Anthropic Nears $10 Billion Funding Deal, Doubling Initial Target Amid Strong Investor Interest

4 Sources

4 Sources

[1]

Anthropic in Talks to Raise Up to $10 Billion in New Funding

Anthropic is nearing a deal to raise as much as $10 billion in a new round of funding, according to people familiar with the matter, a higher than expected sum and one of the largest megarounds to date for an artificial intelligence startup. The discussions are ongoing and the final amount could change, said the people, who spoke on condition of anonymity as the information is not public. Bloomberg News previously reported Anthropic was in advanced discussions to raise up to $5 billion in the round at a $170 billion valuation. The amount increased significantly due to strong investor demand, the people said.

[2]

Anthropic reportedly in talks to raise $10B in new funding as AI boom continues apace - SiliconANGLE

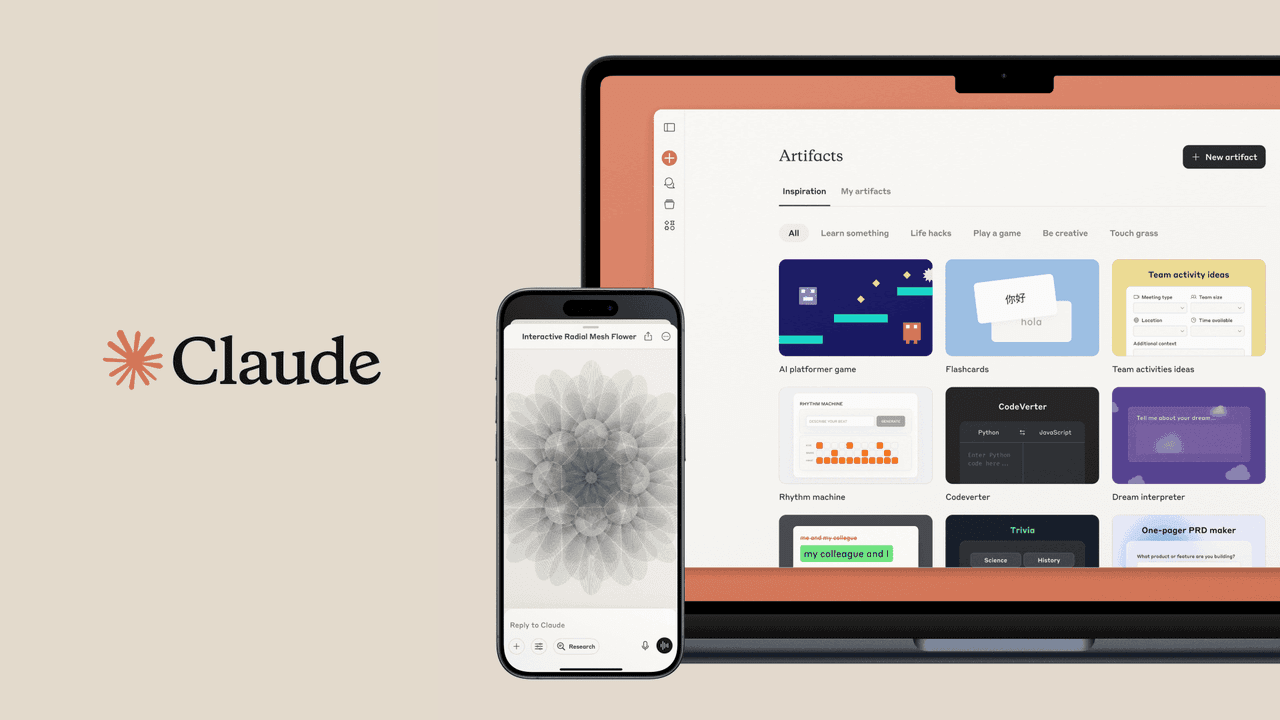

Anthropic reportedly in talks to raise $10B in new funding as AI boom continues apace Anthropic PBC, the company behind the Claude generative artificial intelligence service, is reportedly nearing a deal to raise $10 billion in a new funding round, as the AI boom continues apace. According to Bloomberg referencing people familiar with the matter, the company had previously been in discussions to raise $5 billion on a $170 billion valuation, but the amount the raise has doubled due to strong investor demand. Iconiq Capital is reportedly leading the round, with other participants expected to include TPG Inc., Lightspeed Venture Partners LP, Spark Capital Management and Menlo Ventures LP. Anthropic is also said to have held discussions with the Qatar Investment Authority and Singapore's sovereign fund GIC Pvt. Ltd. about joining the round. The new funding is expected to fuel Anthropic's competition with other leading AI companies, such as OpenAI and xAI Inc., both of which have raised billions in new funding this year. OpenAI last raised $40 billion on a $300 billion valuation in March and was reported to have raised an additional $8.3 billion on Aug. 1, while xAI's last raise was $10 billion in July. Anthropic's last venture capital raised was $3.5 billion on a $61.5 billion valuation on March 3. Whether the new round will be raised at a $170 billion valuation or higher, the final figure will be a significant jump from March. Founded in 2021 by former OpenAI researchers, Anthropic has become a leading player in the generative AI space with its Claude chatbot, which competes with OpenAI's ChatGPT and Google Gemini. Anthropic's Claude models have become popular among developers in particular for coding assistance, with highly regarded and ranked code generation, debugging and workflow automation. Claude can be used for engineering tasks, with the service often integrated into developer environments and productivity platforms. The new funding would likely be used by Anthropic to accelerate model development, scale infrastructure and expand globally to meet rising demand. Coming into its potential new round, Anthropic has previously raised $14.3 billion over 12 rounds.

[3]

Report: Anthropic eyes $10bn raise after strong investor interest

Dario Amodei, co-founder and CEO of Anthropic. Image: Stuart Isett/Fortune via Flickr (CC BY 2.0) The raise, if materialised, is set to become one of the largest funding rounds for an AI start-up. Anthropic is nearing a deal to raise up to $10bn in a new funding round, according to Bloomberg, doubling what the company was previously reportedly set to raise. The raise, if materialised, will be one of the largest funding rounds for an artificial intelligence start-up, only behind the likes of its rival OpenAI, which raised $40bn in a single round and xAI, which raised $10bn earlier this year. According to reports, investment firm Iconiq Capital is leading the round. Other participants include TPG, Lightspeed Venture Partners, Spark Capital and Menlo Ventures. Anthropic has also held discussions with a number of large Middle Eastern investors, including the United Arab Emirates state investment fund MGX about joining the round. Sources told Bloomberg that the final amount remains undecided, however, strong investor demand has led the funding target to increase from the $5bn Anthropic was gearing to raise earlier this year. That raise alone would have nearly tripled the AI company's value in months, ranking it among the most valuable private technology companies in the world, including OpenAI, valued at $300bn, the Chinese TikTok-owner ByteDance at $312bn and SpaceX, which stands at about $400bn. Anthropic had also just raised $3.5bn in a Series E funding round in March, taking the four-year-old start-up to a $61.5bn post-raise valuation. That round was led by Lightspeed Venture Partners and saw participation from several big name investors including Bessemer Venture Partners, Cisco Investments, Fidelity Management and Research Company and General Catalyst. The start-up has also seen massive support from Google, which reportedly pumped more than $1bn into the start-up, as well as Amazon, which invested $8bn into Anthropic over the years. A month after the March raise, Anthropic announced plans to create more than 100 new jobs across its European offices, with a primarily hiring in Dublin and London. Don't miss out on the knowledge you need to succeed. Sign up for the Daily Brief, Silicon Republic's digest of need-to-know sci-tech news. Dario Amodei, co-founder and CEO of Anthropic. Image: Stuart Isett/Fortune via Flickr (CC BY 2.0)

[4]

Anthropic Seeks to Raise $10 Billion Amid Strong Investor Interest | PYMNTS.com

The discussions are ongoing and the terms could change, according to the report. Reached by PYMNTS, Anthropic declined to comment on the report. The company raised $3.5 billion in a Series E funding round in March that gave it a post-money valuation of $61.5 billion. Anthropic said at the time that businesses have integrated its AI assistant, Claude, to perform tasks like turning natural language into code, assisting tax professionals, accelerating the writing of clinical study reports, and helping power Amazon's Alexa+ to bring AI capabilities to households. "With this investment, Anthropic will advance its development of next-generation AI systems, expand its compute capacity, deepen its research in mechanistic interpretability and alignment, and accelerate its international expansion," the company said in a March 3 press release. PYMNTS reported Thursday that venture capital firm Menlo Ventures found that Anthropic's Claude is the AI model with the top market share, at 32%. Menlo Ventures found that Claude began gaining momentum in June 2024, with the release of Claude Sonnet 3.5, Sonnet 3.7, Sonnet 4, Opus 4 and Claude Code, and has been adopted by enterprises because of its code generation capabilities and its development of model context protocol (MCP) that enables it to be broadly used in many industries. On Aug. 12, Anthropic announced that it expanded the size of its prompt window for Claude Sonnet 4 fivefold, allowing it to accommodate 1 million tokens, or roughly 750,000 words. PYMNTS reported at the time that the offer echoed a similar one unveiled by OpenAI a week earlier, but included all three branches, while OpenAI's was only available to the executive branch.

Share

Share

Copy Link

Anthropic, the AI company behind Claude, is close to securing a massive $10 billion funding round, doubling its initial target due to high investor demand. This raise would significantly boost its valuation and fuel its competition with other AI giants.

Anthropic's Unprecedented Funding Round

Anthropic, the artificial intelligence company behind the Claude chatbot, is on the verge of securing a monumental funding round that could reshape the AI industry landscape. The company is reportedly in talks to raise up to $10 billion, doubling its initial target of $5 billion due to overwhelming investor interest

1

.

Source: Bloomberg

Investor Lineup and Valuation

The funding round is being led by Iconiq Capital, with participation from several high-profile investors including TPG Inc., Lightspeed Venture Partners LP, Spark Capital Management, and Menlo Ventures LP

2

. Anthropic has also engaged in discussions with sovereign wealth funds such as the Qatar Investment Authority and Singapore's GIC Pvt. Ltd.While the final valuation remains undisclosed, previous reports suggested a potential $170 billion valuation. This would represent a significant leap from Anthropic's $61.5 billion valuation following its $3.5 billion Series E round in March 2025

3

.Competitive Landscape and Market Position

This substantial funding round positions Anthropic as a formidable competitor in the AI space, directly challenging industry leaders like OpenAI and xAI. OpenAI recently raised $40 billion at a $300 billion valuation, while xAI secured $10 billion in July

2

.Anthropic's Claude AI model has gained significant traction, particularly among developers for its code generation and debugging capabilities. Recent market share analysis by Menlo Ventures revealed that Claude holds the top position with a 32% market share

4

.

Source: PYMNTS

Related Stories

Technological Advancements and Future Plans

The company has been rapidly advancing its AI capabilities. In August 2025, Anthropic expanded Claude Sonnet 4's prompt window to accommodate 1 million tokens, equivalent to approximately 750,000 words

4

. This enhancement significantly improves the model's context understanding and processing capabilities.Anthropic plans to utilize the new funding to accelerate model development, scale infrastructure, and expand globally to meet rising demand. The company is also focusing on deepening its research in mechanistic interpretability and alignment

3

.

Source: SiliconANGLE

Industry Impact and Future Outlook

This unprecedented funding round underscores the intense competition and rapid growth in the AI sector. As Anthropic strengthens its position, it is poised to drive further innovation and potentially reshape the AI landscape. The company's focus on responsible AI development and its commitment to safety and ethics could set new standards for the industry.

With this significant financial backing, Anthropic is well-positioned to accelerate its research and development efforts, potentially leading to breakthroughs in AI capabilities and applications across various sectors.

References

Summarized by

Navi

[2]

[3]

Related Stories

Anthropic Nears $170 Billion Valuation with Potential $5 Billion Funding Round

30 Jul 2025•Business and Economy

Anthropic seeks $10 billion funding at $350 billion valuation, nearly doubling in four months

07 Jan 2026•Business and Economy

Anthropic Secures $3.5 Billion in Funding, Tripling Valuation to $61.5 Billion

25 Feb 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology