Nvidia considers Intel Foundry for Feynman AI chips as TSMC capacity constraints bite

3 Sources

3 Sources

[1]

Nvidia might be doing what was once unthinkable: asking Intel to make some of its future AI chips

Nvidia isn't going all-in on Intel, according to the report, but it's better than nothing for the struggling foundry. Intel has had a tough time convincing companies to come to its manufacturing division, Intel Foundry. Few are biting -- preferring to go with tried-and-tested options, namely TSMC. Though the company may have just won a very important customer: Nvidia. According to Digitimes, citing supply chain sources, Nvidia has signed on with Intel Foundry to manufacture some parts of its forthcoming Feynman chips. Nvidia will reportedly use Intel for only some of its chips, namely the non-core bits. It's said to be choosing between Intel Foundry's 18A or 14A process nodes, dependent on whether Intel has high enough yields to reliably produce enough chips on the latter. TSMC, the top dog in Taiwan, will still be leading the charge with the most important silicon, the GPU itself. Most likely on its A16 process node. Feynman is the next major architecture on from Rubin and Rubin Ultra, which is set to arrive from 2028. Revealed at GTC last year, named after physicist Richard Feynman, Nvidia CEO Jensen Huang said very little about the tech specs of the new chip, but a slide behind him titled "Nvidia Paves Road to Gigawatt AI Factories" depicted the chip paired with a Vera CPU, IO, and network chips. With gaming GPUs still on Blackwell, the architecture prior to Rubin, there's not much here for gamers as of yet. Intel is in no hurry to tool up its fabs for 14A production. In an earnings call last week, Intel CFO David Zinsner confirmed that it's "aggressively getting tools on Intel 7, 10, 3, 18A" but "holding back on is 14A." "14A is really linked to foundry customers, and it does not make sense to build out significant capacity there until we know that we have the customers that will accept that demand," Zinsner said. This follows on from comments made in an SEC filing earlier in 2025 by the company's CEO, Lip Bu-Tan, that put investment into 14A and future cutting-edge process nodes into jeopardy. "If we are unable to secure a significant external customer and meet important customer milestones for Intel 14A, we face the prospect that it will not be economical to develop and manufacture Intel 14A and successor leading-edge nodes on a go-forward basis. "In such event, we may pause or discontinue our pursuit of Intel 14A and successor nodes and various of our manufacturing expansion projects." Though, since that time, both the US government and Nvidia have bought a stake in the business -- Nvidia and Intel will team up on some chips in future -- and the rhetoric from the White House has shifted to aggressively pushing companies to manufacture their chips within the United States. Hence why something once as unthinkable as Nvidia using Intel's manufacturing biz is now closer to reality -- there's politics at play. Intel is also reported to be involved in the packaging process for Feynman, taking on around 25% due to the use of its EMIB tech, which Intel uses to connect various dies together on its chips. TSMC will deal with the rest. So, tentatively a win for Intel, though one surely derived in part from political pressure. That could go away at some point, and Intel Foundry will need something special to compete with TSMC in the long-run. As it stands today, 14A and subsequent process nodes are still on shaky ground.

[2]

NVIDIA Looks to Intel's 18A/14A Process and EMIB Packaging for Next-Gen Feynman AI Chips, Signaling a Major Foundry Shift Beyond TSMC

NVIDIA is reportedly exploring options to diversify its chip supply chain, and Intel Foundry is an optimistic choice for next-gen AI lineups at the moment. NVIDIA Is Looking at a "Low Risk" Partnership With Intel Foundry, Involving the Outsourcing of Just the Feynman I/O Die TSMC is emerging as a major bottleneck in the AI supply chain, and there's no doubt that fabless manufacturers are exploring options to expand their sourcing strategies. With the recent breakthroughs Intel has seen with its 18A process, the foundry division has managed to bring the momentum that could potentially lead to external customers flowing in, and according to a report by DigiTimes, NVIDIA is now exploring Intel's 14A/18A process for Feynman's I/O die, along with EMIB advanced packaging. It is claimed that NVIDIA won't go "all in" on Intel Foundry for Feynman and will instead use chips from TSMC as well. The report says that Team Green will outsource only a Feynman die to Intel and will likely adopt either the 18A or the 14A node, though the latter seems more likely. Moreover, Intel will also provide its EMIB advanced packaging for Feynman, and in terms of the manufacturing split, Intel will get 25% of the entire Feynman production, while the rest will be allocated to TSMC. Several US fabless manufacturers are aggressively pursuing a dual-foundry strategy, with AMD and Qualcomm also looking to pair Samsung and TSMC. This pursuit is driven by two key bottlenecks: the first is that the entire AI supply chain currently depends on the Taiwan giant for front-end and back-end needs, which creates a 'single point of failure' in case geopolitical rivalry between China and Taiwan heats up. Secondly, because the AI buildout is so massive, manufacturers and hyperscalers are scrambling to secure capacity at TSMC, yet many are unable to do so. NVIDIA's approach with Feynman is a "low risk" one, as assigning the I/O die to Intel Foundry ensures volume ramp-up isn't compromised if Intel fails to deliver on yield or capacity. And more importantly, NVIDIA is also looking to outsource 'non-core' products to Intel Foundry, which means next-gen gaming GPUs could be part of a foundry deal with Team Blue. It would be interesting to see how the situation at Intel Foundry evolves going forward, since, by the looks of it, TSMC's customers are now forced to diversify their supply networks, leaving only Samsung and Intel as viable options. Follow Wccftech on Google to get more of our news coverage in your feeds.

[3]

Nvidia's Next-Gen GPU Could be Coming to Intel Foundry | The Motley Fool

DigiTimes reported on Wednesday that Nvidia is planning to tap Intel's (INTC 1.39%) foundry for some manufacturing and advanced packaging needs beginning in 2028. Nothing has been confirmed, so this remains in the realm of rumors and speculation. However, it does line up with comments made by Intel management during the fourth-quarter earnings call. If this Nvidia rumor is true, Intel's foundry business will get a significant boost from the king of AI chips. DigiTimes reports that Nvidia is eyeing Intel Foundry for its Feynman generation of GPUs, which is set to debut in 2028. Given supply constraints at foundry leader TSMC, it would certainly make sense for Nvidia to seek alternative manufacturers. According to the report, Intel won't be manufacturing the GPU compute die. That highly complex part of the chip will stay with TSMC. The plan is for Nvidia to use the Intel 18A process, or potentially the upcoming Intel 14A process, for portions of the I/O die. The report notes that this is all contingent on yield improvements for these processes. The I/O die contains memory controllers and handles inter-chip connectivity. It's not as performance-critical as the GPU compute die, but it still requires an advanced process. Intel will reportedly also handle a portion of the advanced packaging needs for the Feynman family of GPUs. Intel's EMIB technology will be used for up to 25% of chips, with TSMC used for the rest. For Nvidia, there's a strong incentive to reduce its reliance on TSMC while shifting some production to the U.S. This deal, if it's more than just a rumor, could act as a test run for Nvidia as it considers moving more manufacturing business to Intel down the road. During Intel's fourth-quarter earnings call, CFO David Zinsner gave a surprising assessment of Intel's advanced packaging opportunity. Zinsner said he had previously expected individual advanced packaging deals to be worth no more than a few hundred million dollars. That's no longer the case. "I'd say some of the early customer engagements suggest that we'll be well north of $1 billion on many of these opportunities for advanced packaging. So they're way more exciting than even I had expected," Zinsner said. That lines up with the Nvidia rumor. If Nvidia does end up using Intel for a quarter of its advanced packaging needs in 2028, it would almost certainly be a $1+ billion deal for Intel. Zinsner's comments suggest that multiple potential advanced packaging customers are engaging with Intel, so this could be a multi-billion-dollar opportunity overall. TSMC offers its CoWoS advanced packaging services, but supply is reportedly being outpaced by demand amid the AI boom. For Intel, advanced packaging could be an effective way to bring foundry customers in the door. Once those customers are comfortable with Intel as an advanced packaging supplier, they could expand the relationship to also include some semiconductor manufacturing. In addition to the Nvidia rumor, analysts appear confident that Apple will use Intel 18A from some M-series chips and potentially Intel 14A for some future iPhone chips. Packaging revenue will likely arrive sooner than manufacturing revenue, but either way, these potential deals are a positive sign for Intel's foundry ambitions. Intel needs meaningful external customers for its foundry to justify the massive expense associated with keeping up with TSMC. The company may not be able to announce customer wins, depending on its agreements, but there will certainly be signs. Recent hiring at Intel's in-construction Ohio fab complex, which is set to be used for the Intel 14A node, suggests the company is becoming more confident in securing orders. Investors should remember that the DigiTimes report has not been confirmed, and that any potential deal with Nvidia could fall through. However, this rumor is unequivocally good news for Intel.

Share

Share

Copy Link

Nvidia is reportedly exploring Intel Foundry to manufacture portions of its 2028 Feynman AI chips, using Intel's 18A or 14A process nodes for I/O dies and EMIB packaging technology. The move signals a strategic shift to diversify supply chain beyond TSMC, driven by capacity constraints and political pressure to boost US manufacturing.

Nvidia Explores Intel Foundry Partnership for Future AI Chips

Nvidia is reportedly in talks with Intel Foundry to manufacture components of its upcoming Feynman AI chips, according to DigiTimes citing supply chain sources

1

2

. This potential collaboration marks a significant departure from Nvidia's traditional reliance on TSMC and represents a calculated attempt to diversify supply chain amid mounting capacity constraints in the semiconductor manufacturing industry. The deal, expected to materialize around 2028, would see Intel handling non-core portions of the next-generation GPU while TSMC continues producing the critical compute dies3

.

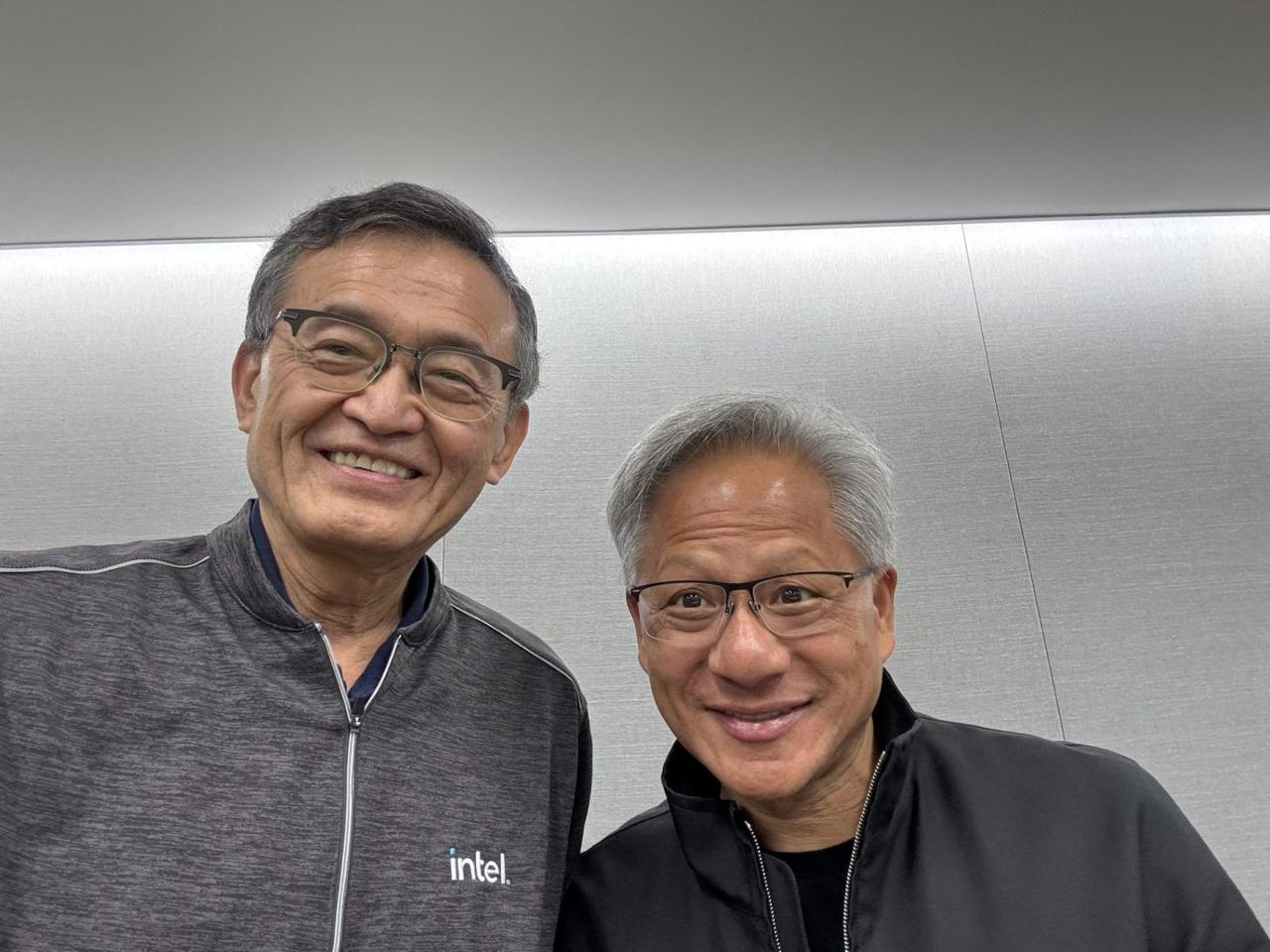

Source: Wccftech

Strategic Allocation Between Intel 18A Process and TSMC

The arrangement follows a "low risk" approach where Nvidia would use either the Intel 18A process or Intel 14A process specifically for the I/O die components of Feynman AI chips

2

. The I/O die handles memory controllers and inter-chip connectivity, making it less performance-critical than the GPU compute die but still requiring advanced process nodes3

. TSMC will retain manufacturing of the most complex silicon using its A16 process node. Intel's selection depends heavily on whether the foundry business achieves sufficient yields on its cutting-edge technologies, with Intel 14A still facing uncertain production timelines1

.EMIB Packaging Technology Secures 25% Share

Beyond wafer fabrication, Intel will provide advanced packaging services using its proprietary EMIB packaging technology for approximately 25% of Feynman production

1

2

. EMIB connects various dies together on chips, a critical capability as AI accelerators grow increasingly complex. During Intel's fourth-quarter earnings call, CFO David Zinsner revealed that individual advanced packaging deals could exceed $1 billion, far surpassing earlier expectations of just a few hundred million dollars3

. This packaging opportunity may serve as Intel's entry point with major customers before expanding into broader semiconductor manufacturing relationships.

Source: Motley Fool

Supply Chain Risk Drives Dual-Foundry Strategy

The potential partnership reflects broader industry concerns about supply chain risk concentrated at TSMC. The Taiwan-based foundry currently dominates both front-end and back-end production, creating what industry observers describe as a "single point of failure" amid geopolitical tensions

2

. TSMC's capacity constraints have left manufacturers scrambling to secure production slots during the AI buildout, with demand for CoWoS advanced packaging services outpacing supply3

. AMD and Qualcomm are similarly pursuing dual-foundry strategy approaches, pairing Samsung with TSMC to reduce dependency2

.Political Pressure Accelerates US Manufacturing Push

Political pressure from the White House to boost US manufacturing has made once-unthinkable partnerships more viable

1

. Both the US government and Nvidia have acquired stakes in Intel's foundry business, aligning financial and strategic interests. Intel CFO David Zinsner confirmed the company is "aggressively getting tools" ready for Intel 7, 10, 3, and 18A nodes but "holding back on 14A" until securing committed foundry customers1

. CEO Lip Bu-Tan warned in an SEC filing that without significant external customers for Intel 14A, the company might pause development of that node and successor leading-edge technologies.Related Stories

Feynman Architecture Timeline and Implications

Feynman represents Nvidia's architecture following Rubin and Rubin Ultra, scheduled to arrive from 2028 onward. Jensen Huang revealed the roadmap at GTC, naming the architecture after physicist Richard Feynman, though technical specifications remain scarce

1

. The chip pairs with Vera CPU, IO, and network components as part of Nvidia's vision for "Gigawatt AI Factories." With gaming GPUs still on the Blackwell architecture preceding Rubin, consumer products won't see these manufacturing changes immediately. However, reports suggest Nvidia may also outsource non-core gaming products to Intel Foundry in future arrangements2

.Intel Foundry's Uncertain Path Forward

Recent hiring activity at Intel's Ohio fab complex, designated for Intel 14A production, suggests growing confidence in securing orders

3

. Analysts also expect Apple to potentially use Intel 18A for M-series chips and Intel 14A for future iPhone components. Yet Intel Foundry faces an uphill battle competing with TSMC's established yields and proven track record. The Nvidia deal, while tentatively positive, remains unconfirmed and could collapse if Intel fails to demonstrate competitive performance on its advanced process nodes. For now, 14A and subsequent technologies remain on shaky ground, with their viability tied directly to landing major external customers willing to take calculated risks on Intel's semiconductor manufacturing capabilities.References

Summarized by

Navi

[1]

Related Stories

Nvidia's $5 Billion Intel Investment Reshapes AI Chip Landscape

18 Sept 2025•Technology

Intel Emerges as Alternative to TSMC's Strained CoWoS Packaging as AI Demand Surges

25 Nov 2025•Business and Economy

Apple and NVIDIA Rumored to Consider Intel's 14A Process for Future Chips

26 Jul 2025•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research