Nvidia Navigates US-China Tensions: CEO Huang Optimistic Despite Challenges

3 Sources

3 Sources

[1]

What's Going On With Nvidia Stock On Monday? - NVIDIA (NASDAQ:NVDA)

Nvidia's tailored A800, H800, and H20 chips remain critical for AI growth, with 1 million H20 chips potentially generating $12B in sales. A government-backed think tank in China has recommended that the country's data centers continue using high-performance chips from Nvidia Corp NVDA, warning of the significant expenses involved in transitioning to domestic alternatives. The report flagged the transition from Nvidia's GPUs to domestic solutions as challenging due to differences in hardware and software that increase costs and complexity. Nvidia, which has maintained that the U.S. semiconductor embargo has had no impact, is trading higher on Monday. Also Read: Next-Gen Nvidia GPUs Could Be Revealed at CES 2025 - What You Need to Know The China Academy of Information and Communications Technology (CAICT) noted that Nvidia's A100 and H100 chips are still the preferred option for centers requiring substantial computing power, SCMP reports. The U.S. semiconductor sanctions prompted Nvidia to develop specially tailored A800, H800, and H20 chips. China is a key semiconductor market for Nvidia, and in 2024, 1 million H20 GPUs in China could generate $12 billion in sales. China's GPU-based computing power, especially for AI development, has been growing by 70% year-over-year. However, CAICT's latest report said many data centers are underutilized due to mismatches between supply and demand and a lack of standardized hardware across different centers. KeyBanc analyst John Vinh flagged Nvidia as the favorite, backed by Blackwell, which could potentially contribute over $7 billion in revenues in the fourth quarter. Strong Hopper demand could translate into ~15% sequential revenue growth in the fourth quarter, according to the analyst. Nvidia chief Jensen Huang recently acknowledged tremendous demand for Nvidia's Blackwell GPU, whose production is going as planned. Nvidia stock has gained over 200% in the last 12 months. Investors can gain exposure to the stock through the SPDR S&P 500 SPY and the iShares Core S&P 500 ETF IVV. Price Action: NVDA stock is up 2.80% at $138.61 at the last check on Monday. Also Read: Hindenburg Hits Roblox With Short Report, Accuses Gaming Platform of Misleading Investors By Inflating Metrics Image via Shutterstock Market News and Data brought to you by Benzinga APIs

[2]

Nvidia's GPU Sales at Risk As China Pushes Local AI Chips in Retaliation - NVIDIA (NASDAQ:NVDA)

China prioritizes Huawei chips in response to US sanctions, creating challenges for Nvidia in one of its largest markets. Nvidia Corp's NVDA H20 graphics processing unit (GPU) revenue could be affected by China's prioritization of domestic-made artificial intelligence (AI) chips. China has informally urged its companies to leverage domestic AI chips over those from Nvidia, SCMP cites familiar sources. The stock is trading lower on Monday. Also Read: Apple To Launch Budget iPhone in 2025, Aims for Market Share Gains from Huawei and Xiaomi The Asian country ordered its companies to prioritize Huawei Technologies chips instead. Reports indicating China's retaliation against the U.S. semiconductor embargo on the Asian country started emerging in May. The U.S. cited national security reasons for the sanctions. According to official records, China committed 43.5 billion yuan ($6.12 billion) to computing data centers. Prior reports said Chinese AI developers bypass U.S. sanctions by leveraging blockchain technology via overseas data centers. China also resorted to smuggling Nvidia chips. Recently, Alibaba Group Holding's BABA cloud computing services unit collaborated with Nvidia to boost the autonomous driving experience for Chinese smart vehicle owners. The Chinese hyperscalar had previously acknowledged the severe impact of US sanctions on its AI ambitions. Nvidia can earn $12 billion in sales from 1 million H20 GPUs in China in 2024. Nvidia acknowledged China as its third-largest market in its financial year, which ended January 28. Investors can gain exposure to Nvidia through SPDR Select Sector Fund - Technology XLK and iShares S&P 500 Growth ETF IVW. Will Nvidia Stock Go Up? When trying to assess whether or not NVIDIA will trade higher from current levels, it's a good idea to take a look at analyst forecasts. Wall Street analysts have an average 12-month price target of $152.76 on NVIDIA. The Street high target is currently at $200.0 and the Street low target is $90.0. Of all the analysts covering NVIDIA, 32 have positive ratings, 2 have neutral ratings and no one has negative ratings. In the last month, one analyst has adjusted price targets. Here's a look at recent price target changes [Analyst Ratings]. Benzinga also tracks Wall Street's most accurate analysts. Check out how analysts covering NVIDIA have performed in recent history. Stocks don't move in a straight line. The average stock market return is approximately 10% per year. NVIDIA is 159.34% up year-to-date. The average analyst price target suggests the stock could have further upside ahead. For a broad overview of everything you need to know about NVIDIA, visit here. If you want to go above and beyond, there's no better tool to help you do just that than Benzinga Pro. Start your free trial today. Price Action: NVDA stock is down 0.43% at $124.38 premarket at last check Monday. Also Read: Amazon Prime Video Ramps Up Ads, Taking on Netflix and Disney+ in Streaming Battle Image via Shutterstock Market News and Data brought to you by Benzinga APIs

[3]

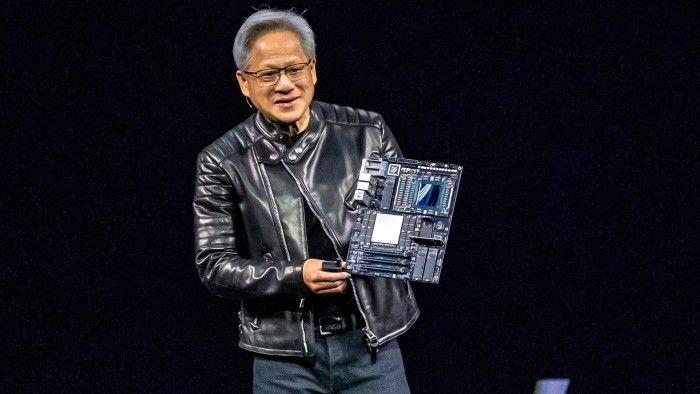

Jensen Huang On China Sanctions - 'We're Exporting American Technology Which Is Really Terrific For The U.S.,' Says Government Backs Nvidia - NVIDIA (NASDAQ:NVDA)

Nvidia NVDA CEO Jensen Huang recently discussed the problems created by U.S. sanctions against China and how they are harming Nvidia's business. While the tech giant is facing restrictions on exporting its most advanced chips to China, Huang believes that Nvidia's global impact is still a major win for the United States. Don't Miss: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500. 'Scrolling to UBI': Deloitte's #1 fastest-growing software company allows users to earn money on their phones - invest today with $1,000 for just $0.25/share In a short interview, Huang shared his thoughts on how his company is balancing national security and technological progress. He emphasized that the U.S. government is doing its best to navigate these tough waters while ensuring that American companies like Nvidia continue to succeed on the world stage. "We have to defer all of the policymaking to the administration," Huang said, continuing that the administration understands the need to balance national security with the prosperity of American technology. Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L'Oréal, Hasbro, and Sweetgreen in just three years - here's how there's an opportunity to invest at $1,000 for only $0.50/share today. "We're exporting American technology, which is really terrific for the U.S. The world is built on American standards." Nvidia, an American company leading the charge in artificial intelligence (AI) chip technology, has been deeply affected by these sanctions. Yet, Huang shared that, "Nvidia is an American company, and our government and the administration would love to see us succeed." The restrictions were put in place to prevent China from using advanced AI chips in its military, which could risk national security. However, these sanctions have also made it harder for Nvidia to sell its most powerful chips, like the H100 and B100, to China, one of its biggest markets, contributing around 17% of its revenue for fiscal 2024. Trending: The global games market is projected to generate $272B by the end of the year -- for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market. Nvidia launched customized chips, such as the H20, for the Chinese market to comply with U.S. restrictions. The market for these chips hasn't been as strong as anticipated. Nvidia reportedly had to lower the price of its H20 processor to compete with Chinese firms like Huawei, which produces the Ascend 910B AI chip. Given the challenging market conditions in China, Nvidia's H20 chip is being sold at a discount of more than 10% compared to Huawei's offering. In addition, China has been pushing domestic manufacturers of AI chips to support the growth of its semiconductor sector. Due to the pressure from Chinese authorities, it is now much more difficult for Nvidia to maintain its market dominance in China. Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today! Beyond its struggles in China, Nvidia continues to see strong global demand for its AI chips. Jensen Huang recently revealed that demand for the company's next-gen Blackwell GPU platform has been "insane." The Blackwell chips, expected to launch in full production by the fourth quarter of 2024, are projected to deliver 2.5 times the performance of Nvidia's previous Hopper chips. "Blackwell is in full production, Blackwell is as planned, and the demand for Blackwell is insane," he said on CNBC's Closing Bell Overtime, adding, "Everyone wants to have the most, and everyone wants to be first." Read Next: Unlock a $400 billion opportunity by investing in the future of EV infrastructure on this startup already valued at $50 million with just $500. This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100. Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia faces hurdles in the Chinese market due to US sanctions, but CEO Jensen Huang remains confident in the company's global impact and future prospects.

Nvidia's Market Challenges in China

Nvidia, a leading American AI chip manufacturer, is facing significant challenges in the Chinese market due to ongoing US sanctions. A government-backed think tank in China, the China Academy of Information and Communications Technology (CAICT), has recommended that the country's data centers continue using high-performance chips from Nvidia, citing the substantial costs and complexities involved in transitioning to domestic alternatives

1

. However, this recommendation comes amid increasing pressure from Chinese authorities to prioritize domestic AI chip manufacturers.US Sanctions and Their Impact

The US semiconductor embargo, implemented for national security reasons, has forced Nvidia to develop specially tailored chips for the Chinese market, including the A800, H800, and H20

1

. These chips are designed to comply with US export restrictions while still meeting the demands of Chinese customers. Despite these efforts, Nvidia's sales in China, which represents its third-largest market, are at risk2

.China's Push for Domestic Chips

In response to US sanctions, China has been actively promoting the use of domestically produced AI chips. The country has informally urged its companies to leverage local AI chips over those from Nvidia, with a particular focus on prioritizing Huawei Technologies chips

2

. This push for domestic alternatives poses a significant threat to Nvidia's market share in China.Nvidia's Response and Strategy

Despite these challenges, Nvidia CEO Jensen Huang remains optimistic about the company's global impact and future prospects. In a recent interview, Huang emphasized that Nvidia is "exporting American technology, which is really terrific for the U.S."

3

. He also expressed confidence in the US government's understanding of the need to balance national security concerns with the prosperity of American technology companies.Future Prospects and Innovations

Nvidia continues to see strong global demand for its AI chips, particularly for its next-generation Blackwell GPU platform. Huang described the demand for Blackwell as "insane," with the chips expected to deliver 2.5 times the performance of Nvidia's previous Hopper chips

3

. The Blackwell chips are scheduled for full production by the fourth quarter of 2024, potentially offsetting some of the challenges faced in the Chinese market.Related Stories

Financial Implications

The Chinese market remains crucial for Nvidia, with the potential for 1 million H20 GPUs to generate $12 billion in sales in 2024

1

. However, the company has had to adjust its pricing strategy, reportedly lowering the price of its H20 processor by more than 10% to compete with Chinese firms like Huawei3

. Despite these challenges, Nvidia's stock has gained over 200% in the last 12 months, reflecting investor confidence in the company's overall performance and future prospects1

.Broader Industry Impact

The ongoing tensions between the US and China in the semiconductor industry are having ripple effects throughout the global AI and technology sectors. As China invests heavily in its domestic chip industry and data center infrastructure, with a commitment of 43.5 billion yuan ($6.12 billion) to computing data centers

2

, the landscape of the global AI chip market is likely to see significant shifts in the coming years.References

Summarized by

Navi

[2]

Related Stories

Nvidia Stock Soars as U.S. Approves Resumption of AI Chip Sales to China

09 Jul 2025•Technology

Nvidia Hit by New U.S. Export Controls on AI Chips to China, Boosting Local Rivals

16 Apr 2025•Technology

Nvidia Navigates US-China Tensions with Potential New AI Chip for Chinese Market

22 Aug 2025•Technology

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation