FuriosaAI targets $500M funding round as RNGD chip production begins, eyes 2027 IPO

2 Sources

2 Sources

[1]

AI Chip Startup FuriosaAI Plans $500 Million Round Before IPO

FuriosaAI is eyeing a potential public listing as early as 2027 and is set to receive its first mass-produced shipment of RNGD AI chips from Taiwan Semiconductor Manufacturing Co. later this month. Artificial intelligence chip designer FuriosaAI is seeking to raise as much as $500 million in a funding round before an initial public offering as it gears up to challenge industry titan Nvidia Corp., according to people with knowledge of the matter. The Seoul-based startup has appointed Morgan Stanley and Mirae Asset Securities Co. as co-advisers for the Series D round, and is targeting $300 million to $500 million in the round, the people said, asking not to be identified because the details aren't public. Proceeds will fund FuriosaAI's mass production of its second-generation RNGD chip, global business expansion and the development of a third-generation chip, the people said. The startup is eyeing a potential public listing as early as 2027, they said. FuriosaAI is set to receive its first mass-produced shipment of RNGD AI chips from Taiwan Semiconductor Manufacturing Co. later this month, one of the people said. Representatives for FuriosaAI and Morgan Stanley declined to comment. Mirae Asset officials weren't immediately reachable for comment. Founded in 2017 by June Paik -- a veteran of Samsung Electronics Co. and Advanced Micro Devices Inc. -- FuriosaAI specializes in high-efficiency AI inference chips. The RNGD, pronounced "renegade," delivers 2.25 times the inference performance-per-watt of traditional graphics processing units, according to the company. The milestone comes amid a boom in AI hardware investment. Groq Inc., raised $750 million in a round last year ahead of a strategic partnership with Nvidia. Other recent deals include Cerebras Systems Inc.'s pursuit of $1 billion in new capital at a $22 billion valuation and Etched's $500 million funding round.

[2]

AI chip developer FuriosaAI reportedly raising up to $500M - SiliconANGLE

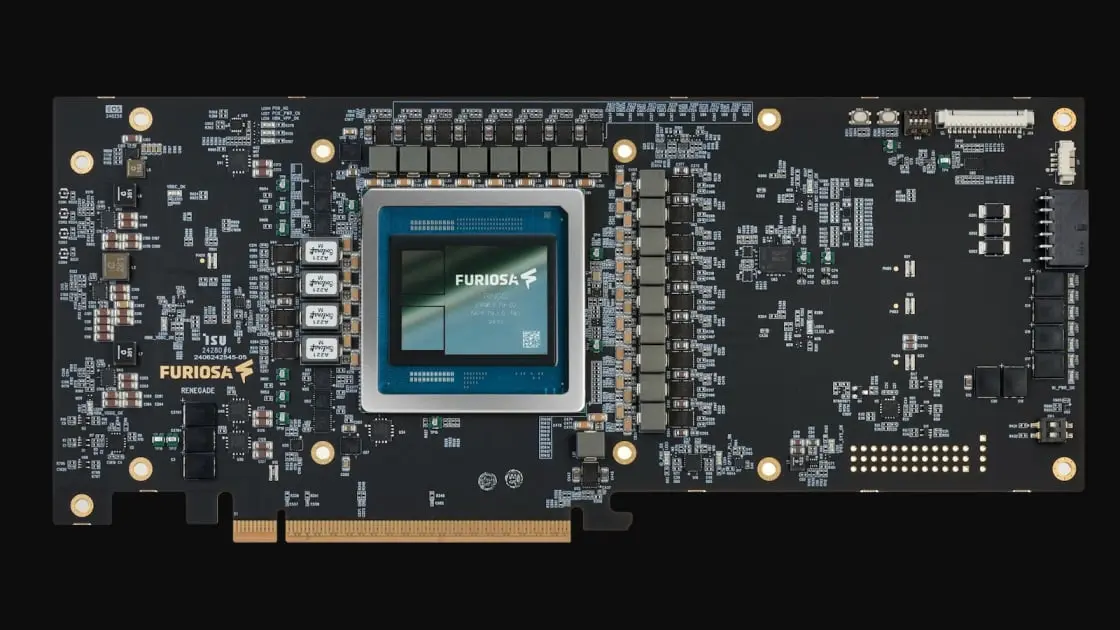

FuriosaAI Inc., a Seoul-based developer of artificial intelligence chips, is reportedly in talks to raise a new round of funding. Sources told Bloomberg today that the startup is seeking $300 million to $500 million. It has reportedly hired Morgan Stanley and Mirae Asset Securities, Korea's largest investment bank, to help it close the round. The proposed investment is described as a Series D raise. The report didn't specify the valuation that FuriosaAI is expected to receive. The company was worth $735 million as of July, when it raised a $125 million round from a group of institutional investors. A few months earlier, it reportedly turned down a $800 million acquisition offer from Meta Platforms Inc. There are often multiple ways to go about a mathematical operation. For example, adding two and two produces the same result as multiplying two by two. A similar principle applies to matrix multiplications, the calculations that AI models use to process data. A matrix is a mathematical structure that comprises a collection of numbers organized into rows and columns. A matrix multiplication combines two matrices into one through a process that involves multiplication, but also comprises other operations. Server-grade graphics processing units have numerous cores optimized specifically to perform matrix multiplications. FuriosaAI has taken a different approach with its flagship RNGD chip (pictured). Instead of designing the processor with matrix multiplications in mind, the company optimized it for a mathematical operation called tensor contraction. FuriosaAI says that tensor contractions can produce the same results as a matrix multiplication but more efficiently, which translates into faster AI performance. The company's chip architecture speeds up neural networks in two main ways. First, it improves their parallelism, which means that more calculations can be carried out side-by-side instead of one after another. The technology also increases data reuse. Reusing a piece of data reduces the number of times it has to be retrieved from memory or generated from scratch, which avoids the associated delays. The RNGD can perform up to 512 trillion calculations per second on data stored in the FP8 format. It ships in a PCIe card with a thermal footprint of 180 watts, which means that it doesn't require water cooling. FuriosaAI also offers a server called the NXT RNGD that includes eight RNGD accelerators and provides up to 4 petaflops of performance. The funding round that the company is raising could reportedly be its last before going public. FuriosaAI is expected to list its shares in 2027.

Share

Share

Copy Link

Seoul-based AI chip developer FuriosaAI is raising $300 million to $500 million in a Series D funding round to challenge Nvidia. The startup, valued at $735 million in July, will receive its first mass-produced RNGD chips from TSMC this month. The company plans an initial public offering as early as 2027 while scaling production of its tensor contraction-based processors.

FuriosaAI Launches Major Funding Round to Scale AI Chip Production

FuriosaAI, a South Korea-based AI chip designer, is seeking to raise between $300 million and $500 million in a Series D funding round as it positions itself to compete directly with industry leader Nvidia

1

2

. The Seoul-based startup has appointed Morgan Stanley and Mirae Asset Securities Co., Korea's largest investment bank, as co-advisers for the fundraising effort1

. This AI chip developer reached a valuation of $735 million as of July 2025, when it closed a $125 million investment from institutional investors2

. Notably, the company reportedly turned down an $800 million acquisition offer from Meta Platforms Inc. just months earlier, signaling its ambitions for independence and growth.Mass Production Milestone and Global Expansion Plans

The funding round comes at a critical juncture for FuriosaAI, as the company is set to receive its first mass-produced shipment of RNGD AI chips from Taiwan Semiconductor Manufacturing Co. (TSMC) later this month

1

. Proceeds from the capital raise will fund the mass production of the second-generation RNGD chip, support global expansion efforts, and accelerate development of a third-generation chip1

. The RNGD chip, pronounced "renegade," delivers 2.25 times the inference performance-per-watt of traditional graphics processing units, according to the company1

. This efficiency advantage positions FuriosaAI's AI inference chips as compelling alternatives in a market dominated by power-hungry accelerators.

Source: Bloomberg

Innovative Tensor Contraction Architecture Sets RNGD Apart

What distinguishes the RNGD chip from conventional AI accelerators is its underlying mathematical approach. Instead of optimizing for matrix multiplications like server-grade graphics processing units, FuriosaAI designed its processor around tensor contraction operations

2

. The company asserts that tensor contraction can produce identical results to matrix multiplication but with greater efficiency, translating into faster AI performance2

. This architectural choice improves neural network parallelism, allowing more calculations to execute simultaneously rather than sequentially, while also increasing data reuse to minimize memory retrieval delays2

.

Source: SiliconANGLE

The RNGD can perform up to 512 trillion calculations per second on data stored in the FP8 format and ships in a PCIe card with a thermal footprint of 180 watts, eliminating the need for water cooling

2

. FuriosaAI also offers the NXT RNGD server, which includes eight RNGD accelerators and provides up to 4 petaflops of performance2

.Related Stories

Path to IPO Amid Surging AI Hardware Investment

The funding round could reportedly be FuriosaAI's last before an initial public offering, with the company eyeing a potential listing as early as 2027

1

2

. Founded in 2017 by June Paik, a veteran of Samsung Electronics Co. and Advanced Micro Devices Inc., FuriosaAI specializes in high-efficiency AI inference chips1

. The milestone arrives amid a boom in AI hardware investment, with competitors securing substantial capital. Groq Inc. raised $750 million in a round last year ahead of a strategic partnership with Nvidia, while Cerebras Systems Inc. pursued $1 billion in new capital at a $22 billion valuation, and Etched secured a $500 million funding round1

. For investors and industry watchers, FuriosaAI's trajectory signals growing confidence in alternatives to established chip architectures, particularly as enterprises seek more energy-efficient solutions for AI inference workloads at scale.References

Summarized by

Navi

Related Stories

FuriosaAI launches RNGD chip in mass production to challenge Nvidia's AI inference dominance

06 Jan 2026•Technology

FuriosaAI Secures Major Partnership with LG After Rejecting Meta's $800M Acquisition Offer

22 Jul 2025•Technology

Meta in Advanced Talks to Acquire Korean AI Chip Startup FuriosaAI

12 Feb 2025•Technology

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology