Nvidia's China Deal: A Game-Changer for AI Chip Exports and Stock Performance

4 Sources

4 Sources

[1]

Nvidia will jump another 20% after report of China export license agreement, Wells Fargo says

A couple of catalysts could propel shares of Nvidia higher in the coming months, according to Wells Fargo. As investors gear up for the artificial intelligence's earnings after the bell Aug. 27, the firm increased its price target to $220 from $185 and reiterated an overweight rating on the stock. The firm's updated target implies 20.4% upside potential from Friday's close. This comes after The Financial Times reported that Nvidia and Advanced Micro Devices agreed to give the federal government a 15% share of their revenue from selling certain chips in China -- namely Nvidia's H20 chips and AMD's MI308 chips. The agreement allows the two companies to receive export licenses to sell those chips. "We would assume NVDA can recapture the full $8B/qtr revenue impact the H20 China ban was expected to have on the F2Q26 (July) qtr by F4Q26 (Jan)," analyst Aaron Rakers wrote in a note on Monday. "We would expect China demand to grow from the $8B/qtr level going forward." Along with the report of approved licenses to resume H20 chip sales in China, Rakers pointed to strength in U.S. imports of automated data processing (ADP) machines in June and Taiwanese exports of ADP machines in July "We see our analysis of highly correlated macro data points coupled w/ strong rptd + guided hyperscale capex trends as supporting solid upside," the analyst wrote. "We also appreciate that there has been increasing upside bogey sentiment into upcoming (8/27) F2Q26 print." NVDA 3M mountain NVDA, 3-month Shares of Nvidia were nearly 1% lower in the premarket Monday. Overall, the stock has had a solid year, outperforming the broader market with a 56% gain in the last three months and a 36% rise year to date.

[2]

Nvidia Stock Investors Just Got Good News From President Trump and Wall Street | The Motley Fool

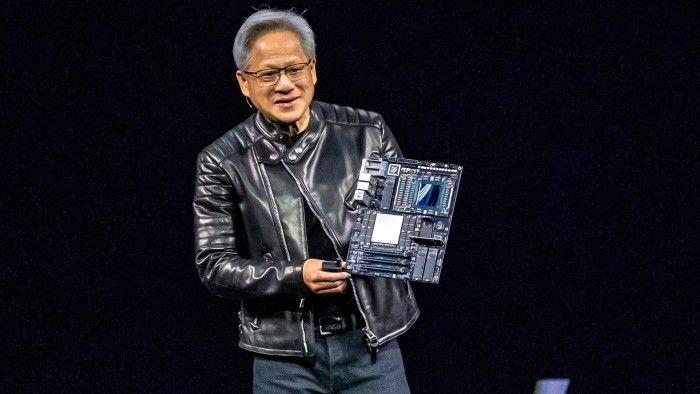

Nvidia can sell its AI chips in China, and hyperscalers are spending more heavily on data center infrastructure than Wall Street anticipated. Nvidia (NVDA -0.85%) stock has rocketed 35% year to date, and that momentum could continue in the coming months. Shareholders just received good news from President Donald Trump regarding export restrictions. They also got good news from Wall Street about how much money hyperscale cloud companies are spending on artificial intelligence (AI) infrastructure. Here's what investors should know. Since 2022, the U.S. government has progressively tightened export controls on AI technologies to keep sophisticated semiconductors and equipment away from the Chinese government and military. For Nvidia, one of the most jarring blows came earlier this year when the Trump administration banned the sale of its H20 GPUs in China. Nvidia took a $4.5 billion charge in the first quarter associated with excess inventory, and CFO Collette Kress warned, "Losing access to the China AI accelerator market, which we believe will grow to nearly $50 billion, would have a material adverse impact on our business going forward and benefit our foreign competitors worldwide." However, President Trump recently reached an agreement with CEO Jensen Huang that will let Nvidia sell H20 GPUs in China in exchange for 15% of the revenue generated from the sales going to the U.S. government. Put differently, Nvidia will pay the U.S. government for access to China. Of course, that raises an important question: What happened to the national security issues that made export restrictions necessary in the first place? Regardless, this development is still positive for Nvidia shareholders. Better yet, President Trump is reportedly open to a similar arrangement with Nvidia Blackwell GPUs. The company would have to build a scaled-back version of the chip, just as the H20 GPU is a scaled-back chip based on the Hopper architecture. But the Trump administration seems willing to let Nvidia operate in China for the foreseeable future, and that's good news for shareholders because China is the second-largest AI market in the world. Hyperscalers are companies with enormous data center footprints. Amazon, Microsoft, and Alphabet are the three most prominent, but the list also includes Meta Platforms, Oracle, CoreWeave, Apple, and several other companies that provide cloud computing services on a large scale. Investors closely track hyperscalers' capital expenditures because they have large budgets and their spending decisions provide insight into future trends. With June-quarter financial results now finalized, capital spending among the 11 largest hyperscalers is on track to reach $445 billion this year, up 56% from last year, according to Morgan Stanley. That is encouraging news for Nvidia shareholders. Before the June quarter, capital spending among the 11 largest hyperscalers was projected to increase 44% to $410 billion in 2025. In other words, the companies with the largest data center footprints are spending more than Wall Street expected, and most of that money is going toward AI infrastructure. Looking ahead, Bank of America estimates spending on data center AI systems will grow at 26% annually through 2030, with nearly 90% of the total sum going toward AI accelerators and networking hardware. Nvidia has a leadership position in both markets. It accounts for about 80% of AI accelerator sales and over 50% of generative AI networking equipment sales. So the company is well-positioned for future sales growth. Here's the bottom line: Nvidia may have opportunities in China that the market previously discounted, and capital spending among hyperscalers is tracking ahead of what Wall Street anticipated. As a result, several analysts have raised their earnings forecasts for Nvidia. The consensus estimate now says its adjusted earnings will grow at 43% annually through the fiscal year ending in January 2027. That makes the current valuation of 57 times adjusted earnings look reasonable.

[3]

Prediction: Nvidia's New China Deal Will Be a Game-Changer. Here's Why | The Motley Fool

Nvidia has agreed to pay 15% of its China sales to the U.S. government. Although it's only August, 2025 has already played out like a modern-day Greek tragedy for semiconductor powerhouse Nvidia (NVDA -0.85%). Its year has been marked by a litany of setbacks, comebacks, and everything in between. Earlier this year, more than $1 trillion of Nvidia's market value was wiped out. Yet today, the company boasts a market cap of $4.4 trillion -- reclaiming the crown as the most valuable company in the world. At the center of Nvidia's headaches in 2025 is China -- and no, not because of DeepSeek. The real culprit has been a wave of sweeping tariff policies and export controls that have curtailed Nvidia's influence in the Chinese AI market. Now, after months of negotiations with regulators in Washington, it appears that the tide may be turning. Nvidia could be on the precipice of reestablishing its presence in one of its most crucial Asian markets. Let's unpack the details of Nvidia's new deal structure in China and examine why it should be celebrated as a massive win for investors. According to accounting and consulting firm Deloitte, the global total addressable market (TAM) for semiconductors, as measured by sales, reached $627 billion in 2024. Deloitte projects that the market will grow at a compound annual growth rate (CAGR) of 19% over the coming decades -- ultimately reaching $2 trillion by 2040. Outside of the U.S., China remains one of the most important markets fueling demand for high-performance chipsets, particularly graphics processing units (GPUs). Nvidia CEO Jensen Huang has estimated that the AI opportunity in China alone could be worth as much as $50 billion. In 2024, Nvidia generated $130 billion in revenue, with China capturing roughly 13% of this sum. During the first quarter of 2025, Nvidia's $5.5 billion of China sales accounted for roughly 12.5% of total revenue. This leveling trend underscores how the current administration's policies toward China have started to constrain Nvidia's growth potential in the region. According to multiple news outlets, Nvidia has reached an agreement with Washington regarding its operation in China. Under the terms, Nvidia will pay 15% of its China-based sales to the U.S. government. In effect, the arrangement provides Nvidia with a pathway to penetrate this critical market through its tailored H20 chips. While this might initially resemble a tax, investors should avoid viewing it through that lens. First, the agreement applies to sales of Nvidia's AI chips rather than to profits, unlike traditional forms of taxation. Moreover, the 15% rate does not appear to be variable in structure like a royalty, which is typically tied to intellectual property (IP) and subject to fluctuate. While this deal might appear unusual at first glance, these structures are not without precedent in global business practices. For example, energy companies that extract natural resources or commodities in foreign countries often operate under similar revenue-sharing agreements with host nations in exchange for distribution rights. In my view, dedicating a modest share of sales to secure access to China represents a strategic trade-off. In the long run, it allows Nvidia to preserve its dominant position in one of the world's most important AI markets and prevents domestic rivals such as Huawei from eroding its competitive moat. While Nvidia's forward price-to-earnings (P/E) ratio has been expanding recently, levels remain muted compared to peaks reached previously during the AI revolution. In my view, part of this multiple compression reflects concerns surrounding China -- perhaps overly so. Nvidia's new agreement in Washington offers the company renewed momentum, securing revenue in a critical market without forfeiting much in the way of profits -- even with the 15% remittance to the U.S. government. Over the long term, I see this arrangement as a strategic mechanism for Nvidia to strengthen its position overseas and deliver durable growth across the global AI infrastructure market. As these fundamentals take hold, I think the company's valuation multiples could expand further, potentially driving the stock to new highs sooner than many investors may be expecting. For that reason, I see Nvidia stock as a no-brainer opportunity to buy hand over fist right now and hold for years to come.

[4]

NVIDIA Stock Slips 0.86% to $181.13 Despite Wells Fargo's 20% Upside Prediction

NVIDIA Corp. (NASDAQ: NVDA) stock may be poised for a 20% rally. Wells Fargo analysts projected this stock upside based on the company's latest US government deal on AI chip exports to China, according to a. This Trump NVIDIA arrangement is 'unusual', . It comes amid increasing tariff threats and trade war tensions. NVIDIA China chip deal would allow the company to resume exports of its H20 artificial intelligence chips to China. In exchange for it, the AI chip giant will pay the US government a 15% share of the sales. This arrangement, alongside strong US imports of automated data processing (ADP) machines, is seen as a favourable dual catalyst in Wells Fargo estimates.

Share

Share

Copy Link

Nvidia reaches an agreement with the US government to resume AI chip exports to China, potentially boosting its stock by 20% and recapturing a significant market share.

Nvidia's Landmark Agreement with US Government

Nvidia, the leading AI chip manufacturer, has reached a groundbreaking agreement with the US government that could significantly impact its market position and stock performance. The deal allows Nvidia to resume exports of its H20 AI chips to China, a market estimated to be worth nearly $50 billion, in exchange for a 15% share of the revenue generated from these sales going to the US government

1

2

.

Source: Motley Fool

This arrangement comes after months of negotiations and addresses the export restrictions imposed earlier this year, which had threatened to materially impact Nvidia's business. The agreement not only applies to the current H20 chips but may also extend to future Blackwell GPUs, suggesting a long-term solution to Nvidia's China market access

2

.Projected Stock Performance and Market Implications

Following this news, Wells Fargo has increased its price target for Nvidia from $185 to $220, implying a 20.4% upside potential. The firm's analyst, Aaron Rakers, expects Nvidia to recapture the full $8 billion per quarter revenue impact that the China ban was expected to have by the fourth quarter of fiscal year 2026

1

.The stock has already shown strong performance this year, with a 56% gain in the last three months and a 36% rise year-to-date. However, despite these positive projections, Nvidia's stock slipped 0.86% to $181.13 in recent trading

4

.Broader Market Trends and AI Infrastructure Spending

The agreement comes at a time of increased spending on AI infrastructure by hyperscalers - companies with enormous data center footprints. Capital spending among the 11 largest hyperscalers is projected to reach $445 billion this year, up 56% from last year, according to Morgan Stanley

2

.

Source: CNBC

Bank of America estimates that spending on data center AI systems will grow at 26% annually through 2030, with nearly 90% of the total sum going toward AI accelerators and networking hardware. Nvidia, with its 80% market share in AI accelerators and over 50% in generative AI networking equipment, is well-positioned to benefit from this trend

2

.Related Stories

Implications for Global AI Market and Competition

The deal is seen as a strategic move by Nvidia to maintain its dominant position in one of the world's most important AI markets. It prevents domestic rivals such as Huawei from eroding Nvidia's competitive advantage and allows the company to preserve its influence in the Chinese AI ecosystem

3

.However, questions remain about the national security implications that initially led to the export restrictions. The unusual nature of this revenue-sharing agreement with the US government has drawn comparisons to arrangements in other industries, such as energy companies operating in foreign countries

3

.Future Outlook and Investor Sentiment

Source: Analytics Insight

Analysts are optimistic about Nvidia's future earnings growth, with consensus estimates projecting adjusted earnings to grow at 43% annually through the fiscal year ending in January 2027. This growth trajectory, combined with the new China deal and strong hyperscaler spending, has led some analysts to view Nvidia's current valuation of 57 times adjusted earnings as reasonable

2

.As these fundamentals take hold, there is speculation that Nvidia's valuation multiples could expand further, potentially driving the stock to new highs. Some investors view Nvidia stock as a strong long-term investment opportunity in the rapidly growing global AI infrastructure market

3

.References

Summarized by

Navi

[1]

[2]

[3]

[4]

Related Stories

Nvidia Stock Soars as U.S. Approves Resumption of AI Chip Sales to China

09 Jul 2025•Technology

Nvidia Hit by New U.S. Export Controls on AI Chips to China, Boosting Local Rivals

16 Apr 2025•Technology

Nvidia Navigates US-China Tensions with Potential New AI Chip for Chinese Market

22 Aug 2025•Technology

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation