Nvidia Stock Surges as Tech Giants Ramp Up AI Infrastructure Spending

7 Sources

7 Sources

[1]

Why Nvidia's stock jumped 5% after Alphabet's announcement

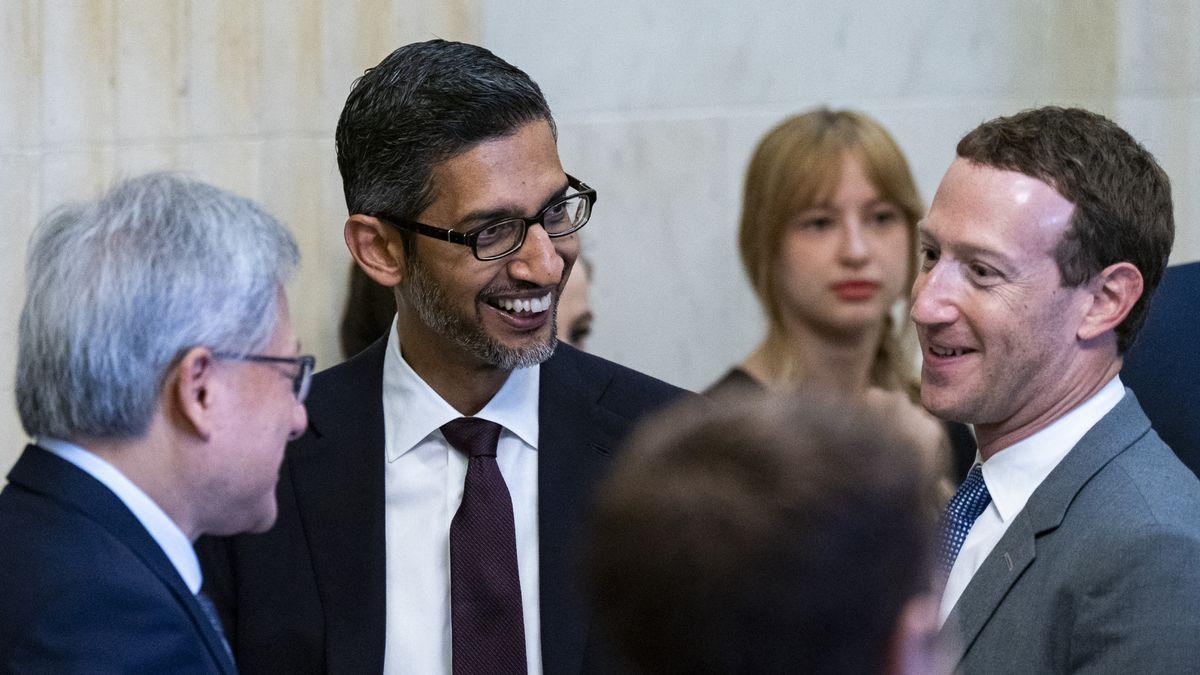

Nvidia (NVDA) shares rose 5.21% on Wednesday following an announcement from Google parent Alphabet (GOOGL) regarding its plan to increase spending on artificial intelligence infrastructure. Alphabet stated on Tuesday that it intends to allocate up to $75 billion for capital expenditures in 2025, significantly surpassing prior analyst expectations of $58 billion. The majority of this investment will be directed toward enhancing its AI infrastructure, particularly servers and data centers, to accommodate the rising demand for AI technologies. Alphabet's CEO, Sundar Pichai, expressed confidence in the ongoing partnership with Nvidia, highlighting the company's commitment to utilizing Nvidia's Blackwell platform for its needs. This news comes shortly after major technology firms Meta Platforms (META) and Microsoft (MSFT) announced their own substantial expenditure plans for AI infrastructure, with Meta planning to spend between $60 billion and $65 billion this year and Microsoft anticipating an $80 billion investment in fiscal 2025. Broadcom (AVGO), known for designing custom AI chips for various large tech companies including Alphabet and Meta, also experienced a share price increase of nearly 6% to $235.69 on Wednesday. Nvidia's stock increased by approximately 4%, closing at $123.43. In addition, other chip manufacturers and partners of Nvidia, such as Arm Holdings (ARM) and TSMC (TSM), saw higher share values. Last week, shares of semiconductor companies, including Nvidia, Advanced Micro Devices (AMD), and Micron Technology (MU), faced pressure following concerns over a Chinese startup, DeepSeek. The company's success in training AI models at significantly lower costs than its American counterparts raised fears of a potential drop in demand for crucial components like graphics processing units (GPUs). However, these concerns may not be justified. During a call with analysts, Meta CEO Mark Zuckerberg reassured investors of their continued demand for AI chips from Nvidia and AMD. He highlighted that while DeepSeek's method of using less computational power is intriguing, it does not necessarily translate to reduced chip demand. Instead, he speculated that a shift in focus from model training to inference might occur, necessitating sustained investments in data center capacity to support the processing needs of AI models as they engage users. Meta intended to invest $39.2 billion in chips and data center infrastructure in 2024, with plans to increase this to $65 billion this year, further developing its Llama large language models (LLMs). The Llama models, which recently achieved 600 million downloads, are poised for continued advancement with the expected release of Llama 4 this year. On February 26, Nvidia will report its official fiscal year 2025 results, where preliminary estimates indicate a significant revenue increase to approximately $128.6 billion, with a substantial portion stemming from its data center segment, assisted by GPU sales. In the meantime, the broader market's reaction to Alphabet's increased capital expenditure plans and the ongoing commitment from major tech players suggest a robust demand outlook for AI infrastructure and associated chip technologies.

[2]

Google Parent Alphabet Just Delivered Great News for Nvidia Investors Worried About DeepSeek | The Motley Fool

Want insight into the business prospects for a company? Pay attention to what its biggest customers are saying. Alphabet (GOOG -6.94%) (GOOGL -7.29%) provided its fiscal 2024 fourth-quarter update after the market closed on Tuesday. And the Google parent delivered great news for Nvidia (NVDA 5.21%) investors worried about the impact of Chinese artificial intelligence (AI) company DeepSeek. Unfortunately, Alphabet's news wasn't so great for its own investors. The tech giant's shares sank around 8% in early trading on Wednesday after the Q4 update Tuesday evening. At first glance, Alphabet's numbers might not seem bad at all. Revenue increased 12% year over year to $96.47 billion. Net income jumped 38%, with earnings per share soaring 31% to $2.15. Google Cloud revenue vaulted 30% higher to $12 billion. What was wrong with those results? Analysts surveyed by LSEG were expecting higher Q4 revenue of $96.56 billion. Google Cloud was the primary culprit, with lower-than-anticipated revenue growth. In addition, Alphabet projected capital expenditures in 2025 Q1 of between $16 billion and $18 billion, well above the level expected by Wall Street. However, there's a silver lining for Nvidia with Google Cloud's disappointing Q4 growth. Alphabet CEO Sundar Pichai noted that cloud revenues "are correlated with the timing of deployment of new capacity." CFO Anat Ashkenazi confirmed that the company continues to have greater demand for cloud services than it has available capacity, driven by demand for its AI products. In other words, Google Cloud could have generated more revenue in Q4 if it had more capacity. Ashkenazi said, "[W]e are in a tight supply demand situation, working very hard to bring more capacity online." That's the reason behind Alphabet's greater-than-expected Q1 capital expenditures. The company plans to spend more on building out its technical infrastructure, especially servers, data centers, and networking. All of this should be music to Nvidia's ears. Although Google has its own AI chips, it still relies heavily on Nvidia's GPUs. In the Q4 earnings call, Pichai highlighted his company's "strong relationship with Nvidia." He noted that Google was the first to announce a customer using Nvidia's new Blackwell platform. Google needs more capacity to handle AI demand; Nvidia will almost certainly benefit. The market reaction to DeepSeek's launch of its R1 reasoning model seemed to indicate that Nvidia's best days are behind it. Many investors panicked in fear that the Chinese AI company's cost-effective technology might shake up the AI world and drastically reduce the demand for Nvidia's GPUs. However, when asked in the Q4 earnings call about DeepSeek's impact, Pichai didn't sound alarmed whatsoever. He first complimented the work that the DeepSeek team had done. But he wasn't surprised about the company's progress. Pichai even argued that Google Gemini 2.0 Flash and 2.0 Flash thinking models "are some of the most efficient models out there, including comparing to DeepSeek's V3 and R1." What's the key takeaway? The CEO of one of Nvidia's biggest customers doesn't view DeepSeek as a huge threat. And this big customer needs more capacity (and therefore more Nvidia GPUs) despite having what it considers to be the most efficient AI models around. That should be welcome news for investors who are concerned about DeepSeek's challenge to Nvidia. Pichai also noted, "[T]he proportion of the spend toward inference compared to training has been increasing." He added that the rise of reasoning models "accelerates that trend." This could translate to sustained demand for Nvidia's GPUs. I think Alphabet and Nvidia are alike in several ways. Both stocks have been beaten down by concerns that appear to be only temporary, in my view. Alphabet's revenue growth should rebound as it ramps up cloud capacity. I also think fears about a disruptive threat to Nvidia from DeepSeek will also fade over time. The future is still bright for both companies.

[3]

Nvidia Stock Rises As Alphabet's AI Investment Boosts Semiconductor Sector: What's Going On? - NVIDIA (NASDAQ:NVDA)

AMD beats earnings expectations, but its stock declines due to weak gaming and embedded segment revenue. NVIDIA Corp NVDA shares are trading higher Wednesday as investors react to Alphabet Inc.'s GOOGGOOGL strong capital expenditure guidance, which exceeded analyst expectations and eased concerns about a slowdown in AI spending. What To Know: Alphabet's fourth-quarter results, released Tuesday after market close, showed plans to spend $75 billion on capital expenditures in 2025, significantly above the expected $58 billion. This bolstered confidence in AI-related chipmakers, including Nvidia, as Alphabet remains a key buyer of AI hardware. Broadcom Inc. AVGO shares also gained on the news, as the company supplies AI accelerators to Alphabet. Advanced Micro Devices, Inc. AMD shares declined after the company's latest earnings report, despite beating revenue and earnings expectations. AMD reported fourth-quarter revenue of $7.66 billion, above the estimated $7.53 billion, and adjusted earnings of $1.09 per share, slightly exceeding the forecasted $1.08 per share. AMD's data center segment led growth, with revenue surging 69% year-over-year to $3.9 billion. However, gaming revenue fell 59%, and embedded revenue declined 13%, weighing on overall performance. AMD expects first-quarter revenue of approximately $7.1 billion, representing around 30% year-over-year growth at the midpoint. Despite its strong data center performance, AMD's stock fell in after-hours trading Tuesday as investors weighed concerns about weaker gaming and embedded segment revenue. The broader semiconductor sector remains focused on Nvidia's upcoming earnings later this month, which will provide further clarity on AI-driven demand and the competitive landscape. NVDA Price Action: Nvidia shares were up 5.15% at $124.76 at the time of publication Wednesday, according to Benzinga Pro. Read Next: Mattel Analyst Sees Hot Wheels Growth While Barbie Faces Mixed Outlook Photo: Shutterstock. NVDANVIDIA Corp$124.324.78%Overview Rating:Good75%Technicals Analysis1000100Financials Analysis600100WatchlistOverviewAMDAdvanced Micro Devices Inc$111.88-6.38%AVGOBroadcom Inc$232.004.30%GOOGAlphabet Inc$193.11-7.03%GOOGLAlphabet Inc$191.26-7.33%Market News and Data brought to you by Benzinga APIs

[4]

Why Nvidia, Broadcom, and Other Chip Stocks Are Surging Wednesday

Nvidia (NVDA) shares surged Wednesday, after Google parent Alphabet (GOOGL), a buyer of Nvidia's chips, said it plans to ramp up spending on artificial intelligence (AI). Alphabet said Tuesday that it plans to spend as much as $75 billion in capital expenditures this year, with most of the funds set to go toward expanding its AI infrastructure, including servers and data centers, to meet demand for AI. That could benefit Nvidia, with Alphabet Chief Executive Officer Sundar Pichai telling investors on the company's earnings call that the tech giant intends to continue its "strong relationship" with the chipmaker, after announcing its first customer running on Nvidia's Blackwell platform last week. Shares of Broadcom were up nearly 6% at $235.69 in intraday trading Wednesday, while Nvidia jumped about 4% to $123.43. Several other chip stocks and shares of Nvidia partners, including chip designer Arm Holdings (ARM) and manufacturer TSMC (TSM), were higher as well. Arm is also set to report earnings after the bell Wednesday, along with chipmaker Qualcomm (QCOM).

[5]

Why Nvidia Stock Rallied on Wednesday | The Motley Fool

Shares of Nvidia (NVDA 4.16%) gained ground on Wednesday, climbing as much as 5%. As of 12:42 p.m. ET, the stock was still up 4.4%. The catalyst that sent the artificial intelligence (AI) chipmaker higher was news that strong demand for its processors will likely continue. Alphabet (GOOGL -7.49%) (GOOG -7.26%) released its fourth-quarter financial report after market close on Tuesday, and investors were keen to understand how demand for AI was progressing. The company reported revenue grew 12% year over year to $96 billion, generating diluted earnings per share (EPS) of $2.15, an increase of 31%. The results were largely in line with Wall Street's expectations, but some investors were troubled by results in the company's cloud segment. Revenue from Google Cloud grew 30% year over year to $12 billion, slightly below consensus estimates of $12.2 billion. Management explained that the shortfall was the result of tough comps, as it began its AI deployment in the year-ago quarter. Additionally, Alphabet had greater demand for AI than it could provide, so the company is scrambling to bring more capacity online. Alphabet is limited by the number of data centers it has and is investing significantly to rectify that situation. CFO Anat Ashkenazi said that the company planned to spend $75 billion on capital expenditures in 2025, noting the majority of that spending would go toward "technical infrastructure, which includes servers and data centers." As the principle supplier of the graphics processing units (GPUs) used to power AI in data centers, Nvidia stands to directly benefit from this increased spending. This follows an announcement by Microsoft (MSFT 0.04%) that it plans to spend $80 billion on data centers this year, also benefiting Nvidia. And at just 28 times next year's earnings, Nvidia stock is attractively priced.

[6]

Why Broadcom Rallied Today

Broadcom didn't report any news itself last night or today; however, a bullish forecast by its largest customer for artificial intelligence (AI) application specific integrated chips (ASICs) last night quelled recent fears around slowing AI spend. Alphabet will be a big spender in 2025 On its earnings call last night, Alphabet's management forecast a whopping $75 billion in capital expenditures in 2025 to supply its artificial intelligence build-out. That would be up nearly 50% from the $52.5 billion Alphabet spent in 2024. The forecast for the huge jump in spending came in spite of Alphabet missing estimates for cloud growth last quarter, which came in at 30% and just below expectations. However, management noted that Google Cloud was supply constrained, saying, "We exited the year with more demand than we had available capacity." Thus, the spending appears to be serving a real demand, and the forecast appeared to quell recent worries over DeepSeek, the Chinese AI model that was supposedly trained with an extremely low budget. The fear for AI chip stocks in the wake of DeepSeek was that AI models may not need as much computing power as previously thought. Broadcom itself got caught up in that sell-off last month, as it makes Google's custom AI ASIC accelerators for its data centers. But since Alphabet is clearly not slowing down its deployment of AI infrastructure, the revenue Broadcom derives from making Alphabet's custom chips seems set to continue, along the lines of its previously stated outlook. Broadcom expects massive growth from AI Back in December, Broadcom forecast a stunning $60 billion to $90 billion in AI chip revenue by 2027, up from just $12.2 billion last year. While the DeepSeek revelation seemed to call that massive growth into question last month, Alphabet's bold spending forecast appears to have alleviated those fears today.

[7]

Broadcom Stock Is Rising Wednesday: What's Going On? - Broadcom (NASDAQ:AVGO)

Google's capital expenditures forecast lowers concerns of an AI spending slowdown. Broadcom Inc AVGO shares are trading higher Wednesday. The stock spiked late Tuesday after Alphabet Inc GOOG reported fourth-quarter results showing it expects to increase AI spending in 2025. What To Know: Google reported fourth-quarter financial results after the market close on Tuesday. The company said it expects $75 billion in capital expenditures in 2025 related to its AI buildout. Google reported $52.5 billion in capital expenditures in 2024 and analysts had been expecting the company to spend about $58 billion in 2025, per Reuters. There had been some concerns about AI spending leading up to earnings season after Chinese startup DeepSeek reportedly developed its open-source LLM in a couple of months at a much lower cost than competitors in the space. Broadcom shares jumped late Tuesday as Google's capital expenditures forecast lowered concerns of an AI spending slowdown. Google is one of Broadcom's largest AI chip customers. Check This Out: Google AI's Search Revenue Matches Traditional Ads, Says Alphabet But There Is Rising Competition From OpenAI, Perplexity, DeepSeek Broadcom isn't expected to report quarterly results again until early March. Analysts currently expect the company to report earnings of $1.49 per share and revenue of $14.63 billion, according to estimates from Benzinga Pro. Last quarter, Broadcom reported mixed financial results. Chip revenue grew to a record $30.1 billion, driven by AI revenue of $12.2 billion, up 220% year over year. The company guided for first-quarter revenue of approximately $14.6 billion and adjusted EBITDA of approximately 66% of projected revenue. "We see our opportunity over the next three years in AI as massive. Specific hyperscalers have begun their respective journeys to develop their own custom AI accelerators," Broadcom CEO Hock Tan said on an earnings call in December. AVGO Price Action: Broadcom shares were up 3.26% at $229.52 at the time of publication Wednesday, according to Benzinga Pro. Photo: Shutterstock. AVGOBroadcom Inc$228.892.90%Overview Rating:Good62.5%Technicals Analysis1000100Financials Analysis400100WatchlistOverviewGOOGAlphabet Inc$194.10-6.55%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia's stock jumped 5% following Alphabet's announcement of increased AI infrastructure spending, signaling continued strong demand for AI chips and allaying concerns about potential market disruptions.

Nvidia Stock Soars on Tech Giants' AI Spending Plans

Nvidia (NVDA) shares experienced a significant boost, rising by 5.21% on Wednesday, following a series of announcements from major tech companies regarding their plans to increase spending on artificial intelligence (AI) infrastructure

1

. This surge in Nvidia's stock price reflects growing investor confidence in the sustained demand for AI chips and technologies.Alphabet's Ambitious AI Investment

The rally was primarily triggered by Google's parent company, Alphabet (GOOGL), which revealed its intention to allocate up to $75 billion for capital expenditures in 2025

2

. This figure significantly surpasses previous analyst expectations of $58 billion. Alphabet CEO Sundar Pichai emphasized that a substantial portion of this investment would be directed towards enhancing AI infrastructure, particularly servers and data centers, to meet the rising demand for AI technologies.Tech Industry's Collective Push into AI

Alphabet's announcement aligns with similar moves by other tech giants. Meta Platforms (META) plans to invest between $60 billion and $65 billion in AI infrastructure this year, while Microsoft (MSFT) anticipates an $80 billion investment in fiscal 2025

1

. These substantial investments underscore the tech industry's commitment to advancing AI capabilities and infrastructure.Broader Impact on the Semiconductor Sector

The positive sentiment extended beyond Nvidia, benefiting other players in the semiconductor sector. Broadcom (AVGO), known for designing custom AI chips for large tech companies, saw its share price increase by nearly 6%

3

. Other Nvidia partners, such as Arm Holdings (ARM) and TSMC (TSM), also experienced gains in their share values4

.Addressing Concerns About Market Disruption

The positive market reaction helped alleviate recent concerns about potential disruptions in the AI chip market. Last week, fears arose following reports of a Chinese startup, DeepSeek, successfully training AI models at significantly lower costs than its American counterparts

1

. However, industry leaders have downplayed these concerns. Meta CEO Mark Zuckerberg reassured investors of their continued demand for AI chips from Nvidia and AMD, suggesting that DeepSeek's approach might lead to a shift in focus from model training to inference rather than reduced chip demand2

.Related Stories

Future Outlook and Upcoming Earnings

Nvidia is set to report its fiscal year 2025 results on February 26, with preliminary estimates indicating a significant revenue increase to approximately $128.6 billion

1

. A substantial portion of this growth is expected to stem from its data center segment, driven by GPU sales for AI applications.Implications for the AI Industry

The collective increase in AI infrastructure spending by major tech companies signals a robust outlook for the AI industry. It suggests that despite potential challenges or new entrants in the market, established players like Nvidia are well-positioned to benefit from the ongoing AI boom. The sustained demand for high-performance AI chips and infrastructure indicates that the AI revolution is far from slowing down, with tech giants betting big on its future potential.

References

Summarized by

Navi

[2]

[5]

Related Stories

Nvidia's Strong Position in AI Market Reaffirmed by Investor Optimism and Strategic Investments

15 Feb 2025•Business and Economy

AI Giants Alphabet and Meta Poised to Outperform Nvidia in Coming Years

29 Oct 2024•Business and Economy

Google TPUs Challenge Nvidia's AI Chip Dominance as Meta Explores Billion-Dollar Switch

25 Nov 2025•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation