Intuit Revolutionizes Business Operations with AI Agents in QuickBooks

4 Sources

4 Sources

[1]

Get paid faster: How Intuit's new AI agents help businesses get funds up to 5 days faster and save 12 hours a month with autonomous workflows

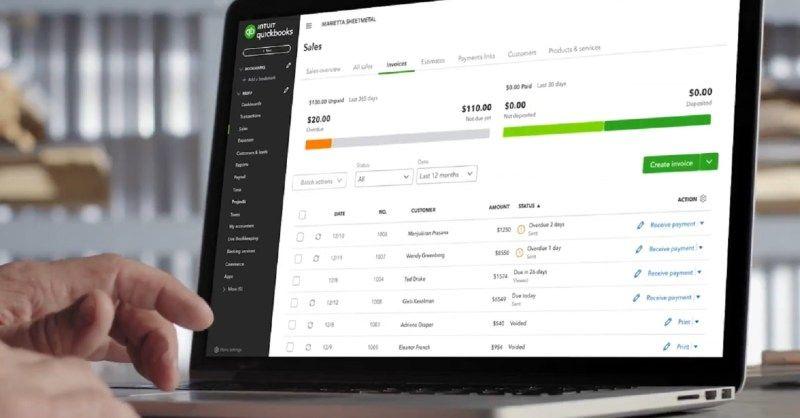

Join the event trusted by enterprise leaders for nearly two decades. VB Transform brings together the people building real enterprise AI strategy. Learn more Intuit has been on a journey over the last several years with generative AI, incorporating the technology as part of its services at QuickBooks, Credit Karma,Turbotax and Mailchimp. Today the company is taking the next step with a series of AI agents that go beyond that to transform how small and mid-market businesses operate. These new agents work as a virtual team that automates workflows and provides real-time business insights. They include capabilities for payments, accounts and finance that will directly impact business operations. According to Intuit, customers save up to 12 hours per month and, on average, will get paid up to five days faster thanks to the new agents. "If you look at the trajectory of our AI experiences at Intuit in the early years, AI was built into the background, and with Intuit Assist, you saw a shift to provide information back to the customer," Ashok Srivastava, chief data officer at Intuit, told VentureBeat. "Now what you're seeing is a complete redesign. The agents are actually doing work on behalf of the customer, with their permission." Technical architecture: From starter kit to production agents Intuit has been working on the path from assistants to agentic AI for some time. In September 2024, the company detailed its plans to use AI to automate complex tasks. It's an approach built firmly on the company's generative AI operating system (GenOS) platform, the foundation of its AI efforts. Earlier this month, Intuit announced a series of efforts that further extend its capabilities. The company has developed its own prompt optimization service that will optimize queries for any large language model (LLM). It has also developed what it calls an intelligent data cognition layer for enterprise data that can understand different data sources required for enterprise workflows. Going a step further, Intuit developed an agent starter kit that builds on the company's technical foundation to enable agentic AI development. The agent portfolio: From cash flow to customer management With the technical foundation in place, including agent starter kits, Intuit has built out a series of new agents that help business owners get things done. Intuit's agent suite demonstrates the technical sophistication required to move from predictive AI to autonomous workflow execution. Each agent coordinates prediction, natural language processing (NLP) and autonomous decision-making within complete business processes. They include: Payments agent: Autonomously optimizes cash flow by predicting late payments, generating invoices and executing follow-up sequences. Accounting agent: Represents Intuit's evolution from rules-based systems to autonomous bookkeeping. The agent now autonomously handles transaction categorization, reconciliation and workflow completion, delivering cleaner and more accurate books. Finance agent: Automates strategic analysis traditionally requiring dedicated business intelligence (BI) tools and human analysts. Provides key performance indicator (KPI) analysis, scenario planning and forecasting based on how the company is doing against peer benchmarks while autonomously generating growth recommendations. Intuit is also building out customer hub agents that will help with customer acquisition tasks. Payroll processing as well as project management efforts are also part of the future release plans. Beyond conversational UI: Task-oriented agent design The new agents mark an evolution in how AI is presented to users. Intuit's interface redesign reveals important user experience principles for enterprise agent deployment. Rather than bolting AI capabilities onto existing software, the company fundamentally restructured the QuickBooks user experience for AI. "The user interface now is really oriented around the business tasks that need to be done," Srivastava explained. "It allows for real time insights and recommendations to come to the user directly." This task-centric approach contrasts with the chat-based interfaces dominating current enterprise AI tools. Instead of requiring users to learn prompting strategies or navigate conversational flows, the agents operate within existing business workflows. The system includes what Intuit calls a "business feed" that contextually surfaces agent actions and recommendations. Trust and verification: The closed-loop challenge One of the most technically significant aspects of Intuit's implementation addresses a critical challenge in autonomous agent deployment: Verification and trust. Enterprise AI teams often struggle with the black box problem -- how do you ensure AI agents are performing correctly when they operate autonomously? "In order to build trust with artificial intelligence systems, we need to provide proof points back to the customer that what they think is happening is actually happening," Srivastava emphasized. "That closed loop is very, very important." Intuit's solution involves building verification capabilities directly into GenOS, allowing the system to provide evidence of agent actions and outcomes. For the payments agent, this means showing users that invoices were sent, tracking delivery and demonstrating the improvement in payment cycles that results from the agent's actions. This verification approach offers a template for enterprise teams deploying autonomous agents in high-stakes business processes. Rather than asking users to trust AI outputs, the system provides auditable trails and measurable outcomes. What this means for enterprises looking to get into agentic AI Intuit's evolution offers a concrete roadmap for enterprise teams planning autonomous AI implementations: Focus on workflow completion, not conversation: Target specific business processes for end-to-end automation rather than building general-purpose chat interfaces. Build agent orchestration infrastructure: Invest in platforms that coordinate prediction, language processing and autonomous execution within unified workflows, not isolated AI tools. Design verification systems upfront: Include comprehensive audit trails, outcome tracking and user notifications as core capabilities rather than afterthoughts. Map workflows before building technology: Use customer advisory programs to define agent capabilities based on actual operational challenges. Plan for interface redesign: Optimize UX for agent-driven workflows rather than traditional software navigation patterns. "As large language models become commoditized, the experiences that are built upon them become much more important," Srivastava said.

[2]

Intuit bets big on AI to boost efficiency and trust in QuickBooks

Intuit -- the fintech platform that owns TurboTax, Credit Karma, Mailchimp, and QuickBooks -- announced that it has implemented a new set of AI agents into its products. The company showcased how the AI agents work within QuickBooks at an event on June 24, and Fast Company was able to see a demonstration of how the agents can help business owners and entrepreneurs use them to speed up their bookkeeping and accounting processes. QuickBooks will incorporate a Payments Agent, an Accounting Agent, a Customer Agent, and a Finance Agent, all of which are designed to become intimately familiar with a business's specific customer base and financial track record, offer up insights, and make additional analyses. And though it's just now being rolled out, the new AI capabilities have been in the works for a long time. "This is five or six years in the making," Sasan Goodarzi, Intuit's CEO, tells Fast Company. "We've made huge investments in the past five years," he says, and the company has taken its time because when it comes to bookkeeping and accounting, "accuracy matters."

[3]

Intuit's CEO Says These AI Tools Will Streamline Your Accounting Department

Intuit, the tech giant behind the QuickBooks accounting platform, previewed technology that it's now making public: a suite of AI agents meant to handle some of the behind-the-scenes accounting and bookkeeping work. Each of four AI tools on display promised to automate a different aspect of business management on QuickBooks -- payments, accounting, finance and customer acquisition -- with video walk-throughs showing the software doing everything from reconciling books to suggesting what late fee a business owner should implement to ranking inbound sales leads as either "cold," "warm," or "hot." Payroll, marketing and project management bots are also on their way, according to the company. It's always a good idea to take these pre-screened tech demos with a grain of salt, especially when it comes to AI, a technology that can act in surprising and unpredictable ways. Still, Intuit seems all-in on the machine learning revolution, and as it rolls out these agents (a process that, for American customers, starts July 1), it's worth understanding the company's vision for the future of accounting.

[4]

Intuit launches AI agents and fintech platform

This content is provided by an external author without editing by Finextra. It expresses the views and opinions of the author. These agents will automate workflows and when combined with human experts will deliver real-time insights and improve cash flow for businesses. The new AI agents, embedded in the Intuit platform, create a more powerful QuickBooks that provides businesses with a virtual team working on their behalf while the customer is always in control. The agents transform how work is done and help customers grow, completing workflows across customer relationship management, financial analysis, payments, accounting, and more, saving businesses up to 12 hours a month.1 Their ability to seamlessly connect data across multiple applications proactively gives customers a 360-view of their business metrics and overall performance - all in one place. The result: 78% of customers say Intuit's AI makes it easier for them to run their business; and 68% state it allows them to spend more time growing their business.2 These AI agents are also able to work along-side trusted AI-enabled human experts to provide businesses with additional expertise and support. "Intuit's AI-driven expert platform is transforming how businesses run and grow with first-of-its-kind agentic AI experiences," said Sasan Goodarzi, Intuit CEO. "When our vast amounts of data and AI capabilities are combined with the power of trusted human experts, Intuit's uniquely designed, integrated platform unlocks next-level efficiencies, profitability, and growth for businesses." These new, done-for-you experiences are part of a completely redesigned and personalized QuickBooks web layout. The homepage is transformed into a striking display of customizable widgets with a powerful business feed that shows real-time intelligent insights, recommendations, and summarizes the workflows and tasks completed by the AI agents. Customers can seamlessly collaborate with human experts and connect to additional Intuit products, services, and third-party apps to truly realize the benefits and power of one integrated platform that drives next-level business efficiencies and growth, all in one place. In addition to the new web experience, the QuickBooks mobile app also has a new, modern interface that delivers the benefits of AI agents on the go. Introducing Intuit AI agents: A virtual team that does virtually everything Intuit's new AI agents will help businesses - at every stage - scale, enabling them to grow on a platform they know and trust. The AI agents complete day-to-day tasks, including managing customer leads, tracking payments, sending invoices, and reconciling a business's books. In addition, new, integrated collaboration tools allow a business owner and their accountant to seamlessly communicate and work together in QuickBooks. With the automation of workflows, collaboration with trusted experts, and the ability to deliver real-time, personalized, and actionable insights, businesses move faster, operate smarter, and uncover greater efficiencies and growth. * Payments Agent: Optimizes and grows cash flow by getting businesses paid an average of 5 days faster3 with tailored acceleration strategies that predict late payments, automate invoice tracking, and create and send invoices and reminders. * Accounting Agent: Automates bookkeeping and transaction categorization, and assists in reconciliation, delivering cleaner, more accurate books. * Finance Agent: Provides a comprehensive approach to the financial management of growing, mid-market businesses with robust reporting, KPI analysis, and scenario planning and forecasting based on performance and peer benchmarking, helping finance teams make smart decisions to achieve financial goals. "I need more time to be able to invest back into my business," said Kurtis Graham, founder, COSIGN Enterprises, LLC. "Intuit's AI can help me save several hours a month and drive revenue for my business. That's a win-win for my business." Customer Hub: AI agents that strengthen relationships and fuel business growth The Customer Hub, included in most QuickBooks Online plans, will provide two new virtual agents that automate and streamline the sales and customer relationship management (CRM) process, managing new leads and existing customers in one place to deliver delightful customer experiences and stronger relationships. * Customer Agent: Sources leads, drafts personalized email responses, suggests and schedules meetings based on engagement data, and tracks every customer opportunity in the sales cycle. * Marketing Agent: Coming later this year, it will automate audience management, campaign execution, and content creation to deliver impactful acquisition and retention marketing campaigns via Mailchimp. Intuit AI agents for growing businesses In the coming months, Intuit AI agents will be available for larger and growing businesses to tackle more complex tasks and boost productivity even further, enabling these businesses to scale with speed. * Payroll Agent: Proactively collects time and attendance data from your employees and runs payroll when you say so. * Project Management Agent: Manages project quotes, milestones, and budgets so businesses stay on track. For more than 40 years, Intuit has been leading the industry in delivering impactful customer experiences that help millions of consumers and businesses put more money in their pockets, helping them achieve their business and financial goals with less effort and complete confidence. The launch of Intuit's transformational AI agents is the latest innovation powered by Intuit's platform, bringing artificial intelligence and human intelligence together to power prosperity for its customers. Now, businesses and their accountants have access to a virtual team that saves them time, simplifies the day-to-day running of a business, and helps accountants more confidently and quickly advise clients on key decisions. Availability The new web and mobile interfaces, integrated AI agents and human experts, and Customer Hub will start rolling out today, July 1, to a range of QuickBooks Online products and customers in the US.

Share

Share

Copy Link

Intuit introduces a suite of AI agents in QuickBooks, automating workflows and providing real-time insights to help businesses save time, improve cash flow, and boost efficiency.

Intuit's AI Revolution in Business Operations

Intuit, the fintech giant behind QuickBooks, TurboTax, Credit Karma, and Mailchimp, has unveiled a groundbreaking suite of AI agents designed to transform how small and mid-market businesses operate

1

. This latest innovation, built on years of development in generative AI, marks a significant shift from background AI to autonomous agents that actively work on behalf of customers1

2

.

Source: Inc.

The AI Agent Suite: A Virtual Team for Businesses

Intuit's new AI agents, embedded in the QuickBooks platform, create a virtual team that automates various business workflows:

- Payments Agent: Optimizes cash flow by predicting late payments, generating invoices, and executing follow-ups

1

4

. - Accounting Agent: Handles transaction categorization, reconciliation, and workflow completion for more accurate bookkeeping

1

4

. - Finance Agent: Provides KPI analysis, scenario planning, and forecasting based on company performance and peer benchmarks

1

4

. - Customer Agent: Manages leads, drafts personalized emails, and tracks customer opportunities throughout the sales cycle

4

.

Additional agents for marketing, payroll, and project management are in development

3

4

.Impressive Results and User Experience

According to Intuit, these AI agents deliver significant benefits:

- Businesses save up to 12 hours per month on average

1

4

. - Payments are received up to five days faster

1

4

. - 78% of customers report easier business management

4

. - 68% of users can dedicate more time to business growth

4

.

The new QuickBooks interface has been redesigned to be task-oriented, featuring a "business feed" that contextually surfaces agent actions and recommendations

1

.

Source: Fast Company

Related Stories

Technical Foundation and Trust-Building Measures

Intuit's AI agents are built on the company's generative AI operating system (GenOS) and incorporate several advanced technologies:

- A proprietary prompt optimization service

1

. - An intelligent data cognition layer for enterprise data

1

. - An agent starter kit to facilitate agentic AI development

1

.

To address trust and verification challenges, Intuit has implemented closed-loop capabilities that provide evidence of agent actions and outcomes

1

.The Future of AI in Business Operations

Sasan Goodarzi, Intuit's CEO, emphasizes that this development has been years in the making, with a focus on accuracy in bookkeeping and accounting

2

. The company's vision extends beyond simple automation, aiming to create a more powerful and integrated platform that drives business efficiencies and growth4

.

Source: VentureBeat

As these AI agents roll out to American customers starting July 1, 2023, they represent a significant step forward in the application of AI to business operations

3

. While the full impact remains to be seen, Intuit's commitment to this technology signals a new era in how small and mid-market businesses may manage their finances and operations in the future.References

Summarized by

Navi

[4]

Related Stories

Intuit Revolutionizes QuickBooks with AI Agents for Enhanced Business Efficiency

29 Jul 2025•Business and Economy

Intuit Launches AI Agent Team to Address SMB Growth Challenges Across Global Markets

13 Nov 2025•Business and Economy

Intuit Unveils Agentic AI: Revolutionizing Consumer and Business Solutions

26 Sept 2024

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation