NVIDIA's Dominance in AI Infrastructure: Record Earnings and Future Projections

4 Sources

4 Sources

[1]

NVIDIA Positions Itself as Backbone of $4 Trillion AI Gold Rush | AIM

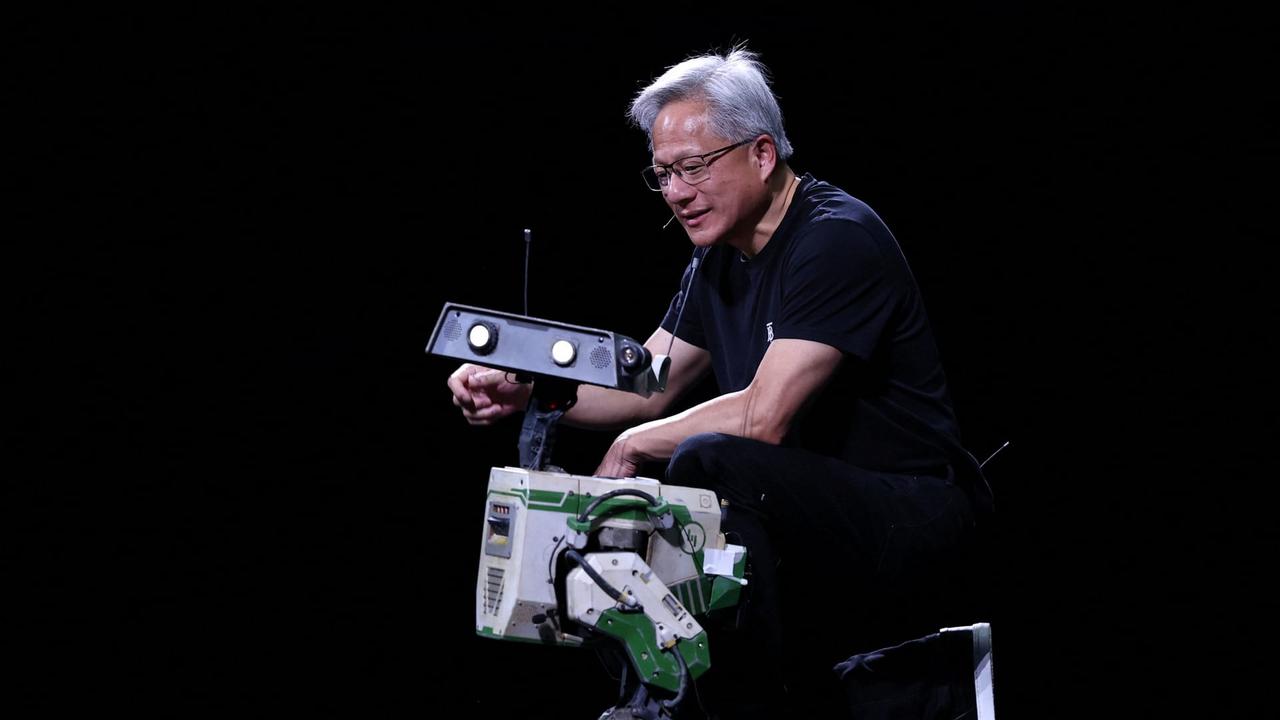

Governments worldwide are racing to build sovereign AI infrastructure and NVIDIA has become the go-to supplier. NVIDIA is no longer just a chipmaker. Its latest earnings suggest it has become the world's most critical supplier of infrastructure for AI. The company posted record quarterly revenue of $46.7 billion, up 56% from a year ago, driven by insatiable demand for its data centre products. Sales of its latest Blackwell and Blackwell Ultra GPUs are ramping at unprecedented speed, with NVIDIA now producing 1,000 AI racks a week. By 2030, NVIDIA expects trillions to be spent worldwide on AI infrastructure, from chips and data centres to software platforms and supercomputers. "Blackwell and Rubin AI factory platforms will be scaling into the $3 trillion to $4 trillion global AI factory build out through the end of the decade," CEO Jensen Huang said on the earnings call. Huang said the

[2]

Nvidia posts $46.7B revenue as AI demand surges

Nvidia, currently the world's most valuable company, reported revenue exceeding analyst predictions for its fiscal second quarter. The AI chipmaker posted $46.74 billion in revenue, signaling continued strong growth in the artificial intelligence sector. Company forecasts suggest sustained economic expansion driven by AI and automation. Nvidia's data center revenue saw a substantial increase, climbing 56% year-over-year to reach $41.1 billion. This growth underscores the increasing demand for Nvidia's chips in data centers that support AI applications. Jensen Huang, Nvidia's CEO, addressed the potential impact of AI on employment. Huang acknowledged that artificial intelligence would cause "some jobs" to disappear. Speaking on Fox Business Network's The Claman Countdown, Huang clarified that the rise of AI would simultaneously result in the creation of new jobs. Huang anticipates a positive economic outlook due to the advancements in AI and automation. Nvidia's market capitalization stands at $4.39 trillion. This valuation reflects the company's dominant position in the AI chip market. Nvidia's financial results and Huang's statements highlight the transformative role of AI in the economy.

[3]

Jensen Huang just dropped 8 shocking quotes that could redefine Nvidia's future

Nvidia is the biggest company in the stock market now with a $4 trillion value, huge sales, and a strong fan base on Wall Street. Earlier, Nvidia was only known for gaming chips used in video game consoles. CEO Jensen Huang changed Nvidia's path by moving from gaming to cryptocurrency chips and then to artificial intelligence. Today Huang is focused on agentic AI, robotics, and global demand for faster chips, including in China. On a call with investors, Huang shared 8 powerful quotes about Nvidia's future. Huang said China could be a $50 billion opportunity for Nvidia this year if it can sell competitive products there, as per TheStreet report. Nvidia had to stop selling its H20 AI chip in China because of U.S. restrictions, causing a $4.5 billion loss. A new deal may allow sales with the U.S. government taking 15% of H20 revenue, possibly opening exports. China is the world's second biggest computing market, and half of AI researchers live there. Nvidia's CFO Colette Kress said they could ship $2-5 billion worth of H20 chips in Q3 if sales are allowed. Huang said agentic AI needs 100x or even 1000x more computation compared to older models. The AI industry is shifting from simple chatbots to agentic AI that can help or replace workers in many industries, as per the reports. This shift means much higher demand for Nvidia's computing power and data centers. Huang said there is a breakthrough happening in robotics and autonomous systems. Nvidia launched Jetson Thor, a platform for robotics computing. Over 2 million developers and 1,000+ hardware and software partners are working with Nvidia on robotics, according to TheStreet report. Partners include Agility Robotics, Amazon Robotics, Boston Dynamics, Caterpillar, Meta, Medtronic, and more. Robots need far more compute power than chatbots, which will create big long-term demand for Nvidia. Huang said over the next 5 years Nvidia will target a $3 trillion to $4 trillion AI infrastructure opportunity. He noted AI startups got $100 billion in funding last year and $180 billion so far this year. ALSO READ: UK banks face new profit tax as shares drop after IPPR proposal Top AI startups may earn $20 billion in 2025, and revenues could grow 10x after that, fueling demand for more data centers. Huang said the top four hyperscalers doubled their capital spending in two years to $600 billion. This shows heavy demand for Nvidia's Blackwell chips and GB300 AI servers. Nvidia plans to launch Rubin, its third-generation AI supercomputer, in 2026. Huang said accelerated computing is very different from general computing because it needs full-stack design, not just chips. ASIC chipmakers like Broadcom are growing, but Huang believes Nvidia's full solution of chips, servers, switches, and cables makes it stronger. Huang said Nvidia is available in every cloud, every computer company, and across edge, on-prem, and robotics, which makes it universal. Nvidia is now the go-to solution for AI, like Microsoft became for PCs, as reported by TheStreet. Huang said Nvidia is already on its fifth generation of scale-out switches, like Quantum and Spectrum-X Ethernet. Nvidia's Spectrum-X Ethernet sales grew double digits in Q2 and now bring in over $10 billion annually. The new Spectrum-XGS will connect multiple data centers into AI super factories. Huang said these networking products boost performance from 65% to 85-90% and pay for themselves. Huang said 2024 is a record-breaking year and 2025 will also be record-breaking. Nvidia expects $54 billion in sales in Q3, which is $7 billion higher than Q2. Wall Street analysts expect Nvidia revenue to hit $207 billion this year and $272 billion next year. Todd Campbell owns shares of Nvidia, according to TheStreet report. Q1. Why is China important for Nvidia's AI business? China is the world's second-largest computing market with half of global AI researchers, making it a $50 billion opportunity for Nvidia if chip sales are allowed. Q2. What future plans did Nvidia CEO Jensen Huang share? Jensen Huang said Nvidia will focus on agentic AI, robotics, supercomputers, and a $3-4 trillion AI infrastructure market over the next five years.

[4]

Why NVIDIA Earnings May Influence AI Market?

CEO Jensen Huang projects $3-4 trillion AI infrastructure spending by 2030, reinforcing NVIDIA's role in powering supercomputers and AI models. NVIDIA has become the most important company in the artificial intelligence (AI) ecosystem. Its second-quarter fiscal 2026 earnings report, released on August 27, 2025, highlighted just how powerful its position has become. The company reported revenue of $46.7 billion, which represented a 56 percent increase compared with the same quarter last year and a 6 percent increase compared with the previous quarter. Out of this, data-center revenue accounted for $41.1 billion, also showing a 56 percent rise year on year. The growth was driven mainly by the strong demand for its Blackwell data-center architecture, which alone saw a 17 percent sequential increase. These numbers matter as NVIDIA is not just another chipmaker. It supplies over 80 percent of the GPUs used for training and deploying AI models. More than 75 percent of the world's top supercomputers are powered by NVIDIA technology. The company's market value has now crossed $4 trillion, making it the most valuable firm globally. This means NVIDIA alone represents about 8 percent of the entire S&P 500 index. When a company with such scale delivers results, the ripple effects reach far beyond its own balance sheet.

Share

Share

Copy Link

NVIDIA reports record quarterly revenue of $46.7 billion, driven by surging demand for AI infrastructure. CEO Jensen Huang projects $3-4 trillion in global AI infrastructure spending by 2030.

NVIDIA's Record-Breaking Earnings

NVIDIA, the world's most valuable company with a market capitalization of $4.39 trillion, has reported staggering financial results for its fiscal second quarter of 2026. The company posted record quarterly revenue of $46.7 billion, marking a 56% increase from the previous year and a 6% rise from the last quarter

1

2

4

. This exceptional performance has solidified NVIDIA's position as the backbone of the global AI infrastructure.

Source: Analytics Insight

Dominance in AI Infrastructure

NVIDIA's data center revenue, which includes its AI-related products, saw a remarkable 56% year-over-year increase, reaching $41.1 billion

2

4

. This growth is primarily attributed to the surging demand for NVIDIA's latest Blackwell and Blackwell Ultra GPUs, with the company now producing an impressive 1,000 AI racks per week1

.NVIDIA's dominance in the AI chip market is undeniable, with the company supplying over 80% of the GPUs used for training and deploying AI models. Moreover, more than 75% of the world's top supercomputers are powered by NVIDIA technology

4

.Future Projections and AI Infrastructure Spending

CEO Jensen Huang has made bold projections for the future of AI infrastructure spending. He anticipates that by 2030, global expenditure on AI infrastructure, including chips, data centers, software platforms, and supercomputers, will reach $3 trillion to $4 trillion

1

3

4

.

Source: AIM

Huang stated, "Blackwell and Rubin AI factory platforms will be scaling into the $3 trillion to $4 trillion global AI factory build out through the end of the decade"

1

. This projection underscores the massive potential for growth in the AI sector and NVIDIA's central role in this expansion.Related Stories

Impact on the AI Market and Economy

NVIDIA's financial results and market position have significant implications for the broader AI market and economy:

-

Job Market Transformation: Huang acknowledged that while AI might cause some jobs to disappear, it would also lead to the creation of new jobs

2

. -

Increased Compute Demand: The shift towards agentic AI, which requires 100 to 1000 times more computation than older models, is driving demand for NVIDIA's computing power and data centers

3

.

Source: Dataconomy

-

Robotics and Autonomous Systems: NVIDIA is making significant strides in robotics with its Jetson Thor platform, collaborating with over 2 million developers and 1,000+ hardware and software partners

3

. -

Global AI Infrastructure: NVIDIA's universal availability across cloud providers, computer companies, edge computing, on-premises solutions, and robotics positions it as the go-to solution for AI infrastructure

3

.

Challenges and Opportunities in China

Despite its overall success, NVIDIA faces challenges in the Chinese market due to U.S. export restrictions. The company had to halt sales of its H20 AI chip in China, resulting in a $4.5 billion loss. However, Huang sees China as a potential $50 billion opportunity if competitive products can be sold there

3

.As NVIDIA continues to shape the future of AI infrastructure, its financial performance and strategic decisions will likely have far-reaching effects on the global AI landscape and technology sector as a whole.

References

Summarized by

Navi

[2]

[4]

Related Stories

Nvidia CEO Jensen Huang Praises DeepSeek's R1 Model, Remains Bullish on AI Chip Demand

22 Feb 2025•Business and Economy

Nvidia's Q2 Earnings Surpass Expectations, Yet Stock Slips Amid High Investor Anticipation

29 Aug 2024

Nvidia posts $68B revenue quarter as AI chips demand accelerates, forecasts $78B ahead

24 Feb 2026•Business and Economy

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation