Publicis Groupe Raises 2024 Guidance Amid Strong Q1 Performance

3 Sources

3 Sources

[1]

Ad group Publicis ups guidance as it gains market share in tough market

French advertising group Publicis raised its organic growth outlook on the back of market share gains on Thursday, after it topped second-quarter expectations driven by its Epsilon and Media branches. Its shares were 4.5% higher by 1020 GMT, the top performers on France's blue-chip index CAC 40. Publicis' recent strong performance runs counter to a general slowdown in the advertising industry, which is seen as a bellwether for broader economic health. "Over the past 3 months, we think the macro backdrop has in fact deteriorated," a BofA Securities analyst wrote in a note to clients, adding that new account wins and market share gains were likely behind the guidance upgrade. The world's largest advertising group by market value expects its organic revenue to grow between 5% and 6%, compared to its previous guidance of 4% to 5% growth. "We are not immune to the macro pressure, but we are winning market share," CEO Arthur Sadoun told analysts in a call. Sadoun said Publicis' implementation of AI was expected to further drive its business, adding it had many projects in the pipeline waiting to be released once market conditions improve. Publicis expects to reach the higher end of its guidance if clients end their "wait and see" attitude and increase spending in digital transformation, allowing its IT consulting unit, Sapient, to bounce back. "There are many (clients) today who are waiting because of macroeconomic uncertainties and who are reluctant to spend capex to put this in place," Sadoun said, adding the unit's performance in the U.S. in the past six months was a good sign. The parent company behind agencies such as Leo Burnett and Saatchi & Saatchi reported a net revenue of 3.46 billion euros ($3.78 billion) in the second quarter, with organic growth of 5.4% beating a consensus of 4.8%. Its Epsilon unit, which provides targeted advertising capacity, continued to drive the group's performance thanks to individualised consumer profiling, Sadoun said. The group has 250 million individualised profiles in the U.S., he added. Its performance in the Asia-Pacific region outpaced that of North America and Europe, achieving 7.7% organic growth, including 10.5% in China alone. ($1 = 0.9151 euros) (Reporting by Leo Marchandon and Dagmarah Mackos; Editing by Sandra Maler and Milla Nissi)

[2]

Publicis Groupe S A : Inside Information / News release on accounts, results

Arthur Sadoun, Chairman and CEO of Publicis Groupe: "Publicis achieved a very strong first half of the year, with net revenue organic growth at +5.4% and +7.4% growth on a like-for-like revenue basis. We continued to win market share, with Q2 net revenue organic growth accelerating to +5.6%, above expectations and 400bps ahead of our industry. For the first 6 months of the year, we kept delivering industry leading financial KPIs. Despite a backdrop of ongoing macro-economic pressures, not only did our H1 performance demonstrate that our model is strong. It also showed that our outperformance versus our peers is sustainable, with our growth rate close to doubling that of our competitors since 2019. As a result, we are confident in our ability to accelerate further in H2. We are raising our net revenue organic growth guidance and now expect to deliver between +5-+6%. We will maintain our best-in-class financial ratios while continuing to make material investments in our talent and AI strategy. As we further extract ourselves from the pack, we have everything we need to continue to lead and reinvent our industry thanks to our transformation. We have a winning go to market, which has put us at the head of the new business rankings for the past five years. We have taken the leadership of personalization at scale, demonstrated by our combined Data and Media offering's double-digit growth this quarter, for the third year in a row. And thanks to Publicis Sapient, we are uniquely positioned to partner with our clients in their AI-led transformation. I would like to take this opportunity to thank all of our clients for their trust. I would also like to thank our people around the world for their outstanding work. Sustaining these levels of outperformance in such a difficult environment is an everyday battle and with the Executive Committee we are truly grateful for all of their efforts."

[3]

Publicis Groupe S.A. Non-GAAP EPS of €3.38, revenue of €6.69B; updates FY24 outlook

Publicis Groupe S.A. press release (OTCQX:PUBGY): 1H Non-GAAP EPS of €3.38. Revenue of €6.69B (+5.9% Y/Y). EBITDA amounted to €1,401 million in H1 2024, compared to €1,335 million in H1 2023, up by +4.9%. Outlook: The Groupe now aims for +5% to +6% organic growth for the full year, compared to +4% to +5% previously. The Groupe also confirms its 2024 guidance on financial ratios, which will be maintained at the industry-leading levels of 18% operating margin rate and between 1.8 and 1.9 billion euros free cash flow before change in working capital, including the Groupe's opex investment of 100 million euros for its AI plan. More on Publicis Groupe S.A. Publicis Groupe: Outperformance, But Significant Overvaluation Seeking Alpha's Quant Rating on Publicis Groupe S.A. Historical earnings data for Publicis Groupe S.A. Dividend scorecard for Publicis Groupe S.A. Financial information for Publicis Groupe S.A.

Share

Share

Copy Link

Publicis Groupe, a leading advertising and communications company, has reported impressive Q1 2024 results and raised its full-year guidance. The company's performance surpassed expectations, driven by market share gains and strong organic growth.

Strong Q1 Performance

Publicis Groupe, one of the world's largest advertising and communications companies, has reported a robust start to 2024 with impressive first-quarter results. The company's organic growth reached 5.3% in Q1, surpassing market expectations and demonstrating its resilience in a challenging economic environment

1

.The group's net revenue for the quarter stood at €3.23 billion, representing a 4.9% increase compared to the same period last year

2

. This strong performance was driven by market share gains across various regions and business segments.Regional Performance

Publicis Groupe's growth was particularly strong in the United States, with organic growth of 5.8% in Q1. Europe also showed resilience, posting 3.4% organic growth, while the Asia Pacific region delivered a solid 6.3% increase

1

.Business Segment Highlights

The company's data and technology services, Epsilon and Publicis Sapient, continued to be key growth drivers. Epsilon reported 9% organic growth, while Publicis Sapient achieved an impressive 8% organic growth in Q1

2

.Raised Full-Year Guidance

In light of the strong Q1 performance, Publicis Groupe has raised its full-year guidance for 2024. The company now expects organic growth to be in the range of 4% to 5%, up from the previous forecast of 3% to 5%

3

.Additionally, Publicis Groupe has increased its operating margin target to between 18% and 18.2%, compared to the previous guidance of about 18%

3

.Related Stories

Management Commentary

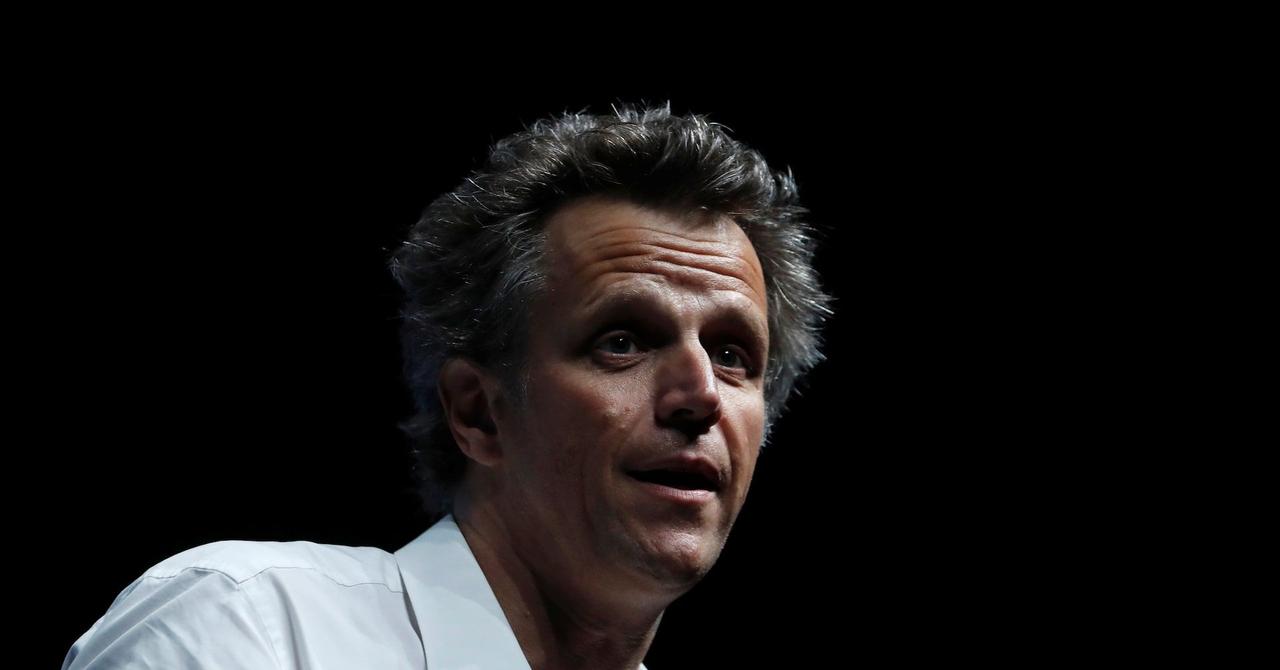

Arthur Sadoun, Chairman and CEO of Publicis Groupe, expressed confidence in the company's performance, stating, "Our Q1 performance demonstrates once again the strength of our model in a tough macroeconomic environment"

1

.He further emphasized the company's ability to gain market share and deliver strong organic growth, attributing this success to Publicis Groupe's unique positioning in the industry

2

.Market Reaction

Following the announcement of the Q1 results and raised guidance, Publicis Groupe's shares saw a positive response in the market. Investors and analysts have welcomed the company's strong performance and improved outlook for the year

3

.References

Summarized by

Navi

[2]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology