Nvidia CEO's Net Worth Soars to $120 Billion Following Saudi AI Chip Deal

4 Sources

4 Sources

[1]

Nvidia CEO's net worth nears $120 billion as shares surge on Saudi chip deal

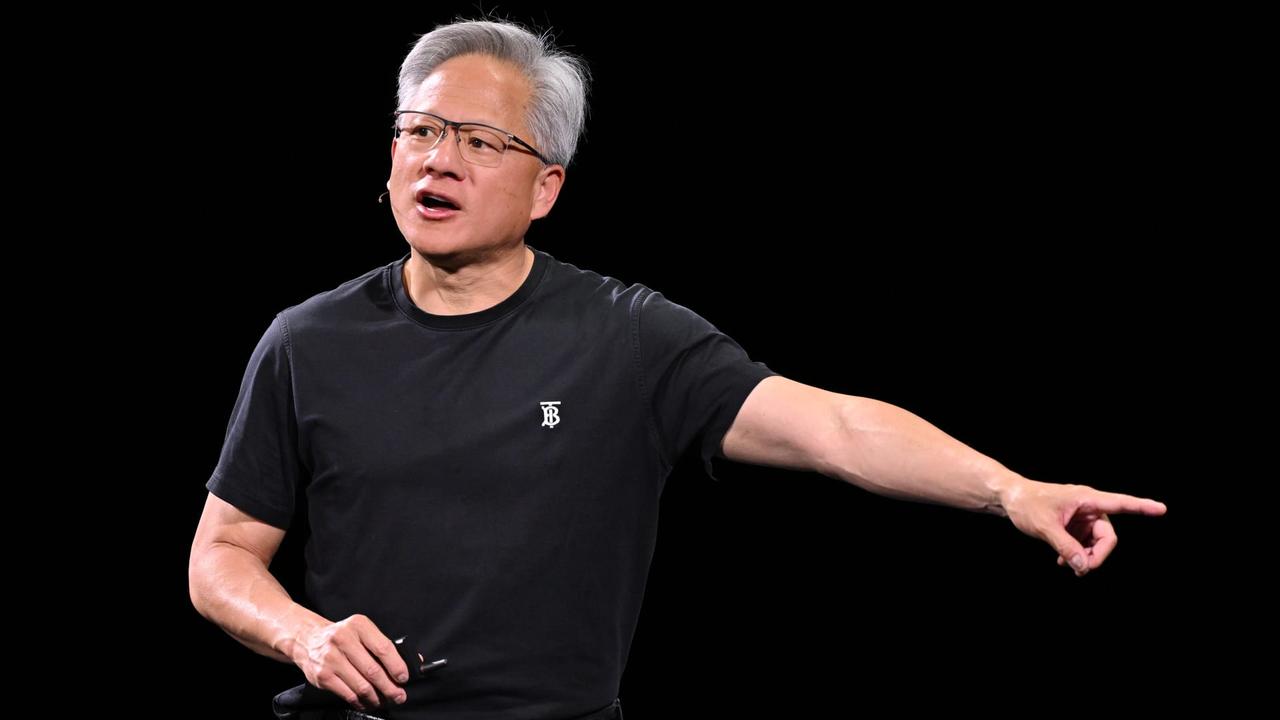

May 13 (Reuters) - Nvidia (NVDA.O), opens new tab CEO Jensen Huang's personal net worth jumped to around $120 billion on Tuesday, up from $80 billion last year, as a boom in demand for the company's artificial intelligence chips has powered a steep rally in its shares. Nvidia hit $3 trillion in market value after it agreed to sell hundreds of thousands of AI chips in Saudi Arabia with many chips to an AI startup launched by its sovereign wealth fund, in a sign demand for its top-line processors is still booming. The company's shares closed 5.6% higher at $129.93. The deal came as a part of U.S. President Donald Trump's Gulf tour, which he kicked off in Saudi Arabia with plans to visit the UAE later in the week. Huang has played a critical role in making Nvidia one of the world's most valuable companies by positioning the chipmaker as the dominant force in the AI semiconductor industry. The latest boost to his net worth puts him among the world's wealthiest people, but just out of the top ten, according to Forbes' real-time billionaires list. Reporting by Zaheer Kachwala in Bengaluru; Editing by Arun Koyyur Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Boards, Policy & RegulationCompensation

[2]

Nvidia CEO's net worth nears $120 billion as shares surge on Saudi chip deal

Jensen Huang has played a critical role in making Nvidia one of the world's most valuable companies by positioning the chipmaker as the dominant force in the AI semiconductor industry. The latest boost to his net worth puts him among the world's wealthiest people, but just out of the top ten, according to Forbes' real-time billionaires list.Nvidia CEO Jensen Huang's personal net worth jumped to around $120 billion on Tuesday, up from $80 billion last year, as a boom in demand for the company's artificial intelligence chips has powered a steep rally in its shares. Nvidia hit $3 trillion in market value after it agreed to sell hundreds of thousands of AI chips in Saudi Arabia with many chips to an AI startup launched by its sovereign wealth fund, in a sign demand for its top-line processors is still booming. The company's shares closed 5.6% higher at $129.93. The deal came as a part of US President Donald Trump's Gulf tour, which he kicked off in Saudi Arabia with plans to visit the UAE later in the week. Huang has played a critical role in making Nvidia one of the world's most valuable companies by positioning the chipmaker as the dominant force in the AI semiconductor industry. The latest boost to his net worth puts him among the world's wealthiest people, but just out of the top ten, according to Forbes' real-time billionaires list.

[3]

Jensen Huang's Wealth Surges 37% Since 'Liberation Day' Lows As Nvidia Re-Enters $3 Trillion Market Cap Club On Saudi Chip Pact - Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL)

On Tuesday, Nvidia Corp. NVDA CEO, Jensen Huang's net worth stood at $114 billion, closing in on $120 billion, with the company's stock rallying by nearly 15% this week, and reentering the $3 trillion market cap club. What Happened: This marks a sharp reversal in fortune for the company and its founder, after a steep decline in early April amid escalating tariffs, trade tensions, and export restrictions that created significant uncertainty, alongside financial and operational headwinds. See Also: Jeremy Siegel Calls US-China Deal 'Amazing,' Expects Long-Term Stability Nvidia shares surged following Monday's de-escalation in U.S.-China trade tensions and Tuesday's announcement of a new agreement to supply 18,000 GB300 Blackwell chips to Saudi-based AI startup Humain, backed by the nation's sovereign wealth fund, according to a report by Reuters. Huang's net worth, which had dropped to $83 billion during the first week of April, just days after the "Liberation Day" tariffs, has witnessed a 37% surge since these lows, ending Tuesday at a little under $120 billion. With a majority of his wealth derived from his 3% stake in Nvidia, Huang's net worth soared by $6.01 billion on Tuesday, due to a 5.3% spike in the company's shares. However, year-to-date, the tech titan's fortune remains down by $636 million, according to the Bloomberg Billionaires Index. Why It Matters: Nvidia has been at the center of this geopolitical storm in recent weeks, with Huang warning last week that losing access to China's potential $50 billion AI chip market would be a "tremendous loss." Just a day after President Donald Trump's Liberation Day tariff announcements, Huang saw his net worth drop $7.4 billion within a single day. Get StartedStart Futures Trading Fast -- with a $200 Bonus Join Plus500 today and get up to $200 to start trading real futures. Practice with free paper trading, then jump into live markets with lightning-fast execution, low commissions, and full regulatory protection. Get Started The 789% rally in Nvidia shares since 2023 has led to a significant rise in Huang's wealth, going from $21.1 billion to an all-time high of $129 billion late last year. Price Action: Shares of Nvidia were up 5.63% on Tuesday, and are up 1.04% after hours, following the announcement of Saudi startup Humain's deal with the company. For more insights on the stock's score, sign up for Benzinga Edge. Photo Courtesy: jamesonwu1972 on Shutterstock.com Read More: Trump Unveils 'Historic And Transformative' $600 Billion Saudi Deal, Predicts Markets Will 'Go A Lot Higher' AAPLApple Inc$212.150.65%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum64.94Growth45.83Quality75.51Value8.15Price TrendShortMediumLongOverviewMSFTMicrosoft Corp$448.27-0.22%NVDANVIDIA Corp$131.286.73%Market News and Data brought to you by Benzinga APIs

[4]

Nvidia CEO's net worth nears $120 billion as shares surge on Saudi chip deal

(Reuters) - Nvidia CEO Jensen Huang's personal net worth jumped to around $120 billion on Tuesday, up from $80 billion last year, as a boom in demand for the company's artificial intelligence chips has powered a steep rally in its shares. Nvidia hit $3 trillion in market value after it agreed to sell hundreds of thousands of AI chips in Saudi Arabia with many chips to an AI startup launched by its sovereign wealth fund, in a sign demand for its top-line processors is still booming. The company's shares closed 5.6% higher at $129.93. The deal came as a part of U.S. President Donald Trump's Gulf tour, which he kicked off in Saudi Arabia with plans to visit the UAE later in the week. Huang has played a critical role in making Nvidia one of the world's most valuable companies by positioning the chipmaker as the dominant force in the AI semiconductor industry. The latest boost to his net worth puts him among the world's wealthiest people, but just out of the top ten, according to Forbes' real-time billionaires list. (Reporting by Zaheer Kachwala in Bengaluru; Editing by Arun Koyyur)

Share

Share

Copy Link

Nvidia's CEO Jensen Huang sees his net worth surge to $120 billion as the company secures a major AI chip deal with Saudi Arabia, highlighting the booming demand for AI technology and its impact on the tech industry.

Nvidia's Market Value Hits $3 Trillion on Saudi AI Chip Deal

Nvidia Corporation, the leading force in AI semiconductor industry, has reached a market valuation of $3 trillion following a significant deal to supply AI chips to Saudi Arabia. The agreement, which involves selling hundreds of thousands of AI chips, including many to an AI startup backed by Saudi Arabia's sovereign wealth fund, has propelled Nvidia's stock to new heights

1

2

.Jensen Huang's Net Worth Skyrockets

As a result of this deal and the subsequent surge in Nvidia's stock price, CEO Jensen Huang's personal net worth has experienced a remarkable increase. His wealth jumped from $80 billion last year to approximately $120 billion, placing him among the world's wealthiest individuals, though just outside the top ten according to Forbes' real-time billionaires list

1

3

.Stock Performance and Market Reaction

Nvidia's shares closed 5.6% higher at $129.93 following the announcement of the Saudi deal. This surge represents a significant turnaround for the company, which had faced challenges earlier in the year due to trade tensions and export restrictions

2

4

.Geopolitical Context and Trade Relations

The deal comes amid U.S. President Donald Trump's Gulf tour, which began in Saudi Arabia and includes plans to visit the UAE. This timing highlights the interplay between technology deals and international diplomacy

1

3

.AI Industry Boom and Nvidia's Position

The substantial Saudi deal underscores the continuing boom in demand for top-line AI processors. Nvidia has positioned itself as the dominant force in the AI semiconductor industry, largely due to Huang's strategic leadership

1

2

.Related Stories

Impact on Huang's Wealth

Huang's net worth, primarily derived from his 3% stake in Nvidia, has seen a 37% increase since early April when it had dropped to $83 billion following the announcement of "Liberation Day" tariffs. Despite this recent surge, Huang's year-to-date net worth remains down by $636 million according to the Bloomberg Billionaires Index

4

.Nvidia's Growth and Future Prospects

The company's remarkable 789% rally in share price since 2023 has been a key factor in Huang's wealth accumulation. However, Nvidia faces ongoing challenges, including potential loss of access to China's estimated $50 billion AI chip market, which Huang has described as a "tremendous loss" if it were to occur

4

.This deal and its impact on Nvidia's valuation and Huang's personal wealth highlight the growing importance of AI technology in the global economy and the significant financial rewards for companies at the forefront of this technological revolution.

References

Summarized by

Navi

[4]

Related Stories

Nvidia CEO Jensen Huang's Net Worth Surges, Rivaling Warren Buffett's as Company Hits $4 Trillion Valuation

11 Jul 2025•Business and Economy

NVIDIA CEO Jensen Huang's Net Worth Surpasses Intel's Market Cap Amid AI Boom

06 Oct 2024•Business and Economy

Nvidia CEO Jensen Huang Loses $10 Billion as Stock Plummets Amid Antitrust Concerns

04 Sept 2024

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology