Meridian raises $17 million to build auditable AI agents for financial modeling

2 Sources

2 Sources

[1]

Meridian raises $17 million to remake the agentic spreadsheet | TechCrunch

The fight to tame spreadsheets with AI isn't over yet. A new company called Meridian has emerged from stealth with a more comprehensive IDE-based approach to agentic financial modeling -- and plenty of funding to build it. On Wednesday, the company announced $17 million in seed funding at a $100 million post-money valuation. "Our goal is to make financial modeling and spreadsheets way more predictable and auditable," CEO and co-founder John Ling told TechCrunch. "How can you take a process that traditionally might have taken cool hours and condense it down into like 10 minutes?" The round was led by Andressen Horowitz and the General Partnership, with participation from QED Investors, FPV Ventures and Litquidity Ventures. The company says it is currently working with teams at Decagon and OffDeal, and signed $5 million of contracts in December alone. Excel agents have been a popular target for AI startups, due in part for the high cost of human-led financial analysis. But where previous Excel agents like Shortcut AI built agents into Excel, Meridian operates as a stand-alone workspace, more akin to Cursor. This allows the app to operate like an IDE, integrating data sources and other outside references that might otherwise create friction. Based in New York, the Meridian team includes both alumni of AI firms like Scale AI and Anthropic as well as financial veterans from firms like Goldman Sachs. As Ling describes it, Meridian's biggest challenge is the strict requirements of financial clients, which often clash with the non-deterministic nature of AI models. "if you go to ten different software engineers at Google, and you want to add some new feature into an app, you'll probably get like, 10 completely different implementations. And that's totally fine," Ling says. "But if you go to 10 banking analysts at Goldman Sachs and you ask for 10 valuation models for a company, you would probably get 10 almost identical workbooks." As a result, the Meridian team has done significant work to make their outputs more auditiable and deterministic, while maintaining the flexibility of LLM-based tools. The result is a mixture of agentic AI and more conventional tooling, minimizing the hallucinations that slow down many enterprise deployments. "Our goal is to really remove the doubt layer right from the LLM process," Li says. "You know exactly how the logic flows, and all of these assumptions or whatever that go into the model, you can see exactly where they're coming from."

[2]

Agentic financial modeling startup Meridian gets $17M in funding - SiliconANGLE

Agentic financial modeling startup Meridian gets $17M in funding Meridian, an agentic artificial intelligence startup trying to reinvent complex financial modeling, has the money it needs to complete that mission after raising $17 million in seed funding today. The round, led by Andreessen Horowitz and The General Partnership, brings the company's post-money valuation to $100 million. The startup, officially known as Longitude Labs Inc., is trying to tackle one of the most promising yet challenging use cases for AI agent automation. Financial modeling is an extremely complex business that's almost always done in Excel spreadsheets, which is why most early efforts have focused on trying to integrate AI agents into Microsoft Corp.'s iconic software. But Meridian believes that's the wrong approach, as it places major limitations on the functionality of AI agents and hinders the auditability of their work. Instead of creating an AI agent and letting it loose in Excel, Meridian operates as a standalone integrated development environment. This architectural choice means it can offer more comprehensive functionality than agentic add-ons. For instance, it can integrate diverse datasets and external references, which would be difficult to implement in Excel workflows. In an interview with TechCrunch, Meridian co-founder and Chief Executive John Ling said financial institutions are heavily regulated and must adhere to very strict rules when building financial models. There's a need for extreme, verifiable accuracy and consistency, but this clashes with the non-deterministic nature of large language models, he said. ""If you go to 10 different software engineers at Google, and you want to add some new feature into an app, you'll probably get like 10 completely different implementations," he said. "But if you go to ten banking analysts at Goldman Sachs and ask for ten valuation models for a company, you would probably get ten almost identical workbooks." This underscores the need for standard, reproducible outputs in financial models, and that's precisely what Meridian is trying to achieve. Its platform blends agentic AI with conventional financial tools and leans heavily on verifiable data to minimize the hallucinations that frequently occur in AI outputs. This allows it to generate deterministic outputs that are consistent and reproducible, Ling explained. Further, its platform provides visibility into every assumption and the logic flow of financial models, in order to facilitate regulatory audits. "Our goal is to really remove the doubt layer right from the LLM process," Ling explained. "You know exactly how the logic flows, and all of these assumptions or whatever that go into the model, you can see exactly where they're coming from." That's exactly what financial institutions need if they're going to be able to embrace automation and reduce the load on their expensive and overworked human analysts, Ling said. Proof of that comes from Meridian's early traction. According to the CEO, the startup secured $5 million in contracts in December with clients including Decagon AI Inc. and OffDeal Inc. With today's funding, Meridian hopes to accelerate the development of its financial modeling platform and grow its adoption among enterprises seeking faster, more reliable ways to build complex financial models.

Share

Share

Copy Link

Meridian emerges from stealth with $17 million in seed funding to tackle AI-powered financial modeling. The startup takes a standalone IDE approach rather than integrating into Excel, aiming to make AI agents more auditable and deterministic for regulated financial institutions. The company secured $5 million in contracts in December alone.

Meridian Secures Major Funding for AI-Powered Financial Modeling

Meridian has emerged from stealth mode with $17 million in seed funding to reimagine how financial modeling works in an AI-driven world. The round, led by Andreessen Horowitz and the General Partnership, values the startup at a $100 million post-money valuation. Additional investors include QED Investors, FPV Ventures, and Litquidity Ventures, signaling strong confidence in the company's approach to agentic financial modeling

1

.The New York-based company, officially known as Longitude Labs Inc., is already showing traction with clients including Decagon and OffDeal. Meridian signed $5 million of contracts in December alone, demonstrating early market validation for its platform

1

.A Different Approach to Spreadsheets and AI Agents

While many AI startups have attempted to integrate AI agents directly into Excel, Meridian takes a fundamentally different path. The company operates as a standalone integrated development environment, similar to Cursor, rather than building agents into existing spreadsheet software. This architectural choice allows Meridian to integrate diverse data sources and external references that would create friction in traditional Excel workflows

2

.

Source: SiliconANGLE

"Our goal is to make financial modeling and spreadsheets way more predictable and auditable," CEO and co-founder John Ling told TechCrunch. "How can you take a process that traditionally might have taken cool hours and condense it down into like 10 minutes?"

1

Source: TechCrunch

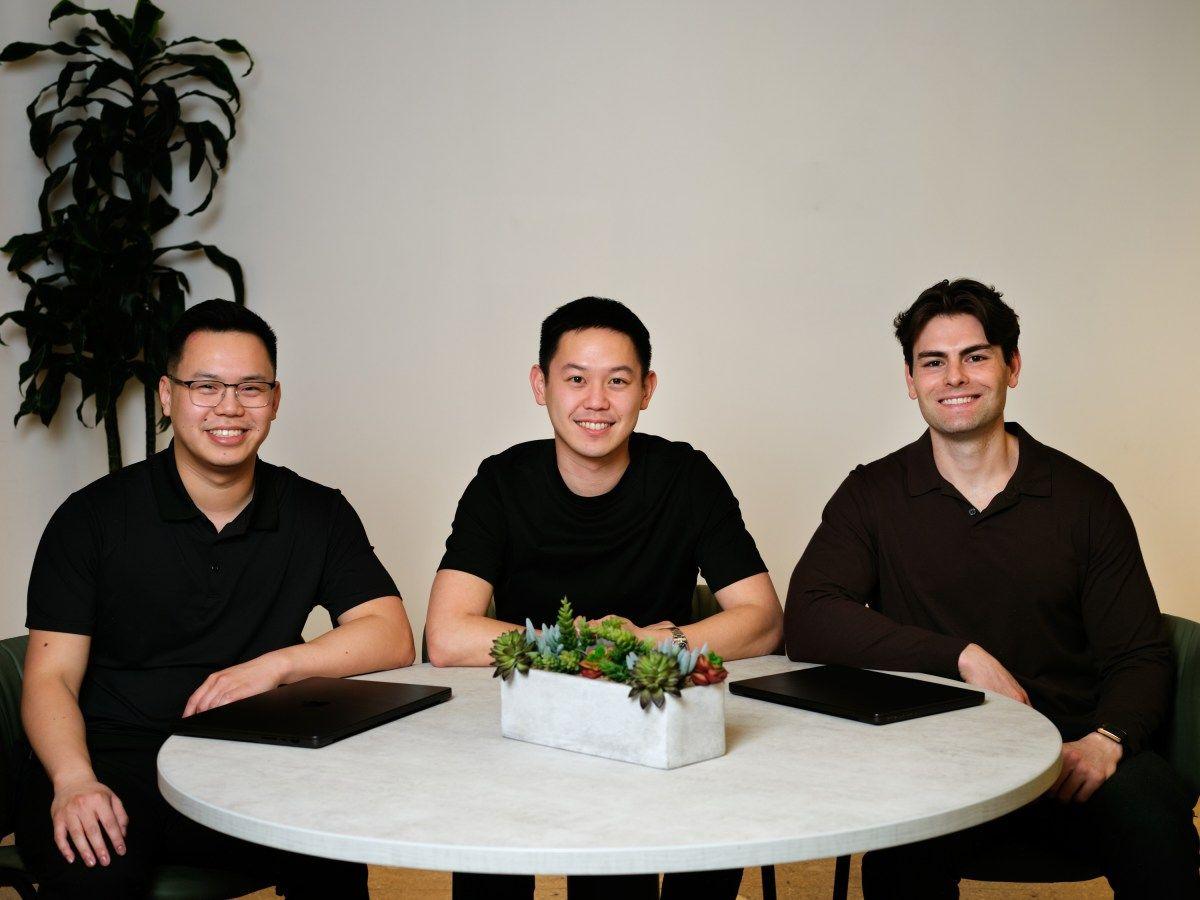

The Meridian team brings together expertise from both AI firms like Scale AI and Anthropic, as well as financial veterans from Goldman Sachs, creating a blend of technical and domain knowledge

1

.Solving the Deterministic Challenge in Agentic Artificial Intelligence

Meridian's biggest challenge lies in reconciling the strict requirements of financial institutions with the non-deterministic AI models that power modern agentic artificial intelligence. Financial modeling demands extreme precision and consistency, particularly for regulated banking analysts who must produce nearly identical outputs for the same valuation scenarios.

Ling illustrated this challenge: "If you go to ten different software engineers at Google, and you want to add some new feature into an app, you'll probably get like 10 completely different implementations. And that's totally fine. But if you go to 10 banking analysts at Goldman Sachs and you ask for 10 valuation models for a company, you would probably get 10 almost identical workbooks"

1

.To address this, Meridian has engineered its platform to produce deterministic and reproducible outputs while maintaining the flexibility of large language models. The AI-powered platform blends agentic AI with conventional financial tools, minimizing the hallucinations that frequently plague enterprise AI deployments

2

.Related Stories

Building Auditable Financial Models for Regulated Industries

The platform's focus on auditability sets it apart in the competitive landscape of AI agents for finance. Meridian provides complete visibility into every assumption and logic flow within financial models, essential for regulatory compliance and institutional trust.

"Our goal is to really remove the doubt layer right from the LLM process," Ling explained. "You know exactly how the logic flows, and all of these assumptions or whatever that go into the model, you can see exactly where they're coming from"

1

.This transparency addresses a critical barrier to AI adoption in financial services, where institutions must verify and audit every calculation. By making the IDE-based system fully auditable, Meridian aims to accelerate automation while reducing reliance on expensive human analysts. The company's early contract wins suggest financial institutions are ready to embrace this approach, provided they can maintain the rigor and reproducibility their regulatory environment demands

2

.References

Summarized by

Navi

Related Stories

Model ML Secures $75 Million Series A to Automate Investment Banking Workflows

24 Nov 2025•Startups

Datarails raises $70M to bring AI Finance Agents to CFOs struggling with fragmented data

21 Jan 2026•Technology

Glassbox Raises $1.2 Million to Revolutionize Financial Modeling with AI-Powered Spreadsheets

19 Feb 2025•Business and Economy

Recent Highlights

1

Trump bans Anthropic from government as AI companies clash with Pentagon over weapons and surveillance

Policy and Regulation

2

Nvidia pulls back from OpenAI investment as Jensen Huang cites IPO plans and complex dynamics

Technology

3

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology