Nuclear Power Emerges as Key Player in AI Infrastructure, Attracting Tech Giants and Investors

2 Sources

2 Sources

[1]

This Little-Known Company Has Outpaced All Of The "Magnificent Seven" Stocks This Year. Here's Why I Think It's Parabolic Run Could Just Be Getting Started. | The Motley Fool

A nuclear power company has outperformed every stock in the S&P 500 so far this year. For the last two years, artificial intelligence (AI) has proven to be a generational influence for the stock market. It seems that every other week the S&P 500 or Nasdaq Composite are setting record highs -- and excitement around AI has a lot to do with that. If you've never heard of Vistra or are unfamiliar with nuclear energy's role in the AI realm, you're in the right place. Below, I'm going to break down how nuclear energy could be a lucrative pocket of the AI landscape, and assess if Vistra's stock is a good opportunity right now. Back in September, Microsoft announced that it signed a 20-year purchase agreement with nuclear power leader Constellation Energy. The primary focus of the deal is to re-open nuclear plants on Pennsylvania's Three Mile Island. It wasn't long for some of Microsoft's Magnificent Seven cohorts to follow up with moves of their own. In mid-October, Amazon announced that it is going to build small modular reactors (SMR) with the help of Dominion Energy and Energy Northwest. While Amazon's may appear to be in response to Microsoft's partnership with Constellation Energy, keep in mind that earlier this year Amazon Web Services (AWS) announced plans to power a data center using Talen Energy's nuclear capabilities. Around the same time as Amazon's recent deals, Alphabet's Google announced that it will be buying SMRs from Kairos Power. These deals have had a direct impact on nuclear power stocks, and the momentum illustrated in the chart below speaks for itself. In just the last three months, shares of popular nuclear power stocks such as Constellation Energy, Vistra, and Oklo have skyrocketed. Although it's fair to say that some of this momentum is correlated with the Magnificent Seven deals highlighted above, there is a case to be made that further gains are on the horizon. One of the most popular technology analysts on Wall Street is Dan Ives of Wedbush Securities. He is frequently a contributor on financial news programs including CNBC and Bloomberg. Recently, Ives suggested that over $1 trillion will be spent on AI infrastructure over just the next three years. Naturally, some of the bigger-ticket items of these capital expenditures (capex) will include semiconductor chips, graphics processing units (GPUs), upgrades in personal computing, and storage solutions such as server racks. An adjacent opportunity that should witness some tailwinds from these spending areas is data centers -- and that is where nuclear power comes into focus. Data centers consume high levels of energy, and with AI becoming more of a staple for businesses of all sizes, these rates are expected to rise considerably over the next several years. At the moment, common energy protocols for data centers include generators, fans, and air conditioning units. But with AI bringing a new level of energy consumption to the table, businesses are looking for more cost-efficient and sustainable alternatives compared to current mainstream solutions. Nuclear energy is emerging as a new option for powering data centers. I think the deals highlighted above serve as an indication of nuclear power's popularity and importance, and I suspect that more large-scale partnerships will be announced over the next couple of years. The chart below benchmarks the forward price to earnings (P/E) multiple for Vistra against a small cohort of other nuclear power stocks. At a forward P/E of roughly 22, shares of Vistra look reasonable compared to its peers -- with Constellation Energy being the anomaly trading at a premium. But as I pointed out above, Vistra and related stocks have been soaring over the last couple of months. To me, these gains seem rooted in the positive outlook at the intersection of nuclear energy and AI, underscored by deals with big tech. At the end of the day, Vistra's recent share price appreciation has come with considerable valuation expansion. I would argue that right now there is still momentum fueling shares of Vistra, and I think that some of the upside from demand for nuclear power combined with macro tailwinds in the AI industry have already been priced into the stock. While I very much see Vistra as a compelling opportunity in nuclear power, I think the prudent strategy right now is to listen to the company's management during earnings calls and be on the lookout for any potential deals or partnerships the company is working on. AI is a long-term play, and nuclear power is just one chapter in the broader story. Even though I like the idea of investing in Vistra and I see further gains on the horizon, long-run investors should have better opportunities to buy the stock over time once the company starts proving that it is emerging as a leader in the AI and nuclear power markets.

[2]

Nvidia CEO Jensen Huang Is Bullish on Nuclear Power. Will Nvidia Invest in Nuclear Stocks? | The Motley Fool

This biggest question in artificial intelligence is rapidly changing from how to use it to how to power it. AI data centers demand massive amounts of power to run the compute necessary to make applications like ChatGPT work. In fact, powering its computers is the biggest cost for the AI start-up and industry bellwether OpenAI, showing how crucial it is for AI companies to find affordable energy. In recent weeks, there seems to be something of a consensus forming on the question of affordable energy for AI: It's going nuclear. Investors are rapidly lining up behind nuclear power stocks as big tech companies like Microsoft, Amazon, and Alphabet all forged deals to source nuclear power in recent weeks. The best-performing stock on the S&P 500 is now Vistra Energy, an unregulated electric utility that owns and operates several utilities. Shares of Vistra and fellow unregulated utility Constellation Energy rose in recent weeks after Constellation signed an agreement with Microsoft to resurrect the Three Mile Island nuclear plant in Pennsylvania. Right now, no company in AI seems to be more influential than Nvidia (NVDA -4.72%). It dominates the market for data center GPUs, the chips that power applications like ChatGPT, and its revenue has skyrocketed since OpenAI launched its large language model. Unlike Microsoft, Amazon, and Alphabet, Nvidia doesn't operate a cloud infrastructure service so it doesn't need to partner with a nuclear energy provider the way those companies do, but given that AI demand now makes up the bulk of its business, it's in the company's best interest to ensure that there is an adequate energy supply to run those AI data centers. Now, Nvidia seems to be turning bullish on nuclear as well. CEO Jensen Huang said in a Bloomberg interview, "Nuclear is wonderful as one of the sources of energy, one of the sources of sustainable energy" in supplying data centers. Since Nvidia is at the center of the AI boom and its CEO has expressed support for nuclear power, the next logical question is if Nvidia will take the step of investing in a nuclear energy company. Nvidia is already a prolific investor. The company acquired shares in publicly traded companies like Arm Holdings, Soundhound AI, and Serve Robotics, among others, and these stocks, especially the smaller ones, popped on news of Nvidia's investment. It's unclear how the company might look to get exposure to the nuclear energy sector, but one of the more popular ways right now is through companies that specialize in small modular reactors (SMRs), which offers some advantages of traditional nuclear power because they can be scaled up and down easily according to energy demands. They're also more affordable, in part, because they can be prefabricated and shipped to the site where they'll be used. SMR nuclear stocks have surged in recent weeks, including NuScale Power and Oklo, which is backed by OpenAI Founder Sam Altman, and NANO Nuclear Energy, which is developing micro-small nuclear reactors. None of those companies currently have material revenue, so investors should understand that SMRs are still largely a development-stage technology. There's also TerraPower, a privately held company backed by Bill Gates, though it's not expected to go public soon. Given the attention from the big cloud infrastructure companies above, nuclear is gaining steam as the leading way to fill the expected gap in energy demand as it is a clean, though not renewable, source of energy. Keep your eye on the three stocks above, as well as comments from Jensen Huang for more insight on Nvidia's direction in nuclear. Stocks like Soundhound and Serve Robotics soared on news of Nvidia's investment, and that would almost certainly happen in the nuclear energy sector if Nvidia took a stake in one of the SMRs above or a company like it. Considering Nvidia's position in AI, I think it's more likely than not that the company will invest in some kind of nuclear energy company.

Share

Share

Copy Link

Major tech companies are turning to nuclear energy to power AI data centers, sparking a surge in nuclear power stocks and raising questions about Nvidia's potential involvement in the sector.

Nuclear Power Gains Momentum in AI Infrastructure

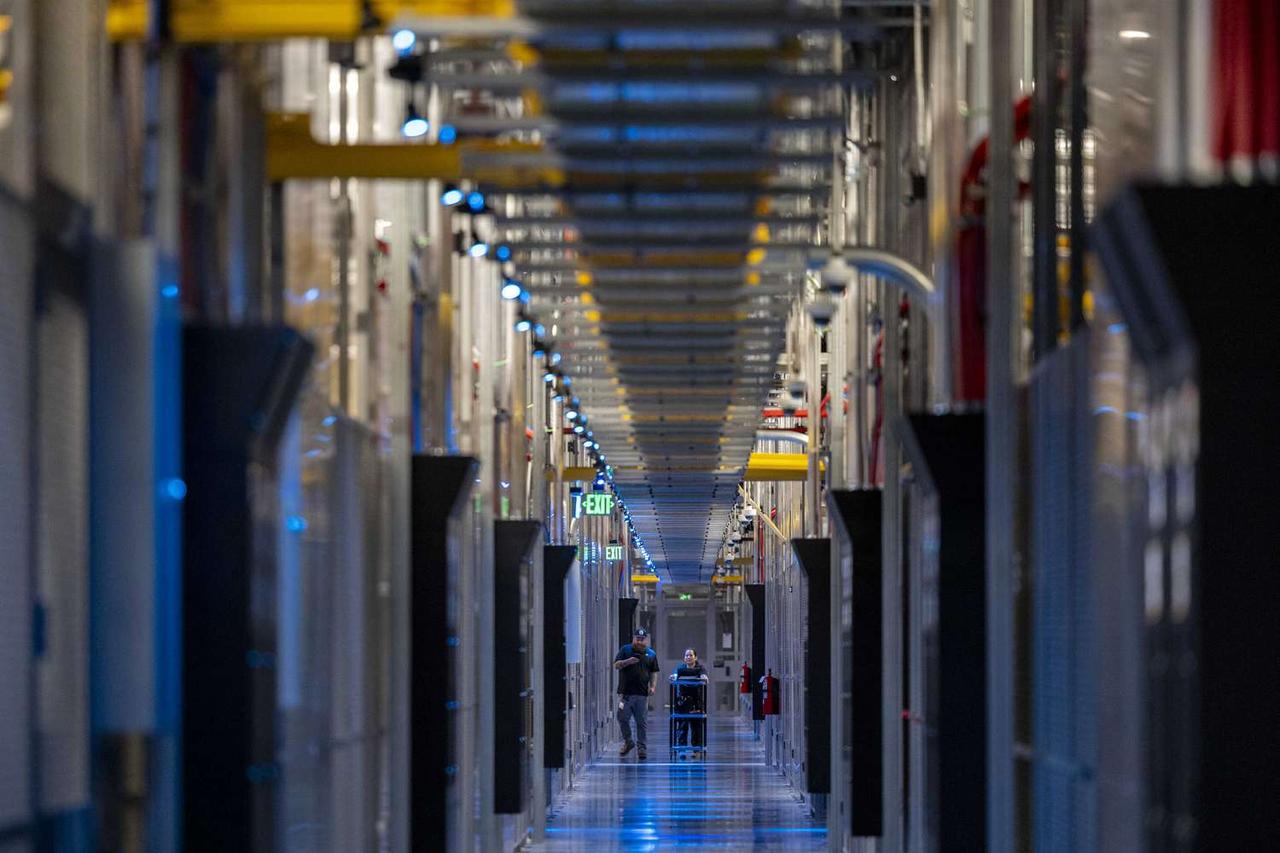

The artificial intelligence (AI) boom has sparked an unexpected resurgence in the nuclear power industry, as tech giants seek sustainable and efficient energy sources for their power-hungry AI data centers. This trend has led to a significant surge in nuclear power stocks, with companies like Vistra Energy outperforming even the "Magnificent Seven" tech stocks

1

.Tech Giants Embrace Nuclear Energy

Major tech companies are making strategic moves in the nuclear energy sector:

- Microsoft signed a 20-year purchase agreement with Constellation Energy to reopen nuclear plants on Pennsylvania's Three Mile Island

1

. - Amazon announced plans to build small modular reactors (SMRs) in partnership with Dominion Energy and Energy Northwest

1

. - Google revealed its intention to purchase SMRs from Kairos Power

1

.

These deals have significantly impacted nuclear power stocks, with shares of Constellation Energy, Vistra, and Oklo experiencing substantial growth in recent months

1

.The AI-Nuclear Power Connection

The growing interest in nuclear power for AI infrastructure is driven by several factors:

- Increasing energy demands: AI data centers consume high levels of energy, which is expected to rise considerably in the coming years

1

. - Cost efficiency: Nuclear power offers a more cost-efficient alternative to current mainstream energy solutions for data centers

1

. - Sustainability: As a clean energy source, nuclear power aligns with tech companies' sustainability goals

2

.

Nvidia's Potential Role in Nuclear Energy

Nvidia, a dominant player in the AI chip market, is showing interest in nuclear power:

- CEO Jensen Huang expressed support for nuclear energy, calling it "wonderful" as a sustainable energy source for data centers

2

. - Speculation is growing about Nvidia's potential investment in nuclear energy companies, particularly those specializing in small modular reactors (SMRs)

2

.

Related Stories

The Rise of Small Modular Reactors (SMRs)

SMRs are gaining popularity in the AI-nuclear power landscape:

- Advantages include scalability, affordability, and ease of deployment

2

. - Companies like NuScale Power, Oklo, and NANO Nuclear Energy are seeing increased investor interest

2

. - Private companies like TerraPower, backed by Bill Gates, are also making strides in SMR technology

2

.

Investment Outlook and Market Impact

The intersection of AI and nuclear power is creating new investment opportunities:

- Nuclear power stocks have seen significant growth, with Vistra Energy becoming the best-performing stock on the S&P 500

2

. - Analysts predict over $1 trillion will be spent on AI infrastructure in the next three years, potentially benefiting the nuclear power sector

1

. - Investors are closely watching for potential investments by major tech companies, as such moves could significantly impact stock prices

2

.

As the AI industry continues to grow, the demand for efficient and sustainable energy sources is likely to keep nuclear power in the spotlight, potentially reshaping both the energy and technology sectors in the coming years.

References

Summarized by

Navi

Related Stories

AI's Energy Appetite: Big Tech Turns to Nuclear and Alternative Power Sources

05 Jun 2025•Business and Economy

Utility Stocks Surge on AI-Driven Energy Demand: Vistra and Constellation Energy Lead the Charge

10 Oct 2024•Business and Economy

Tech Giants Embrace Nuclear Power to Fuel AI's Energy Demands

22 Oct 2024•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology