Nvidia Surges Towards $4 Trillion Valuation, Fueled by AI Chip Demand

25 Sources

25 Sources

[1]

Nvidia reclaimed market value pole position in June

July 2 (Reuters) - Nvidia (NVDA.O), opens new tab reclaimed the top spot among the most valued companies worldwide in June, as its shares were supported by renewed optimism over its leadership in artificial intelligence and expectations of surging demand for its AI chips. The chipmaker's market value stood at $3.86 trillion at the end of June, about 4.3% higher than Microsoft Corp's $3.69 trillion valuation. However, Nvidia's market value has yet to surpass Apple Inc's (AAPL.O), opens new tab record high of about $3.92 trillion set in December 2024. Apple, with a market capitalization of $3.1 trillion, ranked as the third most valuable company at the end of last month. Meta Platforms Inc (META.O), opens new tab, Broadcom Inc (AVGO.O), opens new tab, and Amazon.com Inc (AMZN.O), opens new tab saw their market values rise by 14%, 13.9%, and 7% respectively last month, reaching $1.86 trillion, $1.3 trillion, and $2.33 trillion. The market value of Tesla Inc (TSLA.O), opens new tab dropped 8.3% to $1.02 trillion last month, with sentiment hit by CEO Elon Musk's feud with U.S. President Donald Trump. "We believe both Nvidia and Microsoft will hit the $4 trillion market cap club this summer and then over the next 18 months the focus will be on the $5 trillion club ... as this tech bull market is still early being led by the AI Revolution," said Daniel Ives, an analyst at Wedbush Securities. Reporting by Gaurav Dogra in Bengaluru; Editing by Vidya Ranganathan and David Evans Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Retail & ConsumerADAS, AV & SafetySoftware-Defined VehicleSustainable & EV Supply Chain

[2]

Nvidia set to become the world's most valuable company in history

July 3 (Reuters) - Nvidia (NVDA.O), opens new tab was on track to become the most valuable company in history on Thursday, with the chipmaker's market capitalization reaching $3.92 trillion as Wall Street doubled down on optimism about AI. Shares of the leading designer of high-end AI chips were up 2.2% at $160.6 in morning trading, giving the company a higher market capitalization than Apple's (AAPL.O), opens new tab record closing value of $3.915 trillion on December 26, 2024. Nvidia's newest chips have made gains in training the largest artificial-intelligence models, fueling demand for products by the Santa Clara, California, tech company. Microsoft (MSFT.O), opens new tab is currently the second-most valuable company on Wall Street, with a market capitalization of $3.7 trillion as its shares rose 1.4% on $498. Apple rose 0.5%, giving it a stock market value of $3.19 trillion, in third place. A race among Microsoft, Amazon.com (AMZN.O), opens new tab, Meta Platforms (META.O), opens new tab, Alphabet (GOOGL.O), opens new tab and Tesla (TSLA.O), opens new tab to build AI data centers and dominate the emerging technology has fueled insatiable demand for Nvidia's high-end processors. The stock market value of Nvidia, whose core technology was developed to power video games, has nearly octupled over the past four years from $500 billion in 2021. Nvidia is now worth more than the combined value of the Canadian and Mexican stock markets, according to LSEG data. The tech company also exceeds the total value of all publicly listed companies in the United Kingdom. Nvidia recently traded at about 32 times analysts' expected earnings for the next 12 months, below its average of about 41 over the past five years, according to LSEG data. That relatively modest price-to-earnings valuation reflects steadily increasing earnings estimates that have outpaced Nvidia's sizable stock gains. The company's stock has now rebounded more than 68% from its recent closing low on April 4, when Wall Street was reeling from President Donald Trump's global tariff announcements. U.S. stocks, including Nvidia, have recovered on expectations that the White House will cement trade deals to soften Trump's tariffs. Reporting by Noel Randewich in Oakland, California; Arsheeya Bajwa and Shashwat Chauhan in Bengaluru and Carolina Mandl in New York; Editing by Dawn Kopecki and Matthew Lewis Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Business

[3]

Jim Cramer says a $4 trillion stock market value is just the start for Nvidia

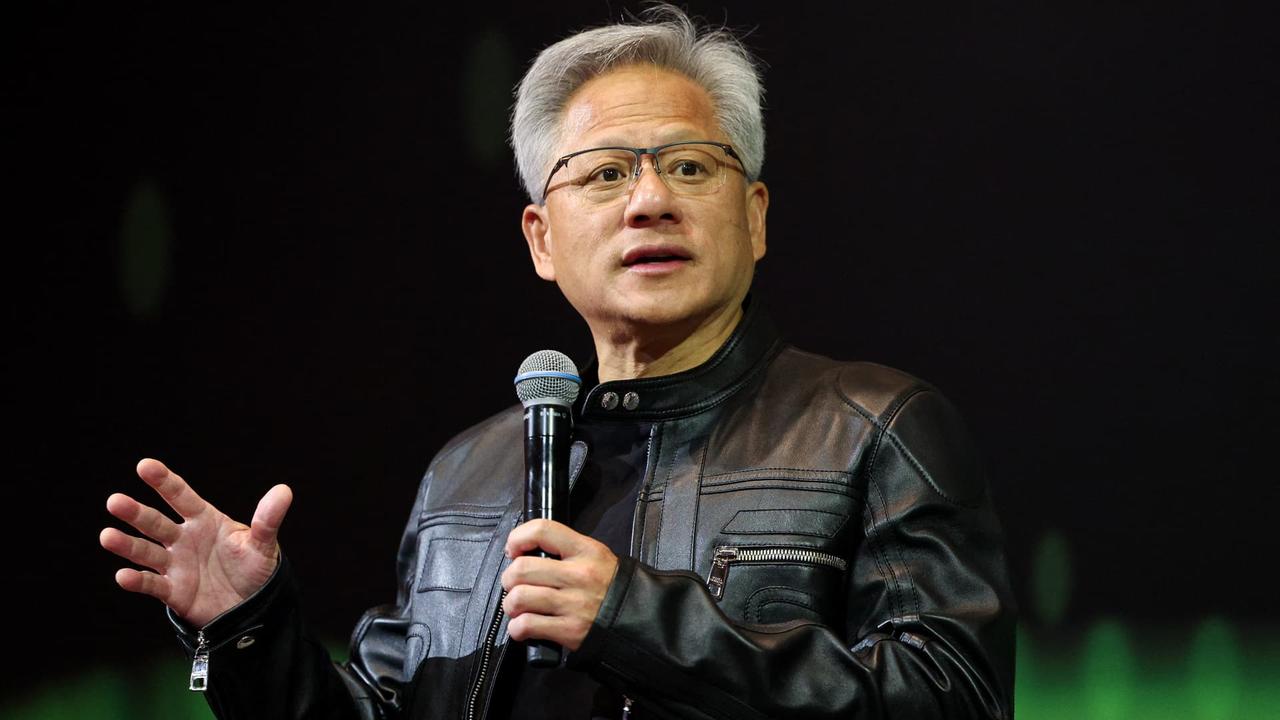

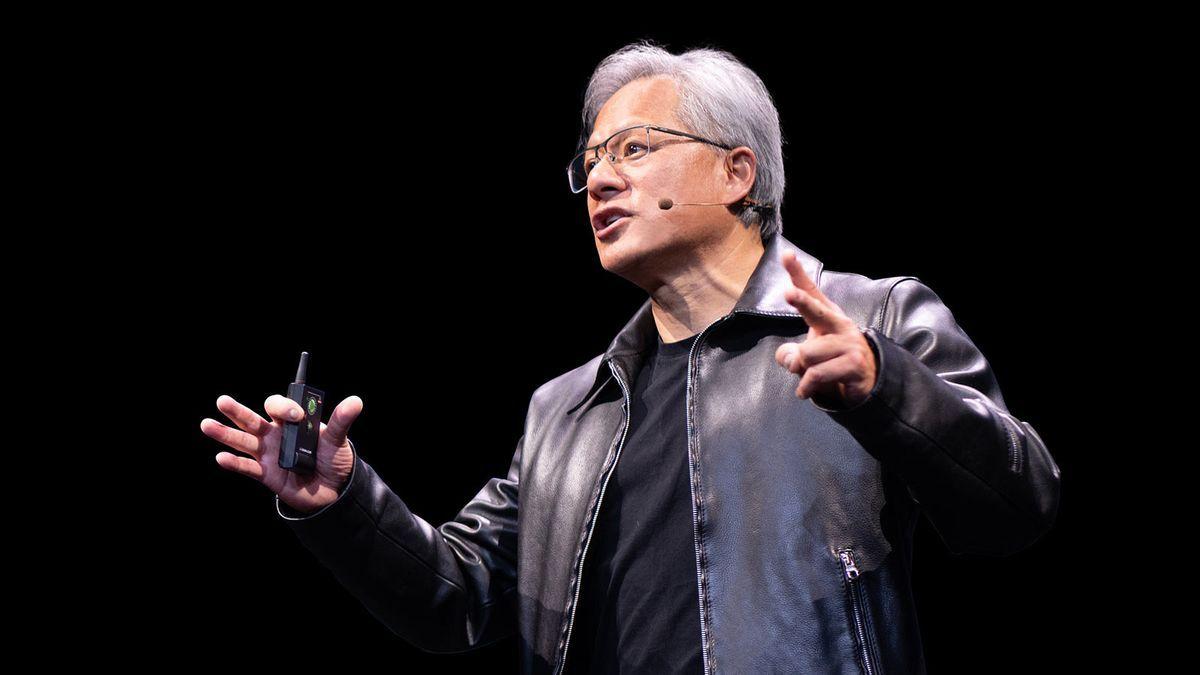

Nvidia is on the brink of a $4 trillion stock market value -- and Jim Cramer believes that is hardly the ceiling for the artificial intelligence giant. With the Club stock trading around $158 per share Tuesday morning, the company's market capitalization stood a smidge below $3.9 trillion. The level to watch for Nvidia to become the first company to ever reach $4 trillion: $163.93 per share. "If it were just a semiconductor [company], this stock would be at $58, not $158," Jim said Tuesday. What makes Nvidia so much more than just a traditional semiconductor design company is that it has so much software and other hardware components that work alongside its core AI chips in data centers, known as graphics processing units (GPUs), according to Jim. In that way, he believes Nvidia provides an entire platform for AI computing rather than one leg supporting it. "People have to recognize there's so much in a platform that this company is worth a great deal more than it's currently trading. I really believe that," Jim said. "There's just this bias against semis," he added, alluding to the industry's long-standing reputation for being notoriously prone to boom-and-bust cycles. "The real value is Nvidia. Why? It's not just hardware. It's software." Nvidia's software offerings includes a library of pretrained AI models and, crucially, a program called CUDA that essentially allows developers to maximize the parallel computing traits of GPUs. Nvidia unveiled CUDA nearly two decades ago and its popularity among developers is seen as one of the company's biggest competitive advantages. NVDA 5Y mountain Nvidia 5 years Nvidia arrives at the doorstep of $4 trillion after an extraordinary stock rally that traces its roots to the launch of ChatGPT in late 2022. The viral chatbot introduced the public to the concept of generative AI -- and kicked off a gold rush for the chips that made it possible: Nvidia's GPUs. Its sales, profits and stock price took off. Nvidia shares were caught up in a geopolitics-driven sell-off earlier this year, during which Jim advised members to manage risk and book some profits in case the Trump administration's policies -- particularly toward China -- remained a forceful headwind. As Trump eased off some of his most hawkish trade policies, Nvidia's biggest customers reaffirmed their multi-billion-dollar capital expenditure plans. As countries in the Middle East got the greenlight to shell out on Nvidia chips, the stock regained the momentum that has defined it for two-plus years. Jim is not alone in thinking Nvidia has plenty more upside beyond $4 trillion. On Monday, Citi raised its price target on the stock to $190 per share from $180, citing a belief that the total market for AI chips in 2028 will be even larger than previously expected, in part due to burgeoning demand from countries outside the U.S. -- something that Nvidia calls "sovereign AI." When Nvidia secured a few big wins in this area in May, Jim was quick to say this could be a durable trend that helps further diversify the company's revenue streams away from a handful of large American tech firms. "Turns out we have another hyperscaler," Jim said after Nvidia announced a deal to sell 18,000 chips to an AI startup owned by Saudi Arabia's sovereign wealth fund. Meanwhile, Mizuho Securities upped its price target last week to $185 from $175 on a belief that improvements in the supply chain could allow Nvidia to ramp availability of its latest generation of AI chips.

[4]

Nvidia closes in on $4 trillion valuation, surpasses Apple's record

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. The big picture: Nvidia came within striking distance of setting a new record for the most valuable company in history on Thursday, as its market capitalization soared to $3.92 trillion during intraday trading, just shy of the $4 trillion mark. The chipmaker's rapid ascent, fueled by relentless demand for its advanced AI chips, briefly pushed it past Apple's previous record closing value of $3.915 trillion set in late 2024. By the end of the trading session, Nvidia's value settled at $3.89 trillion, slightly below the all-time high but still underscoring its extraordinary run. "When the first company crossed a trillion dollars, it was amazing. And now you're talking four trillion, which is just incredible. It tells you that there's this huge rush with AI spending and everybody's chasing it right now," Joe Saluzzi, co-manager of trading at Themis Trading, told Reuters. The surge in Nvidia's stock reflects a broader wave of optimism on Wall Street about the future of AI. The company's latest chips have become essential for training and running the largest and most sophisticated AI models, fueling a race among technology giants to build powerful data centers and dominate the next era of computing. Microsoft, Amazon, Meta, Alphabet, and Tesla are all competing to expand their AI infrastructure, and Nvidia's specialized hardware sits at the heart of this transformation. According to LSEG data, Nvidia's current valuation now exceeds the combined market capitalization of all publicly listed companies in Canada and Mexico, and even surpasses the total value of all publicly traded firms in the United Kingdom. Four years ago, the company was valued at $500 billion and was largely known for its graphics technology used in video games. Since then, its market capitalization has grown nearly eightfold, propelled by the explosive growth in AI applications and the company's ability to deliver the high-performance chips that power them. Credit: Companies by Marketcap The company's financial performance has been equally impressive. In the most recent quarter, Nvidia reported $44.1 billion in revenue, a 69 percent increase from the previous year, with data center sales alone contributing $39.1 billion. This puts Nvidia on track to approach $170 billion in annual revenue for fiscal 2026, up from $130.5 billion in 2025. Analysts expect the company's next-gen Blackwell Ultra GPUs to further accelerate growth, with Wall Street anticipating that Nvidia could soon reach, and potentially surpass, the $4 trillion market cap milestone. Nvidia's rise has also reshaped the broader stock market. The company now represents a significant portion of the S&P 500 index, and its performance has left many investors, including those saving for retirement through index funds, increasingly exposed to the fortunes of the AI sector. Microsoft, currently valued at $3.7 trillion, and Apple, at $3.19 trillion, round out the top three most valuable companies. But Nvidia's momentum has set a new benchmark for what is possible in the technology industry. Despite its dominance, Nvidia faces challenges, including ongoing trade restrictions that limit the sale of its most advanced chips to China, as well as rising competition from rivals developing custom AI hardware. However, the company's innovation pipeline remains robust, with expansion into new markets such as autonomous vehicles and physical AI systems, signaling that its influence in the tech world is likely to persist.

[5]

Nvidia is on track to become the most valuable company in history

The AI chipmaker Nvidia's shares hit a new all-time high on Thursday, briefly giving the company a market capitalisation of $3.92 trillion (€3.33tn), the highest in history for any company. This surpassed Apple's record of $3.91tr set in December 2024, even though Nvidia's market capitalisation dipped once again below this level at market close. The chipmaker's shares traded as high as $160.98 at their peak on Thursday, before the price dipped below this level, placing the market capitalisation at around $3.89tr when daily trading wrapped up. Tech companies' shares benefitted from a better-than-expected nonfarm payrolls report in the US, an indicator of a resilient US economy. This optimism was boosted by forecasts that businesses would continue to spend on AI advances, boosting demand for AI chips. Nvidia shares are up more than 50% in just less than two months. Analysts expect that the company will break the valuation record soon and retain its elevated share price by the close of the trading day. "Chip giant Nvidia is on track to achieve a new closing high," said Dan Coatsworth, investment analyst at AJ Bell, adding that the "AI revolution is still intact". AJ Bell head of financial analysis Danni Hewson added that, "After all the gloomy predictions that this might be the year the AI bubble bursts, Nvidia's found another gear. The chipmaker is on track to smash a coveted record and become the world's most valuable company ever." The value of Nvidia currently is more than three times the total market capitalisation of the stock market in Spain and more than four times that of the Italian stock exchange.

[6]

Nvidia Could Be About To Do Something No Company Has Ever Done

Wedbush analysts said they believe Nvidia and Microsoft could breach the $4 trillion threshold this summer, something no company has done yet. Nvidia (NVDA) could be poised to claim the title of most valuable company in history, as its market value nears $4 trillion. The AI chipmaker's shares rose just over 1% to close at an all-time high of $159.34 Thursday, pushing its market capitalization to $3.89 trillion. If the stock had sustained its intraday highs closer to $161, its market value would have topped Apple's (AAPL) closing record of $3.91 trillion in December. With another roughly 3% rise from Thursday's closing price to $163.93, Nvidia could also hit the $4 trillion market cap threshold soon, something no other company has done. Microsoft (MSFT), which has jockeyed with Nvidia this year for the title of world's most valuable company, could too, according to Wedbush analysts led by Dan Ives. "We believe both Nvidia and Microsoft will hit the $4 trillion market cap club this summer and then over the next 18 months the focus will be on the $5 trillion club....as this tech bull market is still early being led by the AI Revolution," the analysts said in a note to clients Thursday. Thursday's rise came amid broader market gains, with the benchmark S&P 500 index and tech-heavy Nasdaq hitting all-time highs ahead of a long holiday weekend. The stock market closed early at 1 p.m. ET Thursday ahead of the July 4 holiday on Friday.

[7]

Nvidia Briefly on Track to Become World's Most Valuable Company Ever

Apple's market value stands at $3.19 trillion, putting it in third place Nvidia hit a market value of $3.92 trillion on Thursday, briefly putting it on track to become the most valuable company in history, as Wall Street doubled down on optimism about AI. Shares of the leading designer of high-end AI chips rose as much as 2.4 percent to $160.98 in morning trading, giving the company a higher market capitalization than Apple's record closing value of $3.915 trillion on December 26, 2024. The shares were last up 1.5 percent at $159.60, leaving Nvidia's stock market value at $3.89 trillion, just short of Apple's record. Nvidia's newest chips have made gains in training the largest artificial-intelligence models, fueling demand for products by the Santa Clara, California, company. Microsoft is currently the second-most valuable company on Wall Street, with a market capitalization of $3.7 trillion as its shares rose 1.7 percent to $499.56. Apple rose 0.8 percent, giving it a market value of $3.19 trillion, in third place. A race among Microsoft, Amazon.com, Meta Platforms, Alphabet and Tesla to build AI data centers and dominate the emerging technology has fueled insatiable demand for Nvidia's high-end processors. "When the first company crossed a trillion dollars, it was amazing. And now you're talking four trillion, which is just incredible. It tells you that there's this huge rush with AI spending and everybody's chasing it right now," said Joe Saluzzi, co-manager of trading at Themis Trading. The stock market value of Nvidia, whose core technology was developed to power video games, has increased nearly eight-fold over the past four years, from $500 billion in 2021 to now near $4 trillion. Nvidia is now worth more than the combined value of the Canadian and Mexican stock markets, according to LSEG data. The tech company also exceeds the total value of all publicly listed companies in the United Kingdom. Nvidia recently traded at about 32 times analysts' expected earnings for the next 12 months, below its average of about 41 over the past five years, according to LSEG data. That relatively modest price-to-earnings valuation reflects steadily increasing earnings estimates that have outpaced Nvidia's sizable stock gains. The company's stock has now rebounded more than 68 percent from its recent closing low on April 4, when Wall Street was reeling from President Donald Trump's global tariff announcements. US stocks, including Nvidia, have recovered on expectations that the White House will cement trade deals to soften Trump's tariffs. Nvidia's swelling market capitalization underscores Wall Street's big bets on the proliferation of generative AI technology, with the chipmaker's hardware serving as the foundation. The sharp increases in the shares of Nvidia and other Wall Street heavyweights have left people who save for their retirements through widely used S&P 500 index funds heavily exposed to the future of AI technology. Nvidia now accounts for 7 percent of the S&P 500. Nvidia, Microsoft, Apple, Amazon and Alphabet together make up 28 percent of the index. "I strongly believe that AI is a greatly productive tool, but I am fairly sure that the current delivery of AI via large language models and large reasoning models are unlikely to live up to the hype," cautioned Kim Forrest, chief investment officer at Bokeh Capital Partners. Co-founded in 1993 by CEO Jensen Huang, Nvidia has evolved from a niche company popular among video game enthusiasts into Wall Street's barometer for the AI industry. The stock's recent rally comes after a slow first half of the year, when investor optimism about AI took a back seat to worries about tariffs and Trump's trade dispute with Beijing. Chinese startup DeepSeek in January triggered a selloff in global equities markets with a cut-price AI model that outperformed many Western competitors and sparked speculation that companies might spend less on high-end processors. In November of last year, Nvidia took over the spot on the Dow Jones Industrial Average formerly occupied by chipmaker Intel, reflecting a major shift in the semiconductor industry toward AI-linked development and the graphics processing hardware pioneered by Nvidia.

[8]

Nvidia surges past Apple and Microsoft to become most valuable firm globally - The Economic Times

The company recorded a market capitalisation of $3.92 trillion on Thursday, surpassing Apple's previous all-time high of $3.915 trillion set in December 2024, and Microsoft's current valuation of $3.7 trillion.Nvidia has overtaken Apple and Microsoft to become the most valuable company in the world, the first time the chipmaker has claimed the top spot. The company recorded a market capitalisation of $3.92 trillion on Thursday, surpassing Apple's previous all-time high of $3.915 trillion set in December 2024, and Microsoft's current valuation of $3.7 trillion. The milestone reflects Nvidia's growing dominance amid the rapid rise of artificial intelligence (AI). Investor enthusiasm for AI has skyrocketed, with Nvidia at the center of this surge. Its advanced chips are critical for training large AI models, making it a prime beneficiary of the ongoing AI investment boom. ET reported that tech giants such as Microsoft, Amazon, Meta, Alphabet, and Tesla are racing to build massive AI data centers, creating unprecedented demand for Nvidia's processors. From a valuation of around $500 billion in 2021, Nvidia's worth has now soared nearly eight-fold, approaching the $4 trillion mark. The company is now more valuable than the entire Canadian and Mexican stock markets combined, and it exceeds the combined market capitalisation of all UK-listed companies. Shares of Nvidia rose 2.2% to $160.6 in morning trading on Thursday, pushing its market value above its US tech rivals. The stock has rebounded more than 68% since its recent low on April 4, when Wall Street was hit by market jitters following President Donald Trump's global tariff announcements.

[9]

Nvidia reclaimed market value pole position in June - The Economic Times

The chipmaker's market value stood at $3.86 trillion at the end of June, about 4.3% higher than Microsoft Corp's $3.69 trillion valuation.Nvidia reclaimed the top spot among the most valued companies worldwide in June, as its shares were supported by renewed optimism over its leadership in artificial intelligence and expectations of surging demand for its AI chips. The chipmaker's market value stood at $3.86 trillion at the end of June, about 4.3% higher than Microsoft Corp's $3.69 trillion valuation. However, Nvidia's market value has yet to surpass Apple Inc's record high of about $3.92 trillion set in December 2024. Apple, with a market capitalization of $3.1 trillion, ranked as the third most valuable company at the end of last month. Meta Platforms Inc, Broadcom Inc, and Amazon.com Inc saw their market values rise by 14%, 13.9%, and 7% respectively last month, reaching $1.86 trillion, $1.3 trillion, and $2.33 trillion. The market value of Tesla Inc dropped 8.3% to $1.02 trillion last month, with sentiment hit by CEO Elon Musk's feud with U.S. President Donald Trump. "We believe both Nvidia and Microsoft will hit the $4 trillion market cap club this summer and then over the next 18 months the focus will be on the $5 trillion club ... as this tech bull market is still early being led by the AI Revolution," said Daniel Ives, an analyst at Wedbush Securities.

[10]

Nvidia set to become the world's most valuable company in history - The Economic Times

Nvidia's newest chips have made gains in training the largest artificial-intelligence models, fueling demand for products by the Santa Clara, California, tech company. Microsoft is currently the second-most valuable company on Wall Street, with a market capitalization of $3.7 trillion as its shares rose 1.4% on $498.Nvidia was on track to become the most valuable company in history on Thursday, with the chipmaker's market capitalization reaching $3.92 trillion as Wall Street doubled down on optimism about AI. Shares of the leading designer of high-end AI chips were up 2.2% at $160.6 in morning trading, giving the company a higher market capitalization than Apple's record closing value of $3.915 trillion on December 26, 2024. Nvidia's newest chips have made gains in training the largest artificial-intelligence models, fueling demand for products by the Santa Clara, California, tech company. Microsoft is currently the second-most valuable company on Wall Street, with a market capitalization of $3.7 trillion as its shares rose 1.4% on $498. Apple rose 0.5%, giving it a stock market value of $3.19 trillion, in third place. A race among Microsoft, Amazon.com, Meta Platforms , Alphabet and Tesla to build AI data centers and dominate the emerging technology has fueled insatiable demand for Nvidia's high-end processors. The stock market value of Nvidia, whose core technology was developed to power video games, has nearly octupled over the past four years from $500 billion in 2021. Nvidia is now worth more than the combined value of the Canadian and Mexican stock markets, according to LSEG data. The tech company also exceeds the total value of all publicly listed companies in the United Kingdom. Nvidia recently traded at about 32 times analysts' expected earnings for the next 12 months, below its average of about 41 over the past five years, according to LSEG data. That relatively modest price-to-earnings valuation reflects steadily increasing earnings estimates that have outpaced Nvidia's sizable stock gains. The company's stock has now rebounded more than 68% from its recent closing low on April 4, when Wall Street was reeling from President Donald Trump's global tariff announcements. U.S. stocks, including Nvidia, have recovered on expectations that the White House will cement trade deals to soften Trump's tariffs.

[11]

How Jensen Huang's NVIDIA, who started with video game chips, became the world's most valuable firm, bigger than UK's GDP

Nvidia's valuation has soared to an unprecedented $3.92 trillion, overtaking the GDPs of India and Germany and edging closer to Japan's. Born as a gaming graphics chip maker, Nvidia now powers vast AI data centres for tech giants like Microsoft, Amazon and Meta. Despite tariff setbacks under US President Donald Trump, its shares rebounded sharply. Backed by relentless AI demand, Nvidia's dominance reflects investor confidence in its role at the heart of artificial intelligence's next frontier.Nvidia, run by Jensen Huang, has become the world's most valuable company, its market capitalisation hitting $3.9 trillion. The Santa Clara-based chip designer's value now sits above the GDPs of India and Germany, both hovering near $4.19 trillion, and is closing fast on Japan's economy. Only the US and China remain ahead. Shares rose 2.1% to $159.34 at close on Thursday, lifting Nvidia above Apple's record high market cap of $3.915 trillion, which Apple reached on 26 December 2024. Microsoft holds the second spot with $3.7 trillion, while Apple has slipped to third at $3.19 trillion. Nvidia's massive rise invites comparisons with entire countries. But there's a catch. A company's market value reflects how much investors believe it can earn in future, while a nation's GDP measures the total value of all goods and services produced in a year. India's GDP, for example, covers the output of about 1.5 billion people working in farms, factories, IT services, shops and offices. Nvidia's valuation, in contrast, hinges on just 30,000 employees building high-value, cutting-edge technology for artificial intelligence. Yet the symbolism matters. A company built to make video game cards now outvalues the economic output of countries with massive populations and diverse industries. Here's how Nvidia's $3.92 trillion value compares with the world's largest national economies by GDP (nominal), according to IMF and Forbes India data from mid‑2025 India recently overtook the UK to claim fourth place, and is set to surpass Japan by fiscal year-end. Founded in 1993, Nvidia carved its niche by developing high-end graphics cards for video games. Those same graphics processing units (GPUs) later turned out to be perfect for complex AI workloads. Its pivot to chips that drive artificial intelligence training has fuelled staggering growth. Back in 2021, Nvidia's market value was $500 billion -- about an eighth of what it is now. In just four years, it has leapfrogged entire industries and regions. Data from LSEG highlights that Nvidia's market cap now eclipses the combined worth of all publicly listed companies in Canada and Mexico, as well as the full UK stock market, as reported by Reuters. This scale is striking for a company that employs only about 30,000 people. The world's tech giants are competing against each other to get the AI crown. The race among Microsoft, Amazon.com, Meta Platforms , Alphabet and Tesla to build AI data centers and dominate the emerging technology has fueled insatiable demand for Nvidia's high-end processors. Microsoft alone invested billions in OpenAI, the developer of ChatGPT, and pumped fresh capital into UAE's AI firm G42. Tesla, meanwhile, relies on AI models to develop its autonomous driving features. All these systems depend on Nvidia's chips. As Reuters noted, "Nvidia's newest chips have been instrumental in training the largest AI models, driving an insatiable demand for its products." Nvidia's rise is part of a larger reshuffle in the tech hierarchy. Companies that control the AI pipeline -- from chips to data centres -- are now the biggest spenders and earners. Competitors like Taiwan's TSMC and America's Broadcom are also expanding rapidly. TSMC recently secured billions in US funding to build new chip plants under the CHIPS Act, aiming to ensure America's lead in semiconductor production. Meanwhile, Google's parent Alphabet unveiled its new quantum computing chip, Willow, to correct errors in real-time -- a move that could challenge Nvidia's dominance in some advanced workloads. Meta Platforms, too, has poured billions into the AI start-up Scale AI, signalling more competition ahead. Not everything has gone Nvidia's way. This April, Wall Street took a hit when US President Donald Trump announced sweeping global tariffs. On 4 April, Nvidia's share price sank to its lowest close in months, fuelling fears about supply chain costs and trade wars. But optimism returned just as fast. Shares have rebounded by more than 68% since that low point, boosted by expectations that fresh trade deals will help offset the tariffs. This comeback is sharper than many analysts predicted. Even after such a dramatic rise, Nvidia's shares trade at about 32 times projected earnings for the next year -- below its five-year average of 41. Analysts see this as proof that investors expect profits to keep climbing. As AI models grow bigger and more advanced, they need more computing power -- and for now, Nvidia's chips remain the gold standard. From consumer AI assistants to self-driving cars and quantum research, Nvidia's technology sits at the heart of it all. For Wall Street, that promise is enough to stake trillions. For Nvidia, the next leap could well be to cement itself as the biggest company the world has ever seen. The company that once powered video games now powers the race for the future.

[12]

Nvidia Stock Hits New All-Time Highs: What's Driving The Record-Breaking Run? - NVIDIA (NASDAQ:NVDA)

NVIDIA Corp NVDA stock reached another all-time high on Thursday, solidifying its position as the world's most valuable company with a market capitalization of $3.89 trillion. Here's what investors need to know. What To Know: Nvidia's surge Thursday came as U.S. stocks broadly rallied to new records, fueled by stronger-than-expected labor market data that eased recession concerns. The S&P 500 was approaching 6,300, and the Nasdaq-100 climbed to 22,860. Tech stocks, particularly the "Magnificent Seven," were leading the charge. Industry experts, like Wedbush Securities' Dan Ives, anticipate Nvidia and Microsoft could be the first companies to hit a $4 trillion market cap this summer, potentially reaching $5 trillion within the next 18 months. This optimistic outlook is driven by relentless innovation and significant investments in AI infrastructure, with both companies deemed "foundational pieces" of the ongoing AI revolution. Further bolstering the semiconductor sector, the U.S. Senate and House passed the "One Big Beautiful Bill," which includes an increased investment tax credit for chip manufacturers, raising it from 25% to 35% for facilities expanding domestic production by 2026. This legislative support, alongside strong technical indicators like the VanEck Semiconductor ETF (SMH) forming a "Golden Cross," suggests continued bullish momentum for chipmakers. Nvidia, comprising over 21% of the SMH, is poised to benefit significantly from these favorable conditions and the burgeoning demand for AI. Benzinga Edge Rankings: Benzinga Edge data for Nvidia reveals a strong performance across key metrics. The stock boasts a high Growth score of 98.59, indicating robust expansion. Momentum is also significant at 78.44, suggesting a strong upward trend. However, Value is considerably lower at 6.92, implying the stock may be expensive relative to its fundamentals. Price Action: According to data from Benzinga Pro, Nvidia shares closed higher by 1.33% to $159.34 Thursday afternoon. Shares are higher by some 12.8% over the trailing month. The stock hit a 52-week high of $160.98 on Thursday, and has a 52-week low of $86.62. Read Also: CoreWeave Stock Rallied On Thursday: What Happened? How To Buy NVDA Stock Besides going to a brokerage platform to purchase a share - or fractional share - of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument. For example, in Nvidia's case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment. Image: Shutterstock NVDANVIDIA Corp$159.251.27%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum78.44Growth98.59QualityNot AvailableValue6.92Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[13]

Jensen Huang's Wealth Has Shot Up $25 Billion In 2025 As Nvidia Solidifies Position As The World's Most Valuable Company, But Steve Ballmer Is Still Giving Him A Run For His Money - Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL)

Nvidia Corporation NVDA CEO Jensen Huang has added nearly $25 billion to his net worth year to date as the chip giant's market value surges past tech titans to become the most valuable company in the world -- but he's still trailing just behind former Microsoft Corporation MSFT CEO Steve Ballmer. What Happened: Nvidia hit an all-time high on Thursday, closing with a market capitalization of $3.88 trillion, edging out Microsoft and Apple Inc. AAPL to take the top spot globally. The rally came amid broader gains across U.S. equity markets, fueled by stronger-than-expected labor market data that eased recession fears. The Bloomberg Billionaires Index shows Huang's net worth has grown to $139 billion year-to-date -- an increase of $24.8 billion -- placing him tenth among the world's richest people. See Also: Sundar Pichai Next? Trump's Next Big Tech Payday Could Be From YouTube After Settling Lawsuits With Meta And X: 'Productive Discussions' Underway Former Microsoft chief Ballmer, also benefiting from the tech surge, sits in fifth place with $172 billion, after gaining $25.5 billion this year. Analysts, including Wedbush Securities' Dan Ives, predict Nvidia and Microsoft could be the first companies to reach a $4 trillion valuation this summer. The optimism is largely fueled by the global AI boom, in which Nvidia plays a foundational role through its dominance in graphics processing units (GPUs). Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox. Why It's Important: Nvidia's rise reflects broader trends in technology, AI infrastructure and government policy. The House and Senate passed "One Big Beautiful Bill," which increased tax credits for semiconductor manufacturing from 25% to 35% for facilities expanding domestic production by 2026. The company also stands to benefit from strong technical indicators. The VanEck Semiconductor ETF (SMH), where Nvidia accounts for over 21%, has formed a "Golden Cross" -- a bullish signal suggesting continued upward momentum. Price Action: Nvidia shares climbed 1.33% during Thursday's regular session but dipped 0.056% in after-hours trading, according to Benzinga Pro data. The stock is up 15.20% so far this year and has gained 24.21% over the past 12 months. Benzinga's Edge Stock Rankings show that NVDA maintains a solid upward trend across the short, medium and long term. While its value ranking remains relatively weak at 6.92, its momentum and growth scores are strong. More detailed performance metrics are available here. Check out more of Benzinga's Consumer Tech coverage by following this link. Read Next: Satya Nadella Says Microsoft's AI 'Orchestrator' Beats Human Doctors On Tough Diagnoses -- What This Means For The Future of Healthcare Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. AAPLApple Inc$213.550.52%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum25.28Growth32.10Quality76.54Value9.12Price TrendShortMediumLongOverviewMSFTMicrosoft Corp$498.001.41%NVDANVIDIA Corp$159.251.27%Market News and Data brought to you by Benzinga APIs

[14]

Nvidia Nears $4T: Will It Break Out Next Week? - NVIDIA (NASDAQ:NVDA)

As Americans set off fireworks for the Fourth, Nvidia Corp NVDA CEO Jensen Huang might need a bigger sparkler. The stock just closed at $159.34 on Thursday, less than 3% shy of the historic $4 trillion market cap milestone. If it hits $164, it'll become the first chipmaker -- and only the second U.S. company after Microsoft Corp MSFT - to touch that number. That's not just bullish momentum. That's a whole new orbit. The Fundamental Setup After a brief tariff tantrum over AI chip restrictions to China, Nvidia didn't just bounce back - it rocketed. A Morgan Stanley note this week citing "very strong demand for all Blackwell form factors" poured fuel on the fire, reported The Information. And while China sales are under pressure, Europe is stepping up: Nvidia's slew of new partnerships with European AI developers could be the offset investors needed. Read Also: Everyone Talked About Nvidia, Apple And Tesla, But This One Tech Stock Has Left Them All Behind In 2025 Competitive Smoke, No Fire Despite whispers of rivals like Microsoft and Alphabet Inc's GOOGL GOOG Google designing custom AI chips, none have dented Nvidia's dominance. In fact: OpenAI walked back TPU hype, saying no plans to scale Google's chips. Microsoft hit delays in developing its own silicon. Even Apple's AI efforts remain niche, not threatening. Valuation? Still Reasonable For skeptics calling this a bubble, here's the kicker: Nvidia trades at a discount to Advanced Micro Devices Inc AMD and close enough to Broadcom Inc AVGO on forward earnings. Per Benzinga Pro data, NVDA stock currently trades at a forward earnings ratio of 36.63, while AMD and AVGO trade at 37.18 and 32.89 P/E (forward), respectively. In a market where megacap stocks are routinely accused of being overpriced, Nvidia's numbers remain surprisingly grounded - if not a bargain, then at least justifiable. Trading Idea: Long Into the $4 Trillion Launchpad Chart created using Benzinga Pro For those looking for ways to trade/position for the $4 trillion Nvidia moment, you could consider: Accumulate Zone: Accumulating on any dip below $158 if markets stay risk-on. Breakout Trade: Watching any breakout above $164 closely, targeting $170+ short-term. Risk Management: Place stop-loss near $152; reevaluate on new China-related headlines. AI may be the buzzword, but Nvidia's grip on the real infrastructure behind the hype hasn't loosened one bit. With competitive threats fizzling and new demand corridors opening in Europe, the next few days could deliver a firecracker of a milestone: $4 trillion -- and counting. Read Next: The Inverse Cramer AI Play: How Nebius Combines Tesla Vibes With Nvidia Muscle Image: Shutterstock NVDANVIDIA Corp$159.251.27%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum78.44Growth98.59QualityNot AvailableValue6.92Price TrendShortMediumLongOverviewAMDAdvanced Micro Devices Inc$137.97-0.40%AVGOBroadcom Inc$275.622.12%GOOGAlphabet Inc$180.540.43%GOOGLAlphabet Inc$179.500.48%MSFTMicrosoft Corp$498.001.41%Market News and Data brought to you by Benzinga APIs

[15]

Nvidia vs. Microsoft Stock: Which Will Be the First $4 Trillion Company? | The Motley Fool

On Dec. 26, 2024, Apple crossed $3.9 trillion in market capitalization, putting it just 2% away from becoming the world's first $4 trillion company. But it didn't get there. Apple has recovered in recent weeks but remains down big year to date, whereas Nvidia (NVDA 1.28%) and Microsoft (MSFT 1.58%) just made new all-time highs. Here's why Nvidia will likely become the first company to surpass $4 trillion in market value, what Nvidia and Microsoft must do to continue rising in price, and whether either growth stock is a buy now. In less than three years, Nvidia has gone from billions to trillions in market cap. And now, it is the closest company to $4 trillion -- a little over 3% away as of market close on July 3. Nvidia will likely reach $4 trillion before Microsoft simply because it is closer to the threshold, and its stock is more volatile. Nvidia is now up over 18% year to date (YTD), but it was down around 30% YTD in early April during the worst of the tariff-induced sell-off. So it's not unreasonable that the stock could move a few percentage points higher to pole-vault its market cap above $4 trillion. The better question isn't whether Nvidia or Microsoft will hit $4 trillion in market cap but rather what each company must do to justify that valuation. The two biggest drivers of stock-price appreciation are earnings growth and investor sentiment. If earnings are increasing, investors will likely pay a higher price for the company's shares. But if investors expect the pace of earnings growth to accelerate, then they may be willing to give a stock a premium valuation. Nvidia and Microsoft have been such strong performers in recent years because they are growing earnings and investors are willing to pay a premium price for these companies relative to their earnings. Nvidia went from making under $10 billion in annual net income to a staggering $76.8 billion in just a few years. Microsoft has doubled its net income over the past five years, and its stock price has more than doubled as well. For Nvidia and Microsoft to continue being good investments going forward, both companies must demonstrate that their earnings growth is sustainable and not temporary. Nvidia has greatly benefited from the rapid rise of big tech spending on artificial intelligence (AI). Nvidia has a dominant market share in providing high-powered graphics processing units (GPUs) for data centers and associated AI solutions for enterprises. Due to limited supply and high demand, Nvidia can charge top dollar for its AI offerings, which allows it to convert over half of its sales into pure profit. And because Nvidia's customers are some of the most financially secure, big-budget companies in the world (like Microsoft), then Nvidia knows its customers can afford to spend a ton on AI. However, that wouldn't be the case if challenges arise for key Nvidia customers if there is an industrywide slowdown or if competition comes along and erodes Nvidia's margins. Buying Nvidia now is a bet that the company can continue growing its earnings even if its margins gradually decline over time. The good news is that Nvidia doesn't have to double its earnings every year to be a great buy. Even if it grows earnings at, let's say, 25% per year, it could still reduce its valuation over time and be a market-beating stock. Here's a look at how Nvidia's price-to-earnings (P/E) ratio would go from over 50 to under 35 in five years if it grew earnings at 25% per year, and the stock price gained an average of 15% per year. Under these assumptions, Nvidia's stock price roughly doubles in five years, but its earnings triple, so the P/E ratio falls considerably. The key takeaway is that Nvidia doesn't have to sustain its parabolic growth to be a good investment. However, the stock could sell off dramatically if investors believe an unforeseen risk will interrupt its growth trajectory. We got a taste of that in April when Nvidia estimated it would incur multibillion-dollar charges due to tariffs, and the stock price nose-dived in a short period. In sum, investors should only consider Nvidia if they are confident in sustained AI spending and the company's ability to pivot as the market matures. Microsoft may be a better choice for investors seeking a more balanced tech stock to purchase. Microsoft has a lower P/E than Nvidia, and for good reason, because it isn't growing as quickly. However, Microsoft also doesn't need a lot to go right for it to continue growing steadily over time. The vast majority of Nvidia's earnings are directly tied to AI. Microsoft has a diverse earnings profile, encompassing cloud computing, software, hardware, platforms such as GitHub, LinkedIn, and Xbox, as well as other areas. AI is accelerating Microsoft's earnings growth and expanding its earnings, but the company can still do extremely well even if AI investment slows and the industry matures. It's also worth mentioning that Microsoft routinely buys back its stock and has raised its dividend for 15 consecutive years. So it has a more balanced capital-return program than Nvidia, which rewards shareholders by growing the core business rather than directly returning capital. Nvidia and Microsoft are exceptional companies. It wouldn't be surprising to see them both surpass $4 trillion market caps and continue building from there. However, investors should be mindful that both companies are seeing their stock prices rise faster than their earnings are growing, which puts pressure on them to bridge the gap between expectations and reality.

[16]

Prediction: Nvidia Will Do Something No Other Company Has Done, and It Could Happen This Summer | The Motley Fool

Nvidia (NVDA 1.10%) has impressed investors with a string of accomplishments: from double- and triple-digit revenue increases to reaching record revenue levels to soaring stock performance. This is thanks to the company's dominance in a market growing by leaps and bounds toward the trillion-dollar mark: artificial intelligence (AI). Nvidia is the global leader in AI chips, but the company also has constructed an entire portfolio of products and services to ensure its ability to sell to customers throughout their AI journey. The AI giant continues to innovate, too, promising to update its chips on an annual basis. Nvidia has proven it can follow through on this pledge by releasing its Blackwell architecture and chip this past winter and recently beginning the rollout of the next chip, Blackwell Ultra. So, Nvidia is an expert when it comes to meeting milestones and reaching records. My prediction is Nvidia will keep this momentum going by doing something no other company has done, and it will do it this summer. Before diving in, I'll start with a quick summary of Nvidia's moves along the path to AI dominance. The company, originally known for selling its chips -- graphics processing units (GPUs) -- to the video gaming market, expanded into other markets over the years and as soon as the AI opportunity arose, Nvidia took the leap. This first-to-market advantage is a key element in Nvidia's success story as it gave the company the chance to build a solid reputation with customers and keep its innovation ahead of rivals. This translated into explosive growth, with revenue skyrocketing in recent years thanks to demand for the most-powerful AI chips. Customers aim to build top-performing AI models fast, and for that they need the best compute around. Today's tech giants, from Microsoft to Meta Platforms, haven't hesitated about flocking to Nvidia. As mentioned above, the chip powerhouse has added significantly to its range of offerings in order to serve every type of AI customer, every step of the way. Nvidia even makes specific platforms to help particular industries meet their AI goals. For example, it's developed drug discovery systems for pharma companies aiming to apply AI to their research. All of this has not only helped earnings rise, but it's also led the stock to advance a mind-blowing 897% over the past three years -- and this has helped Nvidia stay neck and neck with Microsoft for the title of the biggest company by market value. Here's my prediction: I think Nvidia's market value will climb to $4 trillion ahead of any other company hitting that mark. And it could happen as early as this summer for the following reasons. First of all, Nvidia, trading for 36 times forward earnings estimates, is much cheaper than it's generally been over the past year, and today's valuation looks very reasonable considering Nvidia's growth track record and its potential to keep growth going for many years. At this valuation, investors should continue piling into Nvidia stock to get in on the company's next stages of growth, and this will push the stock price, and market cap, higher. This growth could be unfolding right now as demand for AI inferencing takes off. In the most recent quarter, Nvidia said it saw a jump in demand. Second, Nvidia also could benefit from potential positive news regarding import tariffs. President Donald Trump's plan temporarily exempted electronics from import duties, but these products may eventually be subject to a tariff level that differs from the one applied to other products. There's reason to believe that this delay in setting a tariff suggests the government is aiming for a level that will be manageable for U.S. tech companies. So, any announcement that's better than expected or an exemption that remains ongoing could support Nvidia stock, and tech stocks in general. These two elements could drive Nvidia stock higher this summer. And finally, it's important to keep in mind that at the stock's current price, it only needs to rise about 3.6% from Monday's close to bring its market cap up to the $4 trillion mark. Nvidia is known to gain that much in one trading session on good news, so it's clear the company could quickly make it to $4 trillion. Market cap alone is not a reason to buy a stock, but a new record is exciting and will boost investor confidence. All of this prompts me to predict that Nvidia, even if it slips here and there in the coming days or weeks, may jump to $4 trillion at some point this summer, accomplishing something no other company has ever done.

[17]

1 Market-Crushing AI Stock Is Closing in on a $4 Trillion Market Cap, and 1 Wall Street Analyst Thinks There Is Another 57% Upside | The Motley Fool

Artificial intelligence has taken the market by storm. There likely hasn't been a sector with this much interest since the internet boom, and it still looks like the AI sector is in the early innings. That doesn't mean it won't stumble along the way, and progress may not be linear, either. But it also means that market leaders today could be even bigger in five, 10, or 20 years. In fact, investors are so bullish on the sector that some AI names have already been run up to multitrillion-dollar market caps, which once might have been unimaginable. One company in particular is nearing a $4 trillion market cap, and one Wall Street analyst thinks the party has only just begun, with significant gains to be made over the next 12 months. The AI chip king, Nvidia (NVDA 1.10%), is seemingly invincible and is viewed as the ultimate pick-and-shovel play for AI. Even when challenges present themselves and the stock stumbles, it doesn't last very long. This year alone, Nvidia has faced numerous challenges. First, the Chinese company DeepSeek put a serious scare into AI investors earlier this year after it supposedly developed an AI chatbot that rivaled OpenAI's ChatGPT at a fraction of the cost. However, since then, many have questioned the amount of resources that actually went into building DeepSeek. Then, President Donald Trump's administration launched wide-ranging tariffs and export restrictions on certain chips made by Nvidia that seriously threatened Nvidia's ability to penetrate the Chinese market, which has been a significant source of revenue for the company. While tariffs may end up being more manageable than initially thought, considering all of these challenges, it's pretty remarkable that Nvidia's stock is now up close to 15% this year and has risen to a $3.86 trillion market cap, making it the largest publicly traded company (as of July 7). In late June, Loop Capital Analyst Ananda Baruah became Nvidia's biggest bull on Wall Street, issuing a $250 price target for the stock, implying a market cap of over $6 trillion. Baruah sees Nvidia's next leg higher being fueled by even more intense spending by hyperscalers like Amazon and Microsoft, which are poised to increase spending on graphics processing units (GPUs) and accelerators as these companies increase their AI-related infrastructure from 15% of their total infrastructure to over 50% by 2028. Baruah also expects rising AI factory demand to play a big part in the Nvidia story over the next couple of years. AI accelerator and generative AI spending could rise by $2 trillion by 2028, while gigawatt demand for these factories could create a pipeline for Nvidia of $450 billion to $900 billion over the next few years. More intensive AI reasoning models could also lead to more spending on Nvidia's AI servers. Baruah is modeling for data center revenue to more than double from $115 billion now to $367 billion by fiscal year 2028, and Nvidia "remains essentially a monopoly for critical tech." Perhaps less discussed is Nvidia's robotics efforts, which are starting to get more attention from the market. The company recently released a new humanoid robot called AEON, and Nvidia's CEO Jensen Huang has called humanoid robots, which would ideally be able to complete household chores, possibly "one of the largest industries ever," according to Barrons. Analysts are already projecting a 344% rise in revenue in Nvidia's robotics and auto division by the early 2030s. It's no surprise to see Wall Street analysts bullish on Nvidia, which has returned 1,420% over the last five years. Nvidia has been able to overcome every obstacle thrown its way, and the future looks bright. From a valuation perspective, Nvidia trades at 37 times forward earnings, above its five-year average of roughly 34.3 times, so the stock is not cheap, historically speaking. There are also concerns that the company may be overearning and may not be able to charge as much for its chips in the future. China still looks to be a sore spot for the company due to the regulatory environment, and three-year market projections on AI data center spend and factory demand are largely conjecture. But Nvidia is still clearly the market leader and has significant pricing power. It's still likely the early innings for AI, and the company will be difficult to dethrone, so I think investors can certainly buy the stock. However, given the elevated valuation, it may be best to practice dollar-cost averaging. The market is still at all-time highs, so a decline in market sentiment could lead to a big sell-off and be difficult to shake off -- even for a juggernaut like Nvidia.

[18]

Nvidia Briefly Became Most Valuable Company Ever | PYMNTS.com

Nvidia's market cap dipped to $3.89 trillion later Thursday, according to the report. The company still has the largest market value at this time, with Microsoft ranked second at $3.7 trillion and Apple third at $3.19 trillion, the report said. The report attributed Nvidia's surge to Wall Street's continued optimism about AI; tech giants' demand for the company's products, which they need to build their AI data centers; and Nvidia's relatively modest price-to-earnings valuation. Nvidia's market cap has increased nearly eightfold over the past four years, according to the report. Despite that setback, Nvidia is pushing ahead with AI infrastructure projects worldwide to meet demand for AI workloads.

[19]

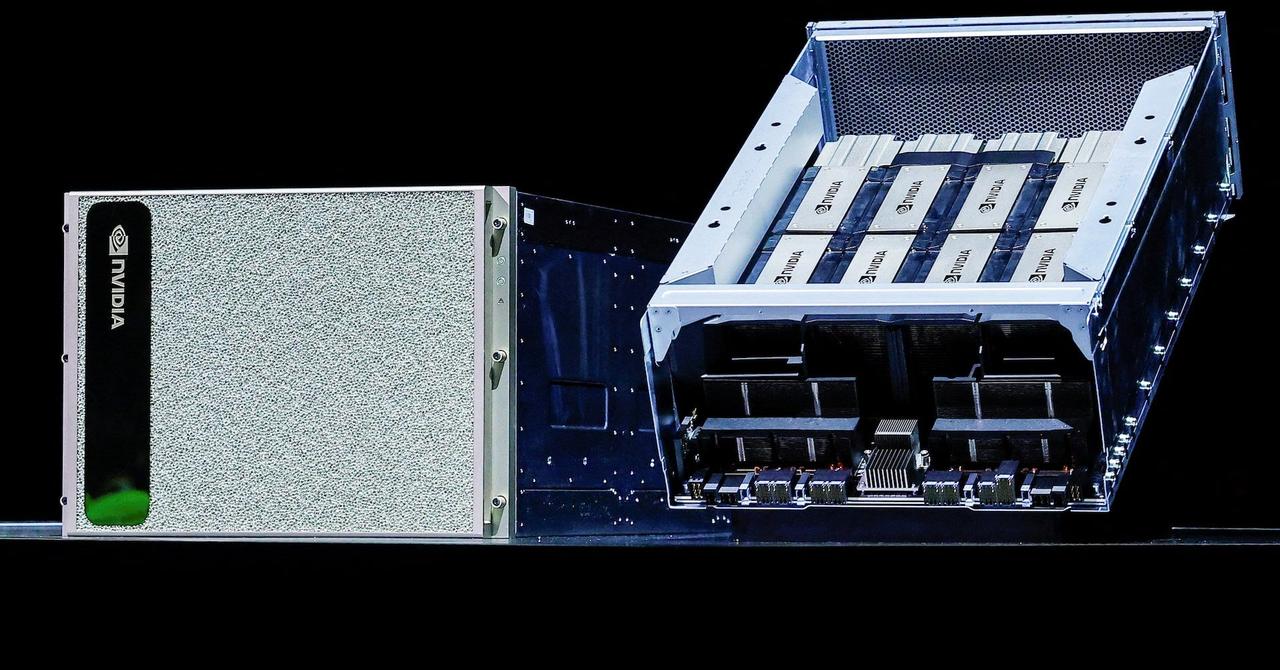

Top analyst revamps Nvidia price target for one surprising reason

Nvidia (NVDA) has shrugged off broader market jitters and become one of this year's biggest stock market winners. Its ubiquitous GPUs have been the gold standard in powering AI breakthroughs, making it a must-have for chip stock investors. Don't miss the move: Subscribe to TheStreet's free daily newsletter Moreover, despite hitting record highs this year, Nvidia still has plenty of gas left in the tank. As we look ahead, it's gearing up to roll out its next-gen GPU system, separating itself further in the data-center space. If all goes to plan, the chip king's grip on AI could tighten, and with fresh nods of approval, the runway's looking long. Why Nvidia's ecosystem keeps rivals chasing its tail It's fair to call Nvidia's GPU lineup a string of mini revolutions, with each chip line outdoing the last by a country mile. It started with Ampere, a massive step-up in performance-per-watt lift and beefed-up Tensor cores. Ampere was a smash hit with the hyperscalers, who looked to power everything from recommendation engines to early AI proofs of concept. Then we had Hopper. Nvidia packed in a special Transformer Engine, boosted NVLink speed, and tweaked its chips so LLMs could train quicker without blowing the budget. Hopper cemented Nvidia's spot as the top dog, both in research labs and mega-scale data centers. Next came Blackwell Ultra, which turned the game around with smarter data handling, faster memory, and techniques to cut lag. Related: Veteran analyst drops shocking Tesla target Suddenly, we saw generative AI come into its own with real-time video, big simulations, and instant data crunching. Now, there's Rubin, Blackwell's successor, which claims to be 3.3× faster. That leap isn't the usual clock-speed bump, but it means you can cram way more AI workloads into the same rack. Its next-generation Tensor cores, high-bandwidth memory interface, and liquid-cooled design let companies run multiple models simultaneously. More Tech Stock News: Rubin seamlessly ties in with Nvidia's mature CUDA ecosystem, with every library, toolchain, and optimization getting a lift. For AI teams, that means shorter training cycles, denser inference deployments, and the freedom to experiment with more complex models simultaneously. If it all lives up to the hype, Nvidia will prove yet again why it's the indispensable engine behind the AI revolution. Mizuho analyst backs Nvidia's AI chip dominance with bold Rubin call Nvidia stock just scored another stamp of approval from Wall Street. Mizuho's top chip analyst, Vijay Rakesh, doubled down on his bullish take on the AI bellwether, with his eyes on the future. Rakesh expects Nvidia to ship north of 5.3 million AI accelerators this year, jumping to 6 million by 2026. However, he feels the real hype is around Rubin, the next-gen server that Nvidia claims will be 3.3 times faster than Blackwell Ultra. In addition, if Rubin can shift to an air-cooled option instead of liquid cooling, we could see a lot more data centers adopting Nvidia's gear. That tweak alone could lead to an explosion in demand for Nvidia GPUs, as companies look to build their AI muscle without massive infrastructure upgrades. Related: Veteran analyst offers eye-popping Nvidia, Microsoft stock prediction Also, Mizuho is keeping an Outperform rating on Nvidia stock with a $170 price target (an 8% jump from July 2's close). Cantor Fitzgerald, in a recent note, is even more upbeat, keeping its Overweight rating and setting the bar even higher at $200 (27.2% higher than July 2's close). Nvidia continues riding high on the tailwind of a blowout second quarter, its 10th consecutive quarter of top- and bottom-line beats. It delivered nearly 60% top-line growth, while its earnings per share of 81 cents beat estimates by six cents. However, it hasn't all been smooth sailing for the AI titan. Two Chinese AI startups, one led by a former Nvidia executive, just filed to go public, stirring up fresh competition. Also, the looming U.S. ban on H20 chip sales to China and Huawei's rumored H100 challenger have kept the pressure on. Nevertheless, Nvidia's pushing hard on new fronts. It's been going all-in on sovereign AI projects in Europe and Saudi Arabia, while building colossal U.S. production hubs for Blackwell to hedge against tariffs. It's important to note that on June 25, NVDA spiked 4% to a record $154.10, briefly overtaking Microsoft as the world's most valuable company, So it's clear Nvidia's still the king of AI chips, and the Street's betting there's still plenty of room to run. Related: Veteran analyst drops bold new call on Nvidia stock

[20]

Nvidia reclaimed market value pole position in June

Nvidia reclaimed the top spot among the most valued companies worldwide in June, as its shares were supported by renewed optimism over its leadership in artificial intelligence and expectations of surging demand for its AI chips. The chipmaker's market value stood at US$3.86 trillion at the end of June, about 4.3 per cent higher than Microsoft Corp's $3.69 trillion valuation. However, Nvidia's market value has yet to surpass Apple Inc's record high of about $3.92 trillion set in December 2024. Apple, with a market capitalization of $3.1 trillion, ranked as the third most valuable company at the end of last month. Meta Platforms Inc, Broadcom Inc, and Amazon.com Inc saw their market values rise by 14 per cent, 13.9 per cent, and seven per cent respectively last month, reaching $1.86 trillion, $1.3 trillion, and $2.33 trillion. The market value of Tesla Inc dropped 8.3 per cent to $1.02 trillion last month, with sentiment hit by CEO Elon Musk's feud with U.S. President Donald Trump. "We believe both Nvidia and Microsoft will hit the $4 trillion market cap club this summer and then over the next 18 months the focus will be on the $5 trillion club ... as this tech bull market is still early being led by the AI Revolution," said Daniel Ives, an analyst at Wedbush Securities.

[21]

Microsoft Vs. Nvidia: Which One to Back as Both Battle for a $4B+ Market Cap | Investing.com UK

Both Microsoft (NASDAQ:MSFT) and Nvidia (NASDAQ:NVDA) are racing toward the historic $4 trillion market cap milestone this summer, with analysts predicting these AI heavyweights will be the first companies to achieve this unprecedented valuation. The race to become the first $4 trillion company is heating up as artificial intelligence heavyweights Microsoft and Nvidia continue their epic battle for market supremacy. Both tech giants have already surpassed the $3 trillion milestone and are now jostling for the coveted position of the world's most valuable company by market capitalization. Microsoft currently holds a $3.7 trillion market cap while Nvidia trails closely at $3.89 trillion, with both companies experiencing remarkable growth driven by the AI revolution. According to Wedbush analysts, both companies are expected to hit the $4 trillion mark this summer, representing what they call "the biggest tech transformation in over 40 years." Microsoft's transformation from a traditional software company to an AI enterprise has been nothing short of remarkable. The company, once primarily known for Windows and Microsoft Office, has successfully rebranded itself as an AI powerhouse through its Azure cloud computing platform. Azure offers a comprehensive suite of tools that allow developers to build and deploy AI applications, positioning Microsoft at the forefront of the cloud computing revolution. This strategic pivot has proven incredibly lucrative, with the company's services segment generating $54.7 billion in revenue in the latest quarter, up from $44.8 billion a year earlier. Nvidia's ascent has been even more meteoric, particularly since ChatGPT launched in late 2022 and sparked unprecedented interest in AI technology. The company's powerful graphics processing units (GPUs) emerged as the essential hardware solution for powering AI applications, making Nvidia the chip maker of choice for hyperscalers including Microsoft. Nvidia's stock has increased nearly eightfold over the past four years, from $500 billion in 2021 to nearly $4 trillion today. The company's dominance in AI chips has given CEO Jensen Huang what analysts describe as "the best vantage point to discuss overall AI demand." From a financial performance standpoint, both companies demonstrate exceptional strength but with notably different profiles. Microsoft trades at a forward P/E ratio of 33.22 with a profit margin of 35.79% and generates $270.01 billion in annual revenue. The company maintains a healthy balance sheet with $79.62 billion in total cash and relatively modest debt levels. Microsoft's year-to-date return stands at an impressive 18.80%, significantly outpacing the S&P 500's 6.76% gain, while its five-year return reaches 152.43%. Nvidia's metrics are even more spectacular, though they reflect the company's more volatile growth trajectory. The chipmaker trades at a higher forward P/E of 37.17 but boasts an extraordinary profit margin of 51.69% on revenue of $148.51 billion. Nvidia's financial returns are staggering, with a return on equity of 115.46% compared to Microsoft's 33.61%. The company's stock performance has been phenomenal, with year-to-date gains of 18.67% and an astronomical five-year return of 1,563.14%. Nvidia maintains $53.69 billion in cash with minimal debt, representing just 12.27% of equity. Wall Street analysts remain bullish on both companies, though they favor different aspects of each investment. Microsoft receives an average analyst price target of $522.26, suggesting modest upside from current levels around $498.84. The company benefits from strong analyst ratings, with Evercore ISI Group providing an "Outperform" rating and overall scores of 77/100. Microsoft's more mature business model and diversified revenue streams provide stability that appeals to conservative investors seeking exposure to AI growth without excessive volatility. Nvidia commands higher analyst enthusiasm with price targets averaging $173.92, though this represents a more limited upside from current prices near $159.34. Bernstein rates the stock "Outperform" with an impressive overall score of 85/100, reflecting confidence in the company's technological leadership. However, some analysts express caution about AI valuations, with concerns that current AI delivery methods may not live up to the hype. This skepticism suggests that while Nvidia's growth potential remains enormous, the investment carries higher risk than Microsoft's more balanced approach. Given the current market dynamics and analyst predictions, Nvidia appears positioned to reach the $4 trillion milestone first, despite Microsoft's current slight lead in market cap. Nvidia's momentum in the AI chip market, combined with its role as the fundamental infrastructure provider for AI applications, gives it a strategic advantage in capturing the immediate benefits of AI adoption. The company's exceptional profit margins and explosive growth rates suggest it can sustain the rapid valuation increases needed to cross the $4 trillion threshold. However, Microsoft's path to $4 trillion may prove more sustainable in the long term due to its diversified business model and entrenched position in enterprise software and cloud services. The company's Azure platform benefits from every dollar spent on AI infrastructure, creating a virtuous cycle that could drive steady, compound growth. While Nvidia may win the race to $4 trillion, Microsoft's broader technological ecosystem and multiple revenue streams position it well for the subsequent journey toward the $5 trillion mark that analysts predict will follow. ***

[22]

Nvidia reclaimed market value pole position in June

(Reuters) -Nvidia reclaimed the top spot among the most valued companies worldwide in June, as its shares were supported by renewed optimism over its leadership in artificial intelligence and expectations of surging demand for its AI chips. The chipmaker's market value stood at $3.86 trillion at the end of June, about 4.3% higher than Microsoft Corp's $3.69 trillion valuation. However, Nvidia's market value has yet to surpass Apple Inc's record high of about $3.92 trillion set in December 2024. Apple, with a market capitalization of $3.1 trillion, ranked as the third most valuable company at the end of last month. Meta Platforms Inc, Broadcom Inc, and Amazon.com Inc saw their market values rise by 14%, 13.9%, and 7% respectively last month, reaching $1.86 trillion, $1.3 trillion, and $2.33 trillion. The market value of Tesla Inc dropped 8.3% to $1.02 trillion last month, with sentiment hit by CEO Elon Musk's feud with U.S. President Donald Trump. "We believe both Nvidia and Microsoft will hit the $4 trillion market cap club this summer and then over the next 18 months the focus will be on the $5 trillion club ... as this tech bull market is still early being led by the AI Revolution," said Daniel Ives, an analyst at Wedbush Securities. (Reporting by Gaurav Dogra in Bengaluru;Editing by Vidya Ranganathan and David Evans)

[23]

Nvidia set to become the world's most valuable company in history

(Reuters) -Nvidia was on track to become the most valuable company in history on Thursday, with the chipmaker's market capitalization reaching $3.92 trillion as Wall Street doubled down on optimism about AI. Shares of the leading designer of high-end AI chips were up 2.2% at $160.6 in morning trading, giving the company a higher market capitalization than Apple's record closing value of $3.915 trillion on December 26, 2024. Nvidia's newest chips have made gains in training the largest artificial-intelligence models, fueling demand for products by the Santa Clara, California, tech company. Microsoft is currently the second-most valuable company on Wall Street, with a market capitalization of $3.7 trillion as its shares rose 1.4% on $498. Apple rose 0.5%, giving it a stock market value of $3.19 trillion, in third place. A race among Microsoft, Amazon.com, Meta Platforms, Alphabet and Tesla to build AI data centers and dominate the emerging technology has fueled insatiable demand for Nvidia's high-end processors. The stock market value of Nvidia, whose core technology was developed to power video games, has nearly octupled over the past four years from $500 billion in 2021. Nvidia is now worth more than the combined value of the Canadian and Mexican stock markets, according to LSEG data. The tech company also exceeds the total value of all publicly listed companies in the United Kingdom. Nvidia recently traded at about 32 times analysts' expected earnings for the next 12 months, below its average of about 41 over the past five years, according to LSEG data. That relatively modest price-to-earnings valuation reflects steadily increasing earnings estimates that have outpaced Nvidia's sizable stock gains. The company's stock has now rebounded more than 68% from its recent closing low on April 4, when Wall Street was reeling from President Donald Trump's global tariff announcements. U.S. stocks, including Nvidia, have recovered on expectations that the White House will cement trade deals to soften Trump's tariffs. (Reporting by Noel Randewich in Oakland, California; Arsheeya Bajwa and Shashwat Chauhan in Bengaluru and Carolina Mandl in New York; Editing by Dawn Kopecki and Matthew Lewis)

[24]

Nvidia set to become world's most valuable company in history

(Reuters) -Nvidia was on track to become the most valuable company in history on Thursday, with the chipmaker's market capitalization reaching $3.92 trillion as Wall Street doubled down on optimism about AI. Shares of the leading designer of high-end AI chips were up 2.2% at $160.6 in morning trading, giving the company a higher market capitalization than Apple's record closing value of $3.915 trillion on December 26, 2024. Nvidia's newest chips have made gains in training the largest artificial-intelligence models, fueling demand for products by the Santa Clara, California, company. Microsoft is currently the second-most valuable company on Wall Street, with a market capitalization of $3.7 trillion as its shares rose 1.5% to $498.5. Apple rose 0.8%, giving it a market value of $3.19 trillion, in third place. A race among Microsoft, Amazon.com, Meta Platforms, Alphabet and Tesla to build AI data centers and dominate the emerging technology has fueled insatiable demand for Nvidia's high-end processors. "When the first company crossed a trillion dollars, it was amazing. And now you're talking four trillion, which is just incredible. It tells you that there's this huge rush with AI spending and everybody's chasing it right now," said Joe Saluzzi, co-manager of trading at Themis Trading. The stock market value of Nvidia, whose core technology was developed to power video games, has increased nearly eight-fold over the past four years, from $500 billion in 2021. Nvidia is now worth more than the combined value of the Canadian and Mexican stock markets, according to LSEG data. The tech company also exceeds the total value of all publicly listed companies in the United Kingdom. Nvidia recently traded at about 32 times analysts' expected earnings for the next 12 months, below its average of about 41 over the past five years, according to LSEG data. That relatively modest price-to-earnings valuation reflects steadily increasing earnings estimates that have outpaced Nvidia's sizable stock gains. The company's stock has now rebounded more than 68% from its recent closing low on April 4, when Wall Street was reeling from President Donald Trump's global tariff announcements. U.S. stocks, including Nvidia, have recovered on expectations that the White House will cement trade deals to soften Trump's tariffs. Nvidia holds a weight of nearly 7.4% on the benchmark S&P 500. AI POSTER CHILD Nvidia's swelling market capitalization underscores Wall Street's big bets on the proliferation of generative AI technology, with the chipmaker's hardware serving as the foundation. Co-founded in 1993 by CEO Jensen Huang, Nvidia has evolved from a niche company popular among video game enthusiasts into Wall Street's barometer for the AI industry. The stock's recent rally comes after a slow first half of the year, when investor optimism about AI took a back seat to worries about tariffs and Trump's trade dispute with Beijing. Chinese startup DeepSeek in January triggered a selloff in global equities markets with a cut-price AI model that outperformed many Western competitors and sparked speculation that companies might spend less on high-end processors. In November of last year, Nvidia took over the spot on the Dow Jones Industrial Average formerly occupied by chipmaker Intel, reflecting a major shift in the semiconductor industry toward AI-linked development and the graphics processing hardware pioneered by Nvidia. (Reporting by Noel Randewich in Oakland, California; Arsheeya Bajwa and Shashwat Chauhan in Bengaluru and Carolina Mandl in New York; Editing by Dawn Kopecki, Matthew Lewis and Nick Zieminski)

[25]

Nvidia briefly on track to become world's most valuable company ever

NVIDIA Corporation is the world leader in the design, development, and marketing of programmable graphics processors. The group also develops associated software. Net sales break down by family of products as follows: - computing and networking solutions (77.8%): data center platforms and infrastructure, Ethernet interconnect solutions, high-performance computing solutions, platforms and solutions for autonomous and intelligent vehicles, solutions for enterprise artificial intelligence infrastructure, crypto-currency mining processors, embedded computer boards for robotics, teaching, learning and artificial intelligence development, etc.; - graphics processors (22.2%): for PCs, game consoles, video game streaming platforms, workstations, etc. (GeForce, NVIDIA RTX, Quadro brands, etc.). The group also offers laptops, desktops, gaming computers, computer peripherals (monitors, mice, joysticks, remote controls, etc.), software for visual and virtual computing, platforms for automotive infotainment systems and cloud collaboration platforms. Net sales break down by industry between data storage (78%), gaming (17.1%), professional visualization (2.5%), automotive (1.8%) and other (0.6%). Net sales are distributed geographically as follows: the United States (44.3%), Taiwan (22%), China (16.9%) and other (16.8%).

Share

Share

Copy Link

Nvidia's market value soars to $3.92 trillion, briefly surpassing Apple's record, as demand for AI chips propels the company to new heights.

Nvidia's Unprecedented Market Valuation

Nvidia, the leading designer of high-end AI chips, has reached a historic milestone in the tech industry. On July 3, 2025, the company's market capitalization soared to $3.92 trillion, briefly surpassing Apple's previous record of $3.915 trillion set in December 2024

1

. This remarkable achievement positions Nvidia on the brink of becoming the first company to reach a $4 trillion valuation.

Source: ET

Driving Forces Behind Nvidia's Success

The chipmaker's meteoric rise can be attributed to several key factors:

- AI Chip Demand: Nvidia's newest chips have made significant gains in training the largest artificial intelligence models, fueling unprecedented demand for the company's products

2

.

Source: Reuters

-

Tech Giants' AI Race: Major players like Microsoft, Amazon, Meta, Alphabet, and Tesla are competing to build AI data centers and dominate emerging technologies, creating insatiable demand for Nvidia's high-end processors

2

. -

Platform Approach: Jim Cramer, a prominent financial analyst, argues that Nvidia's value extends beyond traditional semiconductor companies due to its comprehensive platform of software and hardware components for AI computing

3

.

Financial Performance and Market Impact

Nvidia's financial results reflect its dominant position in the AI chip market:

- Revenue Growth: The company reported $44.1 billion in revenue for the most recent quarter, a 69% increase from the previous year

4

. - Market Comparison: Nvidia's current valuation exceeds the combined market capitalization of all publicly listed companies in Canada and Mexico, and surpasses the total value of all publicly traded firms in the United Kingdom

4

. - Stock Performance: Nvidia's stock has rebounded more than 68% from its recent closing low on April 4, 2025, following concerns about global tariffs

2

.

Source: Benzinga

Related Stories

Future Outlook and Challenges

Analysts remain optimistic about Nvidia's future prospects:

- Price Targets: Citi raised its price target on Nvidia stock to $190 per share, citing expectations of an even larger AI chip market by 2028

3

. - Supply Chain Improvements: Mizuho Securities increased its price target to $185, anticipating enhanced availability of Nvidia's latest generation AI chips

3

. - Expansion into New Markets: Nvidia is exploring opportunities in autonomous vehicles and physical AI systems, potentially extending its influence in the tech world

4

.