DigitalBridge Acquires Yondr Group to Capitalize on AI-Driven Data Center Demand

2 Sources

2 Sources

[1]

DigitalBridge to Acquire Yondr Grou By Investing.com

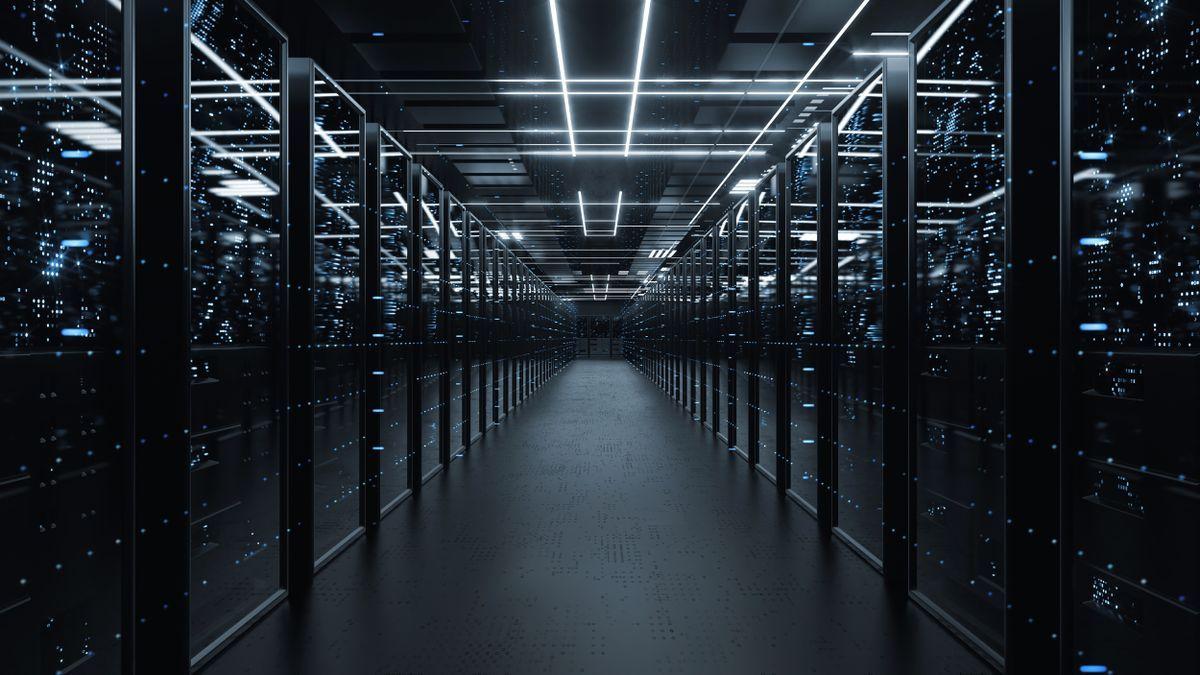

Strategic Investment to Accelerate Global Hyperscale Data Center Growth to Meet Unprecedented AI Demand BOCA RATON, Fla. & LONDON--(BUSINESS WIRE)--DigitalBridge Group, Inc. (NYSE: DBRG) (DigitalBridge), a leading global alternative asset manager dedicated to investing in digital infrastructure, today announced it has reached an agreement to acquire Yondr Group (Yondr), a global developer and operator of hyperscale data centers, through one of its managed investment funds (the DigitalBridge Fund). This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241028784900/en/ Yondr has established itself as a key player in the digital infrastructure sector, addressing the complex data center capacity demands of the world's largest technology companies through the development and operation of sustainable data centers worldwide. With a diverse portfolio of campuses, Yondr is well-positioned to meet the soaring demand for advanced data processing capabilities driven by ongoing digital transformation, the shift to cloud solutions, and the rise of artificial intelligence (AI). The company has more than 420MW of capacity committed to hyperscalers, with significant additional land to support a total potential capacity of over 1GW. The DigitalBridge Fund's strategic investment will drive the development of cutting-edge, sustainable data centers, backed by long-term, stable revenue streams from investment-grade clients. "Yondr's assets and strong relationships with leading hyperscale clients align with DigitalBridge's vision to support the future of digital infrastructure," said Jon Mauck, Senior Managing Director at DigitalBridge. "Yondr enhances our existing data center portfolio and strengthens our ability to support hyperscalers. Together, we are well-positioned to capitalize on the increasing demand for hyperscale data centers " fueled by AI, cloud computing, and the ongoing digital transformation across industries." Yondr will continue to operate as an independent company within DigitalBridge's portfolio, leveraging DigitalBridge's support, expertise, and experience. This partnership will enhance Yondr's ability to serve its clients more effectively while accelerating global expansion efforts. The deal is expected to close in early 2025, subject to customary closing conditions. Citi served as Yondr's exclusive financial advisor, with White & Case LLP as its legal counsel. DigitalBridge engaged Linklaters as legal advisors, Deloitte for financial and tax due diligence, Ramboll for technical expertise, and Nomura for financing support. About DigitalBridge DigitalBridge (NYSE: DBRG) is a leading global alternative asset manager dedicated to investing in digital infrastructure. With a heritage of over 25 years investing in and operating businesses across the digital ecosystem, including cell towers, data centers, fiber, small cells, and edge infrastructure, the DigitalBridge team manages over $84 billion of infrastructure assets on behalf of its limited partners and shareholders. For more information, visit: www.digitalbridge.com. About Yondr Group Yondr Group is a global developer, owner, and operator of hyperscale data centers. The company specializes in delivering and operating dedicated infrastructure that is engineered for scale. As an organization, our mission "'Global capacity responsible delivery'" ensures that we achieve our vision of a tomorrow without constraints. For more information, visit www.yondrgroup.com.

[2]

DigitalBridge Buys Yondr as AI Fuels Demand for Data Centers

DigitalBridge Group Inc. has agreed to buy British data center developer and operator Yondr Group Ltd. as the investment firm seeks to profit from the boom in artificial intelligence. Boca Raton, Florida-based DigitalBridge, a major investor in digital infrastructure, made the purchase via one of its managed investment funds, the companies said in a joint statement on Monday. Financial details of the deal weren't disclosed.

Share

Share

Copy Link

DigitalBridge Group, a global alternative asset manager, has agreed to acquire Yondr Group, a hyperscale data center developer and operator, to meet the surging demand for data processing capabilities driven by AI and cloud computing.

DigitalBridge's Strategic Acquisition of Yondr Group

DigitalBridge Group, Inc., a leading global alternative asset manager specializing in digital infrastructure investments, has announced its agreement to acquire Yondr Group, a global developer and operator of hyperscale data centers

1

. This strategic move, executed through one of DigitalBridge's managed investment funds, aims to capitalize on the unprecedented demand for data center capacity driven by artificial intelligence (AI) and cloud computing2

.Meeting the Surge in AI-Driven Data Processing Demand

Yondr Group has established itself as a key player in the digital infrastructure sector, addressing the complex data center capacity demands of major technology companies worldwide. With over 420MW of capacity already committed to hyperscalers and the potential to support a total capacity exceeding 1GW, Yondr is well-positioned to meet the soaring demand for advanced data processing capabilities

1

.Strategic Alignment and Future Growth

Jon Mauck, Senior Managing Director at DigitalBridge, emphasized the strategic fit of Yondr's assets and client relationships with DigitalBridge's vision for the future of digital infrastructure. The acquisition is expected to enhance DigitalBridge's existing data center portfolio and strengthen its ability to support hyperscalers in the face of increasing demand fueled by AI, cloud computing, and ongoing digital transformation across industries

1

.Operational Independence and Expansion Plans

Following the acquisition, Yondr will continue to operate as an independent company within DigitalBridge's portfolio. This arrangement allows Yondr to leverage DigitalBridge's support, expertise, and experience while maintaining its operational autonomy. The partnership is expected to enhance Yondr's ability to serve its clients more effectively and accelerate its global expansion efforts

1

.Related Stories

Deal Specifics and Advisors

While the financial details of the acquisition were not disclosed, the deal is expected to close in early 2025, subject to customary closing conditions. Citi served as Yondr's exclusive financial advisor, with White & Case LLP as its legal counsel. DigitalBridge engaged Linklaters as legal advisors, Deloitte for financial and tax due diligence, Ramboll for technical expertise, and Nomura for financing support

1

.Implications for the Digital Infrastructure Landscape

This acquisition highlights the growing importance of data centers in the AI and cloud computing era. As digital transformation continues to accelerate across industries, the demand for advanced data processing capabilities is expected to surge. DigitalBridge's strategic investment in Yondr positions both companies to play a crucial role in shaping the future of digital infrastructure and meeting the evolving needs of technology giants and businesses worldwide.

References

Summarized by

Navi

[1]

Related Stories

SoftBank acquires DigitalBridge for $4 billion to secure critical AI data center infrastructure

29 Dec 2025•Business and Economy

SoftBank in talks to acquire DigitalBridge as AI infrastructure demand drives $6.7 trillion market

06 Dec 2025•Business and Economy

Tech Giants and Investment Firms Join Forces in $40 Billion AI Data Center Acquisition

15 Oct 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology