AMD's Stock Soars on Strategic AI Partnership and Analyst Upgrade

4 Sources

4 Sources

[1]

Why AMD Stock Is Soaring Tuesday - Advanced Micro Devices (NASDAQ:AMD)

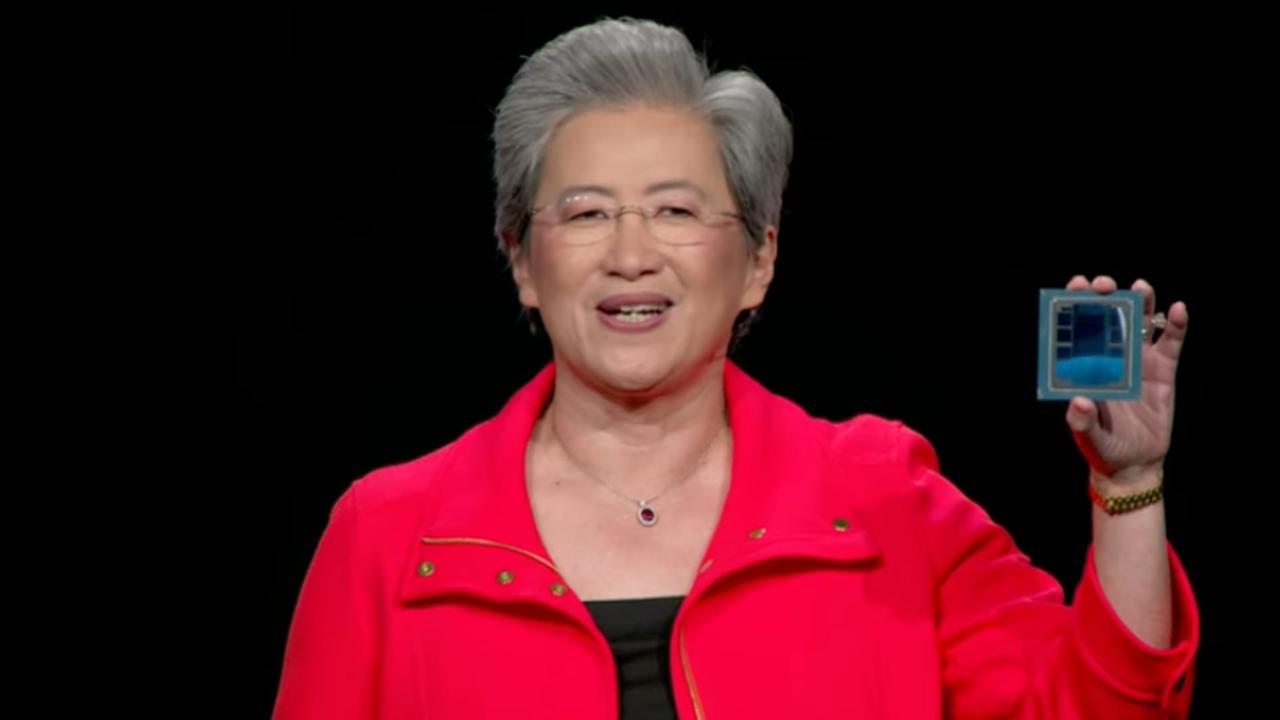

Shares of Advanced Micro Devices Inc AMD are surging higher on Tuesday, driven by a new strategic partnership and an analyst upgrade. What To Know: The semiconductor giant's stock is higher Tuesday following the announcement of a strategic alliance with HCLTech, a leading global technology company. The collaboration is set to accelerate enterprise digital transformation by leveraging AMD's high-performance computing and AI capabilities. The partnership will establish joint innovation labs to develop advanced solutions in AI, digital, and cloud, aiming to enhance operational efficiency and unlock new business opportunities for enterprises globally. In the joint announcement, AMD Chair and CEO Dr. Lisa Su highlighted that the collaboration will provide businesses with "leading-edge technology solutions they need to accelerate innovation." Read Also: Cathie Wood's ARK Invest Predicts $250 Billion GDP Boost From Humanoid Robot Adoption: TSLA, NVDA, AMD To Drive AI Revolution Adding to the bullish momentum Tuesday, Melius Research analyst Ben Reitzes upgraded AMD's stock from Hold to Buy. The analyst also issued a substantial price target increase, moving it from $110 to $175 per share. What Else: Tuesday's upgrade from Melius Research follows a string of optimistic revisions from other Wall Street firms in recent weeks. On June 16, Piper Sandler reiterated its "Overweight" rating while lifting its price target on AMD to $140 from $125. This came shortly after a mid-June flurry of bullish activity where Roth Capital raised its target to $150 and Evercore ISI Group boosted its target to $144, both maintaining their positive ratings. This wave of positive sentiment includes a particularly high price target from Rosenblatt, which has maintained its "Buy" rating with a lofty $200 target. Read Also: Here Are 10 Top Analyst Forecasts For AMD Monday How To Buy AMD Stock By now you're likely curious about how to participate in the market for Advanced Micro Devices - be it to purchase shares, or even attempt to bet against the company. Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy "fractional shares," which allows you to own portions of stock without buying an entire share. In the case of Advanced Micro Devices, which is trading at $138.05 as of publishing time, $100 would buy you 0.72 shares of stock. If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to "go short" a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading - either way it allows you to profit off of the share price decline. Image: Shutterstock AMDAdvanced Micro Devices Inc $137.886.41% Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock Rankings Edge Rankings Momentum 33.80 Growth 97.09 Quality 78.41 Value 14.33 Price Trend Short Medium Long Overview Market News and Data brought to you by Benzinga APIs

[2]

What's Going On With AMD Shares Today? - Advanced Micro Devices (NASDAQ:AMD)

Shares of Advanced Micro Devices Inc. AMD are trading higher Wednesday, adding to gains of more than 25% over the past month. Here's a look at what's going on. What To Know: AMD shares are rallying this week after the chipmaker announced a new collaboration with HCLTech aimed at accelerating enterprise digital transformation. The two companies plan to establish joint innovation labs focused on developing solutions in AI, digital infrastructure and cloud computing. AMD CEO Lisa Su said the partnership will help deliver cutting-edge technology to give businesses the solutions they need to accelerate innovation. "Combining HCLTech's expertise in digital transformation with our industry-leading EPYC, Instinct and Ryzen PRO processors will enable us to provide enterprises with customized, future-ready solutions that maximize the potential of AI, cloud computing and advanced analytics," Su said. Semiconductor stocks have seen strong momentum in recent trading sessions following easing tensions in the Middle East. AMD also got a boost this week after Melius Research analyst Ben Reitzes upgraded AMD from Hold to Buy and raised the price target from $110 to $175, reflecting growing confidence in the company's positioning in the AI and enterprise computing space. Earlier this month, multiple analysts came out with positive updates after AMD unveiled multiple new products at its "Advancing AI" event. Piper Sandler raised its target to $140 and reiterated an Overweight rating. Roth Capital and Evercore ISI also lifted their targets to $150 and $144, respectively, while Rosenblatt recently maintained a Buy rating with a $200 target. Is AMD A Good Stock To Buy? Wall Street analysts view AMD on the whole as a Outperform, given the history of coverage over the past three months. But looking at how the market as a whole thinks of the stock, you can reference historical price action for views on whether investors feel strongly about the stock one way or another. In the past three months, AMD rose 35.59%, which indicates that opinion improved on the business and how attractive it is to own based on either its stock price, or underlying fundamentals, like revenue, which rose 35.9% over the past year. AMD Price Action: AMD shares were up 3.17% at $142.82 at the time of writing, according to Benzinga Pro. Read Next: The AI Rally Just Flipped -- These Stocks Are Now Outgunning Nvidia Image via Shutterstock. AMDAdvanced Micro Devices Inc$142.833.18%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum38.87Growth97.01Quality79.98Value13.30Price TrendShortMediumLongOverview This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[3]

AMD Blows Past S&P And Nasdaq -- Is This Just The Beginning? - Advanced Micro Devices (NASDAQ:AMD)

Get ahead of Wall Street reactions -- Benzinga Pro delivers signals, squawk, and news fast. Now 60% off this 4th of July. Advanced Micro Devices AMD stock surged nearly 38% in the last three months, buoyed by the AI frenzy. PHLX Semiconductor Index (SOX), of which AMD is also a constituent, generated 30% returns during the period. AMD's returns also topped the S&P 500's 11% and the Nasdaq Composite's 18% during the period. Also Read: AMD 'Serious AI Contender' With Sights On Over $500 Billion TAM, Billions In Revenue: Analyst On Monday, Cathie Wood's Ark Invest executed significant portfolio adjustments, prominently acquiring shares of AMD. Last week, on CNBC's "Halftime Report Final Trades," Jason Snipe preferred AMD, emphasizing that Nvidia Corp NVDA isn't the only strong chip stock. In May, AMD reported first-quarter revenue of $7.44 billion, a 36% year-over-year increase, surpassing analyst estimates of $7.13 billion. This was driven by the strength of its core businesses, the expansion of its data center, and the momentum of AI. The chipmaker reported first-quarter adjusted earnings of 96 cents per share, beating analyst estimates of 94 cents per share. The gross margin came in at 54% for the quarter. AMD expects second-quarter revenue of approximately $7.4 billion, plus or minus $300 million. Analysts are currently forecasting second-quarter revenue of $7.24 billion. AMD anticipates a second-quarter adjusted gross margin of 43%, reflecting an $800 million impact from inventory charges resulting from the U.S. government's export controls. AMD has a consensus price target of $141.09 based on the ratings of 38 analysts. The high is $200 issued by Rosenblatt on June 13, 2025. With an average price target of $163.33 between Melius Research and Piper Sandler, there's an implied 16.78% upside for AMD from these most recent analyst ratings. In May, Bank of America Securities analyst Vivek Arya projected that AMD would gain share through server and PC CPU growth, AI momentum, and a $10 billion Middle East contract pipeline. Even though Arya expects Nvidia (80%+ share) and custom chips (10-15%) to dominate, he sees AMD capturing 3-4% of the $300 billion-$400 billion AI accelerator market. Arya views AMD's valuation as compelling and expects $6.6 billion in sales upside by 2027, supported by strong execution and a $6 billion buyback boost. In June, Arya projected strong second-quarter momentum for AMD, driven by higher-priced new products and potential seasonal strength in the second half. Price Action: AMD stock traded lower by 2.46% to $138.44 premarket at Tuesday's last check. Read Next: Billionaire David Tepper Dumps Nvidia, Slashes 'Magnificent 7' Holdings -- But Bets Big On These 2 AI And Blockchain Plays Photo: Shutterstock AMDAdvanced Micro Devices Inc $138.33-2.52% Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full Score Edge Rankings Momentum 47.49 Growth 96.96 Quality 81.79 Value 12.96 Price Trend Short Medium Long Overview NVDANVIDIA Corp $156.33-1.05% This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[4]

Why AMD Stock Is Surging Today | The Motley Fool

Advanced Micro Devices (AMD 6.40%) stock is seeing another day of gains in Tuesday's trading. The semiconductor company's share price was up 6.1% as of 1 p.m. ET. Meanwhile, the S&P 500 index was up 1%, and the Nasdaq Composite index was up 1.5%. AMD's valuation is moving higher today following an announcement that the company has entered into a new partnership with HCLTech to develop artificial intelligence (AI), digital, and cloud solutions. The stock is also getting a boost from bullish momentum for the broader market stemming from favorable macroeconomic and geopolitical dynamics. HCLTech announced today that it has entered into a partnership with AMD to develop innovation labs, training programs, and technologies that will help enterprises with digital transformation initiatives. The development centers created through the partnership will be used to test new technologies and reduce the time that it takes to bring new enterprise technology tools to market. HCLTech is an India-based IT consulting company, and investors may be excited about the potential for AMD to gain a bigger foothold in the country and take advantage of its tech development capabilities. A ceasefire between Israel and Iran was announced today and has helped send the broader market higher. While the ceasefire has reportedly already been violated by both sides, the military actions appear relatively minor in the grand scheme of things -- and investors are relieved that there has been a de-escalation in the conflict. Recent comments from Federal Reserve officials also suggest that the central banking authority may be warming up to the prospect of issuing an interest rate cut at its meeting next month. The market had previously assigned relatively low chances of a rate cut being delivered at the meeting, but Fed membership is now reportedly about evenly divided on what action to take next month. While Fed Chair Jerome Powell said that the central bank will continue to monitor the impact of tariffs before making any cuts, investors are still excited that the potential for a cut next month has seemingly increased. Rate cuts would be a bullish development for AMD and other semiconductor stocks and could help support a continued rally for a leader in the industry.

Share

Share

Copy Link

AMD's stock surges following a new AI-focused partnership with HCLTech and a significant analyst upgrade, highlighting the company's growing position in the AI and enterprise computing space.

AMD's Strategic AI Partnership with HCLTech

Advanced Micro Devices (AMD) has announced a strategic alliance with HCLTech, a leading global technology company, to accelerate enterprise digital transformation

1

. This collaboration aims to leverage AMD's high-performance computing and AI capabilities, establishing joint innovation labs to develop advanced solutions in AI, digital infrastructure, and cloud computing2

.

Source: Benzinga

AMD CEO Lisa Su emphasized that this partnership will provide businesses with "leading-edge technology solutions they need to accelerate innovation"

1

. The joint innovation labs will focus on developing solutions that enhance operational efficiency and unlock new business opportunities for enterprises globally1

.Analyst Upgrades and Market Sentiment

The announcement of the HCLTech partnership coincided with a significant analyst upgrade from Melius Research. Analyst Ben Reitzes upgraded AMD's stock from Hold to Buy and substantially increased the price target from $110 to $175 per share

1

. This upgrade follows a series of optimistic revisions from other Wall Street firms in recent weeks:- Piper Sandler reiterated its "Overweight" rating and raised its price target to $140

1

. - Roth Capital increased its target to $150

1

. - Evercore ISI Group boosted its target to $144

1

. - Rosenblatt maintained its "Buy" rating with a high $200 target

1

.

These upgrades reflect growing confidence in AMD's positioning in the AI and enterprise computing space

2

.AMD's Market Performance and Financial Outlook

AMD's stock has shown impressive performance, surging nearly 38% in the last three months, outpacing both the S&P 500 and the Nasdaq Composite

3

. The company reported strong first-quarter results, with revenue of $7.44 billion, a 36% year-over-year increase, surpassing analyst estimates3

.For the second quarter, AMD expects revenue of approximately $7.4 billion, plus or minus $300 million, with analysts forecasting $7.24 billion

3

. The company anticipates a second-quarter adjusted gross margin of 43%, reflecting an $800 million impact from inventory charges due to U.S. government export controls3

.AMD's Position in the AI Market

Source: Motley Fool

Bank of America Securities analyst Vivek Arya projects that AMD will gain market share through server and PC CPU growth, AI momentum, and a $10 billion Middle East contract pipeline

3

. While Nvidia is expected to dominate the AI accelerator market with an 80%+ share, Arya sees AMD capturing 3-4% of the $300 billion-$400 billion market3

.Related Stories

Investor Interest and Market Dynamics

AMD's recent stock performance has attracted significant investor interest. Cathie Wood's Ark Invest recently executed substantial portfolio adjustments, prominently acquiring AMD shares

3

. The semiconductor industry as a whole has seen strong momentum, with the PHLX Semiconductor Index (SOX) generating 30% returns over the past three months3

.Macroeconomic Factors

Source: Benzinga

Recent geopolitical developments, such as the announced ceasefire between Israel and Iran, have contributed to a broader market rally

4

. Additionally, comments from Federal Reserve officials suggest a potential interest rate cut at the next meeting, which could further boost semiconductor stocks like AMD4

.References

Summarized by

Navi

[3]

[4]

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation