock Besides going to a brokerage platform to purchase a share - or fractional share - of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument. For example, in Advanced Micro Devices' case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment. Image: Shutterstock AMDAdvanced Micro Devices Inc$154.11-1.84%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum74.16Growth97.12Quality79.65Value11.68Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[4]

What's Going On With Advanced Micro Devices Shares Today? - Advanced Micro Devices (NASDAQ:AMD)

Advanced Micro Devices Inc. AMD shares are trading higher Tuesday extending momentum from Monday after reports revealed the company raised the price of its MI350 artificial intelligence chip. What To Know: The chip was up-ed by $10,000, bringing it to $25,000 per unit. The increase reflects growing confidence in AMD's competitiveness within the AI chip market, particularly against rival Nvidia's Blackwell B200. The price adjustment comes amid a broader surge in investor optimism following HSBC's revised forecast for AMD's AI chip sales in 2026. The bank now estimates sales to reach $15.1 billion, significantly higher than its prior projection of $9.6 billion. Analysts view the MI350 as a viable challenger in the high-performance AI segment, boosting expectations for AMD's role in the rapidly expanding AI market. Further supporting AMD's upward trend is a favorable policy shift from the U.S. government. According to the Financial Times, the Commerce Department has paused enforcement of new restrictions on technology exports to China, in an effort to support ongoing trade negotiations and a potential summit between President Donald Trump and Chinese President Xi Jinping. The regulatory easing is expected to benefit chipmakers like AMD that operate within sensitive supply chains. Recent political developments have also factored into the bullish sentiment. At a recent summit, President Trump introduced a trio of executive orders aimed at bolstering AI development, cutting red tape, and advancing infrastructure. AMD CEO Lisa Su and Nvidia CEO Jensen Huang were both acknowledged by Trump as central figures in advancing U.S. AI leadership. Su, in particular, emphasized the potential of AI chip demand surpassing $500 billion in the near future. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get Started AMD shares are now up over 80% in the last three months and 44% year-to-date, with the recent developments reinforcing the company's upward trajectory in a highly competitive and evolving AI market landscape. AMD Price Action: Advanced Micro Devices shares were up 1.21% at $195.74 at the time of writing, according to Benzinga Pro. Read Next: $19.5 Trillion Earnings Blitz: Wall Street Faces Make-Or-Break 72 Hours Image Via Shutterstock. AMDAdvanced Micro Devices Inc$179.353.28%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum83.14Growth97.20Quality79.04Value11.38Price TrendShortMediumLongOverview This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[5]

Why AMD Stock Is Sinking Today | The Motley Fool

Advanced Micro Devices (AMD -1.31%) stock has headed lower in Tuesday's trading, but it's also regained some ground from sell-offs at the beginning of the session. The semiconductor company's share price was down 1.5% as of 3 p.m. ET in the context of flat trading for the S&P 500 index and a 0.3% decline for the Nasdaq Composite index. The stock had been off as much as 4.9% near the start of trading. After hitting a record high in yesterday's trading, the Nasdaq Composite is seeing a modest pullback today. Sell-offs for chip stocks including AMD played a big role in pushing the index significantly lower early in trading, but there has been a valuation recovery trend as the day has progressed. Tech sector valuations have generally been red-hot lately. Encouraging corporate earnings reports and industry performance tracking and expectations that the Federal Reserve will now issue multiple cuts to the benchmark interest rate have helped bolster share prices, but valuations for AMD and many other chip stocks are taking a modest step back today. In addition to profit taking on the heels of the Nasdaq Composite hitting a record high in Monday's session, a report from The Wall Street Journal on the Stargate artificial intelligence (AI) initiative appears to be a factor in the sell-off. Stargate is a $500 billion AI investment collaboration between Softbank, OpenAI, Oracle, and MGX aimed at strengthening U.S. artificial intelligence infrastructure, but it's reportedly run into some early road blocks -- and near-term expansion plans are said to have been pared back. Renewed excitement surrounding the company's opportunities in the AI space has helped power a strong rally for AMD stock recently, and the company's share price is up roughly 81% over the last three months even with today's pullback. Investors won't have to wait long to get a closer look at the company's progress in the AI data center space. AMD is scheduled to report its second-quarter earnings after the market closes on Aug. 5. Performance expectations have been elevated following the company's valuation run-up, but the launch of the company's MI350 processor and some encouraging information shared at its Advancing AI conference last month suggest the company could have some good news to share in the report.

[6]

Why AMD Stock Is Jumping Today | The Motley Fool

AMD's stock is rising today thanks to news that the Trump administration is suspending restrictions that prevented advanced semiconductors and other technologies from being exported to China. The semiconductor stock is also getting a lift from bullish analyst coverage. The Trump administration has at least temporarily lifted export bans that prevented AMD from selling its high-end artificial intelligence (AI) processors into the Chinese market. The move is a concession as Trump aims to secure a trade deal with China, and it could wind up being a significant positive sales and earnings catalyst for AMD. While increased potential for a trade deal to be reached between the two countries is a beneficial development for AMD, the significance that the AI race holds for both countries along national security and economic lines suggests that substantial geopolitical risk factors are still on the table. Before the market opened this morning, Bank of America published new coverage on AMD and raised its one-year price target on the stock from $175 per share to $200 per share. BofA's analysts think that the chipmaker's share of the central processing unit (CPU) market could rise from 20% in 2023 to 30% next year. In addition to taking market share from Intel in the CPU space, Bank of America's analysts noted that AMD's processors are commanding a 17% pricing premium compared to offerings from its competitor. While AMD's performance in the CPU space will continue to be a key factor in the company's performance, sales results for its graphics processing units (GPUs) for AI data centers will likely be the biggest factor shaping the stock's next moves when the company reports its Q2 results on Aug. 5.

Share

Share

Copy Link

AMD's stock hits a 52-week high as the company raises prices on its MI350 AI chip and receives bullish analyst forecasts, signaling growing confidence in its AI market position.

AMD's Stock Soars on AI Chip Momentum

Advanced Micro Devices (AMD) has seen its stock surge to a new 52-week high of $174, marking a 24% gain over the past year and nearly a 46% jump in the last six months

1

. This impressive rally is fueled by growing investor confidence in AMD's expanding presence in artificial intelligence, data centers, and high-performance computing.

Source: Benzinga

Price Hike and Market Positioning

In a bold move signaling market confidence, AMD has raised the price of its MI350 AI chip by $10,000, bringing it to $25,000 per unit

2

. This price adjustment reflects AMD's growing competitiveness in the AI chip market, particularly against rival Nvidia's offerings. Analysts view the MI350 as a viable challenger in the high-performance AI segment, with HSBC noting that it can now compete with Nvidia's Blackwell B2002

.Bullish Analyst Projections

Wall Street's enthusiasm for AMD's AI prospects is evident in recent analyst upgrades. Melius Research upgraded AMD to Buy, lifting its target from $110 to $175, citing accelerating AI traction

1

. HSBC followed with a Buy rating and a $200 price target, emphasizing AMD's pricing advantage in the AI chip landscape1

. The bank has also revised its forecast for AMD's AI chip sales in 2026, now estimating $15.1 billion, significantly higher than its prior projection of $9.6 billion2

.Product Innovation and Market Strategy

Source: Motley Fool

AMD's MI350 Instinct GPU series, launched earlier this year, is making waves due to its performance-per-dollar edge over Nvidia's H100 chips

1

. The MI355X model, in particular, is being pitched as a high-efficiency AI accelerator for training and inference at scale. AMD's strategy extends beyond hardware, with the company steadily building its ROCm (Radeon Open Compute) software stack to rival Nvidia's CUDA, offering developers more flexibility and cost-effective alternatives1

.Upcoming Earnings and Market Expectations

With AMD scheduled to release its Q2 2025 earnings on August 5, expectations are running high

1

. Analysts predict revenue growth near 35% year-over-year, with particular strength in the data center and AI segments. Investors are keenly watching for updates on MI355X adoption, AI market share gains, and gross margin expansion1

.Related Stories

Challenges and Concerns

Despite the positive momentum, some market observers are raising caution flags around AMD's valuation metrics. The stock is currently trading at a forward P/E of ~40, with a price-to-free-cash-flow (P/FCF) ratio near 98

1

. Key concerns include potential production delays at TSMC, which manufactures AMD's AI chips, and the challenge of scaling its ROCm software ecosystem to compete with Nvidia's dominant CUDA platform1

.Political and Regulatory Landscape

Source: Benzinga

Recent policy shifts and political developments have also factored into the bullish sentiment surrounding AMD. The U.S. Commerce Department has reportedly paused enforcement of new restrictions on technology exports to China, potentially benefiting chipmakers like AMD that operate within sensitive supply chains

4

. Additionally, President Donald Trump has introduced executive orders aimed at bolstering AI development and advancing infrastructure, with AMD CEO Lisa Su acknowledged as a central figure in advancing U.S. AI leadership4

.As AMD continues to position itself as a formidable challenger in the AI chip market, its upcoming earnings report and future product roadmap will be crucial in determining whether it can maintain its current momentum and justify its lofty valuation.

References

Summarized by

Navi

[3]

[4]

[5]

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation