Nvidia CEO Jensen Huang Envisions Robotics as Next Multi-Trillion Dollar Opportunity

4 Sources

4 Sources

[1]

Nvidia CEO says robotics is chipmaker's biggest opportunity after AI

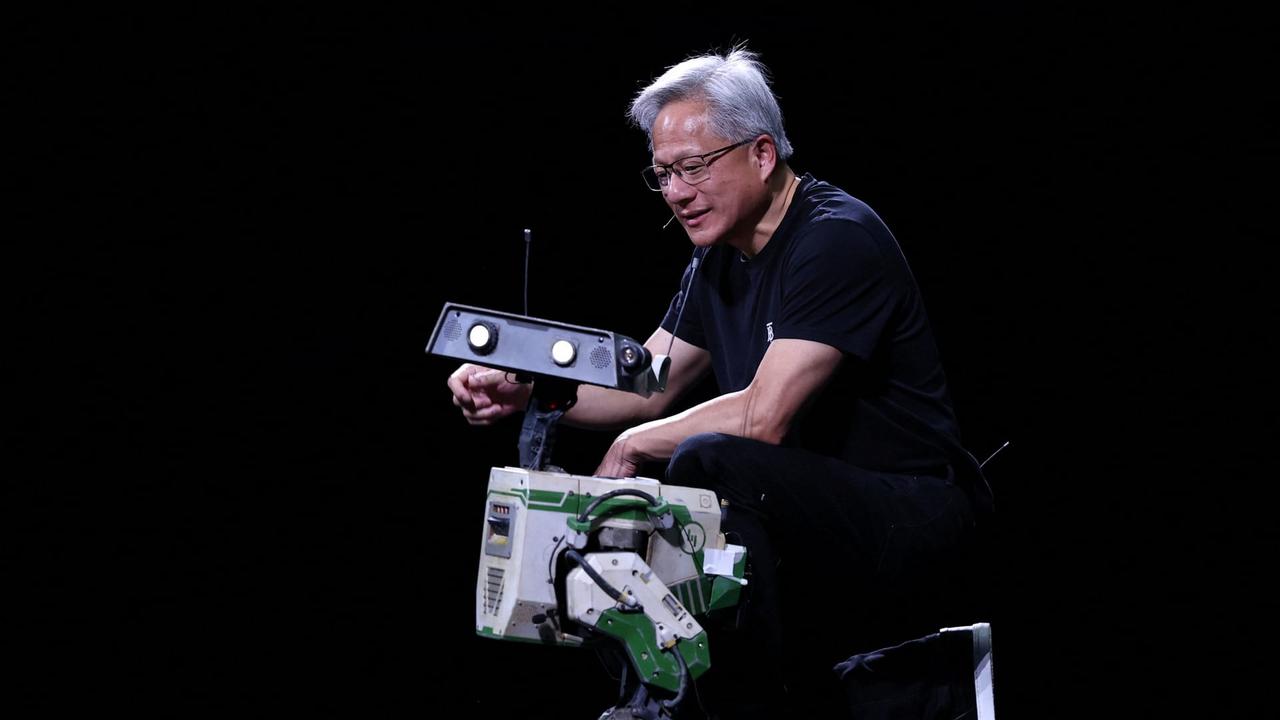

Jensen Huang, CEO of Nvidia, is seen on stage next to a small robot during the Viva Technology conference dedicated to innovation and startups at Porte de Versailles exhibition center in Paris, France, June 11, 2025. Nvidia CEO Jensen Huang said that, other than artificial intelligence, robotics represents the chipmaker's biggest market for potential growth, and that self-driving cars would be the first major commercial application for the technology. "We have many growth opportunities across our company, with AI and robotics the two largest, representing a multitrillion-dollar growth opportunity," Huang said on Wednesday, at Nvidia's annual shareholders meeting, in response to a question from an attendee. A little over a year ago, Nvidia changed the way it reported its business units to group both its automotive and robotics divisions into the same line item. In May, Nvidia said that the business unit had $567 million in quarterly sales, or about 1% of the company's total revenue. Automotive and robotics was up 72% on an annual basis. Nvidia's sales have been surging over the past three years due to unyielding demand for the company's data center graphics processing units (GPUs), which are used to build and operate sophisticated AI applications like OpenAI's ChatGPT. Total sales have soared from about $27 billion in its fiscal 2023 to $130.5 billion last year, and analysts are expecting nearly $200 billion in sales this year, according to LSEG. The stock climbed to a record on Wednesday, lifting Nvidia's market cap to $3.75 trillion, putting it just ahead of Microsoft as the most valuable company in the world. While robotics remains relatively small for Nvidia at the moment, Huang said that applications will require the company's data center AI chips to train the software as well as other chips installed in self-driving cars and robots. Huang highlighted Nvidia's Thrive platform of chips, and software for self-driving cars, which Mercedes-Benz is using. He also said that the company recently released AI models for humanoid robots called Cosmos. "We're working towards a day where there will be billions of robots, hundreds of millions of autonomous vehicles, and hundreds of thousands of robotic factories that can be powered by Nvidia technology," Huang said. Nvidia has increasingly been offering more complementary technology alongside its AI chips, including software, a cloud service, and networking chips to tie AI accelerators together. Huang said Nvidia's brand is evolving, and that it's better described as an "AI infrastructure" or "computing platform" provider. "We stopped thinking of ourselves as a chip company long ago," Huang said. At the annual meeting, shareholders approved the company's executive compensation plan and reelected all 13 board members. Outside shareholder proposals to produce a more detailed diversity report and change shareholder meeting procedure did not pass.

[2]

Nvidia CEO Jensen Huang sees a future with 'billions of robots'

Nvidia is about more than just AI, says CEO Jensen Huang: Robotics, including self-driving cars, are the company's other multi-trillion-dollar bet, he told shareholders on Wednesday, as reported by CNBC. This month Nvidia briefly surpassed Microsoft as the most valuable public company in the world. And even though its wild success is based on chips that are at the forefront of the AI revolution, Huang said that Nvidia "stopped thinking of ourselves as a chip company long ago." He says it is now just as focused on AI infrastructure, like networking chips and cloud services. "We're working towards a day where there will be billions of robots, hundreds of millions of autonomous vehicles, and hundreds of thousands of robotic factories that can be powered by Nvidia technology," Huang said. Earlier in June, Nvidia announced a partnership with Hexagon, a company that makes humanoid robots "engineered to perform a wide range of industrial applications." On Wednesday Jensen mentioned Nvidia's work with another humanoid robot company, Cosmos. Toyota (TM) will use Nvidia's DRIVE AGX Orin system-on-a-chip (SoC) technology for its next-generation vehicles for driving assistance. Aurora (AUR) and Continental will both use Nvidia's DRIVE accelerated compute to deploy driverless trucks through a long-term strategic partnership. In May, Nvidia's automotive and robotics division reported a 27% jump in revenue from the previous year, to $567 million. That's peanuts in a company that just reached an all-time-high stock price, with a market cap of $3.75 trillion -- with a T. Sales of its AI chips quadrupled in the past two years, with analysts expecting sales to increase by 53% this year to $200 billion. At the Consumer Electronics Show in January, Huang said that "the ChatGPT moment for general robotics is just around the corner." There, he unveiled new tools to help companies simulate and deploy robot workforces. The centerpiece is "Mega," a new Omniverse Blueprint that lets companies develop, test, and optimize robot fleets in virtual environments before deploying them in real warehouses and factories. A key part of this effort is the new Isaac GR00T Blueprint, which helps solve a major challenge in robotics: generating the massive amounts of motion data needed to train humanoid robots. Instead of the expensive and time-consuming process of collecting real-world data, developers can use GR00T to generate large synthetic datasets from just a small number of human motions That said, the CEO is cashing out: Huang unloaded $14.4 million of his own stock in Nvidia this June; he's expected to sell up to $865 million worth by the end of 2025.

[3]

Jensen Huang Declares Nvidia Has Outgrown Its Chipmaking Roots

CEO Jensen Huang outlines Nvidia's plan to lead in physical A.I. with tools for self-driving cars, robots and smart factories. Unprecedented demand for A.I. chips has propelled Nvidia to become the world's most valuable company, with a market capitalization of $3.8 trillion. But CEO and founder Jensen Huang says the company has already evolved beyond its origins. "We stopped thinking of ourselves as a chip company long ago," Huang said during Nvidia's annual shareholder meeting yesterday (June 25). Sign Up For Our Daily Newsletter Sign Up Thank you for signing up! By clicking submit, you agree to our <a href="http://observermedia.com/terms">terms of service</a> and acknowledge we may use your information to send you emails, product samples, and promotions on this website and other properties. You can opt out anytime. See all of our newsletters Instead, Huang sees Nvidia's future in "physical A.I.," a branch of artificial intelligence that can reason and operate in the real world. This emerging field could power self-driving vehicles, humanoid robots and sweeping changes in the workforce. "Robots, and all the A.I. infrastructure to train them, will be the next multimillion-dollar industry," Huang said. A.I. chips remain core to Nvidia's business. Founded by Huang more than three decades ago, the company started as a gaming-focused venture and was an early pioneer in graphics processing units (GPUs). Its early bet on GPU computing positioned it perfectly to ride the A.I. wave triggered by OpenAI's 2022 launch of ChatGPT. Since then, Nvidia has become a Silicon Valley powerhouse, with tech firms scrambling to secure its high-performance hardware. That surge in demand has fueled record-breaking sales. Nvidia generated $130.5 billion in revenue last year, and its most recent quarterly sales soared 69 percent year-over-year to $44.1 billion. Most of that revenue still comes from its data center division, but its automotive and robotics segment is growing rapidly. Between February and April, the unit brought in $567 million, up 72 percent from the same period last year. As A.I. moves into its physical era, Huang believes Nvidia's growth is just beginning. The technology has already advanced through stages of perception, generation and, more recently, reasoning. Now, "the next wave is already coming," he said. That next wave, Huang predicts, will begin with autonomous vehicles. Nvidia is betting big on this shift through its Drive platform, a suite of computing and infrastructure tools for self-driving cars. The platform is already in use by leading robotaxi and delivery vehicle companies, with partners like Mercedes-Benz planning to roll out the technology across millions of vehicles. Nvidia is also expanding its footprint in robotics. It has formed partnerships with major players such as Boston Dynamics, KUKA and Universal Robots. Earlier this year, the company introduced Cosmos, a set of "world models" designed to train physical A.I. systems, such as humanoid robots, through advanced, physics-based simulations. Nvidia is betting that the economic potential of physical A.I. is both vast and largely untapped, particularly in its ability to transform the global labor force. Autonomous machines could reshape the world's industrial sectors, which collectively generate $50 trillion in global GDP, Huang noted. He's confident Nvidia is positioned to lead that transformation. "We're working toward a future with billions of robots, hundreds of millions of autonomous vehicles, and hundreds of thousands of robotic factories -- all powered by Nvidia technology," he said.

[4]

Nvidia's Next 'Multitrillion Dollar' Opportunity? Jensen Huang Sees Great Potential Here: 'Stopped Thinking Of Ourselves As A Chip Company Long Ago' - Microsoft (NASDAQ:MSFT), Intel (NASDAQ:INTC)

Nvidia Corp NVDA CEO Jensen Huang has revealed that the company's next major growth opportunity lies in robotics, aside from artificial intelligence (AI). What Happened: At Nvidia's annual shareholders meeting on Wednesday, Huang identified robotics as the company's second-largest market for potential growth, following AI, reported CNBC. "We have many growth opportunities across our company, with AI and robotics the two largest, representing a multitrillion-dollar growth opportunity," stated Huang. He stated that the first significant commercial application for this technology would be self-driving cars. Despite its current relatively small size, the robotics division has seen a 72% annual increase, with $567 million in quarterly sales, accounting for nearly 1% of the company's total revenue. While Nvidia's sales have surged thanks to strong demand for its data center GPUs, Huang expects the robotics sector to drive further growth -- requiring the company's AI chips for software training, along with additional chips used in autonomous vehicles and robots. Huang said Nvidia is shifting its identity toward being an "AI infrastructure" or "computing platform" provider. "We stopped thinking of ourselves as a chip company long ago," Huang says. Huang pointed to Nvidia's Drive platform -- its suite of chips and software for autonomous vehicles -- currently in use by Mercedes-Benz. The company has also recently launched AI models for humanoid robots, known as Cosmos. See Also: Mark Zuckerberg's Meta Beats Lawsuit Over AI Training On Books, Judge Finds 'No Meaningful Evidence On Market Dilution' Why It Matters: Nvidia's stock has been performing exceptionally well, reaching a record high on Wednesday, with the company's market cap now standing at approximately $3.75 trillion. This makes Nvidia the most valuable company in the world, ahead of Microsoft MSFT. This announcement comes on the heels of Nvidia's recent rebound from a 17% drop in January, which was initially sparked by fears that China's DeepSeek AI could challenge Nvidia's market dominance. The stock's recovery has been fueled by a significant easing in U.S.-China trade tensions and a stellar first-quarter earnings report on May 28. Moreover, despite generating almost four times as much revenue as Intel INTC on an annualized basis, Nvidia trades at less than half of Intel's forward price-to-earnings ratio. According to Benzinga Edge Stock Rankings, Nvidia has a growth score of 98.65% and a momentum rating of 70.43%. Click here to see how it compares to other leading tech companies. READ MORE: Nvidia Stock Could Rise Another 38%, Making Jensen Huang-Led AI Giant A Nearly $5 Trillion Company, Says Barclays Image via Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. INTCIntel Corp$22.370.77%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum28.50Growth19.47QualityNot AvailableValue73.90Price TrendShortMediumLongOverviewMSFTMicrosoft Corp$493.700.29%NVDANVIDIA Corp$155.861.00%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia CEO Jensen Huang announces that robotics, including self-driving cars, represents the company's biggest market opportunity after AI, signaling a shift from being just a chip company to an AI infrastructure provider.

Nvidia's Vision for Robotics and AI Infrastructure

Nvidia CEO Jensen Huang has unveiled the company's ambitious plans for the future, positioning robotics as the next frontier for growth after artificial intelligence (AI). At Nvidia's annual shareholders meeting, Huang declared that AI and robotics represent "a multitrillion-dollar growth opportunity" for the company

1

.

Source: Observer

Shifting Focus from Chips to AI Infrastructure

In a significant shift from its origins, Huang stated, "We stopped thinking of ourselves as a chip company long ago"

3

. This evolution reflects Nvidia's transformation into an "AI infrastructure" or "computing platform" provider, emphasizing its expanding role in the tech ecosystem beyond just chip manufacturing1

.The Rise of Physical AI and Robotics

Huang introduced the concept of "physical AI," which encompasses technologies capable of reasoning and operating in the real world. This includes self-driving vehicles, humanoid robots, and smart factories. Nvidia is actively developing tools and platforms to support this vision, such as the Drive platform for autonomous vehicles and Cosmos, a set of AI models for humanoid robots .

Source: CNBC

Self-Driving Cars: The First Major Application

According to Huang, self-driving cars will be the first significant commercial application of Nvidia's robotics technology. The company's Drive platform, which includes chips and software for autonomous vehicles, is already being utilized by Mercedes-Benz

1

. Additionally, partnerships with companies like Toyota, Aurora, and Continental are expanding Nvidia's presence in the automotive sector2

.Rapid Growth in Automotive and Robotics

While still a relatively small part of Nvidia's overall business, the automotive and robotics division has shown impressive growth. In the most recent quarter, this segment reported $567 million in sales, representing a 72% increase year-over-year

1

.Related Stories

Nvidia's Market Dominance and Future Prospects

Nvidia's success in AI has propelled it to become the world's most valuable company, with a market capitalization of $3.75 trillion

4

. The company's total sales have surged from $27 billion in fiscal 2023 to $130.5 billion last year, with analysts projecting nearly $200 billion in sales for the current year1

.A Vision of Billions of Robots

Source: Quartz

Huang painted a bold picture of the future, stating, "We're working towards a day where there will be billions of robots, hundreds of millions of autonomous vehicles, and hundreds of thousands of robotic factories that can be powered by Nvidia technology"

1

. This vision aligns with Nvidia's efforts to develop advanced simulation tools like the Isaac GR00T Blueprint, which aims to streamline the training process for humanoid robots2

.As Nvidia continues to expand its reach beyond traditional chip manufacturing, the company is positioning itself at the forefront of the AI and robotics revolution, with ambitious plans to reshape industries and drive technological innovation in the years to come.

References

Summarized by

Navi

Related Stories

NVIDIA's Dominance in AI Infrastructure: Record Earnings and Future Projections

29 Aug 2025•Technology

Nvidia CEO Jensen Huang Unveils "Agentic AI" Vision at CES 2025, Predicting Multi-Trillion Dollar Industry Shift

07 Jan 2025•Technology

Nvidia CEO Jensen Huang Unveils New AI Technologies at Computex 2025

15 May 2025•Technology

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation