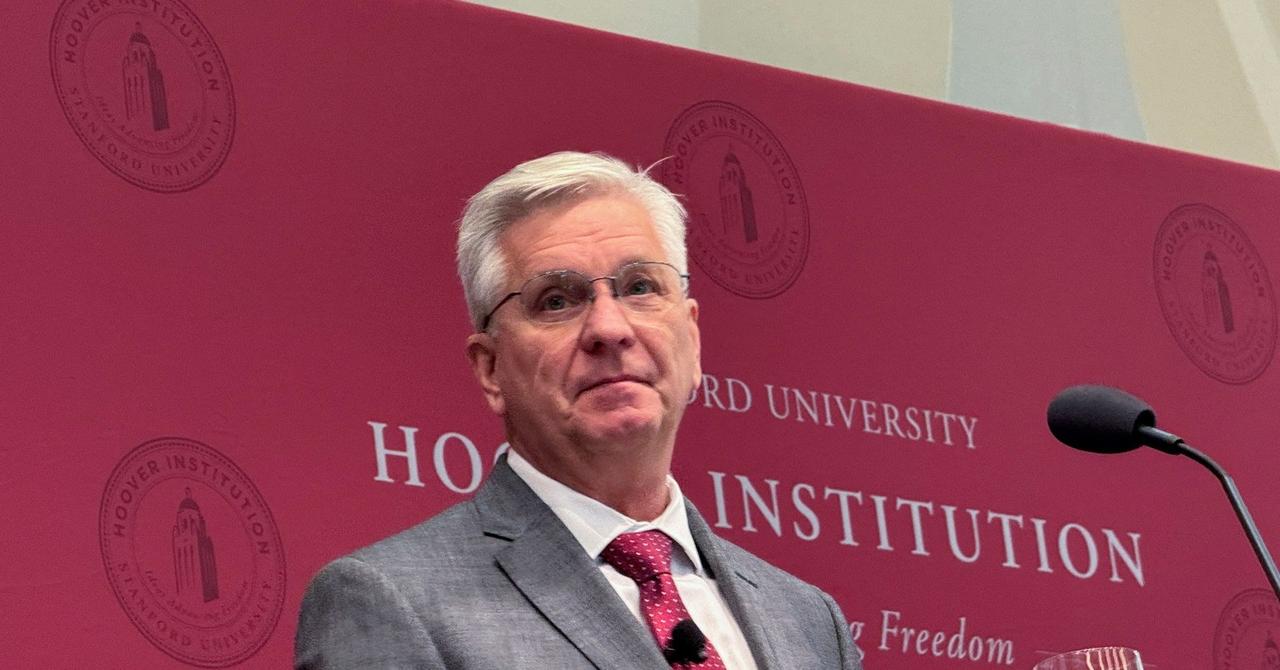

Fed Governor Barr: AI and Fintech Collaboration to Reshape Banking Landscape

3 Sources

3 Sources

[1]

Fed's Barr Sees Banks Pushed to Adopt AI Faster by Fintech Firms

US Federal Reserve Governor Michael Barr said bank regulators will have to adjust their guardrails as competition from fintech companies pushes lenders toward greater use of artificial intelligence. "That's not a zero-sum game," Barr said in prepared remarks for a fintech conference hosted on Friday by the San Francisco Fed. "It's an opportunity for all stakeholders -- banks, fintechs, regulators and consumer -- to help to set the foundation for the benefits of the technology to be achieved and the risks to be effectively managed."

[2]

Fed Governor Michael Barr: Bank-FinTech Relationships Will Drive GenAI Adoption | PYMNTS.com

Bank-FinTech relationships are likely to drive the integration of GenAI into banking, Federal Reserve Governor Michael S. Barr said Friday (April 4). The integration and innovation will be driven by both competition and cooperation, Barr said in a speech prepared for delivery at the Federal Reserve Bank of San Francisco. "As GenAI technology continues to develop, there's a good chance that FinTechs will help drive widespread GenAI adoption in financial services," Barr said. FinTechs can generally integrate the latest AI capabilities because they don't have old infrastructure into which they would have to integrate it, they have financial and time constraints that drive them to use cutting-edge technology for quick solutions, and they have a single product for which they can optimize their tech stack, Barr said. "These attributes of FinTechs can make them symbiotic with banks," Barr said. Banks have the deep customer data needed for large language models (LLMs), the ability to look across a range of business lines, and the customer relationships and control frameworks that support credibility and trust, Barr said. The qualities of FinTechs and banks mean that they may form collaborative partnerships that bring together their strengths, or they may compete in a way that drives banks to adopt GenAI applications more quickly, Barr said. In either case, as GenAI begins to enter the regulated sector, bank risk managers and regulators must become familiar with the technology so that they are ready for its arrival, Barr said. "These changes will require broad-based curiosity from regulators, FinTechs and banks -- combined with education and investment -- to create a culture of awareness on the opportunity and risks of the technology," Barr said. "Equally as important is leadership, to establish appropriate governance over AI and provide appropriate direction on priorities." While AI tools have the potential to revolutionize the financial industry, banks face significant hurdles in effectively integrating these tools into their systems, according to the PYMNTS Intelligence and NCR Voyix collaboration, "Is AI the Master Key to Banking's Next Era?" The report also found that banks can drive innovation and facilitate AI adoption by forming alliances with FinTech companies.

[3]

Fed's Barr discusses AI and fintech role in banking By Investing.com

Investing.com -- Federal Reserve Governor Michael S. Barr shed light on the evolving relationship between artificial intelligence (AI), fintech companies, and banks during his address at the Federal Reserve Bank of San Francisco. Barr emphasized the potential of generative artificial intelligence (Gen AI) in banking and how partnerships between banks and fintech firms could expedite the integration of this technology. According to the governor, banks have been cautious about utilizing Gen AI due to the current state of the technology and the highly regulated environment of banking. However, he pointed out that Gen AI holds significant potential to transform banking, provided that associated risks are managed appropriately. Barr suggested that the increasing advancements in Gen AI could soon make it a competitive necessity in the banking sector. Barr mentioned that fintech companies are well-positioned to integrate Gen AI into their products and services. Banks, possessing valuable customer behavior data, can optimize Gen AI models. He argued that competition and cooperation between banks and fintechs could stimulate innovation and hasten the integration of Gen AI into banking. The governor also highlighted the potential benefits of Gen AI for consumers and businesses, such as improved, cheaper, and faster financial services. However, he stressed the importance of banks, fintechs, and regulators playing their parts in ensuring that the risks associated with Gen AI are managed. Barr further elaborated on the reasons why Gen AI has not been widely integrated into banking yet. He cited factors such as the technology's immaturity, concerns about information security, and the lack of business processes at banks optimized for Gen AI usage. Despite these challenges, Barr expressed optimism that these are surmountable issues. The governor also discussed the role of fintech companies in driving Gen AI adoption in financial services. He noted that fintech firms, being younger companies with a clean tech stack, can integrate new technology more easily into their infrastructure. These firms also have financial and time constraints that drive them to find effective, quick solutions, often involving innovative uses of cutting-edge technology. Barr concluded his address by emphasizing the shared responsibility of banks, fintechs, and regulators in managing Gen AI risks. He stressed the importance of understanding the technology, reviewing and updating existing standards on model risk management, and exploring ways to deploy the technology. He underlined the need for curiosity, education, investment, and leadership from all stakeholders to ensure the benefits of Gen AI are realized and the risks are effectively managed.

Share

Share

Copy Link

Federal Reserve Governor Michael Barr discusses the potential impact of generative AI on banking, highlighting the role of fintech companies in driving innovation and the need for collaboration between banks, fintechs, and regulators.

Federal Reserve Governor Highlights AI's Role in Banking

Federal Reserve Governor Michael S. Barr has shed light on the evolving relationship between artificial intelligence (AI), fintech companies, and traditional banks in a recent address at the Federal Reserve Bank of San Francisco. Barr emphasized the transformative potential of generative AI (GenAI) in the banking sector and how partnerships between banks and fintech firms could accelerate the integration of this technology

1

2

.The Potential of GenAI in Banking

According to Barr, while banks have been cautious about adopting GenAI due to regulatory constraints and the current state of technology, the potential benefits are significant. He suggested that as GenAI advances, it could soon become a competitive necessity in the banking sector

3

. The governor highlighted several potential advantages of GenAI for consumers and businesses:- Improved financial services

- Cost reduction

- Faster service delivery

However, Barr stressed the importance of effective risk management in the deployment of GenAI technologies

2

.Fintech Companies as Drivers of Innovation

Barr pointed out that fintech companies are well-positioned to integrate GenAI into their products and services. He cited several reasons for this advantage:

- Younger companies with clean tech stacks can more easily integrate new technologies

- Financial and time constraints drive them to find innovative, quick solutions

- Single product focus allows for optimized tech stacks

2

The governor suggested that these attributes make fintech companies "symbiotic with banks," potentially leading to collaborative partnerships that combine the strengths of both sectors

2

.Related Stories

Banks' Role in AI Adoption

While fintech companies may lead in technology integration, banks possess valuable assets that are crucial for AI development:

- Deep customer data necessary for large language models (LLMs)

- Ability to look across various business lines

- Established customer relationships and control frameworks that support credibility and trust

2

Barr emphasized that the relationship between banks and fintechs is not a zero-sum game. Instead, it presents an opportunity for all stakeholders to collaborate in setting the foundation for realizing the benefits of AI technology while effectively managing associated risks

1

.Regulatory Considerations and Future Outlook

As GenAI begins to enter the regulated banking sector, Barr stressed the need for bank risk managers and regulators to familiarize themselves with the technology. He called for:

- Broad-based curiosity from regulators, fintechs, and banks

- Education and investment in AI technologies

- Creation of a culture of awareness regarding opportunities and risks

- Strong leadership to establish appropriate governance over AI

2

Barr concluded by emphasizing the shared responsibility of banks, fintechs, and regulators in managing GenAI risks. He underlined the importance of understanding the technology, reviewing existing standards on model risk management, and exploring innovative ways to deploy AI in the financial sector

3

.References

Summarized by

Navi

[2]

[3]

Related Stories

Fed Governor Barr Outlines Two AI Economic Transformation Scenarios at Singapore FinTech Festival

12 Nov 2025•Business and Economy

AI Revolutionizes Banking: Enhancing Customer Experience and Risk Management

07 May 2025•Business and Economy

Federal Reserve deploys AI cautiously with system-wide platform, says Christopher Waller

25 Feb 2026•Technology

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation