Nvidia Stock Soars as U.S. Approves Resumption of AI Chip Sales to China

13 Sources

13 Sources

[1]

Nvidia rallies, leading market, on resumed AI chip exports to China

Why it matters: The export ban cost the company more than $10 billion in revenue, CEO Jensen Huang has said previously, so the reversal will come as a huge boon to its bottom line. By the numbers: Shares in Nvidia rose more than 5% in pre-market trading on Tuesday. * Given Nvidia's outsized importance across financial markets in recent years, that rally gave stocks a broad tailwind, with Nasdaq futures 0.6% higher. * Last week, Nvidia became the world's first $4 trillion company. Since the market bottom in early April, the stock has dramatically outperformed. What they're saying: The company, in a blog post published Monday, said "NVIDIA is filing applications to sell the NVIDIA H20 GPU again. The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon." What to watch: How soon those licenses are approved, and when it shows up in the company's bottom line.

[2]

Watch These Nvidia Price Levels as Stock Surges on News That China Chip Exports to Resume

Nvidia (NVDA) shares jumped premarket trading on Tuesday after the AI investor favorite said it plans to resume selling one of its most popular chips to China. The chipmaker, which recently became the first company in the world to reach a $4 trillion market capitalization, said it's filing applications with the U.S. government to resume sales of its H20 graphics processing unit (GPU) and has been given assurances that licenses will be granted. Nvidia also unveiled a new chip specifically for China called the RTX Pro GPU, which the company said is fully compliant with U.S. export controls and suitable for use in smart factories and logistics. Through Monday's close, Nvidia shares had gained nearly 90% from their early-April low and were up 22% since the start of the year, as major tech companies continue to ramp up spending on AI infrastructure that depends on the company's chips. The stock was up more than 4% at around $171 before the opening bell on Tuesday. Below, we take a closer look at Nvidia's chart and use technical analysis to identify key price levels worth watching out for. After reclaiming the closely watched 200-day moving average (MA) in mid-May, Nvidia shares have continued to trend higher, a move that has coincided with the relative strength index staying near its overbought threshold for most of that time, signaling strong price momentum. In another win for the bulls, the 50-day MA crossed back above the 200-day MA in late June to form a golden cross, a bullish chart pattern that points to a new trend higher. However, trading volume and volatility have contracted in recent months, suggesting market participants may be waiting for the chipmaker's earnings report next month before deploying further capital. When applying this technique to Nvidia's chart, we take the stock's trend higher throughout June and reposition it from this month's low. This projects a price target of around $178, implying about 8% upside from Monday's closing price. We selected this earlier trend as it followed a minor profit-taking dip, closely mimicking the current price action after a similar brief pullback at the start of July. The first lower level worth watching sits around $159. Retracements in the stock could initially find support near last month's high. Selling below this level could see the shares touch support near the key $150 level. Investors may look for buying opportunities in this location near a series of peaks that formed on the chart between November and January. Finally, a more significant pullback in Nvidia shares opens the door for a retest of lower support around $143. This area may attract buying interest near a consolidation period that developed on the chart in mid-June, which also aligns with a range of corresponding trading activity stretching back to late October. The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. Read our warranty and liability disclaimer for more info.

[3]

Nvidia Stock Jumps as Chipmaker Plans to Resume Sales of Key AI Chip to China

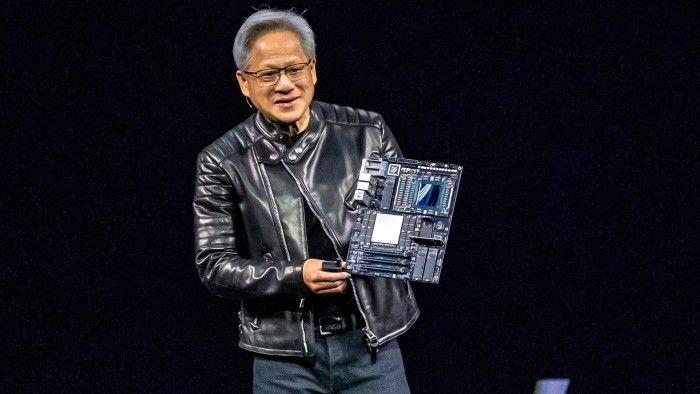

Nvidia shares surged in premarket trading Tuesday following the news. Nvidia said it plans to resume sales of its best-selling H20 AI chip to China, days after CEO Jensen Huang met with President Donald Trump. Shares of Nvidia surged close to 5% in premarket trading Tuesday following the news. Shares of Advanced Micro Devices (AMD), other chip companies, and Nvidia partners including Super Micro Computer (SMCI) also rose, boosting Nasdaq futures. The tech-heavy Nasdaq closed at a record high Monday. "NVIDIA is filing applications to sell the NVIDIA H20 GPU again," the company said in a blog post late Monday. "The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon," the chipmaker said. The green light from Washington marks a big win for Nvidia, as analysts had said the restrictions would send sales in China, a key market, down to "zero." The AI chipmaker said in May that it took a $4.5 billion charge in the fiscal first quarter associated with export curbs imposed by the Trump administration on sales of its H20 products to China. The H20 chips are less powerful than Nvidia's newer ones and had been tailored to meet prior export limits for the Chinese market. Separately, Nvidia announced a new RTX PRO AI chip that it said was "fully compliant" for the Chinese market. The White House didn't immediately respond to an Investopedia request for comment. Nvidia shares entered Tuesday up by more than a fifth this year.

[4]

Nvidia stock surges 4.47% in pre-market as U.S. clears H20 AI chip sales to China -- AMD up 3.18% too as AI trade door reopens

Nvidia stock surged 4.47% in pre-market trading after the U.S. government cleared the company to resume H20 AI chip exports to China. This greenlight could recover billions in lost revenue after Nvidia took a $4.5 billion hit when restrictions were enforced in April. AMD stock also climbed 3.18% pre-market as investor confidence in the AI chip market returned. Nvidia's new RTX Pro chip, designed to meet U.S. export rules, further boosts its China strategy. As Chinese giants like ByteDance and Tencent rush to order, investors now wonder -- could Nvidia hit $200 next?

[5]

Jim Cramer Says Nvidia Getting Trump Approval For H20 Sales To China Is 'So Huge, Could Turn The Nasdaq Futures Around' - Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), NVIDIA (NASDAQ:NVDA)

Jim Cramer believes that Nvidia Corp. NVDA is poised to get a significant boost with the U.S. government assuring licenses for the sale of its H20 chips or general processing units to China, a move that could considerably impact market sentiment. Check out the current price of NVDA stock here. What Happened: This development follows a period where U.S. export curbs, initiated in April, had effectively halted H20 chip sales to Beijing, despite the chips being designed to bypass earlier controls. The news has drawn immediate and enthusiastic reactions from market commentators. Cramer, host of CNBC's "Mad Money," took to X and said, "This Nvidia news, so huge, could turn the Nasdaq futures around." During the time of writing this article, Nvidia shares were up 4.28% on Robinhood. Similarly, Nigam Arora, known for his market analysis, posted that "More bullishness in stock futures on $nvda getting permission to sell H20 chips to China for AI." Nvidia confirmed the breakthrough in a statement Tuesday, expressing hopes to "start deliveries soon." This turnaround comes after extensive lobbying efforts by Nvidia CEO Jensen Huang, including a meeting last week with U.S. President Donald Trump, where Huang reiterated Nvidia's commitment to American job creation and AI leadership. Cramer also appreciated Huang for his efforts to turn this around. The potential change in U.S. stance also aligns with a preliminary trade framework agreed upon last month between Washington and Beijing, which included the easing of tech export curbs. See Also: Dan Ives Bets On Cybersecurity As 'Biggest Subsector' In Tech For 2025; Expects Strong Q2 Earnings From CrowdStrike, Zscaler, Palo Alto, Check Point Why It Matters: Ray Wang, research director at Futurum Group, told CNBC that "The lifting of the H20 ban marks a significant and positive development for Nvidia, which will enable the company to reinforce its leadership in China." He added that this, combined with upcoming export control-compliant RTX PRO AI chips, should act as a "fresh growth catalyst." Meanwhile, NVDA stock ended 0.52% lower at $164.07 apiece on Monday. The stock has advanced 18.62% on a year-to-date basis and 27.74% over a year. Benzinga Edge Stock Rankings shows that NVDA had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, whereas its value ranking was poor; the details of all the metrics are available here. The SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust ETF QQQ, which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Monday. The SPY was up 0.19% at $624.81, while the QQQ advanced 0.36% to $556.21, according to Benzinga Pro data. On Tuesday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher. Read Next: JPMorgan Stock Shows Mixed Signals Ahead Of Q2 Results Even As CEO Jamie Dimon Warns Of 'Complacent' Markets Ignoring Impact Of Trump Tariffs On Interest Rates Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: jamesonwu1972 / Shutterstock.com NVDANVIDIA Corp$163.87-0.64%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum81.59Growth98.61QualityN/AValue6.40Price TrendShortMediumLongOverviewQQQInvesco QQQ Trust, Series 1$555.680.27%SPYSPDR S&P 500$624.120.08%Market News and Data brought to you by Benzinga APIs

[6]

What Propelled Nvidia Near Its Record High In 2025? - NVIDIA (NASDAQ:NVDA)

Nvidia Corp. NVDA is trading close to its 52-week high of $161 on Tuesday. The stock has seen a notable increase this year, rising almost 18% year-to-date and gaining over 64% in market value in the last three months. This performance surpasses the broader market, as the S&P 500 and NASDAQ Composite indexes have generated approximately 6% in returns year-to-date. In May, Nvidia reported first-quarter revenue of $44.1 billion, a 69% increase year-over-year and a 12% sequential rise. This figure exceeded the Street consensus estimate of $43.2 billion, despite a new export ban impacting sales of its chips to China, one of its significant markets. Also Read: AI Momentum Powers Nvidia, Arm And Chip Supply Chain In BofA Recap Recent Key Events Impacting Valuation Several recent events have influenced Nvidia's valuation. On July 4, 2025, President Donald Trump unveiled the "Big Beautiful Bill," which would raise the semiconductor investment tax credit from 25% to 30% through 2026, giving chipmakers more substantial incentives to expand U.S. manufacturing. He also created the United States Investment Accelerator within the Commerce Department by executive order, shifting control of the CHIPS Act program directly under the White House. Although Trump previously criticized the $39 billion in grants and $75 billion in loans under the CHIPS and Science Act, he now backs pro-chip policies through this bill, which has cleared the Senate and is awaiting a House vote. Also in July, OpenAI confirmed it will continue using Nvidia AI chips at scale, rejecting Alphabet's GOOGL GOOG Google's tensor processing units (TPUs) despite a recent cloud deal with Google Cloud. Nvidia, in turn, reaffirmed its partnership with OpenAI, highlighting its role as the core hardware provider for OpenAI's AI models. Supply Chain And Export Controls Reportedly, contract chipmaker and key Nvidia supplier Taiwan Semiconductor Manufacturing Co. TSM has accelerated its U.S. expansion. This move is a response to Washington's chip tariff policies, leading TSM to delay the construction of its second plant in Japan to prioritize its growing American footprint. In March, TSM Chairman C.C. Wei announced an additional $100 billion U.S. investment, building on the $65 billion disclosed in April 2024. This expanded investment aims to boost domestic chipmaking to support major clients like Nvidia and Apple Inc. AAPL and reduce reliance on overseas production. Meanwhile, the U.S. is drafting new export controls to prevent Nvidia AI chips from reaching China via third-party routes, specifically through Malaysia and Thailand. This marks the first formal step in Trump's overhaul of prior AI chip export rules, though key security questions remain unresolved. These U.S. sanctions had previously compelled Nvidia to halt H20 chip exports to China on April 9, resulting in a $4.5 billion first-quarter charge for Nvidia, attributed to excess inventory and purchase commitments. Consequently, Nvidia projected its second-quarter revenue at $45 billion, approximately $780 million below estimates, citing an $8 billion impact from lost H20 sales due to these export restrictions. Analyst Projections Thirty-seven analysts have set a consensus price forecast of $179.17 for Nvidia. Loop Capital issued the highest forecast at $250 on June 25, 2025, while Seaport Global gave the lowest at $100 on April 30, 2025. The latest ratings from Citigroup (July 7), Mizuho (July 3), and Loop Capital (June 25) average a forecast of $208.33, suggesting a potential upside of 30.65% for Nvidia based on those recent views. NVDA Price Action: NVDA stock is trading higher by 0.82% to $159.59 premarket at last check Tuesday. Read Next: Telecom Stocks Are No Longer One-Size-Fits-All, Analyst Says -- Here's Which Company Stands Out Image by Jack Hong via Shutterstock NVDANVIDIA Corp$159.410.74%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum73.56Growth98.58QualityN/AValue6.90Price TrendShortMediumLongOverviewAAPLApple Inc$210.170.10%GOOGAlphabet Inc$178.140.33%GOOGLAlphabet Inc$177.380.33%TSMTaiwan Semiconductor Manufacturing Co Ltd$229.560.17%Market News and Data brought to you by Benzinga APIs

[7]

Nvidia Growth Estimates Get 10% Boost As US Lifts China Chip Export Curbs: Gene Munster Predicts 30-35% Growth For 2026 - Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), NVIDIA (NASDAQ:NVDA)

Nvidia Corp. NVDA is likely to experience an upswing in its growth estimates as the U.S. has lifted chip export curbs to China, bringing the Wall Street estimates about 10% higher, says this expert. Check out the current price of NVDA stock here. What Happened: According to Gene Munster, the managing partner at Deepwater Asset Management, the developments on chip exports to China should add back about 10% to Street estimates. However, he believes that some analysts may have already factored in the return of the H20 chips before the company's announcement. "That means that Street estimates should rise by about 10% on the news.," he said, adding that "Either way you look at it. Great news for $NVDA." This comes as the tech giant led by Jensen Huang took a hit in their first quarter after it faced an export ban on H20 products to China on April 9. The company said it incurred a $4.5 billion charge in the first quarter related to H20 excess inventory and purchase obligations. H20 product sales were $4.6 billion for the first quarter before the new export licensing requirements. Meanwhile, the chipmaker also said that its second-quarter revenue guidance of $45.0 billion, +/- 2%, included the loss of $8.0 billion in H20 revenue due to the export controls. However, Munster added in a following X post that this development of U.S. lifting supply restrictions on China will also uplift the company's future earnings. He said the company's 2026 growth estimates could rise from the current 25% to 30-35% growth. See Also: Jim Cramer Says Nvidia Getting Trump Approval For H20 Sales To China Is 'So Huge, Could Turn The Nasdaq Futures Around' Why It Matters: According to a company statement, Nvidia announced it will resume sales of its H20 GPU to China and unveiled a new RTX PRO graphics processor designed specifically for Chinese customers. This followed Huang's lobbying, including a meeting last week with U.S. President Donald Trump, where Huang reiterated Nvidia's commitment to American job creation and AI leadership. The new RTX PRO GPU was launched for sale in China to maintain market share while navigating heightened trade restrictions. However, the new development uplifts restrictions from H20 chips as well. The RTX PRO chip is "ideal for digital twin AI for smart factories and logistics," Huang announced. Price Action: Nvidia shares were up 3.62% overnight on Robinhood, as of the publication of this article. It ended 0.52% lower at $164.07 apiece on Monday. The stock has advanced 18.62% on a year-to-date basis and 27.74% over a year. Benzinga Edge Stock Rankings shows that NVDA had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, whereas its value ranking was poor; the details of all the metrics are available here. The SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust ETF QQQ, which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Monday. The SPY was up 0.19% at $624.81, while the QQQ advanced 0.36% to $556.21, according to Benzinga Pro data. On Tuesday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher. Read Next: JPMorgan Stock Shows Mixed Signals Ahead Of Q2 Results Even As CEO Jamie Dimon Warns Of 'Complacent' Markets Ignoring Impact Of Trump Tariffs On Interest Rates Photo courtesy: Shutterstock NVDANVIDIA Corp$163.87-0.12%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum81.89Growth98.62QualityN/AValue6.52Price TrendShortMediumLongOverviewQQQInvesco QQQ Trust, Series 1$555.68-0.10%SPYSPDR S&P 500$624.12-0.11%Market News and Data brought to you by Benzinga APIs

[8]

NVIDIA Scores Another Win As Malaysia Announces Chip Restrictions - Shares Gain 4.4% In Premarket

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. After reports surfaced about the Trump administration seeking to impose restrictions on Malaysia and Thailand for importing advanced GPUs, Malaysia has officially decided to restrict exports of high-end AI GPUs and chips without an export license. NVIDIA's GPUs are among the most widely sought commodities in the world, and despite CEO Jensen Huang's chagrin, the US government has restricted high-end GPU sales to China due to national security concerns. The Malaysian restrictions come after authorities in Singapore cracked down on networks purportedly smuggling high-end chips to China as the US restrictions continue to make an impact. NVIDIA's shares were dealt a minor setback earlier this year after the Trump administration decided to block the firm from selling its China-specific H20 GPUs due to fear of misuse. However, after the firm's earnings report in May demonstrated a smaller-than-expected hit to its revenue, the stock jumped and soon catapulted NVIDIA to the top of the global market value pie. The matter was resolved yesterday after NVIDIA revealed in a blog post that it had started accepting orders for the H20 GPUs with the hope that the Trump administration would grant licenses for the GPU exports. The shares have gained 4.9% in premarket trading so far on the news as investors grow increasingly bullish about the broader prospects of AI. Simultaneously, as NVIDIA assures investors that it will receive licenses for H20 GPUs, the Malaysian government has decided to levy export control measures for advanced AI chips. The move should further bode well for investor sentiment surrounding NVIDIA as it removes another potential headwind to the firm's revenue. Investment bank UBS believes that as much as 12% of NVIDIA's revenue could be from Malaysia due to the AI rollout in the country. As per the details, companies or entities seeking to ship advanced AI GPUs out of Malaysia are required to notify authorities at least 30 days before the shipments are expected to occur. With direct NVIDIA sales to China restricted, multiple reports have suggested that Asian nations, including Malaysia, Thailand and Singapore, have become transshipment hubs for Chinese entities to procure high-end AI GPUs. The potential for US chip sanctions on Malaysia grew after Singaporean authorities alleged that fraudulent transactions with Malaysia were part of an investigation regarding the illicit shipment of high-end NVIDIA GPUs to China. Despite hard-hitting sanctions against China, NVIDIA CEO Jensen Huang has asserted multiple times that depriving the Chinese of NVIDIA's AI GPUs can compromise America's lead in the global AI infrastructure race. Yet, government officials have countered and opined that militaristic use of AI GPUs could mean that American technology is used to subvert US national security objectives.

[9]

Trump's Latest Move On AI And China Propels Chip Stocks - NVIDIA (NASDAQ:NVDA)

Artificial intelligence (AI) chip stocks, including industry giants like Nvidia NVDA, Advanced Micro Devices AMD, and Taiwan Semiconductor Manufacturing Co. TSM, alongside key players such as Broadcom AVGO, Arm Holdings ARM, Marvell Technology MRVL, and Micron Technology MU, saw a significant surge in their stock prices on Tuesday. This market uptick was primarily driven by two major developments: reports indicating the Trump administration's plans to announce substantial AI and energy investments in Pennsylvania, and the U.S. government's decision to lift certain chip export restrictions to China. President Donald Trump is set to unveil a major initiative on Tuesday near Pittsburgh, detailing plans for approximately $70 billion in new investments in artificial intelligence and energy infrastructure. Also Read: Nvidia Outpaces Market With AI-Powered Growth, Nears Record Highs Bloomberg reported on Monday that this comprehensive plan encompasses the development of new AI data centers, the expansion of power generation capabilities, critical upgrades to grid infrastructure, and the introduction of new training programs and apprenticeships. This announcement represents a pivotal move in Trump's broader strategy to bolster America's leadership in AI by actively encouraging private investment, streamlining regulatory processes, and expediting permits for both technology and energy projects. The event, hosted by Senator David McCormick at Carnegie Mellon University, is expected to draw a distinguished gathering of around 60 top executives from various sectors, including leaders from BlackRock BLK, Palantir Technologies PLTR, Anthropic, ExxonMobil XOM, and Chevron CVX. Further underscoring the magnitude of these investments, Blackstone President Jon Gray is anticipated to announce a $25 billion initiative specifically targeting data center and energy infrastructure expansion. This project is projected to generate thousands of construction and permanent jobs, contributing significantly to the economy. This follows earlier announcements made under Trump's second term, notably a staggering $100 billion AI investment pledge from a consortium including SoftBank SFTBF SFTBY, OpenAI, and Oracle ORCL. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get Started These strategic moves, alongside the recent rollback of Biden-era AI chip restrictions, are explicitly aimed at counteracting China's aggressive advancements in AI and maintaining the United States' technological superiority on the global stage. Adding to the positive momentum for Nvidia and other chip stocks was the U.S. government's recent decision to ease chip export restrictions to China. This move is particularly impactful for companies like Nvidia, which had faced significant revenue setbacks due to previous bans. Gene Munster, managing partner at Deepwater Asset Management, expressed optimism, stating that Wall Street analysts are likely to raise Nvidia's growth estimates by approximately 10% following this development. While acknowledging that some analysts might have already factored in the return of Nvidia's H20 chips to the Chinese market, Munster still anticipates a boost to overall forecasts, emphasizing that, "Either way you look at it, great news for $NVDA." This is especially relevant given that Nvidia had previously incurred a substantial $4.5 billion charge in the first quarter of this year, directly attributable to the export ban on its H20 products to China, which was enforced on April 9. NVDA Price Action: NVDA stock is trading higher by 4.69% to $171.75 premarket at last check Tuesday. Read Next: Emergence Of UALink As A Viable Alternative Could Challenge Nvidia's Dominance, Analyst Asserts Image via Shutterstock NVDANVIDIA Corp$171.784.70%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum81.89Growth98.62QualityN/AValue6.52Price TrendShortMediumLongOverviewAMDAdvanced Micro Devices Inc$153.785.16%ARMARM Holdings PLC$147.452.01%AVGOBroadcom Inc$279.741.50%BLKBlackRock Inc$1090.00-1.93%CVXChevron Corp$151.30-0.23%MRVLMarvell Technology Inc$74.252.40%MUMicron Technology Inc$120.361.48%ORCLOracle Corp$232.811.54%PLTRPalantir Technologies Inc$148.53-0.42%SFTBFSoftBank Group Corp$71.72-%SFTBYSoftBank Group Corp$35.000.55%TSMTaiwan Semiconductor Manufacturing Co Ltd$233.592.15%XOMExxon Mobil Corp$113.58-0.30%Market News and Data brought to you by Benzinga APIs

[10]

Nvidia's H20 China Play Ignites A $15 Billion AI Bonanza - NVIDIA (NASDAQ:NVDA)

Jim Cramer's shouting "HUGE" for a reason - Nvidia Corp NVDA just scored a major geopolitical win. After a months-long U.S. export ban, the Donald Trump administration has greenlit shipments of Nvidia's H20 AI chips to China, setting off a Wall Street celebration. Nvidia stock surged 4.47% pre-market to $171.40, and analysts are already eyeing $180 as the next stop. Back in April, the H20 ban cost Nvidia $4.5 billion in stranded inventory and up to $15 billion in lost China sales. But CEO Jensen Huang's diplomatic maneuvering - including talks with U.S. and Chinese officials - flipped the script. Now, Chinese giants like TikTok parent ByteDance, Tencent Holdings ADR TCEHY and Alibaba Group Holding Ltd BABA BABAF are scrambling to lock in orders. Read Also: Jim Cramer Says Nvidia Getting Trump Approval For H20 Sales To China Is 'So Huge, Could Turn The Nasdaq Futures Around' $15 Billion Back In Play The H20 chip was custom-built for China's AI market under tighter U.S. export controls. With this green light, Nvidia stands to regain its 13% share of China revenue, and possibly more. The chip powers large language models and enterprise AI applications -- exactly the kind of tech Beijing is racing to scale. At the same time, Nvidia is doubling down with its new RTX Pro GPU, built on its Blackwell architecture and aimed at China's industrial AI boom, from factories to logistics. With both consumer and enterprise demand rebounding, the H20 approval may be the catalyst to reaccelerate Nvidia's revenue machine in Asia. Cramer: "Own It, Don't Trade It" Cramer is putting his stamp on the rally, urging investors to hold Nvidia long-term: "Own it, don't trade it," he posted, echoing his full-throated support for the stock's post-ban upside. His "HUGE!!!" endorsement underscores just how pivotal this policy reversal could be for Nvidia's near-term growth and long-term dominance. But the risks haven't vanished. Tensions between Washington and Beijing remain fragile, and the new approval comes with per-shipment licensing conditions, meaning regulatory whiplash is still on the table. For now, though, Nvidia's back in the China game -- and Wall Street's buying the comeback. Read Next: Nvidia Growth Estimates Get 10% Boost As US Lifts China Chip Export Curbs: Gene Munster Predicts 30-35% Growth For 2026 Photo: Shutterstock NVDANVIDIA Corp$170.734.06%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum81.89Growth98.62QualityN/AValue6.52Price TrendShortMediumLongOverviewBABAAlibaba Group Holding Ltd$114.726.01%BABAFAlibaba Group Holding Ltd$13.11-3.21%TCEHYTencent Holdings Ltd$65.412.75%Market News and Data brought to you by Benzinga APIs

[11]

NVIDIA's China AI GPUs Selling Like Hot Cakes As Firm Starts Accepting Orders - Report

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. Chip designer NVIDIA Corporation's GPUs are in high demand in China after the firm announced earlier that it had started to accept orders for the chips and believes the Trump administration will grant the firm export licenses. NVIDIA's announcement came as CEO Jensen Huang visits Beijing after being constrained earlier this year to sell products to China after restrictions on NVIDIA's H20 chips. NVIDIA and smaller rival and peer AMD's shares are up at market open today as the firms confirmed that they should soon be able to start selling AI chips to China. NVIDIA's stock opened 4.4% higher after the firm shared in an earlier blog post that it was accepting orders for the China-specific H20 AI GPU. NVIDIA added that it was confident that the Trump administration would grant the firm licenses to export the AI chips. While the firm's statement did not imply that the US had waived export license requirements for the H20 AI GPUs, it did nevertheless indicate that it could start shipping the chips to Chinese entities. Multiple reports have suggested that big Chinese technology firms continue to rely on NVIDIA's products due to their performance and software advantages. This reliance has also spurred Huawei to develop better AI chips to compete effectively with NVIDIA's products. NVIDIA's announcement was accompanied by the Malaysian government announcing its own set of export rules for advanced AI chips. These rules will require firms seeking to ship the chips outside Malaysia to inform the government at least 30 days before the shipments. Now, sources quoted by Reuters report that Chinese firms are rushing to place AI GPU orders with NVIDIA as the firm starts to accept them. The decision to place the orders reflects both the shortage of the chips in China and attempts to stock them should the US government decide to tighten the licensing process again in the future. Once the Chinese firms have placed the orders, NVIDIA will forward the details to the US government for approval. Reuters' sources add that ByteDance and Tencent are also submitting applications for the AI chips. Whether these applications will be approved is unclear, and the Trump administration might decide to use them as leverage in its negotiations with China. NVIDIA's optimism on Chinese sales is the result of a long-drawn campaign by CEO Jensen Huang to convince US officials that sanctions against China could prove to be counterproductive and stimulate the country's domestic AI industry. Huang believes that if Chinese firms rely on Huawei or other non-US AI chips, then America will lose the ability to dominate the global AI stack. However, sanctions hawks have warned that providing China with the latest AI chips can lead to their military use to potentially act against US national security interests.

[12]

Stock Market Today: Nvidia Edges Higher on AI Demand, Hitting a New All-Time High

Nvidia (NVDA 1.10%) shares climbed 1.1% to close at $160 today, bucking the cautious sentiment that weighed on major indices. The technology-heavy Nasdaq Composite gained just 0.03% and growth-focused S&P 500 retreated 0.07% amid concerns about tariffs, lingering inflation worries, and mixed economic signals. The AI chipmaking powerhouse traded in a narrow band between $158.39 and $160.22, demonstrating steady buying pressure throughout the session. Despite hitting a new all-time high, trading volume reached approximately 135 million shares, well below its 50-day average of 247 million. Within the semiconductor landscape, rival Advanced Micro Devices (AMD 2.24%) posted a better gain of 2.2% to close at $137.82, reinforcing the AI chip sector's resilience. Meanwhile, traditional chipmaker Intel (INTC 7.29%) jumped 7.2% to $23.59 on news of global layoffs and a price target upgrade by Citigroup. Nvidia continues to benefit from robust demand for its data center GPUs and AI acceleration solutions. The stock is trading at all-time highs, showing strength amid market uncertainty, reflecting institutional confidence in the company's dominant position in AI infrastructure and sustained growth trajectory in high-performance computing markets.

[13]

Nvidia: Why Did the Stock Price Hit a New ATH in Premarket Trading? | Investing.com UK

Nvidia Corporation (NASDAQ:NVDA) surged to new all-time highs in premarket trading on Tuesday, July 15, 2025, reaching $172.38 (+$8.31, +5.06%) as investors reacted positively to news that the U.S. government will allow the company to resume sales of its H20 AI chips to China. The development marks a significant reversal from the export restrictions imposed in April 2025, which had effectively halted Nvidia's H20 chip sales to the Chinese market. This breakthrough comes following a strategic meeting between Nvidia CEO Jensen Huang and President Donald Trump, highlighting the critical intersection of AI technology leadership and geopolitical trade relations. The resumption of H20 chip sales to China represents a pivotal moment for Nvidia, which had been significantly impacted by U.S. export restrictions imposed in April 2025. The H20 chips, specifically designed to comply with earlier export controls while still serving Chinese market needs, became subject to licensing requirements that effectively halted their sales. Jensen Huang had previously stated that chip restrictions had already cut Nvidia's China market share nearly in half, making this reversal particularly significant for the company's global revenue prospects. The policy shift follows a strategic meeting between Huang and President Trump, where the Nvidia CEO reaffirmed the company's commitment to American job creation and technological leadership in AI. This development aligns with a broader preliminary trade framework agreed upon between Washington and Beijing, which allowed for the relaxing of certain export controls in exchange for eased restrictions on rare-earth materials. The timing suggests that Nvidia's lobbying efforts and the broader geopolitical context have created an environment favorable to resuming technological trade with China. Industry analysts view this as a surprise development that could serve as a fresh growth catalyst for Nvidia in the coming quarters. Nvidia's premarket surge to $172.38 represents a dramatic 5.06% increase from the previous close of $164.07, demonstrating strong investor confidence in the company's renewed China prospects. The stock had closed down -0.85% (-0.52%) in regular trading on Monday, making the premarket rally particularly notable. With a current market capitalization of $4.001 trillion, Nvidia maintains its position as one of the world's most valuable companies, supported by exceptional financial metrics including a 51.69% profit margin and 115.46% return on equity. The company's recent performance has been impressive across multiple time frames, with year-to-date returns of +22.20% significantly outpacing the S&P 500's +6.58% gain. More dramatically, Nvidia's five-year return of +1,486.30% dwarfs the broader market's +96.04% performance over the same period, reflecting the company's successful positioning in the AI revolution. Current analyst price targets range from $100 to $250, with an average target of $173.92, suggesting the stock is trading near fair value despite its remarkable run. The technical and fundamental outlook remains strong, with the company reporting trailing twelve-month revenue of $148.51 billion and net income of $76.77 billion. Forward-looking metrics show a PE ratio of 38.31 and expected earnings growth that supports the current valuation. The combination of resumed China sales, strong domestic AI demand, and the company's technological leadership in GPU computing positions Nvidia for continued growth, though investors should monitor geopolitical developments that could impact future export policies. ***

Share

Share

Copy Link

Nvidia's stock rallies after the U.S. government assures licenses for selling H20 AI chips to China, potentially recovering billions in lost revenue and boosting the tech market.

Nvidia's Stock Rally and Market Impact

Nvidia Corporation's stock surged in pre-market trading, jumping by approximately 5%, following the announcement that the U.S. government has approved the resumption of H20 AI chip sales to China

1

. This development comes as a significant boost to the company, which had previously faced export restrictions that cost it an estimated $10 billion in revenue1

.

Source: ET

The news not only propelled Nvidia's stock but also had a broader impact on the market. The Nasdaq futures rose by 0.6%, indicating a positive sentiment across the tech sector

1

. Other chip companies and Nvidia partners, including Advanced Micro Devices (AMD) and Super Micro Computer (SMCI), also saw their stocks rise3

.The H20 Chip and Export Regulations

The H20 GPU is one of Nvidia's most popular chips, specifically designed for the Chinese market to comply with previous export controls

2

. The recent export ban had forced Nvidia to take a $4.5 billion charge in the fiscal first quarter3

. However, the company has now confirmed that it is "filing applications to sell the NVIDIA H20 GPU again" and has received assurances from the U.S. government that licenses will be granted1

.New China-Compliant RTX Pro GPU

Source: Motley Fool

In addition to the H20 chip, Nvidia has unveiled a new RTX Pro GPU specifically designed for the Chinese market

2

. This chip is fully compliant with U.S. export controls and is suitable for use in smart factories and logistics2

. This move further strengthens Nvidia's position in the crucial Chinese market.Related Stories

Political and Economic Implications

The approval for resuming chip sales to China aligns with a preliminary trade framework agreed upon last month between Washington and Beijing, which included the easing of tech export curbs

5

. This development follows extensive lobbying efforts by Nvidia CEO Jensen Huang, including a recent meeting with U.S. President Donald Trump5

.

Source: Benzinga

Market Analysis and Future Outlook

Analysts view this development as a significant positive for Nvidia. Ray Wang, research director at Futurum Group, stated that "The lifting of the H20 ban marks a significant and positive development for Nvidia, which will enable the company to reinforce its leadership in China"

5

.The stock's technical analysis shows strong momentum, with the relative strength index staying near its overbought threshold

2

. However, trading volume and volatility have contracted in recent months, suggesting that market participants may be waiting for the company's upcoming earnings report before making further moves2

.As Chinese tech giants like ByteDance and Tencent rush to place orders, investors are now speculating whether Nvidia's stock could reach $200 in the near future

4

. The coming weeks will be crucial in determining how quickly the new licenses are approved and when the impact will be reflected in Nvidia's bottom line1

.References

Summarized by

Navi

[2]

Related Stories

Nvidia Navigates US-China Tensions with Potential New AI Chip for Chinese Market

22 Aug 2025•Technology

Nvidia's China Deal: A Game-Changer for AI Chip Exports and Stock Performance

12 Aug 2025•Business and Economy

Nvidia Navigates US-China Tensions: CEO Huang Optimistic Despite Challenges

08 Oct 2024•Business and Economy

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation