Microsoft Hits Record High as AI Investments Pay Off

3 Sources

3 Sources

[1]

Microsoft Hits First Record Since July as AI Halo Takes Hold

Microsoft Corp. shares rose to an intraday record on Thursday, taking out an all-time high that's stood for nearly a year as investors increasingly see the software giant as a major winner with artificial intelligence. Shares rose 1% to $468.49, eclipsing a peak hit in July. The record is the latest example of a pronounced rebound in the stock, which has climbed more than 30% off an April low. The rally has added more than $800 billion to Microsoft's market capitalization, and at $3.48 trillion, it is one of the two biggest companies in the world, neck-and-neck with Nvidia Corp., another central winner of the AI era.

[2]

Microsoft's stock hits fresh record, rallying despite drop in broader market

Shares of the software giant rose 0.8% to close at $467.68. Microsoft has once again reclaimed the title of world's largest company by market cap, with a valuation of $3.48 trillion. Nvidia has a market cap of $3.42 trillion, and Apple is valued at $3 trillion. Microsoft last recorded a record close in July 2024. The stock is now up 11% for the year, while the Nasdaq is flat. Tech stocks broadly dropped on Thursday, led by a plunge in Tesla, as CEO Elon Musk and President Donald Trump escalated their public beef. Musk, who was leading the Trump Administration's Department of Government Efficiency (DOGE) until last week, has slammed the Trump-backed spending bill making its way through Congress, a spat that has turned personal. But Microsoft investors appear to be tuning out that noise. Microsoft CEO Satya Nadella focused on his company's tight relationship with artificial intelligence startup OpenAI in an interview with Bloomberg, some portions of which were published on Thursday. "Why would any one of us want to go upset that?" he told Bloomberg. Nadella told analysts in January that OpenAI had made a large new commitment with Microsoft's Azure cloud. In total, Microsoft has invested nearly $14 billion in OpenAI.

[3]

Microsoft stock just hit a record high as it cashes in on the AI boom

Microsoft (MSFT-0.92%) stock just clocked an intraday record on Thursday ($468.49), a milestone that caps off the company's aggressive AI moves -- and even more aggressive expectations. Wall Street isn't just rewarding Microsoft for showing up to the AI race, it's pricing in a future where the company leads the pack. The surge marks the company's biggest high since July 2024 and follows a series of announcements that signal how deeply AI is baked into Microsoft's business. Recently, the company has laid out a massive infrastructure plan, unveiled custom AI chips for Azure, and kept investors buzzing with sharp revenue growth across its cloud and productivity divisions. In many ways, Microsoft's stock high isn't just about AI -- it's about the company's ability to industrialize it. The AI narrative isn't new, but Microsoft is increasingly making it look real. While Google (GOOGL-1.57%) is experimenting and Amazon (AMZN-2.87%) is largely building behind the scenes, Microsoft is out there productizing -- and monetizing -- faster than most expected. GitHub Copilot is gaining traction. Microsoft 365 is increasingly AI-native. Azure has become the go-to cloud for businesses that want ready-to-go AI tools. Microsoft had a rocky start to the year (a 10% decline from its July 2024 peak) but it's rebounded sharply, thanks largely to strong cloud growth -- Azure revenue jumped 33% in the 2025 fiscal third quarter -- and continued momentum in AI integration. Now, Microsoft's stock is up about 12% year-to-date (and 30% since April of this year), easily outperforming fellow tech giants such as Apple (AAPL-0.39%), Amazon, Alphabet, and Nvidia (NVDA-1.54%). The recent rally has added over $800 billion to Microsoft's market capitalization, and the company's performance positions it as one of the more stable, high-conviction bets in a tech sector that is increasingly divided between hype and execution. Earlier this year, Microsoft committed to spending $80 billion in fiscal 2025 -- most of it on AI-enabled data centers. That's a figure that suggests CEO Satya Nadella sees AI as Microsoft's cloud moment all over again. And the market seems to agree. Behind the rally, analysts are circling with revised playbooks. The average analyst price target shows almost double-digit potential over the coming year. And some analysts predict that Microsoft's AI initiatives could bring in over $10 billion annually.

Share

Share

Copy Link

Microsoft's stock reaches a new all-time high, driven by its strategic AI investments and strong market position in cloud computing and productivity software.

Microsoft Achieves New Stock Market Peak

Microsoft Corporation (MSFT) has reached a significant milestone, with its stock price hitting an intraday record of $468.49 on Thursday

1

. This achievement marks the company's highest stock value since July 2024, underscoring the market's growing confidence in Microsoft's artificial intelligence (AI) strategy2

.

Source: CNBC

AI-Driven Growth and Market Position

The recent stock surge has propelled Microsoft's market capitalization to an impressive $3.48 trillion, placing it in a tight race with Nvidia for the title of the world's most valuable company

1

. This remarkable growth is largely attributed to Microsoft's strategic investments in AI technology and its strong position in the cloud computing market.Microsoft's CEO, Satya Nadella, has been vocal about the company's partnership with OpenAI, emphasizing the significance of this collaboration in driving innovation

2

. The tech giant has invested nearly $14 billion in OpenAI, a move that appears to be paying dividends as Microsoft integrates AI capabilities across its product lineup.Financial Performance and AI Integration

Microsoft's financial performance has been robust, with Azure revenue jumping 33% in the 2025 fiscal third quarter

3

. The company's stock is up about 12% year-to-date and has rallied approximately 30% since April 2025, outperforming many of its tech sector peers3

.The company's AI initiatives are becoming increasingly visible in its product offerings. GitHub Copilot is gaining traction, Microsoft 365 is becoming more AI-native, and Azure has positioned itself as the preferred cloud platform for businesses seeking ready-to-use AI tools

3

.

Source: Quartz

Related Stories

Future Outlook and Analyst Predictions

Microsoft's commitment to AI is evident in its planned expenditure of $80 billion in fiscal 2025, with a significant portion allocated to AI-enabled data centers

3

. This substantial investment signals the company's belief in AI as a transformative force, comparable to the impact of cloud computing.Analysts are optimistic about Microsoft's future, with some predicting that the company's AI initiatives could generate over $10 billion in annual revenue

3

. The average analyst price target suggests potential for further growth in the coming year, reflecting confidence in Microsoft's AI-driven strategy.Market Context and Competitive Landscape

While Microsoft celebrates its stock market success, the broader tech sector faces challenges. Other tech stocks experienced a downturn on Thursday, partly due to political tensions involving Tesla's CEO Elon Musk and President Donald Trump

2

. However, Microsoft appears to be weathering these industry headwinds, with investors focusing on the company's long-term AI potential.As Microsoft continues to capitalize on the AI boom, it is increasingly seen as a leader in industrializing and monetizing AI technology. This perception sets it apart from competitors like Google and Amazon, who are perceived as being at different stages of their AI journeys

3

.References

Summarized by

Navi

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

AI chatbots helped teens plan violent attacks in 8 of 10 cases, new investigation reveals

Technology

3

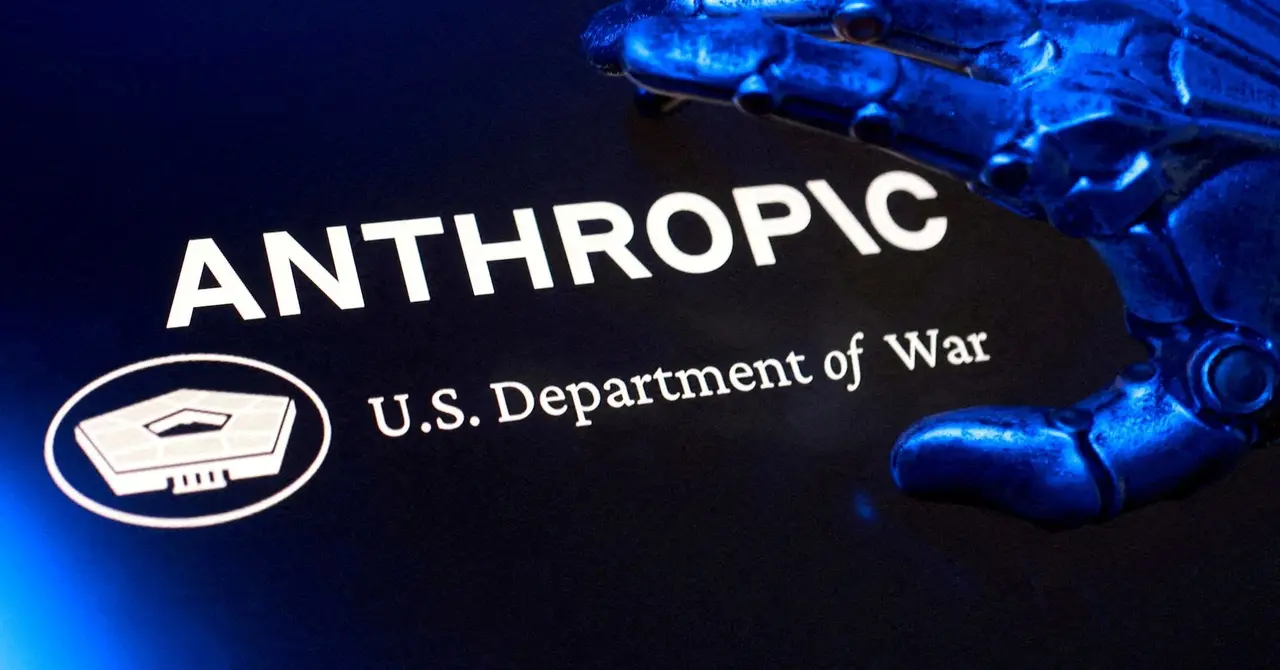

Pentagon shuts door on Anthropic talks as Microsoft and Big Tech rally behind AI firm's lawsuit

Policy and Regulation