Elon Musk's xAI Reports $1.46 Billion Quarterly Loss While Racing to Power Optimus Robots

7 Sources

7 Sources

[1]

Musk's xAI Reports Wider Quarterly Loss, Plans to Power Optimus

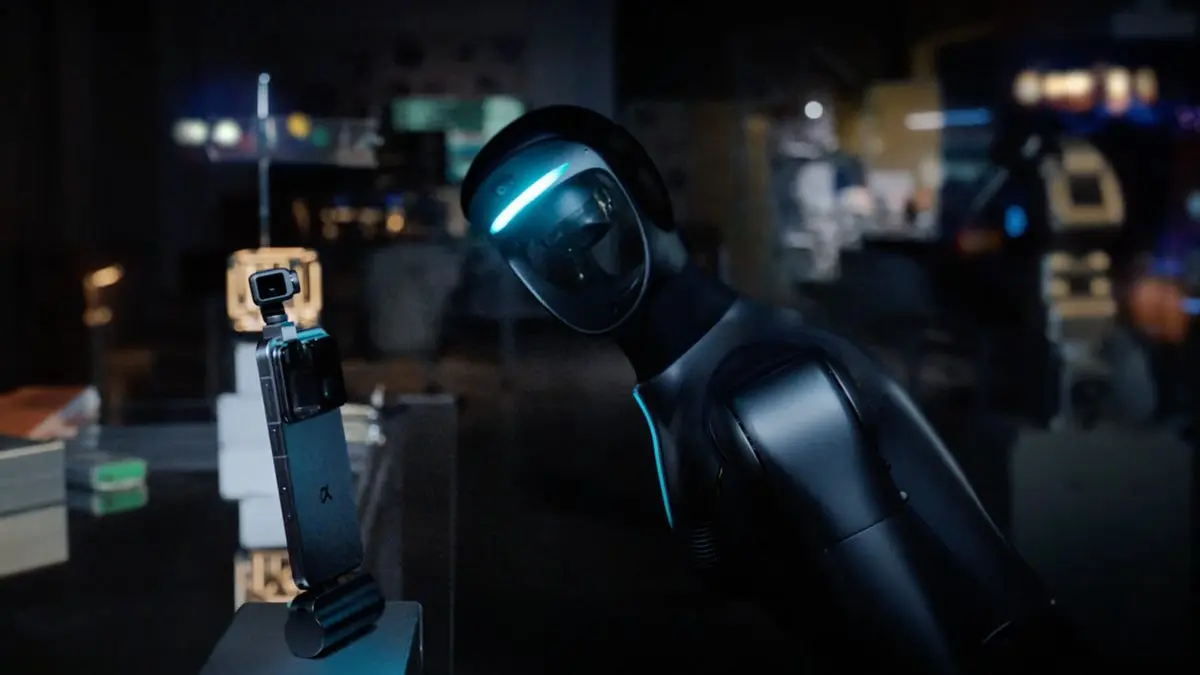

Elon Musk's artificial intelligence startup xAI is burning cash quickly, with losses mounting as it spends to build data centers, recruit talent and develop software that will eventually power humanoid robots, according to internal documents. XAI reported a net loss of $1.46 billion for the September quarter, up from $1 billion in the first quarter, the documents reviewed by Bloomberg show. In the first nine months of the year, it spent $7.8 billion in cash. Like other fast-growing AI startups, xAI is quickly using what it raised in recent funding rounds, it said in its most recent earnings report and a call that xAI executives held with investors, according to people familiar with the matter. The company told investors that its goal is to build AI that is self-sufficient and that will eventually power humanoid robots like Optimus -- Tesla Inc.'s robot that was created to replace human labor. On the investor call, xAI leadership, including Chief Revenue Officer Jon Shulkin, told investors that now xAI's core focus is building out AI agents and other software at speed, said the people, who asked not to be identified discussing private conversations. Those products will feed into what's called "Macrohard" -- a term Musk has said refers to an AI-only software company, the name a play on "Microsoft" -- until it eventually can power Optimus. The firm's executives signaled to investors that xAI had the necessary resources to continue spending aggressively. Documents referred to the rapid growth of AI as "escape velocity" -- a term borrowed from astrodynamics and often used by Musk to talk about how quickly his companies, including Space Exploration Technologies, can grow. XAI revenue nearly doubled quarter-over-quarter to $107 million for the three month period ended Sept. 30, 2025, according to financial documents shared with investors and reviewed by Bloomberg. A representative for xAI declined to comment. While Musk runs several separate businesses and projects, he frequently intertwines their purposes and resources. Grok, xAI's chat bot, has been fully integrated into X, the social network formerly known as Twitter, and is also available in Tesla vehicles. SpaceX, Musk's rocket company, has already invested in xAI, which in turn has spent hundreds of millions on Tesla Megapack batteries. While Musk has talked about the potential benefits of formally linking xAI and Tesla, the automaker is not currently an xAI investor. Tesla shareholders voted in November on whether the company should invest in xAI -- an idea Musk has supported -- but the non-binding proposal did not receive enough votes to pass. Tesla's board is considering next steps, General Counsel Brandon Ehrhart said at the time. For now, xAI Holdings, the parent company of both xAI and X, is focused on raising money to keep up with its large expenses. It recently closed a $20 billion equity round from investors, including Nvidia Corp., Valor Equity Partners and the Qatar Investment Authority, which valued the company at $230 billion. That cash will presumably power the company for the next year or more, as it is still spending under $1 billion per month on investments, according to people familiar with the firm's finances. XAI used almost $8 billion in cash on investments through the first nine months of 2025, financial documents show. XAI has been raising both equity and debt. The firm has worked with Valor and Apollo Global Management on a special purpose vehicle to buy Nvidia Corp. chips, and it expects to do more deals soon to keep building out its Colossus data center site in Memphis, Tennessee. The firm is already planning an expansion of the Memphis complex, and recently purchased a third building in the area that will bring the company's computing capacity to almost 2 gigawatts, Musk said late last year. Get the Tech Newsletter bundle. Get the Tech Newsletter bundle. Get the Tech Newsletter bundle. Bloomberg's subscriber-only tech newsletters, and full access to all the articles they feature. Bloomberg's subscriber-only tech newsletters, and full access to all the articles they feature. Bloomberg's subscriber-only tech newsletters, and full access to all the articles they feature. Bloomberg may send me offers and promotions. Plus Signed UpPlus Sign UpPlus Sign Up By submitting my information, I agree to the Privacy Policy and Terms of Service. The xAI call with investors offered a chance to hear from newly-appointed leadership at the company. Anthony Armstrong, a former Morgan Stanley banker, joined xAI and X as Chief Financial Officer in the fall, while Shulkin, a partner at Valor Equity, also took a new role at xAI late last year, people familiar with the company said. Armstrong and Shulkin did not immediately respond to requests for comment. Mike Liberatore, xAI's prior CFO, resigned from the firm last fall after just three months. On the investor call, xAI executives were optimistic about the firm's results, highlighting the revenue growth. Still, it may not meet its annual goal. In June, the firm told investors it hoped for $500 million in revenue for the year. Through September, xAI reported over $200 million in sales. The company's gross profit has increased, though, and xAI reported $63 million in gross profit during the third quarter, up from just $14 million in the prior quarter, the documents show. Despite this, xAI's losses continue to grow. Ebitda -- earnings before interest, taxes, depreciation and amortization -- were negative. The company reported an ebitda loss of $2.4 billion through September, indicating its earnings have yet to make up for its expenses. That's not uncommon for startups, which often require a lot of cash to grow and take time to turn a profit. Still, xAI's losses were more than initially expected; the firm previously projected an ebitda loss of $2.2 billion for the full year, Bloomberg previously reported. XAI has not yet disclosed to investors the end-of-year results, which executives said had been positive. XAI has raised at least $40 billion in equity to date, including the latest $20 billion round that the firm announced earlier this month. The company paid almost $160 million in stock-based compensation through September, a reflection of the AI talent wars heating up.

[2]

Elon Musk's AI startup is losing billions - and building something huge

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. Bottom line: Elon Musk's artificial intelligence company, xAI, is investing billions of dollars to secure computing power and engineering talent as it accelerates development of software intended to power future humanoid robots. Newly reviewed financial documents obtained by Bloomberg show that the company's rapid expansion is generating heavy losses, but also sharp revenue gains and increasingly ambitious technical goals. For the September 2025 quarter, xAI reported a net loss of $1.46 billion, up from $1 billion earlier in the year. The company burned through $7.8 billion in cash during the first nine months alone, driven by heavy spending on data centers, Nvidia GPU purchases, and compensation tied to AI talent recruitment. Despite the red ink, xAI nearly doubled its quarterly revenue to $107 million. Executives told investors that xAI's current priority is deploying resources toward advanced AI agents and the supporting software infrastructure under an internal initiative known as Macrohard. The project, described as an AI-only software platform, is expected to underpin what Musk envisions as a self-sufficient intelligence system - one that could eventually control humanoid robots such as Tesla's Optimus. That ambition hinges on compute scale. xAI has invested hundreds of millions of dollars into its Colossus data center complex in Memphis, Tennessee, which runs on Tesla Megapack batteries and uses Nvidia-based hardware clusters. The facility is being expanded across three buildings, pushing its computing capacity close to 2 gigawatts, making it one of the largest private AI sites currently under construction worldwide. The company is working with partners including Valor Equity Partners, Apollo Global Management, and Nvidia to fund and provision its infrastructure through structured financing arrangements. The Memphis buildout is central to the firm's plan to reach what internal documents call "escape velocity" - Musk's recurring term for ventures that achieve rapid, self-sustaining growth once scaling begins. According to people familiar with the company's operations, xAI's monthly outlay remains below $1 billion, giving it roughly a year of runway based on its most recent cash infusion. That cushion follows a $20 billion equity round that closed in early 2026, backed by Nvidia, Valor, and the Qatar Investment Authority, and valuing xAI at $230 billion. The company has now raised more than $40 billion in total equity since its founding. Internally, Musk has aligned xAI's technology roadmap with his broader corporate ecosystem. The firm's chatbot, Grok - powered by xAI's models - is integrated into X and Tesla vehicles. SpaceX has also invested in xAI, while Tesla's potential participation remains unresolved. A proposal for the automaker to take a stake in xAI failed to win shareholder approval last November, though Tesla's board continues to explore alternative options. Financial filings show that xAI recorded $63 million in gross profit in the September quarter, up sharply from $14 million in the prior quarter, even as its EBITDA loss widened to $2.4 billion through September. The company had previously projected a $2.2 billion loss for the full year. That surge reflects both mounting infrastructure costs and an aggressive hiring strategy, with nearly $160 million paid out in stock-based compensation through the third quarter of 2025. xAI has yet to disclose its full-year results, which executives have privately described as "positive." With deep capital reserves and an expanding partnership pipeline, the company appears positioned to sustain rapid expansion through 2026 as it seeks to evolve from a chatbot developer into a vertically integrated intelligence platform.

[3]

Elon's xAI Is Losing Staggering Amounts of Money

Executives told investors they still have enough money to "continue spending aggressively." Elon Musk constructed his personal mythology around a pair of weighty accomplishments: building actual, stable businesses around both rockets and electric cars. So far, he has yet to accomplish the same thing around his AI business. According to documents obtained by Bloomberg, xAI recorded a net loss of $1.46 billion over the third quarter of 2025. That's an even worse loss than previous months -- in the first quarter of 2025, for example, the company's net loss was roughly $1 billion, and it's shredded $7.8 billion in cash over the last year, according to documents obtained by the publication. It's in good company. Every major AI company is currently losing money hand over fist on the tech. Like its peers, xAI insists that pattern is temporary; per Bloomberg, its executives told investors in a recent earnings call that the company has the resources to "continue spending aggressively." Eventually, they promised, the company will build "self-sufficient AI" that can power Tesla's Optimus robots. Like xAI, Tesla's stuttering Optimus program is eons away from ever turning a profit -- or even from hitting the market, for that matter. The financial news comes as xAI announces plans to build yet another massive data center, this time in Southaven, Mississippi. With a price tag of $20 billion, it would be the largest private investment in the state's history -- and like previous xAI data centers in Memphis, Tennessee, it will no doubt be a massive headache for its unfortunate neighbors.

[4]

Elon Musk's xAI quarterly net loss widens to $1.46 billion: Bloomberg

Elon Musk's AI firm xAI posted a net loss of $1.46 billion for the September quarter, despite revenue almost doubling to $107 million, according to a report by Bloomberg. However, when contacted by Reuters for comment, xAI replied with the message, "Legacy Media Lies." This comes as xAI announced a $20 billion funding round to expand its AI capabilities. Elon Musk's artificial intelligence startup xAI reported a net loss of $1.46 billion for the September quarter, compared with a loss of $1 billion in the previous three months, Bloomberg News reported on Thursday, citing internal documents. Revenue nearly doubled sequentially to $107 million in the period ended September 30, 2025, the report added. Reuters could not immediately verify the report. When contacted by Reuters for comment, xAI replied with the message, "Legacy Media Lies." The AI startup also spent $7.8 billion in cash in the first nine months of the year, according to the report. Startups in the AI space typically burn through huge amounts of cash, with billions poured into acquiring pricey, advanced data center hardware and attracting top generative AI researchers. This week, xAI said it raised $20 billion in an upsized Series E funding round, exceeding its $15 billion target as it ramps up development of new AI models and computing infrastructure.

[5]

Elon Musk's xAI Is Spending Nearly $1 Billion A Month As AI Ambitions Outpace Revenue, Internal Documents Show: Report - Cisco Systems (NASDAQ:CSCO), NVIDIA (NASDAQ:NVDA)

Elon Musk's AI venture xAI is reportedly amassing significant losses as it spends on infrastructure, talent and software. xAI Losses Mount As Spending Accelerates Grok-parent xAI reported a net loss of $1.46 billion in the September quarter, reported Bloomberg on Thursday, citing internal financial documents. This is up from about $1 billion in the first quarter. In fact, in the first nine months of 2025, the AI startup spent $7.8 billion in cash. This comes despite xAI generating $107 million in revenue for the three months ended on Sept. 30. xAI is currently spending just under $1 billion a month on investments, the report noted, citing people familiar with the company's finances. xAI did not immediately respond to Benzinga's request for comments. Fresh Funding Keeps xAI Running Earlier this week, xAI announced that it has closed a $20 billion equity raise, valuing the startup at $230 billion. The investors in this Series E round included Nvidia Corp (NASDAQ:NVDA), Cisco Investments (NASDAQ:CSCO), Fidelity, Valor Equity Partners, Stepstone Group (NASDAQ:STEP), Qatar Investment Authority, Abu Dhabi's MGX and Baron Capital Group. Benzinga Edge Stock Rankings place Nvidia in the 94th percentile for Growth and the 98th percentile for Quality, highlighting its standout performance compared to companies like Tesla and others. Photo Courtesy: gguy on Shutterstock.com CSCOCisco Systems Inc$73.980.03%OverviewNVDANVIDIA Corp$185.02-0.01%STEPStepStone Group Inc$71.06-%Market News and Data brought to you by Benzinga APIs

[6]

Musk's xAI Posts $1.46 Billion Quarterly Loss as it Expands Data Centers and AI Software

The same documents showed a $1 billion loss in the prior quarter, as spending rose faster than sales. xAI also used large sums to build data centers and hire staff. Internal figures said xAI spent $7.8 billion in cash during the first nine months of 2025. The outlays covered servers, power equipment, real estate, and engineering teams. Documents described rapid scaling as an "escape velocity" push toward larger models and agent tools. The company also discussed software that could support humanoid robots over time. Meanwhile, executives signaled resources for continued heavy investment through 2026 globally. often face high upfront costs, especially for high-end GPUs and networking gear. However, the scale of xAI's spending showed an aggressive build schedule. The documents also reported stock-based compensation of nearly $160 million through September. That figure reflected intense competition for AI researchers and product leaders. Management changes also continued during the year, according to people familiar with the company. The reports said a new chief financial officer joined in the fall.

[7]

Musk's xAI quarterly net loss widens to $1.46 billion, Bloomberg News reports

Jan 8 (Reuters) - Elon Musk's artificial intelligence startup xAI reported a net loss of $1.46 billion for the September quarter, compared with a loss of $1 billion in the previous three months, Bloomberg News reported on Thursday, citing internal documents. Revenue nearly doubled sequentially to $107 million in the period ended September 30, 2025, the report added. Reuters could not immediately verify the report. When contacted by Reuters for comment, xAI replied with the message, "Legacy Media Lies." The AI startup also spent $7.8 billion in cash in the first nine months of the year, according to the report. Startups in the AI space typically burn through huge amounts of cash, with billions poured into acquiring pricey, advanced data center hardware and attracting top generative AI researchers. This week, xAI said it raised $20 billion in an upsized Series E funding round, exceeding its $15 billion target as it ramps up development of new AI models and computing infrastructure. (Reporting by Anusha Shah in Bengaluru; Editing by Alan Barona)

Share

Share

Copy Link

Elon Musk's AI startup xAI burned through $1.46 billion in the September quarter, up from $1 billion earlier in 2025, as it pours resources into data centers, talent, and software development. Despite mounting losses, the company nearly doubled its revenue to $107 million and raised $20 billion in fresh funding to fuel its ambitious plan to build self-sufficient AI that will eventually power Tesla's Optimus humanoid robots.

xAI Reports Widening Quarterly Loss Amid Aggressive Expansion

Elon Musk's AI startup xAI reported a net loss of $1.46 billion for the September quarter, marking a significant increase from the $1 billion loss recorded in the first quarter of 2025, according to internal financial documents reviewed by Bloomberg

1

. The company spent $7.8 billion in cash during the first nine months of the year, with monthly spending approaching $1 billion as it races to build the infrastructure and technology needed to compete in the AI race2

.Despite the mounting quarterly loss, xAI's revenue nearly doubled quarter-over-quarter to $107 million for the three-month period ended September 30, 2025

1

. The company recorded $63 million in gross profit in the September quarter, up sharply from $14 million in the prior quarter, even as its EBITDA loss widened to $2.4 billion through September2

. This pattern mirrors the broader AI industry, where startups typically burn through massive amounts of cash while building their capabilities.Ambitious Plans to Power Humanoid Robots Drive Spending

On a recent investor call, xAI leadership told investors that the company's core focus is building out AI agents and other software at speed, with these products feeding into what's called "Macrohard" - a term Elon Musk uses to refer to an AI-only software company, a play on "Microsoft"

1

. The ultimate goal is to build AI that is self-sufficient and will eventually power humanoid robots like Optimus, Tesla's robot created to replace human labor1

.The firm's executives signaled to investors that xAI had the necessary resources to continue aggressive spending, referring to the rapid growth of AI as "escape velocity" - a term borrowed from astrodynamics and frequently used by Musk to describe how quickly his companies can scale

1

. Chief Revenue Officer Jon Shulkin and newly-appointed Chief Financial Officer Anthony Armstrong, a former Morgan Stanley banker, led the investor discussions1

.Massive Investments in Data Centers and Computing Infrastructure

The bulk of xAI's spending has gone toward building computing infrastructure, particularly its Colossus data center complex in Memphis, Tennessee. The company has invested hundreds of millions of dollars into the facility, which runs on Tesla Megapack batteries and uses Nvidia-based hardware clusters

2

. The Memphis site is being expanded across three buildings, pushing its computing capacity close to 2 gigawatts, making it one of the largest private AI sites currently under construction worldwide2

.xAI has worked with Valor Equity Partners and Apollo Global Management on a special purpose vehicle to buy Nvidia chips, and expects to do more deals soon to keep building out the Colossus facility

1

. The company also announced plans to build another massive data center in Southaven, Mississippi, with a price tag of $20 billion, which would be the largest private investment in the state's history3

.Fresh Funding Provides Runway for Continued Expansion

xAI recently closed a $20 billion equity round from investors including Nvidia, Valor Equity Partners, and the Qatar Investment Authority, which valued the company at $230 billion

1

. This Series E funding round exceeded the company's initial $15 billion target and brings total equity raised to more than $40 billion since its founding2

. Other investors in the round included Cisco Investments, Fidelity, Stepstone Group, Abu Dhabi's MGX, and Baron Capital Group5

.With monthly spending remaining below $1 billion, the fresh cash infusion gives xAI roughly a year of runway based on current burn rates, according to people familiar with the company's finances

2

. The company has also been raising debt alongside equity, working with partners to fund and provision its infrastructure through structured financing arrangements2

.Related Stories

Grok Chatbot Integration Across Musk's Ecosystem

While Musk runs several separate businesses, he frequently intertwines their purposes and resources. Grok, xAI's chatbot, has been fully integrated into X, the social network formerly known as Twitter, and is also available in Tesla vehicles

1

. SpaceX, Musk's rocket company, has already invested in xAI, which in turn has spent hundreds of millions on Tesla Megapack batteries1

.However, Tesla is not currently an xAI investor. Tesla shareholders voted in November on whether the company should invest in xAI - an idea Musk has supported - but the non-binding proposal did not receive enough votes to pass

1

. Tesla's board is considering next steps, according to General Counsel Brandon Ehrhart1

.Talent Acquisition Drives Compensation Costs

The aggressive spending extends beyond physical infrastructure to talent acquisition. Financial filings show that nearly $160 million was paid out in stock-based compensation through the third quarter of 2025, reflecting an aggressive hiring strategy to attract top generative AI researchers

2

. Like other AI startups, xAI faces intense competition for engineering talent as the industry races to develop more advanced AI capabilities.The cash burn rate and mounting losses place xAI in the same category as other major AI companies, all of which are currently losing money as they invest heavily in the technology

3

. The bet is that these investments will eventually pay off as AI capabilities mature and find commercial applications, particularly in robotics and autonomous systems. For xAI, the path to profitability runs through building self-sufficient AI systems that can control humanoid robots - a market that remains years away from maturity but could transform industries if successful.References

Summarized by

Navi

[3]

Related Stories

Elon Musk's xAI Seeks $4.3 Billion in Equity Funding Amid Soaring Expenses

18 Jun 2025•Business and Economy

Elon Musk's xAI Seeks $15 Billion Funding Round at $230 Billion Valuation

13 Nov 2025•Business and Economy

Elon Musk's xAI Secures $6 Billion in Funding, Accelerating AI Race

06 Dec 2024•Technology

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Pentagon Summons Anthropic CEO as $200M Contract Faces Supply Chain Risk Over AI Restrictions

Policy and Regulation

3

Canada Summons OpenAI Executives After ChatGPT User Became Mass Shooting Suspect

Policy and Regulation