Nvidia and Palantir: AI Giants Poised for Significant Growth by 2030

2 Sources

2 Sources

[1]

Nvidia Stock vs. Palantir Stock: Wall Street Says Buy One and Sell the Other | The Motley Fool

Consultancy PwC estimates artificial intelligence (AI) will contribute more than $15 trillion to the global economy by 2030. Investors hoping to benefit are piling into AI stocks, and Nvidia (NVDA -0.03%) and Palantir Technologies (PLTR 1.95%) have been two of the most popular choices. In the last two years, Nvidia shares surged 728%, and Palantir shares advanced 348%. But Wall Street analysts expect the stocks to move in opposite directions over the next 12 months, as detailed below: Here's what investors should know about these AI stocks. Nvidia is best known for its graphics processing units (GPUs), chips that have become the industry standard in accelerating complex data center workloads such as training machine learning models and running AI applications. In March, Forrester Research wrote, "Nvidia sets the pace for AI infrastructure worldwide. Without Nvidia GPUs, modern AI wouldn't be possible." However, the chipmaker is truly formidable because it provides a full-stack computing platform that comprises adjacent hardware, software, and services. Nvidia has secured leadership in generative AI networking gear, and its first server central processing unit (CPU) is ramping toward a multibillion-dollar product line, according to CEO Jensen Huang. Likewise, Nvidia says its software and services business will approach a $2 billion revenue run rate this year due to strength from its AI Enterprise offering. Nvidia AI Enterprise is a software platform that streamlines data preparation and model training, as well as the development and deployment of AI applications. The platform includes frameworks that address specific use cases, including conversational agents, recommender systems, and autonomous robotics. Nvidia reported strong financial results in the second quarter of fiscal 2025 (ended July 2024). Revenue increased 122% to $30 billion on strong demand for AI hardware and software, and non-GAAP (generally accepted accounting principles) earnings surged 152% to $0.68 per diluted share. More importantly, the company is well positioned to maintain that momentum. Nvidia's next generation of data center GPUs, called Blackwell, will ramp up later this year, and the market is rife with anticipation. Earlier this year, CEO Jensen Huang predicted, "The Blackwell architecture platform will likely be the most successful product in our history." Looking ahead, Wall Street expects Nvidia's adjusted earnings to grow at 49% annually through fiscal 2026 (ends January 2026). That estimate makes the current valuation of 54 times adjusted earnings seem reasonable. Patient investors should consider purchasing a small position in Nvidia stock today. Palantir sells data analytics software. Its platforms help enterprises manage data, develop machine learning models, and integrate those digital assets into applications that improve decision-making. Palantir describes its core software products, Foundry and Gotham, as operating systems that connect data, decisions, and operations. Use cases range from managing supply chains to mitigating financial risk to optimizing manufacturing. Last year, Palantir added support for large language models and generative AI to Gotham and Foundry with AIP (Artificial Intelligence Platform). The company also reoriented its go-to-market strategy around the new product with AIP Bootcamps, instructional events where potential customers learn to use AIP on their own data in a matter of days. In August, Forrester Research recognized Palantir as a leader among AI and machine learning platform vendors. Analysts wrote, "Palantir is quietly becoming one of the largest players in this market." Palantir was awarded the highest score for its current product offering, but competitors Alphabet and C3.ai earned higher scores for their growth strategy. Palantir reported encouraging financial results in the second quarter. Its customer count increased by 41% to 593, and the average customer spent 14% more over the past year. In turn, revenue increased 27% to $678 million, the fifth sequential acceleration, and non-GAAP net income jumped 80% to $0.09 per diluted share. Going forward, CEO Alex Karp expects the company to maintain its momentum. "The persistent and unbridled demand for our software, for an effective enterprise platform that makes artificial intelligence capabilities useful to large institutions, shows no signs of relenting." The problem is valuation. Wall Street forecasts adjusted earnings growth of 22% annually through 2025. That makes the current valuation of 109 times adjusted earnings look pricey. Personally, I agree with Wall Street. Palantir looks overvalued, and I would not be surprised to see a substantial correction in the future. Investors should consider trimming their positions.

[2]

2 AI Stocks That Can Crush the S&P 500 Through 2030

These companies have enough opportunities to multiply your investment. The S&P 500 has delivered outstanding returns over the last year and is currently up around 23%. However, the index has returned an average annual return of about 10% going back decades, so if you want to find market-beating stocks, you need to look for companies that can sustain high double-digit growth for several years. The artificial intelligence (AI) market is a promising field to look for growth stocks. Statista estimates spending on AI technology to increase from $184 billion this year to $826 billion by 2030. Here are two AI stocks that have crushed the S&P 500 over the last year and can outpace the index through the end of the decade. 1. Palantir Technologies Shares of Palantir Technologies (PLTR 1.95%) have soared to new highs as the AI software provider reported accelerating growth this year. The company has primarily depended on government deals. However, it's starting to see an increasing number of corporations invest in its software, which could catapult the stock to market-crushing returns over the next six years. In the second quarter, Palantir reported a robust 27% year-over-year increase in total revenue. The company closed 10 deals worth more than $10 million. These results are impressive, considering the headwinds many software companies are experiencing this year due to tightening enterprise spending. Companies seem to be prioritizing investment in AI. After using Palantir, these companies are seeing positive returns, such as faster completion of tasks and better price optimization for products, which can help a business boost profit margins. An important advantage for Palantir is the use of its software engineers as part of the sales process. The engineers work with customers to set up the software and show them ways to get more out of it. This gives Palantir an enormous advantage in driving higher sales from customers. Palantir's high-margin software business should create outstanding shareholder returns in the coming years. Wall Street analysts are projecting Palantir's annualized earnings to grow 85% over the next five years, which implies a substantial increase in the company's margins. There will be ups and downs, but investors should expect Palantir stock to at least double in value from current share prices by 2030 and outperform the market averages. 2. Nvidia Nvidia (NVDA -0.03%) is estimated to control at least 70% of the AI chip market. It has long dominated the market for graphics processing units (GPUs), which have the processing bandwidth to handle the demands of AI training. Nvidia's lead in GPUs has translated to phenomenal returns for shareholders in recent years as companies continue to invest in building more data centers. Nvidia's data center revenue more than doubled year over year last quarter to $26 billion, and the expanding opportunities beyond the U.S. should allow the company to maintain its momentum into next year. While it prepares to launch the next-generation Blackwell AI computing platform, management also continues to emphasize the burgeoning opportunity to supply AI infrastructure for countries worldwide. Foreign nations want to use their own language and culture with generative AI tools, and they are turning to Nvidia to help them build the infrastructure to make this happen. For example, Japan's National Institute of Advanced Industrial Science and Technology uses thousands of Nvidia H200 GPUs for its AI Bridging Cloud Infrastructure 3.0 supercomputer. While Nvidia continues to cash in on the enterprise wave, sovereign AI infrastructure could be the next tidal wave that creates significant growth opportunities for the GPU leader. Management believes its sovereign AI business will surpass $10 billion this year. Nvidia's share price has soared 160% over the last year, but that has been completely driven by its data center growth. The stock still trades at an attractive forward price-to-earnings ratio of 29 using next year's consensus earnings estimates. With analysts forecasting annualized earnings growth of 52% over the next five years, Nvidia stock could significantly outpace the return of the average stock.

Share

Share

Copy Link

A comparative analysis of Nvidia and Palantir, two leading AI stocks, showcasing their potential to outperform the S&P 500 by 2030. The article explores their market positions, growth strategies, and Wall Street predictions.

The Rise of AI Titans: Nvidia and Palantir

In the rapidly evolving landscape of artificial intelligence (AI), two companies have emerged as frontrunners: Nvidia and Palantir. Both stocks have shown remarkable potential, with analysts predicting they could significantly outperform the S&P 500 by 2030

1

.Nvidia: The Hardware Powerhouse

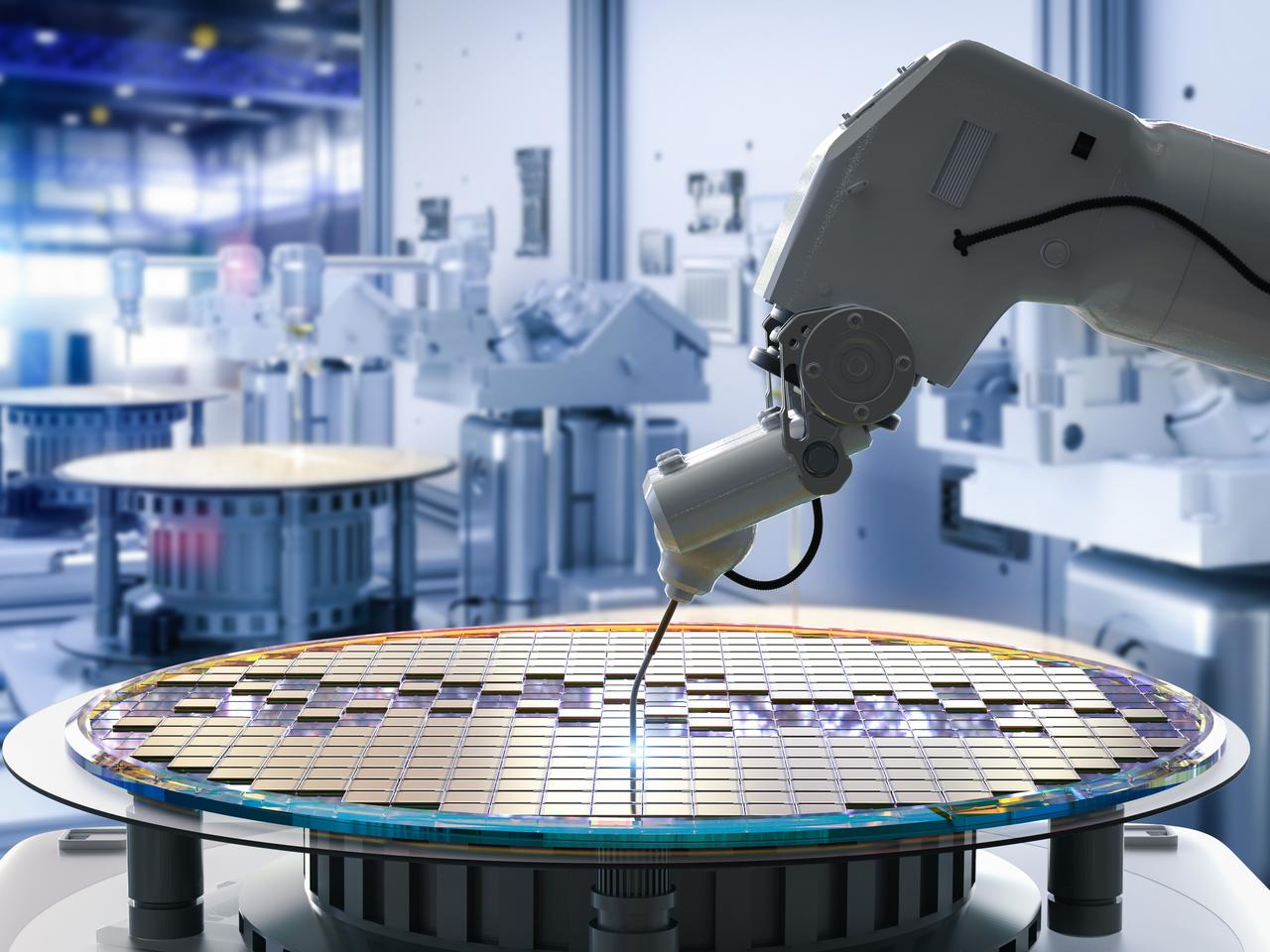

Nvidia, known for its cutting-edge graphics processing units (GPUs), has positioned itself as the backbone of AI infrastructure. The company's GPUs are essential for training and running complex AI models, making Nvidia a critical player in the AI revolution

1

.Wall Street analysts are overwhelmingly bullish on Nvidia, with 86% rating it as a "buy" or "strong buy"

2

. The average price target suggests a potential upside of 8%, reflecting confidence in Nvidia's continued growth and market dominance.Palantir: The Data Analytics Innovator

Palantir, a leader in data analytics and AI-powered software, has been making waves with its innovative solutions for both government and commercial sectors. The company's platforms, Gotham and Foundry, leverage AI to provide actionable insights from vast amounts of data

2

.Despite its potential, Wall Street appears more cautious about Palantir, with only 23% of analysts rating it as a "buy"

2

. The average price target indicates a potential downside of 26%, suggesting some skepticism about the company's near-term prospects.Growth Trajectories and Market Opportunities

Both Nvidia and Palantir are well-positioned to capitalize on the expanding AI market. Nvidia's revenue grew by an impressive 101% year over year in its most recent quarter, driven by strong demand for AI chips

1

. The company's focus on developing specialized AI processors and its partnerships with major cloud providers have solidified its market leadership.Palantir, while growing at a slower pace with a 13% year-over-year revenue increase, has been making significant strides in AI integration

2

. The company's AI Platform (AIP) has garnered attention for its potential to revolutionize enterprise decision-making processes.Related Stories

Valuation and Investment Considerations

Investors should note the stark difference in valuation between the two companies. Nvidia trades at a premium with a forward price-to-earnings ratio of 25, reflecting its strong market position and growth prospects

1

. Palantir, on the other hand, has a more speculative valuation with a forward P/E of 59, indicating higher growth expectations but also increased risk2

.The Road to 2030: Potential for Outperformance

As the AI industry continues to expand, both Nvidia and Palantir are poised for substantial growth. Analysts project that these stocks could potentially deliver returns far exceeding the S&P 500 by 2030

1

. However, investors should carefully consider the different risk profiles and growth trajectories of each company before making investment decisions.References

Summarized by

Navi

[1]

[2]

Related Stories

Nvidia's Q2 Earnings Beat Expectations, Highlighting Continued AI Dominance

29 Aug 2025•Technology

Palantir vs Nvidia: Wall Street's Divergent Views on AI Stock Leaders

15 Jan 2025•Business and Economy

AI Stock Market Volatility: Insider Activity and Investment Opportunities Amid Tech Sector Pullback

02 Mar 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology