Nvidia Reclaims World's Most Valuable Company Title, Driven by AI Boom

9 Sources

9 Sources

[1]

Nvidia tops Microsoft, regains most valuable company title for first time since January

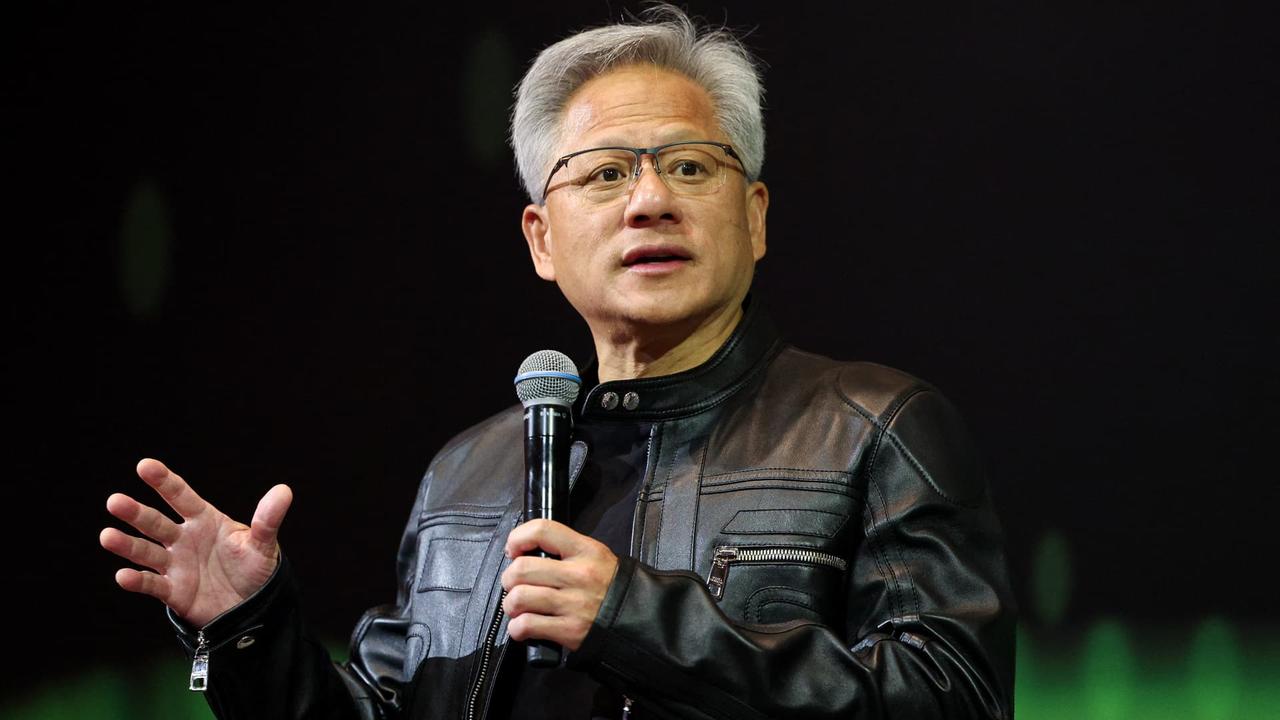

Nvidia CEO Jensen Huang speaks as he visits Lawrence Berkeley National Lab to announce a U.S. supercomputer to be powered by Nvidia's forthcoming Vera Rubin chips, in Berkeley, California, U.S., May 29, 2025. Nvidia passed Microsoft in market cap on Tuesday, once again becoming the most valuable publicly traded company in the world. Shares of the artificial intelligence chipmaker rose about 3% on Tuesday to $141.40, and the stock has surged nearly 24% in the past month as Nvidia's growth has persisted even through export control and tariff concerns. The company now has a $3.45 trillion market cap. Microsoft closed Tuesday with a $3.44 trillion market cap. Nvidia has been trading places with Apple and Microsoft at the top of the market cap ranks since last June. The last time Nvidia was the most-valuable company was on Jan. 24. Last week, Nvidia reported 96 cents in adjusted earnings per share on $44.06 billion in sales in its fiscal first quarter. That represented 69% growth from the year-ago period, an incredible growth rate for a company as large as Nvidia.

[2]

AI chipmaker Nvidia hits $3.46T, overtakes Microsoft and Apple as the world's most valuable company

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. What just happened? Nvidia has announced first quarter results for fiscal 2026 and judging by early numbers, the April downturn looks to be well in the rear view. Nvidia reported revenue of $44.1 billion for the three-month period ending April 27, 2025, an increase of 12 percent quarter over quarter and up a whopping 69 percent from the same period a year earlier. For comparison, analysts polled by LSEG were expecting $43.31 billion for the quarter. Non-GAPP diluted earnings per share were $0.81. Nvidia's data center division continued to impress, netting $39.1 billion in revenue. That is up 10 percent over the previous quarter and 73 percent from a year ago, and is thanks almost exclusively to the AI revolution. Revenue from gaming reached a record $3.8 billion, up 48 percent quarter over quarter and 42 percent year over year. This division will no doubt continue to hold firm in the coming quarters as Nintendo gears up for the launch of its Switch 2 console, which is powered by hardware from Nvidia and launches on June 5. Nvidia CEO Jensen Huang said countries around the world are recognizing AI as essential infrastructure, just like electricity and the Internet, adding that he is proud that Nvidia is standing at the center of the transformation. Nvidia will pay a quarterly cash dividend of $0.01 per share on July 3 to shareholders of record on June 11. Looking ahead to the current quarter, Nvidia expects to bring in $45 billion in revenue (plus or minus two percent). The chipmaker initially expected to generate an extra $8 billion from the sale of H20 products exported to China but new US law now requires an expensive license to do so. Nvidia incurred a $4.5 billion charge in the first quarter for the same reason, and saw its non-GAPP gross margin fall from 71.3 percent to 61.0 percent as a result. Earnings per share would have been $0.96 had it not been for the new law. Shares in Nvidia are up nearly four percent in early morning trading.

[3]

AI chipmaker Nvidia hits $3.46T, overtakes Microsoft and Apple as...

For comparison, analysts polled by LSEG were expecting $43.31 billion for the quarter. Non-GAPP diluted earnings per share were $0.81. Nvidia's data center division continued to impress, netting $39.1 billion in revenue. That is up 10 percent over the previous quarter and 73 percent from a year ago, and is thanks almost exclusively to the AI revolution. Revenue from gaming reached a record $3.8 billion, up 48 percent quarter over quarter and 42 percent year over year. This division will no doubt continue to hold firm in the coming quarters as Nintendo gears up for the launch of its Switch 2 console, which is powered by hardware from Nvidia and launches on June 5. Nvidia CEO Jensen Huang said countries around the world are recognizing AI as essential infrastructure, just like electricity and the Internet, adding that he is proud that Nvidia is standing at the center of the transformation. Nvidia will pay a quarterly cash dividend of $0.01 per share on July 3 to shareholders of record on June 11. Looking ahead to the current quarter, Nvidia expects to bring in $45 billion in revenue (plus or minus two percent). The chipmaker initially expected to generate an extra $8 billion from the sale of H20 products exported to China but new US law now requires an expensive license to do so. Nvidia incurred a $4.5 billion charge in the first quarter for the same reason, and saw its non-GAPP gross margin fall from 71.3 percent to 61.0 percent as a result. Earnings per share would have been $0.96 had it not been for the new law. Shares in Nvidia are up nearly four percent in early morning trading. Permalink to story:

[4]

Nvidia Reclaims Title of World's Most Valuable Company on Solid Earnings

Colin is an Associate Editor focused on tech and financial news. He has more than three years of experience editing, proofreading, and fact-checking content on current financial events and politics. He received his M.A. in journalism from The New School and his B.A. in history and political science from McGill University. Nvidia stock soared on Thursday, returning the AI chip giant to the top of the list of the world's most valuable companies. Nvidia (NVDA) shares were up 4% in trading on Thursday, adding more than $100 billion to the company's market value. Thursday's gains put Nvidia's market cap at about $3.44 trillion, edging out Microsoft's (MSFT) $3.41 trillion value. The shares were reacting on Thursday to a solid quarterly report on Wednesday afternoon. Nvidia reported record revenue in its fiscal first quarter as AI demand remained robust. Nvidia, Microsoft, and Apple (AAPL) have been jostling to be the world's most valuable company for nearly a year. The three are the only companies to have ever achieved a market value of more than $3 trillion. Nvidia reached that milestone almost exactly a year ago, while Apple first closed at $3 trillion in June 2023 and Microsoft reached $3 trillion in January 2024. All three stocks have been hit to a certain degree by economic and trade uncertainty this year, but only Microsoft and Nvidia have shaken off the worst of it. Nvidia's and Microsoft's stocks are up about 5% and 9%, respectively, since the start of the year. Apple shares, meanwhile, are down about 20%, battered by President Donald Trump's aggressive tariffs on China, where the company assembles the majority of its products, and insistence that it move production to America. Nvidia's market cap, despite Thursday's jump, remains below its record of $3.66 trillion from earlier January when shares set their all-time high.

[5]

Nvidia Beats Microsoft To Be The Biggest Of The Big: ETF Strategy - NVIDIA (NASDAQ:NVDA)

Nvidia NVDA once again emerged as the world's most valuable publicly traded company, overtaking Microsoft MSFT on Tuesday to reach a mind-blowing $3.45 trillion market cap. That means the chipmaker's valuation has rebounded by more than $1 trillion from an 11-month low reached in early April amid heightened tariff uncertainties. The rally in the tech giant's stock, fueled by unrelenting demand for its high-caliber chips and data center hardware, is boosting ETF portfolios with high exposure to it. With artificial-intelligence (AI) infrastructure cementing its position as the foundation of modern computing, investors are piling into Nvidia-heavy ETFs, all in on the chipmaker's ongoing dominance of the business. AI Power Play Despite U.S. export restrictions and mounting geopolitical complications, Nvidia's businesses have powered ahead. The company's first-quarter revenue jumped 69% year-on-year to $44.06 billion, with the data center business contributing $39.1 billion alone, up 73% from last year. The release of the chipmaker's Blackwell GPUs, already being used in scale by Microsoft , Meta META, Amazon AMZN, Alphabet GOOGL, and others, highlights the dominance of the company in AI acceleration. CEO Jensen Huang has said that nations now see AI as "essential infrastructure," positioning Nvidia in the midst of a global technological revolution. The firm's latest expansions, AI factories in Saudi Arabia and the U.S., a new Stargate infrastructure cluster in the UAE, and China-focused chip plans, further bolster its global ambitions. Why This Matters For ETFs The market's renewed optimism on Nvidia is spreading through AI and semiconductor ETFs, many of which have large allocations to the stock. Below are some of the most significant such ETFs investors are watching, and each is up more than 10% in the past month: These ETFs provide diversified exposure to semiconductors but are obviously riding Nvidia's dominance in the AI gold rush. For The Daring: Single-Stock Leverage Plays Risk-loving investors can also use leveraged single-stock ETFs that provide double daily exposure to Nvidia: T-REX 2X Long NVIDIA Daily Target ETF NVDX, up more than 50% in the past month. GraniteShares 2x Long NVDA Daily ETF NVDL, up more than 52% in the past month. These tools, although risky, offer leveraged returns directly correlated with Nvidia stock movements, perfect for those bullish on sustained AI momentum. Bottom Line Nvidia reclaiming market-cap crown is more than just a symbolic win. It's a turning point in the evolution of the market, with AI infrastructure now at the forefront of portfolio strategies. For ETF investors, this translates to staying on top of those funds with high Nvidia exposure, not merely for what they own today, but for what the future of technology is quickly becoming. Read Next: How Nvidia's $10 Ripple Effect Could Lift Adobe, Salesforce, ServiceNow Photo: Shutterstock NVDANVIDIA Corp$142.600.48%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum70.60Growth98.62QualityNot AvailableValue6.91Price TrendShortMediumLongOverviewAMZNAmazon.com Inc$211.662.14%GOOGLAlphabet Inc$169.761.02%METAMeta Platforms Inc$689.210.18%MSFTMicrosoft Corp$466.780.63%NVDLGraniteShares 2x Long NVDA Daily ETF$58.171.04%NVDXETF Opportunities Trust T-Rex 2X Long NVIDIA Daily Target ETF$12.051.02%SHOCEA Series Trust Strive U.S. Semiconductor ETF$48.550.67%SMHVanEck Semiconductor ETF$254.140.95%SMHXVanEck Fabless Semiconductor ETF$28.860.63%SOXYTidal Trust II YieldMax Target 12 Semiconductor Option Income ETF$48.160.09%Market News and Data brought to you by Benzinga APIs

[6]

Nvidia Overtakes Microsoft As The World's Most Valuable Company With $3.4 Trillion Market Cap As Morgan Stanley Reaffirms Top Pick Status - Apple (NASDAQ:AAPL), Amazon.com (NASDAQ:AMZN)

On Tuesday, Nvidia Corporation NVDA reclaimed the title of the world's most valuable publicly traded company, surpassing Microsoft Corporation MSFT. What Happened: Shares of Nvidia rose 2.80% during Tuesday's regular session and closed at $141.22, according to data from Benzinga Pro. This boosted Nvidia's market capitalization to $3.444 trillion, slightly ahead of Microsoft's $3.441 trillion. Apple, once the longtime market cap leader, now ranks third at $3.036 trillion, followed by Amazon and Alphabet. Also Read: OpenAI's Acquisition Of Jony Ive's Startup Poses Threat To Apple's Dominance Why It's Important: The rally follows Nvidia's first-quarter earnings last week. The company reported a revenue of $44.1 billion, marking a 69% increase year-over-year and a 12% rise from the previous quarter. The results surpassed Wall Street's consensus estimate of $43.2 billion. The surge reflects booming demand for its AI chips, used in everything from data centers to generative AI platforms. Morgan Stanley has also reaffirmed its "Overweight" rating on Nvidia, calling it a "unique opportunity" in the semiconductor industry and maintaining it as its top pick. Despite sector slowdown concerns, analysts remain confident in Nvidia's growth. Latest Startup Investment Opportunities: Rad IntelDealMakerMin. Investment$1,000IndustryAIGet Offer Elf LabsDealMakerMin. Investment$974IndustryTechGet Offer Meanwhile, Microsoft, which reported third-quarter revenue of $70.07 billion and exceeded the Street consensus estimate of $68.43 billion, has been going through massive layoffs. On Monday, it was reported that Microsoft has announced another round of layoffs, cutting over 300 jobs just weeks after its largest workforce reduction in years. Price Action: In the after-hours trading, Nvidia gained an additional 0.19% and had reached $141.49 at the time of writing. According to Benzinga's Edge Stock Rankings, Nvidia shows a strong price trend across short-, medium and long-term periods. Additional detailed metrics can be found here. Photo Courtesy: Evolf on Shutterstock.com Read Next: Why Google's Demis Hassabis Disagrees With Co-Founder Sergey Brin On When AGI Will Arrive: 'I Have Quite A High Bar' Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. AAPLApple Inc$202.960.62%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum42.45Growth32.95Quality78.46Value8.69Price TrendShortMediumLongOverviewAMZNAmazon.com Inc$205.90-0.36%GOOGAlphabet Inc$168.10-1.33%GOOGLAlphabet Inc$166.60-1.44%MSFTMicrosoft Corp$462.140.04%NVDANVIDIA Corp$141.492.99%Market News and Data brought to you by Benzinga APIs

[7]

Nvidia Just Became the World's Most Valuable Company. Here's What May Happen Next. | The Motley Fool

Nvidia (NVDA 0.51%) might be the company everyone's talking about thanks to its dominance in the high-growth area of artificial intelligence (AI), but it remained behind one other tech player, Microsoft, in terms of market value. Until this week. On June 3, Nvidia roared past the software giant to become the world's most valuable company with a market value of $3.444 trillion. Microsoft's market value totaled $3.441 trillion at the close of trading. This happened a week after Nvidia's fiscal 2026 first-quarter earnings report, one that maintained the company's track record of surpassing analysts' estimates and delivering double-digit revenue growth. And even though investors questioned the strength of AI demand and spending in recent months, Nvidia's words -- and comments from its biggest customers -- showed business still is booming. All of this is great news, but can this AI chip powerhouse maintain this position in the market cap top spot? It's important to note that this isn't the first time Nvidia has claimed the title of the world's most valuable company. In fact, just a few months ago, in January, Nvidia's market value surpassed those of Microsoft and smartphone giant Apple. But concerns about technology spending weighed heavily on Nvidia shares in recent months, and that pushed market value lower once again. Now, though, two elements clearly are driving this rebound in the AI giant. First, market sentiment and stock performance have improved in recent weeks on optimism that President Donald Trump's import tariffs won't result in extreme headwinds for corporate earnings. The U.S. struck an initial trade deal with China at lower-than-expected tariff levels and is working on a permanent arrangement. Lower tariffs suggest less strain on companies' budgets and on the consumer's wallet. Second, as mentioned, Nvidia reported strong demand for its latest release, the Blackwell architecture and chip, and noted that customers are rushing to the company for inferencing power. Nvidia's chips -- graphics processing units (GPUs) -- fuel this process that allows large language models to think through problems and generate answers. All of this helped Nvidia report a 69% increase in revenue to $44 billion in the quarter and deliver strong profitability on sales. Even including a charge Nvidia took for canceled sales to China following U.S. export controls, Nvidia's gross margin came in at more than 60%. And excluding the impact of the charge, Nvidia met its forecast of gross margin in the low-70% range. On top of this, forecasts showing the AI market will increase from hundreds of billions of dollars today to trillions of dollars by early next decade suggest there's room for Nvidia and other AI leaders to grow. So, will Nvidia keep its title as the world's biggest company? One potential risk to Nvidia's share price performance -- and market value gains -- is the situation concerning the export of AI chips to China. Today, U.S. restrictions prevent Nvidia from selling its H20 chip -- one that it designed specifically for the Chinese market -- to that country. If Nvidia remains completely blocked from the Chinese market, revenue growth and stock performance could suffer, at least in the short term. But any progress in that area, even small, could act as a catalyst for share gains. Considering all of these elements, the positive and the negative, I think Nvidia may once again remain neck and neck with Microsoft and Apple when it comes to market cap in the months and quarters to come. We might see each of these companies periodically take the top spot. If tariff issues and the China export situation are completely resolved, though, Nvidia could have the advantage. Nvidia's leadership and innovation in the high-growth AI market as well as its double-digit revenue increases quarter after quarter could eventually push it ahead, making it the world's biggest company for the long term.

[8]

Prediction: 3 Stocks That'll Be Worth More Than Microsoft 10 Years From Now | The Motley Fool

Microsoft (MSFT 0.27%) first became the world's biggest company based on market cap in September 1998. It stayed No. 1 for less than 18 months before being dethroned. But the software giant has clawed its way back to the top in 2025. I don't think Microsoft's reign will last very long this time, either. What's more, I predict that the following three stocks will be worth more than Microsoft 10 years from now. I suspect Nvidia (NVDA 0.51%) will move past Microsoft quite soon. It could even happen in a matter of days or weeks. Nvidia is certainly in the best position to knock Microsoft off its perch with its market cap already topping $3.3 trillion. What will it take for Nvidia to take the top spot? Not much. Any hiccup with Microsoft's business could be enough to enable Nvidia to regain the position it briefly held last year as the world's largest company based on market cap. However, I don't think Microsoft has to stumble for it to happen. Nvidia is poised to be the biggest beneficiary of several artificial intelligence (AI) trends, notably including the rapid adoption of AI agents that can reason. These AI agents require enormous computing power. Nvidia's GPUs remain the most powerful chips on the market for AI inference used by AI agents. It won't surprise me in the least if Nvidia becomes the first company with a market cap of $5 trillion. Sure, the restrictions on AI chip exports to China will hurt its growth to some extent. However, I don't think this headwind will keep Nvidia from becoming much larger over the next decade. Apple (AAPL -0.14%) dominated as the world's largest company throughout most of the last 10 years. Microsoft was its main rival for the No. 1 position during this period. Although Apple's market cap is now smaller than both Microsoft's and Nvidia's, I think the iPhone maker won't be in third place or lower by 2035. The big question hovering over Apple is: What's the next big breakthrough product for the company? Apple Watch has been successful, but it isn't in the same league as the iPhone. Apple's Vision Pro mixed-reality headset has been a commercial disappointment. Its generative AI functionality, branded as Apple Intelligence, hasn't provided the spark that many investors hoped it would, either. I think smart glasses just might be the much-anticipated next huge hit for Apple. Rumors are circulating that the company plans to launch its first AI-enhanced glasses as early as late 2026. These glasses will compete against Meta Platforms Ray-Ban AI glasses. But Apple is also reportedly working on smart glasses that support augmented reality (AR). This could be the real game-changer for the company. If Tim Cook and his team can leverage some of the technology used on Vision Pro, Apple just might be able to launch smart glasses that become nearly as must-have as the iPhone years ago. Amazon (AMZN 0.81%) has never been the world's largest company. It doesn't necessarily have to be to leap past Microsoft over the next 10 years, though. It wasn't too long ago that I thought Microsoft would be able to retain its market cap advantage over Amazon for years to come. Why have I changed my mind? Mainly because I suspect that Amazon Web Services (AWS) will be able to hold on to its leadership in the cloud services market more strongly than I anticipated in the past. Part of my shifting opinion is due to Microsoft's seemingly deteriorating relationship with OpenAI. Without OpenAI's ChatGPT, I don't believe Microsoft would claim the largest market cap today. The less tight the bond between the two companies, the less confidence I have that Microsoft Azure will be able to narrow the market share gap with AWS. Another reason why I'm more optimistic about Amazon now, though, is that the company continues to fire on all cylinders. Its AI initiatives are impressive, including the development of its own AI chips. The company's focus on the bottom line is paying off. Amazon is also expanding into new businesses, with the recent launch of its Project Kuiper satellites that will provide global internet access serving as a great example. Granted, Amazon must grow significantly faster than Microsoft over the next 10 years for its market cap to become larger. However, I predict that's exactly what will happen.

[9]

Prediction: This Unstoppable Stock Will Be the World's First $5 Trillion Company. (Hint: It's Not Apple.) | The Motley Fool

While Apple historically wins the race to various valuation milestones, I think a different company will beat it to the punch to the $5 trillion level, and no, it isn't Microsoft either. I believe that Nvidia (NVDA 0.51%) will win this race, and thanks to its unwavering growth, it will leave both of these two in the dust in the march toward $5 trillion. Just how quickly will Nvidia reach that valuation milestone? It may be quicker than you think. Nvidia's impressive rise can be tied to one trend: artificial intelligence (AI). Nvidia's primary products are graphics processing units (GPUs), which are high-powered computing devices that can process many calculations in parallel. GPUs can also be connected in clusters to amplify this effect, which is why you hear about AI supercomputing clusters being built with more than 100,000 GPUs. Nvidia is at the top of the GPU world, and most estimates point toward it having roughly a 90% market share. Few companies achieve that level of dominance, and no other company has ever been as dominant in a trend that is as important and quickly growing as AI. Nvidia's is truly an unprecedented story. That's why some investors (like me, in the past) underestimated Nvidia's potential. We've barely scratched the surface of what's possible with AI, and AI has yet to be fully integrated into workflows or personal life. This will require an unbelievable amount of computing power, which benefits Nvidia. A report by Dell'Oro Group says that 's data center capital expenditures in 2024 reached $455 billion, and Nvidia believes that number will it $1 trillion by 2028. If that's the case, then Nvidia's growth is far from over, something that its fiscal first-quarter results showcased. One thing that slightly affected Nvidia in the quarter was the loss of its China business. On April 9, the Trump administration established new rules that prevented Nvidia from selling H20 chips designed to meet the United States' previous export restrictions to China. This chip accounted for $4.6 billion of sales in Q1, which ended April 27, and Nvidia missed out on $2.5 billion in additional sales. Furthermore, the company expects about $8 billion in sales to be lost during the second quarter. This is unfortunate for Nvidia and hampers its growth case, but it provides some interesting numbers. For comparison's sake, let's add the lost $2.5 billion in sales to Q1's total and the $8 billion in Q2's projection. If we do that, these are the following growth rates that Nvidia would be posting (if it meets its guidance): Data source: Nvidia. Note: YOY = Year over year. For reference, during the fourth quarter of fiscal year 2025, Nvidia's growth rate was 78%. This clearly indicates a trend: Growth is accelerating despite Nvidia's massive size if the H20 sales are added back in for a proper comparison. Another point to note is that Nvidia's management tends to beat its internal revenue guidance, so these figures may be a bit conservative. Regardless, if the U.S. government didn't create some headwinds for Nvidia, its stock would be soaring due to accelerating revenue, but that gets buried behind the China story. Regardless, I think this is a bullish sign for investors, and this growth will likely persist for some time. Wall Street currently projects Nvidia will grow its revenue by just 26% next year, but I think that is an underprojection. Even if it does match Wall Street's expectations, it will generate around $250 billion in revenue. At Nvidia's current price-to-sales (P/S) ratio, that would value the company at over $5 trillion, so if it meets expectations (which I think it will blow away), it could reach that $5 trillion level as soon as next year. That growth makes Nvidia a screaming buy right now, as I think there's another growth story kicking off that investors aren't ready for.

Share

Share

Copy Link

Nvidia surpasses Microsoft in market capitalization, becoming the world's most valuable public company, fueled by strong AI-driven growth and record-breaking financial results.

Nvidia Surges to Top Spot in Market Valuation

Nvidia, the artificial intelligence chipmaker, has reclaimed its position as the world's most valuable publicly traded company, surpassing tech giants Microsoft and Apple. On Tuesday, Nvidia's market capitalization reached an impressive $3.45 trillion, edging out Microsoft's $3.44 trillion valuation

1

.

Source: Investopedia

Record-Breaking Financial Performance

The company's ascent to the top spot is backed by exceptional financial results. In its fiscal first quarter of 2026, Nvidia reported revenue of $44.1 billion, marking a staggering 69% increase from the previous year

2

. This performance significantly exceeded analyst expectations of $43.31 billion for the quarter.AI-Driven Growth

Nvidia's data center division, which is at the heart of the AI revolution, continued to be the primary driver of growth. It generated $39.1 billion in revenue, representing a 73% year-over-year increase

3

. The company's CEO, Jensen Huang, emphasized the global recognition of AI as essential infrastructure, positioning Nvidia at the center of this technological transformation.Market Dynamics and Competition

The race for the title of the world's most valuable company has been intense, with Nvidia, Microsoft, and Apple jostling for the top position over the past year. These three are the only companies to have ever achieved a market value exceeding $3 trillion

4

. Despite economic uncertainties and trade tensions, Nvidia and Microsoft have shown resilience, with their stocks up 5% and 9% respectively since the start of the year.

Source: Benzinga

Future Outlook and Challenges

Looking ahead, Nvidia projects revenue of $45 billion for the current quarter. However, the company faces challenges due to new U.S. export control laws. These regulations have resulted in a $4.5 billion charge in the first quarter and a reduction in non-GAAP gross margin from 71.3% to 61.0%

2

.Related Stories

Impact on ETFs and Investor Strategies

Nvidia's market dominance is having a significant impact on ETF portfolios with high exposure to the company. Several AI and semiconductor ETFs have seen gains of over 10% in the past month

5

. For risk-tolerant investors, leveraged single-stock ETFs offering double daily exposure to Nvidia have shown even more dramatic gains, with some up more than 50% in the same period.

Source: Benzinga

Conclusion

Nvidia's rise to the top of the market cap rankings signifies more than just a milestone for the company. It represents a shift in the tech landscape, with AI infrastructure becoming a central focus for investors and businesses alike. As Nvidia continues to innovate and expand its global presence, its performance will likely remain a key indicator of the AI industry's growth and impact on the broader technology sector.

References

Summarized by

Navi

[2]

Related Stories

Nvidia Surges Towards $4 Trillion Valuation, Fueled by AI Chip Demand

02 Jul 2025•Business and Economy

Nvidia Surpasses Apple as World's Most Valuable Company, Riding AI Wave

05 Nov 2024•Business and Economy

Nvidia's AI Chip Demand Propels It to Record Highs, Challenging Apple's Market Cap Crown

10 Oct 2024•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy