Nvidia Surpasses Tesla as Top Retail Investment Choice in 2024, Riding AI Wave

3 Sources

3 Sources

[1]

Nvidia Surpasses Tesla As Retail Investors' Top Pick In 2024: Individual Shareholders Pour Nearly $30B Into Jensen Huang's AI Giant - NVIDIA (NASDAQ:NVDA), SPDR S&P 500 (ARCA:SPY)

Amid a booming interest in artificial intelligence, Nvidia Corp. NVDA has witnessed an unprecedented surge in retail investor dollars in 2024. This influx has positioned Nvidia as the most-purchased stock by individual investors, overtaking other popular equities. What Happened: Retail traders have injected nearly $30 billion into Nvidia this year, as of Dec. 17. This amount is almost twice the net inflows compared to the SPDR S&P 500 ETF Trust SPY, a broad U.S. market benchmark, CNBC reported on Thursday The allure of Nvidia for retail investors stems from its robust performance and leadership in artificial intelligence. The stock has surged over 180% in 2024, elevating it into the elite group of companies with market caps exceeding $3 trillion. See Also: Cathie Wood-Led Ark Invest's Monday Moves: Dumps Tesla, Palantir Stock, Adds Amazon Vanda Research's Marco Iachini highlighted that Nvidia's stock has outperformed Tesla Inc. , the previous retail favorite, due to its remarkable price gains. Despite some recent volatility, Nvidia remains a crucial holding for many individual investors, with its weight in the average portfolio increasing significantly this year. Why It Matters: The surge in retail investment in Nvidia comes ahead of the company's upcoming CES 2025 keynote is anticipated to be a major tech event. The keynote, led by CEO Jensen Huang, is expected to unveil the RTX 5000 Series GPUs, further solidifying Nvidia's position as a leader in the AI and tech space. This event is generating significant excitement in the tech community. at a time when the company is making significant strides in the tech industry. Recently, Nvidia shares saw a boost following the Biden administration's announcement of a trade investigation into China's semiconductor industry. The investigation, focusing on China's production and trade practices for "legacy" semiconductors, could lead to increased U.S. tariffs, potentially benefiting U.S. semiconductor producers. Read Next: Bitcoin, Ethereum Rise, Dogecoin Slides Amid Positive Christmas Sentiment: Analyst Cautions $110K Target For BTC Possible Only When... Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors. Image via Shutterstock NVDANVIDIA Corp $139.25-0.69% Overview Rating: Good 75% Technicals Analysis 100 0100 Financials Analysis 60 0100 Watchlist Overview SPYSPDR S&P 500 $599.28-0.34% TSLATesla Inc $468.951.44% Market News and Data brought to you by Benzinga APIs

[2]

Nvidia sees 'remarkable' influx of retail investor dollars as traders flock to AI darling

Jensen Huang, CEO of Nvidia, arrives for the Inaugural AI Insight Forum in the Russell Building on Capitol Hill on Sept. 13, 2023. As Michael MacGillivray saw artificial intelligence becoming more ubiquitous in everyday life, the 25-year-old wanted his investments to reflect that. It didn't take long to figure out how he wanted to play the trend. "Whenever you look at AI, it's like, all the roads lead to Nvidia," said MacGillivray, who's spent thousands of dollars on shares this year from his home in Michigan. "It definitely was a great investment." MacGillivray's purchases have contributed to the nearly $30 billion poured into Nvidia on balance by everyday investors this year, according to data from Vanda Research. That has made it the most-bought equity by retail traders on net in 2024, as of Dec. 17. Nvidia has seen almost double the amount of net inflows from this group compared with the SPDR S&P 500 ETF Trust (SPY), which tracks the broad benchmark for the U.S. stock market. It is also on pace to dethrone Tesla, the retail investor favorite that earned the most-bought title in 2023. (The firm calculates net flows for each security by subtracting its total outflows from inflows.) "Nvidia turned out to be the one stock that kind of stole the show from Tesla because of impressive price gains," said Marco Iachini, senior vice president at Vanda. "The performance speaks for itself."

[3]

Nvidia sees 'remarkable' influx of retail investor dollars as traders flock to AI darling

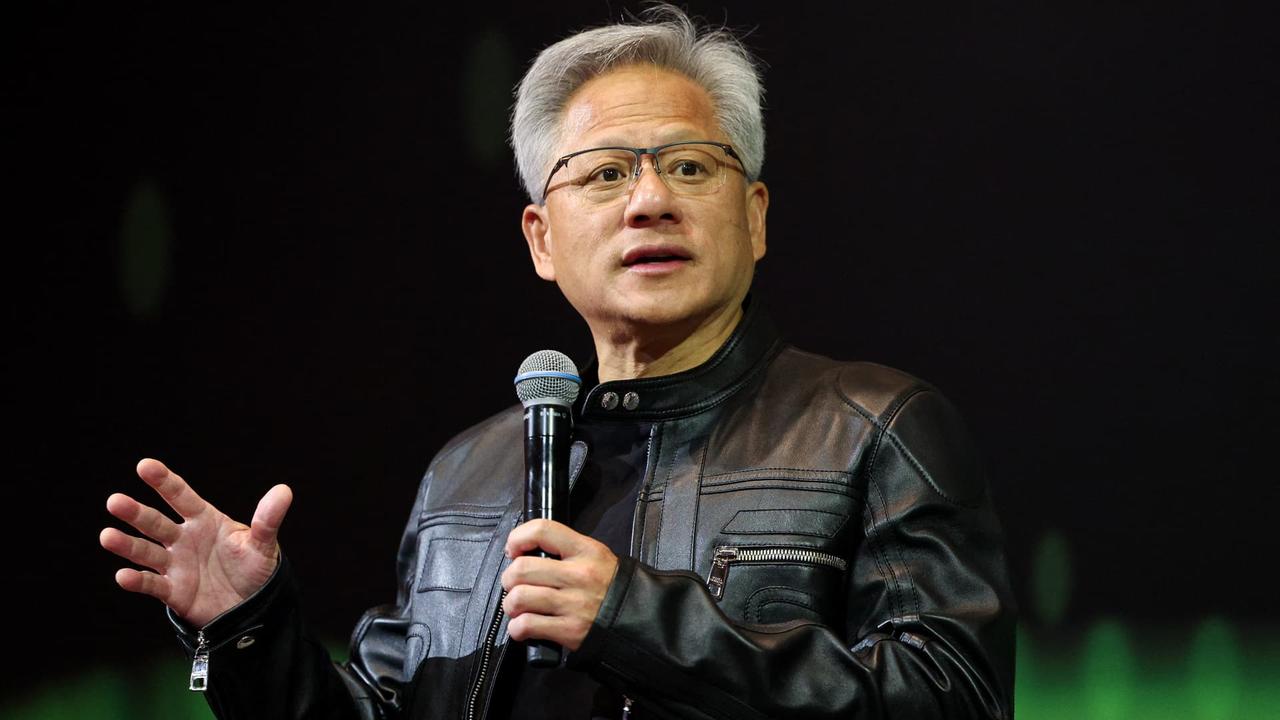

Nvidia CEO Jensen Huang delivers a keynote address during the Nvidia GTC Artificial Intelligence Conference in San Jose, Calif., on March 18, 2024. Justin Sullivan / Getty Images file As Michael MacGillivray saw artificial intelligence becoming more ubiquitous in everyday life, the 25-year-old wanted his investments to reflect that. It didn't take long to figure out how he wanted to play the trend. "Whenever you look at AI, it's like, all the roads lead to Nvidia," said MacGillivray, who's spent thousands of dollars on shares this year from his home in Michigan. "It definitely was a great investment." MacGillivray's purchases have contributed to the nearly $30 billion poured into Nvidia on balance by everyday investors this year, according to data from Vanda Research. That has made it the most-bought equity by retail traders on net in 2024, as of Dec. 17. Nvidia has seen almost double the amount of net inflows from this group compared with the SPDR S&P 500 ETF Trust (SPY), which tracks the broad benchmark for the U.S. stock market. It is also on pace to dethrone Tesla, the retail investor favorite that earned the most-bought title in 2023. (The firm calculates net flows for each security by subtracting its total outflows from inflows.) "Nvidia turned out to be the one stock that kind of stole the show from Tesla because of impressive price gains," said Marco Iachini, senior vice president at Vanda. "The performance speaks for itself." It's the latest feather in the cap for Nvidia. The AI titan has enamored investors big and small for more than a year. The chipmaker gained admission to the highly regarded Dow Jones Industrial Average last month and is, by and far, the 30-stock index's best performer of 2024. Despite rocky trading in December, the "Magnificent Seven" stock is tracking to finish 2024 higher by more than 180%. That surge has propelled the stock into an elite group of companies with market caps that exceed $3 trillion. Nvidia has also become the second-most valuable company in the U.S. Naturally, this push into Nvidia shares has resulted in the stock playing a larger role in the average investor's holdings. Vanda data shows Nvidia has a weight of more than 10% in the typical mom-and-pop trader's portfolio, up from just 5.5% at the start of 2024. It's now the second largest holding of the average retail investor, sitting marginally behind Tesla. Additionally, Nvidia's retail inflows on net in 2024 are more than 885% larger than the amount seen just three years prior. "Nvidia really stands out in terms of how quickly retail investors became such a big part of the ownership stake," said Gil Luria, head of technology research at D.A. Davidson, an investment bank. "The ascent was remarkable." One of those individual stockholders is Genevieve Khoury, a social media marketer. She first began buying shares in 2022 at the recommendation of her dad, who works in the technology sector. Khoury plans to sit on her shares until she can cash in the nest egg for a down payment on a home or other significant purchase. "It kept going up and up and up," said the Los Angeles-area resident. "I'm just holding it." Inflows tended to spike this year around Nvidia's earnings reports, according to Vanda's Iachini. Retail investors also bought in during an early August dip, which coincided with a broader market sell-off. To be sure, the stock has seen inflows cool to an extent as it lost some steam. D.A. Davidson's Luria noted that shares were more expensive six months ago than in recent sessions. Even as Nvidia continued beating Wall Street expectations for earnings, it wasn't exceeding estimates by enough to continue the stock's rapid price growth, Luria said. Now, he said the stock has come to more "balanced" and "reasonable" levels. Despite this recent volatility, individual investors such as Prajeet Tripathy remain optimistic over the company's leadership within AI and focus on innovation. "I think that it's only going to keep rising exponentially," said Tripathy, a recent college graduate. Though investing is largely a digital activity, market participants' love for Nvidia has spilled into the real world. Several gathered in New York City in late August for a well-documented watch party centered around Nvidia's earnings report. This event came within months of the stock's 10-to-1split, a move that's typically done to incentivize retail investors. While Nvidia's retail ownership is substantial, this factor hasn't pushed the price-to-earnings multiple higher in the same way that it has for Tesla and Palantir, Luria said. Still, Morningstar equity strategist Brian Colello said Nvidia has "fairly significant" volatility for a stock of its size, which can underscore the role retail traders can play in driving share prices. "It's jaw dropping at times that such a large company can have such a big move in the stock price on any given day," Colello said. 2024 marks the second straight year that a single stock has eclipsed the SPDR S&P 500 ETF Trust in net flows. However, sizable inflows to the ETF can assuage any concerns that investors are forgoing broad index funds deemed safe investments, according to Iachini. The past two years of high inflows into megcap tech names can instead reflect traders chasing the ongoing bull market, Iachini said. Notwithstanding strong returns, Iachini said, Nvidia can be a surprising pick for the typical at-home investor. Despite Nvidia CEO Jensen Huang's signature leather jacket, the company lacks a "God-like" personality that can garner retail investor attention, Iachini said. For an example, he pointed to Tesla CEO Elon Musk, who made waves this year for his public backing of President-elect Donald Trump during the campaign. Looking ahead, Palantir has gained traction among the retail crowd during the fourth quarter and could be a favorite in the new year, Iachini said. The software stock has been the ninth most-bought security on balance in 2024, beating Amazon, Alphabet and Microsoft, per Vanda data. Palantir CEO Alex Karp thanked small-scale investors during a video posted Sunday that was set against a snow-covered backdrop. "Exceedingly grateful to all of you individual investors who took the time and opportunity, and had the courage to look past conventional, rusty, crusty platitudes," Karp said in the clip, while sporting reflective goggles and gripping ski poles. Fittingly enough, Palantir was one recent pickup from Khoury, the social media marketer in California, on a friend's advice. Khoury is hopeful for a Nvidia-like run, so she can retain bragging rights with acquaintances who believe they know more about investing than her. It's going well so far: The stock has skyrocketed close to 380% in 2024, making it the best performer in the S&P 500 year-to-date. "Multiple times in college, people would try and talk to me about it like I didn't know what I was talking about," said Khoury, who graduated this year with a degree in finance. "I'm like, sure, yeah, I don't know what I'm talking about, but I do have Nvidia." "Probably," she said, "my portfolio looks better than yours."

Share

Share

Copy Link

Nvidia has become the most-bought stock by retail investors in 2024, overtaking Tesla, as individual shareholders pour nearly $30 billion into the AI giant. The company's stock has surged over 180% this year, propelled by its leadership in artificial intelligence technology.

Nvidia's Unprecedented Surge in Retail Investment

In a remarkable shift in the investment landscape of 2024, Nvidia Corporation has emerged as the top choice for retail investors, surpassing previous favorites like Tesla. The company has witnessed an extraordinary influx of nearly $30 billion from individual shareholders, almost doubling the net inflows compared to the SPDR S&P 500 ETF Trust (SPY)

1

2

.Driving Factors Behind Nvidia's Popularity

The surge in retail investment in Nvidia is primarily attributed to the booming interest in artificial intelligence (AI). As AI becomes increasingly ubiquitous in everyday life, investors are keen to align their portfolios with this trend. Nvidia's leadership in AI technology and impressive stock performance have made it an attractive option for individual investors

2

.Stock Performance and Market Position

Nvidia's stock has experienced a meteoric rise, surging over 180% in 2024. This exceptional performance has catapulted the company into an elite group with market capitalizations exceeding $3 trillion. The company has also gained admission to the highly regarded Dow Jones Industrial Average, becoming its best performer of the year

3

.Retail Investor Sentiment

Many retail investors view Nvidia as a central player in the AI revolution. Michael MacGillivray, a 25-year-old investor, echoed this sentiment, stating, "Whenever you look at AI, it's like, all the roads lead to Nvidia"

2

. This perception has led to a significant increase in Nvidia's weight in the average retail investor's portfolio, rising from 5% at the start of 2024 to over 10%3

.Impact on Investment Patterns

The influx of retail investment into Nvidia represents a shift in individual investor behavior. While broad index funds like SPY continue to see substantial inflows, the focus on Nvidia reflects a trend of traders chasing the ongoing bull market in tech stocks. Marco Iachini, senior vice president at Vanda Research, noted that Nvidia has "stolen the show from Tesla because of impressive price gains"

2

.Related Stories

Future Outlook and Investor Expectations

Despite recent volatility, many retail investors remain optimistic about Nvidia's future. The company's upcoming CES 2025 keynote, led by CEO Jensen Huang, is anticipated to be a major tech event, potentially unveiling new products like the RTX 5000 Series GPUs

1

. This continued innovation and leadership in the AI space are key factors driving investor confidence.Market Implications

The remarkable ascent of Nvidia in retail portfolios has caught the attention of market analysts. Gil Luria, head of technology research at D.A. Davidson, highlighted the speed at which retail investors have become a significant part of Nvidia's ownership stake

3

. This trend underscores the growing influence of individual investors in shaping market dynamics, particularly in the tech sector.References

Summarized by

Navi

Related Stories

Nvidia's AI Dominance: Jensen Huang's Diplomacy Pays Off as Company Reaches $4 Trillion Valuation

10 Jul 2025•Business and Economy

NVIDIA's AI Dominance Drives S&P 500 Gains and Market Volatility

16 Sept 2024

Nvidia's AI Dominance Fuels Record Growth and Market Leadership

01 Nov 2024•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology