Point72's AI-Focused Fund Surges to $1.5 Billion in Three Months with Double-Digit Returns

2 Sources

2 Sources

[1]

Point72's new AI fund near $1.5 billion after double-digit returns, sources say

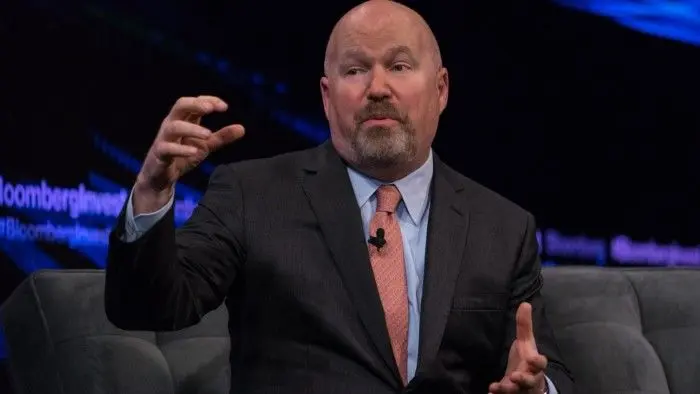

HONG KONG (Reuters) - Steven Cohen's Point72 Asset Management's new artificial intelligence (AI)-focused fund posted a 14% gain after launching just three months ago, growing the fund to nearly $1.5 billion, according to sources familiar with the matter. Point72 Turion, which kicked off trading in October and is run by portfolio manager Eric Sanchez, was expected to reach $1.5 billion in April based on its performance and subscriptions. At that point the fund plans to suspend taking new investors, the sources said. In June, Bloomberg reported Point72 was seeking about $1 billion for the new fund. The quick growth of Point72's AI fund is the latest example of market optimism about the prospects of AI. The hedge fund that picks winners and losers in the AI supply chain rose 3.5%, 4.9% and 5.2% in October, November and December respectively, ending 2024 up 14.2%, compared to a 6.2% in the Nasdaq Composite Index during the same period. Turion is hedge fund giant Point72's first new fund in decades. Point72 currently oversees $35.2 billion with its main fund rising 19% last year. (Reporting by Summer Zhen;Editing by Elaine Hardcastle)

[2]

Point72 AI-focused fund grows to nearly $1.5 billion in three months By Investing.com

Investing.com -- Steven Cohen's Point72 Asset Management has seen rapid growth in its new artificial intelligence (AI)-focused fund, Point72 Turion. After only three months of trading, the fund has posted a 14% gain, expanding its total to almost $1.5 billion, according to Bloomberg insiders familiar with the situation. The fund, managed by portfolio manager Eric Sanchez, began trading in October. Based on its performance and subscriptions, it was projected to reach the $1.5 billion mark by April. Once this target is attained, the fund intends to halt the admittance of new investors, as per the sources. In June, Bloomberg had reported that Point72 was aiming to raise approximately $1 billion for this new fund. The swift expansion of Point72's AI fund serves as a recent illustration of market enthusiasm for AI prospects.

Share

Share

Copy Link

Steven Cohen's Point72 Asset Management's new AI-focused fund, Point72 Turion, has grown to nearly $1.5 billion after posting a 14% gain in just three months of trading, showcasing strong market optimism for AI investments.

Point72 Turion: A New AI-Focused Hedge Fund

Steven Cohen's Point72 Asset Management has made a significant splash in the artificial intelligence (AI) investment space with its new fund, Point72 Turion. Launched in October 2023, the fund has quickly grown to nearly $1.5 billion in assets under management, showcasing the strong market appetite for AI-related investments

1

2

.Impressive Performance in a Short Time

Point72 Turion, managed by portfolio manager Eric Sanchez, has posted remarkable returns in its first three months of operation. The fund achieved a 14% gain by the end of 2023, significantly outperforming the Nasdaq Composite Index, which rose 6.2% during the same period

1

. The monthly breakdown of returns is as follows:- October 2023: 3.5%

- November 2023: 4.9%

- December 2023: 5.2%

This strong performance has contributed to the fund's rapid growth and attractiveness to investors

1

.Growth and Future Plans

Initially, Point72 was reportedly seeking to raise about $1 billion for the new AI fund

1

2

. However, the fund's success has exceeded expectations, with projections indicating it will reach $1.5 billion by April 2024. At this point, the fund plans to suspend taking new investors, signaling confidence in its current size and strategy1

.Market Optimism for AI

The quick growth of Point72's AI fund is seen as a clear indicator of market optimism surrounding the prospects of artificial intelligence. This enthusiasm is reflected not only in the fund's performance but also in the broader market's interest in AI-related investments

1

2

.Point72's Overall Performance

Point72 Turion represents a significant milestone for Point72 Asset Management, being the hedge fund giant's first new fund in decades. The success of Turion complements Point72's overall strong performance, with the firm currently overseeing $35.2 billion in assets. Point72's main fund also performed well in 2023, rising 19%

1

.Related Stories

AI Supply Chain Focus

One of the key strategies employed by Point72 Turion is its focus on picking winners and losers in the AI supply chain. This approach has contributed to its impressive returns and highlights the fund's specialized knowledge in the AI sector

1

.Implications for the AI Investment Landscape

The success of Point72 Turion underscores the growing importance of AI in the investment world. As more funds and investors turn their attention to AI-related opportunities, we may see increased competition and innovation in this space. The rapid growth and strong performance of Turion could potentially inspire other hedge funds to launch similar AI-focused investment vehicles, further driving investment and development in the AI sector.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology