EQT Welcomes Sixth Street as Strategic Investor in EdgeConneX

3 Sources

3 Sources

[1]

EQT Sells Minority Stake in EdgeConneX to Sixth Street

The deal is expected to close by Q4 2024, pending regulatory approvals. EQT Infrastructure has agreed to sell a minority stake in data center operator EdgeConneX to funds managed by investment firm Sixth Street. EQT Infrastructure, which first invested in EdgeConneX in 2020, will remain the largest shareholder after the deal closes, expected in Q4 2024. Also Read: EdgeConneX Secures USD 1.9 Billion in Sustainability-Linked Financing for EMEA Expansion EdgeConneX, known for its energy-efficient data centers optimised for AI and cloud deployments, has tripled its capacity since 2020 and expanded into Asia, Latin America, and new European markets. The company now operates or is developing 80 data centers in over 50 global markets across North America, Europe, APAC and South America, according to the official release. The deal brings Sixth Street on board as a strategic partner to accelerate EdgeConneX's growth in meeting the rising demand for data center capacity, driven by AI and cloud computing, the companies said in a joint statement this week. "With this transaction, EQT believes EdgeConneX is well-equipped to deliver scalable, high-performance data center solutions that will power the next generation of AI," said a Partner at EQT Infrastructure. "As AI continues to drive significant changes and create new opportunities across industries, EQT remains committed to being at the forefront of developing the required datacenter, connectivity and energy infrastructure needed for AI and to ensuring that EdgeConneX and our partners across EQT Infrastructure will continue to capitalise on this powerful industry tailwind." Also Read: EdgeConneX and TA Realty to Develop 324 MW Hyperscale Data Center Campus in Atlanta Sixth Street's investment is a result of cross-platform collaboration between the firm's dedicated digital infrastructure and global real estate platform, the official release said. The transaction is subject to regulatory approvals and standard closing conditions.

[2]

EQT Welcomes Sixth Street as Strategic Investor in EdgeConneX By Investing.com

NEW YORK, Sept. 24, 2024 /PRNewswire/ -- EQT (ST:EQTAB) and Sixth Street are pleased to announce that the EQT Infrastructure IV and EQT Infrastructure V funds ("EQT Infrastructure") have signed an agreement to sell a minority stake in EdgeConneX to funds managed by Sixth Street. Having been invested in the company since 2020, EQT Infrastructure will remain the largest shareholder following the closing of the transaction. EdgeConneX is a leading global provider of data center capacity focused on energy-efficient and sustainable designs optimized for AI and large-scale cloud deployments. Since 2020, EdgeConneX has more than tripled its built data center capacity and expanded its reach into , and new European markets. Today, EdgeConneX has a global footprint of 80 data centers in operation or development in more than 50 markets across , , APAC and . The stake sale marks a strategic milestone in EdgeConneX's journey, welcoming a strategic partner to help accelerate the company's ability to deliver capacity and cutting-edge solutions to its customers. "With this transaction, EQT believes EdgeConneX is well-equipped to deliver scalable, high-performance data center solutions that will power the next generation of AI," said , Partner within EQT Infrastructure's Advisory Team. "As AI continues to drive significant changes and create new opportunities across industries, EQT remains committed to being at the forefront of developing the required datacenter, connectivity and energy infrastructure needed for AI and to ensuring that EdgeConneX and our partners across EQT Infrastructure will continue to capitalize on this powerful industry tailwind." investment is a result of cross-platform collaboration between the firm's dedicated digital infrastructure and global real estate platforms, which offer scaled capital solutions for companies and assets across their respective sectors. "We're pleased to bring our team's deep experience in digital infrastructure and real estate asset investing to this partnership and join EQT in supporting EdgeConneX's strategic growth," said , Co-Chief Investment Officer at . "EdgeConneX is well-positioned for future success with the scale, high-quality performance, and expanding capabilities required to meet the increasing global demand for data center capacity and services." The transaction is subject to customary conditions and approvals and is expected to close in Q4 2024. This information was brought to you by Cision http://news.cision.com https://news.cision.com/eqt/r/eqt-welcomes-sixth-street-as-strategic-investor-in-edgeconnex,c4041985

[3]

EQT Welcomes Sixth Street as Strategic Investor in EdgeConneX - EQT (NYSE:EQT)

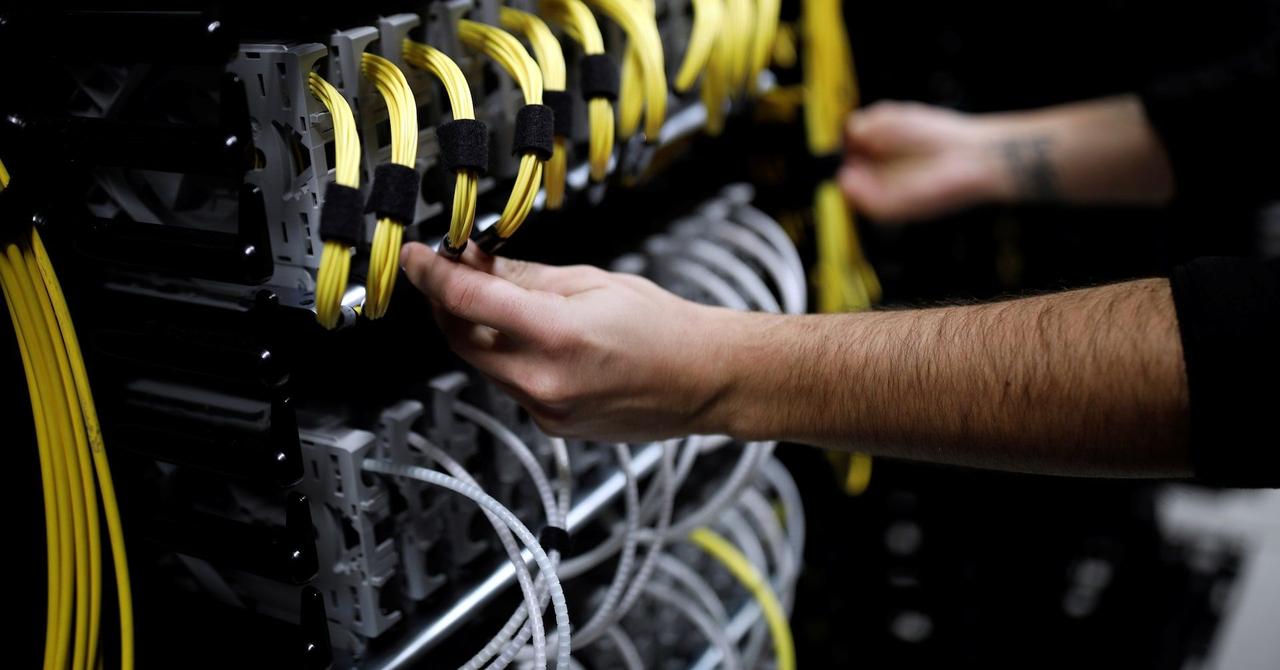

Sixth Street to acquire minority interest in EdgeConneXBroadened investor base adds new resources and expertise, supporting EdgeConneX's long-term ambition as a leading global data center and AI infrastructure provider NEW YORK, Sept. 24, 2024 /PRNewswire/ -- EQT and Sixth Street are pleased to announce that the EQT Infrastructure IV and EQT Infrastructure V funds ("EQT Infrastructure") have signed an agreement to sell a minority stake in EdgeConneX to funds managed by Sixth Street. Having been invested in the company since 2020, EQT Infrastructure will remain the largest shareholder following the closing of the transaction. EdgeConneX is a leading global provider of data center capacity focused on energy-efficient and sustainable designs optimized for AI and large-scale cloud deployments. Since 2020, EdgeConneX has more than tripled its built data center capacity and expanded its reach into Asia, Latin America and new European markets. Today, EdgeConneX has a global footprint of 80 data centers in operation or development in more than 50 markets across North America, Europe, APAC and South America. The stake sale marks a strategic milestone in EdgeConneX's journey, welcoming a strategic partner to help accelerate the company's ability to deliver capacity and cutting-edge solutions to its customers. "With this transaction, EQT believes EdgeConneX is well-equipped to deliver scalable, high-performance data center solutions that will power the next generation of AI," said Jan Vesely, Partner within EQT Infrastructure's Advisory Team. "As AI continues to drive significant changes and create new opportunities across industries, EQT remains committed to being at the forefront of developing the required datacenter, connectivity and energy infrastructure needed for AI and to ensuring that EdgeConneX and our partners across EQT Infrastructure will continue to capitalize on this powerful industry tailwind." Sixth Street's investment is a result of cross-platform collaboration between the firm's dedicated digital infrastructure and global real estate platforms, which offer scaled capital solutions for companies and assets across their respective sectors. "We're pleased to bring our team's deep experience in digital infrastructure and real estate asset investing to this partnership and join EQT in supporting EdgeConneX's strategic growth," said Julian Salisbury, Co-Chief Investment Officer at Sixth Street. "EdgeConneX is well-positioned for future success with the scale, high-quality performance, and expanding capabilities required to meet the increasing global demand for data center capacity and services." The transaction is subject to customary conditions and approvals and is expected to close in Q4 2024. Morgan Stanley & Co. LLC served as lead financial advisor, Goldman Sachs served as financial advisor and Simpson Thacher & Bartlett provided legal counsel to EQT Infrastructure. Centerview Partners LLC served as exclusive financial advisor and Debevoise & Plimpton provided legal counsel to Sixth Street. Contact EQT Press Office, [email protected] Sixth Street Press Office, [email protected] This information was brought to you by Cision http://news.cision.com https://news.cision.com/eqt/r/eqt-welcomes-sixth-street-as-strategic-investor-in-edgeconnex,c4041985 The following files are available for download: https://mb.cision.com/Main/87/4041985/3017133.pdf Press Release_Infra IV, Infra V, EdgeConneX, 242409 https://news.cision.com/eqt/i/ecx-everest-image,c3336515 ECX Everest Image View original content:https://www.prnewswire.com/news-releases/eqt-welcomes-sixth-street-as-strategic-investor-in-edgeconnex-302256953.html SOURCE EQT Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

EQT, a global investment firm, has sold a significant stake in EdgeConneX to Sixth Street, a leading global investment firm. This strategic move aims to accelerate EdgeConneX's growth in the data center industry.

EQT Sells Stake in EdgeConneX to Sixth Street

EQT, a global investment organization, has announced the sale of a significant stake in EdgeConneX, a leading global data center developer and operator, to Sixth Street, a prominent global investment firm

1

. This strategic transaction marks a pivotal moment in the data center industry, as it brings together two powerhouse investors to fuel EdgeConneX's continued growth and expansion.EdgeConneX: A Leader in Data Center Solutions

EdgeConneX has established itself as a key player in the data center sector, providing cutting-edge solutions for cloud, content, network, and other service providers

2

. The company's innovative approach to data center development and operations has positioned it at the forefront of the industry, catering to the ever-increasing demand for digital infrastructure.Strategic Partnership for Accelerated Growth

The partnership between EQT and Sixth Street is expected to propel EdgeConneX's growth trajectory. By leveraging Sixth Street's extensive investment experience and financial resources, EdgeConneX aims to expand its global footprint and enhance its service offerings

3

.EQT's Continued Commitment

Despite the sale of a significant stake, EQT will remain a major shareholder in EdgeConneX. This decision underscores EQT's confidence in the company's future prospects and its commitment to supporting EdgeConneX's long-term success

2

.Related Stories

Impact on the Data Center Industry

This strategic investment is likely to have far-reaching implications for the data center industry. As EdgeConneX gains access to additional resources and expertise, it is well-positioned to drive innovation and meet the growing demand for data center services globally

1

.Future Outlook

With the combined strengths of EQT and Sixth Street, EdgeConneX is poised for significant expansion. The company is expected to accelerate its development of new data center facilities, enhance its technological capabilities, and explore emerging markets

3

.As the digital landscape continues to evolve rapidly, this strategic partnership between EQT, Sixth Street, and EdgeConneX is set to play a crucial role in shaping the future of data center infrastructure and services worldwide.

References

Summarized by

Navi

[1]

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research