Nvidia Faces $10.5 Billion Revenue Hit from H20 Chip Export Restrictions Amid Record Q1 Earnings

62 Sources

62 Sources

[1]

Nvidia expects to lose billions in revenue due to H20 chip licensing requirements | TechCrunch

As Nvidia reports earnings for the first quarter of its fiscal year 2026, which closed on April 28, the company has released numbers on how the Trump administration's recent chip export restrictions are affecting business. Nvidia reported that it incurred a $4.5 billion charge in Q1 due to licensing requirements impacting its ability to sell its H20 AI chip to companies in China. The chipmaker also reported that it was unable to ship an additional $2.5 billion of H20 revenue in the quarter due to the restrictions. When the U.S. licensing requirement was originally announced in April, the company said that it expected $5.5 billion in related charges for Q1. Nvidia also said Wednesday that the H20 licensing requirements will result in an $8 billion hit to the company's revenue in Q2, which is predicted to be around $45 billion -- a significant toll. The company has been outspoken against the Trump administration's push to limit the export of U.S.-made AI chips to countries including China. Huang praised the administration's recent decision to scrap Joe Biden's Artificial Intelligence Diffusion Rule that would have imposed further chip export restrictions. Despite Biden's chip export rules not coming to bear, Nvidia is clearly not immune to the Trump administration's attempt to stifle China's AI market. TechCrunch will update this story as we learn more.

[2]

Nvidia posts record $44 billion revenue, H20 export ban bites as gaming rises

Nvidia on Wednesday disclosed its financial results for the first quarter of its fiscal 2026, posting revenue of $44.062 billion, its best quarter ever. The company's sales increased almost across the board both in terms of quarter-over-quarter and year-over-year comparisons. As the company ramped up its Blackwell GPUs, it also set revenue records both for gaming and datacenter revenues. However, the recent shipments ban of H20 GPUs to China hurt Nvidia's margins quite significantly. For the first quarter of fiscal 2026, Nvida reported GAAP revenue of $44.062 billion, marking a 12% rise quarter-over-quarter (QoQ) and a 69% increase year-over-year (YoY). The company's gross margin fell sharply to 60.5%, primarily due to a $4.5 billion charge related to writing down of H20 inventory due to the latest U.S. export restrictions imposed in early April. Without the charge, Nvidia's non-GAAP margin would have been 71.3%, still considerably lower than 78.9% in Q1 FY2025 or 73.5% in Q4 FY2025. Nvidia's operating income was $21.6 billion, down 10% from the prior quarter but up 28% year-over-year, as for net income, it reached $18.8 billion, a 15% sequential decline but a 26% increase from the same period a year ago. Nvidia's data center revenue set a new record $39.112 billion, comprising of $34.155 billion compute revenue and $4.957 billion networking revenue. The result represented a 10% quarter-over-quarter growth and 73% year-over-year growth, driven by surging global demand for AI infrastructure. Nvidia does not provide split between sales of Blackwell and Hopper AI GPUs as well as Blackwell and Hopper systems, but it said that transition to Blackwell, has been almost complete. This means that while there are still some customers interested in Hopper processors, the vast majority of its clients now want Blackwell products. In addition, the company highlighted strong momentum in Blackwell-based systems as NVL72 GB200 machines ramped to full-scale production during the quarter. "Our breakthrough Blackwell NVL72 AI supercomputer -- a 'thinking machine' designed for reasoning -- is now in full-scale production across system makers and cloud service providers," said Jensen Huang, founder and CEO of Nvidia. "Global demand for Nvidia's AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate." Nvidia's gaming products also achieved a record-breaking revenue of $3.8 billion -- a 48% increase from the previous quarter and a 42% rise YoY -- in the first quarter of FY2025. This growth was driven by multiple factors, including insufficient gaming GPU shipments in the previous quarter as well as launch of Nvidia's mainstream GeForce RTX 5070 and 5060-series products based on the Blackwell architecture. As for OEM and other segment, it generated $111 million, down 12% sequentially but up 42% year-over-year. Nvidia's professional vizualization (ProViz) business reported revenue of $509 million, down from $511 million QoQ, but up 19% from $427 million in the same quarter a year go. Such results may indicate that workstation makers continued to purchase Ada Lovelace-based professional graphics cards despite the imminent release of Blackwell-based RTX Pro graphics boards in May, perhaps because of uncertainities with the U.S. tariffs. It is noteworthy that sales of Nvidia's client and professional GPUs -- which are reported under gaming, ProViz, OEMs, and other monikers -- totaled $4.42 billion, which is lower than sales of Nvidia's networking gear. Nvidia's automotive and robotics segment earned $567 million, down from $570 million in the previous quarter, but up a whopping 72% from $329 million in Q1 FY2025. For the second quarter of fiscal 2026, Nvidia expects revenue of approximately $45.0 billion ± 2%. The company's Q2 revenue outlook could have been $8.0 billion higher if there was no H20 export restrictions. However, the company projects GAAP gross margins of 71.8% and Nvidia's goal is to reach mid-70% gross margins later in the year. This recovery reflects improving product mix and normalization after the Q1 inventory charge related to unsellable H20 units. Operating expenses in Q2 FY2026 are projected to be around $5.7 billion on a GAAP basis. The vast majority of that sum will be used for research and development (R&D).

[3]

Trump trade policy to cost Nvidia $10.5B in lost revenues

US export controls blocking the sale of Nvidia's H20 GPUs to will cost the company $10.5 billion in lost revenues in the first half of the 2026 fiscal year, executives revealed on Wednesday's Q1 earnings call. The export rules, which went into effect in April, effectively cut Nvidia off from the Chinese datacenter market, but not before it managed to deliver roughly $4.6 billion of planned $7.1 billion worth of H20 shipments expected for Q1. According to CFO Colette Kress, Nvidia missed out on $2.5 billion in H20 sales in Q1, and will shave another $8 billion off its Q2 revenues. China's AI moves on with or without US chips On top of the revenues lost to the US-China trade war, Nvidia also booked a $4.5 billion charge in Q1 related to H20 inventory and purchase commitments that it can no longer realize. The situation could have been worse, Kress noted. Nvidia initially expected to write off $5.5 billion, but ended up being able to salvage about $1 billion. Speaking on Wednesday's call, CEO Jensen Huang praised the US president Donald Trump for investing in US manufacturing and the decision to scrap the Biden administration's AI diffusion rules, which would have cost Nvidia even more by capping exports of AI chips to most of the world. However, on China, Huang rehashed many of his talking points from his Computex Q&A last week, warning that US trade policy could backfire. "China's AI moves on with or without US chips. It has the compute to train and deploy advanced models. The question is not whether China will have AI; It already does. The question is whether one of the world's largest AI markets will run on American platforms," Huang said. "Shielding Chinese chip makers from US competition only strengthens them abroad and weakens America's position." With that said, Nvidia clearly hasn't given up on the Chinese market. "We are exploring limited ways to compete, but Hopper is no longer an option," Huang said of the H20 accelerator. And while he declined to offer specifics of future chips for the Chinese market, the company is reportedly preparing a cut down version of its RTX Pro 6000 cards for buyers in the Middle Kingdom. In spite of the geoeconomic headwinds, Nvidia's Q1 delivered $18.8 billion in profits on revenues that surged 69 percent YoY and 12 percent from last quarter to $44.1 billion. Hyperscalers are each deploying 72,000 Blackwell GPUs per week Unsurprisingly, the lion's share of those revenues came from Nvidia's datacenter division, which pulled in $39.1 billion for the quarter, an increase of 73 percent YoY and 10 percent over the prior quarter. "Blackwell contributed nearly 70% of data center compute revenue in the quarter, with a transition from Hopper nearly complete," Kress said. "On average, major hyperscalers are each deploying nearly 1,000 NVL72 racks, or 72,000 Blackwell GPUs, per week and are on track to further ramp output this quarter." Nvidia's other segments also saw solid growth during the first quarter. Gaming revenues topped $3.8 billion, up 42 percent YoY, on the launch of lower-end 50-series graphics hardware. Professional visualization hit $509 million, up 19 percent during the quarter, while Nvidia's automotive and robotics division grew 72 percent YoY to $567 million. Looking ahead to Q2, Nvidia had hoped to pull in revenues of $53 billion, but thanks to changes in US trade policy, the chip biz is now forecasting sales of $45 billion give or take a percent or two. You can pore over the full earnings release here should you be so inclined. Despite the China troubles, the market sent Nvidia stock up nearly five percent after hours, as investors perhaps realized the hit wouldn't be as bad as feared. ®

[4]

Nvidia quarterly revenue surges nearly 70% on AI boom

Nvidia reported a nearly 70 per cent surge in quarterly revenues, as the boom in spending on artificial intelligence chips continued despite rising economic uncertainty and export controls that have dented the chip company's China sales. Nvidia on Wednesday reported revenue of $44.1bn for the quarter to April 27, up 69 per cent year on year and above Wall Street's expectations of $43.3bn. But the US chip designer at the heart of a global spending spree on the infrastructure powering AI said it expected revenue of $45bn for the current quarter, plus or minus 2 per cent, slightly below Bloomberg consensus estimates of $45.5bn. Nvidia chief executive Jensen Huang said the company was seeing "incredibly strong" demand for its products. The company is navigating the impact of US President Donald Trump's trade war with China, as well as new export restrictions in April that have prevented it from selling AI chips designed specifically for the China market. Nvidia shares were up almost 3 per cent in after-hours trading immediately following the announcement. Net income jumped by 26 per cent to $18.8bn, slightly below estimates of $19.5bn. Adjusted gross margins -- a measure of profitability that excludes operating expenses -- were 71.3 per cent, in line with the 71 per cent the company said it expected at its last earnings report in February and what Wall Street had been expecting. Nvidia's margins slipped earlier this year with the company citing the transition to its more complex and higher-cost Blackwell chip systems, which launched last year. Nvidia and its suppliers have recently resolved technical issues with Blackwell servers that threatened to delay the rollout. Ahead of the results, analysts had warned that new China sales restrictions would bring margins down further for the quarter. The company is contemplating how to redesign its chips to serve the Chinese market while complying with the latest US export controls.

[5]

Nvidia forecasts second-quarter revenue below estimates

May 28 (Reuters) - Nvidia (NVDA.O), opens new tab forecast second-quarter revenue below market estimates on Wednesday, expecting a major hit to sales from tighter U.S. curbs on exports of its AI chips to key semiconductor market China. The artificial intelligence market bellwether expects revenue of $45 billion, plus or minus 2%, in the second quarter, compared with analysts' average estimate of $45.90 billion, according to data compiled by LSEG. Reporting by Arsheeya Bajwa in Bengaluru and Stephen Nellis in San Francisco; Editing by Shounak Dasgupta Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Artificial Intelligence

[6]

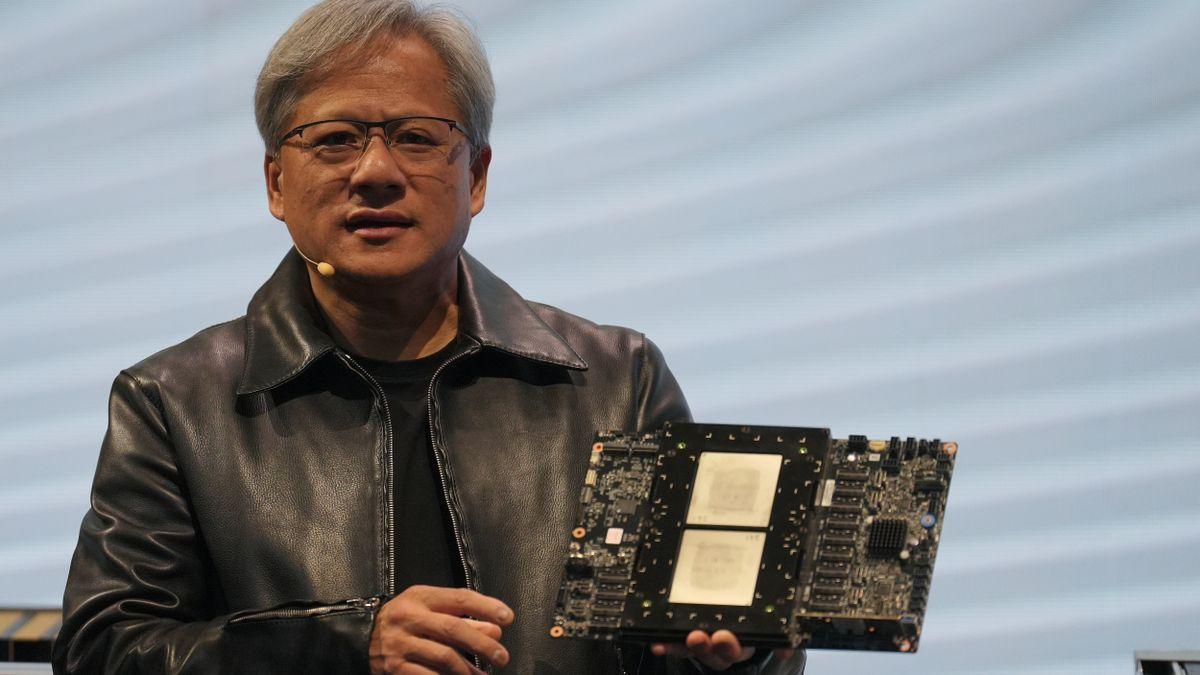

All eyes on China restrictions as Nvidia gets set to report results

Jensen Huang, co-founder and CEO of Nvidia Corp., speaks during a news conference in Taipei on May 21, 2025. Nvidia continues to see massive growth from sales of graphics processors, with demand for artificial intelligence infrastructure showing no signs of cooling. But for the AI chipmaker, the mood is different heading into Wednesday's earnings report than it's been in recent quarters. There's one big reason why: China. On April 9, the Trump administration sent Nvidia a letter, and said it was requiring an export license for the company's H20 chip, a version of its Hopper processor specially designed for the Chinese market to comply with previous U.S. restrictions. Dating back to President Biden's term, the U.S. government has been concerned that AI chips from Nvidia and other semiconductor companies like Advanced Micro Devices can be used to create supercomputers for adversaries' military purposes. Following the new restrictions, Nvidia said it would take a $5.5 billion writedown on inventory. Analysts called it the biggest writedown in the history of the chip industry. The potential impact on future revenue is hefty. "This inventory write-off implies a $15 billion H20 revenue hit on a rolling 12-month basis," wrote David O'Connor, an analyst at BNP Paribas, in a report on Tuesday. For the quarter ended in April, analysts expect Nvidia to report 66% revenue growth to $43.28 billion, according to LSEG. While that level of growth is much higher than the kind of expansion at any of Nvidia's megacap peers, it marks a sharp deceleration from a year ago, when the company recorded growth of over 250%. Because of the new export license requirements, there's a lot of uncertainty surrounding projections for the rest of the year. The average analyst estimate is predicting growth in the current quarter of 53%, with similar a number expected for the full fiscal year, which ends in January. Morgan Stanley analysts wrote in a report on Tuesday that Nvidia faces a bigger hit than expected. "While our thinking at the time was that this was at least partly expected by the management team, it became clear after the ban that the company had been getting indications that H20 would be OK, and that they were materially surprised," the analysts wrote. Nvidia shares have bounced back of late after a rough start to the year and are now up about 1% in 2025, while the Nasdaq is down about 1%.

[7]

Nvidia CEO Jensen Huang hammers chip controls that 'effectively closed' China market

As pleased as Wall Street was with Nvidia's quarterly results on Wednesday, CEO Jensen Huang said the company is leaving billions of dollars in revenue on the table because it can no longer sell to China. "The $50 billion China market is effectively closed to U.S. industry," Huang told analysts at the beginning of his prepared remarks on the earnings call. "As a result, we are taking a multibillion-dollar writeoff on inventory that cannot be sold or repurposed." Even without access to the world's second-biggest economy, Nvidia reported 69% year-over-year revenue growth to $44 billion in the fiscal first quarter, topping analysts' estimates. The stock rose about 4% in extended trading to a level that would be the highest since January if it stays there on Thursday. Nvidia shares are now up for the year, after a difficult start to 2025, adding to a rally that lifted the company's market cap by almost 240% in 2023 and over 170% last year. Still, Huang is making his displeasure with the China situation quite clear. In April, the Trump administration told Nvidia that its previously approved H20 processor for China would require an export license, which effectively cut off sales with "no grace period," the company said on Wednesday. The U.S. government has highlighted the national security concerns of having Nvidia's sophisticated AI chips sold to a chief adversary. The H20 was introduced by Nvidia after the Biden administration restricted AI chip exports in 2022. It's a slowed-down version intended to comply with U.S. export controls.

[8]

3 key takeaways from Nvidia's earnings: China blow, cloud strength and AI future

China could be a $50 billion market for Nvidia, but U.S. export controls are getting in the way Nvidia expects to sell about $45 billion in chips during the July quarter, it revealed on Wednesday, but that's missing about $8 billion in sales that the company would have recorded if not for the U.S. restricting exports of its H20 chip without a license. Nvidia also said that it missed out on $2.5 billion in sales during the April quarter thanks to the export restrictions on H20. In prepared remarks, Nvidia CEO Jensen Huang said that China represented a $50 billion market that had effectively been closed to Nvidia. He also said that the export controls were misguided, and would merely encourage Chinese AI developers to use homegrown chips, instead of making an American platform the world's choice for AI software. "The U.S. has based its policy on the assumption that China cannot make AI chips. That assumption was always questionable, and now it's clearly wrong," Huang said. He said that export controls were driving AI talent to use chips from homegrown Chinese rivals, such as Huawei. Nvidia said it didn't have a replacement chip for China ready, but that it was considering options for "interesting products" that could be sold in the market. Strength in the company's Blackwell business balanced out some concerns over the China impact. "NVIDIA is putting digestion fears fully to rest, showing acceleration of the business other than the China headwinds around growth drivers that seem durable. Everything should get better from here," said Morgan Stanley analyst Joseph Moore.

[9]

Nvidia weathers tariff uncertainty as revenues surge

Nvidia was the last major tech firm to report during a strong earnings season for tech companies whose shares have surged in recent weeks. Tech stocks, including Nvidia, had previously plummeted in April amid uncertainty over US President Trump's tariff policies. On Wednesday, Nvidia said it had incurred a $4.5bn charge during the quarter as demand for its China-specific "H20" products waned. Nvidia's initial forecast for that charge was significantly higher - at $5.5bn - a month ago. Washington restricted the sale of those chips, which are difficult to sell outside of China, in April. Changes in global trade policies loomed large in the company's forecast. New export controls and tariffs have increased the complexity and cost of its supply chain, and may continue to do so, the company said. Nvidia said it planned to increase manufacturing in the United States to strengthen the company's supply chain. Last week, Mr Huang criticised the US rules blocking exports of advanced computing chips to China. The controls were put in place following concerns that chip technology with potential military uses could be deployed by companies loyal to China's communist party. Mr Huang blasted the policies as a "failure" and said they were backfiring against American companies. Meanwhile, the Financial Times reported Wednesday that President Trump was ordering US chip software suppliers to stop selling their products to Chinese chip companies. The move is intended to make it more difficult for China to develop its own advanced chips that would compete with Nvidia's. "The China export restrictions underscore the immediate pressure from geopolitical headwinds," according to Emarketer analyst Jacob Bourne. Sustaining dominance would require Nvidia to navigate "an increasingly complex landscape of geopolitical, competitive, and economic challenges," Bourne added. At the same time, Nvidia has benefitted from the emergence of new buyers among governments in the Gulf states. Earlier this month, Mr Huang travelled with President Trump to the Middle East where the company said it would sell hundreds of thousands of its AI chips in Saudi Arabia. "Countries around the world are recognizing AI as essential infrastructure -- just like electricity and the internet -- and NVIDIA stands at the center of this profound transformation," Mr Huang wrote after the earnings announcement. Sales in Nvidia's key data centre business grew 73% on an annual basis.

[10]

Nvidia's Revenue Jumps to $44.1 Billion Despite A.I. Chip Controls

Sign up for the On Tech newsletter. Get our best tech reporting from the week. Get it sent to your inbox. Nvidia's business prospects have been whipsawed by the U.S. government lately. Last month, the government blocked the sale of artificial intelligence chips to China. Weeks later, it approved the sale of similar chips to the Middle East. Amid the turmoil, Nvidia still maintained its breakneck growth as the leading provider of the computer chips used for building artificial intelligence. Nvidia said on Wednesday that sales in its most recent quarter rose 69 percent to $44.1 billion from a year earlier. Its net income rose 26 percent to $18.78 billion. The company exceeded Wall Street's expectations for sales of $43.28 billion, but fell short of predictions for a profit of $19.49 billion. Nvidia's revenue and profit rose despite it saying on Wednesday that the Trump administration's restrictions on chips to China would cost it $4.5 billion, a billion dollars less than it had estimated in mid-April. The restrictions have pushed Nvidia out of the market for A.I. chips in China, the world's largest buyer of semiconductors, which are used to power smartphones, cars and other electronics. Nvidia also projected that revenue in the current quarter would rise 50 percent from a year ago to $45 billion, as it expands sales of its newest A.I. chip, Blackwell. The sales forecast is in line with Wall Street's prediction of $45.75 billion, suggesting that the tech industry's embrace of artificial intelligence is in its early stages, with ample room to run. Want to stay updated on what's happening in China? Sign up for Your Places: Global Update, and we'll send our latest coverage to your inbox. Shares in Nvidia rose more than 4 percent in after-hours trading. It finished the trading day as the second-most-valuable company in the world behind Microsoft and ahead of Apple, with a market value of $3.3 trillion. "Countries around the world are recognizing A.I. as essential infrastructure -- just like electricity and the internet -- and Nvidia stands at the center of this profound transformation," Jensen Huang, the company's chief executive, said in a statement. The company is showing its strength, even among the tech industry's largest companies. For the first time in the A.I. era, its quarterly sales surpassed those of Meta, the social media pioneer. Nvidia's net income was 13 percent larger than Meta's profit in their most recent quarters. Nvidia has been the early winner in the tech industry's race to develop artificial intelligence. Mr. Huang cornered the market on A.I. chips by being the first chipmaker to develop the software and servers that would train A.I. systems to recognize images and predict words. But government officials have grown increasingly alarmed about the way A.I. could be used by adversaries like China to develop autonomous weapons and coordinate military strikes. Those worries have led Washington officials to crackdown on Nvidia's sales. Explore Our Coverage of Artificial Intelligence OpenAI Unites With Jony Ive in $6.5 Billion Deal to Create A.I. Devices Will Writing Survive A.I.? This Media Company Is Betting on It. Create your free account and enjoy unlimited access -- free for 7 days. Start free trial Nvidia's Chief Says U.S. Chip Controls on China Have Backfired A Tech Hub's Plan to Upgrade for the A.I. Age Runs Into Trump's Tariffs A.I.-Generated Reading List in Chicago Sun-Times Recommends Nonexistent Books At Amazon, Some Coders Say Their Jobs Have Begun to Resemble Warehouse Work How Miami Schools Are Leading 100,000 Students Into the A.I. Future Agatha Christie, Who Died in 1976, Will See You in Class Mr. Huang spent much of the past few months pushing back on that by traveling the world to meet with government officials. An April meeting with President Trump proved to be unsuccessful when the Commerce Department later pushed forward on limiting sales to China. Mr. Huang later flew to Beijing, where he pledged to find a new way to sell chips there, and then to Taiwan, where he complained that the U.S. government's restrictions had been a failure. His efforts haven't changed the trajectory of Nvidia's business in China. Since the U.S. government began restricting chip exports, Nvidia's sales in China have been cut to 13 percent of total revenue from 21 percent two years ago. But Mr. Huang has had more success in persuading the U.S. government to loosen up sales to other countries. After his urging, the Trump administration rolled back Biden-era rules that restricted A.I. chip sales abroad. The change paved the way to a blockbuster deal this month between the United States and the United Arab Emirates to build the world's largest international hub of A.I. data centers. Nvidia has made selling more chips to governments a key part of its strategy. The company relies on customers like Microsoft, Amazon, Google and Meta for a large portion of its sales. It wants to expand its customer base by adding buyers across Europe, Asia and the Middle East, where Mr. Huang has said A.I. could be part of the national infrastructure much like a telecommunications network. The United States also doesn't have the energy resources to support the current demand for data centers. The maximum amount of power available this year for many companies is 50 megawatts, enough to support about 25,000 of Nvidia's newest A.I. chips. By comparison, OpenAI is planning a 200-megawatt data center next year at an A.I. campus in Abu Dhabi that could support 100,000 of Nvidia's chips. The deal was important because Nvidia has a window to sell to countries before competition for A.I. chips increases, said Holger Mueller, principal analyst at Constellation Research, a tech research firm. "Now they're the only game in town," Mr. Mueller said of Nvidia. "These Middle East countries really need them."

[11]

NVIDIA Announces Financial Results for First Quarter Fiscal 2026

NVIDIA (NASDAQ: NVDA) today reported revenue for the first quarter ended April 27, 2025, of $44.1 billion, up 12% from the previous quarter and up 69% from a year ago. On April 9, 2025, NVIDIA was informed by the U.S. government that a license is required for exports of its H20 products into the China market. As a result of these new requirements, NVIDIA incurred a $4.5 billion charge in the first quarter of fiscal 2026 associated with H20 excess inventory and purchase obligations as the demand for H20 diminished. Sales of H20 products were $4.6 billion for the first quarter of fiscal 2026 prior to the new export licensing requirements. NVIDIA was unable to ship an additional $2.5 billion of H20 revenue in the first quarter. For the quarter, GAAP and non-GAAP gross margins were 60.5% and 61.0%, respectively. Excluding the $4.5 billion charge, first quarter non-GAAP gross margin would have been 71.3%. For the quarter, GAAP and non-GAAP earnings per diluted share were $0.76 and $0.81, respectively. Excluding the $4.5 billion charge and related tax impact, first quarter non-GAAP diluted earnings per share would have been $0.96. "Our breakthrough Blackwell NVL72 AI supercomputer -- a 'thinking machine' designed for reasoning -- is now in full-scale production across system makers and cloud service providers," said Jensen Huang, founder and CEO of NVIDIA. "Global demand for NVIDIA's AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate. Countries around the world are recognizing AI as essential infrastructure -- just like electricity and the internet -- and NVIDIA stands at the center of this profound transformation." NVIDIA will pay its next quarterly cash dividend of $0.01 per share on July 3, 2025, to all shareholders of record on June 11, 2025. Highlights NVIDIA achieved progress since its previous earnings announcement in these areas: CFO Commentary Commentary on the quarter by Colette Kress, NVIDIA's executive vice president and chief financial officer, is available at https://investor.nvidia.com. Conference Call and Webcast Information NVIDIA will conduct a conference call with analysts and investors to discuss its first quarter fiscal 2026 financial results and current financial prospects today at 2 p.m. Pacific time (5 p.m. Eastern time). A live webcast (listen-only mode) of the conference call will be accessible at NVIDIA's investor relations website, https://investor.nvidia.com. The webcast will be recorded and available for replay until NVIDIA's conference call to discuss its financial results for its second quarter of fiscal 2026. Non-GAAP Measures To supplement NVIDIA's condensed consolidated financial statements presented in accordance with GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP other income (expense), net, non-GAAP net income, non-GAAP net income, or earnings, per diluted share, and free cash flow. For NVIDIA's investors to be better able to compare its current results with those of previous periods, the company has shown a reconciliation of GAAP to non-GAAP financial measures. These reconciliations adjust the related GAAP financial measures to exclude stock-based compensation expense, acquisition-related and other costs, other, gains/losses from non-marketable and publicly-held equity securities, net, interest expense related to amortization of debt discount, H20 excess inventory and purchase obligation charges, and the associated tax impact of these items where applicable. The inclusion of H20 excess inventory and purchase obligation charges in the reconciliations to adjust the related GAAP financial measures was a result of the U.S. government informing NVIDIA on April 9, 2025 that it requires a license for export to China of H20 products. H20 products were designed primarily for the China market. Free cash flow is calculated as GAAP net cash provided by operating activities less both purchases related to property and equipment and intangible assets and principal payments on property and equipment and intangible assets. NVIDIA believes the presentation of its non-GAAP financial measures enhances the user's overall understanding of the company's historical financial performance. The presentation of the company's non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the company's financial results prepared in accordance with GAAP, and the company's non-GAAP measures may be different from non-GAAP measures used by other companies.

[12]

Nvidia beats estimates for Q1 results as revenues rise 69% from a year ago

Nvidia, the AI and graphics chip company driving societal changes with AI, reported revenue for the first quarter ended April 27, 2025, was $44.1 billion, up 12% from the previous quarter and up 69% from a year ago. On April 9, 2025, the U.S. government told Nvidia that a license is required for exports of its H20 products into the China market. As a result of these new requirements, Nvidia incurred a $4.5 billion charge in the first quarter of fiscal 2026 associated with H20 excess inventory and purchase obligations as the demand for H20 diminished. Sales of H20 products were $4.6 billion for the first quarter of fiscal 2026 prior to the new export licensing requirements. Nvidia was unable to ship an additional $2.5 billion of H20 revenue in the first quarter. Excluding the $4.5 billion charge, first quarter non-GAAP gross margin would have been 71.3%. For the quarter, GAAP and non-GAAP earnings per diluted share were $0.76 and $0.81, respectively. Excluding the $4.5 billion charge and related tax impact, first quarter non-GAAP diluted earnings per share would have been 96 cents. Analysts expected net income of 75 cents a share on Q1 revenue of $43.2 billion. "Our breakthrough Blackwell NVL72 AI supercomputer -- a 'thinking machine' designed for reasoning -- is now in full-scale production across system makers and cloud service providers," said Jensen Huang, founder and CEO of Nvidia, in a statement. "Global demand for Nvidia's AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate. Countries around the world are recognizing AI as essential infrastructure -- just like electricity and the internet -- and Nvidia stands at the center of this profound transformation." Nvidia shareholders got a scare when DeepSeek emerged. Back on January 27, Nvidia's stock fell 17%, losing $600 billion in market value, after investors worried that DeepSeek's efficient AI models might reduce the demand for Nvidia's high-margin AI hardware. But the stock has recovered since that time. Nvidia downplayed the concerns and during the quarter announced a number of new products during the Computex trade show in Taiwan last week. In its outlook for the second quarter, Nvidia said it expects revenues to be $45 billion, plus or minus 2%. This reflects a loss in H20 revenue of $8 billion due to the export control limitations. GAAP and non-GAAP gross margins are expected to be 71.8% and 72.0%, respectively, plus or minus 50 basis points. The company is continuing to work toward achieving gross margins in the mid-70% range late this year. GAAP and non-GAAP operating expenses are expected to be approximately $5.7 billion and $4.0 billion, respectively. Full year fiscal 2026 operating expense growth is expected to be in the mid-30% range. Data Center revenues First-quarter revenue was $39.1 billion, up 10% from the previous quarter and up 73% from a year ago. Nvidia announced it is building factories in the U.S. and working with its partners to produce Nvidia AI supercomputers in the U.S. It also introduced Nvidia Blackwell Ultra and Nvidia Dynamo for accelerating and scaling AI reasoning models. And it announced a partnership with HUMAIN to build AI factories in the Kingdom of Saudi Arabia to drive the next wave of artificial intelligence development. Also in the Middle East, it unveiled Stargate UAE, a next-generation AI infrastructure cluster in Abu Dhabi, United Arab Emirates, alongside strategic partners G42, OpenAI, Oracle, SoftBank Group and Cisco. The company said it plans to work with Foxconn and the Taiwan government to build an AI factory supercomputer. It also announced joint initiatives with Alphabet and Google to advance agentic AI solutions, robotics and drug discovery. And it revealed that Nvidia Blackwell cloud instances are now available on AWS, Google Cloud, Microsoft Azure and Oracle Cloud Infrastructure. Gaming and AI PC First-quarter gaming revenue was a record $3.8 billion, up 48% from the previous quarter and up 42% from a year ago. Nvidia also announced the GeForce RTX 5070 and RTX 5060, bringing Blackwell graphics to gamers at prices starting from $299 for desktops and $1,099 for laptops. And it said Nvidia DLSS 4 is now available in over 125 games, including Black Myth Wukong, DOOM: The Dark Ages, Indiana Jones and the Great Circle, Marvel Rivals and Star Wars Outlaws. It also noted the Nintendo Switch 2, which is launching on June 5, is powered by an Nvidia processor and AI-powered DLSS, delivering up to 4K gaming. And it launched the Nvidia RTX Remix modding platform, attracting over two million gamers, alongside the release of the Half-Life 2 RTX demo. Professional Visualization First-quarter revenue was $509 million, flat with the previous quarter and up 19% from a year ago. Announced the Nvidia RTX PRO Blackwell series for workstations and servers. The company unveiled Nvidia DGX Spark and DGX Station™ personal AI supercomputers powered by the Nvidia Grace Blackwell platform. Nvidia announced that leading industrial software and service providers Accenture, Ansys, Databricks, SAP, Schneider Electric with ETAP, and Siemens are integrating the Nvidia Omniverse platform into their solutions to accelerate industrial digitalization with physical AI. Automotive and Robotics First-quarter Automotive revenue was $567 million, down 1% from the previous quarter and up 72% from a year ago. The company announced a collaboration with General Motors on next-generation vehicles, factories and robots using Nvidia Omniverse, Nvidia Cosmos and Nvidia Drive AGX. It also announced Nvidia Isaac GR00T N1, the world's first open humanoid robot foundation model, followed by Nvidia Isaac GR00T N1.5; Nvidia Isaac GR00T-Dreams, a blueprint for generating synthetic motion data; and Nvidia Blackwell systems to accelerate humanoid robot development.

[13]

Wall Street expects growth from Nvidia even as Trump nixes $15bn in revenue

The chip-manufacturing company, widely seen as a bellwether for AI business, is expected to report its earnings Nvidia is set to report its first quarter earnings after the bell on Wednesday. The company is a bellwether for the business of artificial intelligence, both in its cutting-edge hardware and the new regulatory headwinds it is facing, and investors will be watching closely. Wall Street expects the company to report $43.3bn in revenue, up 66% year over year, and adjusted earnings per share of 73 cents. There's no company more important to "the markets and global investor sentiment" than the high-flying chipmaker, according to Wedbush Securities analysts. Nvidia's quarterly reports for the past year have shown explosive growth and is expected to beat Wall Street expectations Wednesday. The company may provide guidance that underwhelm investors for the first time in two years, though. Donald Trump's April announcement that the administration was tightening export rules on computer chips effectively banned Nvidia from selling its H20 AI chips to China, a major source of revenue. The company revealed in a recent SEC filing that the change would cost the company $5.5bn in charges. In an interview with Ben Thompson, the Nvidia CEO Jensen Huang said the move was "deeply painful" and could result in $15 bn in revenue loss. "No company in history has ever written off that much inventory," Huang said. "[N]ot only am I losing $5.5bn - we wrote off $5.5bn - we walked away from $15bn of sales and probably ... $3bn worth of taxes." The tightening rules on chip exports comes as the committee on China within the US Congress announced it was seeking answers from Nvidia about how its chips ended up powering breakthrough AI models in China, particularly DeepSeek, an AI company that matched the products of US AI companies without the same computing power. The committee alleges in a new report that China-based DeepSeek "covertly funnels American user data to the Chinese Communist party, manipulates information to align with CCP propaganda, and was trained using material unlawfully obtained from U.S". Analysts are bracing for what this could mean for the next few quarters. "Next year will be interesting since there is uncertainty from the geopolitics (ie export controls, tariffs, negotiations), despite strong demand for its data center products (Hopper and Blackwell chips)," said Alvin Nguyen, a senior analyst at Forrester. While in previous quarters, analysts were looking to see how much the company would surpass investor expectations this quarter the considerations are more tame, according to a Wedbush Securities analyst's note. "This quarter its more about strong numbers and the ability to maintain guidance despite the China blockade," the note reads. "Investors are more laser focused on the medium term and long-term outlook from Jensen as the China situation could quickly change depending on the ongoing US/China trade negotiations." While the company's business in China remains up in the air, analysts seem heartened by recent demand for Nvidia chips in Saudi Arabia and the UAE. Nvidia was among the beneficiaries of the AI windfall that arose from Trump's visit to the region, which resulted in Saudi Arabia committing to $600bn to US companies. Nvidia said it will sell hundreds of thousands of AI chips to Saudi Arabia, including 18,000 of its latest chip, Blackwell, to a Saudi Arabian sovereign wealth-fund backed startup called Humain.

[14]

Nvidia under pressure to show growth despite Trump tariffs

Why it matters: With U.S. export restrictions for AI chips tightening, Nvidia finds itself in a revenue pickle -- trying to maintain as much business as possible in China while appeasing the American government. The big picture: "The big question for tomorrow is what type of dent has the Trump H20/China business played in Nvidia's global demand and outlook going forward," Wedbush Securities analyst Dan Ives writes in a research note, referring to an Nvidia AI chip. Catch up quick: Nvidia CEO Jensen Huang argued last week that U.S. chip export controls have been "a failure," with their biggest impact being the erosion of Nvidia's competitive position. State of play: Nvidia's stock has been on a roller coaster ride this year. By the numbers: S&P Global Market Intelligence analysts are projecting revenue of $43.2 billion and net income of $20.3 billion. What we're watching: Whether Nvidia comments on the impact of AI chip spending announcements connected to President Trump's recent trip to the Middle East.

[15]

Nvidia's earnings surged but chip export restrictions dealt a blow

Why it matters: Nvidia has become a bellwether stock for the AI economy as tech companies invest heavily in product development and data center capability, powering Nvidia's rise. By the numbers: The company Wednesday posted revenue of $44.1 billion for its first quarter, up 69% from a year ago and beating S&P Global Market Intelligence expectations of $43.2 billion. Threat level: Nvidia warned that it expects to lose about $8 billion in second-quarter revenue from the loss of sales of H20 chips due to U.S. export control restrictions. Catch up quick: Nvidia CEO Jensen Huang argued last week that U.S. chip export controls have been "a failure," with their biggest impact being the erosion of Nvidia's competitive position. The impact: Nvidia shares rose 2.9% in after-hours trading before the company's earnings call at 5pm ET.

[16]

Nvidia to release cheaper Blackwell AI chip in China to work around U.S. restrictions: Report

Nvidia's (NVDA) delicate dance in China continues. Amid U.S. export restrictions on its advanced AI chips, the chip giant valued at $3.3 trillion is reworking its product line -- again -- to maintain its hold on one of its most important markets without crossing Washington. Reuters (TRI), citing unnamed sources familiar with the matter, reported that the company is preparing to release a stripped-down version of its popular Blackwell AI chips that have been specifically designed to comply with U.S. export rules. The news comes days before Nvidia prepares to release its first-quarter 2025 earnings. The Blackwell-based, China-only chip will reportedly cost from $6,000 to $8,000 and use conventional GDDR7 memory, a step down from the high-bandwidth tech in Nvidia's flagship models. The previous H20 chips offered in the country sold for between $10,000 and $12,000. This coming chip also would ditch packaging in technology from Taiwan Semiconductor Manufacturing Co. (TSM) An Nvidia spokesperson told Reuters that the company is looking at its "limited" options: "Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China's $50 billion data center market." This isn't Nvidia's first regulatory rodeo. After the U.S. blocked chip exports to China in 2022, the company responded with watered-down versions. When those got swept up in restrictions in late 2023, Nvidia developed chips with further reduced performance to comply with regulations. And that regulatory merry-go-round has continued. In April, Nvidia took a $5.5 billion charge after the U.S. government moved to block exports of the company's H20 AI chips to China. Now, Nvidia is hoping that this China-specific chip variant will thread the needle. CEO Jensen Huang has been increasingly vocal about his frustrations with U.S. policy. At an event earlier this month, he called the export controls "a failure," saying they've only accelerated China's push to develop domestic AI hardware -- sidelining U.S. players in the process. Tech has become the next battleground in the trade war between the U.S. and China. As a result of Nvidia's export restrictions, Chinese telecommunications giant Huawei is gaining ground with its AI chips, which are quickly becoming the preferred alternative for Chinese tech firms. Nvidia's market share in China has reportedly fallen from 90% to around 50% since 2022. But China remains a huge market for Nvidia, accounting for 13% of its sales in the past financial year. And this new chip is expected to help the company keep pace overseas despite its market share loss -- because as good as Huawei is becoming, Nvidia is still considered better.

[17]

Nvidia beats on earnings again -- even while it's locked out of China

After the bell on Wednesday, the $3.3 trillion chipmaker reported $44.1 billion in revenue for the fiscal first quarter, up 69% from the same period a year ago, and the company reported a $18.78 billion profit. Analysts had forecasted a revenue surge to $43.26 billion. Adjusted earnings per share came in at $0.81, ahead of Wall Street estimates of $0.75. Nvidia took a $4.5 billion charge related to exports of its H20 chips to China; without that charge and the related tax impact, first quarter non-GAAP diluted earnings per share would have been $0.96. With demand for generative AI infrastructure still booming and competitors struggling to catch up, Nvidia's performance exceeded expectations. In a Tuesday note, Wedbush analysts led by Dan Ives said that Nvidia's earnings would likely be a "bright green light" for the tech sector -- especially companies heavily invested in the "AI Revolution." The company's growth still hinges on its Data Center division, which brought in $39.1 billion in the first quarter, up 10% from the previous quarter and up 73% from a year ago. That means Nvidia's fastest-growing segment is now responsible for nearly 89% of all revenue -- a sign of how deeply embedded its chips are in the AI build-out. Analysts had expected this division to generate $21.27 billion in Q1 revenue. In his note, Ives wrote that, over the past several years, Nvidia's set-up has been about by how much the company would beat Wall Street's expectations, but this quarter, the earnings were "more about strong numbers and the ability to maintain guidance despite the China blockade. Investors are more laser focused on the medium term and long-term outlook." Nvidia has long relied on the Chinese market for a sizable chunk of its revenue, but that has changed dramatically in the wake of tightening U.S. export controls and tariffs. To maintain its foothold, Nvidia is pursuing R&D efforts in Shanghai and developing China-specific downgraded chips that comply with current restrictions. The company is ground zero in the U.S.-China tech rivalry -- its GPUs might just be the most valuable components in the AI arms race, and its position is increasingly shaped by policy, not just engineering. Nvidia has beat analysts' earnings expectations in 14 of the past 16 quarters. So can anything slow Nvidia down? Maybe. Competition is heating up. AMD (AMD+0.47%) and Intel (INTC-1.50%) are sharpening their AI chip offerings, while hyperscalers are continuing to invest in custom silicon. And export restrictions remain a geopolitical wild card. Still, as the first-quarter earnings show, Nvidia's moat is wide. Its software ecosystem, deep relationships with cloud providers, and product cadence make it more than just a chipmaker. It's the AI era's platform company.

[18]

Nvidia's China problem is big. Just not big enough to stop it

Most companies can't shrug off an $8 billion loss. Then again, most companies aren't Nvidia (NVDA). On Wednesday's first-quarter earnings call, Wall Street zeroed in on Nvidia's obvious weak spot: China. Thanks to U.S. export restrictions, Nvidia's custom-built H20 chips, designed to skirt earlier rules, have essentially been made worthless. Nvidia CFO Colette Kress confirmed the damage: "Had the export controls not occurred, we would have had orders of about $8 billion for H20" in the quarter. That $8 billion is more than rival AMD's (AMD) total quarterly revenue -- and Nvidia seems ready to just shrug off the loss The tech giant reported another monster quarter: Revenue soared 69% year-over-year to $44.1 billion, while net income grew even faster. The stock popped more than 4.5% on Thursday, and Nvidia, with a $3.4 trillion market cap, is the most valuable company in the world -- just ahead of Microsoft (MSFT) and now well ahead of Apple (AAPL). Nvidia's data center business alone grew 73% year-over-year and brought in over $39 billion. And with its next-generation Blackwell chips ramping up, inference workloads scaling globally, and governments racing to build AI capacity using Nvidia infrastructure, China has become -- if not an afterthought -- then certainly just one node in a much larger empire. Nvidia has bigger chips to fry. "This is the start of a powerful new wave of growth," CEO Jensen Huang said. Still, Nvidia isn't abandoning China. According to a recent report, the company is designing a modified Blackwell AI chip specifically for the Chinese market that will comply with U.S. export restrictions. Huang didn't confirm this directly -- he said Nvidia doesn't "have anything at the moment, but we're considering it." He did, however, address the broader implications. The question, he said, isn't whether China will have AI -- "it already does" -- but whether one of the world's largest AI markets will run on American platforms. Export controls, in his view, should "strengthen U.S. platforms, not drive half of the world's AI talent to rivals." Kress made the financial stakes clear: Nvidia expects a "meaningful decrease" in China data center revenue in the second quarter. Losing access to what it believes will be a $50 billion AI accelerator market would, she said, have "a material adverse impact" on the business and benefit rivals in China and beyond. As for the politics, Huang said that President Donald Trump "has a plan, and I respect it." But the bigger picture is that Nvidia isn't betting on any single market. It's betting on a global AI infrastructure boom that's only just getting started -- what Huang called "sovereign AI." The company's strategy isn't about selling to tech firms anymore. Entire countries could soon become Nvidia customers. "Nations are investing in AI infrastructure like they once did for electricity and internet," Huang said. "Sovereign AI is a new growth engine for Nvidia." "Every nation now sees AI as core to the next industrial revolution, a new industry that produces intelligence and essential infrastructure for every economy," he added. "Countries are racing to build national AI platforms to elevate their digital capabilities." Nvidia's recent moves show how seriously it's playing this global game. At Computex, Huang announced Taiwan's first AI factory, a collaboration with Foxconn (HNHPF) and the Taiwanese government. Shortly after, Huang was present as Sweden launched its inaugural national AI infrastructure. But perhaps most notable is Nvidia's opportunity in the Middle East. Huang was there for Trump's tour through the region, where the president announced a 500-megawatt AI infrastructure project in Saudi Arabia and a 5-gigawatt AI campus in the United Arab Emirates. Wedbush Securities analysts called it a "watershed moment" for Big Tech that could be a $1 trillion opportunity. Nvidia is positioned to capitalize on that global wave of AI infrastructure investment. As Huang said, this includes everything from powering cutting-edge training models to overhauling $500 billion of enterprise IT with its AI-ready systems. Add in industrial AI -- robotic factories, digital twins, and more -- and the company's footprint keeps expanding. "Just about every country needs to build out AI infrastructure," Huang said. "There are umpteenth AI factories being planned." Behind all of this is a bigger technological shift -- from generative AI to what comes next. "Reasoning AI really busted through," Huang said, referring to AI agents that can make decisions, use tools, remember, and plan. "Reasoning AI agents require orders of magnitude more compute." He added that the demand for AI reasoning is up, and "we would like to serve all of it, and I think we're on track to serve most of it." That shift -- from model training to full life-cycle AI infrastructure -- is fueling demand. Huang said Nvidia's Grace Blackwell NVLink72 is "the ideal engine today, the ideal computer thinking machine, if you will, for reasoning AI." And agentic AI, which takes reasoning a step further by acting autonomously, is making waves, too. "Enterprise AI is ready to take off," Huang said. "Much more than generative AI, agentic AI is game-changing." CFO Kress said the transition from generative to agentic AI will "transform every industry, every company, and country." She said Nvidia envisions AI agents as a "digital workforce capable of handling tasks ranging from customer service to complex decision-making processes." Huang said that Nvidia is in the "beginning of the build-out" -- and that "there should be many, many more announcements in the future." More AI means more chips. More chips need bigger clusters. Bigger clusters demand faster networking. And Nvidia is scaling every layer of that stack. Huang called Spectrum-X -- the company's AI-optimized Ethernet platform -- "a home run," noting that it added two major cloud providers in the past quarter. The platform can effectively turn $10 billion AI clusters into $14 billion ones through increased efficiency. And NVLink is also becoming foundational to the AI data center -- it exceeded $1 billion in the April quarter. Now analysts see networking as a meaningful second leg of Nvidia's AI infrastructure business. The U.S. export controls don't appear to be going anywhere, especially as tense -- and tech-heavy -- trade talks between the U.S. and China continue. But Nvidia seems prepared for what's ahead. The company just lost billions in China, and that might have been the least interesting thing about its quarter. As Nvidia continues to navigate a geopolitical minefield, it's not that China doesn't matter -- it's that everything else now matters more.

[19]

Nvidia earnings beat expectations despite US export controls

Nvidia on Wednesday reported earnings that topped market expectations, with a $4.5 billion hit from US export controls being less than the Silicon Valley chip juggernaut had feared. However, Nvidia Chief Financial Officer Colette Kress warned in an earnings call that export constraints are expected to cost the AI chip titan about $8 billion in the current quarter. Nvidia in April notified regulators that it expected a $5.5 billion hit in the recently-ended quarter due to a new US licensing requirement on the primary chip it can legally sell in China. US officials had told Nvidia it must obtain licenses to export its H20 chips to China because of concerns they may be used in supercomputers there, the company said in a Securities and Exchange Commission filing. The new licensing rule applies to Nvidia graphics processing units, or GPUs, with bandwidth similar to that of the H20. "China is one of the world's largest AI markets and a springboard to global success," Nvidia chief executive Jensen Huang said in an earnings call. "The platform that wins China is positioned to lead globally; however, the $50 billion China market is effectively closed to us." Nvidia cannot dial back the capabilities of its H20 chips any further to comply with US export constraints, winding up forced to write off billions of dollars on inventory that can't be sold or repurposed, according to Huang. "The US has based its policy on the assumption that China cannot make AI chips," Huang said. "That assumption was always questionable, and now it's clearly wrong." China's AI is moving on without Nvidia technology, while that country's chip-makers innovate products and ramp up operations, according to Huang. "The question is not whether China will have AI; it already does," he said. "The question is whether one of the world's largest markets will run on American platforms." The new requirements resulted in Nvidia incurring a charge of $4.5 billion in the quarter, associated with H20 excess inventory and purchase obligations "as demand for H20 diminished," the chip-maker said in an earnings report. US export constraints stopped Nvidia from bringing in an additional $2.5 billion worth of H20 revenue in the quarter, according to the company. Nvidia said it made a profit of $18.8 billion on revenue of $44.1 billion, causing shares to rise more than four percent in after-market trades. Hot demand Huang said demand for the company's AI-powering technology remains strong, and a new Blackwell NVL72 AI supercomputer referred to as a "thinking machine" is in full-scale production. "Countries around the world are recognizing AI as essential infrastructure -- just like electricity and the internet -- and Nvidia stands at the center of this profound transformation," Huang said. Nvidia high-end GPUs are in hot demand from tech giants building data centers to power artificial intelligence. The company said its data center division revenue in the quarter was $39.1 billion, up 10% from the same period last year. The market had expected more from the unit, however. "Nvidia beat expectations again but in a market where maintaining this dominance is becoming more challenging," said Emarketer analyst Jacob Bourne. "The China export restrictions underscore the immediate pressure from geopolitical headwinds but Nvidia also faces mounting competitive pressure as rivals like AMD gain ground," said Emarketer analyst Jacob Bourne. Revenue in Nvidia's gaming chip business hit a record high of $3.8 billion, leaping 48% and eclipsing forecasts. The AI boom has propelled Nvidia's stock price, which has regained much of the ground lost in a steep sell-off in January triggered by the sudden success of DeepSeek. China's DeepSeek unveiled its R1 chatbot, which it claims can match the capacity of top US AI products for a fraction of their costs. "The broader concern is that trade tensions and potential tariff impacts on data center expansion could create headwinds for AI chip demand in upcoming quarters," analyst Bourne said of Nvidia.

[20]

Nvidia earnings beat expectations despite US export controls

San Francisco (AFP) - Nvidia on Wednesday reported earnings that topped market expectations, with a $4.5 billion hit from US export controls being less than the Silicon Valley chip juggernaut had feared. However, Nvidia Chief Financial Officer Colette Kress warned in an earnings call that export constraints are expected to cost the AI chip titan about $8 billion in the current quarter. Nvidia in April notified regulators that it expected a $5.5 billion hit in the recently-ended quarter due to a new US licensing requirement on the primary chip it can legally sell in China. US officials had told Nvidia it must obtain licenses to export its H20 chips to China because of concerns they may be used in supercomputers there, the company said in a Securities and Exchange Commission filing. The new licensing rule applies to Nvidia graphics processing units, or GPUs, with bandwidth similar to that of the H20. "China is one of the world's largest AI markets and a springboard to global success," Nvidia chief executive Jensen Huang said in an earnings call. "The platform that wins China is positioned to lead globally; however, the $50 billion China market is effectively closed to us." Nvidia cannot dial back the capabilities of its H20 chips any further to comply with US export constraints, winding up forced to write off billions of dollars on inventory that can't be sold or repurposed, according to Huang. "The US has based its policy on the assumption that China cannot make AI chips," Huang said. "That assumption was always questionable, and now it's clearly wrong." China's AI is moving on without Nvidia technology, while that country's chip-makers innovate products and ramp up operations, according to Huang. "The question is not whether China will have AI; it already does," he said. "The question is whether one of the world's largest markets will run on American platforms." The new requirements resulted in Nvidia incurring a charge of $4.5 billion in the quarter, associated with H20 excess inventory and purchase obligations "as demand for H20 diminished," the chip-maker said in an earnings report. US export constraints stopped Nvidia from bringing in an additional $2.5 billion worth of H20 revenue in the quarter, according to the company. Nvidia said it made a profit of $18.8 billion on revenue of $44.1 billion, causing shares to rise more than four percent in after-market trades. Hot demand Huang said demand for the company's AI-powering technology remains strong, and a new Blackwell NVL72 AI supercomputer referred to as a "thinking machine" is in full-scale production. "Countries around the world are recognizing AI as essential infrastructure -- just like electricity and the internet -- and Nvidia stands at the center of this profound transformation," Huang said. Nvidia high-end GPUs are in hot demand from tech giants building data centers to power artificial intelligence. The company said its data center division revenue in the quarter was $39.1 billion, up 10 percent from the same period last year. The market had expected more from the unit, however. "Nvidia beat expectations again but in a market where maintaining this dominance is becoming more challenging," said Emarketer analyst Jacob Bourne. "The China export restrictions underscore the immediate pressure from geopolitical headwinds but Nvidia also faces mounting competitive pressure as rivals like AMD gain ground," said Emarketer analyst Jacob Bourne. Revenue in Nvidia's gaming chip business hit a record high of $3.8 billion, leaping 48 percent and eclipsing forecasts. The AI boom has propelled Nvidia's stock price, which has regained much of the ground lost in a steep sell-off in January triggered by the sudden success of DeepSeek. China's DeepSeek unveiled its R1 chatbot, which it claims can match the capacity of top US AI products for a fraction of their costs. "The broader concern is that trade tensions and potential tariff impacts on data center expansion could create headwinds for AI chip demand in upcoming quarters," analyst Bourne said of Nvidia.

[21]

Nvidia shares surge as earnings beat despite chip export restrictions

Nvidia reported first-quarter earnings for fiscal year 2026 that exceeded market expectations and provided an upbeat outlook for the current quarter. This comes despite an estimated $8 billion (€7.1 billion) loss due to US chip export restrictions affecting sales to China. Nvidia's share price jumped nearly 5% in after-hours trading, placing it just 8% below its all-time high in January. Year-to-date, the stock is set to return to a positive return amid the price surge. Nvidia is now the world's biggest company, surpassing Microsoft and Apple in market capitalisation. "Investors entered this quarter looking for signs that Nvidia could alleviate short-term concerns. What they received was a clear message that demand remains robust," said Josh Gilbert, a market analyst at eToro Australia. Sales revenue from Nvidia's core business, data centres, increased by 73% year-on-year to $39.1 billion (€34.7 billion), reaching a new record. However, this represented a deceleration from 93% growth in the previous quarter. Despite the slower pace, the result aligned with market expectations, as some analysts had anticipated weaker figures due to regulatory headwinds. Overall revenue rose 69% to $44.1 billion (€39.2 billion), while earnings per share came in at $0.96 (€0.85), both ahead of expectations. CEO Jensen Huang attributed the sustained growth to strong global demand for artificial intelligence (AI), particularly from major cloud service providers. Nvidia's most advanced AI chip, Blackwell, "is now in full-scale production across system makers and cloud service providers," said Huang. "Global demand for Nvidia's AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate. Countries around the world are recognising AI as essential infrastructure -- just like electricity and the internet -- and Nvidia stands at the centre of this profound transformation," he added. The company expects revenue of $45 billion (€40 billion), plus or minus 2%, for the current quarter. "This outlook reflects a loss in H20 revenue of approximately $8.0 billion due to the recent export control limitations," it stated. The US government required Nvidia to obtain export licences for its H20 GPUs destined for China during the first quarter. Although the H20 chips had previously been approved, the new rules led to $4.5 billion (€4 billion) in write-downs due to excess inventory. Without this, the company would have generated an additional $2.5 billion (€2.2 billion) in sales. As a result, Nvidia's gross margin for the first quarter stood at 61%. It would have been 71.3% had the charges not occurred. "The $50 billion China market is effectively closed to the US industry," Huang said. "As a result, we are taking a multibillion-dollar write-off on inventory that cannot be sold or repurposed." Nvidia expects a non-GAAP gross margin of 72.0%, plus or minus 50 basis points, for the current quarter. For context, the margin was 73.5% in the fourth quarter of 2024 and 79% during the same quarter of the previous fiscal year. In an interview with Bloomberg TV, Huang noted that Nvidia is exploring alternatives to the H20 chip. However, the company must obtain approval from the US government for any such measures. Nvidia is among the tech giants supporting President Donald Trump's ambitious AI initiatives in the United States, announced in January. The company also unveiled a partnership with Saudi Arabia's HUMAIN to build AI factories in the kingdom during a recent visit to the region that coincided with Trump's trip. These developments were highlighted in the earnings report in the section for data centre. "While sales in China are clouded by export restrictions, the Middle East looks set to become the new launchpad for Nvidia's next phase of growth," Gilbert added.

[22]

Nvidia results spark global chip rally

Jensen Huang, co-founder and CEO of Nvidia Corp., speaks during a news conference in Taipei on May 21.I-Hwa Cheng / AFP - Getty Images Nvidia shares jumped on Thursday after posting a positive set of earnings, sparking a rally in global semiconductor stocks. Shares of Nvidia were 6% higher after the company posted better-than-expected earnings and revenue on Wednesday, even as it took a hit from U.S. semiconductor export restrictions to China. Nvidia has been seen by investors as a bellwether for the broader semiconductor industry and artificial intelligence-related stocks, with its latest strong numbers sparking a rally among global semiconductor names. The semiconductor industry has faced a number of headwinds from uncertainty around tariff policy in the U.S. and chip export restrictions to China. Companies such as ASML, which makes machines that are critical for manufacturing the most advanced chips, have seen billions wiped off their value as a result. Nvidia on Wednesday said it wrote off $4.5 billion of H20 chip inventory that it couldn't ship to China because of export curbs, saying it also calculated $2.5 billion of lost revenue as well. The restrictions on China do not seem to be going away. The U.S. has ordered a number of companies, including those producing chemicals and design software for semiconductors, to stop shipping goods to China without a license, according to a Reuters report on Thursday. Despite this, Nvidia still managed to post financial results for the April quarter that beat market expectations, allaying fears that demand for its graphics processing units, which have become key for training huge AI models, is dwindling.

[23]

Nvidia's Hopper GPUs are now dead to the Chinese market after export controls that made the company take a 'multibillion-dollar write-off'

(Image credit: Walid Berrazeg/SOPA Images/LightRocket via Getty Images) There was more than the usual swell of anticipation for Nvidia's latest earnings call, primarily because the last quarter has been tumultuous in the wake of US tariffs and trade restrictions. On this front, and despite the fact that the AI chip giant still seems to be doing phenomenally well, Nvidia has admitted export controls have fully killed off its Hopper generation GPUs in China. During the company's recent Q1 earnings call, Nvidia CEO Jensen Huang explained: "The H20 export ban ended our Hopper Data Center business in China. We cannot reduce Hopper further to comply. As a result, we are taking a multibillion-dollar write-off on inventory that cannot be sold or repurposed. We are exploring limited ways to compete, but Hopper is no longer an option." Hopper is the company's previous-gen GPU/AI accelerator architecture. While its Blackwell architecture -- the architecture at the heart of the RTX 50 series -- is rolling out to fill up data centres despite previous delays, Hopper chips still line many server racks and they were the primary Nvidia export to China. The past couple of years have seen the same scene play out over and over again: The US restricts what Nvidia can export to China, Nvidia starts exporting a slightly less powerful Hopper chip to China, then the US restricts it further so that less powerful Hopper chip is restricted, too. Rinse and repeat. No longer, though, according to Nvidia. Now, there is seemingly no less powerful chip that Nvidia can comfortably make and export to the country. Nvidia Hopper is dead in China. Nvidia CFO Colette Kress says: "our outlook reflects a loss in H20 revenue of approximately $8 billion for the second quarter." H20 is the Hopper chip that Nvidia was previously exporting to China, and $8 billion revenue loss for Q2 is a lot more than the company lost for Q1. Nvidia had previously said that it could lose $5.5 billion in Q1 because of export restrictions, but it looks like that amount turned out to be $2.5 billion in the end: "We recognized $4.6 billion H20 in Q1. We were unable to ship $2.5 billion, so the total for Q1 should have been $7 billion." Despite praising President Trump's "bold vision", the company doesn't seem to agree with his trade restriction strategy in this case. Huang says: "The question is not whether China will have AI, it already does. The question is whether one of the world's largest AI markets will run on American platforms. Shielding Chinese chipmakers from U.S. competition only strengthens them abroad and weakens America's position." We've heard Huang say similar before, and it's certainly an argument to take seriously. At the same time, though, we can hardly expect the CEO of a chip company to support the banning of its exports to one of its biggest markets. The China export restrictions were certainly the main talking point in the earnings call, other than the usual "AI factory" stuff and a sliver of gaming talk. On that front, Nvidia claims a "record $3.8 billion" gaming revenue, but the wow-factor shrivels a little when we remember that Nvidia's pushed out a bunch of its new GPUs over a very short period, so we can expect an inflated number there. Nvidia all but admits this when it calls Blackwell its "fastest ramp ever" -- that's "fastest", not "biggest". Anyway, trade talk aside, Nvidia seems to be doing pretty well in the wake of this news. I'm sure the multi-billion company will survive Hopper waving farewell to China.

[24]

Nvidia delivers another earnings and revenue beat on rampant data center growth - SiliconANGLE

Nvidia delivers another earnings and revenue beat on rampant data center growth Nvidia Corp.'s shares were moving higher in extended trading after the company reported better-than-expected earnings and revenue, with its data center business growing 73% year-over-year. The growth was impressive enough that investors were even willing to forgive Nvidia's guidance miss, and its stock was up 4% after-hours. The company reported first-quarter earnings before certain costs such as stock compensation of 96 cents per share, beating the analyst forecast of 93 cents. Revenue for the period came to $44.06 billion, up 69% from a year ago, and ahead of the $43.31 billion expected. That helped propel Nvidia's net income to $18.8 billion for the quarter, up from $14.9 billion in the year-ago period. With respect to guidance, Nvidia came up short, but the forecast was not entirely unexpected. The company said it's looking at around $45 billion in current-quarter sales, trailing Wall Street's target of $45.9 billion. But even so, investors probably suspected the company might come up short, for Nvidia explained that its guidance would have been around $8 billion higher if not for the U.S. government's latest export restrictions on advanced chips being sold to China. In April, the U.S. government told the company it would need to obtain a special export license to sell any more of its H20 graphics processing units to Chinese customers, effective immediately. The H20 chip is a specialized, scaled-down version of the company's older H100 and H200 GPUs, based on the Hopper architecture that dates back to 2023. The new restrictions, which were heavily criticized by Nvidia Chief Executive Jensen Huang (pictured), forced the company to write off around $4.5 billion in stock. This month, Nvidia said it had to walk away from around $15 billion in planned sales due to the restrictions. According to Nvidia Chief Financial Officer Collette Kress, the company's gross margin would have been 71.3% in the previous quarter, rather than 61%, if not for the China-related charges. On a conference call today, Huang told analysts that the $50 billion market for artificial intelligence chips in China is "effectively closed to U.S. industry." He added that the H20 export ban has "ended our Hopper data center business in China." While the company is unlikely to sell any more Hopper-based chips to Chinese customers, there have been unconfirmed reports that it hasn't entirely given up on the market. Earlier this week, a report by Reuters quoted anonymous sources familiar with the company's plans as saying that it's now racing to develop yet another, even more scaled-down GPU for China, based on its newer Grace Blackwell architecture. But it's not clear if Nvidia will be able to develop a new chip that satisfies the U.S.'s strict regulations on shipments to China, and there's no word on when such a chip might be ready for export. Despite these problems, Nvidia is still growing aggressively, benefiting from enormous demand from hyperscale data center operators and enterprises that continue to snap up as many of its GPUs as possible, in a frenzy to power advanced generative AI and agentic AI applications. "Global demand for Nvidia's AI infrastructure is incredibly strong," Huang told analysts. "AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate." Sales in Nvidia's biggest business unit, the data center division, rose 73% from a year earlier to $39.1 billion, and now account for 88% of the company's total revenue. Officials said that large cloud hyperscalers such as Microsoft Corp., Amazon Web Services Inc. and Meta Platforms Inc. accounted for just under half of the total data center revenue. Also, $5 billion of sales in the unit were related to Nvidia's InfiniBand networking products, which are used to connect thousands of GPUs into enormous clusters to power the most demanding AI workloads. Kress told analysts that the company was enjoying brisk sales of its latest Grace Blackwell GPUs. She said that Microsoft has already "deployed tens of thousands of Blackwell GPUs, and is expected to ramp to hundreds of thousands" in the coming months, largely due to its close relationship with AI leader OpenAI. AI isn't the only growth avenue for the company, either. Nvidia reported that its gaming division, which was once its largest business but is now dwarfed by the data center unit, saw revenue increase 42% during the quarter. All told, it delivered $3.8 billion in sales of chips used for PC graphics cards and games consoles such as the new Nintendo Switch 2. Nvidia also has a small but growing business selling chips for automotive and robotics applications, and that unit saw sales rise 72% to $567 million in the quarter. The company attributed growth there to increased demand for chips for self-driving cars. Meanwhile the professional virtualization business, which sells chips for high-powered workstations used for 3D design applications, saw revenue increase 19% to $509 million. Thanks to the after-hours bump, Nvidia's stock is now almost flat in the year-to-date, and less than 5% below its record high of 148.59 reached on Jan. 6.

[25]

The $50 Billion Market That's Haunting NVIDIA | AIM