Nvidia CEO Jensen Huang's Net Worth Surges, Rivaling Warren Buffett's as Company Hits $4 Trillion Valuation

9 Sources

9 Sources

[1]

Nvidia CEO Jensen Huang sells another $37 million worth of stock

Nvidia CEO Jensen Huang sold another 225,000 shares of the chipmaker, totaling about $37 million, according to a U.S. Securities and Exchange Commission filing. The sale comes as part of a plan adopted in March for Huang to sell up to 6 million shares of the leading artificial intelligence company. Huang began trading stock last month. His most recent sale, disclosed last Friday, totaled 225,000 shares, or about $36 million. Since he began selling stock this year, Huang has unloaded 1.2 million shares, totaling about $190 million, according to InsiderScore. In last year's prearranged plan, Huang cashed in over $700 million. AI demand and the need for graphics processing units powering large language models have spiked Huang's net worth and propelled Nvidia past a $4 trillion market capitalization, making it the most valuable company. That surge in value has put Huang above Berkshire Hathaway's Warren Buffett in net worth on Bloomberg's Billionaire Index.

[2]

Nvidia CEO Jensen Huang could soon be richer than Warren Buffett -- he's worth $142 billion now

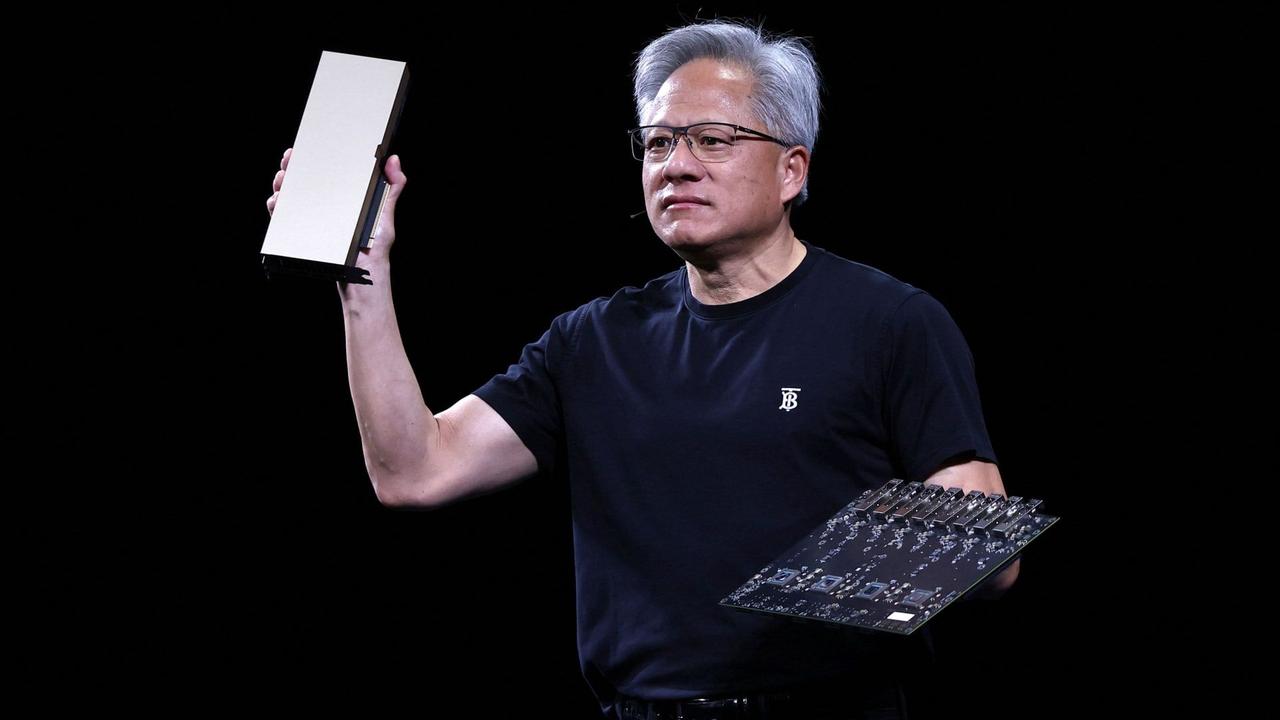

Nvidia CEO Jensen Huang visits Lawrence Berkeley National Lab to announce a U.S. supercomputer to be powered by Nvidia's forthcoming Vera Rubin chips, in Berkeley, California, on May 29, 2025. Nvidia co-founder and CEO Jensen Huang is now nearly as rich as longtime billionaire Warren Buffett -- and could even soon surpass the Oracle of Omaha, in terms of net worth. Huang, 63, has a $142 billion net worth -- including a $27.6 billion increase since January 1 -- according to a Bloomberg estimate on Wednesday evening. Much of his wealth comes from his roughly 3.5% stake in Nvidia, which is currently the world's most valuable public company. Nvidia's market cap briefly passed $4 trillion on Wednesday, making it the first to ever reach that benchmark, and its stock is up roughly 22%, year-to-date. In the technology industry's artificial intelligence arms race, Nvidia's computer chips have become valuable components for multiple leading AI developers. The company currently has a market cap of $4 trillion. Its market valuation could peak near $6 trillion, Loop Capital analyst Ananda Baruah said in a client note on Wednesday, according to Forbes. DON'T MISS: A step-by-step guide to buying your first home -- and avoiding costly mistakes Buffett's $144 billion estimated net worth has also grown since January 1 -- by $2.19 billion, according to Bloomberg. His conglomerate holding company Berkshire Hathaway has performed well in 2025 -- its stock is up approximately 5%, year-to-date -- but given Nvidia's growth rate, Huang could soon overtake Buffett on the list of world's richest people. Buffett, 94, has also given away some of his wealth. He recently donated $6 billion to five different charities, and has now given over $60 billion of his fortune away over the past two decades -- a number that's "substantially more than my entire net worth in 2006," Buffett announced in a press release on June 27. (Buffett's net worth that year was $46 billion, and he was the world's second-wealthiest person, behind Microsoft co-founder Bill Gates, according to Forbes.) Of course, Huang's net worth isn't guaranteed to surpass Buffett's. Despite Nvidia's year-to-date stock growth, the business has experienced large market swings in both directions in 2025. Nvidia's shares dropped 17% in one day on January 27, after a report that Chinese AI lab DeepSeek used reduced-capacity chips from Nvidia to power its then-new language model, sparking panic in investors. It was the biggest single-day drop for a U.S. company in history, with Nvidia losing almost $600 billion in market cap, CNBC reported at the time. The company's stock then fell 9% in one day on March 3, after U.S. President Donald Trump announced tariffs on Mexico, where the company hosts a portion of its manufacturing. But the company has been on a winning streak on Wall Street since June, perhaps a sign that investors' concerns have quelled -- at least, for now. Huang co-founded Nvidia with fellow engineers Chris Malachowsky and Curtis Priem in 1993, when he was just 30 years old. None of them had never run a company before, which may have worked in their favor, Huang told the "Acquired" podcast, in an episode that aired on October 15, 2023. "If we realized the pain and suffering, just how vulnerable you're going to feel, and the challenges that you're going to endure, the embarrassment and the shame, and the list of all the things that go wrong, I don't think anybody would start a company," said Huang. "I think that's the superpower of an entrepreneur," he added. "They don't know how hard it is, and they only ask themselves, 'How hard can it be?'" Are you ready to buy a house? Take Smarter by CNBC Make It's new online course How to Buy Your First Home. Expert instructors will help you weigh the cost of renting vs. buying, financially prepare, and confidently navigate every step of the process -- from mortgage basics to closing the deal. Sign up today and use coupon code EARLYBIRD for an introductory discount of 30% off $97 (+taxes and fees) through July 15, 2025.

[3]

Nvidia's Jensen Huang sells more than $36 million in stock, catches Warren Buffett in net worth

The sale, which totals 225,000 shares, comes as part of Huang's previously adopted plan in March to unload up to 6 million shares of Nvidia through the end of the year. He sold his first batch of stock from the agreement in June, equaling about $15 million. Last year, the tech executive sold about $700 million worth of shares as part of a prearranged plan. Nvidia stock climbed about 1% Friday. Huang's net worth has skyrocketed as investors bet on Nvidia's AI dominance and graphics processing units powering large language models. The 62-year-old's wealth has grown by more than a quarter, or about $29 billion, since the start of 2025 alone, based on Bloomberg's Billionaires Index. His net worth last stood at $143 billion in the index, putting him neck-and-neck with Berkshire Hathaway's Warren Buffett at $144 billion. Shortly after the market opened Friday, Fortune's analysis of net worth had Huang ahead of Buffett, with the Nvidia CEO at $143.7 billion and the Oracle of Omaha at $142.1 billion.

[4]

Nvidia CEO Jensen Huang's net worth passes Warren Buffett's

Nvidia became the first U.S. company to close at a $4 trillion market cap on Thursday -- and CEO Jensen Huang's fortune skyrocketed alongside his company's. Now, with an estimated $145.4 billion net worth, Huang has a higher net worth than Warren Buffett ($142 billion). While Buffett's wealth has inched upward this year, bolstered by Berkshire Hathaway's ever-stable performance, Huang's trajectory has been rocket-fueled. His estimated fortune has jumped nearly $28 billion in 2025 alone, thanks to a 20% year-to-date rise in Nvidia's stock price. On Thursday, Huang's net worth climbed $2.5 billion, according to Forbes. The company's GPUs have become the essential infrastructure for artificial intelligence development, making it one of the most valuable -- and essential -- firms in the global tech stack. And Huang is cashing in -- slowly. According to SEC filings, he began selling shares this summer under a pre-arranged 10b5-1 trading plan filed in March. So far, he's sold just over $40 million worth of Nvidia stock in June, but filings suggest he could sell up to six million shares by the end of the year -- potentially generating more than $850 million at current prices. Even after that, Huang will retain the vast majority of his stake, commanding almost 75.7 million shares directly and hundreds of millions more through trusts and partnerships. Meanwhile, Nvidia insiders -- including board members and executives -- have collectively cashed in over $1 billion worth of stock in the past year. Huang's ascent is a staggering one for a CEO who, just a few years ago, was better known in certain Silicon Valley circles than in the global billionaire class. Huang founded Nvidia in 1993, building it from a scrappy graphics card company into the backbone of the AI economy. Today, its chips power everything from OpenAI's large language models to Meta's data centers. Huang now ranks as the seventh-richest person in the world, according to Forbes' real-time billionaires list, ahead of Buffett, Steve Ballmer, and Sergey Brin. He trails Larry Page (No. 6) and sits within striking distance of French luxury titan Bernard Arnault and his family (No. 5). At the top of the list sit Elon Musk, Larry Ellison, Mark Zuckerberg, and Jeff Bezos. But don't count Huang out: He's built the infrastructure of AI's present -- and possibly its future. Now, he has a fortune to match. Buffett's net worth, meanwhile, has only budged a few billion this year, rooted in Berkshire Hathaway's diversified holdings and his well‑known tradition of charitable distributions. In June, he donated $6 billion in Berkshire B shares to five foundations, part of a long-standing philanthropic pledge to eventually give away over 99% of his wealth. Huang's rise is neither luck nor hype. Nvidia's AI edge is deeply structural. The company's H100 and Blackwell chips are the gold standard in AI training, and Huang has successfully positioned Nvidia as more than just a chipmaker -- he sees it as a full-stack AI platform, complete with software, networking, and even datacenter blueprints. Analysts see room for further growth, with some (such as Wedbush's Dan Ives) projecting a $5 trillion or even $6 trillion valuation within the next 12-18 months. For years, Buffett was the gold standard of American wealth, but Huang's ascent underscores a new era: one where fortunes aren't built over decades of compound interest but instead in the blink of an AI.

[5]

Nvidia CEO Jensen Huang Is Now as Wealthy as Warren Buffett. Here's How.

Nvidia CEO Jensen Huang, 62, has reached the same amount of wealth as Warren Buffett. Huang and Buffett have been ping-ponging back and forth for the No. 9 and No. 10 richest people spots with around $143 billion to $144 billion in wealth each, according to Bloomberg's Billionaires Index. Related: Nvidia Pulls Ahead of Apple and Microsoft to Become the World's First $4 Trillion Public Company Huang, who has been selling Nvidia stock as part of pre-arranged agreements, has gained $28.7 billion in wealth this year alone, per the Index. He unloaded $36.4 million worth of stock on July 8, per an SEC filing. Earlier this week, Nvidia became the world's first-ever $4 trillion company, flying past Microsoft and Apple. Huang has sold more than $1.9 billion in Nvidia shares to date, per Bloomberg. Huang co-founded Nvidia in 1993 and has been leading it ever since. He owned about 3.5% of the AI chipmaker as of March. CNBC reports that Huang still has more than 858 million shares of Nvidia in various trusts and partnerships.

[6]

Jensen Huang richer by another $28 billion this year amid Nvidia's $4 trillion feat

Nvidia CEO Jensen Huang has added a staggering $27.6 billion to his net worth in 2025 alone, after Nvidia briefly crossed a $4 trillion market valuation on Wednesday, making it the first publicly listed company to do so, and placing Huang among the top three billionaire gainers this year. Shares of Nvidia rose 2.8% to $164.42 on July 9, briefly pushing the company's market capitalisation above $4 trillion, a milestone no other listed firm has ever reached. Although the valuation pulled back by market close, the rally was enough to hand Huang a single-day wealth gain of $2.47 billion, according to Bloomberg Billionaires Index. Huang, who owns a 3.5% stake in Nvidia, is now worth $142 billion as on Thursday, July 10, ranking as the world's 10th richest individual. In 2025 so far, he is the third-largest gainer in terms of net worth, behind Oracle's Larry Ellison and Meta CEO Mark Zuckerberg, who have added $58.6 billion and $51 billion to their fortunes, respectively. The latest stock surge was fuelled in part by the launch of Comet, an AI-powered web browser from Nvidia-backed startup Perplexity AI. The product, announced on Wednesday, aims to challenge Google Chrome's dominance and marks the company's entry into the highly competitive browser space. According to Reuters, the launch marks Perplexity AI's entry into the competitive browser market, aiming to replace traditional navigation with agentic AI that can think, act, and decide on behalf of users. Chrome currently holds a commanding 68% share of the global browser market, StatCounter data shows. Comet enables users to ask questions, compare products, book meetings, and simplify workflows through a unified AI interface. The browser is also backed by heavyweight investors including Jeff Bezos and SoftBank. The euphoria around Nvidia's AI leadership has sent its stock soaring 21% year-to-date, far outpacing the Nasdaq Composite's 6.5% return. Over the last 12 months, Nvidia shares have gained 24%, compared to the Nasdaq's 11%. Since early 2023, Nvidia's market capitalisation has jumped tenfold, from $400 billion to the $4 trillion mark, making it the most valuable public company in the world, ahead of Microsoft ($3.7 trillion) and Apple ($3.1 trillion). At its peak valuation, a mere 5% increase in Nvidia's stock price would have added more to its market cap than the entire size of the Indian economy. The IMF estimates India's GDP at $4.2 trillion, expected to reach $4.27 trillion by the end of 2025. According to Bloomberg, Nvidia now accounts for 7.5% of the S&P 500 Index, near its highest level of index influence on record. The demand for its AI chips is widely seen as the most consequential tech shift since the launch of the iPhone nearly two decades ago. Also read | Nvidia at $4 trillion m-cap! Chip titan just 5% away from surpassing India's GDP (Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)

[7]

Is Nvidia's Jensen Huang closing in on Warren Buffett soon to climb higher on the world's richest list?

At 63, Nvidia co-founder and CEO Jensen Huang stands at a staggering $142 billion net worth, according to Bloomberg, placing him in striking proximity to billionaire investor Warren Buffett, whose fortune was recently estimated at $160.2 billion by Forbes . With Nvidia becoming the first-ever U.S. company to breach a $4 trillion market cap, largely fueled by the AI boom, Huang's wealth surge has catapulted him toward an elite class traditionally led by long-time titans like Buffett . Born in 1963 to Taiwanese immigrants and raised across Taiwan and Thailand, Jensen Huang's journey is the stuff of legend. After earning his degree from Stanford, Huang launched Nvidia from a Denny's restaurant at age 30 -- a small start that would spark a global semiconductor revolution . Through turbulence in the 1990s, he steered Nvidia away from near-bankruptcy and transformed it into a powerhouse in GPUs, high-performance computing, and AI. Since January, Huang's fortune has surged by over $27.6 billion, riding Nvidia stock's roughly 22% year-to-date increase . Fueled by escalating demand for AI, analysts expect further escalation. One bullish projection from Loop Capital sees Nvidia's market cap reaching $6 trillion, implying even steeper climbs in Huang's net worth . By contrast, Warren Buffett, known affectionately as the "Oracle of Omaha," has built his wealth steadily through decades of value investing at Berkshire Hathaway, now valued at over $800 billion. As of May 2025, Buffett's net worth rests around $160.2 billion . Should Nvidia's MS rally continue, Huang could eclipse this benchmark, marking a seismic shift in the wealth landscape. Buffett's legendary frugality and disciplined investment foundation stand in contrast to Huang's dynamic rise, driven by cutting-edge tech and AI. In May 2025, Buffett announced plans to pass the CEO mantle at Berkshire Hathaway to Greg Abel by year-end, a graceful step toward succession . Meanwhile, Huang remains firmly at the helm of Nvidia, directing it into promise-laden frontiers of AI and computing. Huang attributes his resilience and success in part to his entrepreneurial mindset. Speaking to the Acquired podcast in 2023, he emphasized that successful entrepreneurs often thrive because "they don't know how hard it is" ahead of time. "They only ask themselves, 'How hard can it be?'" he said, underscoring the audacity and bold vision that fuel innovation . This fearless spirit enabled Nvidia to navigate early turbulence and pivot into becoming a world leader in semiconductors and AI -- positioning Huang's net worth for explosive growth. If Huang surpasses Buffett, it won't just signal a change in wealth rankings -- it's a symbol of seismic economic and cultural shifts. It would underline how tech-driven innovation and AI are reshaping global fortunes, challenging long-established paradigms of investment and wealth creation. Are we witnessing a new era where visionary tech leaders not only rival but surpass the titans of traditional investing? For now, Huang is closing the gap at an unprecedented pace. With Nvidia's stock still riding high and AI permeating every industry, Jensen Huang's net worth may soon supplant Buffett's century-old benchmark. Whether he crosses that threshold or not, the acceleration of his wealth highlights a deeper narrative -- one of entrepreneurial daring, technological transformation, and the reshaping of how we define and build wealth in the 21st century.

[8]

Nvidia CEO Jensen Huang sells shares worth $36 million, net worth nears Buffett

Nvidia CEO Jensen Huang has sold $36.4 million worth of his company's shares, adding to previous sales under a prearranged trading plan. This move comes as Huang's wealth approaches Warren Buffett's due to Nvidia's success in the AI hardware market. Despite the sales, Huang still holds a significant number of Nvidia shares. Nvidia CEO Jensen Huang has sold shares of the chipmaking giant worth approximately $36.4 million, further trimming his holdings in the company he co-founded. The move comes as Huang's soaring net worth places him in close proximity to legendary investor Warren Buffett in global wealth rankings. According to CNBC reports, the latest transaction involved 225,000 shares and was part of a broader trading plan adopted in March, which allows Huang to sell up to six million shares of Nvidia through the end of 2025. He had earlier sold a separate tranche in June worth around $15 million under the same arrangement. Last year, Huang had divested nearly $700 million worth of shares under a similar prearranged plan. Following the most recent disclosure, Nvidia shares rose by about 1% in Friday trading, CNBC reported. The tech executive's wealth has surged alongside Nvidia's meteoric rise as a leader in the artificial intelligence hardware space. The company's GPUs have become indispensable for training and running large language models, fueling massive demand from both enterprises and investors. As per CNBC, Huang's net worth has jumped by over $29 billion just in 2025 so far, marking a gain of more than 25%. Bloomberg's Billionaires Index estimates his fortune at $143 billion, placing him nearly neck and neck with Berkshire Hathaway chairman Warren Buffett, who stands at $144 billion. The company itself has hit record-breaking milestones in recent months. CNBC noted that Nvidia became the first U.S. firm to cross a $4 trillion market capitalization earlier this week, surpassing tech giants Microsoft and Apple in the process. Despite his ongoing stock sales, Huang continues to hold over 858 million Nvidia shares, both directly and indirectly through various partnerships and trusts. Also read: Use market dips to build portfolios; these 8 sectors have high growth potential: Alok Agarwal (Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

[9]

Jensen Huang Is Closing in on Warren Buffett's Fortune And The Numbers Might Surprise You - NVIDIA (NASDAQ:NVDA)

Jensen Huang, co-founder and CEO of Nvidia, is on the verge of overtaking investment guru Warren Buffett in terms of net worth, thanks to the skyrocketing value of his company. What Happened: Huang's net worth has skyrocketed to $142 billion, marking an impressive increase of $27.6 billion since the beginning of the year. This wealth explosion is primarily due to his roughly 3.5% stake in Nvidia Corporation NVDA, the world's most valuable public company at present. Last week, Nvidia's market cap momentarily reached the $4 trillion milestone, a historic first. The company's stock has risen by 22% year-to-date, fueled by the robust demand for its computer chips in the AI technology sector. Loop Capital analyst Ananda Baruah suggests that Nvidia's market valuation could potentially reach a staggering $6 trillion, reports CNBC. Also Read: If I Were A Student Today, Here's How I'd Use AI To Do My Job Better, Says Nvidia CEO In contrast, Buffett's net worth, currently estimated at $144 billion, has seen a modest increase of $2.19 billion since the start of the year. Despite the strong performance of his holding company, Berkshire Hathaway Inc. BRK, Huang could soon outstrip Buffett in the wealth rankings due to Nvidia's rapid growth. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get Started It's important to note, however, that Nvidia's business has faced considerable market volatility in 2025, and Huang's net worth isn't guaranteed to surpass Buffett's. Despite these uncertainties, Nvidia has been on a roll on Wall Street since June. Why It Matters: The potential shift in wealth rankings underscores the increasing value of technology companies, particularly those in the AI sector. Nvidia's meteoric rise reflects the growing demand for advanced computer chips, a trend that is likely to continue as AI technology evolves. This could further bolster Huang's net worth, potentially solidifying his position above Buffett. However, the volatile nature of the tech market means that this is far from certain. The coming months will reveal whether Huang can maintain his company's impressive growth trajectory and secure his position in the wealth rankings. Read Next Nvidia CEO Jensen Huang's Joke Sparks Concerns Over Rapid Depreciation Of AI Chips Image: Shutterstock NVDANVIDIA Corp$164.900.49%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum75.97Growth98.61QualityN/AValue6.61Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia CEO Jensen Huang's net worth has skyrocketed to rival that of Warren Buffett, as Nvidia becomes the first $4 trillion public company. Huang's recent stock sales and Nvidia's pivotal role in AI development highlight the shifting landscape of wealth and technology.

Nvidia's Meteoric Rise to $4 Trillion Valuation

Nvidia, the leading artificial intelligence chipmaker, has achieved a historic milestone by becoming the first U.S. company to close at a $4 trillion market capitalization

4

. This unprecedented growth has catapulted CEO Jensen Huang's net worth to new heights, placing him in direct competition with Warren Buffett for the title of one of the world's wealthiest individuals.Jensen Huang's Wealth Surge

Source: ET

Jensen Huang, the 62-year-old co-founder and CEO of Nvidia, has seen his net worth skyrocket to an estimated $145.4 billion

4

. This remarkable increase, largely driven by Nvidia's stock performance, has propelled Huang past Warren Buffett's $142 billion net worth on some wealth indexes3

4

. Huang's fortune has grown by approximately $28 billion in 2025 alone, reflecting a 20% year-to-date rise in Nvidia's stock price4

.Strategic Stock Sales and Ownership

Despite his growing wealth, Huang has been strategically selling portions of his Nvidia holdings. According to recent SEC filings, he sold 225,000 shares totaling about $37 million as part of a prearranged trading plan adopted in March

1

3

. This plan allows for the sale of up to 6 million shares by the end of the year, potentially generating over $850 million at current prices4

.However, it's important to note that Huang retains a substantial stake in the company. He still owns approximately 3.5% of Nvidia, with direct ownership of 75.7 million shares and hundreds of millions more through trusts and partnerships

4

5

.Related Stories

Nvidia's AI Dominance and Future Prospects

Source: CNBC

Nvidia's remarkable valuation is largely attributed to its dominance in the AI chip market. The company's graphics processing units (GPUs) have become essential components for AI development, powering large language models and data centers for tech giants like OpenAI and Meta

2

4

.Analysts remain optimistic about Nvidia's growth potential, with some projecting a possible $5 trillion or even $6 trillion valuation within the next 12-18 months

4

. This optimism is rooted in Nvidia's structural advantages in the AI industry and Huang's vision of the company as a full-stack AI platform.The Changing Landscape of Wealth and Technology

Source: ET

Huang's rapid ascent in the billionaire rankings underscores a shift in how fortunes are made in the modern era. While Warren Buffett's wealth has grown steadily through traditional investment strategies and compound interest, Huang's net worth has exploded in a relatively short time frame, driven by the AI boom

4

.This changing dynamic reflects the growing importance of technology, particularly AI, in shaping the global economy and wealth distribution. As Nvidia continues to play a pivotal role in AI infrastructure, Huang's position among the world's wealthiest individuals serves as a testament to the transformative power of innovation in the tech sector.

References

Summarized by

Navi

[2]

[3]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology