Fermi, AI-Focused Data Center Builder, Files for US IPO Amid Market Enthusiasm

3 Sources

3 Sources

[1]

Data center builder Fermi files for US IPO as new listings accelerate - The Economic Times

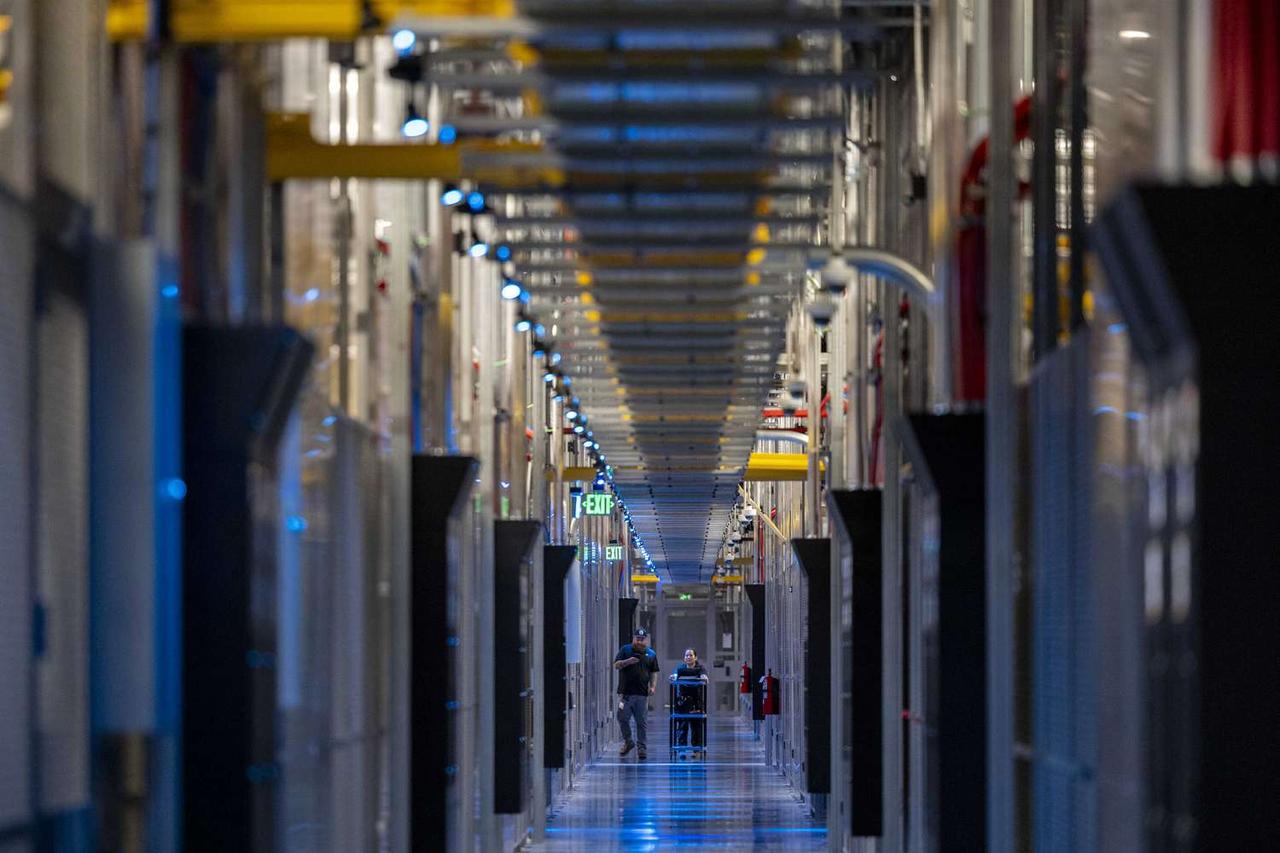

Fermi in June announced plans to build the world's largest energy and data complex, powered by nuclear along with natural gas and solar, to meet the rising energy demands of artificial intelligence.Fermi, a Texas company co-founded by former US Energy Secretary Rick Perry, on Monday filed for an initial public offering in the United States, as companies rush to tap investor enthusiasm for new issues. The terms of the offering were not disclosed. Wall Street's IPO season is off to a strong start post-Labor Day, bouncing back from the August slowdown, with a busy calendar featuring big names like Swedish fintech Klarna and the Winklevoss twins' crypto exchange Gemini. Ticket reseller StubHub and cybersecurity firm Netskope also launched their roadshows on Monday, aiming to raise up to $851 million and $813 million, respectively. Fermi in June announced plans to build the world's largest energy and data complex, powered by nuclear along with natural gas and solar, to meet the rising energy demands of artificial intelligence. The announcement marks the first major nuclear investment since President Donald Trump issued executive orders in May to streamline the Nuclear Regulatory Commission's licensing process and accelerate deployment, supporting plans to increase US nuclear energy capacity from about 100 GW currently to 400 GW by 2050. Fermi said that the global generative AI market is expected to grow from $64 billion in 2023 to $457 billion by 2027, citing data from Bloomberg Intelligence. The company, which is pre-revenue till now, about nine months since its inception, closed a $100 million funding round last month led by Macquarie Group. UBS Investment Bank, Cantor, and Mizuho are among the book-running managers for the offering. Fermi has applied to list on the Nasdaq under the symbol "FRMI". The company also plans to apply to list on the main market of the London Stock Exchange.

[2]

Fermi IPO: FRMI initial public offering on Nasdaq. What do we know?

Fermi IPO on Nasdaq under symbol FRMI. It has been a busy IPO season for the US Stock Market. Fermi IPO was filed on NASDAQ under the ticker symbol FRMI. Fermi, a Texas company co-founded by former U.S. Energy Secretary Rick Perry, on Monday filed for an initial public offering in the United States, as companies rush to tap investor enthusiasm for new issues. The terms of the offering were not disclosed. Wall Street's IPO season is off to a strong start post-Labor Day, bouncing back from the August slowdown, with a busy calendar featuring big names like Swedish fintech Klarna and the Winklevoss twins' crypto exchange Gemini. Ticket reseller StubHub and cybersecurity firm Netskope also launched their roadshows on Monday, aiming to raise up to $851 million and $813 million, respectively. Fermi in June announced plans to build the world's largest energy and data complex, powered by nuclear along with natural gas and solar, to meet the rising energy demands of artificial intelligence. The announcement marks the first major nuclear investment since President Donald Trump issued executive orders in May to streamline the Nuclear Regulatory Commission's licensing process and accelerate deployment, supporting plans to increase U.S. nuclear energy capacity from about 100 GW currently to 400 GW by 2050. Fermi said that the global generative AI market is expected to grow from $64 billion in 2023 to $457 billion by 2027, citing data from Bloomberg Intelligence. The company, which is pre-revenue till now, about nine months since its inception, closed a $100 million funding round last month led by Macquarie Group. UBS Investment Bank, Cantor, and Mizuho are among the book-running managers for the offering. Fermi has applied to list on the Nasdaq under the symbol "FRMI". The company also plans to apply to list on the main market of the London Stock Exchange. Q1. What did Fermi announce? A1. Fermi in June announced plans to build the world's largest energy and data complex, powered by nuclear along with natural gas and solar, to meet the rising energy demands of artificial intelligence. The announcement marks the first major nuclear investment since President Donald Trump issued executive orders in May to streamline the Nuclear Regulatory Commission's licensing process and accelerate deployment, supporting plans to increase U.S. nuclear energy capacity from about 100 GW currently to 400 GW by 2050. Q2. What has Fermi said about global generative AI market? A2. Fermi said that the global generative AI market is expected to grow from $64 billion in 2023 to $457 billion by 2027, citing data from Bloomberg Intelligence.

[3]

Data center builder Fermi files for US IPO as new listings accelerate

(Reuters) - Fermi, a Texas company co-founded by former U.S. Energy Secretary Rick Perry, on Monday filed for an initial public offering in the United States, as companies rush to tap investor enthusiasm for new issues. The terms of the offering were not disclosed. Wall Street's IPO season is off to a strong start post-Labor Day, bouncing back from the August slowdown, with a busy calendar featuring big names like Swedish fintech Klarna and the Winklevoss twins' crypto exchange Gemini. Ticket reseller StubHub and cybersecurity firm Netskope also launched their roadshows on Monday, aiming to raise up to $851 million and $813 million, respectively. Fermi in June announced plans to build the world's largest energy and data complex, powered by nuclear along with natural gas and solar, to meet the rising energy demands of artificial intelligence. The announcement marks the first major nuclear investment since President Donald Trump issued executive orders in May to streamline the Nuclear Regulatory Commission's licensing process and accelerate deployment, supporting plans to increase U.S. nuclear energy capacity from about 100 GW currently to 400 GW by 2050. Fermi said that the global generative AI market is expected to grow from $64 billion in 2023 to $457 billion by 2027, citing data from Bloomberg Intelligence. The company, which is pre-revenue till now, about nine months since its inception, closed a $100 million funding round last month led by Macquarie Group. UBS Investment Bank, Cantor, and Mizuho are among the book-running managers for the offering. Fermi has applied to list on the Nasdaq under the symbol "FRMI". The company also plans to apply to list on the main market of the London Stock Exchange. (Reporting by Arasu Kannagi Basil and Pritam Biswas in Bengaluru; Editing by Vijay Kishore)

Share

Share

Copy Link

Fermi, a Texas-based company co-founded by former U.S. Energy Secretary Rick Perry, has filed for an IPO on Nasdaq. The company plans to build the world's largest energy and data complex to meet AI's rising energy demands.

Fermi's IPO Filing and Market Context

Fermi, a Texas-based company co-founded by former U.S. Energy Secretary Rick Perry, has filed for an initial public offering (IPO) in the United States

1

. The company, which aims to build the world's largest energy and data complex, is entering a bustling IPO market that has seen renewed enthusiasm post-Labor Day2

.

Source: ET

While the terms of Fermi's offering remain undisclosed, the company has applied to list on the Nasdaq under the symbol "FRMI" and plans to apply for listing on the London Stock Exchange's main market as well

3

. UBS Investment Bank, Cantor, and Mizuho are among the book-running managers for the offering.Fermi's Ambitious Energy and Data Complex

In June, Fermi announced plans to construct the world's largest energy and data complex, designed to meet the escalating energy demands of artificial intelligence

1

. This complex will be powered by a combination of nuclear, natural gas, and solar energy sources, marking a significant step in addressing the infrastructure needs of the rapidly growing AI industry.The announcement represents the first major nuclear investment following President Donald Trump's executive orders in May. These orders aim to streamline the Nuclear Regulatory Commission's licensing process and accelerate deployment, supporting plans to increase U.S. nuclear energy capacity from about 100 GW to 400 GW by 2050

2

.AI Market Growth and Fermi's Position

Fermi's strategic focus on AI infrastructure is backed by impressive market projections. The company cites data from Bloomberg Intelligence, stating that the global generative AI market is expected to grow from $64 billion in 2023 to $457 billion by 2027

1

. This projected growth underscores the potential demand for Fermi's energy and data solutions.Related Stories

Company Background and Recent Funding

Despite being in a pre-revenue stage, approximately nine months since its inception, Fermi has already attracted significant investor interest. The company recently closed a $100 million funding round led by Macquarie Group

3

. This substantial investment, coupled with the company's ambitious plans and the booming AI market, positions Fermi as a noteworthy player in the intersection of energy infrastructure and artificial intelligence.

Source: Market Screener

Broader IPO Market Trends

Fermi's IPO filing comes amid a resurgence in the U.S. IPO market. Other high-profile companies entering the market include Swedish fintech Klarna, the Winklevoss twins' crypto exchange Gemini, ticket reseller StubHub, and cybersecurity firm Netskope

1

. StubHub and Netskope have launched roadshows aiming to raise up to $851 million and $813 million, respectively, indicating strong investor appetite for new listings2

.References

Summarized by

Navi

[3]

Related Stories

Fermi's AI-Powered Data Center IPO Surges Amidst Soaring AI Demand

29 Sept 2025•Business and Economy

Fermi America's Ambitious Plan: World's Largest AI-Powered Energy Complex in Texas

27 Jun 2025•Business and Economy

Fermi America's 'HyperGrid': Nuclear-Powered AI Data Center Planned for Texas

05 Aug 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology