Nvidia Poised for Growth Despite Challenges: Bank of America Maintains 'Buy' Rating

3 Sources

3 Sources

[1]

Nvidia stock set to soar? Bank of America calls it a 'Compelling' buy ahead of earnings - Here's why investors are paying attention

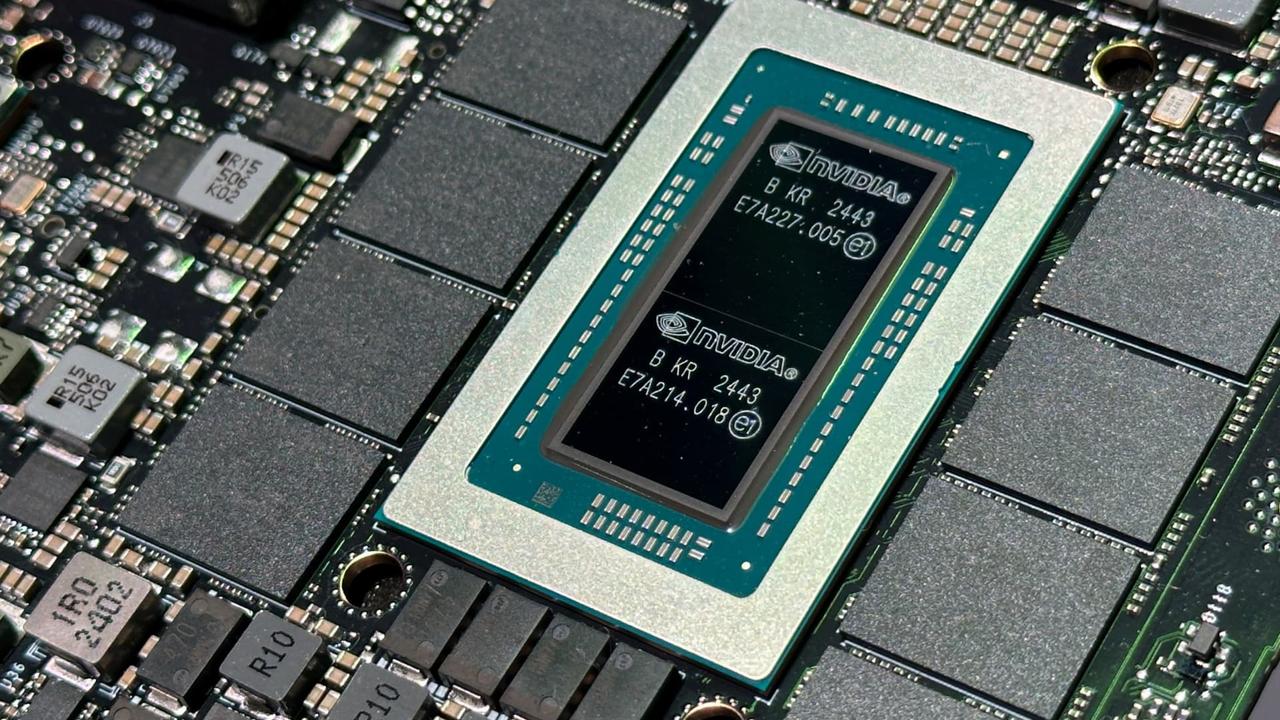

Bank of America (BofA) is urging investors to buy Nvidia stock ahead of its upcoming earnings report. The bank's analysts have labeled Nvidia as a "compelling" investment, citing its strong position in the artificial intelligence (AI) sector, robust financial performance, and future growth potential. Nvidia has become the leader in AI-driven technology, with its advanced graphics processing units (GPUs) powering AI applications worldwide. The demand for its AI chips has surged, with companies like Microsoft, Meta, and Google relying on Nvidia's hardware for their AI advancements. According to BofA analyst Vivek Arya, Nvidia's earnings potential remains strong, and the market is underestimating the impact of its latest AI chips. He has raised the stock's price target from $165 to $190, indicating a potential upside of nearly 39% from its current level (CNBC). Nvidia has delivered remarkable stock performance over the past year, tripling its value as the AI sector expands. Analysts expect the company to generate at least $200 billion in free cash flow over the next two years, strengthening its ability to invest in research and development. The company's upcoming earnings report will be crucial. Wall Street estimates suggest Nvidia could continue its growth streak, with revenue expected to surpass $30 billion this quarter, reflecting the high demand for AI-powered GPUs. Market Leadership: Nvidia dominates the AI chip market, holding over 80% of the GPU segment for AI workloads. Strong Demand for AI Chips: Companies investing in AI, including OpenAI and Amazon, use Nvidia's chips. Future Growth: Nvidia is projected to quintuple its earnings per share by 2027, making it a long-term growth stock. Positive Analyst Ratings: Out of 64 analysts surveyed, none have a sell rating on Nvidia. Why is Nvidia stock a strong buy before earnings? Bank of America cites AI chip demand, strong cash flow, and growth potential. What is Nvidia's new stock price target? BofA raised it to $190, predicting a 39% upside.

[2]

Bank of America sees Nvidia overcoming DeepSeek, trade war challenges and rising to all-time high

Nvidia should have no issue navigating headwinds tied to global trade and rising competition, allowing shares to hit a fresh all-time high, according to Bank of America. BofA reiterated a buy rating on the artificial intelligence darling, alongside a $190 price target. Bank of America's forecast implies nearly 63% upside from Monday's $116.66 close. While Nvidia stock has surged more than 76% over the past year, its shares have been under pressure so far in 2025 and have dipped 13% year-to-date, as the rise of DeepSeek sparked a tech sector sell-off. Investors are reevaluating the AI trade, as they try to gauge how much investment will be needed and which companies will dominate the technology. NVDA 1Y mountain Nvidia stock. Bank of America analyst Vivek Arya said Nvidia is still well positioned despite DeepSeek's large language model sparking questions about whether or not the tech sector's high spending for AI development is necessary. The analyst noted large customers, Meta Platforms and Microsoft , which recently reported earnings, have not pulled back on their capital expenditure plans. This suggests Nvidia's sales will continue to grow at a robust pace. Nvidia reports its fourth-quarter results on Feb. 26. While President Donald Trump on Saturday announced stiff tariffs on Canada, China and Mexico, and Beijing hit back with its own duties, set to begin on Feb. 10, the door is open for the world's largest economies to come to a new trade agreement, Arya said. At the moment, tariffs for Canada and Mexico have been placed on pause . Regardless, the analyst expects overall demand will offset any losses seen in the Chinese market. This is especially true given most global server production has shifted away from Beijing and toward Taiwan, Mexico and even the U.S., he said. "Overall, we expect rising demand from the west (US cloud, enterprise, OpenAI Stargate etc.) to offset China headwinds for NVDA," Arya said. "Some have pointed to NVDA's rising Singapore exposure but that's a 'bill-to' and not a 'ship-to' destination, per NVDA."

[3]

Nvidia will grow despite trade wars, DeepSeek: Bank of America

BofA analysts, in a note, highlighted that Nvidia's strong performance has been driven by derivative model training, infrastructure upgrades, artificial general intelligence (AGI), and increasing AI inference requirements.Ahead of the release of Nvidia's fourth quarter earnings on February 26, Bank of America (BofA) analysts maintained their "buy" rating on the technology giant. Analysts highlighted the strong position of the company despite geopolitical tensions and trade wars. BofA believes that the breakthrough of artificial intelligence startup DeepSeek will not impact the semiconductor giant. Bank of America analysts expect Nvidia to report a lower gross margin in Q1 2025 due to restrictions in China and the transition to the Blackwell product, Investing.com reported. According to the report, Nvidia is expected to reassure investors on execution of Blackwell GPUs and signal confidence in 2025-2026. This has the potential to represent a low point in investor sentiment. The forecast for data center sales growth could go above 60 percent year-on-year. Also Read : After retaliatory tariffs against US, China to investigate Google over violation of antitrust laws BofA analysts, in a note, highlighted that Nvidia's strong performance has been driven by derivative model training, infrastructure upgrades, artificial general intelligence (AGI), and increasing AI inference requirements. As per their note, the mix between the drivers could change over time, but the overall performance of the company will be positive. The note carried an example of Nvidia's processors and data center sales from CY18-24, stating that the growth in one sector did not impede progress in another. The note may calm investors after DeepSeek's open source AI model led to turbulence in the markets. On January 27, Nvidia recorded its biggest single-day market value loss in the American stock market, with $600 billion being wiped out, as per CNBC. The shares of the semiconductor company had tumbled after DeepSeek's latest AI model made its debut. Also Read : Elon Musk explains how Tesla's robotaxi will work In January, Nvidia CEO Jensen Huang predicted that practical quantum computing was 15-30 years away. This was met with skepticism by Meta head Mark Zuckerberg. Microsoft founder Bill Gates added his own take on the matter, saying that logical quantum computing qubits may be developed in three to five years, but the process could be longer. When will Nvidia reveal its Q4 earnings? The technology giant will reveal the data on February 26 at approximately 1:20 PM PT. Will tensions with China affect Nvidia's growth? The Bank of America expects that any negative impact from China will be countered by strong demand from Western markets.

Share

Share

Copy Link

Bank of America reaffirms its 'buy' rating for Nvidia, citing strong AI chip demand and growth potential despite challenges from trade wars and emerging competitors like DeepSeek.

Bank of America Bullish on Nvidia's Prospects

Bank of America (BofA) has reaffirmed its 'buy' rating for Nvidia, positioning the tech giant as a "compelling" investment ahead of its upcoming fourth-quarter earnings report on February 26, 2025. Despite recent market turbulence and emerging challenges, BofA analysts remain confident in Nvidia's ability to maintain its dominant position in the artificial intelligence (AI) sector

1

2

.Raised Price Target and Growth Projections

BofA analyst Vivek Arya has increased Nvidia's price target from $165 to $190, suggesting a potential upside of nearly 63% from its recent closing price of $116.66

1

2

. This optimistic outlook is based on Nvidia's strong financial performance and future growth potential, with analysts expecting the company to generate at least $200 billion in free cash flow over the next two years1

.AI Market Leadership and Demand

Nvidia continues to dominate the AI chip market, holding over 80% of the GPU segment for AI workloads

1

. The demand for its AI chips remains robust, with major tech companies like Microsoft, Meta, and Google relying on Nvidia's hardware for their AI advancements1

2

. BofA analysts highlight that Nvidia's growth is driven by various factors, including derivative model training, infrastructure upgrades, artificial general intelligence (AGI), and increasing AI inference requirements3

.Navigating Challenges: Trade Wars and Competition

While geopolitical tensions and trade wars pose potential risks, BofA expects Nvidia to successfully navigate these challenges. The analysts anticipate that rising demand from Western markets, including US cloud providers, enterprises, and projects like OpenAI's Stargate, will offset any potential losses in the Chinese market

2

3

.DeepSeek and Market Volatility

The recent breakthrough by AI startup DeepSeek caused some market turbulence, leading to a significant single-day market value loss for Nvidia in January 2025

3

. However, BofA analysts believe that DeepSeek's open-source AI model will not significantly impact Nvidia's long-term prospects. They argue that the overall demand for AI infrastructure and Nvidia's products will remain strong2

3

.Related Stories

Future Outlook and Investor Sentiment

As Nvidia prepares to release its Q4 earnings, BofA expects the company to reassure investors about the execution of its new Blackwell GPUs and signal confidence in its 2025-2026 outlook. While a lower gross margin is anticipated in Q1 2025 due to restrictions in China and the transition to the Blackwell product, analysts forecast data center sales growth could exceed 60% year-on-year

3

.Long-term Growth Potential

Despite short-term challenges, Nvidia's long-term growth potential remains strong. The company is projected to quintuple its earnings per share by 2027, solidifying its position as a long-term growth stock

1

. With positive ratings from analysts and continued innovation in the AI sector, Nvidia appears well-positioned to maintain its leadership in the evolving landscape of artificial intelligence technology.References

Summarized by

Navi

[2]

Related Stories

Bank of America Bullish on Nvidia Despite AI Chip Export Concerns

28 Mar 2025•Business and Economy

Nvidia's AI Dominance Expands: Analysts Project $2 Trillion Market Opportunity

11 Jan 2025•Business and Economy

Nvidia Surges Past $5 Trillion Market Cap as CEO Huang Reveals $500 Billion Order Backlog

04 Nov 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology