AWS Drives Partner Growth with AI Innovation and Enhanced Channel Strategy

4 Sources

4 Sources

[1]

AWS GenAI And AI Innovation Driving Sales Spike For Partners

'Not only did we grow our AWS business 184 percent (in 2024), our pipeline is forecasting over 300 percent growth in 2025,' said DoiT International's Tracie Stamm. Amazon Web Services partners are witnessing massive sales growth in 2024 thanks to the company's ever-expanding generative AI product portfolio and AI channel investments. Global powerhouse DoiT International has grown its AWS business a whopping 184 percent in 2024 thanks, in part, to AWS solutions enabling successful customer AI use cases and DoiT homegrown innovation. "Not only did we grow our AWS business 184 percent, our pipeline is forecasting over 300 percent growth in 2025," said Tracie Stamm, global head of product and content marketing, for Santa Clara, Calif.-based DoiT. "AWS is at the bleeding edge of GenAI. Every move they make closer and closer to that, I see the market accepting it and going from that learning curve of just being aware of [GenAI], to accepting it, and then really learning how to leverage it to their advantage. DoiT's leaning right into that as well with our own AI assisted expertise," Stamm said. [Related: CEO Matt Garman: Why Partners Are Picking AWS Vs. Microsoft And Google Cloud] AWS CEO Matt Garman recently told CRN that the $110 billion cloud unit needs a partner-centric strategy in order for AWS to truly scale on a worldwide basis, particularly in the AI era. "Generative AI is going to reshape almost every single industry and every single business," Garman told CRN. "As we continue to expand globally, we lean more and more on our global and regional channel partners to help us because they're the ones that oftentimes know the customers best." For its part, DoiT has unleashed a slew of new GenAI and AI innovation this year, including its own GenAI assistant Ava and Cloud Intelligence service that optimizes customers' cloud usage at every stage. "Cloud Intelligence is the culmination of more than a decade of industry-leading cloud expertise that we've infused into our technology platform and continue to leverage in the form of our cloud engineers that helps customers plan, procure and operate this incredible investment," said Stamm. "We're bringing all of our expertise to bear in the spirit of helping our customers fully optimize their cloud usage and prevent waste. We're also looking at: How is your infrastructure supporting your business goals? How is your architecture built? Is it flexible, resilient, performant, secure for the demands of not just today, but this exploding AI future before us?" DoiT won AWS' 2024 Partner of the Year Award for Aerospace and Satellite, thanks to its ability to deliver solutions for public sector aerospace or satellite customers. 'AWS Knows How To Partner Better' Than Other Cloud Providers Another top partner seeing its AWS business surge this year is Irvine Calif.-based Caylent. Caylent CEO Lori Williams said her company's AWS business increased 80 percent in 2024 due to customers realizing this year that they cannot evolve into the new AI world without cloud computing. "Customers want to get to models and to platforms where they can actually take advance of the new technology," Williams said. "Customers like us because we're all-in with AWS. We understand AWS and AWS adjacent, which is increasingly like Anthropic, Nvidia, Databricks, those things that are based on the platform as well," said Williams. "We'll go into a customer and talk about AI, talk about how they can look at Bedrock, and how to leverage those pieces. But then it immediately becomes, 'Well, what about the infrastructure? You got to really rev your infrastructure. You got to really think about your app modernization.' So it's just the breadth of things that AWS have to offer. There's so many other things we're able to do on the platform that's given us a lot of growth." This week, Caylent unveiled its new Applied Intelligence delivery model dedicated to AI-first cloud services. Caylent's new model is designed to lower the barriers of cloud migration and modernization through the strategic and intentional application of AI at every stage of a customer's cloud evolution. Caylent won the AWS Migration Partner of the Year award, AWS' GenAI Industry Solution Partner of the Year award, and Industry Partner of the Year award for Financial Services for North America. "I've worked with all the all the cloud partners. AWS knows how to partner better than all of them," she said. Spending on worldwide public cloud services is expected to reach $219 billion by 2027, according to data from IT research firm IDC. "The demand for data analytics, cybersecurity and AI solutions drives cloud adoption," said IDC in its 2024 'Worldwide Software and Public Cloud Servies Spending Guide' report. "This reflects the crucial role software plays in digital transformation initiatives across various industries. Businesses are investing heavily in cloud-based software, data analytics tools and AI platforms to optimize operations, enhance customer experiences and gain valuable insights." AWS' New Innovation At AWS re:Invent 2024 this week in Las Vegas, the Seattle-based company launched dozens of new products and channel incentives aimed at driving AI sales. This includes AWS eliminating the financial cap on how much money partners can make inside the company's popular Migration Acceleration Program (MAP) to a new Digital Sovereignty Competency that helps partners gain more knowledge around the specific requirements and regulations in different geographies. On the product front, AWS launched new AI, security, storage and compute solutions. "The launches and new products and services are immense. It's almost too much for any one person to keep track of, or one function to keep track of," said DoiT's Stamm. "That's why the market really needs strong partnerships with a high level of deep expertise that can stitch together the context of: how this market has evolved over time and bring that to bear so they don't have to be the experts in all of these AWS developments. They can be the experts in their own business and driving their own innovation while we help with the rest."

[2]

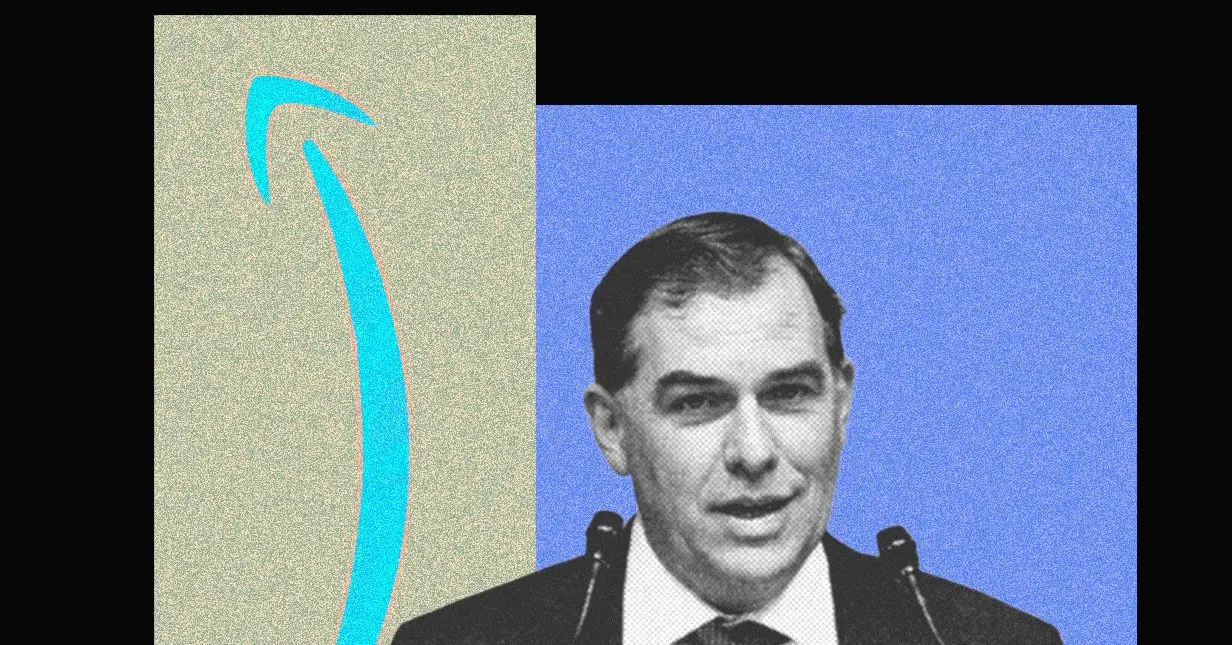

AWS CEO Matt Garman: Partners Are Our 'Co-Inventors'

Matt Garman's channel charge is in high gear as he aligns internal sales teams with partners, drives new partner business through the AWS Marketplace and accelerates joint innovation to boost GenAI adoption. Matt Garman's message is loud and clear: Amazon Web Services partners need to be attached to every customer account if the $110 billion cloud giant wants to remain a dominant force in the AI era. "I'm encouraging every single one of our accounts to make sure that partners are attached to almost every single thing that we do," said AWS' new CEO. "So that is a message heard loud and clear across our field and is the message that I will continue to push on our field -- that every single opportunity should have a partner attached to it in some way, shape or form." Garman has been on a channel charge ever since stepping into the CEO role in June after 18 years of working in top executive positions in nearly every crucial AWS department. That experience gives him deep insight into the entire company inside and out -- from being at the table with customers to understanding how the channel drives scale. [RELATED: CEO Matt Garman: Why Partners Are Picking AWS Vs. Microsoft And Google Cloud] "Partners are an incredibly important relationship for us and for our customers because we know that at the scale that we're trying to grow and the scale that we're trying to help our customers modernize, we don't have enough humans in order to do that," said Garman. "We want to build great software services and cloud services, but we need those partners to help go and actually make that happen all around the world." Partners are cheering Garman's channel investments -- such as signing dozens of heavily funded Strategic Collaboration Agreements with partners and creating an AI innovation center full of solution provider IP -- along with his bold strategy to align AWS' internal sales teams with the channel more than ever before. With Garman saying he views partners now as "co-inventors with us," many of the largest solution providers in the world are placing big bets on the Seattle-based company. Global IT powerhouse Presidio believes Garman will elevate channel sales to the next level thanks to his partnering mindset and being "one of the most technological CEOs" in the industry, said Chris Cagnazzi, chief innovation officer at New York-based Presidio. For example, one top channel priority for Garman this year is driving partner sales via the AWS Marketplace, which generated $400 million in revenue for Presidio in 2024. "Because of Matt's diverse background and how he's grown within AWS -- and the fact that he understands technology and he understands the challenges around driving outcomes -- it's a huge benefit for AWS and for partners because of the diversity of his viewpoint," said Cagnazzi. "He can look at a lot of different areas within the business to really say, 'This is working well. This isn't working well' and understand how that impacts the partner." From Garman's roots as an intern working underneath AWS founder and former CEO Andy Jassy in 2005 to climbing the ranks to become senior vice president of sales, marketing and global services, AWS partners believe Garman brings a clear understanding of what customers need and how the push for a partner-centric future will drive success. "He didn't just start from the bottom, but he's gotten his hand dirty working directly with customers," said Justin Copie, CEO of West Henrietta, N.Y.-based Innovative Solutions. Copie touts Garman's channel charge as one of the main reasons why Innovative Solutions has seen a 240 percent spike in AWS sales in 2024 year over year. One key growth driver, Copie said, was a 50 percent increase this year in the number of new customer opportunities that AWS referred to his company. "[We see] the approach he's taken already with some of the program rollouts, the big bet that AWS is making around GenAI, and the fact that he sees a vision for AWS to not only be customer-centric but he sees it equally in value that AWS needs to be partner-centric. And not every hyperscaler thinks that way," Copie said. Garman said a partner-centric strategy is the only way AWS can truly scale on a worldwide basis, particularly in the AI era. "Generative AI is going to reshape almost every single industry and every single business," Garman said. "As we continue to expand globally, we lean more and more on our global and regional channel partners to help us because they're the ones that oftentimes know the customers best." Garman has a visionary plan for the channel, and it starts with aligning AWS' internal sales teams with partners unlike ever before. Chris Sullivan, AWS' Americas channel chief, is a driving force behind Garman's plan. "In the past, we had great collaboration, but more [like] two strategies than one. It's an example of Matt's leadership, where the organizational structure -- as well as the way we go to market, the way we plan, the way we enable and drive our business with partners -- has moved even closer together," said Sullivan, vice president of Americas channel and alliances. As AWS evolves under Garman, Sullivan said, "the role that partners play has become more and more essential" to both AWS and customers. "We've made moves internally to ensure that how we plan and support and drive our go-to-market actions are as inclusive as possible to partners," Sullivan said. "If you think about our technology strategy and our generative AI strategy, partners are at the core of that strategy. ... So partners are now woven into the fabric of everything we do very intentionally, and we couldn't be more excited about that." Not only is Garman weaving partners into the fabric of AWS, he's investing large amounts of money into many channel partners by signing Strategic Collaboration Agreements (SCAs). These deals see AWS pouring tons of money into providing technical resources, go-to-market and proof-of-concept funding, the hiring of new employees, and much more. SCAs are basically a huge shot in the arm for partners to elevate their AWS business to the next level as quickly as possible. For example, Presidio's SCA aims to increase its head count and co-innovation with AWS around GenAI. "There are probably 80 people that will get hired, specifically between AWS and Presidio, to focus on reaching the targets we want to get jointly together," Cagnazzi said. "This is industry-focused, and it's generative-AI-focused. ... We're developing a lot of really unique things around innovation with AWS right now, especially around generative AI." Another channel charge Garman is helping to drive includes the recent launch of the AWS Business Outcomes Xcelerator (BOX) program, which helps partners develop and deliver solutions that meet the demands of line-of-business buyers. In addition, Garman has revamped AWS' highly popular Migration Acceleration Program (MAP). The cloud migration program provides partners with various financial incentives and joint go-to-market resources to make customer migration to the AWS cloud as cost-efficient as possible. AWS partner Mission Cloud said AWS is co-funding the cost of migrating customer workloads to the cloud via MAP, which is boosting profitability and helping the Los Angeles-based company capture net-new customers. "Prospects know that not only will some of the cost of us doing the migration for them effectively be funded by AWS, but then once the migration is [complete], there will also be a discount that will be applied for a period of time to the consumption of AWS," said Mission Cloud CEO Simon Anderson. "The combination of those two things really drives a lot of velocity in decisions to do migrations." Leveraging MAP and other AWS partner programs has led to millions of dollars in sales and profitable ongoing support services for Mission Cloud. "There are a lot of AWS financial levers we can pull to really help customers at any stage, whether that's through instant discounts on their spend when they first join us because we can start optimizing their environment all the way through to when they're making a big forward commitment through an Enterprise Discount Program [EDP], which is partner-led," Anderson said. "The classic journey of a Mission Cloud-type customer is they start with us spending $20,000 to $40,000 per month. Then they scale up into the hundreds of thousands of dollars, and sometimes the millions of dollars a month." Over the past several years, AWS sales for Mission Cloud have grown by 10X with "strong double-digit growth" year over year expected in 2024. "The partnering aspect of AWS right now is second to none," said Anderson. "Because of things like MAP and our SCA with AWS, we're able to scale our sales and marketing team more quickly than we'd otherwise be able to because of the support coming from AWS and Matt right now." Garman's Software Services Push To Drive Profitability Garman believes software services are what partners should be offering if they want to be highly profitable in 2025 and beyond. With so much co-innovation and co-selling happening at AWS today, Garman sees the lines between channel partners -- particularly systems integrators -- and ISVs "are blurring." "We are definitely seeing some convergence there, where the SIs are seeing themselves as delivering cloud services to customers as well," said Garman. "If they can build software solutions, which we're increasingly seeing them do, they can actually then charge much higher margins and get leverage on those customers where they can sell a software solution in addition to implementation." Garman is telling the AWS field sellers to lean into partner software and service offerings as much as possible. "I'm talking to the field about how we jointly go after opportunities with partners together. We're going to be leaning into partner-driven workloads as much as we can," he said. Mission Cloud, for its part, created its Mission Control Platform, which simplifies the entire AWS customer experience around cloud optimization, workflows and professional services. "We're now a software partner to AWS as well," Mission Cloud's CEO said. "That has really enabled us to get even more deeply into the AWS Marketplace and drive opportunities for ourselves." Garman's channel strategy also involves providing partners with new services opportunities via Master Services Agreements (MSAs) that enable AWS teams to contract out services to a partner. AWS opened the services floodgates for AWS consulting partner Redapt after the Woodinville, Wash.-based company signed an MSA that included the ability for Redapt to provide sub services underneath the umbrella of AWS professional services. "Our MSA allows us to now sub for [AWS] services and for their customers too," said Redapt's Paul Shaffer, executive vice president of business development and partner programs. "Our MSA is important because then the AWS sales organization knows that we can actually do their services on their paper." AWS' Sullivan said the cloud provider's professional services team handing over services sales to partners is an important strategy. "It allows partners to participate more in the services opportunity with our customers, and it allows AWS to bring some additional business to those partners to ensure that there's a strong solution for the customer at the end of the day," he said. Shaffer said Redapt is generating AWS sub services revenue around advanced analytics, AI, cloud migration, DevOps and machine learning. The MSA is driving so much momentum for Redapt that the solution provider is potentially eyeing an acquisition of a boutique AWS-focused partner. "We're interested in that because we want that engineering talent that can come in and build off of our services practice areas around a partner like an AWS," Shaffer said. AWS Marketplace: 'A Super Important Lever' One major channel initiative where Garman plans to drive software services revenue and new customer wins for partners is via the AWS Marketplace. "It's a super important lever for us," said Garman. "The Marketplace is enabling systems integrators to go sell their solutions to end customers and get all of those benefits that the ISVs are getting with regard to faster billing, easier invoicing, it allows partners to get paid more quickly and consolidates software solutions into the customer's bill." Over the past year, AWS has enhanced its one-stop-shop cloud marketplace to make it easier and more profitable for partners to sell, such as "significantly lowering the fees" associated with partner-originated deals inside the Marketplace, Garman said. One key reason why Marketplace is so popular is the ability for AWS customers to use cloud credits and use their EDP commitments to purchase channel partner professional services and offerings listed there. "That's a very powerful channel for us. We get about 25 percent of our net-new logos now from the AWS Marketplace," said Mission Cloud's Anderson. For Presidio, capturing over $400 million through the Marketplace this year shows just how hungry customers are for channel partner offerings. "Think of the Marketplace as this platform that we can now help them cost-optimize around their consumption and the services that they're buying because we're driving more software licensing and even specific types of managed services or service offerings through the Marketplace that help them retire quota," said Cagnazzi. "It's a great channel to be able to complete a customers' full software life cycle, but do it in a way where you're also helping them on their goals." Garman's bullish push on Marketplace is also seeing AWS working hand-in-hand with partners to build and sell joint AI solutions on the marketplace. AWS is putting its money where its mouth is in terms of driving GenAI via channel partners. The company invested $100 million last year to open its AWS Generative AI Innovation Center with the goal of driving joint AI advancements with partners as well as accelerating GenAI customer adoption. "We're now opening that up to deliberately incorporate partners, their value proposition and their capabilities into the Generative AI Innovation Center, and then help partners drive those outcomes with customers," said Sullivan. "We're leveraging all of the best practices we're learning around how to deliver the most effective proofs of concept, how to move from a POC to a production environment for specific workloads, strategic considerations around security compliance and how we deliver outcomes leveraging these technologies -- we need partners in the core of that. That's another example of our services organization incorporating and aligning with partners to deliver for customers." AWS' innovation center is stuffed full of partner technology and solutions. "As we get closer and closer to our partners, we're at the point where we're creating IP together at a very high rate in support of customer outcomes," Sullivan said. Garman said AWS' AI road map is to build open platforms that integrate with third-party technologies on which partners can build their own AI offerings. However, to fully reap all the benefits of AI, a customer's data estate needs to be in order so AI can do its magic. Garman and partners believe this is a massive sales opportunity for the channel. AI "opens up the aperture [through] which companies are actually going to consider doing big migrations from legacy workloads -- whether they're legacy databases, legacy operating systems, legacy mainframes -- into a more modernized workflow," Garman said. "Partners are going to be able to win many of those workloads and help customers go much faster because the ROI math just works better." AWS partner InterVision Systems is winning large deals by migrating customers with vast amounts of unstructured data to the cloud as part of their AI journey. Santa Clara, Calif.-based InterVision is leveraging Amazon Bedrock, Amazon Connect and Amazon SageMaker to make all this possible. "If you think about all the data that all our customers have inside their buildings, pretty much every answer to every question is somewhere hidden in documentation or in their data," said Jonathan Lerner, president and CEO of InterVision. "So we started with a data ingestion engine that we're taking petabytes of unstructured information into and framing it up into a manageable set of information," Lerner said. "Then from there, we're tuning it and tuning it to get to the outcome that the clients need." For example, InterVision developed its own Contact-Center-as-a-Service offering, ConnectIV CX, powered by Amazon Connect and augmented with AI to include real-time data management and automation. "We're replacing 20- to 30-year-old antiquated, premises-based solutions every day," said Lerner. "And we're managing some of the most complex Amazon Connect deployments on the planet right now." InterVision said AWS sales "are exploding," with several AWS markets increasing by "triple digits" over the past three years. "We view AWS as the best builders on the planet," said Lerner. "Partners are closest to the customer, and together, that is scale." To win the AI market-share battle, Garman is building an open GenAI portfolio that lets customers easily build their own GenAI applications on top of it. "That means, 'How do we have the broadest set of models -- not just a model -- but the broadest set of models?' Some of them are built by us, many of them are built by other companies out there," Garman said. "So we built this platform in Bedrock and in SageMaker and a bunch of the capabilities that we have inside AWS -- including our own custom silicon -- as a low-cost model so that customers have the very best in performance and capability." Amazon Bedrock enables partners to create AI agents and finetune foundation models for customers, with large language models (LLMs) available from Amazon and third parties like Anthropic, Meta, AI21 Labs, Cohere, Mistral AI and Stability AI. "We have that platform that really makes it possible for partners to then go build added capabilities on top of that," Garman said. "We want to enable that broader partner ecosystem to go innovate around us and enhance what we've built." Mission Cloud is working on "hundreds" of AI solutions that leverage the AWS AI portfolio to help build GenAI applications for customers. Use cases include creating an AI system for improving a company's entire hiring and job interviewing process, as well as building a GenAI system for a media and entertainment company to translate its libraries of English-speaking documentaries into various languages at lightning speed. "It was cost-prohibitive to them to do that through traditional translation and dubbing, so we built a whole generative AI system for them. They've leveraged a lot of AWS services: Polly, Transcribe, SageMaker, Bedrock and so on," said Mission Cloud's Anderson. In conjunction with AWS, Mission Cloud launched its Mission AI Foundation managed services offering that leverages its cloud services platform along with Amazon QuickSight and Amazon Q to provide detailed cost visualization and management tools for customers. "Once a customer gets to AWS, they need all sorts of specialized help that's continuous," said Anderson. "So with prompt engineering, sustainability, helping them with token usage, helping them with cost optimization around the GenAI workload, etc., AI Foundation is our own, effectively, managed service that delivers all of that and expertise 24x7 for customers." AWS' AI strategy "opened the door for choice" when it comes to GenAI, said Innovative Solutions' Copie. This strategy enabled the solution provider's GenAI business to grow an unprecedented 1,900 percent in 2024. "They didn't come out with a set of services and say, 'Well, if you do this, you're now locked into AWS.' They actually took the opposite approach. They said, 'Listen, we put something out there called Bedrock, which is like a garden of LLM models. Customers, you choose the model or models that you want to use. And by the way, if you need third-party tools for things like cost optimization or security, you can bolt those things on together. You don't have to use native products or services from AWS to do that,'" said Copie. "That fundamentally has accelerated so many customers that we've worked with in the space because they want choice." Innovative Solutions and AWS have worked on dozens of successful GenAI implementations this year. One that stands out is with health-care technology startup Healthmetryx, which needed to build an IoT device to facilitate early detection and prevention of diseases. "Basically, you blow and breathe into the Healthmetryx device called Clarinet, and based on a number of machine learning models and a ton of GenAI that's built into the solution that we've helped build, they can do early detection of respiratory illness, infection or disease," said Copie. Innovative Solutions built the software on Amazon Bedrock and IBM watsonx Assistant technology and implemented AI technology that now manages all of the data for Healthmetryx. "You can think of us as really the IT arm for their entire business. They're stacked with physicians and these Ph.D.s, very smart individuals that understand medicine. What they didn't have was a really strong technical team to help them and be by their side," said Copie. "It's remarkable because it's the type of device that not only can save lives but will capture so much data that they're able to do clinical research with," he said. "Maybe a new drug can be developed because they have the data accessible now through this IoT device that has very real AWS technology at play." Copie touted AWS' new CEO as the leader who is driving joint AI innovation as well as new customer wins for Innovative Solutions. "Matt, I believe, single-handedly led to not only the growth of our business this year, but certainly the ecosystem in general," said Copie. Garman said he's approaching AI "with a partner-centric mindset" and with the goal of forming long-lasting channel partnerships. "We don't think about, 'We're going to partner with you until we replace you.' We're thinking about, 'How do we partner together for the long term, to go work together and grow this business together?'" said Garman. "So when you have that mentality, a lot of things land in the right place." For its third quarter of 2024, AWS increased sales 19 percent year over year to $27.5 billion. AWS' annual run rate is now $110 billion, and the company currently has a leading 31 percent share of the global cloud computing market. When Garman decided on AWS for his internship in the summer of 2005, he was wildly interested in working under founder Jassy. Garman said Jassy has been a "big help in encouraging me to always just think bigger" about what AWS can accomplish. "One of the things that Andy pushes onto us, within our teams, is to have what seems like unreasonable expectations for what we can accomplish. Because when you have those unreasonable expectations for your teams, a lot of times they actually get very creative and figure out how to actually go accomplish what seemed like something that was impossible that you asked them to do," said Garman. "And that's how AWS comes out with incredible innovations and things that surprised the world, and moves at a faster pace than you might otherwise think possible." Garman is setting up the chess pieces so that in 2025, partners will be in position to deliver on the company's AI hopes and overall future. "If you look at the massive adoption of enterprises where a bunch of these workloads are still running on-premises, or a bunch of AI workloads are going to be integrating themselves into a lot of these legacy industry environments -- those are all going to run on the cloud. They're not going to run on-premises," said Garman. "So there's a massive opportunity for all these channel partners to help that meaty middle of the adoption curve of enterprises around the world to move to the cloud. I really believe that we're just at the early stages of what this business could be -- both for us and for our partners."

[3]

CEO Matt Garman: Why Partners Are Picking AWS Vs. Microsoft And Google Cloud

CEO Matt Garman believes Amazon Web Services is winning channel partner mindshare via its cybersecurity posture, generative AI strategy and the opportunity to reach more customers globally compared to rivals Microsoft and Google Cloud. "From a partner perspective, they don't want to be dealing with bad security or they don't want to have to be dealing with bad operational excellence either because that's going to look bad and it reflects poorly on them," said Garman in an interview with CRN. Garman took over the reins at AWS this past June. He hit the ground running by taking the Seattle-based cloud computing unit's generative AI and overall AI market position to new heights. "On the GenAI front, if you look at the differences in approaches, some other competitors out there started first with their consumer applications. And then following with, how do they add generative AI to their cloud products?" AWS CEO said. "We instead said, 'How do we build a platform that customers can go build generative AI applications on top of?' And that means, 'How do we have the broadest set of models -- not just a model -- but the broadest set of models?' [Related: Microsoft Vs. AWS Vs. Google Cloud Earnings Q3 2024 Face-Off] For its most recent third quarter 2024, the AWS reported a record $27.5 billion in revenue, representing a 19 percent sales increase year over year. This means that AWS now has a whopping $110 billion annual run rate. AWS has been the dominant global cloud computing market share leader for years. Currently, Amazon owns 31 percent share of the worldwide enterprise cloud infrastructure services market, followed by Microsoft at 20 percent share and Google Cloud at 12 percent share. In an interview with CRN, Garman explains why channel partners are placing their AI and cloud computing bets on AWS compared to rivals Microsoft and Google Cloud.

[4]

AWS re:Invent 2024: 7 New Partner Offers For SAP, AI Security And MAP Funding

At AWS re:Invent 2024 Wednesday, the cloud giant launched a new SAP offering targeting SMBs, three new cybersecurity partner competencies and boosted how much money partners can make in AWS' Migration Acceleration Program. Here's what you need to know. From a new SAP offering and extra partner funding for its popular Migration Acceleration Program (MAP) to launching several cybersecurity competencies, AWS is providing the channel a shot in the arm heading into 2025. "We want to make sure channel partners differentiate themselves with where they're delivering business outcomes," Ruba Borno, Amazon Web Services' worldwide channel chief, told CRN. "I want partners to be more bullish in the level of transformation and modernization that they're taking to clients. We want them to be a lot more bullish with the customers, to help our customers be more competitive in their industries." Borno said AWS is unleashing several new offerings, program enhancements and AWS' highly regarded competencies to help partners with this. CRN breaks down seven new AWS partner launches at AWS re:Invent 2024 Wednesday in Las Vegas. AWS launched a new solution alongside SAP targeting the SMB market called GROW With SAP on AWS. GROW with SAP provides cloud-native ERP software solutions created specifically for the SMB market. "GROW with SAP is launching first on AWS and first on the AWS Marketplace," said Borno. "What value is this providing for customers? It streamlines integration with AWS generative AI services like Bedrock. It helps our customers build GenAI applications using real-time data from SAP, and that's really how customers are going to get value out of generative AI investments," Borno said. "So we're super excited about this announcement, especially for that cohort of customers and SMB." Partners leveraging AWS' popular cloud Migration Acceleration Program (MAP) in large deals are getting a major boost. AWS is eliminating the funding cap partners are able to receive in the program. "It used to be if a partner sold a really, really large deal, there was a cap on how much funding they would be able to get for that migration. Now we've eliminated that cap," Borno told CRN. "We are eliminating the cap that we used to have on how much we could pay partners. So that's really exciting because partners can make more money on that." AWS is providing MAP funds to partners tied to key performance milestones as well as customer transformation and modernization success. "Now partners are getting rewarded for the full breadth of their work. It's not just stopped once they reach that cap and then they're continuing to do that work -- they are continually getting rewarded. The customer is also getting the benefit of taking on that broader transformation," she said. In addition, Borno said AWS has added a few strategic areas where MAP funding is being increased. "So if you sell bigger deals, you can make more money," Borno said. "If you sell to greenfield customers, you make more money. We're doing this because we recognize the cost of acquiring those customers is higher." AWS is launching a new Digital Sovereignty Competency as solution providers need to grasp more knowledge around the specific requirements and regulations in different geographies. "A lot of our customers are very much focused on the digital sovereignty requirements that they are going to have to adhere to geo by geo, region by region, country by country," said Borno. "We're really excited about how that's going to help customers adhere to the requirements that they need to." At launch, partners who have already achieved AWS Digital Sovereignty Competency include large partners and vendors including Accenture, Capgemini, Deloitte, IBM and NTT DATA. Borno said one of the most foundational requirements AWS hears from customers is cybersecurity. "It has to be one of the top things we discuss with every partner and with every customer. It's always been important, but with generative AI, it's even become more critical," said Borno. AWS created its new Security Competency specifically focused on AI security. "This is just responding and working backward from customer demand of, 'When I'm adopting new generative AI technology, which partners can ensure me that I've got a good secure posture?'" said Borno. Two other new security-focused AWS competencies for partners include Amazon Security Lake Service Ready and AWS Security Incident Response Service Ready and Delivery. "Both of these give customers confidence in a partner's ability to help them see if they have the right security posture with Security Lake and also with Incident Response," said Borno.

Share

Share

Copy Link

AWS partners are experiencing significant sales growth due to the company's expanding generative AI portfolio and increased channel investments. CEO Matt Garman emphasizes the importance of partner involvement in every customer account to maintain AWS's dominance in the AI era.

AWS Partners See Massive Growth in AI-Driven Sales

Amazon Web Services (AWS) partners are experiencing a significant surge in sales growth throughout 2024, primarily attributed to the company's expanding generative AI product portfolio and increased channel investments

1

. This trend highlights the growing importance of AI in cloud computing and business strategies.DoiT International's Remarkable Growth

DoiT International, a global powerhouse in the AWS partner ecosystem, reported an impressive 184% growth in its AWS business for 2024. The company's success is largely due to AWS solutions enabling successful customer AI use cases and DoiT's own homegrown innovation

1

. Tracie Stamm, global head of product and content marketing at DoiT, expressed optimism about future growth, forecasting over 300% growth in 20251

.AWS CEO Matt Garman's Partner-Centric Vision

Matt Garman, AWS's new CEO, has emphasized the critical role of partners in the company's strategy, especially in the AI era. He stated, "Generative AI is going to reshape almost every single industry and every single business," highlighting the need for global and regional channel partners to help AWS expand globally

2

. Garman's vision includes aligning AWS's internal sales teams more closely with partners and viewing them as "co-inventors"2

.New Initiatives and Product Launches

At AWS re:Invent 2024, the company unveiled several new products and channel incentives aimed at driving AI sales:

- Elimination of the financial cap on partner earnings in the Migration Acceleration Program (MAP)

1

. - Introduction of a new Digital Sovereignty Competency

1

. - Launch of new AI, security, storage, and compute solutions

1

. - Introduction of GROW with SAP on AWS, targeting the SMB market

4

. - New security competencies, including AI security, Amazon Security Lake Service Ready, and AWS Security Incident Response Service Ready and Delivery

4

.

Partner Success Stories

Several AWS partners have reported significant growth:

- Caylent saw an 80% increase in its AWS business in 2024

1

. - Innovative Solutions experienced a 240% spike in AWS sales year-over-year

2

. - Presidio generated $400 million in revenue through the AWS Marketplace in 2024

2

.

Related Stories

AWS's Competitive Edge

AWS believes it's winning channel partner mindshare over competitors like Microsoft and Google Cloud due to its cybersecurity posture, generative AI strategy, and the opportunity to reach more customers globally

3

. The company's approach to generative AI focuses on building a platform for customers to develop AI applications, offering a broad set of models rather than just a single model3

.Future Outlook

As AWS continues to evolve under Garman's leadership, the role of partners is becoming increasingly essential. The company is investing heavily in Strategic Collaboration Agreements (SCAs) with channel partners and creating an AI innovation center full of solution provider IP

2

. These initiatives, combined with the growing demand for AI and cloud services, position AWS and its partners for continued growth in the coming years.References

Summarized by

Navi

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic sues Pentagon over supply-chain risk label as AI safety debate reaches court

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation