Nvidia Soars Past $3 Trillion Valuation on Saudi AI Deal and U.S.-China Trade Truce

15 Sources

15 Sources

[1]

Nvidia turns positive for 2025, third 'Magnificent 7' member to do so as favored group regains groove

The artificial intelligence darling surged more than 4% in the session, bringing its gain for this week above 15%. That rally has pulled the stock up about 0.7% year to date. Nvidia's surge above its 2025 flatline comes after CEO Jensen Huang announced Tuesday that the company would sell more than 18,000 of its top AI chips to Saudi Arabia. Huang joined other technology executives and President Donald Trump on a trip to a Saudi-U.S. investment forum held in Riyadh. Multiple Wall Street analysts told clients that the deal between Saudi Arabia and the U.S. could help the company alleviate any hit from shipping constraints on goods going to China. "We believe the sale of thousands of ... chips to Saudi Arabia this year could help mitigate some of the estimated low-teens billions of dollars in revenue headwinds tied to the China restrictions," Rosenblatt analyst Kevin Cassidy wrote.

[2]

Bank of America raises price targets on Nvidia, AMD after the pair land Saudi deals during Trump visit

Bank of America sees more room for Nvidia and Advanced Micro Devices shares to run after the technology companies inked deals with a subsidiary of the Saudi Arabia Public Investment Fund. Analyst Vivek Arya lifted his Nvidia price target by $10 to $160, which now implies 23.1% upside over Tuesday's close. Arya also added $10 to his price target for AMD, with the refreshed $130 estimate suggesting shares can jump 15.6%. The analyst cited the companies each announcing multiyear projects tied to artificial intelligence infrastructure with a Saudi subsidiary called Humain. Bank of America predicts these projects to cost between $3 billion to $5 billion annually, which equates to a range of $15 billion to $20 billion across multiple years. "Sovereign AI nicely complements commercial cloud investments with a focus on training and inference of LLMs in local culture, language and needs," Arya told clients. Arya also noted that Sovereign AI can help with limited power availability for data centers in the U.S. Both Nvidia and AMD rose more than 2% in Wednesday's premarket trading. These deals come as President Donald Trump's team has courted the Middle Eastern country. The White House on Tuesday announced Saudi Arabia's commitment to invest $600 billion through several business agreements with the U.S. Trump spoke at an investment conference in the country and met with Saudi Crown Prince Mohammed bin Salman. Several tech CEOs including Nvidia's Jensen Huang, who announced a deal to sell the kingdom more than 18,000 of its Blackwell AI chips , also attended the investment forum.

[3]

Nvidia Leads Chips Stocks Higher on Optimism About New Partnerships, Trade Deals

Kara Greenberg is a senior news editor for Investopedia, where she does work coordinating, writing, assigning, and publishing multiple daily and weekly newsletters. Prior to joining Investopedia, Kara was a researcher and editor at The Wire. Earlier in her career, she worked in financial compliance and due diligence at Loomis, Sayles & Company, and The Bank of New York Mellon. Shares of Nvidia (NVDA) and other semiconductor stocks surged Tuesday amid optimism about new partnerships and trade deals. Nvidia's stock jumped over 6% in recent trading, and Advanced Micro Devices (AMD) shares were up 4% after the companies said they would supply semiconductors to Saudi Arabian AI startup Humain, as part of initiatives announced as President Trump kicked off a four-day trip to the Middle East, starting in Saudi Arabia. As part of Nvidia's partnership with Humain, which CEO Jensen Huang reportedly announced on stage at an event in Riyadh, the company said it will deploy "several hundred thousand" of Nvidia's most advanced GPUs over the next five years, starting with an 18,000 GB300 Grace Blackwell AI supercomputer with Nvidia's InfiniBand networking technology. Meanwhile, AMD said it and Humain would invest up to $10 billion over the next five years to build out AI computing centers "stretching from the Kingdom of Saudi Arabia to the United States." The announcements come as President Trump reportedly looks to secure $1 trillion in investment and trade pledges from Saudi Arabia, with plans to visit Qatar and the United Arab Emirates as well during his trip. The White House didn't immediately respond to an Investopedia request for comment on the chip partnerships. Shares of Broadcom (AVGO), Micron Technology (MU), and other chip stocks were also higher in recent trading, driving the PHLX Semiconductor Index (SOX) up about 3%, extended Monday's gains after the U.S. and China agreed to lower tariffs on each other's imports for 90 days.

[4]

Nvidia Returns to $3 Trillion Club as Stock Surges on Saudi AI Partnership

Colin is an Associate Editor focused on tech and financial news. He has more than three years of experience editing, proofreading, and fact-checking content on current financial events and politics. He received his M.A. in journalism from The New School and his B.A. in history and political science from McGill University. Nvidia (NVDA) leaped back into the $3 trillion club on Tuesday as its stock shot up following the announcement of a major deal with a state-backed Saudi Arabian AI company. Nvidia shares rose nearly 6% to close just under $130. The gains put Nvidia's market capitalization at nearly $3.2 trillion, more than every other U.S. company aside from Microsoft (MSFT) and Apple (AAPL). Nvidia on Tuesday announced a partnership with Humain, an AI subsidiary of Saudi Arabia's sovereign wealth fund. Nvidia will sell Humain "several hundred thousand" advanced GPUs over the next five years, starting with an AI supercomputer powered by 18,000 GB300 chips. The announcement coincided with the beginning of President Trump's four-day tour through the Middle East, the first major international trip of his second term. Nvidia became only the third U.S. company to reach a $3 trillion market value in June 2024. The AI chipmaker's path to that milestone looked very different than the two companies that preceded it, Microsoft and Apple. Its shares began a near-constant $3 trillion ascent in late 2022 when the release of ChatGPT sparked the generative AI boom. It was around the time Nvidia topped $3 trillion that the stock's meteoric rise gave way to a more volatile sideways drift. Still, it competed with Apple and Microsoft for the title of the world's most valuable company throughout the remainder of the year before its market cap topped out at about $3.66 trillion in early January. The stock has been on a wild ride since. The company lost about $1.3 trillion in value between early January and early April as Wall Street questioned both the economics of AI and how President Trump's trade war with China would affect sales. The stock has rebounded in the last month, driven higher by solid earnings reports from big tech and the White House's softened stance on tariffs. Nvidia is set to report its first-quarter results later this month, on May 28.

[5]

Nvidia hits the jackpot following the U.S.-China trade truce; here's why Jensen Huang is smiling all the way

Following a US-China tariff pause, tech stocks rallied, with Nvidia emerging as a key beneficiary. Wedbush analyst Dan Ives highlights that the AI chip leader is poised for new highs, fueled by broader tech relief and sustained AI investment. Nvidia's deal to supply chips to Saudi Arabia further boosts its prospects, despite concerns about potential rerouting to China.After the announcement of a 90-day tariff pause between the US and China, the Nasdaq Composite, which is led by tech stocks, has nearly wiped out all of its losses so far this year, as per a report. But in the widespread rally, there's one winner according to Wedbush analyst and tech stock watcher Dan Ives, that is; Nvidia. The stock of the chipmaker jumped over 5% Monday after the deal's news came out, however, shares are still down 3% year to date, as per Yahoo Finance. During an interview with Yahoo Finances, Ives said, "It would have to be Nvidia," as quoted in the report. His remark came just before Nvidia's market capitalization broke above $3 trillion for the first time since February, reported Yahoo Finance. He explained that the broader tariff relief rally in tech, along with an artificial intelligence investment cycle that remains intact, creates a "dream scenario" for the AI chip leader, as per the report. The analyst said, "I think [the stock] makes ... new all-time highs because there's only one chip in the world fueling the AI revolution, and that's led by [the] godfather of AI, Jensen, and Nvidia," as quoted in the report. Another reason for the chipmaker's stock to go up is because Nvidia announced it would sell 18,000 chips to an AI startup owned by Saudi Arabia's sovereign wealth fund, according to Yahoo Finance. While, there is a potential concern with shipping top chips to Saudi Arabia as those chips could then be smuggled to China, bypassing US export controls, as per the report. Chief strategist at MacroLens, Brian McCarthy pointed out that, "It's just very, very hard to put a net around this stuff," adding, "The Chinese are very diligent. They have a very good network of ways to move products underground ... for all kinds of products," quoted Yahoo Finance. However, apart from the national security concerns, in case China indirectly buys the chip, that could be a boon for Nvidia shareholders, according to the report. Ives mentioned, "It shows it's not just about China," adding, "This just shows what I believe is going to be happening over the coming years -- the trillions being spent on AI," quoted Yahoo Finance. Why is Saudi Arabia involved with Nvidia now? Nvidia struck a deal to send 18,000 chips to a Saudi-backed AI startup, as per Yahoo Finance. Could these chips end up in China somehow? It's possible. Experts warn that enforcing chip export controls is difficult, and there's concern about chips being rerouted through third parties.

[6]

What's Going On With NVIDIA Stock Tuesday? - NVIDIA (NASDAQ:NVDA)

NVIDIA Corporation NVDA shares are trading higher Tuesday. The stock may be moving on continued momentum after the U.S. and China on Monday agreed to a reduction in most tariffs on each other's goods. What To Know: The deal will lower U.S. tariffs on Chinese imports from 145% to 30% and Chinese levies on U.S. goods from 125% to 10% for a three-month period. The revised U.S. tariffs consist of a 10% base rate on all imports, plus an additional 20% tariff implemented earlier this year by President Donald Trump in response to claims that China is manufacturing chemicals associated with fentanyl. On the U.S. side, the talks were led by Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent, while Vice Premier He Lifeng led the discussions for China. Bessent said at a news conference that, "We concluded that we have shared interests, and we both have an interest in balanced trade." What Else: NVIDIA announced a strategic partnership with HUMAIN on Tuesday aimed at establishing Saudi Arabia as a leader in artificial intelligence (AI) and GPU cloud computing. As part of its plan to build AI factories in Saudi Arabia, HUMAIN will deploy an 18,000-unit NVIDIA GB300 Grace Blackwell AI supercomputer powered by NVIDIA InfiniBand networking. HUMAIN also plans to use the NVIDIA Omniverse platform as a multi-tenant system to support development in AI and robotics. Nvidia is also set to report first-quarter earnings on May 28 after the market closes. Analysts estimate earnings per share of 89 cents and revenue of $43.07 billion, per data from Benzinga Pro. See Also: Is Cheesecake Factory Gaining or Losing Market Support? NVDA Price Action: At the time of writing, NVIDIA stock is trading 5.56% higher at $129.84, according to data from Benzinga Pro. Image: via Shutterstock NVDANVIDIA Corp$129.555.33%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum78.55Growth94.97Quality93.92Value7.13Price TrendShortMediumLongOverviewGot Questions? AskWhich tech stocks may benefit from tariff reductions?How could NVIDIA leverage U.S.-China trade talks?What industries will thrive from lower tariffs on imports?Which companies are positioned well for AI growth in Saudi Arabia?Will GPU manufacturers see increased demand after the partnership?How might HUMAIN's initiatives boost NVIDIA's revenue?What impact will NVIDIA's earnings have on investor sentiment?Which sectors could see shifts due to U.S.-China trade relations?Are there opportunities in cloud computing post-NVIDIA's announcement?What implications do tariff changes have for consumer goods companies?Powered ByMarket News and Data brought to you by Benzinga APIs

[7]

Nvidia Climbs On Saudi AI Investments: Analyst Estimates $15 Billion To $20 Billion In Revenue - NVIDIA (NASDAQ:NVDA)

President Doanld Trump led a high-profile delegation of U.S. tech CEOs, including Nvidia's Jensen Huang, to an investment conference in Saudi Arabia on Tuesday. Trump and Saudi Crown Prince Mohammed bin Salman jointly announced a $600 billion investment package, which included massive AI infrastructure partnerships with Nvidia Corp. NVDA. The Details: As part of the visit, the Trump administration announced the rescinding of Biden-era restrictions on the export of advanced U.S. AI chips, clearing the way for Nvidia and other American firms to supply processors to Saudi Arabia and the UAE. Nvidia announced that it partnered with several leading Saudi organizations to collaborate on AI initiatives. It's worth noting that the Biden administration implemented restrictions on the export of advanced semiconductor chips to Saudi Arabia, primarily due to concerns about potential risks to U.S. national security and the possibility of these chips being diverted to China Read Next: Trump Again Promises Lower Drug Prices By 'Cutting Out Middlemen' Like UnitedHealth, CVS: Will It Work This Time? HUMAIN, a subsidiary of Saudi Arabia's Public Investment Fund dedicated to artificial intelligence, will construct AI factories across Saudi Arabia powered by several hundred thousand of Nvidia's most advanced GPUs over the next five years with a projected total capacity of up to 500 megawatts. The first stage of the rollout features the deployment of an 18,000-unit Nvidia GB300 Grace Blackwell AI supercomputer, integrated with Nvidia InfiniBand networking for high-speed connectivity. In addition, HUMAIN will introduce Saudi Arabia's first Nvidia Omniverse Cloud platform, enabling the simulation and testing of physical AI solutions through digital twins. "AI, like electricity and internet, is essential infrastructure for every nation," Huang said. "Together with HUMAIN, we are building AI infrastructure for the people and companies of Saudi Arabia to realize the bold vision of the Kingdom." Additionally, Nvidia and the Saudi Data & AI Authority (SDAIA) will deploy up to 5,000 Blackwell GPUs to establish a sovereign AI factory and advance smart city initiatives. The partnership will also provide training for government and university scientists and engineers to equip them with the skills needed to develop and implement models for both physical and agentic AI. It was also announced that Aramco Digital will build AI computing infrastructure, partner with Nvidia's startup ecosystem, launch AI enterprise platforms, and establish a center of excellence for engineering and robotics incorporating Nvidia technologies. Expert Ideas: Bank of America Securities analyst Vivek Arya estimated the size of the HUMAIN deals to be between $2 billion to $3 billion annually, likely starting in 2025, with a total of between $15 billion and $20 billion over a multi-year period. The analyst also pointed to Sovereign AI as a potential offset to China export restrictions and limited data center power capabilities in the U.S. Bank of America maintained its Buy rating on Nvidia shares and raised its price target from $150 to $160 on the Saudi investments. Read Next: Quantum Stocks Are Hot In 2025: Biggest Movers To Watch Photo: Shutterstock NVDANVIDIA Corp$134.433.46%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum82.75Growth95.00Quality93.64Value6.65Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[8]

Nvidia Scores Big As Trump Brokers Major AI Export Pact With UAE and US Tech Giants - NVIDIA (NASDAQ:NVDA)

The Trump administration forged a preliminary deal with the United Arab Emirates involving importing 500,000 of Nvidia Inc.'s NVDA advanced AI chips annually. The deal was at least through 2027 but could be in place until 2030, Reuters reported on Wednesday, citing unnamed sources familiar with the matter. Under the deal, 20% of the chips, or 100,000 of them per year, will serve UAE's tech firm G42, while the rest would be split among U.S. companies, including Microsoft Corp MSFT and Oracle Corp ORCL that might also seek to build data centers in the UAE. Also Read: Nvidia, AMD And Other Chip Stocks Gain As Trump Plans To Ease AI Chip Export Rules U.S. President Donald Trump is on a tour of the Gulf region this week and on Tuesday announced a $600 billion investment package from Saudi Arabia. The package includes massive AI infrastructure partnerships with Nvidia, Advanced Micro Devices AMD, and Qualcomm Inc QCOM. Saudi Arabia's Public Investment Fund subsidiary HUMAIN will construct AI factories across Saudi Arabia over the next five years, powered by Nvidia's most advanced GPUs. The factories' projected total capacity is up to 500 megawatts. HUMAIN will also introduce Saudi Arabia's first Nvidia Omniverse Cloud platform. Bank of America Securities analyst Vivek Arya expects the HUMAIN deals to range between $2 billion and $3 billion annually, likely starting in 2025, with a total of between $15 billion and $20 billion over a multi-year period. NVIDIA Stock Prediction For 2025 Equity research analysts on and off Wall Street typically use earnings growth and fundamental research as a form of valuation and forecasting. But many in trading turn to technical analysis as a way to form predictive models for share price trajectory. Some investors look to trends to help forecast where they believe a stock could trade at a certain point in the future. Looking at NVIDIA, an investor could make an assessment about a stock's long term prospects using a moving average and trend line. If they believe a stock will remain above the moving average, which many believe is a bullish signal, they can extrapolate that trend into the future using a trend line. For NVIDIA, the 200-day moving average sits at $125.33, according to Benzinga Pro, which is below the current price of $133.04. For more on charts and trend lines, see a description here. Traders believe that when a stock is above its moving average, it is a generally bullish signal, and when it crosses below, it is a more negative signal. Investors could use trend lines to make an educated guess about where a stock could trade at a later date if conditions remain stable. Price Actions: NVDA stock is down 1.40% at $133.45 at the last check on Thursday. Read Next: Nvidia, Amazon, Tesla, Palantir Among Top Beneficiaries Of $1 Trillion Saudi Arabia AI Push, Analyst Says Photo by epha1st0s via Shutterstock NVDANVIDIA Corp$133.15-1.62%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum84.99Growth95.06Quality93.61Value6.20Price TrendShortMediumLongOverviewAMDAdvanced Micro Devices Inc$114.61-2.64%MSFTMicrosoft Corp$453.640.15%ORCLOracle Corp$160.63-1.42%QCOMQualcomm Inc$151.36-1.06%Market News and Data brought to you by Benzinga APIs

[9]

Two Key Developments Sparked a Rally for Nvidia Stock on Tuesday | The Motley Fool

The catalyst that sent the artificial intelligence (AI) chipmaker higher was news that the company could gain greater access to two important markets. A story broke late Monday that the Trump administration was considering a deal that would involve a large-scale sale of AI-centric chips to G42, a company located in the United Arab Emirates, according to a report in The New York Times. The deal could send hundreds of thousands of graphics processing units (GPUs) to the Emirati AI specialist and its U.S. partner, OpenAI. Then, less than 24 hours later, Nvidia announced a strategic partnership with Saudi Arabian company Humain to sell more than 18,000 AI-centric chips. These state-of-the-art GB300 Blackwell chips will power a 500-megawatt data center in the Middle Eastern country. These reports come on the heels of the Trump administration's decision to rescind the so-called AI Diffusion Rule, which would have limited the sale of Nvidia's most advanced processors in the region. Investors have been concerned that stricter controls on the sale of GPUs to companies outside the U.S. would hamstring Nvidia, casting doubt on the company's potential for future growth. The willingness of the Trump administration to revise these rules seems like it is opening up new opportunities for Nvidia. And at just 29 times next year's expected earnings, Nvidia stock is attractively priced.

[10]

Why Nvidia Stock Surged Higher Again Today | The Motley Fool

The recovery in Nvidia (NVDA 6.22%) stock continues again today. After plunging more than 30% from 2025 highs, shares of the advanced semiconductor company have been staging a comeback in recent weeks. Today's move comes as CEO Jensen Huang attends the Saudi Arabia-U.S. investment forum along with other business leaders and President Trump. Huang has already made that visit lucrative for Nvidia. Investors heard the news of a new business deal for the artificial intelligence (AI) leader and pushed Nvidia shares higher by 5.6% as of 11:45 a.m. ET. Nvidia announced a deal to sell more than 18,000 of its latest Blackwell chips to Saudi Arabian company Humain for hyperscale AI data centers. That deal is just the first phase of a new partnership. Humain plans to be a leading Saudi builder of AI infrastructure that will deploy AI models and other digital platforms. Nvidia will participate in much of that growth. Humain will also utilize Nvidia's Omniverse cloud platform to power applications in a new 500-megawatt data center. Tareq Amin, CEO of Humain, stated, "Our partnership with Nvidia is a bold step forward in realizing the Kingdom's ambitions to lead in AI and advanced digital infrastructure." That's not the only news that has Nvidia shareholders excited today. The White House also announced $600 billion worth of Saudi Arabian investments in the U.S. That includes a planned $20 billion investment in AI data centers and energy infrastructure. While Nvidia wasn't mentioned by name in the announced $600 billion commitment, it stands to reason that it will be involved in supplying chips and other products for the increasing growth of data centers and AI infrastructure in the U.S. going forward. All of that news has investors believing that Nvidia still has a long runway for growth. There is no reason to dispute that belief, and investing in Nvidia stock now looks to be a good bet.

[11]

Nvidia Stock Investors Just Got Good News From the Trump Administration | The Motley Fool

Semiconductor company Nvidia (NVDA 0.28%) has been a shining star of the artificial intelligence (AI) boom. The stock has advanced more than 800% since January 2023, and the Trump administration's recent decision not to enforce the so-called Framework for AI Diffusion could lead to more share price appreciation. The Commerce Department during the final days of the Biden administration announced the Framework for Artificial Intelligence (AI) Diffusion, far-reaching rules that limited or prevented the sale of advanced semiconductors in most countries, including some United States allies. Importantly, the AI Diffusion framework expanded on previously imposed export controls by dividing countries into three tiers with varying degrees of access to U.S. technology: Nvidia slammed the AI Diffusion rule in a blog post: Built on American technology, the adoption of AI around the world fuels growth and opportunity for industries at home and abroad. That global progress is now in jeopardy. The Biden administration now seeks to restrict access to mainstream computing applications with its unprecedented and misguided 'AI Diffusion' rule, which threatens to derail innovation and economic growth. The AI Diffusion rule was set to take effect on May 15, 2025, but the Trump administration this week chose to scrap the framework. The Commerce Department said the AI Diffusion rule would have stifled American innovation and undermined diplomatic relations with dozens of countries. Instead, Citigroup analysts think the Trump administration will negotiate export rules on a country-by-country basis. President Trump recently toured the Middle East, during which a number of U.S. technology companies struck deals with Saudi Arabia that would been complicated or prohibited by the Biden administration's AI Diffusion framework. Nvidia is one of those companies, but the list also includes AMD, Alphabet, Amazon, and Super Micro Computer. Nvidia and Saudi Arabian company Humain will collaborate to build AI data centers. The initial phase will involve 18,000 Nvidia Grace Blackwell superchips -- which combine Grace CPUs and Blackwell GPUs -- and InfiniBand networking. Additionally, Humain will deploy Nvidia's Omniverse simulation software to test physical AI solutions. Nvidia will also collaborate with the Saudi Data & AI Authority (SDAIA), a government agency that aims to position Saudi Arabia as a global leader in artificial intelligence. SDAIA will deploy 5,000 Nvidia Blackwell GPUs to build a sovereign AI factory, meaning secure data center infrastructure not controlled by foreign countries. Importantly, many investors had largely written off the Middle East as a significant source of GPU demand due to the AI Diffusion rules. So, the recent rescission is good news for Nvidia shareholders because it opens a new market for the company. But Nvidia is still facing headwinds. Most notably, the Trump administration recently restricted the sale of H20 GPUs to China. Wall Street is overwhelmingly optimistic where Nvidia is concerned. Among the 69 analysts who follow the company, 87% have a buy rating on the stock and the median target price is $160 per share. That implies 18% upside from the current share price of $135. Importantly, Wall Street's consensus estimate says Nvidia's adjusted earnings will increase 46% over the next four quarters. That makes the current valuation of 45 times earnings look quite reasonable, especially because the company beat the consensus earnings estimate by an average of 7% in the last four quarters. Patient investors who want more exposure to Nvidia should consider buying a few shares today.

[12]

The Top Tech Stock Winners From Trump's $600 Billion Saudi Arabian Deal | The Motley Fool

Following a visit to Saudi Arabia last week, President Donald Trump announced that the kingdom has pledged to invest $600 billion in deals with U.S. companies. The agreement includes $142 billion in defense sales to help supply the country with "state-of-the-art warfighting equipment." However, the two biggest winners are U.S. chipmakers Nvidia (NVDA 0.28%) and Advanced Micro Devices (AMD 1.91%). Following Trump's announcement, both companies revealed deals to provide chips to Humain, a Saudi Arabian artificial intelligence (AI) start-up owned by the kingdom's public investment fund. Nvidia announced it will supply Humain with several hundred thousand of its most advanced graphics processing units (GPUs) over the next five years to help power the AI data centers the company will begin building in Saudi Arabia. It will begin by shipping 18,000 of its GB300 Grace Blackwell AI supercomputer chips, while it will also provide InfiniBand networking equipment. In addition, the Saudi Data & AI Authority (SDAIA) will deploy up to 5,000 Blackwell GPUs to help enable smart city solutions. Nvidia will also help train thousands of developers in the country and deploy the country's first Omniverse Cloud to simulate and test physical AI solutions. Bank of America analysts estimated that the deal could be worth between $15 billion to $20 billion in total spending over the length of the agreement. That would equal $3 billion to $5 billion in annual sales. In addition, the U.S. is reportedly close to easing chip export restrictions on the United Arab Emirates. The deal would let the nation import 500,000 advanced AI chips a year through at least 2027. About 20% of the chips would go to Abu Dhabi AI company G42, with the rest distributed to U.S. companies building data centers in the country. The deals should help replace some of the company's lost revenue to China, after the U.S. tightened export controls to the country. China accounted for about $17 billion of Nvidia's revenue last fiscal year, but it said it was down to mid-single digits of its data center revenue in fiscal Q4. Based on its Q4 run rate, that would be about $7 billion a year. AMD, meanwhile, announced it had struck a $10 billion deal with Humain to supply chips to the company over the next five years. AMD said it will provide the full spectrum of its AI compute portfolio, which seemingly means both GPUs and central processing units (CPUs). It also signed a memorandum of understanding with SDAIA to explore using AMD chips to power future AI-focused data centers. When it reported its Q1 results, AMD noted that it would take a $700 million hit in revenue in Q2 due to new Chinese export restrictions and $1.5 billion for the year. With the Humain deal being worth $2 billion a year, that should replace much of this lost revenue. In addition to the deals helping replace lost Chinese revenue, they also mark what could be one of the next big growth drivers for the chipmakers: sovereign AI investments. Saudi Arabia and the United Arab Emirates are clearly looking to invest in AI and data centers, but they are not the only countries. Just within the Middle East, Kuwait has partnered with Microsoft to help position the company as a regional AI leader. Bahrain and Qatar are also spending to build out AI infrastructure in their countries. Outside of the Middle East, India has partnerships with the big three cloud computing companies to help scale its AI infrastructure. Even smaller countries like Singapore are allocating money toward AI. Meanwhile, it seems like President Trump is willing to use the AI semiconductor dominance of the U.S. as a bargaining chip in trade deals. As the U.S. negotiates a new trade deal with China, perhaps the recent chip restrictions could even be rescinded. Both Nvidia and AMD are well-positioned to benefit from increased AI infrastructure spending. Nvidia is the clear leader in the GPU space with an over 80% market share, and should continue to see strong growth as data center spending continues to ramp up. Meanwhile, AMD has proven to be a leader when it comes to supplying CPUs for data centers. It's also carved a nice niche in the GPU market for AI inference. With inference eventually expected to become a much larger market than AI model training, the company is well situated. In addition, both stocks are attractively valued, with each trading around a 30 times forward price-to-earnings ratio (P/E) and a lot of growth potential still ahead. As such, both stocks look like attractive investment options right now, given the growth opportunities both still have ahead.

[13]

NVIDIA, AMD targets raised at BofA following sovereign AI deals By Investing.com

Investing.com -- Bank of America raised its price targets for NVIDIA and AMD (NASDAQ:AMD) on Wednesday, citing wins in sovereign artificial intelligence projects that could help offset export restrictions to China beginning in calendar year 2026. The bank raised its target for Nvidia (NASDAQ:NVDA) to $160 from $150 and the target for AMD to $130 from $120 a share. NVIDIA and AMD announced separate multi-year AI infrastructure projects with HUMAIN, a subsidiary of Saudi Arabia's Public Investment Fund. Bank of America (NYSE:BAC) estimates these projects could be worth "$3-$5 billion annually, or $15-$20 billion over a multi-year period." According to BofA, sovereign AI is poised to become a "$50bn+ annually" opportunity, accounting for 10%-15% of the global $450-$500 billion AI infrastructure market. BofA said, "Sovereign AI nicely complements commercial cloud investments with a focus on training and inference of LLMs in local culture, language and needs," and could mitigate challenges such as "limited power availability for data centers in US" and trade restrictions with China. NVIDIA is expected to receive about $7 billion in direct contracts, with Phase 1 alone including 18,000 Blackwell GPUs worth roughly $700 million. Over five years, BofA expects "several hundred thousand of NVIDIA's most advanced GPUs" to be delivered. AMD's portion, which could total $10 billion, will likely begin later in 2026 and include "CPU, GPU, networking and its 'open-source' software stack called ROCm." While AMD's project appears to follow a joint-venture approach with Cisco (NASDAQ:CSCO), BofA noted it marks the first time AMD is "on a 'similar' footing as NVIDIA in terms of engagement in large projects." BofA reiterated Buy ratings on both NVIDIA and AMD, citing stronger long-term AI demand and "GPU as the new 'coin of the realm.'"

[14]

AI-Fueled Chip Rally Gains Renewed Breath From Middle East Data Center Push | Investing.com UK

The Trump administration has announced plans to rescind a Biden-era rule that prohibited or capped the sale of advanced semiconductors outside of the US in an effort to keep the technology out of "countries of concern." The details are expected in the next few weeks. But before the ink is dry on the new rules, Saudi Arabia ordered billions of dollars of semiconductor chips from Nvidia (NASDAQ:NVDA), AMD (NASDAQ:AMD), and others during President Trump's trip to the Kingdom (TADAWUL:4280) this week. More orders are expected as Trump continues on to Doha and Abu Dhabi. AMD signaled its optimism about the future by announcing a $6 billion stock buyback program on Wednesday. It has all contributed to a furious semiconductor rally that has lifted the S&P 500 Semiconductors industry index by 43.6% since its April low. Here are some additional details on what's led to the chip revival: (1) Lifting the AI Diffusion Rule. The "Diffusion Rule" had been opposed by many technology companies, including Microsoft (NASDAQ:MSFT), Oracle (NYSE:ORCL), and Nvidia, which believed it would limit US tech companies' opportunities abroad without achieving its goal of impeding China. Eliminating the rule means advanced semis can now be sold into India, Switzerland, Saudi Arabia, Israel, and Singapore, among other countries. The move was expected to benefit chip makers including Nvidia, Intel (NASDAQ:INTC), and AMD. (2) Chip orders surge. Nvidia announced on Tuesday a "partnership" that will help turn Saudi Arabia into a "global powerhouse in AI, cloud, and enterprise computing, digital twins, and robotics." The company is working with Humain, a subsidiary of the Saudi's Public Investment Fund that was launched this week to focus on AI. Humain will build AI data centers (which Nvidia calls "AI factories") powered by several hundred thousand of Nvidia's most advanced chips over the next five years. Nvidia will train thousands of Saudi developers, teaching them the skills to work in accelerated computing and AI. And Aramco Digital will develop AI computing infrastructure using Nvidia platforms. Humain also announced partnerships with AMD, Amazon's (NASDAQ:AMZN) AWS, and Groq during President Trump's visit to Saudi Arabia. It will build additional data centers with AMD in Saudi Arabia and the US, using AMD chips and hardware. AWS announced it would invest $5.3 billion in a partnership with Humain, which will build an AI zone in Saudi Arabia. It will use AWS AI infrastructure and services. This is in addition to another infrastructure region that AWS is building in the country, which will be available next year. (3) Buybacks abound. AMD's board of directors authorized a new $6 billion share buyback program in addition to the $4 billion of capacity remaining on an existing program. "Our expanded share repurchase program reflects the Board's confidence in AMD's strategic direction, growth prospects, and ability to consistently generate strong free cash flow," AMD CEO Lisa Su said in a statement on Wednesday. AMD isn't alone. In February, ON Semiconductor (NASDAQ:ON) announced a new $3 billion share repurchase program. ASM International started on April 29 a €150 million buyback program that it announced in February. KLA increased its share buyback program by $5 billion, and Broadcom (NASDAQ:AVGO) announced a $10 billion buyback program. (4) A look at the numbers. It's not surprising that semiconductor companies are buying back their shares -- the S&P 500 Semiconductors industry stock price index fell by 35.1% from its peak in January through April's low. The index has enjoyed a 43.6% bounce since April, leaving it down only 6.8% from its peak. The S&P 500 Semiconductors industry index had rallied dramatically in recent years, rising 300% from the start of 2023 to its peak in January. The sharp move left the index's valuation stretched near 35. At the height of the selloff, Semiconductors' forward P/E fell to a low of 19.8 on April 3; it has since recovered a bit to 26.0. Semiconductor stocks may have also come under pressure because the industry's astronomical revenues and earnings growth has slowed, though continued to improve. The S&P 500 Semiconductors industry posted revenue growth of 30.9% in 2024, but that's expected to moderate to 26.0% this year and 17.3% in 2026. Likewise, earnings growth has decelerated from 49.1% in 2024 to an expected 40.6% in 2025 and 26.8% in 2026. Net earnings estimate revisions for the industry have been negative over the last eight months. That may change given the new orders that many of these players have coming out of the Middle East.

[15]

Nvidia leads premarket gains after deal with Saudi Arabian AI firm By Investing.com

Investing.com -- Nvidia (NASDAQ:NVDA), the semiconductor giant, is leading the way in premarket trading, with its shares set to extend gains following a deal to supply chips to Saudi Arabian AI company, Humain. The chips will be used for a substantial data center project. This news follows a week in which Nvidia's shares have already surged approximately 11%. This deal is part of a wave of tech investments and agreements coinciding with the visit of U.S. President Donald Trump to Saudi Arabia. This visit has boosted stocks, with a notable rise on Tuesday. Among the group known as the 'Magnificent Seven', Nvidia saw a premarket increase of 2.1%. Other companies in this group also experienced premarket movement. Tesla (NASDAQ:TSLA) saw a 2% rise, Alphabet (NASDAQ:GOOGL) increased by 0.4%, and Meta (NASDAQ:META) experienced a 0.3% increase. Meanwhile, Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), and Microsoft (NASDAQ:MSFT) all saw a slight decline of less than 1%. The S&P 500 and Nasdaq 100 have also managed to erase their 2025 drop, sparking a rebound in the wake of renewed trade optimism.

Share

Share

Copy Link

Nvidia's stock surges following a major AI chip deal with Saudi Arabia and easing U.S.-China trade tensions, propelling the company back into the $3 trillion market cap club.

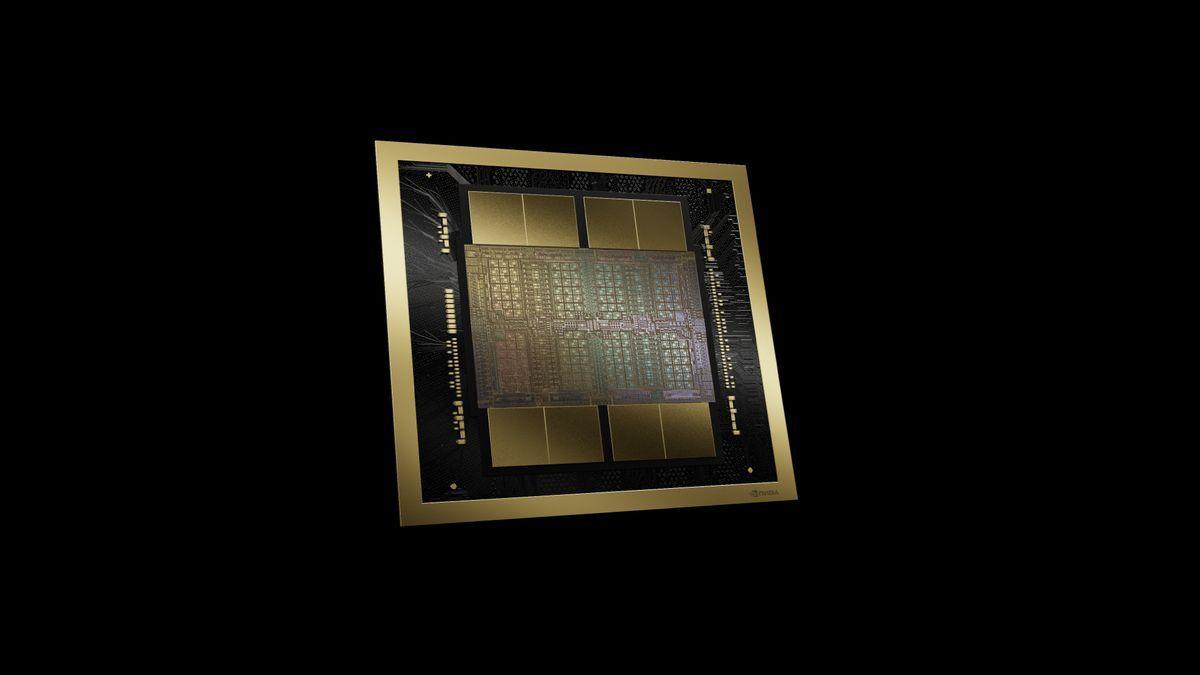

Nvidia's Stock Surge and $3 Trillion Milestone

Nvidia, the artificial intelligence chip giant, has reclaimed its position in the exclusive $3 trillion market capitalization club, following a significant stock rally. The company's shares surged by nearly 6%, closing just under $130, which pushed its market value to approximately $3.2 trillion

4

. This remarkable ascent places Nvidia third among U.S. companies by market capitalization, trailing only Microsoft and Apple4

.Saudi Arabia AI Partnership

The catalyst for Nvidia's recent stock surge was the announcement of a major partnership with Humain, an AI subsidiary of Saudi Arabia's sovereign wealth fund. As part of this collaboration, Nvidia will supply "several hundred thousand" of its advanced GPUs to Humain over the next five years

3

. The initial phase of this deal involves the deployment of an AI supercomputer featuring 18,000 GB300 Grace Blackwell chips, complemented by Nvidia's InfiniBand networking technology3

.U.S.-China Trade Truce Impact

Nvidia's stock rally was further bolstered by the announcement of a 90-day tariff pause between the United States and China

5

. This trade truce has sparked a broader tech stock rally, with the Nasdaq Composite nearly erasing its year-to-date losses5

. Wedbush analyst Dan Ives described this scenario as a "dream" for Nvidia, citing the combination of tariff relief and sustained AI investment as key drivers for the company's growth5

.Geopolitical Context and Presidential Visit

The timing of Nvidia's deal with Saudi Arabia coincides with President Donald Trump's four-day Middle East tour, which began in Saudi Arabia

2

. This visit is part of a broader initiative to secure substantial investment and trade commitments from the region. The White House has announced Saudi Arabia's commitment to invest $600 billion through various business agreements with the U.S.2

.Related Stories

Industry-wide Impact and Competitive Landscape

Nvidia's success has had a ripple effect across the semiconductor industry. Other chip manufacturers, including Advanced Micro Devices (AMD), Broadcom, and Micron Technology, also saw their stocks rise

3

. AMD, in particular, announced its own partnership with Humain, planning to invest up to $10 billion over five years to establish AI computing centers3

.Potential Concerns and Future Outlook

While the Saudi deal has been met with enthusiasm, some experts have raised concerns about the potential for these advanced chips to be indirectly rerouted to China, potentially circumventing U.S. export controls

5

. However, from a shareholder perspective, the deal underscores Nvidia's expanding global footprint in the AI sector.As Nvidia prepares to report its first-quarter results later this month, the company's trajectory remains closely tied to the evolving landscape of AI technology and international trade relations. The recent developments have reinforced Nvidia's position as a leader in the AI chip market, with analyst Dan Ives predicting that the stock could reach new all-time highs in the near future

5

.References

Summarized by

Navi

Related Stories

Trump Administration Plans to Ease AI Chip Export Restrictions, Boosting Semiconductor Stocks

08 May 2025•Business and Economy

AMD's New AI Chips Challenge Nvidia's Dominance, Sparking Stock Rally

11 Jul 2025•Technology

Nvidia Stock Soars as U.S. Approves Resumption of AI Chip Sales to China

09 Jul 2025•Technology

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology