HSBC Upgrades Data Center Stocks as AI Drives Growth and Demand

2 Sources

2 Sources

[1]

HSBC says buy this data center stock as AI drives growth

HSBC thinks Equinix could see strong growth ahead thanks to strong demand for artificial intelligence data centers. "[Our] valuation looks attractive considering the company's growth opportunity, especially as the three growth themes of digital transformation, cloud, and AI continue to benefit the data center industry over the next few years," analyst Phani Kanumuri wrote on Thursday. The company operates as a real estate investment trust (REIT) that focuses primarily on data centers. Kanumuri upgraded the data center stock to buy from hold and raised his price target to $1,000 per share from $865. HSBC's forecast implies more than 14% upside from Thursday's close. EQIX YTD mountain Equinix stock. Data centers are an essential component of powering AI applications. The power-hungry technology tied to AI has sparked a race to buildout data centers, which has seen companies including Alphabet and Microsoft spend billions to accelerate growth . And while lower utilization rates remain a headwind for Equinix, Kanumuri said that the company has been able to charge more because its servers use more energy than others. "Higher-power densities from new cabinets compared to churned cabinets led to lower utilization in 2024," Kanumuri said. "However, we see this as a value-accretive opportunity for Equinix to accelerate growth and improve revenue per data center in 2025." Equinix stock has advanced roughly 9% in 2024. Analysts in general are bullish on the stock as well. Of the 27 covering Equinix, 21 rate it as a buy or a strong buy. Only six analysts have a hold rating on shares.

[2]

HSBC upgrades US data center stocks on AI demand By Investing.com

Equinix was upgraded to 'Buy' from 'Hold' with a new price target of $1,000, up from $865, while Digital Realty was upgraded to 'Hold' from 'Reduce', with its target price raised to $160 from $124. The demand for data centers has significantly exceeded supply year-to-date in 2024, driven by robust AI demand and limited supply in key markets. Despite this, shares of Equinix and Digital Realty have underperformed compared to the broader index due to specific company concerns. However, HSBC anticipates that these operational challenges will diminish, leading to strong momentum in 2025. For Equinix, the upgrade is supported by several factors. Improved utilization rates are expected to boost revenue growth to 10% in 2025, an increase from the 7% forecasted for 2024. This growth is attributed to a lower interest rate environment benefiting small and medium-sized enterprise consumption and increased capacity in major markets. Furthermore, contributions from the xScale joint venture are projected to grow significantly, and Equinix is expected to be "a major beneficiary when AI moves to the inferencing phase," HSBC notes. Also, Equinix's growth potential seems higher and more stable than that of Digital Realty, due to its exposure to the retail vertical and an attractive valuation. Meanwhile, Digital Realty's upgrade reflects a strong pricing environment for the ">1MW" power block segment over the next one to two years. Still, growth may be limited due to the company's lease expiration schedule, according to HSBC's team. Despite this, adjusted funds from operations (AFFO) growth is expected to align more consistently with revenue growth due to a leaner balance sheet, although it may be lower than that of Equinix. Digital Realty's greater exposure to the ">1MW" segment is anticipated to secure higher bookings from AI, but the benefits of bookings and pricing power seem to be already reflected in the market price. The raised target price for Digital Realty is based on an increased target multiple to reflect a better AFFO growth trajectory, the note states.

Share

Share

Copy Link

HSBC upgrades Equinix and Digital Realty stocks, citing strong AI-driven demand for data centers and potential for growth in the coming years.

HSBC Upgrades Data Center Stocks

HSBC has recently upgraded its outlook on key data center stocks, citing the growing demand for artificial intelligence (AI) as a primary driver. The bank's analysts have particularly focused on Equinix and Digital Realty, two major players in the data center industry

1

2

.Equinix: A Strong Buy

HSBC analyst Phani Kanumuri has upgraded Equinix from 'Hold' to 'Buy', raising the price target from $865 to $1,000 per share. This new target implies a potential upside of over 14% from recent closing prices

1

. The upgrade is based on several factors:- Improved utilization rates are expected to boost revenue growth to 10% in 2025, up from the 7% forecasted for 2024.

- A lower interest rate environment is anticipated to benefit small and medium-sized enterprise consumption.

- Increased capacity in major markets is projected to drive growth.

- Significant growth in contributions from the xScale joint venture is expected

2

.

Digital Realty: Upgraded to Hold

Digital Realty has also received an upgrade from HSBC, moving from 'Reduce' to 'Hold' with a new price target of $160, up from $124

2

. The upgrade reflects:- A strong pricing environment for the ">1MW" power block segment over the next one to two years.

- Greater exposure to the ">1MW" segment, which is expected to secure higher bookings from AI

2

.

AI Driving Data Center Demand

The upgrades come as demand for data centers has significantly exceeded supply year-to-date in 2024, driven by robust AI demand and limited supply in key markets

2

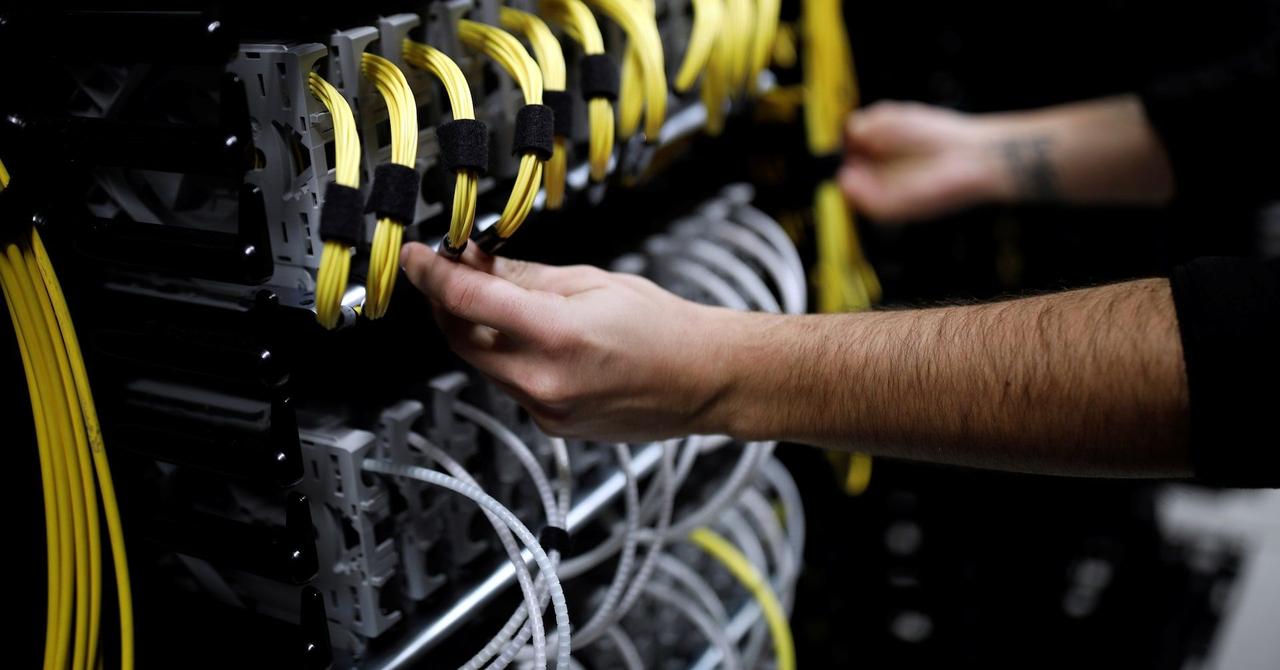

. Data centers are an essential component of powering AI applications, and the power-hungry nature of AI technology has sparked a race to build out data centers1

.Related Stories

Industry Outlook

Despite recent underperformance compared to the broader index, HSBC anticipates that operational challenges for both Equinix and Digital Realty will diminish, leading to strong momentum in 2025

2

. The data center industry is expected to benefit from three key growth themes over the next few years:- Digital transformation

- Cloud computing

- Artificial Intelligence

1

Market Sentiment

The positive outlook for data center stocks is not limited to HSBC. Of the 27 analysts covering Equinix, 21 rate it as a buy or a strong buy, with only six maintaining a hold rating

1

. This bullish sentiment reflects the growing importance of data centers in the AI-driven tech landscape.References

Summarized by

Navi

[2]

Related Stories

Equinix Shares Tumble as AI-Driven Expansion Plans Raise Investor Concerns

27 Jun 2025•Business and Economy

Equinix Forms $15 Billion Joint Venture to Expand Data Center Infrastructure for AI and Cloud Growth

02 Oct 2024

AI Drives Tech Industry Growth: Nvidia, Apple, and Others Poised for Strong Performance

17 Nov 2024•Technology

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research