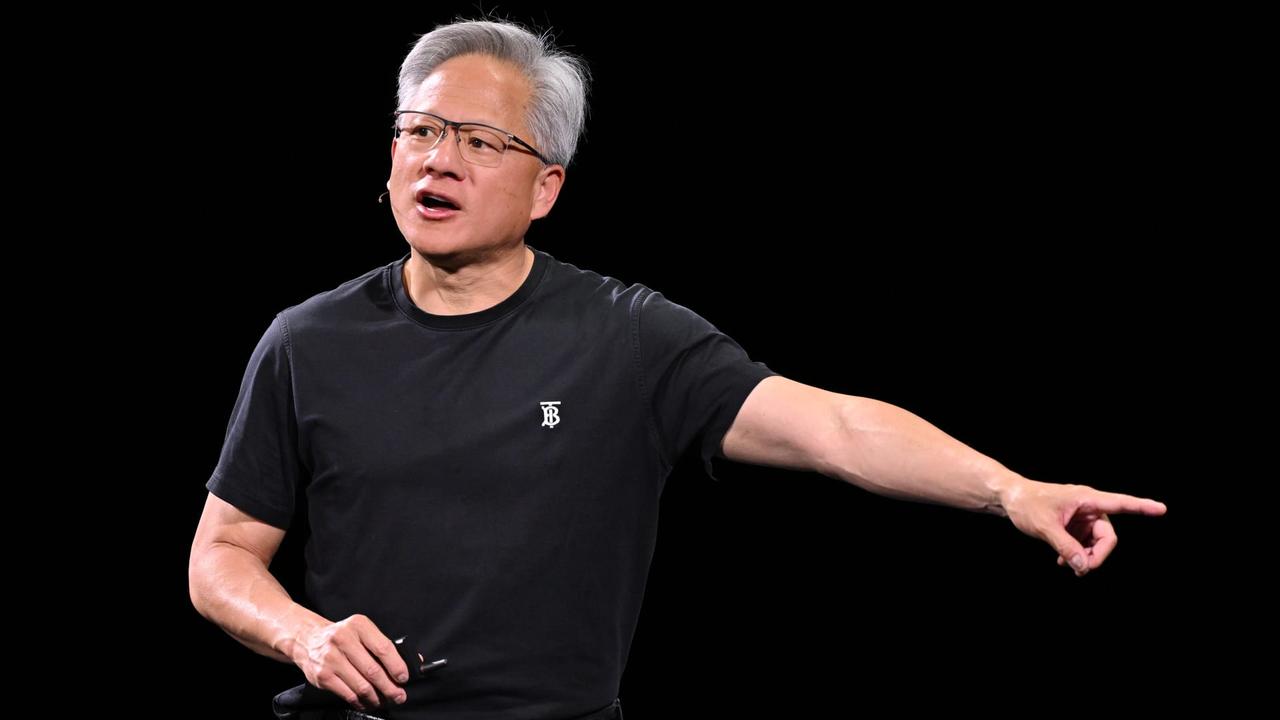

NVIDIA CEO Jensen Huang's Net Worth Surpasses Intel's Market Cap Amid AI Boom

5 Sources

5 Sources

[1]

Jensen Huang's net worth passes Intel's market cap

The big picture: Nvidia's share value is once again on the rise, boosting CEO Jensen Huang's net worth. According to the latest data from the Forbes 400 list, which ranks the richest people in America, Huang's fortune now sits at $104 billion. That's more than the total worth of fellow chipmaker Intel, whose market cap is currently $96.43 billion. Nvidia has been at the forefront of the AI revolution since early 2023, and its shareholders have been rewarded accordingly. The company's stock more than tripled in value last year, and the meteoric rise continued into 2024. Values corrected a bit over the summer, but things have been trending upward once again as of late. AI is showing no signs of slowing down, and that is great news for one of leading hardware suppliers. Forbes has Huang as the 11th richest person in the US. Unsurprisingly, almost everyone in the top 10 has earned their wealth in the technology sector. Tesla and SpaceX boss Elon Musk remains the richest person in America with a net worth of $244 billion, and his lead is substantial. Amazon founder Jeff Bezos is worth around $197 billion - or about $47 billion less than Musk. Facebook founder Mark Zuckerberg ranks third with a net worth of $181 billion. Microsoft co-founder Bill Gates, who previously held the top spot for several years, now sits in ninth place with a fortune of $107 billion. This past summer, longtime company man Steve Ballmer passed Gates in terms of net worth. Considering Gates has pledged to give away most of his fortune, his fall down the list isn't surprising. Only two people in the top 10 - investor Warren Buffet and businessman Michael Bloomberg - made their money outside of tech. Nvidia, meanwhile, remains in a prime position with a market cap of $3.11 trillion. That's good enough for second place among all American companies, trailing only Apple whose value sits at $3.42 trillion. Microsoft, Alphabet, and Amazon round out the top five with values of $3.09 trillion, $2.05 trillion, and $1.91 trillion, respectively.

[2]

Nvidia's CEO -- yes, one person -- is worth more than Intel | Digital Trends

Nvidia is one of the richest companies in the world, so it's no surprise that the company's CEO, Jensen Huang, is quite wealthy. The most recent net worth numbers from Forbes puts into context just how wealthy the executive really is, though. Huang has an estimated net worth of $109.2 billion, which is around $13 billion more than the market cap of Intel across the entire company. Although Nvidia makes some of the best graphics cards, the obscene amount of money the company has racked up over the past two years stems from its AI accelerators. In 2020, Forbes estimated that Huang was worth $4.7 billion, and even in 2023, after ChatGPT had already exploded onto the scene, the executive was worth $21.1 billion. Now, Huang is the 11th richest person in the world, outpacing Bill Gates, Michael Dell, and Michael Bloomberg. Recommended Videos Huang and other Nvidia executives are making good on that value, too. Earlier this month, Nvidia executives sold almost 11 million shares, accounting for $1.8 billion. Huang aso cashed in $713 million in shares, according to Bloomberg. Get your weekly teardown of the tech behind PC gaming ReSpec Subscribe Check your inbox! Privacy Policy Intel, meanwhile, has its lowest market cap since December 2008, during the housing market crash. During that time, Intel's market cap dipped to $71 billion. The company peaked in early 2000 with a market cap over $500 billion, and it sat around $250 billion throughout 2020 and 2021. The dip now comes on the back of financial troubles within Intel, which has prompted shareholders to sue the company and Intel to split its Foundry business into its own subsidiary. Comparing net worth to market cap isn't exactly one-to-one -- and at some level, these two numbers themselves represent value more so than actual money. However, it puts into context just how massive Nvidia has become over the past year. Nvidia's market cap is over $3 trillion, making it the third-richest company in the world. Nvidia is worth more than Google and Amazon, and it's worth more than Walmart, Tesla, Visa, and Netflix combined. It certainly helps that the top two richest companies in the world, Microsoft and Apple, have spent big with Nvidia over the past few years. Microsoft has been clear that Nvidia GPUs are the backbone of the infrastructure that built ChatGPT, and with AI continuing to be a hot commodity, Nvidia shows no signs of slowing down. However, the recent share sale from Nvidia's executives suggests the boom may not last forever.

[3]

Jensen Huang is now worth more than Intel -- personal net worth currently valued at $109B vs. Intel's $96B market cap

If he decided to buy Team Blue, Huang would still have $13 billion in change. Nvidia CEO Jensen Huang's current net worth is listed at $109.2 billion, putting him a significant valuation step ahead of Intel, whose stock price took a beating when its financial troubles were made public in August. The news has gotten to the point that various social media users have been sharing posts about it. See a popular example, below, with the caption encouraging the leather-jacket-loving executive to buy Team Blue. The AI frenzy and Nvidia's performance as the leading AI GPU accelerator manufacturer has supercharged its stock performance, making it the world's most valuable company by market cap last June. Although its share price has since corrected, dropping by around 10% from its record high, it's still third in line with the five largest companies, next to other tech giants like Apple, Microsoft, Alphabet (Google), and Amazon. This jump in stock performance has done wonders for Huang, who directly holds over 75 million Nvidia shares, plus 786 million more through various trusts and a partnership. Even though he has cashed in more than $700 million by selling 6 million shares this year, this is just a drop in the bucket versus the estimated total value of his Nvidia holdings, at over $100 billion. This combination has allowed the Nvidia CEO to jump ahead in Forbes' real-time billionaires list, putting him in the 11th spot, less than $20 billion shy of breaking the top 10. One interesting story, though, is that both Elon Musk and Larry Ellison, currently sitting at number one and two on Forbes' list of richest billionaires, were known to have begged Jensen Huang for more AI GPUs, with the latter confirming the story during Oracle's latest earnings calls. This adds to the Nvidia CEO's star appeal, with several A-listers seen attending his keynote at GTC 2024. On the other hand, Intel, which hasn't been having a good year, is currently valued at $96.39 billion. Its stock price at the time of writing is $22.59 per share, which is less than half of its record high from late 2023, of over $50. The company's value plummeted in early August when its financial struggles made a huge splash in the tech and finance worlds. This news caused the company to shed $39 billion in market capitalization practically overnight, with rumors saying that it could be kicked out of the Dow Jones Industrial Average because of this. While it may be amusing to see that Jensen Huang could buy up Intel and have around $13B in change, it is a highly unlikely move, and no one is expecting an offer to be made. There are also multiple huge regulatory and trust hurdles facing such a deal with the embattled chip maker. However, if Jensen Huang even showed an interest in an Intel purchase, as he did with Arm, it could be a story so big that Musk's surprise Twitter purchase would seem like a tiny sand grain on the dunes of time.

[4]

NVIDIA's CEO Jensen Huang Is Now Worth More Than "All Of Intel" Combined

NVIDIA's CEO Jensen Huang is now worth more than Team Green's arch-rival Intel, reaching a net worth of $109 billion, marking an impressive milestone. Well, it won't be wrong to say that NVIDIA has capitalized immensely on the AI hype, to the point where the firm has seen its market cap almost grow by three times in just a year. With every mainstream tech firm getting involved in building their very own AI compute portfolio, NVIDIA's offerings were pretty much in hot demand throughout the year, especially the Hopper generation, which played a pivotal role in where NVIDIA is today. Now, NVIDIA's CEO, Jensen Huang, has reached a net worth that is larger than Intel combined, which shows the level of progress Team Green has made over the past few months. Just on paper, Jensen himself can acquire Intel based on the firm's valuation, which also shows us how distant the competition has become between Intel and NVIDIA. However, apart from NVIDIA's gigantic growth, another factor that has led to Jensen reaching this stage is the surprising downfall of Team Blue and its chip business, which we'll talk about next. By now, everyone is aware of Intel's constant decline in business revenue and the strategies it has adopted in the past few quarters. Intel has seen its valuation drop by over $30 billion in just a day, and the firm is currently undergoing its worst financial period in 50 years. While many factors are associated with this decline, a lack of business opportunities has played a major role, followed by the firm's ineffective execution of its ambitions related to the foundry and chip divisions. The current market dynamics clearly show us how a business falls apart when it doesn't manage to keep up with trends, and Intel's lack of involvement in the AI frenzy certainly has cost them enormously. As for Jensen, well, he is riding the AI wave with confidence, and NVIDIA's future is brighter than ever, especially with the anticipation surrounding NVIDIA's Blackwell architecture.

[5]

NVIDIA's CEO is currently worth more than the entirety of Intel

NVIDIA's share price recently reached a point where it became the biggest company in the world - with growth driven by the AI boom and the seemingly insatiable hunger or thirst for NVIDIA's most powerful GPUs. Even though NVIDIA's share price has fallen, it's still one of the largest companies in the world, alongside Microsoft, Apple, Amazon, and Google. One company not included in that list and one that finds itself in a rather precarious spot is Intel. Even though Intel is debuting new chips for mobile and desktop, controversies, foundry delays, and a few years of losing market share to the competition have seen its stock price fall, and its market cap hit $97 billion in recent days. As pointed out by many, this figure now sits considerably lower than NVIDIA CEO Jensen Huang's worth. A remarkable stat is driven by the fact that NVIDIA has added just about 20 times Intel's market cap to its value in a year. So, valued at $109 billion, Jensen Huang could theoretically buy Intel for himself - and still have plenty left to pick up a few mansions and super yachts. It's an impressive milestone that indicates how quickly the tide can change in tech, where companies rise and fall - even those with established histories like Intel and NVIDIA. With the demand for NVIDIA's next-generation Blackwell hardware and the GeForce RTX 50 Series on the horizon, NVIDIA looks to be in an excellent spot for the foreseeable future. Intel's troubles have been widely publicized in recent months, culminating in the company cutting jobs after its valuation dropped by $30 billion or so in a single day. It'll be interesting to see if Intel can turn things around with the recent Lunar Lake launch and its upcoming data center and consumer products.

Share

Share

Copy Link

NVIDIA CEO Jensen Huang's personal net worth has reached $109 billion, surpassing Intel's entire market capitalization of $96 billion, highlighting the dramatic shift in the tech industry driven by the AI revolution.

NVIDIA's Meteoric Rise in the AI Era

In a striking illustration of the shifting dynamics in the tech industry, NVIDIA CEO Jensen Huang's personal net worth has soared to an estimated $109.2 billion, surpassing the entire market capitalization of Intel, which currently stands at $96.43 billion

1

2

. This remarkable development underscores the transformative impact of artificial intelligence on the tech landscape and highlights NVIDIA's dominant position in the AI hardware market.The AI-Driven Ascent of NVIDIA

NVIDIA's stock value has experienced exponential growth since early 2023, largely fueled by the company's pivotal role in the AI revolution. The company's share price more than tripled in 2023 and continued its upward trajectory into 2024

1

. This surge has catapulted NVIDIA to become the third-richest company globally, with a market capitalization of $3.11 trillion, surpassing tech giants like Google and Amazon2

3

.Jensen Huang's Wealth in Perspective

Huang's net worth has seen an astronomical increase, rising from $4.7 billion in 2020 to $21.1 billion in 2023, and now reaching $109.2 billion

2

. This places him as the 11th richest person in America, outpacing tech luminaries such as Bill Gates and Michael Dell2

3

. Huang's wealth is primarily tied to his substantial holdings in NVIDIA, with over 75 million shares held directly and an additional 786 million through various trusts and partnerships3

.Intel's Contrasting Fortunes

While NVIDIA has thrived, Intel has faced significant challenges. The company's market cap has plummeted to its lowest point since December 2008, during the housing market crash

2

. Intel's stock price, currently at $22.59 per share, is less than half of its late 2023 peak of over $503

. The company's financial struggles led to a dramatic $39 billion loss in market capitalization overnight in early August 20233

.Related Stories

The Broader Tech Landscape

The disparity between NVIDIA and Intel reflects broader trends in the tech industry. NVIDIA's success is largely attributed to its dominance in AI accelerators, particularly GPUs, which are crucial for training and running AI models

2

. This has made NVIDIA an indispensable partner for tech giants like Microsoft and Apple, who have invested heavily in AI infrastructure2

.Future Outlook and Industry Implications

While NVIDIA's current position seems unassailable, there are signs of potential challenges ahead. Recent share sales by NVIDIA executives, including a $713 million sale by Huang himself, suggest some caution about the sustainability of the current boom

2

. Meanwhile, Intel is attempting to reposition itself, including splitting its Foundry business into a separate subsidiary2

.The stark contrast between NVIDIA's rise and Intel's struggles serves as a potent reminder of the rapid pace of change in the tech industry, particularly in the age of AI. It also highlights the critical importance of positioning and adapting to emerging technologies in maintaining market leadership

4

5

.References

Summarized by

Navi

[3]

Related Stories

Nvidia CEO Jensen Huang's Net Worth Surges, Rivaling Warren Buffett's as Company Hits $4 Trillion Valuation

11 Jul 2025•Business and Economy

Nvidia CEO Jensen Huang Loses $10 Billion as Stock Plummets Amid Antitrust Concerns

04 Sept 2024

Nvidia CEO's Net Worth Soars to $120 Billion Following Saudi AI Chip Deal

14 May 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology