Nvidia's Strong Earnings Boost AI-Related Stocks and Signal Positive Outlook for Server Makers

2 Sources

2 Sources

[1]

These Stocks Are Rising Due to Nvidia's Solid Earnings Report

Dell (DELL) and HP Enterprise (HPE) stocks were up 1% Thursday morning, as JPMorgan analysts said Nvidia's earnings showing strong demand and supply of Nvidia's latest products serves as a strong signal for the server makers' earnings and outlooks. Shares of a pair of energy-related companies, GE Vernova (GEV) and Constellation Energy Group (CEG), were also up just over 1% as nuclear energy stocks have been lifted by the AI trade and expected rise in power demand that more data centers will bring. Nvidia shares were still leading the way, up more than 5% about 45 minutes ahead of markets opening on Thursday.

[2]

Dell, Hewlett Packard, Super Micro Set To Benefit From Nvidia's AI Chip Ramp - Hewlett Packard (NYSE:HPE), Dell Technologies (NYSE:DELL)

JPMorgan analyst Samik Chatterjee on Thursday noted that Nvidia Corp's NVDA first-quarter reported revenue tracked modestly ahead of consensus. In contrast, the fiscal second-quarter of 2025 revenue outlook tracked largely in line with consensus. Total revenues grew +12% Q/Q and +69% Y/Y, tracking to $44.1 billion in the fiscal first-quarter of 2026 (versus consensus of $43.3 billion and guidance of $42.1 billion-$43.9 billion). Datacenter revenue tracks to $39.1 billion (+10% Q/Q and +73% Y/Y), including Compute revenue of $34.2 billion (+5% Q/Q and +76% Y/Y) and Networking revenue of $5.0 billion (+64% Q/Q and +56% Y/Y), the analyst noted. Sequential growth in Data Center Compute revenues was led by a robust ramp in Blackwell, which tracked to 70% of Compute revenues (implying $24 billion in the fiscal first quarter of 2026 versus $11 billion in the fiscal fourth quarter of 2025). This suggests almost a -50% Q/Q moderation in the rest of the computing business as the company practically completed the transition from Hopper to Blackwell during the quarter, he noted. Also Read: When Nvidia Wins, Broadcom Climbs: AI Boom Sends Chip Stocks Soaring Chatterjee said the company highlighted that major hyperscalers are deploying NVL 72 racks at 1,000 racks per week and expects the deployment rate to ramp. Nvidia forecasts total revenue to range between $44.1 billion and $45.9 billion for the fiscal second quarter of 2026 (versus consensus of $45.5 billion). This implies growth of +2% Q/Q and +50% Y/Y at the midpoint, despite $8 billion (versus $2.5 billion in fiscal first-quarter of 2026) of headwind from H20 export restrictions, as per the analyst. However, he noted that both included a headwind from H20 export restrictions ($2.5 billion and $8.0 billion, respectively). However, Data Center trends continue to be solid, particularly as the rate of Blackwell deployments continues to accelerate. Blackwell-based revenue expands by over twice on a Q/Q basis. Management suggests it is the "fastest ramp in company's history," Chatterjee said. The analyst noted the solid Compute trends, particularly relative to the increasing supply of Blackwell-based products, is a positive read-through relative to Server OEMs, including Dell Technologies DELL and Hewlett Packard Enterprise Co HPE (as well as Super Micro Computer, SMCI) which has already reported) and their guidance for AI server revenues in the coming July quarter despite the mixed supply trends expected in the April quarter. Price Actions: At last check on Thursday, DELL stock was down 0.57% at $113.12. HPE is up 0.14%, and SMCI is down 0.26%. Read Next: AMD Deepens AI Ecosystem With Enosemi Acquisition Image: Shutterstock DELLDell Technologies Inc$113.44-0.29%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum21.70Growth83.49QualityNot AvailableValue36.14Price TrendShortMediumLongOverviewHPEHewlett Packard Enterprise Co$17.780.51%NVDANVIDIA Corp$140.534.24%SMCISuper Micro Computer Inc$41.66-0.73%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia's impressive earnings report has led to a rise in AI-related stocks, particularly benefiting server manufacturers and energy companies. The report signals strong demand for AI chips and positive prospects for the AI industry.

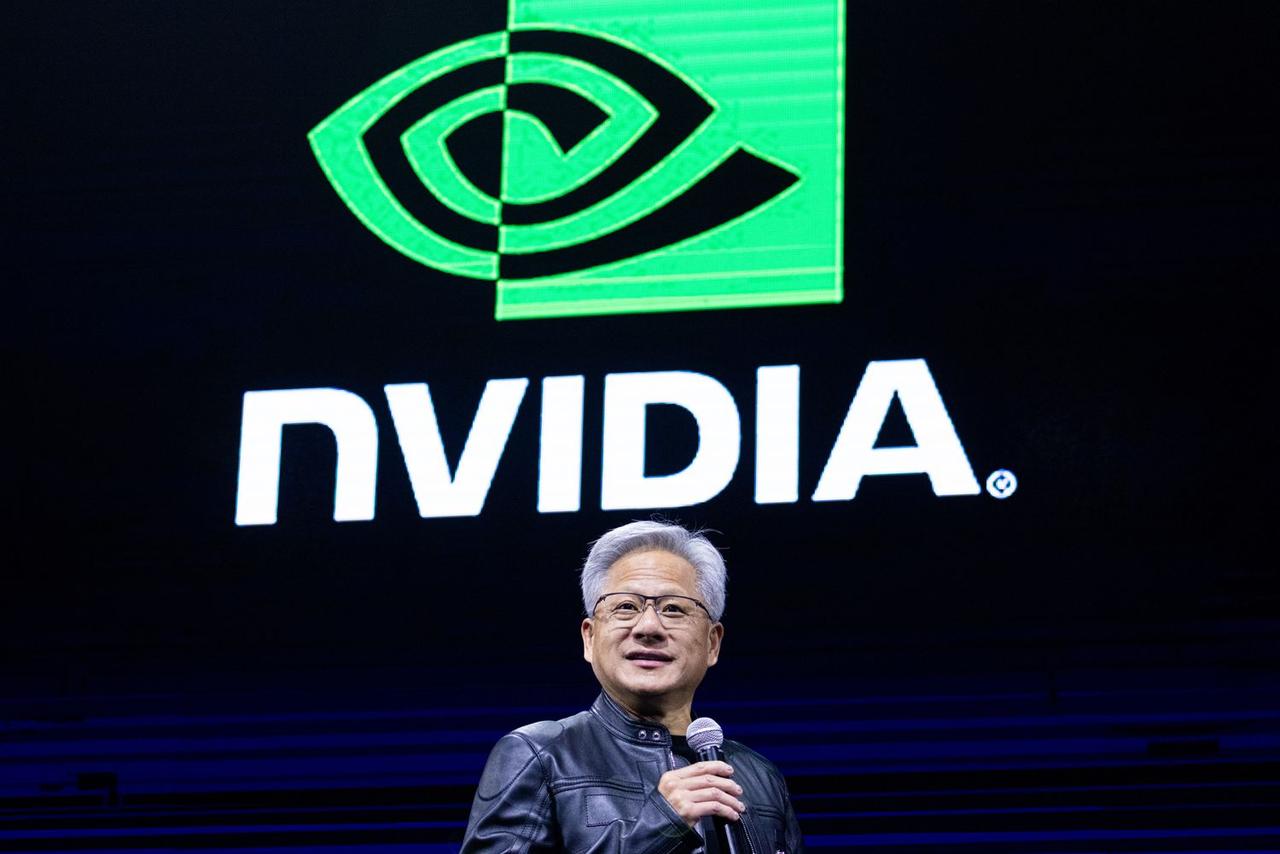

Nvidia's Earnings Spark Market Enthusiasm

Nvidia Corporation's recent earnings report has sent ripples through the tech industry, boosting not only its own stock but also those of related companies in the AI ecosystem. The company's solid performance and optimistic outlook have become a catalyst for growth across various sectors, particularly benefiting server manufacturers and energy companies

1

2

.Server Manufacturers Ride the AI Wave

Dell Technologies (DELL) and Hewlett Packard Enterprise (HPE) saw their stocks rise by 1% following Nvidia's earnings announcement. JPMorgan analysts interpret Nvidia's strong demand and supply of its latest products as a positive signal for server makers' earnings and future prospects

1

. This optimism extends to other players in the server market, such as Super Micro Computer (SMCI), as the demand for AI-capable hardware continues to grow2

.Nvidia's Impressive Performance

Source: Investopedia

Nvidia's financial results exceeded expectations, with total revenues growing 12% quarter-over-quarter and 69% year-over-year, reaching $44.1 billion in the fiscal first quarter of 2026. The company's data center revenue, a key indicator of AI-related growth, increased to $39.1 billion, representing a 10% quarter-over-quarter and 73% year-over-year growth

2

.Blackwell: Driving Nvidia's Success

Source: Benzinga

A significant contributor to Nvidia's success is the robust ramp-up of its Blackwell architecture. Blackwell-based revenue expanded by over twice quarter-over-quarter, accounting for 70% of compute revenues. This rapid adoption rate has been described by Nvidia's management as the "fastest ramp in company's history"

2

.Energy Sector Benefits from AI Boom

The AI revolution is not limited to tech companies alone. Energy-related stocks such as GE Vernova (GEV) and Constellation Energy Group (CEG) also experienced gains of over 1%. This uptick is attributed to the expected rise in power demand that the proliferation of data centers will bring, highlighting the far-reaching impact of AI technology on various sectors of the economy

1

.Related Stories

Challenges and Future Outlook

Despite the overall positive outlook, Nvidia faces some challenges. The company reported a headwind of $2.5 billion in the fiscal first quarter of 2026 due to H20 export restrictions, with this figure expected to increase to $8 billion in the following quarter. However, the strong demand for AI chips and the accelerating deployment of Blackwell-based products are expected to offset these challenges

2

.Implications for the AI Industry

Nvidia's performance and the subsequent market reactions underscore the growing importance of AI in the tech industry and beyond. As major hyperscalers deploy NVL 72 racks at a rate of 1,000 racks per week, with expectations for this deployment rate to increase, the demand for AI infrastructure shows no signs of slowing down

2

.This trend not only benefits Nvidia but also creates opportunities for a wide range of companies involved in the AI supply chain, from server manufacturers to energy providers. As the AI revolution continues to unfold, it is likely to reshape various industries and drive innovation across multiple sectors of the global economy.

References

Summarized by

Navi

[1]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology