Broadcom secures 60% AI chip market dominance as hyperscalers race to build custom silicon

4 Sources

4 Sources

[1]

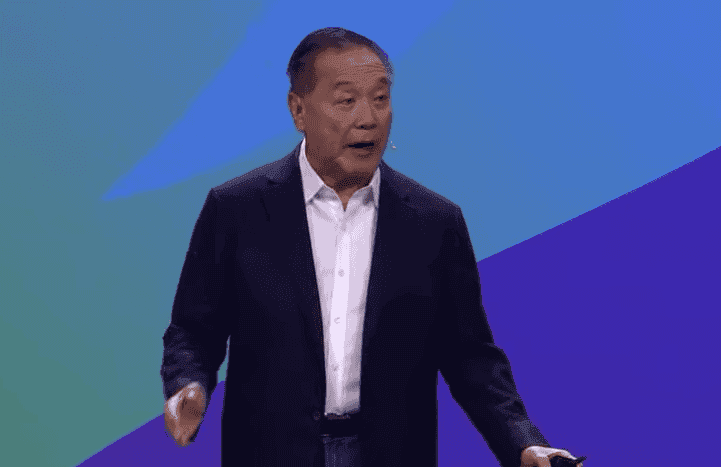

Broadcom CEO told TD Cowen analysts there's insatiable demand for its chips

Artificial intelligence is continuing to boost demand for Broadcom's chips, TD Cowen analysts told clients after meeting with the company. Analysts led by Joshua Buchalter reiterated a buy rating and $450 price target over the next 12 months on Broadcom shares, suggesting 35% potential upside against Tuesday's close. Broadcom has recently stalled after scoring massive gains over the past few years, with shares down roughly 3% over the past three months and 4% in 2026 alone. The downbeat sentiment comes as fears have grown about margin compression, a dip in Broadcom's AI order backlog, the stock's lofty valuation and, more broadly, a potential bubble in the stock market that could tear apart the biggest leaders of the AI trade. For all that, Palo Alto, California-based Broadcom remains 39% higher over the past year. Broadcom executives laid those concerns to rest in a recent virtual meeting with TD Cowen, however. The meeting, in which TD Cowen hosted the company's CEO Hock Tan and CFO Kristen Spears, assured analysts that demand is not only growing for Broadcom's XPUs, but also for its networking business, where the company holds a leading position in a variety of components needed to build AI infrastructure. That includes Ethernet solutions, PCI Express switches used to connect hardware components inside computers and optical interconnect solutions. "Mr. Tan expressed clear confidence in meaningful upside to its most recently disclosed backlog figure, including networking, and that customer owned tooling is not a major concern," Buchalter said in a report issued Tuesday, adding that Tan "emphasized that Broadcom has seemingly insatiable demand for its products." AVGO 1Y mountain Broadcom stock performance over the past year. Broadcom management noted in the meeting that its bookings have grown meaningfully since the company's disclosure in December that it had a backlog of $73 billion that it expected shipping over the next 18 months. Although Buchalter said Broadcom's multi-year chip production deal with OpenAI was likely not included in that figure, he said Tan appeared "fully confident" in the deal being deployed between 2027 and 2029. Broadcom's AI networking sales are also likely to become a larger part of total revenue than investors expect, TD Cowen said. "We think the scale of Broadcom's networking business within its AI backlog is underappreciated, with Mr. Tan suggesting meaningful momentum across scale up and scale out in its Tomahawk franchise," Buchalter wrote. "We believe XPU sales continue to drive the bulk of AI revenue sales (and the stock). However, we think AI networking will remain a critical part of both Broadcom's business and cluster buildouts as performance requirements continue to move higher," he continued.

[2]

Broadcom Holds 18-Month Edge In Custom AI Chips, 'Buy Aggressively:' JPMorgan Analyst - Broadcom (NASDAQ:AVGO)

JPMorgan analyst Harlan Sur said Broadcom Inc's (NASDAQ:AVGO) long lead in custom artificial intelligence (AI) chips is helping its AI Application-Specific Integrated Circuit (ASIC) outlook accelerate into fiscal 2026 and fiscal 2027, with Alphabet Inc (NASDAQ:GOOGL) Google as the key driver. Broadcom Extends Its Lead Over Customer-Led Chip Programs Sur maintained an Overweight rating on Broadcom and a price forecast of $475. The analyst said Broadcom has an 18-month-plus head start over internal customer-owned tooling efforts, in which customers handle about 90% of the design work. He pointed to Google's 3nm Zebrafish program as an example, saying it has faced repeated delays and may not produce first silicon until the end of this quarter or early next quarter. Sur contrasted that with Broadcom's next-gen 3nm Tensor Processing Unit (TPU), code-named Sunfish, which he said Google evaluated and qualified earlier, giving Broadcom a meaningful timing advantage. Sur said Google is seeing more success supporting external AI workloads with its TPU platform and now targets deploying 6 million to 7 million TPU processors in calendar 2027, up from his prior view of 5 million units. The analyst expects most of those 2027 shipments to support external customers and said those deployments will be powered entirely by Broadcom and Google's Sunfish 3nm TPU ASIC. He added that even Google's internal TPU usage in 2027 should rely primarily on Sunfish, leaving more than 95% of Google's 6 million to 7 million TPU units in 2027 powered by Broadcom silicon. Purchase Orders, Supply Constraints, And The Next Node Sur added that Broadcom already has multi-billions of dollars in purchase orders tied to the Sunfish ramp that starts in the second half of this year, and he believes Broadcom's AI backlog has continued to grow by billions since the December earnings call across current-gen Ironwood and next-gen Sunfish shipments. The analyst also said that tightening lead times for wafers, CoWoS, HBM, and advanced substrates make early qualification critical. He expects that dynamic to limit volume potential for later-starting programs like Zebrafish. Sur added that Broadcom has already begun designing Google's next TPU ASIC on 2nm, targeted for volume production in calendar 2028. The analyst said he would buy aggressively at current levels. Sur projects first-quarter revenue of $19.14 billion and adjusted EPS of $2.02. AVGO Price Action: Broadcom shares were up 1.93% at $320.10 at the time of publication on Monday, according to Benzinga Pro data. Photo by Tada Images via Shutterstock AVGOBroadcom Inc $325.351.66% Overview GOOGLAlphabet Inc $333.141.59% Market News and Data brought to you by Benzinga APIs

[3]

Artificial Intelligence (AI) Spending Is Exploding. This Stock Stands to Benefit Most

Broadcom is poised to be one of the biggest beneficiaries of increasing AI infrastructure spending. Spending on artificial intelligence (AI) infrastructure is booming, but there is also a shift in the market. While Nvidia's graphics processing units (GPUs) continue to dominate the market, more and more large companies are turning toward developing AI ASICs (application-specific integrated circuits) to handle some of these workloads. ASICs are custom chips that have been preprogrammed for specific tasks, and because of that, they tend to have strong performance and are more energy efficient. Meanwhile, the company that hyperscalers (owners of large data centers) are increasingly turning to to help them make custom AI chips is Broadcom (AVGO 1.14%). Broadcom is a leader in ASIC technology, where it can help turn customers' designs into physical chips and get them manufactured at scale. It basically provides the building blocks and some of the important intellectual property (IP) for these chips to work. Broadcom made its mark in the space by helping Alphabet create its well-regarded tensor processing units (TPUs). It continues to benefit from the success of TPUs, and it will deliver $21 billion worth of TPUs to Anthropic later this year, as Alphabet is now letting customers deploy its chips through its cloud computing unit, Google Cloud. Alphabet's TPU success has also led other hyperscalers to flock to its ASIC services. The company has said that its three earliest customers -- believed to be Alphabet, Meta Platforms, and TikTok owner ByteDance -- are a $60 billion to $90 billion market opportunity in fiscal 2027 (ending October). Meanwhile, it has also added OpenAI as a customer, signing a deal to supply it with custom AI accelerators that can support data centers capable of generating 10 gigawatts of computing power. Based on the pricing of Nvidia GPUs, that would value the deal at around $350 billion. Broadcom is also reportedly working with Apple to develop custom AI chips for the iPhone maker, as well. Citigroup analysts estimate that Broadcom's AI revenue could surge from around $20 billion last fiscal year to over $50 billion this fiscal year. It then sees it doubling again to $100 billion in fiscal 2027. Given that Broadcom produced just $63.9 billion in total revenue in the just-completed fiscal 2025, that's an enormous growth opportunity for the company. Broadcom's VMware virtualization business should also continue to see solid growth, while the company's non-AI semiconductor business is already at trough levels, with the potential for a rebound in the coming years. With AI spending growth set to explode over the coming years and companies looking for an alternative to Nvidia's GPUs to reduce cost, Broadcom's stock stands to be one of the biggest winners.

[4]

Broadcom set to retain leadership position as AI server compute ASIC partner through 2027: Counterpoint

Broadcom is projected to retain its leadership as an artificial intelligence server compute ASIC design partner with 60% of market share in 2027, according to an analysis by Counterpoint Research. AI server compute ASIC shipments are expected to triple by Broadcom is projected to retain leadership with about 60% partner share in AI server compute ASIC design by 2027. Growth is driven by acceleration of in-house AI accelerator deployments by Google, AWS, Meta, Microsoft and others for varied workloads, meeting increasing compute demands and reducing reliance on general-purpose GPUs like Nvidia's. Google and Amazon's share is declining as hyperscalers diversify with internal silicon and partners like Broadcom and Marvell; Marvell's share is expected to decrease, but its new technologies and acquisitions could expand its market in scale-up connectivity.

Share

Share

Copy Link

Broadcom is cementing its position as the go-to partner for custom AI chips, with analysts projecting 60% market share in AI server compute ASIC design through 2027. CEO Hock Tan reports insatiable demand across both chip and networking divisions, with Google alone planning to deploy 6-7 million TPU processors in 2027. The company holds an 18-month lead over customer-owned chip programs, positioning it to capture explosive AI infrastructure spending growth.

Broadcom Dominates Custom AI Chips Market With 60% Share

Broadcom is projected to retain its leadership position as an artificial intelligence server compute ASIC design partner with 60% of market share through 2027, according to Counterpoint Research

4

. This commanding position comes as hyperscalers including Google, Amazon Web Services, Meta, and Microsoft accelerate their shift away from general-purpose GPUs like Nvidia's offerings toward Application-Specific Integrated Circuit solutions tailored for specific AI workloads4

.

Source: Benzinga

The momentum reflects a fundamental shift in AI infrastructure spending. While Nvidia's GPUs continue to dominate, large companies are increasingly turning to custom AI chips that offer stronger performance and greater energy efficiency for specific tasks

3

. Broadcom provides the building blocks and critical intellectual property that enable customers to transform their chip designs into physical products manufactured at scale3

.

Source: Motley Fool

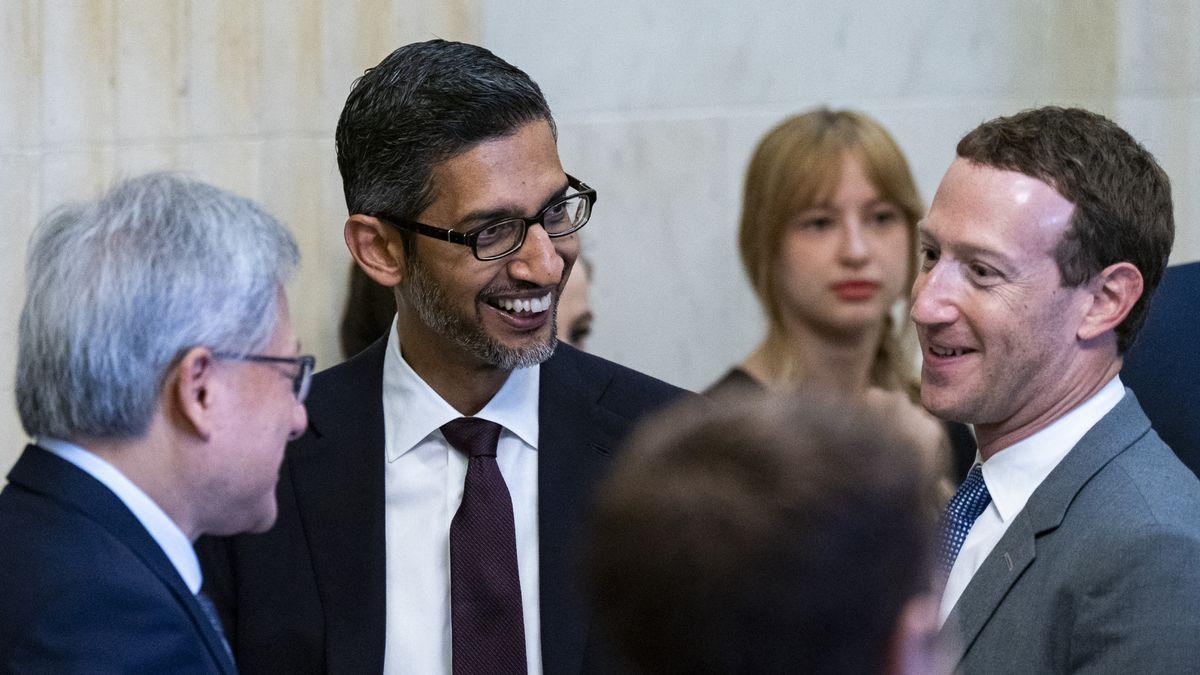

CEO Hock Tan Reports Insatiable Demand Across Product Lines

In a recent virtual meeting with TD Cowen analysts, Broadcom CEO Hock Tan and CFO Kristen Spears delivered reassuring guidance that demand is growing not only for the company's XPUs but also for its AI networking solutions

1

. Tan emphasized that Broadcom faces "seemingly insatiable demand for its products" and expressed clear confidence in meaningful upside to the company's recently disclosed backlog figure of $73 billion expected to ship over the next 18 months1

.TD Cowen analysts, led by Joshua Buchalter, reiterated a buy rating with a $450 price target, suggesting 35% potential upside

1

. The firm noted that bookings have grown meaningfully since December's disclosure, with the multi-year chip production deal with OpenAI likely not even included in that $73 billion backlog1

. Tan appeared "fully confident" that the OpenAI deal would be deployed between 2027 and 20291

.Broadcom Holds 18-Month Lead Over Customer-Owned Chip Programs

JPMorgan analyst Harlan Sur maintained an Overweight rating with a $475 price target, highlighting that Broadcom has an 18-month-plus head start over internal customer-owned tooling efforts where customers handle about 90% of the design work

2

. He pointed to Google's 3nm Zebrafish program as an example, noting it has faced repeated delays and may not produce first silicon until the end of this quarter or early next quarter2

.In contrast, Broadcom's next-generation 3nm Tensor Processing Units, code-named Sunfish, were evaluated and qualified by Google earlier, providing a meaningful timing advantage

2

. Sur said he would "buy aggressively" at current levels, noting that tightening lead times for wafers, CoWoS, HBM, and advanced substrates make early qualification critical2

.Related Stories

Google Plans Massive TPU Deployment Powered by Broadcom Silicon

Google is now targeting deployment of 6 million to 7 million TPU processors in calendar 2027, up from prior estimates of 5 million units

2

. JPMorgan expects most of those 2027 shipments to support external customers through Google Cloud, with more than 95% of Google's TPU units in 2027 powered by Broadcom silicon2

. Sur added that Broadcom already has multi-billions of dollars in purchase orders tied to the Sunfish ramp starting in the second half of this year2

.

Source: Seeking Alpha

Broadcom's success with Alphabet's TPUs has led other hyperscalers to adopt its ASIC services. The company has indicated that its three earliest customers—believed to be Alphabet, Meta Platforms, and ByteDance—represent a $60 billion to $90 billion market opportunity in fiscal 2027

3

. Broadcom has also added OpenAI as a customer, signing a deal to supply custom AI accelerators capable of supporting data centers generating 10 gigawatts of computing power3

.AI Networking Sales Emerge as Underappreciated Growth Driver

Broadcom's AI networking sales are likely to become a larger part of total revenue than investors currently expect, according to TD Cowen

1

. The company holds leading positions in various components needed to build AI infrastructure, including Ethernet solutions, PCI Express switches used to connect hardware components, and optical interconnect solutions1

. Tan suggested meaningful momentum across scale-up and scale-out in the company's Tomahawk franchise1

.Citigroup analysts estimate that Broadcom's AI revenue could surge from around $20 billion last fiscal year to over $50 billion this fiscal year, then potentially double again to $100 billion in fiscal 2027

3

. Given that Broadcom produced just $63.9 billion in total revenue in fiscal 2025, this represents enormous growth potential3

. AI server compute ASIC shipments are expected to triple by 2027 as AI accelerator deployments accelerate across major cloud providers4

.References

Summarized by

Navi

[3]

Related Stories

Broadcom Poised for $150 Billion AI Revenue Opportunity, Analysts Bullish

16 Jul 2024

Broadcom AI revenue surges 74% but stock tumbles on profitability concerns despite record earnings

11 Dec 2025•Business and Economy

Broadcom Secures $10 Billion AI Chip Order, Likely from OpenAI, Fueling Market Surge

04 Sept 2025•Technology

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology