Nvidia's AI Chip Demand Propels It to Record Highs, Challenging Apple's Market Cap Crown

22 Sources

22 Sources

[1]

Here's Why Nvidia Just Broke Another Record and Could Take Apple's Crown as the Most Valuable Company in the World

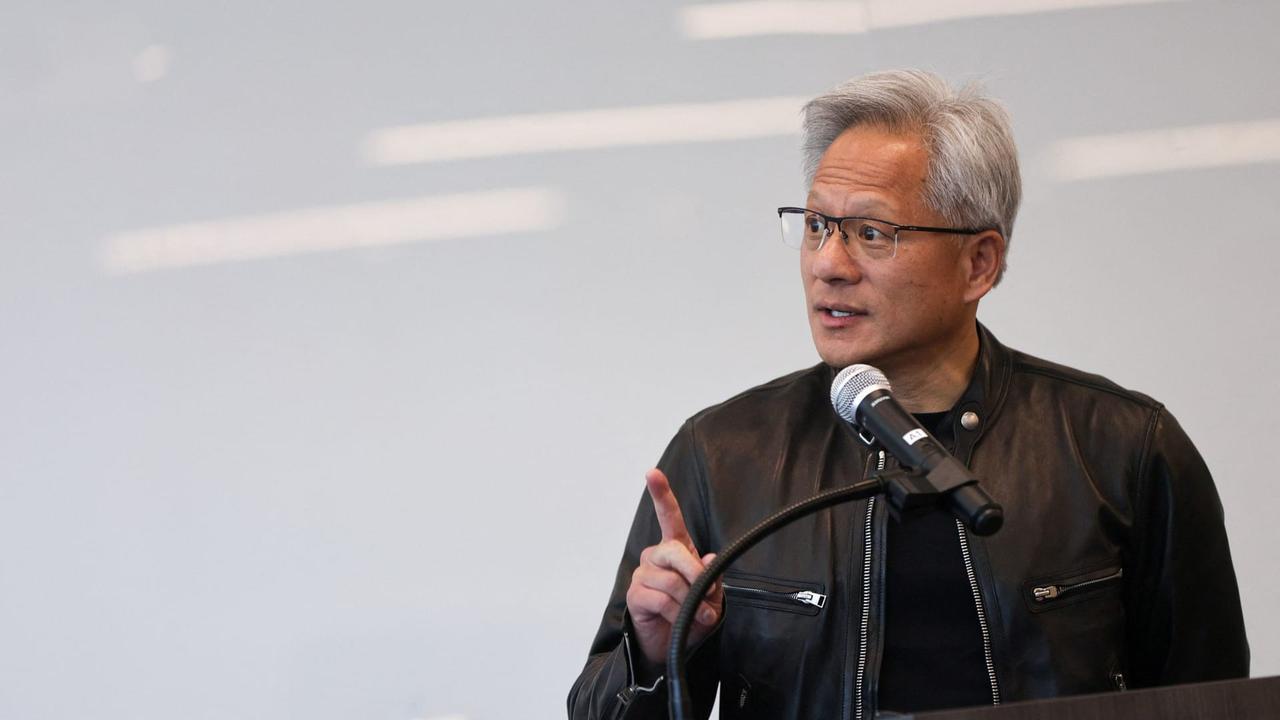

Nvidia CEO Jensen Huang said last month that the "insane" demand was his biggest worry. Nvidia is the second most valuable company in the world, with a market cap of over $3 trillion. At market close on Monday, shares of the AI chipmaker hit an unprecedented high of $138.07 before falling to $131.32 at the time of writing. Nvidia's performance is tied to strong demand for its AI chips. Nvidia CEO Jensen Huang stated recently that demand for Nvidia's Blackwell AI chip is "insane" and "everybody wants to have the most." Nvidia expects to ship enough of the new chip to make several billion dollars. Nvidia was briefly on the edge of unseating Apple as the most valuable company in the world on Monday. Last week, Nvidia shares grew by $400 billion in five days, more than the entire market cap of Costco. Related: Employees Who Worked at This Company for the Past 5 Years Are Now Multi-Millionaires in 'Semi-Retirement' Huang also said last month that demand was his biggest worry, or what kept him up at night. "We have a lot of people on our shoulders, and everybody is counting on us," he said, adding that having access to Nvidia's technology was a "really emotional" point for the company's clients. Nvidia counts the biggest tech players among its clients: Amazon, Meta, Microsoft, and Google contribute to more than 40% of its revenue. Nvidia's earnings beat analyst expectations last quarter, with revenue growing 122% year-over-year, the fourth quarter in a row of growth over 100%.

[2]

Nvidia Share Price Moves Could Unseat Apple as Most Valuable Company

Shares of Nvidia closed at their highest ever on Monday, putting the heavyweight AI chipmaker on the brink of dethroning Apple as the world's most valuable company. A Tuesday drop of about 5 percent by midday made it less likely the crown would pass, but investors remain focused on the prices of top tech firms. With investors betting on strong demand for its current and next-generation AI processors, the Santa Clara, California company's stock climbed 2.4 percent to end Monday at $138.07. In June, Nvidia briefly became the world's most valuable company. It was overtaken by Microsoft, and the tech trio's market capitalizations have been neck-and-neck for several months. The latest gains lifted Nvidia's market value to $3.39 trillion, just below Apple's $3.52 trillion value and above Microsoft's $3.12 trillion.

[3]

Nvidia notches record close, could unseat Apple as most valuable company

In June, Nvidia briefly became the world's most valuable company. It was overtaken by Microsoft, and the tech trio's market capitalizations have been neck-and-neck for several months.Shares of Nvidia closed at their highest ever on Monday, putting the heavyweight AI chipmaker on the brink of dethroning Apple as the world's most valuable company. With investors betting on strong demand for its current and next-generation AI processors, the Santa Clara, California company's stock climbed 2.4% to end the day at $138.07. In June, Nvidia briefly became the world's most valuable company. It was overtaken by Microsoft, and the tech trio's market capitalizations have been neck-and-neck for several months. The latest gains lifted Nvidia's market value to $3.39 trillion, just below Apple's $3.52 trillion value and above Microsoft's $3.12 trillion. Nvidia has been Wall Street's biggest winner from a race between Alphabet, Microsoft, Amazon and other major tech companies to dominate emerging AI technology. "We believe the major companies in AI ... face an investment environment characterized by a Prisoner's Dilemma - each is individually incentivized to continue spending, as the costs of not doing so are (potentially) devastating," TD Cowen analysts wrote in a report on Sunday. TD Cowen reiterated its $165 price target for Nvidia, which it called its "Top Pick", and it said demand for the company's current generation of AI chips remained strong. Nvidia in August confirmed reports that a ramp-up in production of its upcoming Blackwell chips was delayed until the fourth quarter, but downplayed the impact, saying customers were snapping up existing chips. As investors gear up for quarterly reporting season, Apple rose almost 2% and Microsoft added 0.7%, helping propel the S&P 500 up 0.8% to its own record high close. Nvidia, Apple and Microsoft account for about a fifth of the S&P 500's weight, giving them a hefty influence in the index's day-to-day gains and losses. Taiwan Semiconductor Manufacturing Co, the contract manufacturer that produces Nvidia's processors, is expected to report a 40% leap in quarterly profit on Thursday, thanks to soaring demand. Analysts expect spending to build out AI data centers will help Nvidia's annual revenue more than double to nearly $126 billion, according to LSEG data. While Nvidia's rally has lifted the S&P 500 to record highs, investors worry optimism about AI could evaporate if signs emerge of a slowdown in spending on the technology.

[4]

Nvidia rallies, poised to dethrone Apple as most valuable company

(Reuters) - Shares of Nvidia neared record highs on Monday, putting the heavyweight AI chipmaker on the brink of dethroning Apple as the world's most valuable company. With investors betting on strong demand for its next-generation Blackwell AI processors, the Santa Clara, California company's stock climbed 2.8% to $138.57, just short of its intraday record high of $140.76 on June 20. In June, Nvidia briefly became the world's most valuable company. It was overtaken by Microsoft, and the tech trio's market capitalizations have been neck-and-neck for several months. The latest gains lifted Nvidia's market value to $3.4 trillion, just below Apple's $3.5 trillion value and above Microsoft's $3.1 trillion. Nvidia has been Wall Street's biggest winner from a race between Alphabet, Microsoft, Amazon and other major tech companies to dominate emerging AI technology. "We believe the major companies in AI ... face an investment environment characterized by a Prisoner's Dilemma -- each is individually incentivized to continue spending, as the costs of not doing so are (potentially) devastating," TD Cowen analysts wrote in a report on Sunday. TD Cowen reiterated its $165 price target for Nvidia, which it called its "Top Pick". As investors gear up for quarterly reporting season, Apple rose 1.2% and Microsoft added 0.9%, helping drive the S&P 500 up 0.7% to its own record high. Taiwan Semiconductor Manufacturing Co, the contract manufacturer that produces Nvidia's processors, is expected to report a 40% leap in quarterly profit on Thursday, thanks to soaring demand. Analysts expect spending to build out AI data centers will help Nvidia's annual revenue more than double to nearly $126 billion, according to LSEG data. While Nvidia's rally has lifted the S&P 500 to record highs, investors worry optimism about AI could evaporate if signs emerge of a slowdown in spending on the technology. (Reporting by Noel Randewich; Editing by David Gregorio)

[5]

Nvidia could be about to knock Apple off the top spot for most valuable company

Shares of Nvidia has surged to a record high once more, closing at $138.07 on Monday, leading it well on its way to becoming the world's most valuable company again. Per CNBC, Nvidia had dropped a couple of places to make room for long-time leaders Apple and Microsoft after a very brief period in pole position. However the chipmaker has now overtaken Microsoft once more and set its sights on the Cupertino iPhone maker. With a market cap of $3.386 trillion, Nvidia is one of only three companies to have surpassed a three-trillion-dollar valuation. Nvidia's early entry into the artificial intelligence (AI) chip market has allowed it to become a dominant player in the ongoing AI race, with major tech companies and market cap rivals like Microsoft, Google, Meta and Amazon purchasing its processors to support their expanding AI infrastructure. Nvidia shares are up 186.6% this year to date, and up a staggering 2,800.6% over five years. Much of Nvidia's success must be credited to the public preview launch of ChatGPT in November 2022, which fueled widespread interest and adoption of the technology. In the space of twelve months, Nvidia has more than doubled its quarterly revenue to the sum of $30 billion thanks to its 95% share in the AI chips market. However, this is a long reach from Apple's most recent quarterly revenue of $85.8 billion. Furthermore, Nvidia's upcoming Blackwell chips could further boost revenue as companies look to acquire more powerful components to futureproof their infrastructure, which analysts predict could reach nearly $33 billion this quarter. If true, it would mark a considerable 82% year-over-year increase. However, despite off-the-scale figures, some investors remain cautious that optimism surrounding AI could fade, leaving Nvidia with little to hang on to.

[6]

Nvidia Rallies, Poised to Dethrone Apple as Most Valuable Company

(Reuters) - Shares of Nvidia neared record highs on Monday, putting the heavyweight AI chipmaker on the brink of dethroning Apple as the world's most valuable company. With investors betting on strong demand for its next-generation Blackwell AI processors, the Santa Clara, California company's stock climbed 2.8% to $138.57, just short of its intraday record high of $140.76 on June 20. In June, Nvidia briefly became the world's most valuable company. It was overtaken by Microsoft, and the tech trio's market capitalizations have been neck-and-neck for several months. The latest gains lifted Nvidia's market value to $3.4 trillion, just below Apple's $3.5 trillion value and above Microsoft's $3.1 trillion. Nvidia has been Wall Street's biggest winner from a race between Alphabet, Microsoft, Amazon and other major tech companies to dominate emerging AI technology. "We believe the major companies in AI ... face an investment environment characterized by a Prisoner's Dilemma -- each is individually incentivized to continue spending, as the costs of not doing so are (potentially) devastating," TD Cowen analysts wrote in a report on Sunday. TD Cowen reiterated its $165 price target for Nvidia, which it called its "Top Pick". As investors gear up for quarterly reporting season, Apple rose 1.2% and Microsoft added 0.9%, helping drive the S&P 500 up 0.7% to its own record high. Taiwan Semiconductor Manufacturing Co, the contract manufacturer that produces Nvidia's processors, is expected to report a 40% leap in quarterly profit on Thursday, thanks to soaring demand. Analysts expect spending to build out AI data centers will help Nvidia's annual revenue more than double to nearly $126 billion, according to LSEG data. While Nvidia's rally has lifted the S&P 500 to record highs, investors worry optimism about AI could evaporate if signs emerge of a slowdown in spending on the technology. (Reporting by Noel Randewich; Editing by David Gregorio)

[7]

Nvidia rallies, poised to dethrone Apple as most valuable company

Oct 14 (Reuters) - Shares of Nvidia (NVDA.O), opens new tab neared record highs on Monday, putting the heavyweight AI chipmaker on the brink of dethroning Apple (AAPL.O), opens new tab as the world's most valuable company. With investors betting on strong demand for its next-generation Blackwell AI processors, the Santa Clara, California company's stock climbed 2.8% to $138.57, just short of its intraday record high of $140.76 on June 20. In June, Nvidia briefly became the world's most valuable company. It was overtaken by Microsoft, and the tech trio's market capitalizations have been neck-and-neck for several months. Advertisement · Scroll to continue The latest gains lifted Nvidia's market value to $3.4 trillion, just below Apple's $3.5 trillion value and above Microsoft's $3.1 trillion. Nvidia has been Wall Street's biggest winner from a race between Alphabet (GOOGL.O), opens new tab, Microsoft, Amazon (AMZN.O), opens new tab and other major tech companies to dominate emerging AI technology. "We believe the major companies in AI ... face an investment environment characterized by a Prisoner's Dilemma -- each is individually incentivized to continue spending, as the costs of not doing so are (potentially) devastating," TD Cowen analysts wrote in a report on Sunday. Advertisement · Scroll to continue TD Cowen reiterated its $165 price target for Nvidia, which it called its "Top Pick". As investors gear up for quarterly reporting season, Apple rose 1.2% and Microsoft added 0.9%, helping drive the S&P 500 (.SPX), opens new tab up 0.7% to its own record high. Taiwan Semiconductor Manufacturing Co (2330.TW), opens new tab, the contract manufacturer that produces Nvidia's processors, is expected to report a 40% leap in quarterly profit on Thursday, thanks to soaring demand. Analysts expect spending to build out AI data centers will help Nvidia's annual revenue more than double to nearly $126 billion, according to LSEG data. While Nvidia's rally has lifted the S&P 500 to record highs, investors worry optimism about AI could evaporate if signs emerge of a slowdown in spending on the technology. Reporting by Noel Randewich; Editing by David Gregorio Our Standards: The Thomson Reuters Trust Principles., opens new tab

[8]

Nvidia shares hit record high, challenges Apple as world's most valuable company

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. What just happened? There have been plenty of warnings recently that Nvidia's meteoric rise over the last 22 months is about to come to an abrupt end, but we're still not seeing any signs of it happening. Team Green's share price has just hit an all-time high as it looks set to once again take the title of world's most valuable company. Nvidia's share price has been climbing since January 2023, back when it was $14.86. The company provides an estimated 80% or more of the advanced GPU hardware used for training and running AI models, such as the A100 and H100 series. With the generative AI revolution in full swing, Nvidia stock is now at an all-time high of $138.07, an 829% increase over the last year and a half. The price rise means that Nvidia's market capitalization has now hit $3.39 trillion. That puts it in second place on the list of largest companies by market cap, above Microsoft's $3.12 trillion and just below leader Apple's $3.52 trillion. Nvidia will almost certainly unseat Apple as the world's most valuable company if the current trend continues. It wouldn't be the first time that Jensen Huang's firm has been in this position. In June, the company briefly overtook Apple and Microsoft at the top of the rich list. It was reported last week that overwhelming demand for Nvidia's upcoming Blackwell GPUs had led to a 12-month backlog. Companies such as Microsoft, AWS, and Google have purchased every Blackwell GPU, which includes the B200 GPU and GB200 Grace super chip, that Nvidia and its manufacturing partner TSMC can produce for the next four quarters. To help meet Blackwell demand, Nvidia is partnering with Foxconn to significantly boost availability. The Taiwanese manufacturer said it is constructing the largest GB200 production facility in the world in Guadalajara, Mexico. Nvidia will be relieved to see its stock price reach a record high, considering there were warnings that the AI bubble had burst last month. A report on the state of the manufacturing sector and claims (which it later denied) that Nvidia had received a subpoena from the Department of Justice as part of an antitrust probe wiped $279 billion off the company's market cap, the largest one-day drop in US history. But it didn't take long for the firm to recover.

[9]

Nvidia's Record-Breaking Stock Price Challenges Apple's Tech Throne

As of now, Nvidia's market capitalization stands at US$3.39 trillion, just below Apple's US$3.52 trillion. In third place stands Microsoft (MSFT.O) with market value at US$3.12 trillion. This recent run-up follows after Nvidia recently briefly took over the top spot as the most valuable company in the world in June. However, it was quickly knocked off by Microsoft soon, ensuing a neck-to-neck competition between the two for the rest of the summer. Nvidia is dominating the AI space among some of the top Wall Street performers like Alphabet (GOOGL.O) and Amazon (AMZN.O). "We believe the major companies in AI ... face an investment environment characterized by a Prisoner's Dilemma -- each is individually incentivized to continue spending, as the costs of not doing so are (potentially) devastating," TD Cowen analysts said in a recent report. They highlighted that every firm is driven to continue investing heavily in AI since the risk of not doing so is catastrophic.

[10]

NVDA closes on record high, Nvidia could top Apple as world's most valuable company: Here's what's driving the latest rally

Chipmaker Nvidia's stock may just be the hottest thing on the stock market -- and as share prices rise, it's getting closer to becoming the most valuable company in the world. Nvidia's shares were up Monday, priced at more than $138 at the end of the trading day. That's up from below $135 on Friday, and up more than 18% over the past month. Opening up the aperture even more, Nvidia's shares are up almost 61% over the past six months, and more than 187% year-to-date. So, it's hard to say that there's a hotter stock on the market than Nvidia. But what's fueling the recent surge to start the week? In a broader sense, demand for chips to fuel AI technology is what's really giving the company a boost. But within the past week or so, analysts have reaffirmed their bullishness on Nvidia, which is what may be helping propel share prices.

[11]

NVIDIA stock closes at a record high: market value at $3.39T, just below Apple at $3.52T

NVIDIA stock closed at a new record high on Monday, topping $3.39 trillion and is expected to topple Apple as the most valuable company in the world sitting at $3.52 trillion market cap. The rise in NVIDIA stock is driven by the unstoppable success of its AI GPUs and its newly-launched Blackwell AI GPUs including the B200 AI GPU and GB200 AI servers, which can't be fabbed by TSMC and made quick enough, with an expected $210 billion in revenue from Blackwell chips alone in 2025. NVIDIA CEO Jensen Huang recently said that Blackwell AI GPUs are "in full production" and that the demand for them "is insane". TSMC is one of the key partners for NVIDIA and its runaway success in the AI market, with the Taiwanese semiconductor manufacturer set to enjoy a massive 40% increase in its quarterly profits, and expected to make that report later this week. There is the worry that we're in an AI bubble, but I don't see it going away anytime soon... every major company, every game developer, and everyone in between is using AI for something right now, and it will only increase in the future. Intel, AMD, Qualcomm are all enjoying processors on the market with NPUs for AI workloads, with so many new chips coming out in 2025 with AI-ready features.

[12]

Nvidia Poised To Overtake Apple As World's Most Valuable Company: How Much Jensen Huang's Company Needs To Gain By Wednesday - NVIDIA (NASDAQ:NVDA)

Nvidia ended Tuesday's session with a market capitalization of $3.260 trillion compared to Apple's $3.429 trillion. Nvidia Corp.'s NVDA nearly two-year run continues unabated even amid market swings as the Jensen Huang-led company has emerged as the poster child of artificial intelligence technology. The Wild Rally: Nvidia is the second best-performing S&P 500 stock for the year-to-date period behind only utility company Vistra Corp. VST. After ending 2023 with a robust gain of 240%, the stock has tacked on an incremental 168% so far this year. Nvidia, which started the week as the third most-valued company, overtook Microsoft Corp. MSFT on Monday and cemented its second position further on Tuesday. The AI stalwart's stock ended Tuesday's session up 4.05% at $132.89, according to Benzinga Pro data. The protracted rally marks a turnaround from 2022 when the stock fell over 50%, as the rising AI tide lifted all boats levered to AI technology. Nvidia's first-mover advantage, cutting-edge technology, full-stack AI solutions and a strong management team have been hallmarks of the company's success. Skeptics often have a red wave of heavy spending needed to keep the lead in the AI race and potential AI bubbles burst as headwinds. The company has defied the doomsday predictions as it continues to execute on plans and outperforms relative to expectations. See Also: How To Buy Nvidia (NVDA) Stock What Would Take To Push To Lead: Nvidia ended Tuesday's session with a market capitalization of $3.260 trillion compared to Apple's $3.429 trillion. The differential is $169 billion Nvidia has 24.85 billion in outstanding shares on a diluted basis. To catch up with Apple, assuming Apple's stock price either remains the same or declines, Nvidia has to add $6.8 to its per-share market price. This is not a tough ask, given Nvidia added $5.17 on Tuesday. Does the stock have it in it to make this jump to leapfrog past Apple? In premarket trading on Wednesday, Nvidia is up about a dollar, while Apple is down $1.28 or 0.57%. Speeches by a slew of Federal Reserve officials and the minutes of the September rate-setting meeting in which the central bank announced the first rate cut of the current monetary policy meeting cycle, could dictate sentiment in Wednesday's session. If not for any drastic stock-specific catalysts, the possibility of Nvidia ending Wednesday's session as the most valued company cannot be ruled out. Read Next: Nvidia Shares Riding On Huge AI Tailwind, Says Portfolio Strategist: Why Expert Says Stock Will Stay On An Upward Path For Next 2-3 Years Image via Shutterstock Market News and Data brought to you by Benzinga APIs

[13]

NVIDIA stock soars, closing at a new high of $138.07

NVIDIA's stock just hit a record high, closing at $138.07. If you're wondering why this is significant, let me take you through a clearer view of what's happening. NVIDIA is now the second most valuable company in the U.S., with a market cap of $3.4 trillion, right on the heels of Apple. In simpler terms, NVIDIA's meteoric rise is no accident -- it's tied to something much bigger: artificial intelligence, or AI for short. And here's why that matters. NVIDIA's surge in stock value (180% in 2023 so far) is because it controls a staggering portion of the AI chip market -- anywhere from 70% to 95%, depending on whose numbers you trust. What does that mean for you? Well, nearly every major AI development you've heard about -- think OpenAI's ChatGPT, self-driving cars, or the AI systems running complex data centers -- is powered by NVIDIA's technology. OpenAI, the company behind ChatGPT, just secured a massive $6.6 billion funding round. Why does this matter for NVIDIA? Because OpenAI is buying up NVIDIA's AI chips like there's no tomorrow. In fact, CEO Jensen Huang recently said NVIDIA's next-generation Blackwell chips are already sold out for the next 12 months. Think about that: products that aren't even out yet have waiting lists. That's what we'd call "insane" demand, as Huang himself put it. Companies like Microsoft, Meta, and Amazon are pouring billions into their AI infrastructure, all of which requires NVIDIA's chips. AI is a long-term growth driver, and NVIDIA is perfectly positioned to ride that wave. China tightens grip on AI chip market, targeting NVIDIA's influence The company is playing an intricate game on the global stage. Recently, NVIDIA partnered with Foxconn to build Taiwan's largest supercomputer. At the same time, Foxconn is setting up a megafactory in Mexico to assemble NVIDIA's servers, reducing NVIDIA's reliance on China in a time of trade tensions between the U.S. and China. This diversification is a strategic masterstroke. Why is this significant? Simple. NVIDIA is ensuring its supply chain is robust enough to meet global demand, while also hedging its bets against geopolitical risks. Now, not everything has been smooth sailing for NVIDIA. Earlier this year, its stock stumbled a bit after missing some earnings expectations. That's bound to happen when the hype train is moving at 100 miles per hour. Add in a subpoena from the U.S. Department of Justice over concerns about trade with China, and there were a few rocky months. At this point, you might be wondering, "Is NVIDIA really about to overtake Apple as the world's most valuable company?" Well, with a market cap of $3.4 trillion, it's getting closer by the day. Apple's still ahead at $3.5 trillion, but NVIDIA's rapid ascent makes it a serious contender for the top spot. Over the past year, NVIDIA, Apple, and Microsoft have been playing musical chairs with the top three spots on Wall Street. NVIDIA's rise tells us something important about the future of technology. So, if you're thinking long-term, NVIDIA is a company worth watching. The AI boom is far from over, and NVIDIA's hardware is essential to that growth. For investors, that means NVIDIA might still have plenty of room to climb, despite its already impressive gains. According to TradingView, NVIDIA recently reached an all-time high stock price of $139.42. As of the most recent data, NVIDIA's stock is trading around $136.71. With NVIDIA's Blackwell chips sold out for a year and demand for its AI infrastructure growing every day, the future looks bright for the chipmaker. Wall Street analysts are already predicting billions in revenue from NVIDIA's next-generation technology, and that doesn't even account for the sustained demand for its older GPU models. Disclaimer: The information provided in this article is for informational and educational purposes only and should not be construed as financial or investment advice. While the data discussed pertains to NVIDIA's stock performance and market trends, readers should not interpret this as a recommendation to buy, sell, or hold any securities.

[14]

Nvidia heads for record close as AI chipmaker's market cap tops $3.4 trillion

Nvidia shares headed for a record close on Monday as Wall Street gears up for earnings season and updates from all of the chipmaker's top customers on their planned spending on artificial intelligence infrastructure. The stock climbed 2.6% to $138.31 as of about 1 p.m. Eastern time. Its highest close to date was $135.58 on June 18. The shares are now up almost 180% for the year and have soared more than nine-fold since the beginning of 2023. Nvidia, widely viewed as the company selling the picks and shovels for the AI gold rush, has been the biggest beneficiary of the generative AI boom, which started with the public release of OpenAI's ChatGPT in November 2022. Nvidia's graphics processing units (GPUs) are used to create and deploy advanced AI models that power ChatGPT and similar applications. Companies including Microsoft, Meta, Google, and Amazon are purchasing Nvidia GPUs in large quantities to build increasingly large clusters of computers for their advanced AI work. Those companies are all slated to report quarterly results by the end of October. Of the billions of dollars the top tech companies are spending annually on their AI buildouts, an outsized amount is going to Nvidia, which controls about 95% of the market for AI training and inference chips, according to analysts at Mizuho. Nvidia's revenue has more than doubled in each of the past five quarters, and at least tripled in three of those periods. Growth is expected to modestly slow the rest of the year, with analysts projecting expansion of about 82% to $32.9 billion in the quarter ending in October, according to LSEG. Nvidia recently said that demand for its next-generation AI GPU called Blackwell is "insane" and it expects billions of dollars in revenue from the new product in the fourth quarter. With a market cap of $3.4 trillion, Nvidia is the second most valuable publicly traded U.S. company, behind Apple at about $3.53 trillion.

[15]

Nvidia, the AI chipmaker, just hit another record high | TechCrunch

Nvidia shares hit a record high on Monday, closing at $138.07 as Wall Street anticipates earnings updates from Microsoft, Meta, Google and Amazon on their AI infrastructure spending. The stock's climb has been stupefying -- surging nearly 180% this year, following a rapid climb last year; it's also a reflection of Nvidia's renowned stronghold on the AI chip market, 70% to 95% of which is controlled by the outfit, per estimates by Mizuho Securities. Indeed, with a market cap of $3.4 trillion, Nvidia is now the second-most valuable U.S. company, behind only Apple. At the center of it all is Nvidia CEO Jensen Huang, now himself worth an estimated $121.5 billion, per Forbes. The ride looks to continue, too. Alongside continuing demand for its current chips, Huang said earlier this month Nvidia is seeing "insane" demand for its next-generation Blackwell chips, which are slated to roll out in the fourth quarter. According to Morgan Stanley, which recently hosted meetings with Huang and other Nvidia execs, the chips are already sold out for the next 12 months.

[16]

Nvidia Stock Hits Record Closing High on Growing Optimism About AI Demand

Nvidia (NVDA) shares rose again Monday in the wake of bullish comments from Wall Street analysts. The stock gained 2.4% to finish at a record closing high of $138.07 and has nearly tripled in value this year, as demand for the company's chips to support artificial intelligence (AI) has surged. Shares are just shy of their intraday high of $140.76 set in June. Several stocks with ties to the chipmaker, including partners Arm Holdings (ARM), TSMC (TSM), and Nvidia-backed Soundhound AI (SOUN), gained Monday. The moves helped boost the tech sector, leading the S&P 500 index to a record high. In a note to clients Sunday, Citi analysts said Nvidia is "still king" when it comes to its client base in the AI accelerator market. They said they expect chipmaker's GPU sales to hyperscalers like Alphabet's (GOOGL) Google and Microsoft (MSFT) will double this year. Citi and all but one of the other 22 analysts covering Nvidia tracked by Visible Alpha held a "buy" or equivalent rating on the stock as of Monday, with a consensus price target of $152.41, implying about 10% upside from Monday's closing price. Citi's comments come after Goldman Sachs analysts said Friday they came away from an investor meeting with Nvidia CEO Jensen Huang "with a better appreciation of the company's competitive moat," citing the company's large customer base, "robust and growing" software offerings, and ability to innovate. The analysts said orders for Nvidia's Blackwell chip are booked out with lead times extending up to a year, and that Nvidia "expects supply to remain tight for the foreseeable future." Goldman Sachs analysts also maintained a "buy" rating on the stock, and raised their price target to $150 from $135 previously. A week ago, Nvidia overtook Microsoft as the world's second largest company by market capitalization, behind only Apple (AAPL). With Monday's gains, Nvidia's market cap is at $3.386 trillion, compared with Apple's $3.516 trillion. Apple, Nvidia and Microsoft are the only three companies with a market cap above $3 trillion.

[17]

Nvidia Leapfrogs Microsoft Following Meteoric Rally: Can It Reach All-Time High?

The chipmaker's market capitalization has surpassed Microsoft's for the second time. Nvidia has seen a remarkable surge in its market capitalization in recent days, propelling it past Microsoft to become the second most valuable company in the world. After Nvidia's value rose nearly 10% over the past week, shares hit $134.69 on Wednesday, Oct. 9, as they close in on their all-time price of $136.33 recorded on June 18. Nvidia Q3 Revenues Boosted by Blackwell Sales Against the backdrop of already bullish investor sentiment, Microsoft's announcement on Tuesday that it has integrated Nvidia's next-generation Blackwell system into its AI data centers further boosted optimism about the chip makers' revenues. The news was widely interpreted to mean that Nvidia's AI chip deliveries are moving ahead as planned, dispelling previous concerns over delayed shipments. As market analyst Jose Najarro observed , the fact that Microsoft already has a Blackwell system up and running means Nvidia will likely post the first revenues from the new platform in its third quarter financial statement, earlier than some pundits had expected. Alongside the positive Blackwell news, sales numbers reported by Nvidia supplier TSMC (Taiwan Semiconductor Manufacturing Company) on Wednesday propelled the latest rally even further. For comparison, in its most recent earnings call in July, TSMC forecast third-quarter revenues of between $22.4 billion to $23.2 billion. Surpassing Microsoft's Market Capitalization With its recent stock market performance, Nvidia's market cap stood at $3.235 trillion at the time of writing on Wednesday, surpassing Microsoft for the second time this year. Back in June, Nvidia briefly became the most valuable company in the world when its market cap rose to $3.34 trillion when it reached a new all-time high. Although it maintained the pole position for about a week, by the beginning of July, Nvidia's rally lost momentum and Apple and Microsoft regained the top two spots. Although a 3.2% rise will be enough for Nvidia's stock price to reach a new all-time high, with Apple's current market cap of $3.434 trillion, it will need to climb to nearly 6% to $138.2 per share to reclaim the top spot.

[18]

Nvidia shares hit new high as demand soars for AI supercomputer chips

Nvidia's shares closed at a record high on Monday, driven by growing optimism around the strong demand for its new supercomputing AI chips, Blackwell. Analysts have maintained their "buy" ratings and raised price targets, reflecting confidence in the company's continued success in the AI sector. Nvidia's stock soared to a record high on Monday, closing up 2.4% at $138.07 (€126.6), driven by strong demand for its new Blackwell supercomputing AI chips. This marks the second time Nvidia's shares have hit an all-time high this year, following a peak in June. The surge came amid positive analyst commentary and a broader rally in the technology sector, contributing to record closes for the Dow Jones Industrial Average and the S&P 500. Nvidia's shares have now risen by 180% year-to-date, making it the second-best performer in the S&P 500. After experiencing a sell-off in early September due to sector rotations and an antitrust investigation by the US Department of Justice, Nvidia shares quickly rebounded in October, rising 18% from the previous month. With Monday's close, Nvidia's market capitalisation surpassed $3.4 trillion (€3.12 trillion), solidifying its position as the world's second-largest company, behind Apple, which boasts a market cap of $3.51 trillion (€3.22 trillion). Microsoft ranks third, with a valuation of $3.12 trillion (€2.86 trillion). Nvidia's exceptional stock market performance is underpinned by strong revenue growth, which has tripled over the past four quarters. Its new Blackwell AI chips are in such high demand that production is reportedly booked out for a year, according to Morgan Stanley analysts. Nvidia CEO Jensen Huang recently confirmed that Blackwell is in full production, calling demand "insane," easing concerns over previous rumours of delays. Since the AI boom of 2023, Nvidia has become the leading beneficiary, with its Graphics Processing Units (GPUs) widely used by tech giants like Microsoft, Alphabet, Amazon, Meta, and OpenAI for AI applications. The company's CFO, Colette Kress, revealed that around 45% of Nvidia's Data Centre revenue came from these cloud providers in the second quarter. Nvidia currently supplies 80% of advanced AI chips used globally for training Large Language Models (LLMs). Josh Gibert, market analyst at eToro, said: "The bottom line is that the long-term story remains, demand is huge and the juggernaut that is Nvidia rolls on." He added that rising AI spending by tech giants will go straight to Nvidia: "AI spending will stay high and quite clearly remains a technology revolution rather than a passing fad." Citi analysts continue to label Nvidia as the dominant player in the AI sector and predict its AI chip sales to tech giants will double this year. The consensus from Visible Alpha suggests analysts maintain a "buy" rating on Nvidia stock, with an average price target of $152.41. Goldman Sachs analysts also raised their target price for Nvidia from $135 to $150, representing a 9% increase from current levels. The broader technology sector has regained momentum in October, as concerns about the pace of the Federal Reserve's rate cuts resurface. Investors have started rotating funds back into tech stocks, particularly those related to AI, as these companies tend to fare better in tough macroeconomic conditions due to their cash reserves and growth potential. AI-related stocks, in particular, are seeing renewed interest, bolstered by positive earnings from chipmakers. Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker, reported a 36.5% annual revenue increase for the third quarter, exceeding market expectations. TSMC supplies tech giants such as Apple and Nvidia. Additionally, US server company Super Micro Computer revealed that it ships over 100,000 high-end AI GPUs per quarter, signalling continued robust demand in the AI sector. Nvidia's upcoming third-quarter fiscal 2025 earnings report, due next month, will be closely watched by investors. Along with the US presidential election, it is expected to influence market trends, particularly amid ongoing concerns about potential restrictions on exporting AI chips to China. These developments could affect market sentiment, especially in the rapidly growing AI sector.

[19]

Nvidia's Value Balloons By $400 Billion In Only 5 Days - Now Exceeds The Entire Market Cap Of Costco

Nvidia's stock value has ballooned by an incredible $400 billion in just five days, causing quite the stir in tech and investment circles. Now at a staggering $3.26 trillion, as per Business Insider Africa, Nvidia has soared past many competitors, though it remains behind Apple and Microsoft in terms of global market capitalization. That $400 billion increase alone surpasses the entire market value of Costco, which is roughly $250 billion, even though the retail giant posted an impressive $254 billion in revenue last year. Don't Miss: The average American couple has saved this much money for retirement -- How do you compare? This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L'Oréal, Hasbro, and Sweetgreen in just three years - here's how there's an opportunity to invest at $1,000 for only $0.50/share today. The massive surge is largely thanks to Nvidia's AI-focused chips. The newly launched Blackwell chip, designed specifically for artificial intelligence, has been dubbed a game-changer. Nvidia CEO Jensen Huang called it "the engine to power this new industrial revolution." Major tech players like Microsoft, Oracle and Google seem to be on the same page, pouring their support into Nvidia's technology and betting on its future impact. Trending: 'Scrolling to UBI': Deloitte's #1 fastest-growing software company allows users to earn money on their phones - invest today with $1,000 for just $0.25/share In 2024 alone, Nvidia's stock jumped by 170% and since early 2023, its growth has been nothing short of explosive - up 800%, as per Reuters. The financial numbers are jaw-dropping. While Costco generated $7.4 billion in net income last year, Nvidia boasted a whopping $30 billion in profit from $61 billion in revenue. This speaks volumes about how profitable the tech space has become, especially compared to traditional powerhouses like Costco. Jensen Huang, now worth $106 billion, is at the heart of Nvidia's extraordinary run. With his focus on AI chip development, Nvidia has cemented itself as a key player in the ongoing AI revolution. Trending: The global games market is projected to generate $272B by the end of the year -- for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market. Beth Kindig from I/O Fund speculated that Nvidia could hit a valuation of $10 trillion by 2030 thanks to its then-anticipated Blackwell GPU chip, supported by its CUDA software platform. The ripple effects of Nvidia's success are hard to miss. The "Magnificent Seven" tech giants - Meta, Alphabet, Apple, among others - are all riding the AI wave, with Nvidia's technology fueling their stock's demand by 1%. AI integration is becoming a major part of daily life and Nvidia's chips are a crucial piece of that puzzle, pushing the tech market to even greater heights. But not everyone is cheering. Some experts have voiced concerns about the growing reliance on Nvidia in the chip industry. The worry is that if Nvidia becomes too dominant, it could lead to supply bottlenecks and increased prices, ultimately hurting competition. Read Next: Beating the market through ethical real estate investing' -- this platform aims to give tenants equity in the homes they live in while scoring 17.17% average annual returns for investors - here's how to join with just $100 This billion-dollar fund has invested in the next big real estate boom, here's how you can join for $10. Market News and Data brought to you by Benzinga APIs

[20]

These 2 Words Could Make Nvidia the First $4 Trillion Company | The Motley Fool

All eyes are on Nvidia (NVDA 1.63%) this week as the company is hosting its AI Summit in Washington, D.C. The three-day event will give Nvidia its latest opportunity to show off its AI innovations, including its brand-new Blackwell platform, which is now in production. The event will feature live demos and hands-on workshops in areas like generative AI, robotics, and industrial digitalization. The event also seems likely to focus on Nvidia's vision for the future, which centers around "AI Factories," the phrase CEO Jensen Huang likes to use in his vision of the data center of the future, and Nvidia's key role in running those AI factories. Nvidia laid out its plans in a recent investor presentation ahead of the AI Summit. With Nvidia's market cap now at $3.1 trillion, selling the market on his vision for AI factories and making that transition happen could drive the AI chip star to a valuation of $4 trillion, making it the first company ever to achieve that milestone. Let's take a closer look at Nvidia's plan to get there. Nvidia envisions a new, more advanced form of data center it calls AI factories, the purpose of which is to take data, process it, convert it into models, and finally convert it into usable pieces of information Nvidia calls "tokens." These AI factories will run on Nvidia's accelerated-computing platform. In this evolving paradigm, companies will produce digital intelligence that serves needs such as customer-service agents, drug discovery, autonomous vehicles, and weather predictions. Additionally, sovereign AI is becoming another large market for Nvidia, and nations are producing their own artificial intelligence to improve infrastructure, security, and communications. Nvidia thinks these AI factories will have a significant impact on all industries, from manufacturing to education to financial services. If this turns out to be true, the company is all but set to stay on top. Nvidia has a dominant share of the data-center graphics processing unit (GPU) market at an estimated 98% in 2023. While competition is heating up in that market as AMD launched its Mi300 accelerator and Intel recently introduced the Gaudi 3, Nvidia continues to think expansively with its new Blackwell platform. This platform is four times faster and also decreases power consumption by four times, versus the previous Hopper generation. Nvidia is also the only chip company that offers a full-stack solution for AI and accelerated computing thanks to its CUDA library of pre-built functions and software that runs on its GPUs. Finally, it's built the leading inference platform, which is accelerated by OpenAI's new o1, the newly released advanced model from the AI start-up. Unrelated to its AI summit this week, Nvidia got some good news from close partner-server provider Super Micro Computer, which said it's currently shipping more than 100,000 GPUs per quarter and noted that its ultradense servers include 8 Nvidia HGX GPUs. It also said its highly regarded liquid-cooling solution can hold up to 96 Nvidia B200 GPUs per rack. Nvidia shares rose on the news as it reaffirmed that demand for its products remains strong. While there's been concern among some investors that the cloud-infrastructure giants like Microsoft and Alphabet are overspending on AI, the facts on the ground continue to indicate otherwise, and innovations and tech accelerations like Blackwell should continue to incentivize AI investment. OpenAI, the leading generative AI start-up, also just nearly doubled its valuation to $157 billion in its latest funding round, in which Nvidia participated, which also shows that the market for AI technology continues to grow. Huang's vision of AI factories is becoming a reality as companies like OpenAI race to build artificial general intelligence. The AI chip maker could reach a $4 trillion valuation faster than you think.

[21]

Nvidia rides fierce Blackwell demand to record stock close

Nvidia Corp.'s shares are roaring back after the company successfully calmed investor concerns about product delays and its long-term growth prospects. The stock is up almost 14% this month, including a 2.4% gain on Monday that resulted in its first record close since June, though it remains below an intraday peak. It's the second-best performer in the S&P 500 Index this year. Recent strength came after CEO Jensen Huang said Nvidia's Blackwell chip "is in full production," and that demand for it "is insane," comments that came after Blackwell was delayed due to engineering snags, prompting a selloff that has now been erased. In addition, a report last week from Morgan Stanley analysts who met management said that Blackwell orders "are booked out 12 months or so," with "every indication that business remains robust with very high forward visibility." The comments cement the view that Nvidia is still a favored way to invest in artificial intelligence, especially as major companies remain committed to their AI initiatives. Microsoft Corp., for example, is projected to boost capex spending by nearly a third in fiscal 2025 to about $58 billion, according to the average of analyst estimates compiled by Bloomberg. "There had been questions about the impact production delays could have, so these updates are reassuring," said Zehrid Osmani, portfolio manager at Martin Currie Investment Management. Beyond the Blackwell optimism, recent sales from Taiwan Semiconductor Manufacturing Co. showed strong AI demand, while a funding round for OpenAI resulted in a $157 billion valuation. OpenAI recently released an AI model with reasoning capabilities, something Alphabet Inc. is also working on. These events "have driven a reinvigoration of interest in the space, and people are really getting excited about the use cases for reasoning-based AI," said John Belton, a portfolio manager at Gabelli Funds. "Reasoning represents a new area for Nvidia, and when you consider how compute-intensive it is, this could be a huge new product category." Belton views Nvidia as a core holding and sees AI offering "a steady drumbeat of demand" for years. "It's not an undiscovered stock, but the valuation is still reasonable if it can deliver the numbers that are expected." Analysts expect Nvidia's revenue to more than double in its current fiscal year, and rise another 44% the following one, according to data compiled by Bloomberg. The Street has continually raised estimates for Nvidia's earnings and profit over the past quarter. Nvidia's strong growth prospects have kept its valuation in check, helping bulls support their case to keep buying. It trades above 37 times estimated earnings, which represents a premium to the Nasdaq 100 Index, but is below its five-year average and under a June peak of more than 44 times. "Nvidia still looks formidable," said Osmani, of Martin Currie. "It remains really well positioned to harness the AI opportunity." Signs of optimism have also been flashing in the options market. On Thursday, there was a wave of purchases in calls that allow holders to buy more than 30 million shares at levels from $150 to $189 through March. Nvidia closed at $138.07 on Monday. The cost of calls relative to bearish put options -- known as the skew -- has fallen, making it cheaper to bet on a further rally. The contracts won't expire until after Nvidia's fourth-quarter earnings release, expected in late February. "The stock will remain volatile and orders will be lumpy," said Dan Flax, managing director and senior research analyst at Neuberger Berman. "But so long as Nvidia executes on its product road map, that will drive the kind of healthy growth that keeps the stock attractive."

[22]

Will Nvidia Be a $10 Trillion Stock by 2029? | The Motley Fool

From the beginning of 2019 to the end of 2020, Nvidia (NVDA -0.41%) more than tripled its market capitalization. Three years later, the value of the company tripled again. And in just the past 12 months, Nvidia stock is on the verge of tripling its market cap once again. Already one of the largest companies in the world with a $3.2 trillion market cap, is it possible Nvidia extends its streak to surpass $10 trillion over the next five years? Nvidia ended 2019 with a market cap of $144 billion. At the time, nearly half of its revenue stemmed from chips designed for the video game market, while the data center segment accounted for about 30%. But as of the most recent quarter, 87% of the top line comes from the data center and AI segment. This is undoubtedly the category that will most influence the future of the business. Part of the reason AI chips now dominate the company's top line is the sheer growth of the industry. In 2024, Gartner expects demand for AI chips to rise 33%. Over the next five years, average annual growth is expected to top 20%. Right now, Nvidia has a stranglehold on the market with an estimated 88% share of GPU spending. Data from Jon Peddie Research suggests Nvidia's market share has only continued to grow over the last 12 months. Even if Nvidia's market share pulls back in the face of competitive pressure over the next few years, the underlying market growth can still fuel strong results for the company. AI is on its way to becoming the biggest new trend in a generation, and there will be plenty of industry spending to go around. Wall Street analysts are forecasting 52.5% annual sales growth for Nvidia over the next five years, which is only a small decrease from the 57.2% compound annual growth it's delivered in the previous five years. When Nvidia had a $144 billion market cap five years ago, shares were valued at 15 times sales. As a $3.2 trillion company as of this writing, Nvidia's price-to-sales valuation has climbed to 34 (down from its peak at 46). Based on that year-end 2019 multiple, Nvidia would be worth $1.4 trillion today. While that's still impressive, it's a stark reminder to investors that Nvidia's value has surged thanks to multiple expansion as well as its underlying sales growth. Because Nvidia is growing so quickly, though, one could argue its premium valuation is justified. And if the company lives up to analysts' expectations for 52.5% annual revenue growth going forward, Nvidia will report a whopping $794 billion of revenue by 2029. At that level, the company would need a price-to-sales multiple of about 12.5 to bring its market cap to $10 trillion. There are zero guarantees this incredibly bullish scenario will come to pass, but if analysts' growth forecasts for Nvidia are even close to accurate, the company could indeed approach the $10 trillion milestone.

Share

Share

Copy Link

Nvidia's stock reaches unprecedented levels due to surging demand for AI chips, positioning the company to potentially overtake Apple as the world's most valuable company.

Nvidia's Meteoric Rise in the AI Chip Market

Nvidia, the Santa Clara-based AI chipmaker, has seen its stock price soar to unprecedented heights, closing at a record $138.07 on Monday

1

2

. This surge has propelled Nvidia's market capitalization to $3.39 trillion, positioning it to potentially overtake Apple as the world's most valuable company3

. The company's remarkable growth is primarily attributed to the booming demand for its AI processors, particularly in the wake of the AI revolution sparked by technologies like ChatGPT5

.Record-Breaking Performance and Market Position

Nvidia's stock has experienced an astounding 186.6% increase year-to-date and a staggering 2,800.6% growth over the past five years

5

. This phenomenal performance has placed Nvidia in an elite group of only three companies to surpass a $3 trillion market valuation5

. The company briefly held the title of the world's most valuable company in June before being overtaken by Microsoft, but recent gains have reignited the race for the top spot2

4

.AI Chip Demand and Revenue Growth

The driving force behind Nvidia's success is the insatiable demand for its AI chips. CEO Jensen Huang recently described the demand for Nvidia's new Blackwell AI chip as "insane," with expectations to ship enough units to generate several billion dollars in revenue

1

. This surge in demand has led to Nvidia's quarterly revenue more than doubling to $30 billion, largely due to its dominant 95% share in the AI chips market5

.Major Tech Companies Fuel Demand

Nvidia's client base includes tech giants such as Amazon, Meta, Microsoft, and Google, which collectively contribute to over 40% of its revenue

1

. These companies are heavily investing in AI infrastructure, creating a "Prisoner's Dilemma" scenario where each is incentivized to continue spending to avoid falling behind in the AI race3

4

.Related Stories

Future Prospects and Challenges

Analysts project that Nvidia's annual revenue could more than double to nearly $126 billion, driven by ongoing investments in AI data centers

3

4

. The upcoming release of Nvidia's next-generation Blackwell chips is expected to further boost revenue, with predictions of reaching nearly $33 billion in the next quarter, marking an 82% year-over-year increase5

.Market Impact and Investor Sentiment

Nvidia's success has had a significant impact on the broader market, helping to lift the S&P 500 to record highs

3

4

. However, some investors remain cautious about the sustainability of the AI boom, with concerns that a potential slowdown in AI spending could negatively impact Nvidia's growth trajectory3

5

.As Nvidia continues to ride the wave of AI innovation, its journey towards becoming the world's most valuable company highlights the transformative power of artificial intelligence in shaping the global technology landscape and financial markets.

References

Summarized by

Navi

[1]

[4]

Related Stories

Nvidia Surpasses Apple as World's Most Valuable Company, Riding AI Wave

05 Nov 2024•Business and Economy

Nvidia Briefly Overtakes Apple as World's Most Valuable Company Amid AI Boom

26 Oct 2024•Technology

Nvidia Reclaims World's Most Valuable Company Title, Driven by AI Boom

30 May 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy