HSBC Downgrades Nvidia: AI GPU Pricing Power Wanes Amid Market Challenges

3 Sources

3 Sources

[1]

HSBC downgrades Nvidia, sees 'limited room' for any upside despite recent drop

HSBC sees limited upside potential ahead for artificial intelligence darling Nvidia . Analyst Frank Lee downgraded shares of the chipmaker to hold from buy and cut his price target by $55 to $120, reflecting only more than 8% upside ahead, as of Wednesday's close. "We expect Nvidia to deliver YoY sales growth of 62% and EPS growth of 58% in FY26e, while the current FY26e [price-to-earnings ratio] of 23x also does not look demanding to us," Lee wrote in a note on Thursday. "However, we now expect to see limited upside potential going forward given limited room for significant earnings upside surprise over the next 1-2 years and potential re-rating headwinds that we think are yet to be fully factored in by the market." The stock has already come under significant pressure in 2025, spurred by developments from Chinese AI startup DeepSeek earlier in the year. Shares have fallen more than 27% over the past three months and about 8% in the past month, lagging the broader market. NVDA 3M mountain NVDA, 3-month Nvidia could experience less pricing power with its graphics processing units (GPUs), Lee said, which could ultimately limit the stock's earnings momentum. The analyst also sees "limited spec migration" with the company's Vera Rubin - its next-generation GPUs slated to launch in 2026. "We first upgraded Nvidia to Buy in April 2023 on the back of Nvidia's strong AI GPU pricing power and product mix being underestimated by the market that we believe has continued for past two years," he wrote. "However, we now think Nvidia's GPU pricing power is slowing down as we have seen no significant ASP boost between B200 and B300 GPU or the GB200 and GB300 NVL72 rack architecture." Lee also pointed to other headwinds possibly in store for the stock, such as the potential slowdown in demand over the long term as a result of DeepSeek and increasing inconsistencies with the company's supply chain. That said, Lee's neutral view is in the minority on Wall Street. He is among only five analysts with hold ratings on the name out of the 64 covering it, according to LSEG data. The remaining 59 analysts all have strong buy or buy ratings. Nvidia has an average target of nearly $173, implying more than 56% upside from here. Shares fell 6% during Thursday's session. The move comes amid declines among other semiconductor stocks after President Donald Trump announced new reciprocal tariffs Wednesday.

[2]

NVIDIA Might Have Lost AI GPU Pricing Power, Says Bank As It Downgrades Stock To Hold

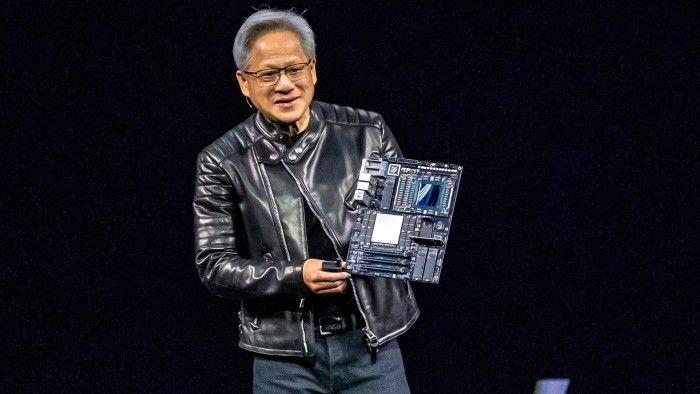

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. Chip designer NVIDIA Corporation is losing its GPU pricing power, according to a fresh note from investment bank HSBC. The note cuts NVIDIA's share price target to $120 from $175 and downgrades the shares to Hold from Buy. NVIDIA's GPU prices, driven by the firm's considerable technological advantages, short supply and high manufacturing costs, have set the narrative around its products and share price. They were at the heart of January's DeepSeek selloff, which wiped off close to $600 billion from the firm's market value as investors wondered whether the GPUs would be in high demand after purported efficiency demonstrations by the Chinese AI startup DeepSeek. NVIDIA's shares are among the worst performers in 2025 due to investor skepticism about the firm's AI GPU demand. Year-to-date, the stock has 24% and is down 4.9% at market open today after the Trump administration's latest set of tariffs roiled US and global stock markets. Amidst the chaos, HSBC believes that NVIDIA is losing the pricing power with its AI GPUs. In a fresh analyst note, the firm's analyst Frank Lee analyzes the pricing trend between NVIDIA's B200 and B300 Blackwell AI GPUs and GB200 and GB300 NVL72 server racks. The B300 GPUs are among the latest AI products from NVIDIA and is build on TSMC's N4P manufacturing process node. According to HSBC, there has been no significant average selling price (ASP) bump between the B200 and B300 GPUs. "[W]e have seen no significant ASP boost between B200 and B300 GPU or the GB200 and GB300 NVL72 rack architecture," notes Lee and adds that there appear to be limited upgrades in GPU specifications as well apart from the next-generation Vera Rubin GPUs relying on HBM4 memory. HSBC adds that NVIDIA's systems will support 72 GPUs per rack until 2027, when the firm launches its Rubin Ultra products. As a result, the bank has downgraded NVIDIA's shares to Hold from Buy, a downgrade that appears to have come just in time as the firm's shares extended their losses to 5.34% as trading commenced today. HSBC's latest remarks about NVIDIA follow NVIDIA CEO Jensen Huang's remarks last month where he justified his firm's GPU prices. In an interview after NVIDIA's GTC conference, Huang shared that not only do his firm's GPUs allow users to generate money and save money by being more efficient, by added that they are pricey due to manufacturing complexities. Huang also added that his company is working with TSMC and Foxconn to manufacture GPUs onshore in the US. Trump's latest round of tariffs left NVIDIA out of the loop, and the firm is also reportedly pressuring the US government to scrap the latest set of rules that prevent unlimited sales of its AI GPUs to most countries except for 18 that are determined to be key US allies and partners.

[3]

HSBC downgrades Nvidia, slashes target as it sees limited upside By Investing.com

Investing.com -- HSBC downgraded Nvidia Corp (NASDAQ:NVDA) to Hold from Buy, citing limited upside potential in the near term as the company enters a transition phase ahead of new AI market opportunities in robotics and autonomous vehicles. Shares of the company were down 5.8% in early trading. The brokerage also slashed its price target to $120 from $175, reflecting lower earnings estimates and a reduced target price-to-earnings (PE) ratio. Nvidia's share price has fallen 26% from its peak in January 2025, despite fourth-quarter results and first-quarter guidance meeting expectations. HSBC (LON:HSBA) expects Nvidia's fiscal 2026 revenue to grow 62% year-over-year and earnings per share (EPS) to rise 58%. However, the firm now sees limited room for further earnings surprises, which could cap share price gains. HSBC noted that Nvidia's pricing power for its GPUs is weakening, limiting upside momentum. While the company previously benefited from strong AI GPU pricing and an improved product mix, recent GPU generations, such as the B300 and GB300 NVL72 rack architecture, have not seen major average selling price (ASP) increases. The upcoming Vera Rubin platform is also expected to offer only marginal improvements until the Rubin Ultra upgrade in 2027. The brokerage also cited potential re-rating headwinds, including uncertainty around cloud service provider capital expenditures and long-term demand from DeepSeek. Supply chain mismatches could further constrain upside potential. HSBC sees robotics and autonomous AI as Nvidia's next major growth catalysts but believes revenue contributions from these markets will take time to materialize. The firm cut its fiscal 2026 and 2027 EPS estimates by 8% and 18%, respectively, and lowered its target PE multiple to 25x from 34x, aligning with historical trough valuations.

Share

Share

Copy Link

HSBC downgrades Nvidia to 'Hold' from 'Buy', citing limited upside potential and weakening GPU pricing power. The move comes as Nvidia faces market challenges and transitions towards new AI opportunities.

HSBC Downgrades Nvidia Amid Concerns Over GPU Pricing Power

In a significant move that has sent ripples through the tech industry, HSBC has downgraded Nvidia Corporation from 'Buy' to 'Hold', citing concerns over the company's future growth potential and weakening GPU pricing power. This decision comes as Nvidia, a leading player in the AI chip market, faces increasing challenges in maintaining its market dominance

1

.Revised Price Target and Market Reaction

HSBC analyst Frank Lee has slashed Nvidia's price target from $175 to $120, reflecting a mere 8% upside from the current trading price. This downgrade has contributed to a significant drop in Nvidia's stock price, with shares falling 6% during Thursday's trading session

1

.The market's reaction to this news has been swift, with Nvidia's stock performance lagging behind the broader market. The company's shares have declined by more than 27% over the past three months and about 8% in the past month alone

1

.Factors Behind the Downgrade

Several key factors have contributed to HSBC's decision to downgrade Nvidia:

-

Limited Pricing Power: HSBC notes that Nvidia's GPU pricing power is slowing down, with no significant average selling price (ASP) boost observed between the B200 and B300 GPU generations or the GB200 and GB300 NVL72 rack architectures

2

. -

Earnings Growth Expectations: While HSBC projects Nvidia to deliver year-over-year sales growth of 62% and EPS growth of 58% in FY26, they see limited room for significant earnings upside surprises over the next 1-2 years

1

. -

Market Headwinds: The potential slowdown in demand over the long term, partly due to developments from Chinese AI startup DeepSeek, and increasing inconsistencies with Nvidia's supply chain are cited as additional concerns

1

.

Related Stories

Future Outlook and Industry Impact

Despite the downgrade, HSBC acknowledges that Nvidia's next major growth catalysts could come from robotics and autonomous AI. However, they believe that revenue contributions from these markets will take time to materialize

3

.It's worth noting that HSBC's view is in the minority on Wall Street. Out of 64 analysts covering Nvidia, only five now have 'Hold' ratings, while the remaining 59 maintain 'Strong Buy' or 'Buy' ratings

1

.Broader Market Context

The downgrade comes amid a challenging market environment, with President Donald Trump's announcement of new reciprocal tariffs adding to the pressure on semiconductor stocks. Notably, Nvidia was left out of the latest round of tariffs, and the company is reportedly lobbying the US government to ease restrictions on AI GPU sales to most countries

2

.References

Summarized by

Navi

Related Stories

Nvidia Faces Potential Headwinds: Analyst Downgrades Stock Amid AI Efficiency Concerns

27 Feb 2025•Business and Economy

Nvidia's Strong Earnings Fail to Impress Investors, Raising Questions About AI Market Momentum

21 Feb 2025•Technology

Nvidia Hit by New U.S. Export Controls on AI Chips to China, Boosting Local Rivals

16 Apr 2025•Technology

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology