Freshworks Raises Annual Revenue Forecast on Strong AI-Driven Demand

5 Sources

5 Sources

[1]

Freshworks raises annual revenue forecast on AI-driven demand

July 29 (Reuters) - Freshworks (FRSH.O), opens new tab raised annual revenue forecast on Tuesday, betting on growing demand for its artificial intelligence-powered software designed to manage IT services. Businesses are increasingly adopting software solutions from companies such as Freshworks, ServiceNow (NOW.N), opens new tab and Salesforce (CRM.N), opens new tab to automate repetitive tasks and streamline customer interactions. The company now expects revenue for the year 2025 to be between $822.9 million and $828.9 million, up from its previous forecast of $815.3 million to $824.3 million. Analysts, on average, project annual revenue of $819.6 million, according to data compiled by LSEG. Freshworks, which serves over 74,000 clients, including American Express (AXP.N), opens new tab and Databricks, offers products that assist clients with employee onboarding and management. The company said more than 5,000 customers are now paying for its Freddy AI products, which help resolve customer inquiries, automate routine tasks and provide tailored solutions. It also offers its products to U.S. state and local governments. "We have over 1,000 government entities currently working on our platform," CEO Dennis Woodside said in an interview. Freshworks reported second-quarter revenue of $204.68 million, surpassing analysts' estimates of $198.83 million. Adjusted profit per share of 18 cents for the quarter ended June 30 also exceeded analysts' expectations of 11 cents. The company's third-quarter forecasts for revenue and adjusted profit per share came in line with analysts' estimates. It expects quarterly revenue between $207 million and $210 million and adjusted profit between 12 cents and 14 cents per share. Reporting by Jaspreet Singh in Bengaluru; Editing by Mohammed Safi Shamsi Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

Freshworks quarterly results top estimates with double-digit growth in revenue and customer spending - SiliconANGLE

Freshworks quarterly results top estimates with double-digit growth in revenue and customer spending Shares in Freshworks Inc. were up slightly in after-hours trading today after the customer service and support software firm reported earnings and revenue ahead of expectations in its fiscal second quarter. For the quarter that ended on June 30, Freshworks reported adjusted earnings per share of 18 cents, up from eight cents in the same quarter of 2024, on revenue of $204.7 million, up 18% year-over-year. Both figures were ahead of the 12 cents per share and revenue of $198.84 million expected by analysts. Freshworks' strong results were powered by customer growth, with the company seeing the number of customers spending more than $5,000 in annual recurring revenue growing 10% year-over-year to 23,975. The company's customers are also sticking around, with Freshworks reporting a net dollar retention rate in the quarter of 106%, up from 105% in the previous quarter. Notable new customers in the quarter included AEP Energy Inc., California Franchise Tax Board, Covington & Burling LLP, Manchester Metropolitan University, Reed Elsevier plc and Seagate Technology Holdings plc. Freshworks saw net cash provided by operating activities of $58.6 million, up from $36.3 million in the second quarter of 2024 and the company ended the quarter with $962.2 million in cash, cash equivalents and marketable securities on hand. Business highlights in the quarter include the June 11 debut of an expanded version of the Freddy Agentic AI Platform at Freshworks' annual Refresh event. The Freddy AI Agent, originally launched in October, was designed to improve customer and employee experiences by autonomously resolving a significant portion of service requests. The new, updated version of the Freddy Agentic platform offers a connected, intelligent, continuously learning system of AI agents that don't just reply to service questions, but can resolve them. The new update also included the introduction of the Freddy AI Agent Studio, a no-code platform that allows customer service teams to build and deploy custom AI agents without needing technical expertise. Right at the end of the quarter, Freshworks also announced the general availability of Freshservice Journeys, an AI-assisted feature within its information technology and employee service management platform. The tool is designed to simplify complex employee lifecycle events, such as onboarding, offboarding, promotions and relocations. "Freshworks delivered another strong quarter, exceeding our previously provided financial estimates in Q2 with 18% year-over-year revenue growth to $204.7 million, a 29% operating cash flow margin and 27% adjusted free cash flow margin," said Dennis Woodside, chief executive officer and president of Freshworks, in the company's earnings release. "We believe our strong momentum through the first half of the year reflects that businesses are increasingly turning to Freshworks to reduce complexity. They want AI-powered employee and customer service solutions that are fast to implement, easy to use, and built to deliver results." For its fiscal third quarter, Freshworks expects adjusted earnings per share of 12 cents to 14 cents on revenue of $207 million to $210 million. Both figures, at the midpoint, were dead on the 13 cents per share and revenue of $208.5 million expected by analysts. For the full year, the company expects adjusted earnings of 56 cents to 58 cents per share on revenue of $822.9 million to $828.9 million. The earnings outlook was in line with an expected 67 cents, while the revenue outlook was ahead of an expected $820.7 million.

[3]

Freshworks Reports Net Loss of $1.7 Mn in Q2 as Revenue Rises 18% | AIM

The Nasdaq-listed SaaS company Freshworks reduced its consolidated net loss by 91.4%, bringing it down to $1.73 million in the second quarter of 2025 (Q2 2025) from $20.18 million in the same quarter the previous year, driven by a steady increase in customer adoption and enhanced operational efficiency through AI. Dennis Woodside, CEO & president of Freshworks, said, "We believe our strong momentum through the first half of the year reflects that businesses are increasingly turning to Freshworks to reduce complexity. They want AI-powered employee and customer service solutions that are fast to implement, easy to use, and built to deliver results." Revenue increased by 17.5% to $204.7 million in the reviewed quarter, up from $174.1 million in Q2 2024. On a quarterly basis, it rose by 4.3% to $194.6 million. The generally accepted accounting principles (GAAP) loss from operations improved significantly to $8.7 million, down from $43.8 million in the same quarter a year ago. Non-GAAP income from operations jumped to $44.8 million, up from $13.1 million in Q2 2024. GAAP net loss per share decreased to $0.01, based on 294.4 million shares outstanding, compared to $0.07 with 299.8 million shares last year. "We have not reconciled our Q3 and full-year 2025 estimates for non-GAAP financial measures to GAAP due to the uncertainty and potential variability of expenses that may be incurred in the future," the company said. The company reported that the number of customers contributing over $5,000 in annual recurring revenue (ARR) grew by 10% year-over-year (YoY) to reach 23,975 in the second quarter. Freshworks states that ARR is the total expected revenue from subscriptions, software licenses, and maintenance over the next year from all clients. The AI service provider offers a range of employee experience solutions, including IT and enterprise service management, as well as customer service, sales, and marketing products.

[4]

Freshworks Q2 revenue rises 18% to $205 million, net loss narrows - The Economic Times

Freshworks reported an 18% year-on-year revenue rise to $204.7 million for Q2, with net loss narrowing to $1.7 million. Boosted by strong AI adoption and cost reductions, the SaaS firm raised its FY25 revenue guidance. AI tools Freddy Copilot and Agent surpassed $20 million ARR, reflecting strong enterprise demand.Nasdaq-listed software-as-a-service (SaaS) company Freshworks reported an 18% year-on-year increase in revenue to $204.7 million for the quarter ended June 30, up from $174.1 million a year earlier. The San Mateo- and Chennai-headquartered company also narrowed its net loss to $1.7 million, compared to $20.1 million in the same period last year. The improvement came as the company reduced operating expenses and saw increased adoption of its AI-powered solutions among mid-market and enterprise customers. Buoyed by improved quarterly financials, Freshworks has raised its revenue guidance for the third quarter of FY25. It now expects revenue to be in the range of $207 million to $210 million, reflecting 11% to 12% year-on-year growth. For the full year, the company has projected revenue between $822.9 million and $828.9 million. "Freshworks delivered another strong quarter, exceeding our previously provided financial estimates in Q2," said Dennis Woodside, chief executive officer and president of Freshworks. "We believe our strong momentum through the first half of the year reflects that businesses are increasingly turning to Freshworks to reduce complexity. They want AI-powered employee and customer service solutions that are fast to implement, easy to use, and built to deliver results." Woodside said the company's growth strategy is anchored around three key drivers of investing in employee experience, delivering AI capabilities across its product suite to accelerate adoption, and expanding its customer experience offerings. Freshworks said over 60% of its total annual recurring revenue (ARR) now comes from mid-market and enterprise customers. It defines mid-market as organizations with 251 to 5,000 employees, and enterprises as those with more than 5,000 employees. Non-GAAP income from operations rose to $44.8 million, up from $13.1 million in Q2 FY24. Net cash provided by operating activities also grew to $58.6 million, compared to $36.3 million a year ago. Total operating expenses fell 4% year-on-year to $182.1 million, from $189.7 million, driven by reductions in sales and marketing, as well as research and development expenses. Addressing the potential impact of US tariffs on its business on an earnings call, Woodside said Freshworks continues to see robust demand, supported by a highly diversified customer base. He added that no single industry dominates its portfolio, and the company has limited exposure to sectors particularly affected by tariffs. Freshworks' AI tools, including its Freddy Copilot assistant, are expected to further drive adoption and monetisation across its product lines. During the quarter, the company launched the next generation of its Freddy Agentic AI platform, which includes Freddy AI Agent Studio, a no-code platform designed to help businesses deploy autonomous AI agents to scale customer support. The company noted its Freddy Copilot and Freddy Agent products have already crossed $20 million in combined ARR. The number of customers contributing more than $5,000 in annual recurring revenue (ARR) rose 10% year-on-year to 23,975 during the quarter, while Freshwork's net dollar retention rate, a metric that measures revenue retention from existing customers, remained steady at 106%, similar to Q2 2024. It currently serves more than 74,000 customers across over 120 countries in industries including ecommerce, logistics, financial services, automotive, manufacturing, entertainment, and hospitality. Founded in Chennai in 2010, Freshworks initially targeted small and medium businesses (SMBs). However, it has increasingly shifted focus to mid-market and enterprise clients to counter macroeconomic softness in its traditional SMB base. In May 2024, the company underwent a major internal restructuring, with founder Girish Mathrubootham moving into the role of executive chairman and Dennis Woodside stepping in as CEO.

[5]

Freshworks (FRSH) Q2 Revenue Up 18%

Freshworks (FRSH -2.41%), a business software provider specializing in customer support and IT service management solutions, reported its second-quarter 2025 financial results on July 29, 2025. The announcement featured GAAP revenue of $204.7 million, outpacing analyst expectations of $198.8 million, and non-GAAP earnings per share of $0.18, widely exceeding the predicted $0.11 non-GAAP figure. Freshworks also reported a significant increase in non-GAAP profitability and adjusted free cash flow. The quarter was marked by operational improvements, continued AI product rollout, and rising adoption of its AI-powered solutions. Source: Analyst estimates provided by FactSet. Management expectations based on management's guidance, as provided in Q1 2025 earnings report. What Freshworks Does and Where It's Focusing Freshworks delivers a suite of cloud-based software to companies for customer engagement, support, and IT service management. Its flagship products include IT service management tools (known as Freshservice), customer support ticketing (Freshdesk), and a newer family of artificial intelligence (AI) solutions called Freddy AI. In recent periods, Freshworks has leaned into artificial intelligence to differentiate its offerings in the software-as-a-service (SaaS) market. The company's focus areas are building integrated AI-driven features across its software, using a product-led growth strategy (which means acquiring and expanding customers mainly through easy-to-use, self-serve products), and competing on ease of deployment and cost. Key business success factors include sustained customer growth, high rates of customer spending retention, maintaining competitive technology, and compliance with global data privacy standards. Quarter in Detail: Financials, Key Metrics, and Product Moves Freshworks outperformed both revenue and non-GAAP profitability estimates. The revenue figure represented 18% year-over-year growth. Non-GAAP operating income surged sharply compared to the prior year, while non-GAAP margins improved across the board. Profitability gains were evident: non-GAAP income from operations was $44.8 million, compared to $13.1 million in the second quarter of 2024. Operating cash flow (GAAP) climbed to $58.6 million, Adjusted free cash flow increased 65% year-over-year. The free cash flow margin improved to 26.5%. The company's gross margin (GAAP) -- a measure of how well it controls direct costs -- was 84.8%, up from 83.8 % a year ago. Non-GAAP operating margin reached 21.9%. Non-GAAP operating margin reached 21.9%, up from 7.5% in the prior year quarter. These expansions were supported by ongoing discipline in controlling operating expenses relative to revenue. Freshworks continued to report growth in its key customer segment: those generating more than $5,000 in annual recurring revenue, with the number of such customers reaching 23,975, an increase of 10% year-over-year. This customer group remains essential, representing the core of long-term revenue retention and expansion. Net dollar retention -- an industry metric that reflects whether existing customers are increasing, decreasing, or maintaining spending -- held steady at 106%. Artificial intelligence developments stood out. The Freddy AI suite, which includes Freddy AI Copilot (an AI productivity aid for employees) and Freddy AI Agent (an always-on AI customer support platform), passed $20 million in annual recurring revenue. Freshworks launched the Freddy AI Agent Studio, a no-code tool allowing businesses to create their own AI-powered automation agents. From a market perspective, Freshworks highlighted new marquee customer wins and a notable multi-year partnership with McLaren Racing. The partnership includes adoption of Freshservice as the IT service management solution for the motorsports team. These references boost the company's visibility in enterprise sales and support its effort to compete with larger SaaS vendors like Salesforce and Zendesk, which also offer customer support software platforms. There were no major one-time items distorting results for the quarter. Cash and cash equivalents plus marketable securities were $926.2 million. Freshworks remains without a dividend and instead, it continued to invest in growth and technology infrastructure. Within its product suite, Freshworks debuted Freshservice Journeys, an AI-assisted feature designed to streamline employee service management. Management promoted ongoing deployment of Freddy AI modules into both customer support (Freshdesk) and employee support (Freshservice), underpinning the push for outcomes from AI, rather than just hype. Looking Ahead: Guidance and Points for Investors to Watch Management raised financial guidance for both the next quarter and full fiscal 2025. It now expects revenue between $207.0 million and $210.0 million for Q3 2025, up 11-12% year over year. Full-year revenue is projected in the $822.9 million to $828.9 million range, for 14-15 % growth. Non-GAAP operating income is anticipated to rise to $153.0-$157.0 million. Forecasted non-GAAP earnings per share are $0.56-$0.58. The updated outlook implies that growth rates are moderating as the business matures, in line with industry patterns for SaaS providers scaling towards $1 billion in annual revenue, with operating discipline expected to continue even as operating expenses may increase in the second half as personnel investments and marketing spend return to a normal cadence. The company did not declare or adjust any dividend payout. Other important watchpoints include competitive dynamics, as larger software companies roll out their own AI features, and the pace at which customers adopt new AI-driven modules within the Freshworks product family. Management did not flag any material exposure to economic risk in the quarter but did reference future spending increases, which could place a ceiling on continued margin expansion if not offset by equally rapid revenue growth. Revenue and net income presented using U.S. generally accepted accounting principles (GAAP) unless otherwise noted.

Share

Share

Copy Link

Freshworks reports strong Q2 2025 results, with revenue up 18% year-over-year, driven by increased adoption of AI-powered solutions. The company raises its annual revenue forecast and sees significant growth in its Freddy AI product line.

Freshworks Reports Strong Q2 2025 Results

Freshworks Inc., a leading provider of customer and employee experience software, has reported impressive second-quarter results for 2025, showcasing the growing demand for its AI-powered solutions. The company's performance exceeded analyst expectations and led to an upward revision of its annual revenue forecast

1

.Financial Highlights

Source: AIM

Freshworks reported a significant increase in revenue for Q2 2025:

- Revenue reached $204.7 million, up 18% year-over-year from $174.1 million in Q2 2024

2

. - Adjusted earnings per share stood at 18 cents, surpassing analysts' expectations of 11 cents

1

. - Net loss narrowed to $1.73 million, a substantial improvement from $20.18 million in the same quarter last year

3

.

The company's strong performance has led to an upward revision of its annual revenue forecast. Freshworks now expects revenue for the year 2025 to be between $822.9 million and $828.9 million, up from its previous forecast of $815.3 million to $824.3 million

1

.AI-Driven Growth and Product Innovation

Freshworks' success can be largely attributed to the increasing adoption of its AI-powered solutions:

- The company's Freddy AI products, including Freddy Copilot and Freddy Agent, have surpassed $20 million in combined annual recurring revenue (ARR)

4

. - Over 5,000 customers are now paying for Freddy AI products, which help resolve customer inquiries, automate routine tasks, and provide tailored solutions

1

.

Freshworks has continued to innovate and expand its AI offerings:

- In June, the company launched an expanded version of the Freddy Agentic AI Platform, which offers a connected, intelligent, and continuously learning system of AI agents

2

. - The company introduced Freddy AI Agent Studio, a no-code platform allowing customer service teams to build and deploy custom AI agents without technical expertise

2

. - Freshworks also announced the general availability of Freshservice Journeys, an AI-assisted feature within its IT and employee service management platform

2

.

Related Stories

Customer Growth and Market Position

Freshworks has seen steady growth in its customer base and market position:

- The number of customers contributing over $5,000 in annual recurring revenue (ARR) grew by 10% year-over-year to reach 23,975 in Q2 2025

3

. - The company's net dollar retention rate remained steady at 106%, indicating strong customer loyalty and increased spending

2

. - Freshworks now serves over 74,000 clients across various industries, including notable names such as American Express and Databricks

1

.

Future Outlook and Strategy

Source: ET

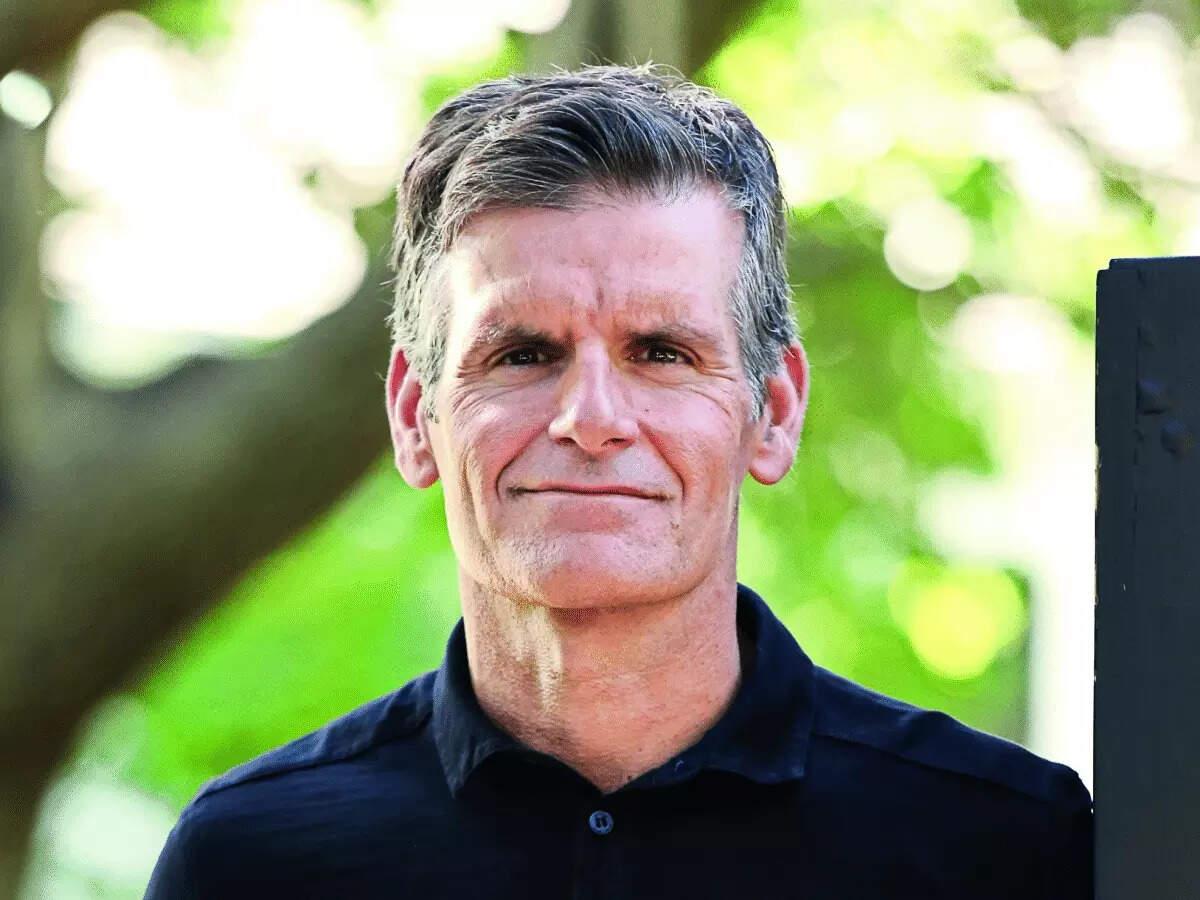

Dennis Woodside, CEO and President of Freshworks, emphasized the company's focus on reducing complexity for businesses through AI-powered solutions that are fast to implement and easy to use

4

. The company's growth strategy centers around three key drivers:- Investing in employee experience

- Delivering AI capabilities across its product suite

- Expanding its customer experience offerings

Source: SiliconANGLE

As Freshworks continues to leverage AI technology and focus on mid-market and enterprise customers, it is well-positioned to compete with larger SaaS vendors in the customer support and IT service management space

5

.References

Summarized by

Navi

[2]

[5]

Related Stories

Freshworks Raises 2025 Outlook on Strong AI-Driven Growth and Improved Profitability

30 Apr 2025•Business and Economy

Freshworks Reports Strong Q2 2023 Performance, Driven by AI Integration and Customer Growth

31 Jul 2024

Freshworks Exceeds Expectations with AI-Driven Growth, Forecasts Strong 2025 Revenue

12 Feb 2025•Business and Economy

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology