Nvidia invests $2 billion in CoreWeave to build 5GW of AI factories and deploy new Vera CPU

32 Sources

32 Sources

[1]

Nvidia invests $2B to help debt-ridden CoreWeave add 5GW of AI compute

Nvidia said on Monday it has invested $2 billion in CoreWeave to hasten the data center company's efforts to add more than 5 gigawatts of AI computing capacity by 2030. The chipmaker, already an investor in CoreWeave, said it had bought the company's Class A shares at $87.20 per share. As part of the deal, CoreWeave and Nvidia plan to together build "AI factories" (data centers) that would use the chipmaker's products. CoreWeave will also integrate Nvidia's products across its platform, including the new Rubin chip architecture (set to replace the current Blackwell architecture), Bluefield storage systems, as well as the chipmaker's new CPU line, Vera. The deal is a strong show of support for CoreWeave, which has come under scrutiny over the past few months for raising billions in debt to continue building out its data center operations. The company had $18.81 billion in debt obligations as of September 2025, according to PitchBook data, and it reported revenue of $1.36 billion in the third quarter. The company's CEO Michael Intrator has defended its business model (funding operations by raising debt with its GPUs as collateral), and has addressed concerns of circular deals in the AI industry by saying companies have to "work together" to address a "violent change in supply and demand." The company has managed to successfully ride the AI wave since its transition from a crypto mining company to a provider of data center services for AI training and inference. And since its IPO in March last year, it has been busy fleshing out its technology stack with a slew of acquisitions. It acquired Weights & Biases, an AI developer platform, in March, and then soon after bought reinforcement learning startup OpenPipe. In October, it agreed to acquire Marimo (an open-source Jupyter notebook competitor) and Monolith, another AI company. It also recently expanded its cloud partnership with OpenAI. The company currently counts several hyperscalers as customers, including OpenAI, Meta, and Microsoft. As part of the deal, Nvidia will also help CoreWeave buy land and power for data centers, and work with the smaller company to include its AI software and architecture within Nvidia's reference architecture to sell to cloud businesses and enterprises. CoreWeave's shares were up more than 15% following news of the deal. For Nvidia, arguably the biggest benefactor and driver of the AI boom, the deal is the latest of several dozen investments in the past year as the company does its best to continue fueling the precipitous pace of investment in, and development of, the nascent technology.

[2]

Nvidia pumps another $2 billion into CoreWeave and announces standalone availability of Vera CPU -- chipmaker increases stake in its customer to 9%

Another day, another deal earmarking large amounts of money from a big corporation to one of its customers in the AI world. The latest exchange is between Nvidia and cloud datacenter makers CoreWeave, where Jensen Huang's outfit bought a helping of CoreWeave Class A shares, for $87.20 a piece. Before the deal, Nvidia owned just over 6% of CoreWeave, a slice that ought to have increased today to around 9%. Although those figures and today's purchase relate to standard Class A shares, some outfits are reporting that the chipmaker also owns some Class B stock -- shares with 10x voting rights, privately traded. For Huang, this investment reflects "confidence in their growth and confidence in CoreWeave's management and confidence in their business model" [sic]. CoreWeave is one of the many companies rapidly burning through far more money than it's getting revenue, a fact that previously had some investors skittish, particularly after December when the firm revealed a plan to raise $2 billion by issuing debt to be exchanged for shares. After today's news, though, CoreWeave's shares rallied to a 9% bump, reflecting the sizable cash injection and perhaps also Huang's outlook on the matter. Additionally, CoreWeave is apparently the first Nvidia customer getting access to its Vera CPU chip as a standalone unit, something that might have helped with the stock rise. The green team's fresh Arm-based design was previously only available as part of an entire system board, but it's now going to be available as a standalone product, though seemingly for datacenter customers only for the time being. As a refresher, Vera's specs are 88 cores and 176 threads, an Arm v9.2-A instruction set, 2 MB of L2 cache on each core, and 162 MB of shared L3 cache. Among many other interesting bits of info, Nvidia's Spatial Multithreading should allow each Vera core to effectively run two hardware threads, by way of divvying up resources by partition instead of time slicing them like standard SMT. Other interesting figures include up to 1.5 TB of precious RAM per CPU, capable of pushing data at up to 1.2 TB per second. The onboard NVlink interconnect can also handle 1.8 TB/s of bytes flying by. As a rather obvious statement, the chip's super-wide design makes it perfect for AI workloads. Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

[3]

Nvidia Invests $2 Billion More in CoreWeave, Offers New Chip

The investment has sparked concerns about circular financing deals that have lifted valuations of AI companies and fueled concerns about a bubble, but Nvidia Chief Executive Officer Jensen Huang said the investments represent confidence in the growth and business models of the companies. Nvidia Corp., the dominant maker of artificial intelligence chips, invested an additional $2 billion in the cloud computing firm and key customer CoreWeave Inc., marking the latest example of the circular financing deals that have lifted valuations of AI companies and fueled concerns about a bubble. Bloomberg Intelligence Nvidia Invests $2 Billion More in CoreWeave, Offers New Chip Arrow Right 15:44 Nvidia purchased CoreWeave Class A common stock at $87.20 a share, the companies said Monday, in a move aimed at speeding up an effort to add more than 5 gigawatts of AI computing capacity by 2030. As part of the collaboration, CoreWeave will be among the first to deploy forthcoming Nvidia products, including storage systems and a new central processing unit, or CPU. Nvidia, already a CoreWeave investor, previously agreed to buy more than $6 billion in services from the firm through 2032. "The investment is confidence in their growth and confidence in CoreWeave's management and confidence in their business model," Nvidia Chief Executive Officer Jensen Huang said in an interview. But the partnership itself is more focused on aligning the two companies' engineering work and getting computing capacity online, he said. Nvidia has been using its enormous resources to propel the broader artificial intelligence industry, by partnering with and heavily investing in its own customers. The world's most valuable company has pledged tens of billions of dollars toward AI companies that use its chips and is bankrolling the deployment of new infrastructure that's critical to sustaining demand for its products. CoreWeave shares rose as much as 17% in trading Monday, while Nvidia's stock inched up by less than 1%. The announcement puts a spotlight on a new business avenue for Nvidia. The CPU, which carries the Vera brand, marks the first time the company has offered such a chip on a standalone basis. That means Nvidia will be challenging processors from Intel Corp. and Advanced Micro Devices Inc. inside data centers. The Vera product also could offer an alternative to in-house components that cloud providers use, such as Amazon.com Inc.'s Graviton. Previous Nvidia CPUs have been only available as part of systems combined with other chips. "Vera is completely revolutionary," Huang said of the CPU. He declined to name other customers for it besides CoreWeave but said, "There are going to be many." Intel shares fell as much as 6.1%, while AMD's slipped as much as 3.6%. Nvidia already leads the market for graphics processing units, or GPUs, the powerful chips used to develop and run AI models. With a CPU, often described as the brains of a computer, it's taking aim at more of the computing industry. CoreWeave, which went public last year in one of the biggest stock offerings of 2025 and is now worth more than $50 billion, is known as a neocloud -- a specialized cloud-computing provider used by AI services. The Nvidia investment will shore up CoreWeave's finances and help allay concern about its costly spending spree on data centers. Under their agreement, Nvidia will assist CoreWeave with the purchase of land and power for data centers. It also will market CoreWeave's AI software and architecture designs to cloud partners and large business customers. CoreWeave has ambitious plans. Five gigawatts is equivalent to the output of five large nuclear reactors. A single gigawatt of electricity is enough to power roughly 750,000 US homes at any moment. The Nvidia funds represent about 2% of what CoreWeave plans to spend to bring new infrastructure online, CEO Mike Intrator said in an interview. "This year, we're going to deliver an enormous amount of infrastructure, and that's just going to accelerate over the next three years," he said. Before Monday's accord, Nvidia was the fourth-largest holder of CoreWeave shares, according to data compiled by Bloomberg. The Santa Clara, California-based chip giant owned about 6% of the data center operator. Nvidia has said that it's spending money to help remove barriers to AI adoption. But the massive investments have intertwined many of the biggest AI companies, sparking concerns about how circular deals -- arrangements where a business invests in an entity that also serves as a customer -- are inflating the demand outlook for AI tools. Besides CoreWeave, Nvidia has invested in OpenAI, Anthropic PBC, Elon Musk's xAI and others. In response to the circular-deal concerns, Nvidia's CEO said the investments represent a fraction of the total infrastructure spending those businesses will have to make. Large customers such as Microsoft Corp. and Alphabet Inc. continue to pour money into new equipment because it helps their existing business, he said. New companies -- described by Huang as "AI-native" -- were born in a wave of venture investments. Those firms, in areas such as automated coding, health care and video editing, need access to their own computing resources, he said. "These are generational companies -- the investments that we make is confidence in them," Huang said. "But it's a small percentage of the amount of money that they ultimately have to go raise, and so the idea that it is circular is -- it's ridiculous." CoreWeave has worked to diversify its customer base away from Microsoft, which accounted for two-thirds of sales in the most recently reported quarter. The push has included agreements with OpenAI and Facebook owner Meta Platforms Inc. CoreWeave is losing money, with its capital spending far outstripping revenue. And the company's use of debt financing for its data center build-out had spooked some investors. In December, CoreWeave's shares fell after it unveiled plans to raise $2 billion by issuing debt that can be exchanged for shares. That move also contributed to broader concerns about an AI bubble -- something Huang and his peers have downplayed. Nvidia's CEO has argued that new technology is being adopted so fast that investments are already paying off. The only obstacle is the shortage of computing capacity, he's said. Nvidia's own growth run has shown little signs of fading. After predicting about half a trillion dollars of revenue from data center chips by the end of 2026, Nvidia said this month that its forecast has only grown more bullish. In the interview, Huang repeated the assertion that total demand remains "enormous."

[4]

Nvidia invests $2 billion in CoreWeave, expands partnership

Jan 26 (Reuters) - Nvidia (NVDA.O), opens new tab has invested $2 billion in CoreWeave (CRWV.O), opens new tab at a purchase price of $87.20 per share, the companies said on Monday, as they expand their partnership to boost CoreWeave's data center build out ambitions. Shares of CoreWeave jumped nearly 10% in premarket trading. CoreWeave is targeting to build more than 5 gigawatts in AI data center capacity by 2030. The fresh investment from Nvidia will help the AI infrastructure provider speed up procurement of the land and power required to build the facilities. So-called "neoclouds" like CoreWeave, which provide tech companies with the infrastructure needed to build, run and deploy AI technologies, have seen a surge in demand in recent years as enterprise adoption of AI picks up. Nvidia was CoreWeave's third largest shareholder with a 6.3% stake, or 24.3 million shares, in the company. It is now nearly doubling its stake in Coreweave by adding roughly 23 million shares in the firm, becoming its second-largest investor now, according to Reuters calculations based on data compiled by LSEG. Reporting by Deborah Sophia in Bengaluru; Editing by Shinjini Ganguli Our Standards: The Thomson Reuters Trust Principles., opens new tab

[5]

CoreWeave gets an upgrade from Deutsche Bank following Nvidia investment

A new deal with Nvidia bolsters CoreWeave's long-term case as it heads into its upcoming earnings, according to Deutsche Bank. Analyst Brad Zelnick upgraded the artificial intelligence infrastructure provider to buy from hold. He also raised his target price to $140 from $100, implying upside of 42%. Nvidia on Monday said it had invested $2 billion into CoreWeave, which will help it accelerate its buildout of "5 gigawats of AI factories by 2030," the companies said. Zelnick said this deal strengthened CoreWeave's long-term case by helping to further validate its technical leadership. "We don't claim to be able predict with confidence how AI evolves over CY26 but all the signal we see today suggests demand growth continuing to outpace new capacity," Zelnick added. "Until that changes and based on our favorable view of the setup, healthy GPU-level economics, and the asset quality of CoreWeave, this leave us comfortable upgrading the shares." CRWV 1Y mountain CRWV 1Y chart The deal successfully leverages Nvidia's financial strength to secure access to additional resources to help realize CoreWeave's goal, while also deepening technical integration that allows CoreWeave to remain among the very first to market with new Nvidia compute architectures, Zelnick wrote. It also increases the potential for Nvidia to include CoreWeave's SUNK and Mission Control software in its reference architectures, which opens up "a sizeable and high margin standalone hybrid and multi-cloud SW opportunity over time." Zelnick said that CoreWeave's valuation has "returned to very reasonable levels" and adopted a bullish stance heading into the company's next earnings report. "Amid dynamic swings in narrative and stock performance over the past several months, the fundamental medium-term outlook appears solid for CoreWeave heading into 4Q25 results and initial CY26 guidance, which we expect to be released in the coming weeks," he wrote. "This will be mgmt.'s first time initiating full year ahead guidance as a public company, and while the novelty creates a wider range of potential targets in our mind, our analysis suggests consensus revenue forecasts can move meaningfully higher over the course of the year if the company in fact delivers capacity on plan to its contracted customers." CoreWeave has surged 146% since going public in March, although it is down 46% from its all-time high last June.

[6]

CoreWeave stock jumps 10% as Nvidia invests $2 billion to expand AI data center capacity

Shares of CoreWeave popped 10% in premarket trading on Monday after Nvidia announced it has invested $2 billion in the artificial intelligence infrastructure provider. Nvidia purchased CoreWeave Class A common stock at $87.20 per share, according to a release. "CoreWeave's deep AI factory expertise, platform software, and unmatched execution velocity are recognized across the industry," Nvidia CEO Jensen Huang said in a statement. "Together, we're racing to meet extraordinary demand for NVIDIA AI factories -- the foundation of the AI industrial revolution."

[7]

Nvidia takes $2 billion stake in CoreWeave

Why it matters: The investment shows that the AI spending spree is far from slowing, even with questions over circular deals growing. Driving the news: Nvidia is buying CoreWeave Class A common stock at a purchase price of $87.20 per share. * The companies said the investment was part of an expansion of their partnership. * CoreWeave shares were up more than 10% in pre-market trading Monday morning. Nvidia was down 0.6% pre-market. What they're saying: "CoreWeave's deep AI factory expertise, platform software and unmatched execution velocity are recognized across the industry," Nvidia CEO Jensen Huang said in a statement. * "Together, we're racing to meet extraordinary demand for Nvidia AI factories -- the foundation of the AI industrial revolution." Zoom out: Nvidia, the main beneficiary of the AI boom, has made multiple investments in other AI companies. * Over the last two years, the company and its venture capital arm have made more than 100 investments, per PitchBook data. * Nvidia took a $2 billion stake in chip-software designer Synopsys late last year. * The chip maker also committed last year to invest $10 billion in AI developer Anthropic. The bottom line: The AI trade is alive and well.

[8]

Nvidia buys $2B worth of CoreWeave's stock to accelerate AI factory buildout

Nvidia buys $2B worth of CoreWeave's stock to accelerate AI factory buildout Nvidia Corp. said today it's investing an additional $2 billion into the cloud infrastructure company CoreWeave Inc., which operates enormous data centers packed full of graphics processing units. The companies said the money will help to fund the development of new artificial intelligence factories based on Nvidia's technology. The AI factories, which will be operated by CoreWeave, are expected to reach a capacity of five gigawatts by 2030. "This expanded collaboration underscores the strength of demand we are seeing across our customer base and the broader market signals as AI systems move into large-scale production," said CoreWeave Chief Executive Michael Intrator. Gigawatts are a common metric used to describe AI data center power capacity. According to the U.S. Energy Information Administration, five gigawatts is equivalent to the annual power consumption of around four million American households. Nvidia's $2 billion investment is only going to be enough to finance a portion of that capacity, though, with Barron's reporting that the total cost is likely to exceed $250 billion. In an interview with CNBC, Nvidia CEO Jensen Huang said the amount of funding needed to support five gigawatts is "really quite significant." He added that the company is "investing a small percentage of the amount that ultimately has to be provided." The chipmaker, which previously invested $6.3 billion into CoreWeave in September to acquire a 6.6% stake, said the investment reflects the confidence it has in the cloud provider's business model, team and growth strategy. CoreWeave operates dozens of data centers that are primarily equipped with Nvidia's GPUs. It rents those chips out to enterprise customers and AI models developers looking for computing power to train and run powerful large language models, which consume vast resources. The company is considered to be one of the top "neoclouds," which compete with established public cloud infrastructure providers such as Amazon Web Services Inc. and Microsoft Azure. In recent weeks, there has been a lot of concern from investors about how viable CoreWeave's business model really is, due to the way it finances its data centers through high-interest debt. Its stock was down 30% since October, although it gained just over 5% today after reports of Nvidia's new investment emerged. CoreWeave does at least seem to have plenty of demand for its GPUs. In September, it announced it had struck a deal with Meta Platforms Inc. to provide it with $14.2 billion worth of cloud compute capacity, just days after agreeing a deal worth $6.5 billion with OpenAI Group PBC.

[9]

Nvidia invests $2B in CoreWeave for 5GW AI capacity

Nvidia invested $2 billion in CoreWeave on Monday to accelerate the data-center company's addition of more than 5 gigawatts of AI computing capacity by 2030. The chipmaker purchased Class A shares at $87.20 per share and plans joint construction of AI factories using Nvidia products. Nvidia, which already held a stake in CoreWeave, deepened its involvement through this transaction. The investment supports CoreWeave's expansion of data-center infrastructure tailored for AI workloads. CoreWeave committed to integrating Nvidia's latest technologies across its platform. These include the Rubin chip architecture, designed to succeed the current Blackwell architecture, along with Bluefield storage systems and the Vera CPU line. CoreWeave has drawn attention for its financing approach amid rapid growth. As of September 2025, PitchBook data records $18.81 billion in debt obligations. The company generated $1.36 billion in revenue during the third quarter. CEO Michael Intrator justified the model of raising debt secured by GPUs as collateral. He stated that companies must "work together" to manage a "violent change in supply and demand." CoreWeave originated as a crypto mining operation before shifting to data-center services for AI training and inference. This pivot positioned it to capitalize on rising AI demand. The company completed its initial public offering in March of the previous year. Post-IPO, CoreWeave pursued multiple acquisitions to strengthen its offerings. In March, it acquired Weights & Biases, a platform for AI developers. Shortly afterward, CoreWeave bought OpenPipe, a startup focused on reinforcement learning. During October, agreements covered Marimo, a competitor to open-source Jupyter notebooks, and Monolith, another AI-focused entity. CoreWeave serves major clients among hyperscalers, including OpenAI, Meta, and Microsoft. It recently broadened its cloud partnership with OpenAI, enhancing service delivery for these customers. Beyond the investment, Nvidia will assist CoreWeave in securing land and power resources for new data centers. The partners aim to embed CoreWeave's AI software and architecture into Nvidia's reference designs. These designs target cloud providers and enterprise users. CoreWeave's shares increased by more than 15 percent in response to the announcement. For Nvidia, this represents one of dozens of investments made over the past year. The chipmaker deploys these funds to support ongoing development and deployment of AI technologies.

[10]

Nvidia invests $2.8b more in CoreWeave, offers new chip

Nvidia, the dominant maker of artificial intelligence chips, invested an additional $US2 billion ($2.8 billion) in CoreWeave to help speed up an effort to add more than 5 gigawatts of AI computing capacity by 2030. Nvidia purchased CoreWeave Class A common stock at $US87.20 a share, the companies said Monday. As part of the collaboration, CoreWeave will be among the first to deploy forthcoming Nvidia products, including storage systems and a new central processing unit, or CPU. Nvidia, already a CoreWeave investor, previously agreed to buy more than $US6 billion in services from the firm through 2032.

[11]

With a $2 Billion Investment, Nvidia Just Became CoreWeave's Second‑Largest Shareholder

The expanded partnership will see CoreWeave help build out AI factories as enterprise demand accelerates, the companies said, in addition to CoreWeave being among the first to deploy new Nvidia products. CoreWeave is an AI hyperscaler that rents out access to more than 300,000 NVIDIA GPUs across dozens of data centers that it operates. In a Monday post, CoreWeave CEO Michael Intrator underscored that the deal is the next step as AI transitions from "the pilot phase into production." Nvidia CEO Jensen Huang says that AI is responsible for the "largest infrastructure buildout in human history," and praised CoreWeave's expertise. "Together, we're racing to meet extraordinary demand for NVIDIA AI factories -- the foundation of the AI industrial revolution," Huang said in a written statement.

[12]

CoreWeave Stock Soars as Nvidia Boosts Its Investment -- What You Need to Know

CoreWeave was one of the stocks hit hardest by concerns about an AI bubble last year, when investors intensely scrutinized how companies are financing the data center boom. Shares of CoreWeave jumped on Monday after the cloud computing company extended its partnership with Nvidia, a tie-up that last year helped fuel Wall Street's AI bubble debate. The companies on Monday announced they had expanded their partnership to accelerate CoreWeave's development of AI data centers operating on Nvidia's technology stack. Nvidia, which invested $250 million in CoreWeave during its IPO last March, agreed to invest an additional $2 billion in the company as part of the deal. CoreWeave agreed to deploy Nvidia's latest products, including storage systems and a new central processing unit. Coreweave (CRWV) shares were up 8% in recent trading, leading a relatively broad AI rally. Nvidia (NVDA) shares were down slightly. CoreWeave stock has had a good start to the year, rising 40% since the start of the year as of mid-day Monday. The stock has regained some of the ground lost when AI bubble concerns weighed on tech stocks in the final months of 2025. AI stocks slumped late last year as investors debated whether tech giants were spending too much, too fast on AI infrastructure with uncertain commercial prospects. That debate reached a new pitch last year when tech giants increased their reliance on capital markets to fund the AI infrastructure buildout that, up to that point, was mostly covered by cash flows. CoreWeave, a so-called "neocloud" that doesn't have the deep pockets of hyperscalers such as Microsoft (MSFT) and Alphabet (GOOG), was hit particularly hard by Wall Street's scrutiny of debt-financed AI investment. CoreWeave shares lost more than half of their value between late October and mid-December when the AI bubble debate raged most fiercely. To some investors, CoreWeave's partnership with Nvidia appears eerily similar to the business deals that fueled the Dotcom Bubble of the 1990s. Skeptics worry that Nvidia, by investing in CoreWeave and other companies that buy its technology, is subsidizing the AI data center boom. The partnerships, they argue, are reminiscent of the vendor-financing deals that encouraged telecommunications companies to overbuild fiber-optic networks that sat idle for years before internet demand materialized. So far this year, the AI trade has been dominated by memory chip and data storage stocks. Shares of Sandisk (SNDK), Western Digital (WDC) and Micron (MU) have all soared amid a memory shortage, the latest bottleneck threatening to hamper AI development. The concerns about AI monetization that hit data center stocks last year are now dragging on the software industry.

[13]

Why CoreWeave stock is surging today: CRWV shares rallies 10% on Nvidia's $2 billion AI infrastructure bet

Why CoreWeave shares are up today: CRWV shares rallies 10% on Nvidia's $2 billion AI infrastructure bet - CoreWeave shares jumped nearly 10% today after Nvidia invested $2 billion in the AI cloud firm at $87.20 per share. The deal nearly doubles Nvidia's stake and strengthens its long-term partnership with CoreWeave. CoreWeave shares surged almost 10% in early trading after Nvidia disclosed a $2 billion strategic investment in the AI cloud infrastructure provider, deepening one of the most consequential partnerships in the artificial intelligence economy. The deal prices CoreWeave's Class A stock at $87.20 per share, nearly doubling Nvidia's ownership stake and formally positioning the chipmaker as a long-term anchor partner in CoreWeave's growth strategy. Markets responded quickly. The move signaled strong confidence from the world's most influential AI hardware company at a moment when global demand for computing power is outpacing supply. The investment is aimed squarely at scale. CoreWeave plans to build more than 5 gigawatts of AI-optimized data center capacity by 2030, a level typically associated with the world's largest hyperscale cloud operators. That capacity will be dedicated to AI training and inference workloads, serving enterprises, governments, and advanced research clients. The heart of the Nvidia‑CoreWeave deal goes beyond a financial stake. The companies plan to co‑develop AI factories -- large, purpose‑built data centers optimized for training and deploying advanced AI models. These facilities are designed to support everything from large foundational model training to inference workloads for enterprise and government clients. Under the agreement: This collaboration aims not just at increasing capacity but at ensuring that future AI infrastructure is tightly tuned to the latest hardware and software innovations from Nvidia. This could give both companies a competitive edge as rivals like Microsoft, Google, and Amazon expand their own AI cloud offerings. Investors reacted positively to the news, lifting CoreWeave's stock by about 10 % in early trading. The rise reflects several key market drivers: CoreWeave's market valuation and trading momentum also benefit from past large agreements -- including previous multi‑billion‑dollar cloud capacity deals with Nvidia and others -- which have helped cushion revenue visibility. Despite some industry commentary about debt‑fuelled expansion and financial risks, the partnership deals have tended to bolster market sentiment. Analysts see the stock move as a barometer of AI infrastructure demand. As generative AI and large model applications proliferate across sectors, businesses need more compute power than traditional cloud providers can supply without long lead times. CoreWeave's specialized infrastructure -- built around Nvidia GPUs -- positions it as a go‑to provider for GPU‑intensive work. CoreWeave's expansion comes amid a larger global push to scale AI infrastructure. Enterprises are rapidly increasing their investments in AI compute resources, often requiring more GPU capacity than traditional hyperscale cloud providers can deliver on short timelines. Nvidia's deepened involvement signals a shift toward specialised infrastructure ecosystems beyond public clouds. This development sits against a backdrop of geopolitical technology competition, especially in U.S.-China AI chip and data center supply chains. U.S. policymakers and private companies are increasingly focused on building resilient domestic tech infrastructure to safeguard critical AI capabilities. Moreover, global AI alliances -- such as transatlantic partnerships on AI and semiconductor technology -- are boosting investment flows into AI data centers and cloud infrastructure. These trends create strong tailwinds for companies like Nvidia and CoreWeave that sit at the intersection of compute supply, software frameworks, and enterprise AI adoption. Q: What is the scale and purpose of Nvidia's $2 billion investment in CoreWeave? A: Nvidia purchased $2 billion of CoreWeave stock at $87.20 per share, nearly doubling its stake. The investment supports building AI factories targeting 5 gigawatts of data center capacity by 2030. It helps CoreWeave acquire land, power, and facility shells, accelerating deployment of AI infrastructure for enterprise clients globally. Q: Why did CoreWeave stock rise nearly 10% after Nvidia's investment? A: The stock surge reflects strong investor confidence in Nvidia's vote of support and CoreWeave's growth. Existing contracts, including multi‑billion-dollar GPU orders and long-term agreements, ensure revenue visibility. The move positions CoreWeave as a leading AI infrastructure provider amid surging demand for cloud-based AI computing services. (You can now subscribe to our Economic Times WhatsApp channel)

[14]

Is Nvidia Investing In CoreWeave, Or Its Own Next Quarter? - CoreWeave (NASDAQ:CRWV), NVIDIA (NASDAQ:NVDA)

Nvidia Corp's (NASDAQ:NVDA) $2 billion investment in CoreWeave Inc (NASDAQ:CRWV) is being framed as a vote of confidence in AI infrastructure. Skeptics see something else entirely: a financial feedback loop that quietly manufactures demand for Nvidia's own chips. The theory is simple and uncomfortable. Nvidia injects capital into one of its fastest-growing customers. That capital, combined with guaranteed GPU supply, helps CoreWeave secure massive debt facilities. CoreWeave then uses that debt to buy more Nvidia hardware. Capital in, GPUs out, revenue reported. Call it synthetic demand. The AI Perpetual Motion Machine CoreWeave has become one of the most aggressive buyers of Nvidia GPUs, scaling its cloud infrastructure at a debt-fueled pace. By investing equity, Nvidia doesn't just support a partner -- it strengthens CoreWeave's balance sheet, making lenders more comfortable extending billions in financing. The result is a near-perpetual motion machine for quarterly earnings: Nvidia helps finance the customer, the customer buys Nvidia products, Nvidia posts record revenue. Everyone wins -- until the financing stops. This isn't unprecedented. Vendor financing helped fuel telecom buildouts in the 2000s and cloud infrastructure expansions a decade later. The sales were real. The capital was circular. Confidence or Capital Injection? NVDA bulls argue this is strategic vertical integration. Nvidia is locking in a critical distribution channel for AI compute, ensuring that demand scales alongside supply. In a capital-intensive AI arms race, controlling the customer is as powerful as controlling the chip. Skeptics counter that the investment raises a more fragile question: How much of the AI boom is organic, and how much is engineered by capital markets? If CoreWeave's expansion is driven by cheap debt and vendor-aligned capital, any tightening in financing conditions could ripple straight back into Nvidia's order book. For now, the loop is working. Nvidia invests. CoreWeave scales. Revenue prints. The real test isn't this quarter. It's what happens when the capital cycle turns -- and whether AI demand still hums when the perpetual motion machine slows. Image: Shutterstock CRWVCoreWeave Inc $110.5112.4% Overview NVDANVIDIA Corp $189.501.63% Market News and Data brought to you by Benzinga APIs

[15]

Is CoreWeave a Buy After This Big News From Nvidia?

CoreWeave (CRWV 6.37%) was one of 2025's artificial intelligence (AI) success stories. The company launched an initial public offering in March and then saw its shares soar more than 300% in the months to follow. Investors got excited about CoreWeave because the company is providing a service that's greatly needed as the AI revolution unfolds: access to top-performing AI chips. Customers clearly love the offering as they're flocking to CoreWeave and driving its sales to triple-digit gains. Still, CoreWeave stock stumbled later in the year amid general concern about the risk of a slowdown in AI spending -- so the stock pared gains, finishing 2025 with a 79% increase. But in recent days, Nvidia (NVDA 0.72%) delivered some big news that's clearly positive for CoreWeave. Is the stock now a buy? Let's find out. CoreWeave and Nvidia First, it's important to note that CoreWeave and Nvidia have a particularly close relationship. CoreWeave's business is essentially built around Nvidia's graphics processing units (GPUs), the key AI chips needed for the development and deployment of AI. Other companies make AI chips, but Nvidia's so far have steadily been ahead of the pack in terms of power and efficiency. Some companies buy GPUs from Nvidia and set up their own data centers, but this is costly and requires a lot of time. CoreWeave gives customers a shortcut. The company, known as a GPU-as-a-Service provider, offers customers access to its massive fleet of Nvidia GPUs as needed -- so customers can literally rent by the hour and gain access for a short period of time or for a great deal of time. As we can see through CoreWeave's surging revenue -- it more than doubled to reach $1.3 billion in the recent quarter -- this service has been in high demand. A $2 billion investment from Nvidia But the relationship with Nvidia doesn't end there. Nvidia owns shares of CoreWeave as part of its investment portfolio -- in fact, it's the company's biggest holding. And this brings me to the recent news. Nvidia just invested another $2 billion in CoreWeave Class A common stock, an effort to help the company reach its infrastructure buildout goals. Does this make CoreWeave a buy? For aggressive investors looking for growth -- yes. Nvidia has proven itself to be a key financial supporter of CoreWeave, and this may reduce the risk that CoreWeave will fail to fund its buildout. And Nvidia also has a deep understanding of the AI market, so the company might be good at selecting potential winners. Though CoreWeave still comes with too much risk for the cautious investor, aggressive investors should consider buying and holding a few shares of this exciting AI player.

[16]

Nvidia invests $2 billion in CoreWeave, expands partnership - The Economic Times

Nvidia has invested $2 billion in CoreWeave, becoming the AI infrastructure provider's second-largest shareholder, as the companies expand their partnership to boost data center capacity in the United States. The announcement on Monday sent CoreWeave's shares up 9% in premarket trading. So-called neocloud companies like CoreWeave, which provide tech companies with the hardware and cloud capacity needed to build, run and deploy AI technologies, have seen a surge in demand in recent years as enterprise adoption of AI picks up. The fresh investment from Nvidia will help CoreWeave speed up the procurement of land and power required to build data centers. CoreWeave is targeting to build more than 5 gigawatts in AI data center capacity by 2030. Nvidia will invest in CoreWeave at a purchase price of $87.20 per share, the companies said. That represents an addition of roughly 23 million shares, nearly doubling Nvidia's stake in the firm, according to Reuters calculations based on data compiled by LSEG. Nvidia was CoreWeave's third largest shareholder with a 6.3% stake, or 24.3 million shares, in the company. The chip giant has drawn scrutiny for pouring billions of dollars into AI firms including ChatGPT maker OpenAI and neoclouds, raising investor concerns about potential circular financing. A CoreWeave spokesperson told Reuters that the cash from the new investment will not be used to purchase Nvidia processors, but directed toward accelerating other data center investments, research and development, and scaling its workforce. Once a cryptocurrency miner, CoreWeave has pivoted to capitalize on the AI boom by repurposing its infrastructure to lease Nvidia GPUs to tech and AI firms. "Nvidia is the leading and most requested computing platform at every phase of AI ... This expanded collaboration underscores the strength of demand we are seeing across our customer base," CoreWeave CEO Michael Intrator said

[17]

Deutsche upgrades CoreWeave to Buy on 2026 setup, Nvidia deal

Deutsche Bank upgraded CoreWeave (CRWV) to Buy from Hold due to a combination of its setup entering 2026 and Monday's announcement that Nvidia (NVDA) has invested $2B in the hyperscaler and expanded their collaboration to Nvidia's investment will accelerate CoreWeave's path to adding 5GW+ of AI infrastructure by 2030, securing access to land and powered shells using Nvidia's financial strength. The collaboration deepens technical integration for early access to NVIDIA compute, validates technical leadership, and could include CoreWeave's software in NVIDIA reference architectures, opening new high-margin software opportunities. Deutsche Bank sees CoreWeave's business in a strong position due to the Nvidia collaboration, supply-constrained market, upcoming new business bookings, and its advantage in early adoption of new computing platforms.

[18]

Nvidia Invests $2 Billion in CoreWeave Amid Data Center Project | PYMNTS.com

This new collaboration is aimed at allowing CoreWeave to accelerate the development of more than 5 gigawatts of AI data centers by 2030, the companies announced Monday (Jan. 26). As part of the partnership, Nvidia has invested $2 billion in CoreWeave stock. "From the very beginning, our collaboration has been guided by a simple conviction: AI succeeds when software, infrastructure and operations are designed together," Michael Intrator, co-founder, chairman and CEO, CoreWeave, said in a news release. "NVIDIA is the leading and most requested computing platform at every phase of AI -- from pre-training to post-training -- and Blackwell provides the lowest cost architecture for inference. This expanded collaboration underscores the strength of demand we are seeing across our customer base and the broader market signals as AI systems move into large-scale production." Gigawatts are units of power often used for illustrating the capacity of an AI data center. A report on the partnership by CNBC points to data from the Energy Information Administration that 5 gigawatts would equal the yearly power consumption of 4 million American households. "The thing to remember is we've invested $2 billion into CoreWeave, but recognize that the amount of funding that needs to be raised yet to support that five gigawatts is really quite significant," Nvidia CEO Jensen Huang told CNBC. "We're investing a small percentage of the amount that ultimately has to go and be provided." PYMNTS wrote recently about a growing body of research challenging industry assumptions about data center needs. This work argues that the infrastructure requirements of AI have been shaped more "by early architectural choices" and not "by unavoidable technical constraints." Among the studies is a recent one from Switzerland-based tech university EPFL, which contends that while frontier model training is still computationally intensive, many operational AI systems can be employed without centralized hyperscale facilities. "Instead, these systems can distribute workloads across existing machines, regional servers or edge environments, reducing dependency on large, centralized clusters," PYMNTS said. The research also illustrates a growing mismatch between AI infrastructure and real-world enterprise use cases, PYMNTS added. These systems often depend on smaller models, repeated inference and localized data instead of ongoing access to massive, centralized models. As PYMNTS has reported, Nvidia has argued that small-language-models (SLMs) could carry out 70% to 80% of enterprise tasks, putting the most complex reasoning in the hands of large-scale systems. "That two-tier structure, small for volume, large for complexity, is emerging as the most cost-effective way to operationalize AI," the report added.

[19]

These Analysts Increase Their Forecasts On CoreWeave - CoreWeave (NASDAQ:CRWV), NVIDIA (NASDAQ:NVDA)

CoreWeave, Inc. (NASDAQ:CRWV) announced an expanded collaboration with Nvidia Corporation (NASDAQ:NVDA) to accelerate the buildout of more than 5 gigawatts of AI factories by 2030 to advance AI adoption at global scale. As part of the broader partnership, NVIDIA invested $2 billion in CoreWeave Class A common stock at a purchase price of $87.20 per share. The companies said the investment reflects NVIDIA's confidence in CoreWeave's business, team and growth strategy as a cloud platform built on NVIDIA infrastructure. Under the collaboration, CoreWeave plans to build and operate AI factories using NVIDIA's accelerated computing platform technology. NVIDIA will also leverage its financial strength to help accelerate CoreWeave's procurement of land, power and shell infrastructure for AI factory development. CoreWeave shares closed at $98.31 on Monday. These analysts made changes to their price targets on CoreWeave following announcement. * Deutsche Bank analyst Brad Zelnick upgraded CoreWeave from Hold to Buy and raised the price target from $100 to $140. * Mizuho analyst Gregg Moskowitz maintained the stock with a Neutral and raised the price target from $92 to $100. Considering buying CRWV stock? Here's what analysts think: Photo via Shutterstock CRWVCoreWeave Inc $103.214.98% Overview NVDANVIDIA Corp $187.110.34% Market News and Data brought to you by Benzinga APIs

[20]

1 Brilliant Stock That Nvidia Owns That You Should Buy Hand Over Fist in 2026 | The Motley Fool

Demand for artificial intelligence (AI) data center capacity is insatiable, and hyperscalers and AI companies have been taking up all that's available. This explains why neocloud provider CoreWeave (CRWV 6.13%) has been witnessing stunning growth in its revenue backlog. CoreWeave rents out its dedicated AI data center capacity to hyperscalers such as Microsoft and Meta Platforms, as well as large language model leader OpenAI and other customers. The key parallel processing power in its data centers primarily comes from Nvidia's (NVDA 0.72%) graphics processing units (GPUs). But CoreWeave is more than just an Nvidia customer -- the chipmaker recently tightened its relationship with the neocloud provider. On Jan. 26, Nvidia and CoreWeave announced that they are expanding their prior relationship, under which the graphics card giant had committed $6.3 billion to purchase any unsold data center capacity that CoreWeave had through April 2032. Their new agreement will see Nvidia investing $2 billion in CoreWeave at a price of $87.20 per share. The press release announcing the agreement pointed out that it will "enable CoreWeave to accelerate the buildout of more than 5 gigawatts of AI factories by 2030 to advance AI adoption at global scale." Specifically, CoreWeave will continue to build AI infrastructure powered by Nvidia's advanced data center chip systems, including its upcoming Vera Rubin offerings. Also, Nvidia's financial strength will help CoreWeave procure land to build AI data centers and electricity to power them. Citing a CoreWeave spokesperson, Reuters reports that the company will be directing the proceeds from the chipmaker's investment mainly toward research and development, workforce improvement, and other data center-related expenses. The money will not be used to purchase Nvidia's hardware, which should allay investors' concerns that this is a circular financing deal. Even better, Nvidia will help strengthen CoreWeave's software suite. This should help the neocloud provider become more of a full-stack AI solutions company that provides its customers with the ability to build, deploy, and scale AI solutions efficiently, in addition to renting computing hardware to them. But most importantly, the Nvidia investment should enable CoreWeave to quickly convert more of its tremendous backlog into actual revenue. That revenue backlog stood at nearly $56 billion as of the end of the third quarter of 2025, up from $15 billion a year earlier. This massive year-over-year increase was driven by huge contracts from Meta Platforms, OpenAI, and other hyperscalers. For comparison, CoreWeave estimates that its 2025 revenue was around $5.1 billion. Another important point to note is that it had 590 megawatts of active data center capacity at the end of Q3 2025. The money that it receives from Nvidia will ensure that it remains on track to achieve its 5 gigawatt (5,000 megawatt) target by the end of the decade. Between CoreWeave's terrific backlog and the backing from Nvidia, it's positioned to grow at a phenomenal rate. This probably explains why analysts who follow the company are expecting its revenue to quadruple in just two years. If CoreWeave indeed generates $20 billion in revenue by the end of 2027 and trades at 5.5 times sales at that time (in line with the average sales multiple of the tech-heavy Nasdaq Composite index), its market cap would nearly double to $110 billion. That suggests that Nvidia may have made a smart investment here. Retail investors should consider following suit and buying CoreWeave stock before it skyrockets.

[21]

Nvidia Has A Personal AI Factory In CoreWeave - CoreWeave (NASDAQ:CRWV), NVIDIA (NASDAQ:NVDA)

The relationship between Nvidia Corp. (NASDAQ:NVDA) and CoreWeave, Inc. (NASDAQ:CRWV) has far surpassed the traditional vendor-customer dynamic. Monday's $2 billion investment cements CoreWeave as Nvidia's go-to lab for next-generation infrastructure experiments. * CRWV stock is climbing. See the chart and price action here. While hyperscalers like AWS and Google increasingly move toward their own custom chips, CoreWeave has stayed Nvidia-native. CoreWeave serves as the tip of the spear for Nvidia's deployment. The new Rubin architecture and Vera standalone CPUs will roll off the line in 2026. CoreWeave will then stress-test them in highly specialized AI factories. "CoreWeave's deep AI factory expertise, platform software, and unmatched execution velocity are recognized across the industry. Together, we're racing to meet extraordinary demand for NVIDIA AI factories -- the foundation of the AI industrial revolution," Nvidia CEO Jensen Huang said. The Software Feedback Loop The R&D collaboration extends deep into the software stack. Nvidia is actively validating CoreWeave's proprietary tools -- specifically SUNK (Slurm on Kubernetes) and CoreWeave Mission Control -- to be integrated into Nvidia's own reference architectures. CoreWeave CEO Michael Intrator spoke directly to the synergistic relationship with Nvidia in a statement announcing the latest investment. "From the very beginning, our collaboration has been guided by a simple conviction: AI succeeds when software, infrastructure, and operations are designed together," Intrator said. CoreWeave's Lab Status CoreWeave's "lab" status gives Nvidia a controlled environment to refine its full-stack offerings -- networking, storage and compute -- without the friction of a competitor's proprietary hardware. By the time a new Nvidia chip reaches the broader market, CoreWeave has already written the instruction manual for running it at peak efficiency. "AI is entering its next frontier and driving the largest infrastructure buildout in human history," Huang said. CoreWeave clusters are running at the cutting edge of what Nvidia's hardware can do. The deepening partnership positions CoreWeave at the forefront of the AI revolution buildout CRWV Price Action: CoreWeave shares were up 8.73% at $101.19 at the time of publication Monday, according to Benzinga Pro. Image: Shutterstock CRWVCoreWeave Inc $101.979.67% Overview NVDANVIDIA Corp $186.78-0.47% Market News and Data brought to you by Benzinga APIs

[22]

Nvidia invests US$2 billion in CoreWeave, expands partnership

Nvidia has invested US$2 billion in CoreWeave at a purchase price of $87.20 per share, the companies said on Monday, as they expand their partnership to boost CoreWeave's data center build out ambitions. Shares of CoreWeave jumped nearly 10 per cent in premarket trading. CoreWeave is targeting to build more than 5 gigawatts in AI data center capacity by 2030. The fresh investment from Nvidia will help the AI infrastructure provider speed up procurement of the land and power required to build the facilities. So-called "neoclouds" like CoreWeave, which provide tech companies with the infrastructure needed to build, run and deploy AI technologies, have seen a surge in demand in recent years as enterprise adoption of AI picks up. Nvidia was CoreWeave's third largest shareholder with a 6.3 per cent stake, or 24.3 million shares, in the company. It is now nearly doubling its stake in Coreweave by adding roughly 23 million shares in the firm, becoming its second-largest investor now, according to Reuters calculations based on data compiled by LSEG. (Reporting by Deborah Sophia in Bengaluru; Editing by Shinjini Ganguli)

[23]

The Artificial Intelligence (AI) Stock That Refuses to Stay Down

Artificial intelligence (AI) stocks have soared in recent years, but the path for some hasn't been linear. While they've delivered great gains, they've also been through rough patches, falling significantly -- and even prompting concern that growth may be tapering off. That was the case of CoreWeave (CRWV 6.12%) over the past several months. The company launched its initial public offering in March and rose more than 300% in the months that followed. But as 2025 wore on, the stock progressively slipped. However, this tech stock now is showing us that it refuses to stay down. Let's check out this exciting AI story. CoreWeave is serving a major need So, first, a quick look at CoreWeave's business. The company offers something that's in high demand right now, and that's capacity for AI workloads. Customers may come to CoreWeave for access to its enormous fleet of Nvidia graphics processing units (GPUs). This allows customers to power their AI projects without the expensive and time-consuming step of building out their own infrastructure. They can use CoreWeave's material for a few hours or for much longer periods according to their needs. This has resulted in triple-digit revenue growth for the company and contracts to serve the needs of tech giants such as Meta Platforms and OpenAI. CoreWeave's relationship with Nvidia also is a plus. Nvidia as of last year held about 7% of the company and just recently the chip giant made a fresh purchase of CoreWeave stock. Nvidia invested $2 billion in Class A common stock, a move to help support CoreWeave's plan to build out 5 gigawatts of AI factories by 2030. Nvidia last year also committed to buying any leftover CoreWeave capacity through April 2032. Why did the stock fall? So, considering all of this, why did the stock lose momentum in the latter part of 2025? Investors worried about the debt levels CoreWeave would need to build to meet AI demand. Any possible slowdown in AI spending, could delay potential profitability and hurt the stock -- and CoreWeave would be left with a wall of debt. And some investors considered that AI stocks had climbed too far too fast, and that an AI bubble may take shape. Still, these worries didn't keep CoreWeave down for long. Even after last year's dip, the stock has climbed 172% since its IPO and has gained more than 50% since the start of this year. CoreWeave does come with some risk as its potential success is linked to ongoing AI spending -- but, if the AI story progresses as expected, CoreWeave may continue to soar in the months to come.

[24]

CoreWeave shares extend gains following $2B Nvidia deal By Investing.com

Investing.com -- Shares of CoreWeave are trading nearly 6% higher in pre-market on Tuesday, extending Monday's 5.7% gain that followed a $2 billion investment in the company from Nvidia. Nvidia purchased CoreWeave Class A common stock at $87.20 per share as part of an expanded AI infrastructure partnership. The investment increases Nvidia's stake in CoreWeave to approximately 9%, up from about 7% at the time of CoreWeave's IPO. Access deep analyst research, upgraded forecasts, and stock-level insights available only on InvestingPro -- grab 55% off while it lasts. The collaboration aims to accelerate the buildout of more than 5 gigawatts of AI factories by 2030, significantly expanding CoreWeave's current capacity of approximately 2.9 gigawatts of contracted power. Jefferies analyst Brent Thill reiterated a Buy rating on CoreWeave with a $120.00 price target on Tuesday. Thill noted that Nvidia's support on land and powered shells should ease execution risk and help scaling, while also highlighting the potential for CoreWeave's software offerings to create "a high-margin, asset-light growth avenue." The analyst views the increased equity exposure positively, seeing it as a signal of Nvidia's confidence in CoreWeave's capabilities and strategic relevance to major AI labs. Thill described CoreWeave as having an "attractive risk/reward profile," trading at 12x Jefferies' rolled-forward EV/CY28 EBIT. "With CRWV currently holding ~2.9 GW of contracted power as of last quarter, this partnership marks a meaningful expansion of the company's growth trajectory," the analyst said. In a separate move, Deutsche Bank upgraded CoreWeave to Buy on Tuesday, further boosting investor sentiment toward the stock. As of Monday's close, CoreWeave is up roughly 24% year-to-date.

[25]

Nvidia invests $2 billion in CoreWeave to accelerate AI factory buildout By Investing.com

NEW YORK/SANTA CLARA - Nvidia (NASDAQ:NVDA) has invested $2 billion in cloud computing provider CoreWeave (NASDAQ:CRWV) as part of an expanded partnership to build more than 5 gigawatts of AI computing infrastructure by 2030. CoreWeave, with its current market capitalization of $46.33 billion, has seen remarkable revenue growth of 235.4% over the last twelve months according to InvestingPro data. The investment, at $87.20 per share of CoreWeave Class A common stock, comes as both companies work to meet growing demand for AI computing resources. CoreWeave's stock currently trades at $92.98, close to its InvestingPro Fair Value, though InvestingPro analysis shows the company is quickly burning through cash with a negative free cash flow yield. Under the expanded collaboration, CoreWeave will develop and operate AI factories using Nvidia's accelerated computing platform. Nvidia will leverage its financial resources to help CoreWeave accelerate procurement of land, power, and building shells for these facilities. The companies will also work to validate CoreWeave's AI-native software and reference architecture for potential inclusion in Nvidia's reference designs for cloud partners and enterprise customers. CoreWeave plans to deploy multiple generations of Nvidia infrastructure across its platform, including early adoption of Nvidia's Rubin platform, Vera CPUs, and Bluefield storage systems. "AI is entering its next frontier and driving the largest infrastructure buildout in human history," said Jensen Huang, founder and CEO of Nvidia, in a press release statement. "CoreWeave's deep AI factory expertise, platform software, and execution velocity are recognized across the industry." Michael Intrator, co-founder, chairman, and CEO of CoreWeave, noted that "Nvidia is the leading and most requested computing platform at every phase of AI - from pre-training to post-training - and Blackwell provides the lowest cost architecture for inference." CoreWeave completed its public listing on Nasdaq in March 2025. The company specializes in providing cloud infrastructure optimized for AI and other compute-intensive workloads. In other recent news, CoreWeave has announced plans to incorporate NVIDIA Rubin technology into its AI cloud platform. This move will enhance options for customers focusing on agentic AI, reasoning, and large-scale inference workloads, with deployment expected in the second half of 2026. CoreWeave has also amended its $2.6 billion delayed-draw term loan agreement to align covenant timelines with delivery schedules, providing liquidity relief by adjusting the minimum liquidity requirement for upcoming payment dates. Analyst activity around CoreWeave has been notable, with Compass Point maintaining a Buy rating and a $150 price target, citing the company's strategic financial adjustments. Meanwhile, JPMorgan has maintained a neutral rating, noting strong demand in the AI compute capacity market, with customer contracts extending from three to five or six years. Goldman Sachs initiated coverage with a Neutral rating and a price target of $86, highlighting CoreWeave's competitive advantage in the AI compute industry. Truist Securities also began coverage with a Hold rating and an $84 price target, acknowledging CoreWeave's role in serving major AI enterprises. These developments reflect the company's ongoing strategic positioning in the AI cloud services sector. This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

[26]

This Company Just Made a Big Move. Here's What It Means for Investors.

This AI leader continues to back one of the fastest-growing data center companies. Nvidia (NVDA 0.23%) is a key cog in the ongoing data center investment cycle. Most AI hyperscalers use Nvidia's GPUs to train and run artificial intelligence (AI) in massive data centers. Recently, the company announced a new $2 billion investment in CoreWeave, which specializes in building AI factories, specialized data centers. It then rents that computing capacity to AI companies, including OpenAI, Meta Platforms, and others. What could this new investment mean for Nvidia stock? It gives Nvidia direct exposure to CoreWeave's growth and strengthens its partnership with the company Nvidia's investment adds to its approximate 6.6% stake in CoreWeave. CoreWeave's data centers are designed and built specifically for AI. It's like a shortcut for AI hyperscalers, who can access computing resources more quickly by renting from CoreWeave than building their own data centers from the ground up. Since CoreWeave's data centers use Nvidia GPUs, any business the company does with AI hyperscalers also means it is doing business with Nvidia. In other words, it helps protect Nvidia's AI market share. The ongoing data center boom feels like a technological arms race. The immense investment is driving remarkable growth for CoreWeave. Analysts estimate that CoreWeave's revenue will skyrocket from $4.3 billion over the past 12 months to $12.0 billion this fiscal year and $19.5 billion the following year. Setting the stage for Nvidia's Rubin launch Another layer to this is Nvidia's upcoming Rubin chip. CoreWeave prides itself on its data center engineering, which it builds with future hardware in mind. Nvidia recently entered full production for the Rubin AI chip architecture, and as CoreWeave grows, it could help Nvidia launch Rubin and future chips more effectively. It could still be extremely early in what appears to be a generational investment boom. AI is still becoming more intelligent, and real-world adoption is only just beginning. These two trends both translate to more energy and chips to make it all work. That's why experts believe global data center spending could reach the trillions of dollars over the coming years. As explosive as the AI era has been, it could still be in its early innings. The U.S. government only recently launched the Genesis Mission to build out its AI. Is the CoreWeave investment a game changer for Nvidia? All of that said, it's a stretch to call this a game changer for Nvidia. CoreWeave and Nvidia's stake in the company are both relatively tiny compared to Nvidia as a whole. Nvidia's core business is still selling its GPU chips directly to the hyperscalers who have gone to CoreWeave for some capacity, but are still pouring billions of dollars into their own data centers. Investors should applaud Nvidia for proactively making moves, game changing or not, to maintain its position as the leader in AI GPU chips. It should help Nvidia continue to grow throughout 2026 and beyond.

[27]

Nvidia invests $2 billion in CoreWeave, expands partnership

CoreWeave, Inc. is an American technology company founded in 2017, specializing in cloud infrastructure designed for compute-intensive workloads. It has positioned itself as a niche player in a market dominated by generalist giants. Its offering is built on a vertical specialization in artificial intelligence (AI) and related applications, notably high-performance computing (HPC) and graphical rendering. CoreWeave operates a GPU-first architecture, optimized for training and inference of generative AI models. It also targets scientific and financial computing, as well as real-time 3D rendering needs. With its own data centers located in the United States and Europe, the company maintains full control over its infrastructure. This control enables it to deliver high performance, low latency, and flexible deployment capabilities. Some facilities are shared among clients, while others are fully dedicated to a single customer. CoreWeave serves a diverse clientele, ranging from AI startups to research labs, as well as production studios and financial institutions. In addition to its hardware infrastructure, the company develops its own GPU management software. These tools enable intelligent resource allocation, continuous performance optimization, and better cost control. This vertical integration, from hardware to software, enhances the company's competitiveness. CoreWeave stands out through its tailored approach and its ability to meet clients' specific needs. It aims to become the leading provider for AI workloads on a global scale. In a context of surging demand for computing power, its model is appealing due to its specialization and agility.

[28]

CoreWeave stock rises 10% after NVIDIA invests $2 billion to expand AI partnership By Investing.com

Investing.com -- CoreWeave (NASDAQ:CRWV) stock rose 10% Monday morning after NVIDIA (NASDAQ:NVDA) announced a $2 billion investment in the company to expand their AI infrastructure partnership. NVIDIA purchased CoreWeave Class A common stock at $87.20 per share as part of a broader collaboration to accelerate the buildout of more than 5 gigawatts of AI factories by 2030. The investment reflects NVIDIA's confidence in CoreWeave's business model and growth strategy as a cloud platform built on NVIDIA infrastructure. The expanded partnership will focus on building AI factories using NVIDIA's accelerated computing platform technology, with CoreWeave handling development and operations. NVIDIA will leverage its financial strength to help CoreWeave accelerate procurement of land, power, and shell infrastructure. The companies will also test and validate CoreWeave's AI-native software and reference architecture, including SUNK and CoreWeave Mission Control, aiming to include these offerings within NVIDIA's reference architectures for cloud partners and enterprise customers. Additionally, CoreWeave will deploy multiple generations of NVIDIA infrastructure across its platform through early adoption of NVIDIA computing architectures, including the Rubin platform, Vera CPUs, and Bluefield storage systems. "AI is entering its next frontier and driving the largest infrastructure buildout in human history," said Jensen Huang, founder and CEO of NVIDIA. "CoreWeave's deep AI factory expertise, platform software, and unmatched execution velocity are recognized across the industry." The collaboration builds on CoreWeave's purpose-built cloud, software, and operational expertise to enable customers to run demanding AI workloads efficiently and at scale.

[29]

The Artificial Intelligence (AI) Stock That's Quietly Building the Future of Cloud Computing

CoreWeave has built a compelling AI cloud product despite the stiff competition in the space. When it comes to cloud computing, Amazon was the pioneer, and it remains the leading company in the industry: Amazon Web Services still has a 29% market share. Over time, though, companies like Microsoft, Alphabet, and many others have emerged as competitors. Nonetheless, when it comes to the next generation of data center technology, CoreWeave (CRWV 2.61%) seems to be emerging as a leader, particularly when it comes to a cloud infrastructure that's designed specifically to support artificial intelligence (AI) applications. Thanks to that technology, it is set to lead the future of the cloud. Why CoreWeave? Admittedly, with a market cap of just $46 billion, CoreWeave is a tiny fraction of the size of the megacaps that it's competing with. It's also operating at a loss, which might lead one to wonder how it competes with these larger rivals at all. Still, some customers prefer CoreWeave's AI-specific cloud offerings to the general-purpose infrastructure of the larger hyperscalers. The company's backlog was more than $55 billion as of the end of 2025's third quarter, up from about $30 billion just three months earlier. Moreover, it has partnered with Nvidia, a CoreWeave investor that is supplying the cloud company with its latest AI accelerators. So it should come as little surprise that not only are AI software leaders like OpenAI among its clientele, so are some of its cloud competitors. Microsoft struck a multibillion-dollar deal that will have CoreWeave supplying the tech giant with processing power for its AI models, which frees up some of its own Azure infrastructure for Microsoft's cloud customers. CoreWeave's financial condition Though the company is losing money on the bottom line, CoreWeave's most significant challenge is not keeping its doors open. It's keeping up with its massive demand. In the first nine months of 2025, it booked nearly $3.6 billion in revenue, a 204% increase compared to the same period in 2024. Still, operating expenses rose by 267% over that time frame as it invested in building out its infrastructure so that it could attempt to fulfill its massive backlog commitments. CoreWeave laid out over $6.2 billion in capital expenditures in the first nine months of the year. It has had borrow money cover those costs, and had accumulated more than $14 billion in debt as of the end of Q3, most of which is at interest rates between 9% and 15%. However, it recently began to address that by issuing a $2.2 billion offering in convertible notes at just 1.75%. In exchange for that low interest rate, note holders will have the option of exchanging those notes for stock at a price of $215.60 per share through 2031. That is close to twice the current stock price. Nonetheless, CoreWeave could surpass that level over the next few years and deliver those noteholders strong returns. Its price-to-sales (P/S) ratio of 9 compares well to most tech growth stocks, which suggests that it has considerable room for stock price increases. Neoclouds as the future of cloud computing CoreWeave's AI-focused neocloud is benefiting from its partnership with Nvidia, as evidenced by its growing backlog. Admittedly, it's necessary for the company to borrow heavily in the near term to build out its footprint so it can meet that demand. Those conditions are putting pressure on CoreWeave's business model, and by some measures, there are high expectations baked into the stock price, making it a somewhat risky investment. However, given its relatively low P/S ratio, CoreWeave may be worth the risks it faces. Considering its huge backlog and its revenue growth track record, it more than likely will be able to live up to the hype.

[30]

Coreweave says Nvidia invests $2 billion in Coreweave

CoreWeave, Inc. is an American technology company founded in 2017, specializing in cloud infrastructure designed for compute-intensive workloads. It has positioned itself as a niche player in a market dominated by generalist giants. Its offering is built on a vertical specialization in artificial intelligence (AI) and related applications, notably high-performance computing (HPC) and graphical rendering. CoreWeave operates a GPU-first architecture, optimized for training and inference of generative AI models. It also targets scientific and financial computing, as well as real-time 3D rendering needs. With its own data centers located in the United States and Europe, the company maintains full control over its infrastructure. This control enables it to deliver high performance, low latency, and flexible deployment capabilities. Some facilities are shared among clients, while others are fully dedicated to a single customer. CoreWeave serves a diverse clientele, ranging from AI startups to research labs, as well as production studios and financial institutions. In addition to its hardware infrastructure, the company develops its own GPU management software. These tools enable intelligent resource allocation, continuous performance optimization, and better cost control. This vertical integration, from hardware to software, enhances the company's competitiveness. CoreWeave stands out through its tailored approach and its ability to meet clients' specific needs. It aims to become the leading provider for AI workloads on a global scale. In a context of surging demand for computing power, its model is appealing due to its specialization and agility.

[31]

Stock Market Today, Jan. 27: Nvidia's $2 Billion Bet Lifts CoreWeave and Refocuses the AI Infrastructure Trade

CoreWeave (CRWV +10.86%), a cloud-based GPU infrastructure provider for AI workloads, closed Tuesday at $108.86, up 10.73%. The stock moved higher after Nvidia (NVDA +1.10%)'s $2 billion investment and a Deutsche Bank upgrade. Investors are watching CoreWeave's AI data center buildout toward 5-7.9 GW of capacity by 2030. CoreWeave's trading volume reached 45.4 million shares, coming in about 55% above compared with its three-month average of 29.3 million shares. CoreWeave IPO'd in 2025 and has grown 172% since going public. How the markets moved today The S&P 500 (^GSPC +0.41%) added 0.41% to finish Tuesday at 6,979, while the Nasdaq Composite (^IXIC +0.91%) rose 0.91% to close at 23,817. Within cloud infrastructure services, industry peers Nvidia (NVDA +1.10%) closed at $188.52 (+1.10%) and Microsoft (MSFT +2.23%) finished at $480.58 (+2.19%) as investors tracked AI-focused capacity and spending plans. What this means for investors CoreWeave rose sharply on Tuesday after Nvidia committed $2 billion to the AI infrastructure provider, a move that investors read as a strong endorsement of CoreWeave's position in the fast-growing market for GPU-powered cloud services. The investment, priced at $87.20 a share, deepens ties between the chipmaker and CoreWeave's data center platform. Reports that Nvidia's stake could increase to roughly 11% and help fund plans for more than 5 gigawatts of AI data center capacity by 2030 added to the rally. The stock also benefited from a Deutsche Bank upgrade, which brought added institutional attention to the story. A recently filed securities class action tied to data center delays underscores that execution risk has not disappeared, even with Nvidia's backing. Delivery timelines, power availability, and build-out discipline will be closely watched as CoreWeave works to translate a high-profile partnership into sustained operating momentum.

[32]

Stock Market Today, Jan. 26: CoreWeave Jumps After Nvidia Invests $2 Billion in AI Infrastructure Partnership

CoreWeave (CRWV +5.73%), an AI-focused cloud GPU provider, closed Monday at $98.31, up 5.73%. The stock advanced after Nvidia disclosed a $2 billion equity stake and an expanded AI infrastructure partnership. Trading volume reached 48.5 million shares, about 67% above its three-month average of 29 million shares. CoreWeave IPO'd in 2025 and has grown 146% since going public. How the markets moved today The S&P 500 (^GSPC +0.50%) added 0.50% to finish Monday at 6,950, while the Nasdaq Composite (^IXIC +0.43%) rose 0.43% to close at 23,601. Within cloud infrastructure services, industry peers Nvidia (NVDA 0.65%) closed at $186.36 (-0.70%) and Microsoft (MSFT +0.93%) finished at $470.28 (+0.93%), underscoring mixed reactions to AI demand and spending. What this means for investors Nvidia was already an investor and partner with CoreWeave, and the AI leader expanded its stake with the announcement today that it will invest another $2 billion in the company. That brings its ownership stake to over 10%, and maybe more importantly, signals a long runway for AI infrastructure demand. The fact that it is supporting building another 5 megawatts (MW) of AI infrastructure by 2030 strengthens the investing case for CoreWeave. CoreWeave is quickly expanding capacity and spending large amounts of capital. Investors should be aware of the risks involved, however. If demand for that capacity eases, it would leave CoreWeave in a financially precarious position and could hit the stock in a big way.

Share

Share

Copy Link

Nvidia has invested $2 billion in CoreWeave to accelerate the company's plans to add over 5 gigawatts of AI computing capacity by 2030. The chipmaker purchased Class A shares at $87.20 per share, increasing its stake to approximately 9%. CoreWeave, which carries $18.81 billion in debt, will be the first customer to receive Nvidia's new Vera CPU as a standalone product.

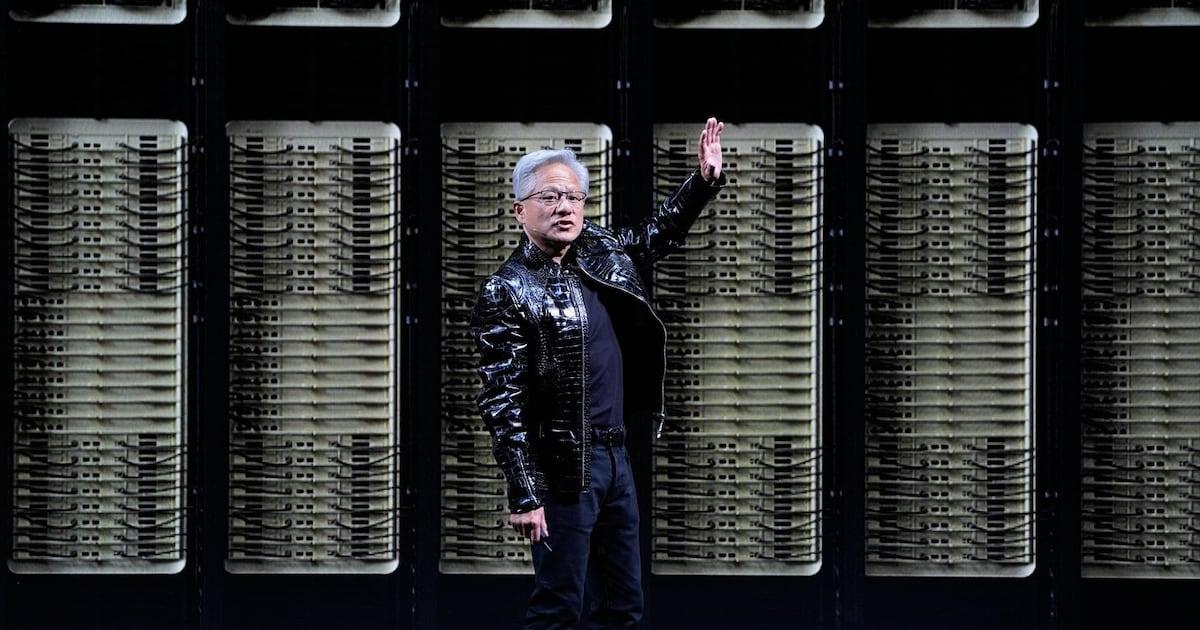

Nvidia Doubles Down on CoreWeave with $2 Billion Investment

Nvidia has committed a $2 billion investment in CoreWeave, purchasing Class A shares at $87.20 per share to accelerate the cloud datacenter provider's ambitious expansion plans

1

. The chipmaker, already CoreWeave's fourth-largest shareholder with a 6.3% stake, has now increased its ownership to approximately 9%, making it the second-largest investor in the AI infrastructure company4

. This Nvidia investment represents a strong vote of confidence in CoreWeave's business model at a time when the company faces scrutiny over its debt-heavy financing strategy.

Source: BNN

Building AI Factories at Unprecedented Scale

The partnership aims to help CoreWeave build more than 5 gigawatts of AI data center capacity by 2030, equivalent to the output of five large nuclear reactors . CoreWeave CEO Mike Intrator noted that the Nvidia funds represent about 2% of what the company plans to spend bringing new infrastructure online, signaling massive capital requirements ahead . As part of the deal, Nvidia will assist CoreWeave with purchasing land and power for these AI factories, addressing critical bottlenecks in data center development

1

.

Source: TechCrunch

Vera CPU Marks Nvidia's Standalone Processor Debut

CoreWeave will be the first customer to deploy Nvidia's Vera CPU as a standalone product, marking a significant shift in the chipmaker's strategy

2

. The Arm-based chip features 88 cores and 176 threads, with up to 1.5 TB of RAM per CPU capable of pushing data at 1.2 TB per second2

. Nvidia CEO Jensen Huang described Vera as "completely revolutionary," positioning it to compete directly with processors from Intel and AMD in data centers . CoreWeave will also integrate Nvidia's upcoming Rubin chip architecture, Bluefield storage systems, and other products across its platform1

.Related Stories

Addressing Concerns About Debt Financing and Circular Deals

CoreWeave reported $18.81 billion in debt obligations as of September 2025, while generating $1.36 billion in revenue in the third quarter

1

. The company has defended its business model of funding operations by raising debt with GPUs as collateral, a strategy that has drawn scrutiny from investors1