Anthropic doubles funding target to $20B as enterprise AI revenue surges toward $18B in 2026

8 Sources

8 Sources

[1]

Anthropic reportedly upped its latest raise to $20B

Anthropic has doubled the amount of VC funding it aims to raise, the FT reports, increasing the target from $10 billion to $20 billion. The round, expected to close soon, will give the company a valuation of $350 billion, sources told the FT. Anthropic, which makes the popular AI Claude and the equally popular Claude Code, decided to double its funding target due to booming investor interest. Backers in this round are expected to include Sequoia Capital (which also invests in its rival OpenAI), Singapore's sovereign wealth fund, and investment management firm Coatue, per the FT. Late last year, it was reported that Anthropic hired lawyers as a step toward prepping for an IPO that could come sometime this year. The company announced a $13 billion raise in September, making it one of the industry's most valuable private companies, valued at $183 billion.

[2]

Anthropic closes latest funding round above $10 billion and could go higher, sources say

Anthropic has closed its latest funding round above the initial $10 billion target at a $350 billion valuation, CNBC confirmed on Tuesday. The round closed at a total between $10 billion and $15 billion, according to three sources familiar with the discussions who asked not to be named because the details are confidential. But that figure could still grow if Microsoft and Nvidia decide to contribute, the people said. In November, Microsoft and Nvidia announced plans to invest up to $5 billion and up to $10 billion into the artificial intelligence startup, respectively. It's not clear if they plan to participate in Anthropic's latest round, or how much they might commit, the people said. Coatue and Singapore sovereign wealth fund GIC are leading the financing, as CNBC previously reported. Sequoia Capital, which is an investor in Anthropic's rival OpenAI, is also participating, according to the people. The Financial Times was first to report Anthropic's oversubscribed funding round. Anthropic was founded in 2021 by former OpenAI research executives, including its CEO, Dario Amodei. The company is best known for developing a family of large language models called Claude, and its AI coding tool Claude Code has exploded in popularity in recent months. Amodei told CNBC earlier this month that Anthropic generated close to $10 billion in revenue last year.

[3]

Anthropic doubles funding target to $20B at $350B valuation

Anthropic doubled its latest venture capital funding target from $10 billion to $20 billion, with the round expected to close soon at a $350 billion valuation, sources told the Financial Times. The AI company, developer of the popular Claude model and Claude Code tool, increased the target amid booming investor interest. Expected participants include Sequoia Capital, an investor in rival OpenAI; Singapore's sovereign wealth fund; and investment management firm Coatue, according to the FT. In September, Anthropic announced a $13 billion funding round that valued the company at $183 billion, positioning it among the most valuable private AI firms. Late last year, reports indicated Anthropic hired lawyers to prepare for a potential initial public offering this year.

[4]

Anthropic Eyes 180% Revenue Surge -- OpenAI Under Pressure

OpenAI dominates headlines, but Anthropic may be winning the business model war. While consumers play with chatbots, enterprises are signing nine-figure contracts -- and Anthropic is capturing them at scale. Internal forecasts point to $18 billion in revenue by 2026 and a path to $50 billion-plus by 2027 -- implying a nearly 180% jump in a single year, reported Reuters. The underappreciated detail: around 85% of Anthropic's revenue now comes from enterprise customers, a structural divergence from OpenAI's consumer-heavy model, where churn is higher and monetization is still evolving. Anthropic is embedding Claude into corporate tech stacks -- across platforms like ServiceNow and deployments at JPMorgan -- where contracts are long-term and measured in eight- or nine-figure commitments. Enterprise AI Revenue Vs Consumer AI Growth OpenAI still owns mindshare and usage. Anthropic is quietly winning where valuation frameworks are built: recurring enterprise revenue. Enterprise contracts bring predictability, pricing power and lower churn -- more akin to a cloud software platform than a consumer AI app. If this trajectory holds, Anthropic's financial profile could start to resemble a high-margin SaaS infrastructure company, not just an AI lab. AI Safety As An Enterprise Sales Advantage Anthropic's safety-first positioning has often been framed as philosophy or regulatory signaling. In practice, it may be its sharpest enterprise sales tool. Conservative CIOs signing $100 million contracts don't want viral demos. They want compliance guardrails, predictable model behavior and reputational risk controls. Anthropic's governance-heavy approach is becoming a commercial wedge as enterprises move from experimentation to procurement. The Enterprise AI Endgame If enterprise adoption continues, Anthropic's near-180% revenue jump could reset the AI monetization narrative -- from consumer engagement metrics to enterprise infrastructure economics. OpenAI still owns the headlines. Anthropic may be quietly building the P&L. In AI, hype grabs attention. Enterprise revenue wins cycles. Photo: Shutterstock This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[5]

Anthropic raises 2026 revenue forecast by 20% to $18B

In December 2025, Anthropic (ANTHRO) forecasted to generate up to $18B in 2026, about 20% more than its summer forecast, and $55B next year, The Information reported. Anthropic -- which is backed by Amazon (AMZN) and Alphabet's ( Anthropic projects up to $148B revenue in 2029, about $3B more than OpenAI's forecast for that year. Higher costs to train and run AI models have led Anthropic to delay reaching cash flow positive status to 2028. Business API sales, especially Claude Code's popularity in coding tasks, have fueled Anthropic's fast revenue growth.

[6]

Anthropic Close to Finalizing Fundraising Deal at $350 Billion Valuation | PYMNTS.com

The artificial intelligence (AI) startup doubled the amount it was in talks to raise after seeing a high level of demand from investors, according to the report. One investor told the FT that Anthropic has seen as much as six times the interest it originally expected. Other sources said the company will lock in as much as $15 billion as early as Tuesday and the remainder of the raise within weeks, per the report. These figures are separate from the $15 billion that Microsoft and Nvidia have committed to invest in Anthropic, according to the report. Anthropic did not immediately reply to PYMNTS' request for comment. The company said in September 2025 that it raised $13 billion in a Series F funding round that valued it at $183 billion. It said at the time that its run-rate revenue leapt from about $1 billion at the beginning of 2025 to over $5 billionin August, and that its Claude Code tool for developers was generating run-rate revenue of over $500 million. The company added that it was serving more than 300,000 business accounts and that over the previous year, it increased by seven times the number of customers that each represent run-rate revenue of over $100,000. "We are seeing exponential growth in demand across our entire customer base," Anthropic Chief Financial Officer Krishna Rao said in a September 2025 press release. "This financing demonstrates investors' extraordinary confidence in our financial performance and the strength of their collaboration with us to continue fueling our unprecedented growth. Anthropic CEO Dario Amodei said in December 2025 that the future of AI's economic value lies in a relentless, technically rigorous focus on enterprise needs and disciplined, long-term infrastructure planning. While the company's competitors sprint for mass-market adoption, Amodei positioned Anthropic as having a "privileged position" to methodically "keep growing and just keep developing our models," deliberately rooting its value in the stability and consistency required by high-stakes business users. On Jan. 9, financial services provider Allianz said it planned to deploy AI throughout its insurance business around the world with the help of Anthropic. On Jan. 14, it was reported that Microsoft has become one of Anthropic's top customers and is on track to spend around $500 million a year to use Anthropic's AI in Microsoft products.

[7]

Anthropic Closes Funding Round Exceeding Its $10 Billion Target

Enter your email to get Benzinga's ultimate morning update: The PreMarket Activity Newsletter Artificial intelligence company Anthropic has closed its latest funding round at a $350 billion valuation, exceeding its $10 billion target. * NVIDIA stock is showing upward bias. What's next for NVDA stock? The round closed between $10 and $15 billion, a CNBC article stated. Although it is understood that the number could increase if Microsoft and Nvidia decide to invest. In November, the company received a $15 billion investment from the companies. In December, Anthropic signed a term sheet for its $10 billion funding round led by sovereign wealth fund GIC and Coatue Management, with both entities contributing $1.5 billion. Private equity firm Sequoia Capital is also contributing, Benzinga reported last week. Earlier this month, the company announced it was targeting a 2026 IPO, putting its valuation above $300 billion. Forge Global noted the deal is still in the works, but conversations with investment banks are understood to be taking place. Anthropic lost around $5.6 billion in 2024, but expects to reach $70 billion in revenue and $17 billion in positive free cash flow by 2028, the Forge article stated. The company's Forge price was $272 as of Jan. 27, 2026, a 386 percent increase over the past year, putting the company's valuation at $354 billion. Anthropic was founded in 2021 by former OpenAI employees, brother and sister Dario Amodei and Daniela Amodei. The San Francisco-based company is known for its AI coding tool, Claude. The company is shifting its focus from experiential use to developer tools and Claude-powered business workflows, aiming to convert hype into recurring, long-term revenue instead of short-term, churn-prone usage, this publication noted. Market News and Data brought to you by Benzinga APIs

[8]

Anthropic ups 2026 revenue forecast, delays cash-positive target - The Information By Investing.com

Investing.com-- Artificial intelligence startup Anthropic has boosted its 2026 revenue projections by about 20%, but pushed back its timeline for becoming cash‑flow positive, a report by The Information showed on Wednesday. According to the report, the San Francisco‑based company now expects sales to nearly quadruple this year to as much as $18 billion, before rising to around $55 billion in 2027 -- significantly above earlier internal forecasts. However, rising expenses tied to training and operating its AI models have outpaced revenue growth, prompting Anthropic to delay its target for positive cash flow to 2028, about a year later than previously anticipated, the report said. Higher costs include expanded model training and compute infrastructure, it added. Anthropic, maker of the Claude AI family, has in recent months drawn strong investor interest that could support growth. But the company faces continued pressure to balance rapid expansion with longer‑term financial sustainability ahead of any potential public listing.

Share

Share

Copy Link

Anthropic has doubled its latest venture capital funding target from $10 billion to $20 billion at a $350 billion valuation, driven by booming investor demand. The AI company behind Claude large language models is projecting $18 billion in revenue for 2026—a 180% jump fueled by enterprise customers. With 85% of revenue now coming from corporate contracts, Anthropic is positioning itself as a formidable OpenAI competitor in the enterprise AI adoption race.

Anthropic Funding Round Doubles to $20 Billion

Anthropic has doubled its latest venture capital funding target from $10 billion to $20 billion, with the round expected to close soon at a $350 billion AI company valuation, according to sources cited by the Financial Times

1

. The dramatic increase reflects high investor interest in the AI company, which develops the Claude large language models and the increasingly popular Claude Code tool. CNBC confirmed that the Anthropic funding round has already closed above the initial $10 billion target, landing between $10 billion and $15 billion, though the figure could climb higher if Microsoft and Nvidia decide to contribute2

. Leading the financing are Coatue and Singapore sovereign wealth fund GIC, with Sequoia Capital also participating despite being an investor in OpenAI competitor ChatGPT2

.

Source: PYMNTS

Enterprise AI Adoption Drives Revenue Surge

What distinguishes Anthropic from rivals is its enterprise-focused business model. Around 85% of Anthropic revenue now comes from enterprise customers, a structural shift that contrasts sharply with consumer-heavy models where churn rates run higher

4

. The company is embedding Claude into corporate technology stacks across platforms like ServiceNow and through deployments at JPMorgan, where contracts are measured in eight- or nine-figure commitments4

. This approach brings predictability, pricing power, and lower churn—characteristics more aligned with cloud software platforms than consumer AI applications.

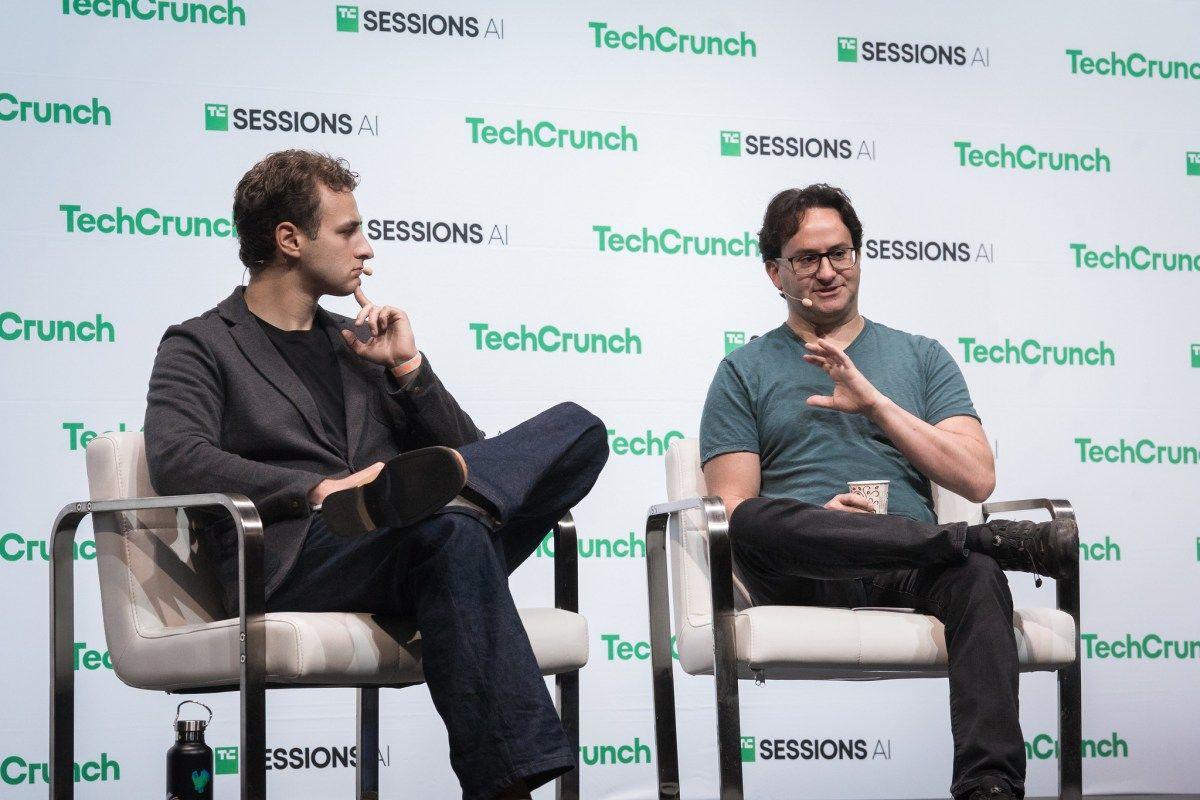

Source: Benzinga

Anthropic Revenue Projections Signal Aggressive Growth

Internal forecasts point to $18 billion in revenue by 2026, representing approximately 20% more than its summer forecast and implying a nearly 180% jump from current levels

5

. CEO Dario Amodei told CNBC earlier this month that Anthropic generated close to $10 billion in revenue last year2

. Looking further ahead, the company projects up to $55 billion in 2027 and $148 billion by 2029—approximately $3 billion more than OpenAI's forecast for that same year5

. Business API sales, particularly Claude Code's popularity in coding tasks, have fueled this rapid expansion5

.

Source: Seeking Alpha

Related Stories

AI Safety Becomes a Commercial Advantage

Anthropic's safety-first positioning, often framed as philosophical or regulatory signaling, is proving to be a sharp enterprise sales tool. Conservative CIOs signing $100 million contracts prioritize compliance guardrails, predictable model behavior, and reputational risk controls over viral demonstrations

4

. This governance-heavy approach is becoming a commercial wedge as enterprises move from experimentation to procurement, giving Anthropic an edge in sectors where AI safety concerns remain paramount.Path to Initial Public Offering and Profitability

Late last year, reports indicated that Anthropic hired lawyers as a step toward preparing for an Initial Public Offering (IPO) that could come sometime this year

1

. The company announced a $13 billion raise in September, which valued it at $183 billion, positioning it among the industry's most valuable private companies3

. However, higher costs to train and run AI models have led Anthropic to delay reaching cash flow positive status to 20285

. Founded in 2021 by former OpenAI research executives including CEO Dario Amodei, Anthropic is reshaping the AI monetization narrative from consumer engagement metrics to enterprise infrastructure economics2

. If enterprise AI adoption continues at this pace, Anthropic's financial profile could start to resemble a high-margin SaaS infrastructure company rather than just an AI lab, with recurring enterprise revenue providing the foundation for sustained growth.References

Summarized by

Navi

[1]

[5]

Related Stories

Anthropic's Ambitious Revenue Projections: Aiming for $26 Billion by 2026

15 Oct 2025•Business and Economy

Anthropic Projects $70 Billion Revenue by 2028 as B2B Strategy Drives Explosive Growth

04 Nov 2025•Business and Economy

Anthropic's Meteoric Rise: Potential $40 Billion Valuation and $1 Billion Revenue Forecast

24 Sept 2024

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology